Low Density SLC NAND Flash Memory Market

Low Density SLC NAND Flash Memory Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_706774 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Low Density SLC NAND Flash Memory Market Size

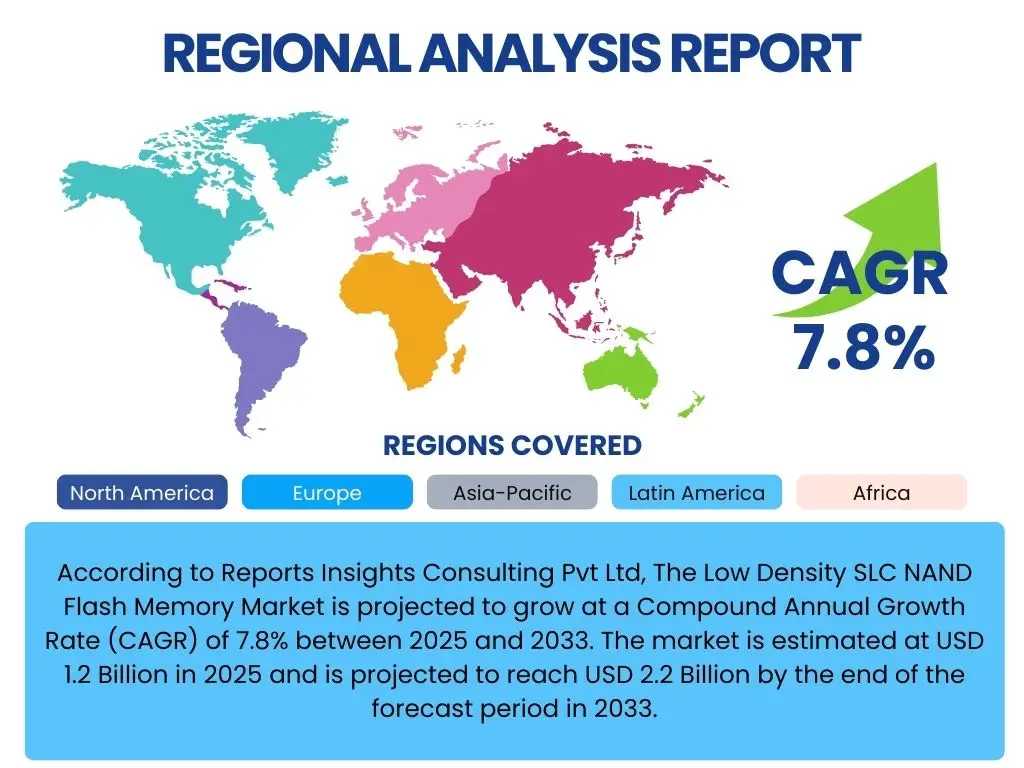

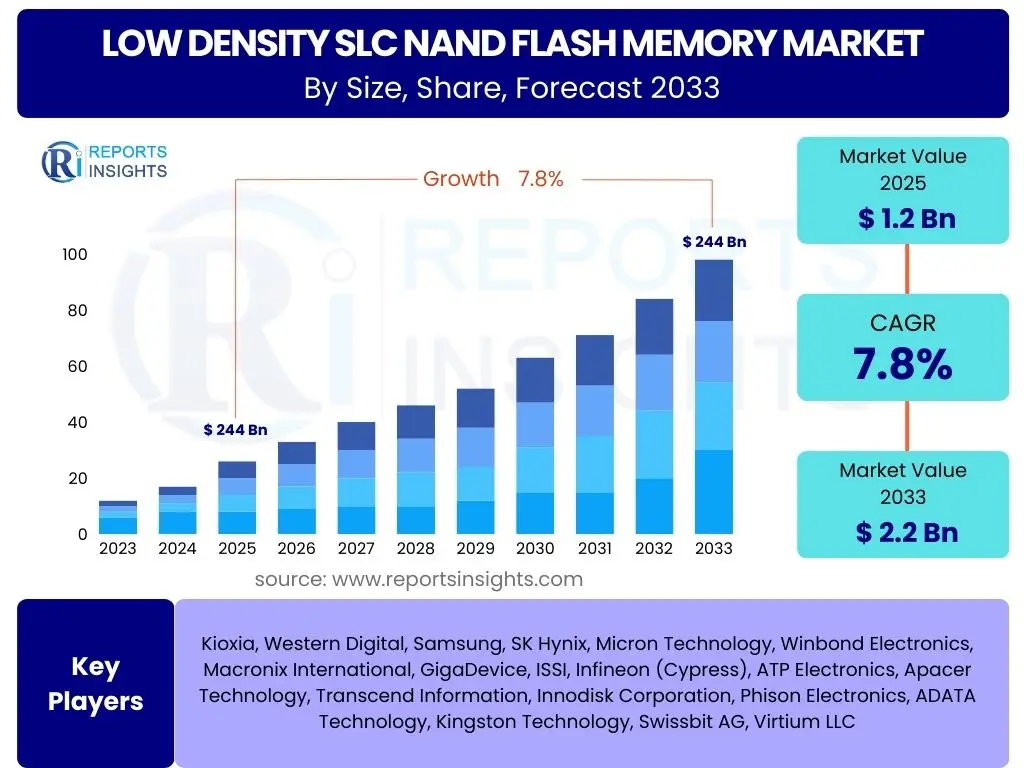

According to Reports Insights Consulting Pvt Ltd, The Low Density SLC NAND Flash Memory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 1.2 Billion in 2025 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

Key Low Density SLC NAND Flash Memory Market Trends & Insights

Common user inquiries regarding Low Density SLC NAND Flash Memory market trends frequently center on its sustained relevance amidst advancements in higher-density flash technologies. Users are keen to understand how this niche segment maintains its growth, what applications are driving demand, and whether new technological refinements are emerging. The analysis indicates that the market is characterized by a persistent need for highly reliable, durable, and stable data storage solutions, particularly in industrial, automotive, and specialized embedded systems where data integrity and longevity are paramount.

A significant trend is the increasing integration of Low Density SLC NAND in critical infrastructure, including industrial automation, smart grid components, and advanced medical devices. These applications demand memory solutions that can withstand harsh operating environments, extreme temperatures, and offer extended product lifecycles, attributes that Low Density SLC NAND inherently provides. Furthermore, the rising proliferation of edge computing and the Internet of Things (IoT) is fueling demand for robust boot code storage and firmware execution, solidifying SLC NAND's position in these growing ecosystems. The focus on supply chain resilience and long-term availability for industrial-grade components also underpins its continued adoption.

- Increasing adoption in industrial automation and IoT edge devices for critical boot and firmware storage.

- Rising demand from the automotive sector for reliable and durable memory in infotainment, ADAS, and engine control units.

- Growing emphasis on extended product lifecycles and long-term supply stability for industrial and medical applications.

- Continued preference for high endurance and data retention capabilities over cost per bit in mission-critical systems.

- Advancements in flash controller technology to further optimize SLC NAND performance and lifespan.

AI Impact Analysis on Low Density SLC NAND Flash Memory

User questions related to the impact of AI on Low Density SLC NAND Flash Memory predominantly revolve around whether AI's exponential growth directly translates into increased demand for SLC NAND, especially concerning edge AI applications. Users inquire about the specific roles SLC NAND plays within AI ecosystems, given its traditional use in low-density, high-reliability scenarios. The analysis reveals that while high-performance AI training typically utilizes different memory architectures, edge AI inference and embedded AI systems present a compelling use case for SLC NAND due to its inherent reliability, endurance, and low power consumption, crucial for local data processing and secure boot functionalities.

The proliferation of AI at the edge necessitates robust, non-volatile memory for storing AI models, boot code, and critical system firmware directly on devices with limited power and computational resources. Low Density SLC NAND is ideally suited for these applications, offering the stability required for continuous operation and resistance to environmental factors often encountered in edge deployments. Its capability to handle frequent read/write cycles and maintain data integrity over extended periods makes it a preferred choice for ensuring the reliable operation of AI-enabled sensors, industrial robots, and autonomous systems. This niche but critical role ensures a steady demand for SLC NAND within the broader AI landscape.

- Increased demand for reliable, high-endurance storage in edge AI devices for boot code, firmware, and small AI models.

- SLC NAND's suitability for mission-critical AI applications requiring robust data integrity and extended operational lifecycles.

- Role in secure boot and system initialization for AI-enabled industrial and automotive systems.

- Preference in low-power and resource-constrained AI environments due to its efficient design.

- Contribution to the longevity and stability of AI hardware in demanding environmental conditions.

Key Takeaways Low Density SLC NAND Flash Memory Market Size & Forecast

Common user questions regarding key takeaways from the Low Density SLC NAND Flash Memory market size and forecast often focus on understanding the primary drivers of its growth despite competition from higher-density solutions. Users seek clarity on which sectors will contribute most significantly to market expansion and what fundamental aspects distinguish this market's trajectory. The insights reveal that the market's stability and projected growth are firmly rooted in its indispensable role within specialized, high-reliability applications where performance, endurance, and data integrity outweigh the cost per bit considerations typically associated with consumer-grade flash memory.

The market is poised for consistent expansion, driven by the escalating demand from industrial, automotive, and medical sectors, which prioritize the inherent benefits of SLC NAND such as its superior write endurance, data retention, and robust performance across wide temperature ranges. Unlike the volatile consumer electronics memory market, the Low Density SLC NAND segment demonstrates resilience, supported by long product lifecycles and the critical nature of its applications. Strategic partnerships between manufacturers and long-term component suppliers are becoming increasingly vital to ensure steady supply and support for these demanding industries, further solidifying the market's predictable growth path.

- Consistent growth is primarily driven by industrial, automotive, and specialized embedded applications.

- SLC NAND's high endurance and reliability remain critical differentiators, ensuring demand in mission-critical systems.

- The market exhibits relative stability compared to higher-density flash markets, due to long product lifecycles and niche demands.

- Supply chain robustness and long-term availability are key factors influencing procurement decisions in target industries.

- Innovation in controller technology is expected to further enhance SLC NAND's performance and broaden its applicability.

Low Density SLC NAND Flash Memory Market Drivers Analysis

The Low Density SLC NAND Flash Memory market is propelled by a confluence of factors, predominantly stemming from the increasing demand for highly reliable and durable storage solutions across critical industrial and automotive sectors. These industries necessitate memory components that can withstand extreme environmental conditions, offer extended operational lifecycles, and guarantee data integrity under continuous read/write cycles, making SLC NAND a preferred choice. The burgeoning landscape of industrial IoT, coupled with the need for robust embedded systems, further accentuates the demand for memory solutions with superior endurance and reliability, which SLC NAND inherently provides.

Moreover, the stringent quality and safety standards in sectors such as medical devices and aerospace and defense mandate the use of memory technologies with proven longevity and consistent performance. SLC NAND's architecture, characterized by its single bit per cell, minimizes error rates and extends the operational lifespan significantly compared to multi-level cell technologies. This inherent reliability positions SLC NAND as a cornerstone technology for applications where failure is not an option, contributing significantly to its sustained market demand and growth trajectory. The ongoing development of sophisticated embedded systems across various sectors also drives the need for reliable boot media and code storage, which Low Density SLC NAND efficiently fulfills.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand from Industrial IoT and Automation | +1.8% | Global, particularly North America, Europe, Asia Pacific | 2025-2033 |

| Rising Adoption in Automotive Electronics | +1.5% | Global, particularly Germany, Japan, China, USA | 2025-2033 |

| Growing Need for High Reliability and Endurance in Embedded Systems | +1.2% | Global | 2025-2033 |

| Expansion of Medical and Aerospace & Defense Applications | +0.8% | North America, Europe | 2025-2033 |

| Long-Term Product Lifecycle Requirements | +0.5% | Global | 2025-2033 |

Low Density SLC NAND Flash Memory Market Restraints Analysis

Despite its critical role in specialized applications, the Low Density SLC NAND Flash Memory market faces several restraints that could temper its growth rate. A primary limiting factor is its relatively higher cost per bit when compared to higher-density NAND solutions such as MLC (Multi-Level Cell) or TLC (Triple-Level Cell). While SLC offers superior performance and endurance, its lower storage capacity per die inherently translates to a higher manufacturing cost per unit of data, making it less attractive for cost-sensitive applications that do not require its specific high-endurance characteristics.

Furthermore, the continuous advancements in alternative memory technologies, including high-endurance eMMC (embedded Multi-Media Card) and certain types of SPI NOR flash, present competitive pressures. For some applications that require moderate endurance but are highly cost-constrained, these alternatives can offer a more economically viable solution. The inherently limited capacity of Low Density SLC NAND also restricts its applicability to scenarios where only small amounts of critical data or boot code need to be stored, preventing its penetration into applications demanding large-scale data storage. This narrow scope, coupled with potential manufacturing complexities for older process nodes, forms a significant restraint on its broader market expansion.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Higher Cost per Bit Compared to High-Density NAND | -1.0% | Global | 2025-2033 |

| Limited Storage Capacity | -0.7% | Global | 2025-2033 |

| Competition from Alternative Memory Technologies (e.g., high-endurance eMMC, SPI NOR) | -0.5% | Global | 2025-2033 |

| Decreasing Number of Manufacturers for Older Process Nodes | -0.3% | Global | 2025-2033 |

Low Density SLC NAND Flash Memory Market Opportunities Analysis

Significant opportunities exist within the Low Density SLC NAND Flash Memory market, largely driven by the evolving technological landscape and the increasing demand for specialized, high-performance computing at the edge. The burgeoning fields of artificial intelligence (AI) and machine learning (ML), particularly in edge computing scenarios, create a compelling need for memory solutions that offer both reliability and endurance for local data processing and secure boot functionalities. As more devices become intelligent and require onboard processing capabilities, the demand for robust embedded memory like SLC NAND for firmware and critical data storage is expected to surge, opening new avenues for market growth.

Furthermore, the continuous expansion of industrial IoT and the advent of Industry 4.0 initiatives present substantial growth opportunities. These advancements rely heavily on interconnected, intelligent devices that operate in often harsh industrial environments, demanding memory solutions that can guarantee data integrity and long-term reliability. The automotive sector's ongoing transition towards autonomous vehicles and advanced driver-assistance systems (ADAS) also offers a fertile ground for SLC NAND, where mission-critical functions require unparalleled memory stability. Additionally, niche markets within the medical, aerospace, and defense sectors continue to evolve, requiring highly specialized and dependable memory components, creating enduring demand for SLC NAND where its unique attributes are irreplaceable.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Adoption of Edge Computing and AI Devices | +1.5% | Global | 2025-2033 |

| Expansion of Industrial IoT and Industry 4.0 Initiatives | +1.2% | Global, particularly Asia Pacific, Europe | 2025-2033 |

| Increased Demand in Autonomous Vehicles and ADAS | +1.0% | North America, Europe, Asia Pacific | 2025-2033 |

| Development of New Niche Applications in Medical and Defense | +0.8% | North America, Europe | 2025-2033 |

| Advancements in Flash Controller Technologies | +0.5% | Global | 2025-2033 |

Low Density SLC NAND Flash Memory Market Challenges Impact Analysis

The Low Density SLC NAND Flash Memory market faces several inherent challenges that require strategic navigation for sustained growth. One significant challenge is the ongoing pricing pressure from higher-density NAND flash technologies, which offer a much lower cost per gigabyte. While SLC NAND serves a distinct niche, the broader memory market's focus on cost-efficiency often leads to perceived value gaps, making it difficult to justify the higher per-bit cost of SLC for applications that might compromise on endurance for cost savings. This constant pressure necessitates continuous innovation in manufacturing processes and controller design to maintain a competitive edge.

Another critical challenge is maintaining a stable and reliable supply chain for a specialized product with potentially fewer manufacturers compared to mainstream memory types. Geopolitical factors, natural disasters, and unexpected shifts in demand or production capacity can significantly impact availability and pricing, leading to supply volatilities. Furthermore, the limited scalability of SLC NAND beyond certain capacities restricts its addressable market, preventing its adoption in applications requiring extensive storage. Ensuring long-term support and obsolescence management for industrial customers with product lifecycles extending over a decade also presents an ongoing challenge for manufacturers in this segment, requiring robust product roadmaps and commitment.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Pricing Pressure from Higher-Density NAND Technologies | -0.8% | Global | 2025-2033 |

| Supply Chain Volatility and Raw Material Costs | -0.6% | Global | 2025-2033 |

| Limited Scalability Beyond Niche Capacities | -0.5% | Global | 2025-2033 |

| Maintaining Long-Term Product Support and Obsolescence Management | -0.4% | Global | 2025-2033 |

Low Density SLC NAND Flash Memory Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Low Density SLC NAND Flash Memory market, covering its historical performance, current dynamics, and future projections. The scope encompasses detailed insights into market size, growth trends, key drivers, significant restraints, emerging opportunities, and critical challenges impacting the industry. It further breaks down the market by various segments including type, capacity, and application, alongside a thorough regional analysis. The report also features a competitive landscape section, profiling leading market players and their strategies, offering a holistic view for stakeholders seeking to understand and capitalize on this specialized memory market.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 7.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Kioxia, Western Digital, Samsung, SK Hynix, Micron Technology, Winbond Electronics, Macronix International, GigaDevice, ISSI, Infineon (Cypress), ATP Electronics, Apacer Technology, Transcend Information, Innodisk Corporation, Phison Electronics, ADATA Technology, Kingston Technology, Swissbit AG, Virtium LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Low Density SLC NAND Flash Memory market is comprehensively segmented to provide a granular understanding of its diverse applications and product variations. This segmentation helps in identifying specific growth pockets and market dynamics across different product types, capacities, and end-use industries. The fundamental categories include segmentation by type, which often delineates between parallel and serial interfaces, influencing their integration into various system architectures. Each type caters to specific performance requirements and board design considerations, driving differentiated demand within the market.

Further segmentation by capacity provides insights into the prevailing demand for various storage sizes, ranging from very small capacities suitable for boot code and configuration data to moderately larger ones for firmware and operating systems in embedded devices. The application-based segmentation is crucial, highlighting the primary industries driving demand for SLC NAND, such as industrial automation, automotive electronics, and medical devices. This granular analysis ensures that stakeholders can pinpoint high-growth areas and tailor their strategies to address the unique needs of each segment, optimizing product development and market penetration efforts within this specialized memory sector.

- By Type:

- Parallel NAND: Offers higher throughput, typically used where speed is critical for data access.

- Serial NAND: Provides simplified interface and lower pin count, ideal for space-constrained and cost-sensitive applications.

- By Capacity:

- Up to 2Gb: Commonly used for boot code, firmware, and small configuration files.

- 2Gb-8Gb: Suitable for operating systems, application code, and essential data logging.

- 8Gb and Above: Utilized in more complex embedded systems requiring larger persistent storage.

- By Application:

- Industrial: Robotics, factory automation, smart grids, industrial PCs, control systems.

- Automotive: Infotainment systems, ADAS, engine control units, telematics, navigation.

- Consumer Electronics: High-end wearables, certain smart home devices, digital cameras (niche).

- Medical: Diagnostic equipment, patient monitoring systems, portable medical devices.

- Telecommunications: Routers, switches, base stations, network infrastructure.

- Other Specialized Applications: Aerospace and defense, energy management, security systems.

Regional Highlights

- North America: This region demonstrates strong demand driven by its robust industrial automation sector, significant investments in automotive electronics, and a burgeoning market for edge computing and AI-enabled embedded systems. The presence of key technology developers and a strong focus on high-reliability applications in defense and aerospace further contribute to its market share.

- Europe: Europe is a key market, particularly due to its advanced automotive industry, strong industrial manufacturing base, and stringent regulatory requirements that favor high-quality and durable electronic components. Germany, in particular, stands out with its leadership in industrial IoT and automotive innovation.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid industrialization, expanding manufacturing capabilities, and increasing adoption of IoT across various sectors. Countries like China, Japan, South Korea, and Taiwan are significant hubs for electronics manufacturing and R&D, leading to high consumption and production of Low Density SLC NAND.

- Latin America: While smaller in market share, Latin America shows emerging opportunities, especially with growing investments in industrial infrastructure, smart cities initiatives, and increasing automotive production. The region's developing manufacturing base will gradually contribute to demand.

- Middle East and Africa (MEA): The MEA region is expected to witness steady growth, driven by investments in smart infrastructure, telecommunications expansion, and diversification of economies into manufacturing and technology sectors. Applications in energy management and security systems are notable.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Density SLC NAND Flash Memory Market.- Kioxia

- Western Digital

- Samsung

- SK Hynix

- Micron Technology

- Winbond Electronics

- Macronix International

- GigaDevice

- Integrated Silicon Solution Inc. (ISSI)

- Infineon Technologies (formerly Cypress Semiconductor)

- ATP Electronics

- Apacer Technology

- Transcend Information

- Innodisk Corporation

- Phison Electronics

- ADATA Technology

- Kingston Technology

- Swissbit AG

- Virtium LLC

- Alliance Memory

Frequently Asked Questions

Analyze common user questions about the Low Density SLC NAND Flash Memory market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes Low Density SLC NAND Flash Memory from other NAND types?

Low Density SLC NAND (Single-Level Cell) stores one bit of data per cell, offering superior endurance, data retention, and reliability compared to MLC (Multi-Level Cell) or TLC (Triple-Level Cell) NAND, which store multiple bits per cell. This makes SLC ideal for mission-critical applications requiring long lifespan and high data integrity, despite its higher cost per bit and lower density.

What are the primary applications for Low Density SLC NAND Flash Memory?

Primary applications include industrial automation, automotive electronics (e.g., infotainment, ADAS, ECUs), medical devices, telecommunication infrastructure, and specialized embedded systems. It is preferred for boot code, firmware storage, and data logging in harsh environments due to its robustness and endurance.

How does the endurance of SLC NAND compare to MLC or TLC NAND?

SLC NAND offers significantly higher endurance, typically achieving 60,000 to 100,000 P/E (program/erase) cycles per block, or even more. In contrast, MLC NAND typically offers 3,000-10,000 P/E cycles, and TLC NAND offers 500-3,000 P/E cycles. This superior endurance is crucial for applications involving frequent data writes.

What is the expected growth trajectory for the Low Density SLC NAND Flash Memory market?

The Low Density SLC NAND Flash Memory market is projected to experience steady and stable growth, with a CAGR of 7.8% between 2025 and 2033. This growth is primarily driven by persistent demand from industrial, automotive, and specialized embedded sectors where reliability and longevity are paramount, ensuring its niche market expansion.

Which industries are the major consumers of Low Density SLC NAND Flash Memory?

The major consumer industries for Low Density SLC NAND Flash Memory are industrial (e.g., factory automation, IoT, smart grids), automotive (for critical vehicle systems), and medical devices (e.g., diagnostic equipment, patient monitors). These sectors prioritize the high reliability, endurance, and extended temperature range capabilities of SLC NAND.