Network Camera Market

Network Camera Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702896 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Network Camera Market Size

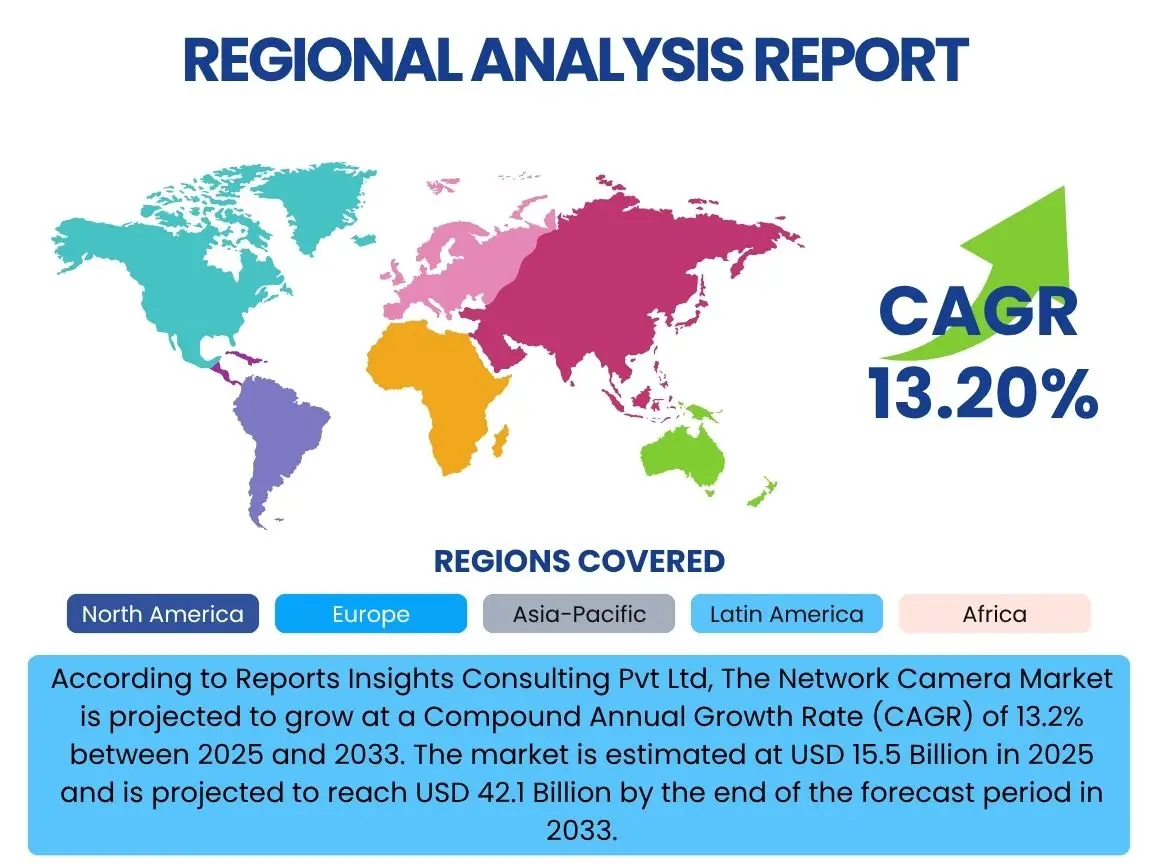

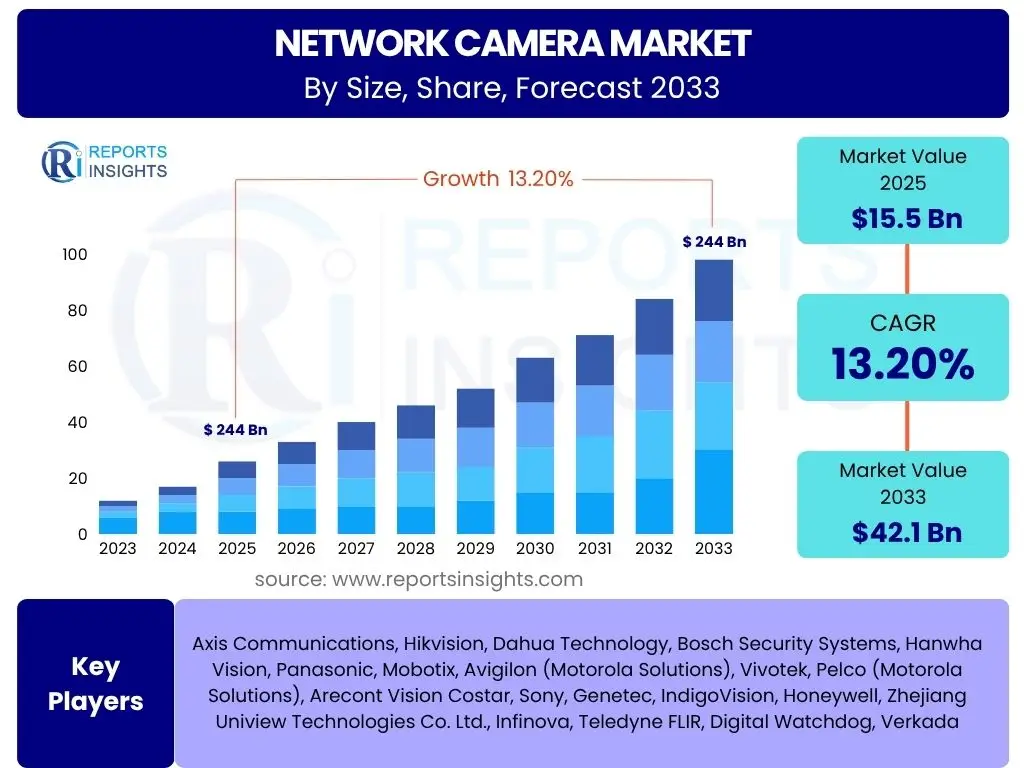

According to Reports Insights Consulting Pvt Ltd, The Network Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.2% between 2025 and 2033. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 42.1 Billion by the end of the forecast period in 2033.

Key Network Camera Market Trends & Insights

The Network Camera market is currently undergoing a significant transformation, driven by advancements in digital imaging and data analytics. A prominent trend involves the increasing adoption of high-resolution cameras, including 4K and beyond, which provide superior image clarity crucial for detailed surveillance and forensic analysis. This push for higher fidelity is complemented by the growing demand for cameras with enhanced low-light performance and wider dynamic range, ensuring effective monitoring across diverse environmental conditions.

Another critical trend is the widespread integration of network cameras into smart city infrastructure and broader IoT ecosystems. This integration facilitates comprehensive urban monitoring, traffic management, and public safety initiatives, moving beyond traditional security applications. The shift towards cloud-based surveillance solutions is also gaining momentum, offering scalable storage, remote accessibility, and simplified management for both enterprise and residential users, reducing the need for extensive on-premise hardware.

Furthermore, edge computing is emerging as a vital trend, enabling network cameras to process data locally, reducing bandwidth requirements and latency while enhancing real-time analytical capabilities. This on-device processing supports intelligent features like anomaly detection and object classification directly at the source. The market is also witnessing a surge in demand for specialized cameras, such as thermal cameras for perimeter security and sophisticated PTZ (Pan-Tilt-Zoom) cameras for expansive area coverage, indicating a diversification of product offerings to meet specific security and operational needs.

- Increased adoption of Ultra-High Definition (4K and higher) resolution cameras.

- Rising integration with smart city frameworks and Internet of Things (IoT) platforms.

- Growing preference for cloud-based video surveillance as a service (VSaaS).

- Expansion of edge computing capabilities for real-time analytics and reduced latency.

- Development of specialized cameras, including thermal and advanced PTZ units.

- Enhanced focus on cybersecurity measures for networked surveillance systems.

- Leveraging Artificial Intelligence (AI) and Machine Learning (ML) for advanced analytics.

- Demand for privacy-by-design features and adherence to data protection regulations.

- Hybrid deployments combining on-premise and cloud solutions.

- Emphasis on energy-efficient and sustainable camera designs.

AI Impact Analysis on Network Camera

Artificial Intelligence is fundamentally reshaping the capabilities and applications of network cameras, transitioning them from mere recording devices into intelligent, proactive surveillance tools. Users are keenly interested in how AI enhances the efficiency and effectiveness of security operations, particularly through features like accurate object detection, facial recognition, and behavioral anomaly detection. AI-driven analytics significantly reduce false alarms, allowing security personnel to focus on genuine threats and improve response times, which is a major driver of user adoption.

The influence of AI extends beyond basic security to encompass broader operational intelligence. For instance, AI-powered network cameras are being utilized for retail analytics to monitor customer flow, optimize store layouts, and identify purchasing patterns, or in industrial settings for predictive maintenance and safety compliance. While the benefits of enhanced automation and intelligence are clear, users also express concerns regarding data privacy, ethical implications of facial recognition, and the potential for misuse of sophisticated surveillance technologies. Therefore, manufacturers are increasingly focusing on incorporating privacy-preserving features and ensuring compliance with evolving regulatory frameworks.

Furthermore, AI is facilitating the development of advanced capabilities such as predictive analytics, where cameras can anticipate potential incidents based on observed patterns, and adaptive surveillance, where camera settings automatically adjust to optimize performance in varying conditions. This continuous innovation, fueled by AI, is setting new benchmarks for intelligent video surveillance, enabling more sophisticated and nuanced monitoring solutions across diverse sectors. The integration of deep learning algorithms is also making cameras smarter at distinguishing between benign events and actual threats, thereby enhancing overall system reliability and actionable insights.

- Enhanced accuracy in object detection and classification (e.g., distinguishing between humans, vehicles, and animals).

- Advanced facial recognition and people counting for access control, security, and retail analytics.

- Behavioral anomaly detection to identify unusual or suspicious activities in real-time.

- Reduced false alarms through intelligent filtering of non-threat events.

- Automated alerts and notifications based on predefined rules and learned patterns.

- Integration with broader AI platforms for comprehensive data analysis and decision-making.

- Predictive analytics for anticipating potential incidents or operational issues.

- Improved forensic capabilities through faster and more precise video search and retrieval.

- Optimization of bandwidth and storage through intelligent video compression and event-based recording.

- Support for privacy-preserving techniques like blurring or anonymization of non-relevant individuals.

Key Takeaways Network Camera Market Size & Forecast

The Network Camera market is poised for robust expansion over the forecast period, driven by an escalating global demand for advanced security and surveillance solutions across both public and private sectors. The projected significant growth from USD 15.5 Billion in 2025 to USD 42.1 Billion by 2033 underscores the increasing reliance on networked video systems for enhancing safety, improving operational efficiency, and enabling smart infrastructure development.

A primary takeaway is the accelerating adoption of intelligent features, particularly those powered by Artificial Intelligence and Machine Learning. These technologies are transforming network cameras into sophisticated analytical tools, capable of real-time threat detection, behavior analysis, and predictive insights, moving beyond basic recording functions. This technological evolution is not only expanding the market's traditional security applications but also opening new avenues in areas such as retail analytics, smart manufacturing, and healthcare monitoring.

Furthermore, the market's growth is strongly supported by the global proliferation of high-speed internet infrastructure and the increasing demand for cloud-based surveillance solutions. These factors enhance accessibility, scalability, and ease of management for networked camera systems, making them attractive to a wider range of users, from large enterprises to individual consumers. Strategic investments in research and development by market players, focusing on enhanced imaging capabilities, cybersecurity, and seamless integration with IoT ecosystems, are crucial for sustaining this upward trajectory and addressing evolving market needs and regulatory landscapes.

- Significant market growth anticipated, with a robust CAGR of 13.2% from 2025 to 2033.

- Technological advancements, particularly AI and edge computing, are core drivers of market expansion.

- Increasing adoption across diverse sectors including smart cities, commercial, and residential.

- Shift towards cloud-based and managed video surveillance services.

- Rising focus on cybersecurity and data privacy regulations influencing product development.

- Emerging opportunities in niche applications and integration with broader IoT ecosystems.

- Competitive landscape characterized by continuous innovation and strategic partnerships.

Network Camera Market Drivers Analysis

The Network Camera market is significantly propelled by the escalating demand for advanced surveillance and security solutions across various sectors. Growing concerns over public safety, asset protection, and crime prevention are compelling governments, businesses, and residential consumers to invest in robust monitoring systems. Furthermore, the integration of network cameras with smart city initiatives and Internet of Things (IoT) ecosystems is creating new avenues for growth, enabling comprehensive monitoring and data collection for urban planning and public services.

Technological advancements, particularly in areas like high-resolution imaging, artificial intelligence, and cloud computing, are key enablers for market expansion. The development of cameras capable of 4K and higher resolution provides clearer imagery for detailed analysis, while AI-driven analytics enhance capabilities such as facial recognition, object detection, and behavioral analysis. The increasing affordability of these advanced features, coupled with ease of installation and remote accessibility via cloud platforms, is lowering barriers to adoption for a wider range of end-users.

Additionally, the proliferation of broadband internet infrastructure globally and the rising awareness about the benefits of IP-based surveillance over traditional analog systems are contributing factors. The flexibility and scalability offered by network cameras, allowing for seamless integration with existing IT networks and future system expansions, make them an attractive option for large-scale deployments and distributed environments. The shift towards proactive security measures, enabled by real-time alerts and intelligent monitoring, further solidifies the market's upward trajectory.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Security Concerns & Crime Rates | +3.5% | Global, particularly North America, Europe, Asia Pacific | Short to Mid-Term (2025-2029) |

| Technological Advancements (AI, IoT, 4K) | +4.2% | Global, Led by Developed Markets | Mid to Long-Term (2026-2033) |

| Growth in Smart City & Infrastructure Projects | +2.8% | Asia Pacific, Europe, Middle East | Mid to Long-Term (2027-2033) |

| Proliferation of Cloud-Based Surveillance Solutions | +2.0% | Global, especially North America, Europe | Short to Mid-Term (2025-2030) |

| Rising Adoption in Commercial & Industrial Sectors | +1.5% | Global, Emerging Economies | Short to Mid-Term (2025-2029) |

Network Camera Market Restraints Analysis

Despite robust growth, the Network Camera market faces several significant restraints that could impede its full potential. One primary concern is the relatively high initial investment required for advanced networked surveillance systems, encompassing not only the cameras themselves but also network infrastructure, storage solutions, and analytical software. This cost barrier can be prohibitive for small and medium-sized enterprises (SMEs) or individual residential consumers, limiting broader market penetration, particularly in price-sensitive regions.

Data privacy and security concerns represent another major restraint. As network cameras collect vast amounts of sensitive visual data, there is increasing scrutiny regarding how this data is stored, transmitted, and utilized. Regulatory frameworks like GDPR and CCPA impose strict guidelines, and failure to comply can result in severe penalties and erosion of public trust. The potential for cyberattacks, including unauthorized access, data breaches, and system manipulation, also poses a substantial risk, discouraging adoption among organizations wary of compromising their data integrity and operational continuity.

Furthermore, technical complexities associated with the integration of diverse systems and devices, along with the need for specialized technical expertise for installation, maintenance, and troubleshooting, can act as deterrents. Interoperability issues between different manufacturers' products and platforms can lead to fragmented systems and hinder seamless expansion or upgrades. Addressing these challenges through standardization and user-friendly interfaces is crucial for overcoming these restraints and ensuring sustained market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment & Installation Costs | -1.8% | Global, particularly Emerging Economies | Short to Mid-Term (2025-2029) |

| Data Privacy & Security Concerns | -2.5% | Global, especially Europe, North America | Short to Mid-Term (2025-2030) |

| Complex Integration & Interoperability Issues | -1.2% | Global | Short to Mid-Term (2025-2028) |

| Bandwidth Limitations in Certain Regions | -0.9% | Developing Regions (MEA, parts of APAC, LATAM) | Mid-Term (2026-2031) |

| Ethical Concerns & Public Perception | -1.5% | Global, particularly Developed Markets | Long-Term (2028-2033) |

Network Camera Market Opportunities Analysis

The Network Camera market is rich with opportunities, particularly stemming from the accelerating pace of technological innovation and the expansion into new application domains. The integration of advanced AI and machine learning capabilities into network cameras presents a significant avenue for growth, enabling more sophisticated analytics such as predictive maintenance, environmental monitoring, and comprehensive retail intelligence. These advanced functionalities move beyond traditional security to offer substantial operational benefits, driving demand from a broader range of industries seeking data-driven insights.

The increasing trend towards smart cities and interconnected urban ecosystems offers immense potential for large-scale deployments of network cameras. These deployments are crucial for public safety, traffic management, waste management, and environmental monitoring, providing a robust platform for future expansion. Furthermore, the growing adoption of cloud-based video surveillance as a service (VSaaS) models simplifies deployment, reduces upfront costs, and offers enhanced scalability and accessibility, appealing to a wider customer base including small and medium-sized businesses and residential users.

Emerging markets in Asia Pacific, Latin America, and the Middle East and Africa present considerable untapped potential due to rapid urbanization, increasing infrastructure development, and a growing awareness of modern security solutions. As these regions continue to invest in smart infrastructure and public safety initiatives, the demand for networked cameras is expected to surge. Additionally, the development of specialized cameras for niche applications, such as thermal imaging for industrial safety or explosion-proof cameras for hazardous environments, creates distinct market segments and revenue streams for manufacturers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into New Application Verticals (e.g., healthcare, retail analytics) | +2.3% | Global | Mid to Long-Term (2026-2033) |

| Increased Demand for Cloud-Based & VSaaS Solutions | +2.0% | Global, particularly North America, Europe | Short to Mid-Term (2025-2030) |

| Growth in Emerging Economies & Infrastructure Projects | +3.0% | Asia Pacific, Middle East, Africa, Latin America | Mid to Long-Term (2027-2033) |

| Integration with AI, Deep Learning & Predictive Analytics | +2.8% | Global | Mid to Long-Term (2026-2033) |

| Development of Specialized & Niche Camera Solutions | +1.5% | Global | Short to Mid-Term (2025-2029) |

Network Camera Market Challenges Impact Analysis

The Network Camera market faces several persistent challenges that require strategic navigation by market participants. One significant challenge is the ongoing concern around data privacy and ethical considerations, particularly with the proliferation of advanced features like facial recognition and biometric analysis. Public apprehension about surveillance, coupled with evolving and often disparate data protection regulations across different jurisdictions, mandates constant adaptation from manufacturers and solution providers to ensure compliance and maintain public trust. Balancing security needs with individual privacy rights remains a delicate act.

Another key challenge is the escalating threat of cyberattacks. As network cameras become more interconnected and sophisticated, they present potential vulnerabilities that can be exploited for unauthorized access, data manipulation, or even denial-of-service attacks. Ensuring robust cybersecurity measures, including encryption, secure boot processes, and regular firmware updates, is paramount. The increasing complexity of integrating diverse systems, often from multiple vendors, also poses interoperability challenges, leading to higher installation costs and potential operational inefficiencies for end-users.

Furthermore, the market must contend with intense price competition, particularly from manufacturers in Asia, which can compress profit margins for established players. Rapid technological obsolescence due to frequent innovations also poses a challenge, requiring continuous investment in research and development to stay competitive. Addressing the shortage of skilled professionals capable of deploying, managing, and maintaining complex IP-based surveillance systems is also critical for supporting widespread adoption and ensuring effective system performance in the long term.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving Regulatory Landscape & Data Privacy Concerns | -2.0% | Global, particularly Europe, North America | Long-Term (2025-2033) |

| Increasing Cybersecurity Threats & Vulnerabilities | -2.5% | Global | Short to Long-Term (2025-2033) |

| Interoperability & Integration Complexities | -1.3% | Global | Short to Mid-Term (2025-2029) |

| High Competition & Price Pressure | -1.0% | Global, especially Asia Pacific | Short to Mid-Term (2025-2030) |

| Requirement for Skilled Workforce & Technical Expertise | -0.8% | Global | Mid-Term (2026-2031) |

Network Camera Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Network Camera Market, covering market size estimations, growth forecasts, key trends, and the impact of technological advancements, particularly Artificial Intelligence. It offers detailed segmentation analysis across various parameters and highlights regional dynamics and the competitive landscape, providing stakeholders with actionable insights for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 42.1 Billion |

| Growth Rate | 13.2% CAGR |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Axis Communications, Hikvision, Dahua Technology, Bosch Security Systems, Hanwha Vision, Panasonic, Mobotix, Avigilon (Motorola Solutions), Vivotek, Pelco (Motorola Solutions), Arecont Vision Costar, Sony, Genetec, IndigoVision, Honeywell, Zhejiang Uniview Technologies Co. Ltd., Infinova, Teledyne FLIR, Digital Watchdog, Verkada |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Network Camera market is extensively segmented to provide a granular view of its diverse components and drivers. These segmentations allow for a detailed understanding of consumer preferences, technological adoption patterns, and market dynamics across various applications. Understanding these segments is crucial for stakeholders to identify specific growth areas and tailor their strategies to address distinct market needs, from resolution requirements to deployment environments.

The market is primarily segmented by camera type, distinguishing between wired and wireless solutions, each catering to different infrastructure capabilities and installation flexibility. Resolution is another critical segment, reflecting the increasing demand for higher image clarity, ranging from standard HD to advanced 4K and beyond. Sensor type, predominantly CMOS and CCD, influences image quality and performance under varying light conditions.

Further segmentation includes applications, delineating usage across commercial sectors (retail, offices, hospitality), residential areas, government and public infrastructure (smart cities, traffic monitoring), industrial environments, and healthcare. Technological distinctions are also vital, categorizing cameras by their AI capabilities (AI-enabled vs. non-AI), deployment models (cloud-based vs. on-premise), and specific form factors or functionalities like thermal imaging, Pan-Tilt-Zoom (PTZ), dome, and bullet cameras. This multi-faceted segmentation provides a comprehensive framework for analyzing market trends and opportunities.

- By Type:

- Wired Network Cameras

- Wireless Network Cameras

- By Resolution:

- HD Network Cameras

- Full HD Network Cameras

- 4K Network Cameras

- Others (e.g., 5MP, 8MP, 12MP)

- By Sensor Type:

- CMOS Network Cameras

- CCD Network Cameras

- By Application:

- Commercial

- Retail & E-commerce

- Office & Corporate

- Hospitality

- Education

- Banking & Finance

- Healthcare

- Residential

- Government & Public Infrastructure

- Smart Cities

- Traffic Monitoring

- Public Safety

- Critical Infrastructure

- Industrial

- Manufacturing

- Oil & Gas

- Mining

- Others (e.g., Transportation, Logistics)

- Commercial

- By Technology:

- AI-enabled Network Cameras

- Non-AI Network Cameras

- Cloud-based Solutions

- On-premise Solutions

- Thermal Network Cameras

- PTZ (Pan-Tilt-Zoom) Cameras

- Dome Cameras

- Bullet Cameras

- Fisheye Cameras

Regional Highlights

- North America: This region holds a significant market share, driven by a high adoption rate of advanced surveillance technologies, increasing smart home integration, and robust investments in commercial and government security infrastructure. The presence of key market players and a strong focus on cybersecurity also contribute to its dominance. The United States and Canada are leading countries due to their technological readiness and stringent security regulations.

- Europe: Characterized by strong regulatory frameworks concerning data privacy and a mature security market, Europe is a substantial contributor to the network camera market. Growth is fueled by smart city initiatives, rising commercial security demands, and the continuous upgrade of outdated surveillance systems. Countries such as the UK, Germany, and France are at the forefront of adopting AI-powered and cloud-based solutions.

- Asia Pacific (APAC): Expected to witness the highest growth rate during the forecast period, APAC's market expansion is propelled by rapid urbanization, significant infrastructure development, and increasing public and private sector investments in smart city projects and security solutions. China, India, Japan, and South Korea are key markets, driven by mass deployments and local manufacturing capabilities, alongside growing disposable incomes leading to increased residential adoption.

- Latin America: This region presents considerable growth opportunities, primarily due to escalating crime rates, which are spurring demand for enhanced security systems across residential, commercial, and public sectors. Brazil and Mexico are leading the adoption, albeit facing challenges related to economic stability and infrastructure development.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth, largely due to rising investments in tourism, smart city developments, and critical infrastructure projects in countries like UAE, Saudi Arabia, and South Africa. Enhanced security concerns due to geopolitical factors also contribute significantly to the demand for network cameras.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Network Camera Market.- Axis Communications

- Hikvision

- Dahua Technology

- Bosch Security Systems

- Hanwha Vision

- Panasonic

- Mobotix

- Avigilon (Motorola Solutions)

- Vivotek

- Pelco (Motorola Solutions)

- Arecont Vision Costar

- Sony

- Genetec

- IndigoVision

- Honeywell

- Zhejiang Uniview Technologies Co. Ltd.

- Infinova

- Teledyne FLIR

- Digital Watchdog

- Verkada

Frequently Asked Questions

What is a network camera?

A network camera, also known as an IP camera, is a digital video camera that can send and receive video footage and data over a computer network or the internet. Unlike traditional analog cameras, network cameras do not require a local recording device (like a DVR) and can be accessed remotely, offering greater flexibility and advanced features.

How do network cameras differ from traditional CCTV cameras?

Network cameras transmit digital video data over an IP network, allowing for higher resolution, remote accessibility, and advanced features like AI analytics. Traditional CCTV cameras transmit analog signals to a DVR or VCR, offering lower resolution and limited remote access capabilities. Network cameras are generally more scalable, flexible, and feature-rich.

What are the primary applications of network cameras?

Network cameras are widely used across various applications including security and surveillance in commercial buildings, residential properties, and public spaces (e.g., smart cities, traffic monitoring). They are also increasingly deployed for operational intelligence in retail analytics, industrial monitoring, healthcare facility surveillance, and educational institutions.

What role does AI play in network camera technology?

AI significantly enhances network camera capabilities by enabling intelligent features such as accurate object detection and classification, facial recognition, behavioral anomaly detection, and predictive analytics. AI-powered cameras can reduce false alarms, automate alerts, optimize search functions, and provide actionable insights beyond basic video recording, transforming surveillance into a proactive security tool.

What are the main factors driving the growth of the network camera market?

Key growth drivers include rising global security concerns and crime rates, rapid technological advancements (AI, 4K resolution, cloud computing), increasing investments in smart city infrastructure, and the growing demand for remote monitoring solutions. The expanding applications of network cameras beyond traditional security into operational intelligence also contribute significantly to market growth.