Last Mile Delivery Market

Last Mile Delivery Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700841 | Last Updated : July 28, 2025 |

Format : ![]()

![]()

![]()

![]()

Last Mile Delivery Market Size

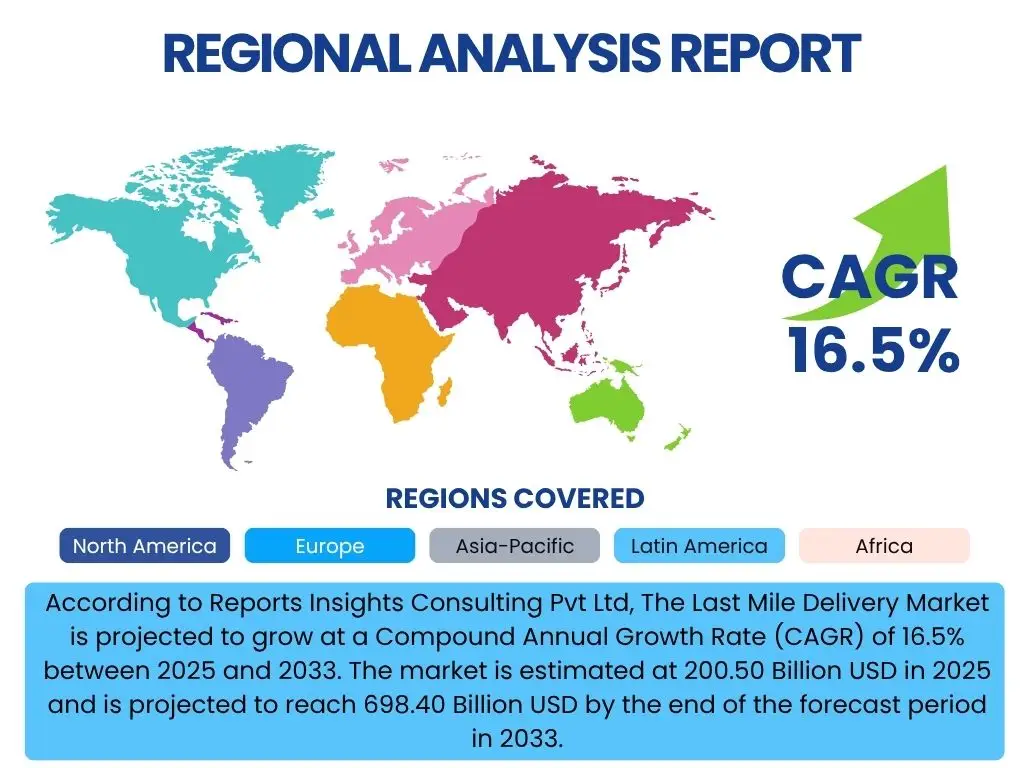

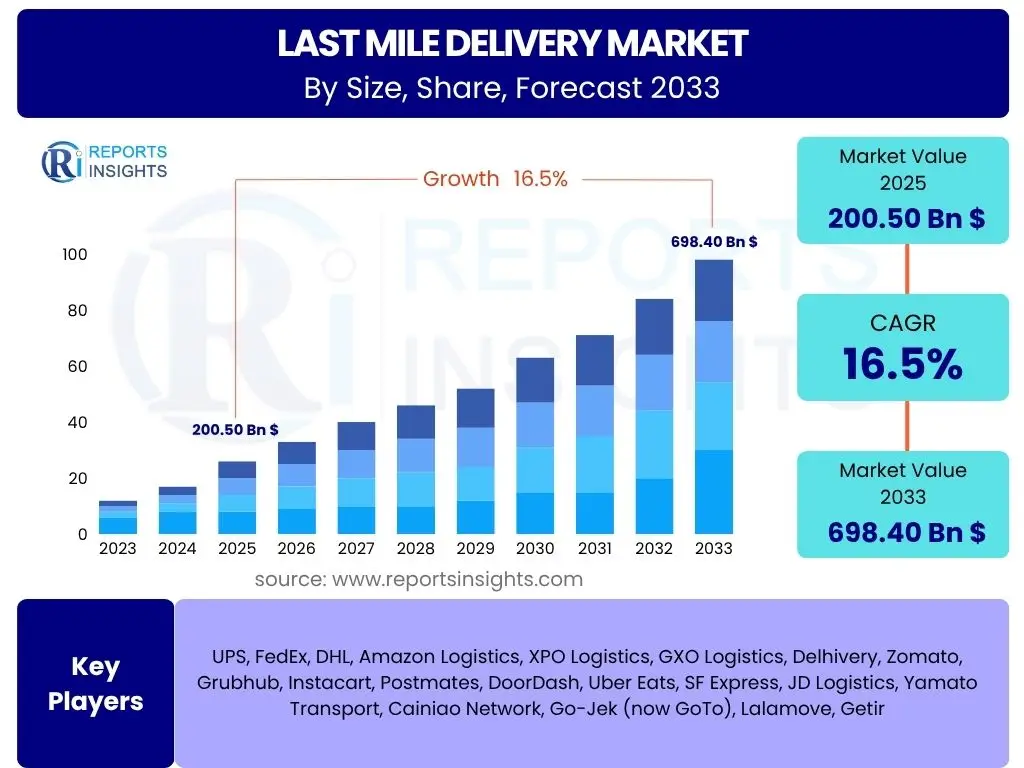

According to Reports Insights Consulting Pvt Ltd, The Last Mile Delivery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2025 and 2033. The market is estimated at 200.50 Billion USD in 2025 and is projected to reach 698.40 Billion USD by the end of the forecast period in 2033.

Key Last Mile Delivery Market Trends & Insights

Common user inquiries concerning the Last Mile Delivery market frequently focus on the evolving operational paradigms and technological advancements shaping its future. Users are keen to understand how global events and shifts in consumer behavior are influencing delivery expectations, alongside the integration of sustainable practices. There is significant interest in how companies are adapting to increasing demand for speed and convenience, while also managing costs and environmental impact.

The market is witnessing a profound transformation driven by digital innovation and a heightened focus on efficiency. Trends indicate a clear shift towards automated processes, real-time visibility, and more flexible delivery options that cater to immediate consumer needs. Furthermore, the emphasis on ecological responsibility is leading to widespread adoption of greener logistics solutions, redefining traditional last mile operations.

- Hyper-Personalized Delivery: Tailored delivery slots, locations, and methods enhancing customer experience.

- Sustainable Logistics Adoption: Increased use of electric vehicles, cargo bikes, and optimized routing to reduce carbon footprint.

- Automation and Robotics: Deployment of autonomous mobile robots (AMRs), drones, and automated sorting centers for efficiency.

- Gig Economy Integration: Leveraging flexible labor models for scalable and on-demand delivery services.

- Micro-Fulfillment Centers: Establishing smaller, strategically located warehouses to reduce delivery distances and times.

- Data Analytics and AI: Advanced analytics for predictive routing, demand forecasting, and operational optimization.

- Evolving Delivery Models: Expansion of click-and-collect, locker systems, and drone delivery for diverse consumer preferences.

AI Impact Analysis on Last Mile Delivery

Users frequently inquire about the transformative potential of Artificial Intelligence (AI) in revolutionizing Last Mile Delivery. Key questions revolve around how AI can enhance efficiency, reduce costs, and improve customer satisfaction. There is a strong interest in AI's role in predictive analytics for demand forecasting, dynamic route optimization, and autonomous delivery solutions, highlighting expectations for a smarter, more responsive logistics ecosystem. Concerns often include data privacy, the initial investment required, and the displacement of human labor.

AI's influence on Last Mile Delivery is multifaceted, extending from operational intelligence to strategic planning. It enables logistics providers to move beyond reactive problem-solving to proactive optimization, leveraging vast datasets to predict traffic patterns, optimize loading capacities, and even anticipate potential delivery delays. This proactive approach significantly enhances efficiency, reduces fuel consumption, and allows for more precise resource allocation, ultimately leading to improved delivery times and reduced operational expenditure. The technology also plays a crucial role in enabling autonomous delivery systems, such as drones and ground robots, which promise to redefine delivery paradigms in urban and remote areas.

- Route Optimization: AI algorithms analyze real-time traffic, weather, and delivery schedules to identify the most efficient routes.

- Predictive Analytics: Forecasting demand, peak hours, and potential delays to proactively manage resources and inventory.

- Autonomous Delivery Systems: Powering drones and ground robots for automated delivery, reducing human intervention and costs.

- Warehouse and Inventory Management: Optimizing stock placement and retrieval processes within micro-fulfillment centers.

- Customer Service Automation: AI-powered chatbots and virtual assistants providing real-time updates and support.

- Dynamic Pricing and Capacity Planning: Adjusting delivery fees and resource allocation based on real-time market conditions.

- Fraud Detection and Security: Enhancing security protocols and identifying suspicious activities within the delivery network.

Key Takeaways Last Mile Delivery Market Size & Forecast

Common user questions about key takeaways from the Last Mile Delivery market size and forecast consistently point to an eagerness to understand its growth trajectory, the primary drivers of this expansion, and the long-term viability of various delivery models. There is a strong focus on identifying sectors that will experience the most significant impact from last mile innovations, and how market participants can capitalize on the burgeoning opportunities. Users are also interested in understanding the factors that might restrain this growth or present significant challenges.

The market is poised for substantial and sustained expansion, primarily fueled by the relentless growth of e-commerce and the escalating consumer demand for expedited and convenient delivery options. Technology, particularly AI and automation, will serve as pivotal enablers, shaping more efficient, cost-effective, and environmentally friendly delivery networks. Strategic investments in infrastructure, innovative delivery solutions, and a strong emphasis on customer experience will be critical for market players aiming to capture a significant share of this evolving landscape. The forecast underscores a shift towards more agile, data-driven, and customer-centric last mile operations.

- Significant Market Expansion: The market is projected for robust growth, driven by e-commerce proliferation.

- Technology as a Core Enabler: AI, automation, and data analytics are foundational to future last mile efficiency.

- Evolving Consumer Expectations: Demand for speed, convenience, and transparency dictates service innovation.

- Operational Efficiency Imperative: Companies must continuously optimize processes to manage rising costs and competition.

- Sustainability Focus: Environmental considerations are becoming integral to logistics strategies and consumer preference.

- Diversification of Delivery Models: A shift towards varied options including autonomous, drone, and locker-based systems.

Last Mile Delivery Market Drivers Analysis

The Last Mile Delivery market's robust growth is primarily propelled by several interconnected factors that reflect global economic shifts and evolving consumer behaviors. The digital transformation has accelerated the adoption of online shopping across diverse demographics, creating an unprecedented volume of parcels requiring efficient final-leg delivery. This surge in demand necessitates innovative solutions and expanded logistics capabilities, driving investment and technological advancements within the sector.

Beyond the sheer volume, consumer expectations have fundamentally changed, prioritizing speed, convenience, and transparency. This demand for faster, often same-day or next-day, delivery puts immense pressure on logistics providers to enhance their operational agility and optimize routing. Furthermore, urbanization trends contribute to a higher density of deliveries within concentrated areas, while technological advancements in vehicle autonomy, data analytics, and sustainable energy solutions present new avenues for efficiency and service improvement, actively shaping the market's trajectory.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Booming E-commerce Penetration | +5.0% | Global, particularly APAC and North America | 2025-2033 |

| Increasing Consumer Demand for Faster Delivery | +4.5% | Urban Centers Globally | 2025-2033 |

| Technological Advancements in Logistics | +4.0% | Global | 2025-2033 |

| Urbanization and Population Density | +3.0% | Developing Regions, Megacities | 2025-2033 |

Last Mile Delivery Market Restraints Analysis

Despite its significant growth potential, the Last Mile Delivery market faces several formidable restraints that can impede its expansion and challenge profitability. One of the most prominent challenges is the inherently high operational cost associated with the final leg of delivery. This includes expenses related to fuel, labor, vehicle maintenance, and navigating congested urban environments, which collectively erode profit margins for logistics providers.

Furthermore, external factors such as traffic congestion in metropolitan areas significantly impact delivery times and efficiency, leading to delays and increased operational expenditures. Labor shortages, particularly for skilled drivers and delivery personnel, present ongoing challenges, affecting service capacity and quality. Regulatory hurdles, including varied city ordinances on vehicle types, emissions, and delivery hours, add layers of complexity, requiring adaptive and often costly compliance measures that can slow down innovation and market entry for new players.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Operational and Fuel Costs | -3.5% | Global, particularly high-cost regions | 2025-2033 |

| Traffic Congestion and Urban Logistics Challenges | -3.0% | Major Cities Worldwide | 2025-2033 |

| Labor Shortages and Workforce Management | -2.5% | North America, Europe | 2025-2033 |

| Infrastructure Limitations and Regulatory Hurdles | -2.0% | Varies by Region/Country | 2025-2033 |

Last Mile Delivery Market Opportunities Analysis

The Last Mile Delivery market is rich with opportunities stemming from technological advancements, shifting consumer behaviors, and a global push towards sustainability. The ongoing development of autonomous delivery vehicles and drones represents a significant pathway for reducing labor costs and improving delivery speed, particularly in areas with challenging urban logistics or remote access. These innovations promise to reshape traditional delivery paradigms, opening new possibilities for efficiency and scalability.

Additionally, the expansion of alternative delivery models, such as parcel locker systems and pickup-drop-off (PUDO) points, offers convenience for consumers while optimizing delivery routes and reducing failed delivery attempts. The increasing focus on green logistics and electric vehicle (EV) fleets provides a dual opportunity: meeting environmental mandates and attracting environmentally conscious consumers. Furthermore, the integration of advanced data analytics and IoT devices offers unprecedented insights into delivery operations, enabling predictive maintenance, dynamic routing, and enhanced customer communication, all of which contribute to optimized service delivery and competitive advantage.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Adoption of Autonomous Vehicles and Drones | +4.0% | North America, Europe, parts of APAC | 2028-2033 |

| Expansion of Green Logistics and EV Fleets | +3.5% | Global, especially Europe | 2025-2033 |

| Growth of PUDO and Locker Systems | +3.0% | Urban Centers Globally | 2025-2033 |

| Leveraging Data Analytics and IoT for Optimization | +2.5% | Global | 2025-2033 |

Last Mile Delivery Market Challenges Impact Analysis

The Last Mile Delivery market faces persistent challenges that demand innovative solutions and strategic adaptation from market participants. One significant hurdle is the complexity of managing returns efficiently and cost-effectively, particularly with the proliferation of e-commerce, which has led to a substantial increase in reverse logistics. This process often involves additional transportation, inspection, and restocking costs, impacting profitability.

Security concerns, including package theft and ensuring the integrity of goods during transit, represent another critical challenge, especially as delivery methods become more varied, involving unattended drop-offs. Moreover, scaling operations to meet fluctuating demand while maintaining profitability in a highly competitive landscape requires sophisticated planning and agile execution. The imperative for last mile sustainability, balancing rapid delivery with environmental responsibility, adds further complexity, pushing companies to invest in greener technologies and practices. Finally, maintaining consistent profitability amidst intense competition and consumer expectations for low or no delivery fees remains a continuous operational challenge for many providers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Managing Returns and Reverse Logistics | -2.0% | Global | 2025-2033 |

| Security Concerns and Package Theft | -1.5% | Urban Areas, Residential Zones | 2025-2033 |

| Scaling Operations and Maintaining Profitability | -2.5% | Global, Competitive Markets | 2025-2033 |

| Meeting Sustainability Goals Amidst Demand | -1.0% | Europe, North America | 2025-2033 |

Last Mile Delivery Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Last Mile Delivery Market, offering a detailed understanding of its current landscape, historical evolution, and future growth projections. The scope encompasses a thorough examination of market size, key trends, drivers, restraints, opportunities, and challenges influencing the industry. It delves into the impact of emerging technologies like Artificial Intelligence, provides extensive segmentation analysis by service, vehicle, end-use, business model, and solution, and highlights key regional dynamics, providing stakeholders with actionable insights for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | 200.50 Billion USD |

| Market Forecast in 2033 | 698.40 Billion USD |

| Growth Rate | 16.5% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | UPS, FedEx, DHL, Amazon Logistics, XPO Logistics, GXO Logistics, Delhivery, Zomato, Grubhub, Instacart, Postmates, DoorDash, Uber Eats, SF Express, JD Logistics, Yamato Transport, Cainiao Network, Go-Jek (now GoTo), Lalamove, Getir |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Last Mile Delivery market is comprehensively segmented to provide a granular understanding of its diverse operational landscape and varying demands across different sectors. This segmentation allows for a detailed analysis of how market dynamics, technological adoption, and consumer preferences differ, enabling businesses to tailor their strategies effectively. Understanding these segments is crucial for identifying niche opportunities, optimizing resource allocation, and developing targeted service offerings that cater to specific market needs and regulatory environments.

Each segment, from the type of service and vehicle used to the end-use industry and business model, reflects unique challenges and opportunities. For instance, the B2C segment is characterized by high volume and a strong emphasis on speed and convenience, while the B2B segment might prioritize reliability and specialized handling. Similarly, the increasing adoption of electric vehicles in certain regions highlights a shift towards sustainable practices, distinguishing market players committed to environmental responsibility. This detailed breakdown facilitates a holistic view of the market's structure and competitive dynamics.

- By Service Type:

- B2B (Business-to-Business): Focuses on bulk deliveries, often requiring specific logistics for commercial clients.

- B2C (Business-to-Consumer): Dominant segment driven by e-commerce, emphasizing speed, convenience, and package tracking.

- C2C (Consumer-to-Consumer): Growing segment often facilitated by peer-to-peer delivery platforms.

- By Vehicle Type:

- Light Duty Vehicles (LDVs): Vans, cars, typically used for standard parcel delivery.

- Heavy Duty Vehicles (HDVs): Trucks, for larger volume or specialized cargo.

- Drones: Emerging for rapid, low-weight, or remote deliveries.

- Robots: Ground-based autonomous robots for urban and campus deliveries.

- Autonomous Vehicles: Self-driving cars/vans for future mainstream delivery.

- Electric Vehicles (EVs): Growing in popularity for sustainable and cost-effective urban logistics.

- By End-Use:

- E-commerce: Largest segment, driven by online retail growth.

- Retail and FMCG (Fast-Moving Consumer Goods): Includes groceries, daily essentials, requiring rapid and frequent replenishment.

- Food and Beverage: High-frequency, time-sensitive deliveries for restaurants and food services.

- Healthcare: Delivery of pharmaceuticals, medical supplies, often requiring temperature control and specialized handling.

- Automotive: Parts delivery for manufacturing or repair services.

- Postal and Courier: Traditional mail and parcel services adapting to new demands.

- Others: Including industrial goods, construction materials, etc.

- By Business Model:

- Traditional Delivery: Standard scheduled deliveries by established logistics companies.

- On-Demand Delivery: Real-time, immediate deliveries, often leveraging gig economy platforms.

- Hub and Spoke: Centralized distribution centers with spokes reaching final destinations.

- Direct-to-Consumer (D2C): Brands managing their own last mile logistics.

- By Solution:

- Order Management Systems: Software for processing and tracking orders.

- Route Optimization Software: Algorithms for efficient delivery path planning.

- Warehouse and Inventory Management: Systems for efficient stock handling and order fulfillment.

- Tracking and Monitoring: Real-time visibility of packages and delivery vehicles.

- Fleet Management: Tools for managing vehicle maintenance, fuel, and driver performance.

- Predictive Analytics: Using data to forecast demand, optimize operations, and anticipate issues.

- By Destination:

- Urban: High density, traffic congestion, shorter distances, focus on speed.

- Rural: Longer distances, lower density, accessibility challenges.

- Semi-urban: Hybrid characteristics, often serving as transition zones.

Regional Highlights

The Last Mile Delivery market exhibits distinct characteristics across various global regions, influenced by economic development, technological adoption rates, consumer preferences, and regulatory frameworks. Each region presents a unique set of drivers and challenges, shaping the competitive landscape and investment opportunities. Understanding these regional nuances is critical for market players to develop localized strategies and effectively penetrate specific markets.

For instance, while Asia Pacific leads in market size due to its vast population and booming e-commerce, North America and Europe are at the forefront of technological innovation and sustainable logistics adoption. Latin America and the Middle East & Africa, though smaller in market share, represent significant growth potential driven by increasing urbanization and digital penetration. These regional dynamics necessitate tailored approaches to infrastructure development, labor force management, and the integration of advanced delivery solutions.

- North America: Characterized by a highly developed e-commerce ecosystem and early adoption of advanced logistics technologies such as AI-driven route optimization and autonomous delivery trials. High consumer expectations for fast and convenient delivery drive innovation, though labor costs and urban congestion remain significant challenges.

- Europe: Focus on sustainable logistics, with stringent environmental regulations promoting the adoption of electric vehicles and cargo bikes for urban deliveries. Dense urban centers necessitate micro-fulfillment strategies and sophisticated traffic management. Strong growth in online grocery and apparel sectors.

- Asia Pacific (APAC): The largest and fastest-growing market, driven by immense population size, rapid urbanization, and an unparalleled e-commerce boom, particularly in China, India, and Southeast Asian countries. Features diverse logistics landscapes from highly automated mega-cities to challenging rural terrains, fostering innovation in drone delivery and PUDO networks.

- Latin America: An emerging market with significant growth potential, fueled by increasing internet penetration and rising e-commerce adoption. Faces infrastructure challenges and security concerns in some areas, but sees increasing investment in logistics technology and flexible delivery models.

- Middle East and Africa (MEA): Experiencing rapid urbanization and digital transformation, leading to a growing demand for efficient last mile solutions. Government initiatives to diversify economies and invest in logistics infrastructure, coupled with a young, tech-savvy population, drive market expansion, particularly in GCC countries and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Last Mile Delivery Market.- United Parcel Service (UPS)

- FedEx

- DHL Express (Deutsche Post DHL Group)

- Amazon Logistics

- XPO Logistics

- GXO Logistics

- Delhivery

- Zomato

- Grubhub

- Instacart

- Postmates

- DoorDash

- Uber Eats

- SF Express

- JD Logistics

- Yamato Transport

- Cainiao Network

- Go-Jek (now GoTo)

- Lalamove

- Getir

Frequently Asked Questions

What is Last Mile Delivery?

Last Mile Delivery refers to the final step of the delivery process from a distribution center or transportation hub to the end customer's doorstep. It is the most critical and often the most expensive leg of the supply chain, directly impacting customer satisfaction and overall delivery efficiency.

Why is Last Mile Delivery so important in today's market?

Last Mile Delivery is crucial because it is the direct point of contact between a business and its customer, significantly influencing brand perception and customer loyalty. With the explosive growth of e-commerce, efficient and timely last mile delivery has become a key competitive differentiator, directly impacting sales and repeat business.

What are the primary challenges faced in Last Mile Delivery?

Key challenges include high operational costs due to fuel, labor, and vehicle maintenance, urban traffic congestion, infrastructure limitations, labor shortages, managing increasing return volumes, and meeting rising customer expectations for speed and convenience while maintaining profitability.

How is technology transforming Last Mile Delivery?

Technology is revolutionizing Last Mile Delivery through AI-powered route optimization, real-time tracking, predictive analytics for demand forecasting, autonomous delivery vehicles (drones, robots), and the implementation of sophisticated warehouse automation. These innovations enhance efficiency, reduce costs, and improve the overall delivery experience.

What are the key trends shaping the future of Last Mile Delivery?

Major trends include a strong emphasis on sustainable logistics (e.g., electric vehicles), the adoption of automation and robotics, the rise of micro-fulfillment centers, the integration of the gig economy for flexible workforces, and the expansion of alternative delivery points like parcel lockers and pickup-drop-off (PUDO) locations.