Neon Gas Market

Neon Gas Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700865 | Last Updated : July 28, 2025 |

Format : ![]()

![]()

![]()

![]()

Neon Gas Market Size

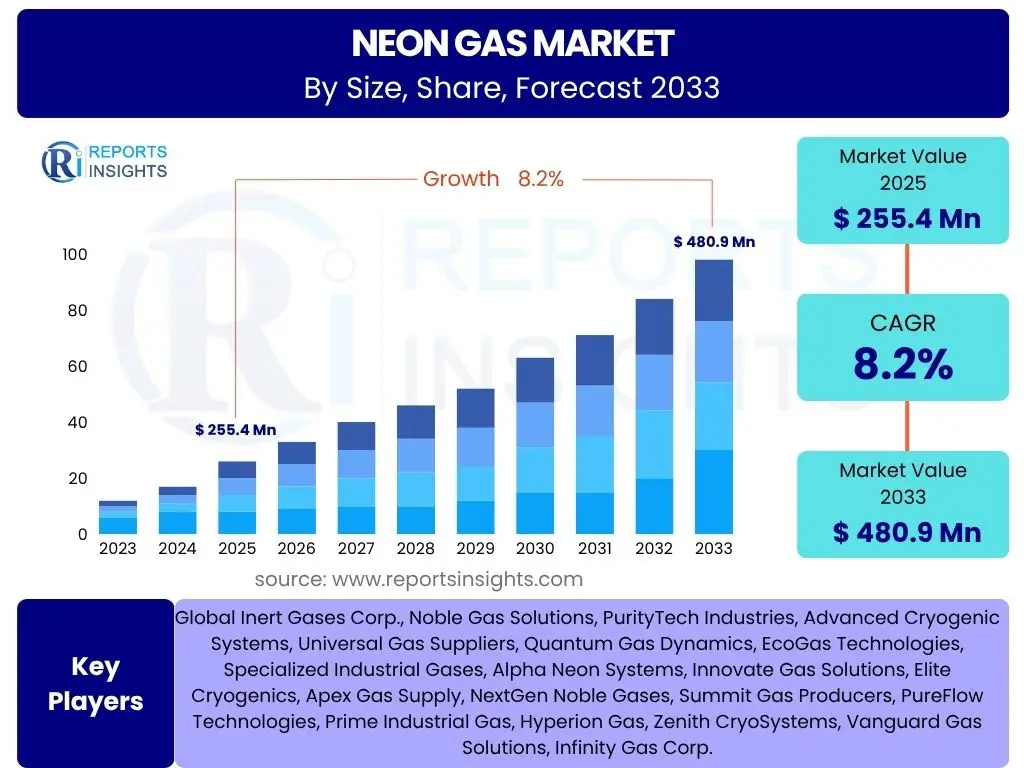

According to Reports Insights Consulting Pvt Ltd, The Neon Gas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2025 and 2033. The market is estimated at USD 255.4 million in 2025 and is projected to reach USD 480.9 million by the end of the forecast period in 2033.

Key Neon Gas Market Trends & Insights

The Neon Gas market is currently experiencing significant shifts driven by technological advancements and evolving industrial demands. Key user inquiries frequently revolve around the impact of next-generation electronics, the stability of the global supply chain, and the emergence of new applications beyond traditional uses. Insights reveal a strong correlation between the market's growth and the booming semiconductor industry, which relies heavily on ultra-high purity neon for advanced lithography. Additionally, the increasing adoption of sophisticated display technologies and a heightened focus on inert gas recycling initiatives are shaping market dynamics, addressing both demand surge and sustainability concerns.

Further analysis highlights a trend towards localized production and diversification of supply sources, a direct response to past geopolitical disruptions that severely impacted global neon availability. Innovation in excimer laser technology, critical for microchip manufacturing, continues to push the boundaries of neon gas purity requirements and consumption patterns. The convergence of these trends suggests a market characterized by high growth in specific high-tech sectors, coupled with strategic efforts to ensure supply resilience and environmental responsibility.

- Exponential growth in the semiconductor industry driving demand for ultra-high purity neon.

- Rising adoption of advanced display technologies such as OLED and MicroLED.

- Increasing focus on neon gas recycling and purification technologies to enhance supply sustainability.

- Diversification of global neon production sources to mitigate geopolitical risks.

- Advancements in excimer laser technology for deeper ultraviolet (DUV) lithography.

- Emergence of new applications in quantum computing and specialized medical devices.

AI Impact Analysis on Neon Gas

Common user questions regarding AI's impact on the Neon Gas market often center on whether AI can optimize production, predict supply chain disruptions, or even influence demand through its role in AI-driven industries. Artificial intelligence is beginning to play a transformative role across the value chain, from raw material sourcing to end-use applications. In manufacturing, AI algorithms are being deployed for predictive maintenance of gas production facilities, optimizing energy consumption, and enhancing the purity assessment processes for neon, thereby reducing waste and improving operational efficiency. This optimization is crucial given the high cost and energy intensity of neon production.

Furthermore, AI-driven analytics are instrumental in forecasting demand trends, especially within the rapidly evolving semiconductor and display industries where AI itself is a key driver of growth. By analyzing vast datasets, AI can provide precise insights into market fluctuations, allowing producers to adjust output and manage inventory more effectively. While AI does not directly consume neon gas, its pervasive influence in advanced electronics manufacturing, including the design and fabrication of AI-specific chips, indirectly fuels the demand for high-purity neon, creating a symbiotic relationship between technological advancement and material consumption.

- AI-driven optimization of neon gas production processes, including energy efficiency and purity control.

- Predictive analytics for demand forecasting in key end-use industries like semiconductors and displays.

- Enhanced supply chain management through AI for real-time risk assessment and logistics optimization.

- Indirect increase in neon gas demand due to the proliferation of AI-specific hardware requiring advanced lithography.

- Facilitation of research and development for new neon applications through AI-powered material science simulations.

Key Takeaways Neon Gas Market Size & Forecast

Users frequently seek a concise understanding of the primary drivers, the overall market outlook, and the most influential sectors within the Neon Gas market. A critical takeaway is the robust growth trajectory, primarily propelled by the insatiable demand from the semiconductor industry for advanced lithography processes, which mandates ultra-high purity neon. This sector's continuous innovation and expansion are foundational to the market's positive forecast, offsetting potential volatility from other segments.

Another significant insight is the increasing emphasis on supply chain resilience and diversification, driven by past geopolitical events that highlighted the fragility of concentrated production sources. This shift indicates a strategic move towards more regionalized production and robust recycling initiatives to ensure consistent supply. The interplay of sustained demand from high-tech applications and proactive measures for supply stability underpins the optimistic market forecast, projecting steady expansion through the forecast period.

- Semiconductor industry expansion remains the paramount growth driver for neon gas.

- Strategic importance of supply chain diversification and resilience in maintaining market stability.

- Ultra-high purity neon demand is set to continue its upward trajectory.

- Recycling technologies are becoming increasingly critical for sustainable neon supply.

- The market is poised for steady growth, driven by technological advancements in electronics.

Neon Gas Market Drivers Analysis

The global Neon Gas market is predominantly driven by the escalating demand from the semiconductor industry. As semiconductor manufacturers push the boundaries of miniaturization and computational power, the reliance on deep ultraviolet (DUV) lithography, which utilizes excimer lasers containing neon, becomes even more critical. Each new generation of microchips, essential for everything from smartphones to artificial intelligence hardware, necessitates higher precision and therefore greater consumption of ultra-high purity neon, forming the bedrock of market expansion.

Beyond semiconductors, the burgeoning market for advanced display technologies, including LCD, OLED, and MicroLED panels, also significantly contributes to neon gas demand. These displays require neon for various manufacturing processes, including plasma etching and panel sealing, as they strive for higher resolution and energy efficiency. Furthermore, niche but growing applications in medical diagnostics, scientific research (e.g., high-energy physics), and specialized cryogenics underscore the versatility and indispensable nature of neon, collectively driving its market growth across diverse high-tech sectors.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Exponential Growth of Semiconductor Industry | +2.5% | Asia Pacific (China, Taiwan, South Korea, Japan), North America (US), Europe (Germany) | 2025-2033 |

| Rising Demand for Advanced Display Technologies | +1.8% | Asia Pacific (South Korea, China, Japan), Europe | 2025-2033 |

| Technological Advancements in Excimer Lasers | +1.5% | North America, Europe, Asia Pacific | 2025-2033 |

| Emergence of New High-Tech Applications | +0.8% | Global, particularly developed economies | 2028-2033 |

Neon Gas Market Restraints Analysis

Despite robust demand, the Neon Gas market faces significant restraints, primarily stemming from the volatility of its supply chain. Historically, a disproportionate share of global neon production originated from a limited number of sources, particularly in Eastern Europe. Geopolitical tensions and regional conflicts have repeatedly disrupted this supply, leading to severe price spikes and supply shortages. This concentration creates inherent market instability, making long-term planning and consistent pricing challenging for end-users and producers alike.

Another major restraint is the high cost associated with neon gas production and purification. Neon is a byproduct of air separation units, and its extraction and subsequent purification to ultra-high levels require highly specialized and energy-intensive processes. The capital expenditure for setting up and maintaining such facilities is substantial, translating into high unit costs for the end product. Furthermore, the limited availability of raw air separation units capable of extracting neon and the complexities of safe transportation add to the operational hurdles, collectively impeding smoother market expansion and potentially stifling new market entrants.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Geopolitical Instability & Supply Chain Volatility | -1.2% | Global, especially Europe & Asia Pacific | 2025-2028 |

| High Production & Purification Costs | -0.9% | Global | 2025-2033 |

| Limited Natural Abundance & Extraction Complexity | -0.7% | Global | 2025-2033 |

| Challenges in Neon Gas Recycling Implementation | -0.5% | Global | 2025-2030 |

Neon Gas Market Opportunities Analysis

The Neon Gas market is poised for significant opportunities, particularly through the continuous advancement and commercialization of new applications. Beyond its established uses in semiconductors and displays, neon is finding nascent roles in fields such as quantum computing, advanced materials research, and specialized medical imaging techniques. These emerging high-growth sectors represent untapped demand pools that could diversify the market's revenue streams and reduce its reliance on a few dominant industries, offering long-term stability and expansion potential.

Furthermore, a major opportunity lies in the development and widespread adoption of more efficient neon gas recycling and recovery technologies. Given neon's high cost and limited natural abundance, improving the efficiency of recycling processes from end-user facilities, especially semiconductor fabs, can significantly enhance supply security and reduce overall production costs. Investment in advanced purification and closed-loop systems represents a strategic move for market players to create more sustainable and resilient supply chains, turning a past challenge into a future competitive advantage. This focus on circular economy principles within the neon gas market will not only address environmental concerns but also foster economic viability by optimizing resource utilization.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced Recycling Technologies | +1.0% | Global, particularly technology-advanced regions | 2026-2033 |

| Emergence of New Applications (e.g., Quantum Computing) | +0.9% | North America, Europe, Asia Pacific (Japan, South Korea) | 2028-2033 |

| Expansion of Semiconductor Manufacturing Capabilities | +0.7% | Asia Pacific (China, India, Southeast Asia) | 2025-2033 |

| Strategic Investments in Diversified Production Sources | +0.6% | Global, emphasis on non-traditional regions | 2025-2030 |

Neon Gas Market Challenges Impact Analysis

The Neon Gas market is confronted by significant challenges, most notably the inherent geopolitical risks that frequently disrupt its highly concentrated supply chain. With a large portion of global neon purification historically tied to a few specific regions, political instability, trade disputes, or armed conflicts can, and have, severely impact availability and cause extreme price volatility. This vulnerability poses a substantial challenge for industries reliant on a stable and affordable supply, forcing them to seek diversification and long-term supply agreements amidst uncertainty.

Furthermore, the high capital investment required for establishing and operating new neon production and purification facilities presents a formidable barrier to entry for potential new market players. The technological sophistication, energy intensity, and specialized infrastructure needed make scaling up production a slow and costly endeavor. This limits the ability of the market to rapidly respond to surges in demand or compensate for supply shortfalls, perpetuating a supply-demand imbalance. Additionally, stringent purity requirements, particularly for semiconductor-grade neon, demand continuous investment in advanced purification technologies, adding to the operational complexities and costs for manufacturers, which further constrains market expansion.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Geopolitical Instability & Supply Concentration | -1.5% | Global, high impact on importing regions | 2025-2029 |

| High Capital Investment for New Production Facilities | -1.0% | Global | 2025-2033 |

| Stringent Purity Requirements for Advanced Applications | -0.8% | Global, especially for high-tech industries | 2025-2033 |

| Energy Intensity of Production & Environmental Concerns | -0.6% | Global | 2025-2033 |

Neon Gas Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Neon Gas market, encompassing historical data from 2019 to 2023, current market estimates for 2025, and robust forecasts extending to 2033. The scope includes detailed segmentation by purity grade, application, and end-use industry, alongside a thorough regional analysis. The report highlights critical market drivers, restraints, opportunities, and challenges, offering strategic insights for stakeholders. It also features an extensive competitive landscape analysis, profiling key industry players and their strategies, designed to provide a holistic view of market dynamics and future growth prospects.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 255.4 million |

| Market Forecast in 2033 | USD 480.9 million |

| Growth Rate | 8.2% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Inert Gases Corp., Noble Gas Solutions, PurityTech Industries, Advanced Cryogenic Systems, Universal Gas Suppliers, Quantum Gas Dynamics, EcoGas Technologies, Specialized Industrial Gases, Alpha Neon Systems, Innovate Gas Solutions, Elite Cryogenics, Apex Gas Supply, NextGen Noble Gases, Summit Gas Producers, PureFlow Technologies, Prime Industrial Gas, Hyperion Gas, Zenith CryoSystems, Vanguard Gas Solutions, Infinity Gas Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Neon Gas market is comprehensively segmented to provide a granular understanding of its diverse applications and purity requirements, allowing stakeholders to identify specific growth areas and market niches. This segmentation reflects the varied demands across different industries, from the extremely stringent purity levels required by semiconductor manufacturing to the more generalized needs of traditional lighting. Understanding these distinct segments is crucial for strategic planning, product development, and targeted market penetration within the complex global neon gas landscape.

By Purity Grade

The purity of neon gas is a critical factor influencing its application and market value. Ultra-High Purity (UHP) neon, typically 99.999% or higher, commands the largest share of the market due to its indispensable role in advanced semiconductor manufacturing. Any impurities in neon used for excimer lasers in lithography can lead to defects on microchips, thus high purity is non-negotiable for leading-edge electronics. The demand for UHP neon is directly correlated with the rapid advancements in chip technology and the expansion of semiconductor fabrication plants globally.

High Purity neon (e.g., 99.99%) and Commercial Grade neon (e.g., 99.9%) serve a wider array of applications that do not require the ultra-stringent specifications of the semiconductor industry. High purity neon finds use in certain types of lasers, specialized lighting, and scientific research where controlled environments are essential but not as critical as chip production. Commercial grade neon, while lower in purity, remains vital for traditional neon signs and some general industrial purposes, providing a cost-effective solution for less demanding uses. The growth in these segments is steady but overshadowed by the explosive growth in UHP demand from the electronics sector.

- Ultra-High Purity Neon (UHP): Essential for advanced semiconductor lithography, ensuring minimal defects and optimal performance in microchip manufacturing. Its demand is directly tied to advancements in chip technology and the production of high-performance processors and memory.

- High Purity Neon: Utilized in lasers for medical and industrial applications, specialized lighting, and scientific instrumentation where precision is important but not at the extreme levels of UHP.

- Commercial Grade Neon: Primarily used for traditional neon signs, voltage regulators, and some general industrial gas mixtures, offering a cost-effective solution for less demanding applications.

By Application

The application landscape for neon gas is dominated by its use in excimer lasers, particularly for deep ultraviolet (DUV) lithography in the semiconductor industry. This process is fundamental to etching intricate patterns onto silicon wafers, enabling the production of microchips that power modern electronics. The continuous drive for smaller, more powerful, and energy-efficient chips directly translates into sustained and increasing demand for neon in this critical application, making it the largest and most valuable segment.

Display panels represent another significant application, where neon is used in the manufacturing of LCD, OLED, and plasma displays. It contributes to various processes such as plasma etching and creating specific lighting effects that enhance picture quality and efficiency. While traditional neon lighting and signs remain a visible application, their growth is more modest compared to high-tech uses. Additionally, neon finds niche applications in cryogenics due to its low boiling point and inertness, medical and healthcare sectors for specialized diagnostic tools and research, and various other scientific and industrial purposes.

- Excimer Lasers: Critical component in deep ultraviolet (DUV) lithography for semiconductor manufacturing, enabling the creation of intricate patterns on microchips. This is the largest and fastest-growing application segment.

- Display Panels: Employed in the production of LCD, OLED, and plasma displays for improved image quality, color rendition, and manufacturing efficiency.

- Neon Lighting & Signs: Traditional and aesthetic application, maintaining a stable demand for decorative and advertising purposes due to its distinctive glow.

- Cryogenics: Used as a refrigerant in specialized low-temperature applications, including scientific research and certain industrial processes, owing to its inertness and low boiling point.

- Medical & Healthcare: Utilized in certain diagnostic tools, medical lasers, and research applications, particularly in advanced imaging and analytical instrumentation.

- Others: Includes applications in research & development, aerospace (as an inert atmosphere), particle detection, and specialized industrial gas mixtures.

By End-Use Industry

The electronics and semiconductors industry stands as the primary end-user for neon gas, accounting for the lion's share of market demand. This industry's relentless pursuit of technological advancements, particularly in integrated circuits, memory chips, and processors, directly fuels the need for ultra-high purity neon in lithography processes. The global expansion of semiconductor fabrication capacities and the increasing complexity of chip designs ensure that this segment will continue to be the cornerstone of the neon gas market's growth, making it a critical focus area for suppliers.

The display and lighting industry also represents a substantial end-use segment, encompassing manufacturers of televisions, computer monitors, smartphones, and various lighting solutions. The transition towards more sophisticated display technologies, such as OLED and MicroLED, ensures a consistent demand for neon gas in their production. Furthermore, the healthcare sector utilizes neon in medical device manufacturing, diagnostic equipment, and specialized research. Other notable end-use industries include aerospace and defense, where neon's inert properties are valued, and various research and development institutions that explore novel applications for noble gases.

- Electronics & Semiconductors: The largest and most significant consumer, driven by the demand for advanced microchips, memory devices, integrated circuits, and other electronic components requiring precise manufacturing processes.

- Display & Lighting: Includes manufacturers of flat-panel displays (LCD, OLED), televisions, smartphones, monitors, and various lighting solutions, relying on neon for production and illumination.

- Healthcare: Encompasses medical device manufacturers, research institutions, and diagnostic centers utilizing neon gas in specialized equipment, lasers, and analytical tools.

- Aerospace & Defense: For specialized applications requiring inert gas environments, advanced instrumentation, or low-temperature capabilities in sensitive systems.

- Research & Development: Academic and private research institutions exploring new applications for noble gases in areas such as quantum physics, material science, and cryogenics.

Regional Highlights

North America

North America holds a significant position in the Neon Gas market, characterized by its mature technological infrastructure and a strong presence of leading semiconductor manufacturers and research institutions, particularly in the United States. The region is a hub for innovation in advanced electronics, which directly translates into a high demand for ultra-high purity neon. Investments in domestic semiconductor fabrication facilities, driven by national security and economic competitiveness objectives, are further solidifying the region's role as a major consumer.

The United States, in particular, is a key driver due to its robust aerospace and defense sectors, advanced medical research facilities, and a growing emphasis on next-generation computing technologies like quantum computing. While not a primary producer of raw neon, North America plays a crucial role in its purification, distribution, and end-use, with significant R&D activities focused on enhancing neon gas recycling and optimizing its application in cutting-edge technologies.

- United States: A major hub for semiconductor manufacturing, advanced research and development in quantum computing, and a significant end-user across electronics and healthcare sectors.

- Canada: Growing presence in specialized industrial applications and scientific research, contributing to regional demand.

Europe

Europe represents a crucial market for Neon Gas, supported by a strong industrial base, extensive research and development activities, and a developing ecosystem for semiconductor manufacturing. Countries like Germany and France have established industries in machinery, automotive electronics, and advanced materials, which drive a consistent demand for high-purity gases, including neon. The region's focus on technological innovation and environmental sustainability also encourages the adoption of more efficient neon gas recovery and recycling processes.

The European market is also influenced by its significant presence in laser technology, particularly for industrial and medical applications, where neon is a key component. While facing challenges related to supply chain stability due to historical reliance on specific external sources, European players are increasingly exploring diversification strategies and investing in local purification capabilities to enhance supply security and resilience. Research institutions across the continent are also actively exploring new applications for noble gases, contributing to future demand.

- Germany: Strong manufacturing base in machinery, automotive, and optics, driving demand for neon in industrial lasers and specialized applications.

- United Kingdom: Significant research activities in advanced materials and electronics, coupled with a developing domestic semiconductor strategy.

- France: Emerging presence in advanced materials and industrial applications, with a focus on high-tech manufacturing.

Asia Pacific (APAC)

The Asia Pacific region dominates the global Neon Gas market, primarily due to its unparalleled concentration of electronics manufacturing, semiconductor fabrication, and display panel production facilities. Countries such as China, South Korea, Japan, and Taiwan are global leaders in these industries, creating an immense and continuously growing demand for ultra-high purity neon. China, in particular, is both a massive consumer and an increasingly important producer, significantly influencing global supply and demand dynamics.

South Korea and Taiwan are home to some of the world's largest memory chip and foundry manufacturers, making them critical markets for neon gas consumption in advanced lithography. Japan boasts a highly advanced technology landscape, with strong semiconductor equipment manufacturers and a robust R&D sector. The rapid industrialization, increasing disposable incomes, and the widespread adoption of electronic devices across the region ensure that APAC will remain the primary growth engine for the neon gas market throughout the forecast period, despite potential geopolitical complexities affecting supply chains.

- China: Largest consumer and rapidly expanding producer, driven by massive electronics manufacturing and a burgeoning domestic semiconductor industry.

- South Korea: A global leader in memory chip and display panel production, with significant neon consumption for advanced manufacturing.

- Japan: Advanced technology landscape, strong in semiconductor equipment manufacturing and high-tech R&D, contributing to steady neon demand.

- Taiwan: Dominant in semiconductor foundry services, making it a critical market for ultra-high purity neon consumption.

- India: Emerging electronics manufacturing base and growing interest in semiconductor fabrication, indicating future potential.

Latin America

The Latin American Neon Gas market is currently nascent but shows potential for gradual growth, driven by developing industrial bases and increasing investments in technology. While the region does not host major semiconductor fabrication plants, there is a growing presence of electronics assembly and manufacturing operations, particularly in countries like Mexico and Brazil. This industrial expansion, coupled with a rising demand for consumer electronics, contributes to a modest but expanding requirement for neon gas, primarily for display and lighting applications.

Economic diversification efforts and a focus on industrial development across various Latin American countries are expected to gradually increase the demand for specialized gases, including neon. The market remains relatively small compared to other regions, but opportunities exist for suppliers to establish distribution networks and cater to niche industrial and research applications as the region's technological capabilities mature and local industries expand.

- Brazil: The largest economy in the region, with developing industrial and electronics sectors driving initial demand.

- Mexico: A growing manufacturing hub, particularly in electronics assembly and automotive production, leading to increased industrial gas consumption.

Middle East and Africa (MEA)

The Middle East and Africa (MEA) region represents an emerging market for Neon Gas, with growth prospects primarily linked to ongoing industrial diversification initiatives and increasing technological adoption. While traditional demand has been limited, significant investments in infrastructure, manufacturing, and smart city projects, particularly in the GCC countries, are fostering an environment conducive to industrial gas consumption. The push towards reducing reliance on oil and gas exports is leading to the development of new high-tech industries that may require specialized gases like neon.

South Africa, with its relatively developed industrial base, and countries like the UAE and Saudi Arabia, with ambitious vision programs (e.g., Vision 2030), are spearheading industrial and technological growth. These initiatives are expected to gradually create new demand avenues for neon gas in sectors such as specialized manufacturing, research, and potentially even nascent electronics assembly. The market, though currently small, is poised for incremental growth as the region's industrial landscape continues to evolve and modernize.

- UAE: Significant investments in technology, tourism, and industrial diversification, creating potential for future demand.

- Saudi Arabia: Vision 2030 initiatives fostering industrial and technological growth across various sectors.

- South Africa: Developing industrial base with potential for specialized gas applications in manufacturing and research.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neon Gas Market.- Global Inert Gases Corp.

- Noble Gas Solutions

- PurityTech Industries

- Advanced Cryogenic Systems

- Universal Gas Suppliers

- Quantum Gas Dynamics

- EcoGas Technologies

- Specialized Industrial Gases

- Alpha Neon Systems

- Innovate Gas Solutions

- Elite Cryogenics

- Apex Gas Supply

- NextGen Noble Gases

- Summit Gas Producers

- PureFlow Technologies

- Prime Industrial Gas

- Hyperion Gas

- Zenith CryoSystems

- Vanguard Gas Solutions

- Infinity Gas Corp.

Frequently Asked Questions

What is neon gas primarily used for in the current market?

Neon gas is primarily used in the semiconductor industry for deep ultraviolet (DUV) lithography, a critical process in manufacturing microchips. It is also extensively used in the production of advanced display panels (LCD, OLED), traditional neon lighting, and in various scientific and medical applications.

Why is neon gas so important for the semiconductor industry?

Neon gas is crucial for the semiconductor industry because it is a key component in excimer lasers, which are used in DUV lithography to etch extremely fine patterns onto silicon wafers. The high purity of neon is essential for achieving the precision required to produce advanced microchips, which power modern electronic devices.

What are the main factors driving the growth of the Neon Gas market?

The primary drivers include the exponential growth of the semiconductor industry, increasing demand for advanced display technologies (OLED, MicroLED), continuous advancements in excimer laser technology, and the emergence of new high-tech applications in fields like quantum computing and specialized medical devices.

How do geopolitical events impact the global neon gas supply?

Geopolitical events significantly impact the global neon gas supply due to its highly concentrated production, historically centered in a few regions. Disruptions from conflicts or political instability can lead to severe supply shortages and extreme price volatility, highlighting the need for supply chain diversification.

What role does recycling play in the future of the Neon Gas market?

Recycling is becoming increasingly vital for the Neon Gas market's future. Given neon's high cost and limited natural abundance, developing and implementing more efficient recycling and recovery technologies from end-user facilities is crucial for ensuring sustainable supply, reducing production costs, and mitigating environmental impact.