IT Asset Disposition Market

IT Asset Disposition Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703567 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

IT Asset Disposition Market Size

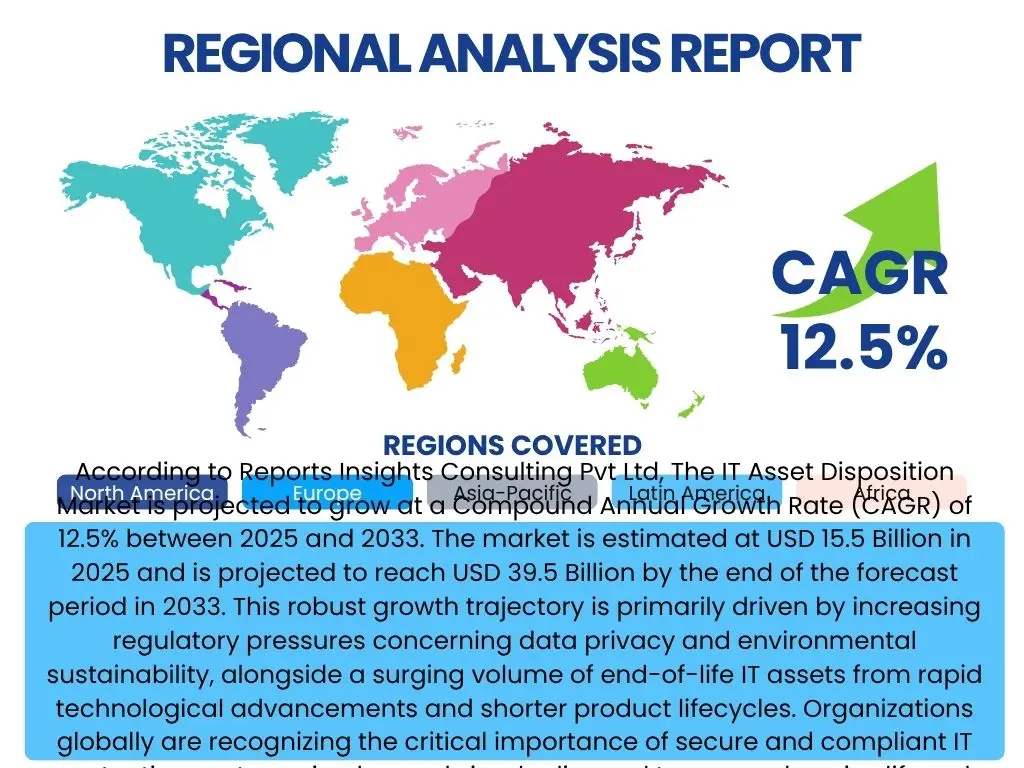

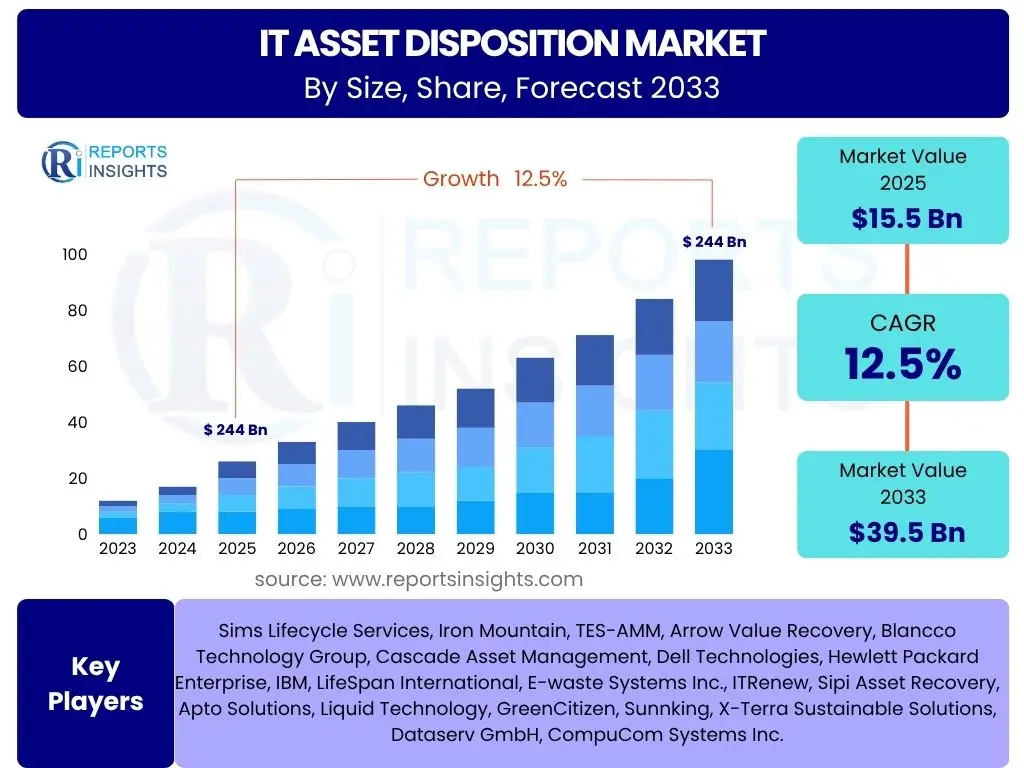

According to Reports Insights Consulting Pvt Ltd, The IT Asset Disposition Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2033. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 39.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasing regulatory pressures concerning data privacy and environmental sustainability, alongside a surging volume of end-of-life IT assets from rapid technological advancements and shorter product lifecycles. Organizations globally are recognizing the critical importance of secure and compliant IT asset retirement, moving beyond simple disposal to comprehensive lifecycle management.

The expanding digital infrastructure, particularly the proliferation of data centers and cloud services, contributes significantly to the demand for professional ITAD services. As businesses scale their digital operations, the need for efficient and secure management of retired IT assets becomes paramount to prevent data breaches and ensure regulatory adherence. Furthermore, the global shift towards circular economy principles is fostering greater adoption of ITAD practices that prioritize reuse, refurbishment, and recycling, thereby reducing electronic waste and maximizing resource value. This paradigm shift underscores the market's evolution from a niche service to an essential component of corporate environmental, social, and governance (ESG) strategies.

Key IT Asset Disposition Market Trends & Insights

Users frequently inquire about the evolving landscape of IT asset disposition, seeking to understand the most impactful shifts affecting their operations and compliance. They are particularly interested in how sustainability efforts are gaining traction, how data security challenges are being addressed with new technologies, and the influence of global economic factors or geopolitical shifts on ITAD practices. Additionally, there is significant interest in understanding how the increasing adoption of cloud services and hybrid work models is reshaping traditional asset management and disposition strategies, particularly concerning asset tracking and data handling for remote devices.

A prominent trend is the integration of Environmental, Social, and Governance (ESG) criteria into corporate ITAD policies, moving beyond mere compliance to proactive sustainability initiatives. Companies are increasingly seeking ITAD partners who can demonstrate verifiable processes for recycling, remarketing, and reducing carbon footprints. Another significant insight relates to the heightened focus on data sanitization and destruction, driven by stringent data protection regulations suchances as GDPR, CCPA, and various industry-specific mandates. Organizations are investing in advanced data wiping technologies and on-site destruction services to mitigate the risk of data breaches associated with retired assets. The market is also witnessing a shift towards ITAD-as-a-Service models, offering more flexible, scalable, and integrated solutions for managing the entire lifecycle of IT assets, rather than just end-of-life disposal.

The proliferation of hybrid work environments has introduced complexities in asset tracking and disposition, necessitating robust solutions for managing geographically dispersed devices. This has fueled demand for comprehensive logistics and remote data destruction capabilities. Furthermore, the market is experiencing a growing emphasis on transparency and reporting in ITAD processes, as organizations require detailed audit trails to demonstrate compliance and prove their commitment to responsible asset management. The increasing sophistication of cyber threats also mandates that ITAD providers continuously innovate their security protocols to ensure complete data eradication from even damaged or obsolete devices.

- Increased focus on ESG principles and circular economy integration.

- Enhanced demand for certified data sanitization and physical destruction services.

- Growth in ITAD-as-a-Service (ITADaaS) and comprehensive lifecycle management solutions.

- Impact of hybrid work models on asset tracking and remote ITAD needs.

- Adoption of advanced technologies for improved security, efficiency, and compliance.

- Rising importance of transparent reporting and auditable processes.

- Shift towards value recovery through remarketing and refurbishment.

AI Impact Analysis on IT Asset Disposition

Users frequently pose questions regarding the transformative potential of Artificial Intelligence (AI) within the IT Asset Disposition sector. Common inquiries revolve around how AI can enhance data wiping efficacy, automate asset processing, optimize logistics, and improve the overall security posture of ITAD operations. There is also curiosity about the challenges AI might introduce, such as the need for specialized skills, the reliability of AI-driven decisions in critical data destruction, and the ethical implications of using AI in handling sensitive information.

AI's influence on ITAD is multifaceted, promising significant advancements in efficiency, security, and sustainability. In data sanitization, AI algorithms can analyze data patterns to identify and securely erase residual information more comprehensively, reducing the risk of data breaches. For asset triage and sorting, AI-powered vision systems and robotics can automate the identification, grading, and sorting of diverse IT assets, accelerating processing times and minimizing human error. Predictive analytics, driven by AI, can also optimize reverse logistics by forecasting asset return volumes and equipment failure rates, allowing ITAD providers to better manage inventory and transport, reducing costs and environmental impact.

Furthermore, AI can enhance compliance and reporting by automating the generation of audit trails and compliance reports, ensuring that all disposition processes adhere to relevant regulations. This automation reduces manual effort and improves accuracy. While AI offers substantial benefits, its implementation requires careful consideration of data privacy, algorithmic bias, and the need for robust cybersecurity measures to protect AI systems themselves. Integrating AI into ITAD will necessitate investment in new technologies, specialized training for personnel, and a clear understanding of regulatory frameworks pertaining to AI use in data-sensitive environments, ensuring responsible and effective deployment.

- Enhanced data sanitization and validation through AI-driven algorithms.

- Automation of asset sorting, grading, and de-manufacturing processes via robotics and machine vision.

- Optimization of reverse logistics and supply chain management using predictive analytics.

- Improved auditability and compliance reporting through AI-powered data analysis.

- Fraud detection and anomaly identification in asset handling and data destruction.

- Potential for intelligent asset valuation and remarketing strategies.

- Challenges related to data privacy, ethical AI use, and specialized skill requirements.

Key Takeaways IT Asset Disposition Market Size & Forecast

Users frequently ask for a concise summary of the most critical insights from the IT Asset Disposition market size and forecast, aiming to understand the primary drivers of growth, the underlying market dynamics, and the long-term outlook. They seek clarity on whether the market is truly expanding significantly, what factors are sustaining this growth, and how these trends translate into actionable intelligence for businesses and service providers alike. This synthesis helps stakeholders quickly grasp the market's trajectory and its strategic implications.

The IT Asset Disposition market is poised for substantial and sustained growth, driven by an confluence of factors that reinforce its strategic importance to organizations worldwide. The primary drivers include the escalating need for robust data security measures in the face of increasingly sophisticated cyber threats, ensuring that sensitive information is completely eradicated from retired assets. Concurrently, a burgeoning global emphasis on environmental sustainability and circular economy principles is compelling businesses to adopt more responsible and eco-friendly IT asset management practices, moving away from landfills towards recycling, reuse, and refurbishment. This dual imperative of security and sustainability is fundamentally reshaping the ITAD landscape.

Furthermore, the rapid pace of technological innovation, leading to shorter product lifecycles and a continuous stream of obsolete IT equipment, guarantees a consistent demand for efficient disposition services. Regulatory bodies globally are also enacting stricter compliance mandates related to e-waste and data protection, compelling organizations to invest in professional ITAD solutions to avoid severe penalties and reputational damage. The market's future is characterized by increasing specialization, technological integration (including AI), and the emergence of comprehensive lifecycle management services, reflecting a broader shift towards proactive and strategic asset retirement rather than reactive disposal. This signifies that ITAD is no longer merely a cost center but a critical component of corporate governance and risk management.

- The ITAD market is experiencing significant growth, projected to more than double by 2033.

- Primary growth drivers are stringent data security regulations and escalating environmental concerns.

- Technological obsolescence and increasing volumes of e-waste are creating consistent demand.

- Market evolution towards comprehensive, value-driven asset lifecycle management.

- Compliance and risk mitigation are central to ITAD adoption across industries.

IT Asset Disposition Market Drivers Analysis

The IT Asset Disposition market is significantly propelled by several key drivers that reflect evolving global priorities and technological advancements. A primary catalyst is the escalating stringency of data privacy and security regulations worldwide, such as GDPR, CCPA, and HIPAA. These mandates impose severe penalties for data breaches stemming from improperly disposed IT assets, compelling organizations to adopt certified and secure ITAD processes. The growing awareness among businesses about the critical importance of protecting sensitive information, even on retired hardware, fuels the demand for expert data sanitization and destruction services.

Another major driver is the increasing global focus on environmental sustainability and the principles of the circular economy. Companies are under mounting pressure from consumers, investors, and regulatory bodies to reduce their ecological footprint and manage e-waste responsibly. This societal shift encourages the adoption of ITAD services that prioritize reuse, refurbishment, and ethical recycling, thereby diverting electronic waste from landfills and recovering valuable materials. Furthermore, the rapid pace of technological innovation leads to shorter IT asset lifecycles, with organizations frequently upgrading hardware to maintain competitive edge and operational efficiency. This continuous churn of obsolete equipment creates a consistent and growing supply of assets requiring professional disposition.

The expansion of cloud computing and the proliferation of data centers also contribute significantly to market growth. As organizations migrate to the cloud or expand their data center infrastructure, they require efficient and secure means to dispose of legacy hardware. Moreover, the recent surge in remote and hybrid work models has complicated asset tracking and disposition, necessitating specialized ITAD solutions for geographically dispersed devices. These combined factors underscore the essential role of ITAD in modern corporate governance, risk management, and environmental stewardship, solidifying its position as a critical service across various industries.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Regulatory Compliance and Data Privacy Laws (e.g., GDPR, CCPA) | +2.5% | Global, especially Europe, North America, parts of Asia | Short-term to Long-term |

| Growing Awareness of Environmental Sustainability and Circular Economy Principles | +2.0% | Europe, North America, Australia, parts of Asia | Mid-term to Long-term |

| Rising Volume of End-of-Life Electronic Devices and E-waste Generation | +1.8% | Global | Continuous |

| Enhanced Need for Data Security and Breach Prevention | +2.2% | Global, all industries | Immediate to Long-term |

| Rapid Technological Obsolescence and Shorter Product Lifecycles | +1.5% | Global, particularly IT and consumer electronics sectors | Short-term to Mid-term |

| Expansion of Cloud Computing and Data Centers Infrastructure | +1.0% | North America, APAC, Europe | Mid-term |

| Growth in Remote and Hybrid Work Models and Distributed IT Assets | +0.8% | Global | Short-term |

IT Asset Disposition Market Restraints Analysis

Despite the robust growth of the IT Asset Disposition market, several significant restraints pose challenges to its expansion and wider adoption. A primary concern is the relatively high cost associated with certified and secure ITAD services, especially for small and medium-sized enterprises (SMEs). The comprehensive processes involved in secure data sanitization, compliant recycling, and transparent reporting can be perceived as expensive, leading some organizations to opt for less secure or non-compliant disposal methods to cut costs. This cost sensitivity often acts as a barrier, particularly in regions with less stringent regulatory enforcement or limited awareness of potential risks.

Another key restraint is the persistent lack of awareness or understanding among some organizations regarding the critical importance of proper ITAD. Despite the increasing prevalence of data breaches and environmental regulations, many businesses still view asset disposition as a mere logistical task rather than a strategic component of risk management and corporate social responsibility. This knowledge gap can lead to inadequate budgeting for ITAD services, reliance on informal disposal channels, and a higher risk of non-compliance. Furthermore, the inherent data breach risks associated with the transfer and processing of sensitive information during the ITAD process itself can deter organizations. Concerns about chain of custody, vendor trustworthiness, and potential liabilities act as significant deterrents, particularly for highly regulated industries.

Logistical complexities, especially for global enterprises with diverse and geographically dispersed IT assets, also present a considerable restraint. Managing the secure collection, transportation, and processing of IT equipment across different countries with varying regulations and infrastructure can be challenging and costly. Additionally, economic downturns or budget constraints can lead organizations to postpone or scale back IT asset refreshes, thereby reducing the volume of assets requiring disposition. Such financial pressures can impact the short-term demand for ITAD services. Addressing these restraints requires concerted efforts to educate the market, demonstrate the value proposition of certified ITAD, and develop more cost-effective and globally streamlined solutions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of Certified and Secure ITAD Services | -1.5% | Global, particularly impacting SMEs in developing regions | Short-term to Mid-term |

| Lack of Awareness and Understanding of ITAD Importance among Some Organizations | -1.2% | Global, prominent in less regulated markets | Mid-term |

| Perceived Data Breach Risks During Asset Transition and Processing | -1.0% | Global, especially sensitive industries (BFSI, Healthcare) | Immediate to Short-term |

| Logistical Complexities for Global Operations and Diverse Asset Types | -0.8% | Global enterprises | Continuous |

| Economic Downturns and Budget Constraints Limiting IT Refresh Cycles | -0.7% | Global, cyclical | Short-term |

| Existence of Informal and Non-Compliant Disposal Channels | -0.5% | Developing regions | Long-term |

IT Asset Disposition Market Opportunities Analysis

The IT Asset Disposition market presents numerous growth opportunities driven by evolving technological landscapes, heightened regulatory focus, and a global shift towards sustainable practices. A significant opportunity lies in the expanding adoption of emerging technologies such as the Internet of Things (IoT) and edge computing. As these technologies proliferate, they generate a new category of IT assets, often distributed and specialized, that will eventually require secure and compliant disposition. This diversification of asset types broadens the scope of ITAD services beyond traditional computers and servers, creating new revenue streams for specialized solutions.

The continuous evolution and strengthening of environmental regulations globally, particularly those pertaining to e-waste and material recovery, provide a robust tailwind for the ITAD market. Regions like Europe are consistently tightening WEEE directives, while others are developing similar frameworks. This regulatory push not only mandates responsible disposal but also incentivizes value recovery through recycling and reuse, creating demand for sophisticated ITAD solutions that can navigate complex compliance landscapes. Furthermore, the growing corporate emphasis on Environmental, Social, and Governance (ESG) reporting and corporate social responsibility (CSR) creates a strong market for ITAD providers who can demonstrate verifiable, sustainable, and transparent processes, allowing companies to enhance their brand image and meet stakeholder expectations.

The expansion into untapped and emerging markets, particularly in Asia Pacific, Latin America, and Africa, represents a substantial growth avenue. These regions are experiencing rapid digitalization, industrial growth, and increasing IT infrastructure development, leading to a burgeoning volume of IT assets that will eventually require disposition. As these markets mature and regulatory frameworks strengthen, the demand for professional ITAD services is expected to surge. Additionally, the development and adoption of advanced technologies like AI and blockchain within ITAD operations offer opportunities for enhanced efficiency, improved data security, and greater transparency. These innovations can streamline processes, reduce costs, and provide auditable trails, making ITAD services more attractive and effective for enterprises of all sizes.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving Regulatory Landscape and Stricter E-waste Policies | +2.0% | Global, strong in Europe, North America, developing APAC | Mid-term to Long-term |

| Adoption of IoT and Edge Devices Generating New Asset Streams | +1.5% | Global, across various industries | Mid-term to Long-term |

| Growth in ITAD-as-a-Service (ITADaaS) and Managed Services Models | +1.2% | Global, particularly for large enterprises and SMEs | Short-term to Mid-term |

| Expansion into Untapped and Emerging Markets | +1.0% | Asia Pacific, Latin America, Middle East & Africa | Mid-term to Long-term |

| Integration of AI, Blockchain, and Advanced Analytics for Efficiency and Transparency | +0.8% | Global, especially tech-forward enterprises | Mid-term |

| Increasing Focus on Corporate ESG Goals and Sustainability Initiatives | +0.7% | North America, Europe, developed APAC | Long-term |

IT Asset Disposition Market Challenges Impact Analysis

The IT Asset Disposition market faces several critical challenges that can impede its growth and complicate service delivery. One significant challenge is managing the diverse range of IT asset types and their varying disposition requirements. Modern IT environments comprise a vast array of devices, from traditional laptops and servers to specialized IoT sensors and complex data center infrastructure. Each asset type may have unique data destruction protocols, recycling mandates, and logistical considerations, requiring ITAD providers to possess highly specialized expertise and versatile processing capabilities, which can increase operational complexity and cost.

Another major hurdle is the persistent threat of cybersecurity breaches throughout the ITAD process. Even after data sanitization, the risk of residual data or vulnerabilities during transit, storage, or physical destruction remains a concern. Organizations demand absolute assurance that their sensitive information is irretrievably destroyed, requiring ITAD providers to invest continuously in cutting-edge security technologies, robust chain-of-custody protocols, and highly trained personnel. Maintaining compliance with the myriad of varying global regulations further compounds this challenge, as legal frameworks for data privacy and e-waste differ significantly across countries and regions. Navigating these disparate compliance requirements necessitates extensive legal knowledge and adaptive operational models, adding layers of complexity for international ITAD providers.

The market also contends with a shortage of skilled labor proficient in ITAD processes, particularly in areas requiring advanced technical expertise for data recovery prevention, asset testing, and specialized de-manufacturing. This talent gap can affect service quality and scalability. Furthermore, achieving scalability for large enterprises with vast volumes of assets across multiple locations presents a logistical and operational challenge. Ensuring consistent service quality, security, and compliance across a global footprint demands significant infrastructure and coordination capabilities. Addressing these challenges requires continuous innovation, investment in technology and human capital, and a commitment to robust security and compliance frameworks to build client trust and facilitate market expansion.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Managing Diverse IT Asset Types and Evolving Technologies | -1.5% | Global, especially for comprehensive service providers | Continuous |

| Mitigating Cybersecurity Threats and Ensuring Complete Data Eradication | -1.2% | Global, all industries | Immediate to Long-term |

| Compliance with Varying and Evolving Global Regulatory Frameworks | -1.0% | Global, particularly for multi-national clients | Continuous |

| Skilled Labor Shortage in Technical ITAD Operations | -0.8% | Global, especially in developed markets | Mid-term |

| Scalability and Consistency of Services for Large Enterprises | -0.7% | Global, for large service providers | Continuous |

| Complexity of Reverse Logistics for Geographically Dispersed Assets | -0.6% | Global | Short-term to Mid-term |

IT Asset Disposition Market - Updated Report Scope

This report provides an in-depth analysis of the global IT Asset Disposition market, offering a comprehensive overview of its size, growth trajectory, key trends, drivers, restraints, opportunities, and challenges. The scope encompasses detailed segmentation by service type, asset type, end-user industry, and organization size, alongside a thorough regional analysis. It aims to deliver actionable insights for stakeholders seeking to understand market dynamics, identify growth prospects, and navigate the evolving regulatory and technological landscape. The report leverages extensive market research to provide a forward-looking perspective, aiding strategic decision-making and investment planning within the ITAD ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 39.5 Billion |

| Growth Rate | 12.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Sims Lifecycle Services, Iron Mountain, TES-AMM, Arrow Value Recovery, Blancco Technology Group, Cascade Asset Management, Dell Technologies, Hewlett Packard Enterprise, IBM, LifeSpan International, E-waste Systems Inc., ITRenew, Sipi Asset Recovery, Apto Solutions, Liquid Technology, GreenCitizen, Sunnking, X-Terra Sustainable Solutions, Dataserv GmbH, CompuCom Systems Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The IT Asset Disposition market is meticulously segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for targeted analysis of consumer needs, industry-specific demands, and technological trends, enabling stakeholders to identify precise growth opportunities and strategic niches. The market is broadly categorized by service type, asset type, end-user industry, and organization size, each reflecting distinct operational requirements and compliance considerations.

The segmentation by service type highlights the comprehensive nature of ITAD, ranging from core data sanitization and physical destruction to value-added services like asset recovery, remarketing, and advanced recycling. This reflects the industry's shift from simple disposal to full lifecycle management, emphasizing maximum value extraction and environmental responsibility. Asset type segmentation addresses the unique handling and disposition challenges posed by various devices, from traditional computing hardware to complex data center equipment and emerging IoT devices. This differentiation is crucial for providers offering specialized expertise.

End-user industry segmentation reveals varying ITAD requirements based on regulatory environments, data sensitivity, and asset volumes across sectors such as BFSI, IT & Telecom, Government, Healthcare, and Manufacturing. For instance, the BFSI and Healthcare sectors demand the highest levels of data security due to stringent compliance mandates. Finally, segmentation by organization size differentiates the needs of Small and Medium-sized Enterprises (SMEs) from those of Large Enterprises, often in terms of volume, logistical complexity, and the need for scalable, integrated solutions versus more ad-hoc services. This multi-dimensional segmentation provides a robust framework for market analysis and strategic planning.

- By Service:

- Data Sanitization/Wiping

- On-site Data Destruction

- Secure Destruction/Shredding

- De-manufacturing

- Asset Recovery/Remarketing

- Recycling

- Reverse Logistics

- Auditing & Reporting

- ITAD Consulting

- By Asset Type:

- Laptops/Desktops

- Servers

- Storage Devices (HDDs, SSDs, Tapes)

- Mobile Devices (Smartphones, Tablets)

- Networking Equipment (Routers, Switches)

- Peripherals (Printers, Monitors)

- Data Center Equipment

- Others (Medical devices, IoT devices)

- By End-user Industry:

- BFSI (Banking, Financial Services & Insurance)

- IT & Telecom

- Government & Public Sector

- Healthcare

- Education

- Manufacturing

- Retail

- Media & Entertainment

- Energy & Utilities

- Others

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Regional Highlights

The global IT Asset Disposition market exhibits significant regional variations in growth drivers, regulatory landscapes, and market maturity, offering diverse opportunities and challenges across continents. Each region contributes uniquely to the overall market trajectory, influenced by factors such as economic development, technological adoption rates, and the stringency of environmental and data privacy regulations. Understanding these regional nuances is critical for stakeholders to tailor their strategies and investments effectively.

- North America: This region is a leading market for ITAD services, characterized by early adoption of advanced ITAD practices, stringent data privacy regulations (e.g., CCPA, HIPAA), and a high volume of IT asset refreshes. The presence of numerous large enterprises, data centers, and a strong emphasis on corporate social responsibility drives consistent demand for secure and compliant ITAD solutions. Innovation in data sanitization and value recovery is also prominent here.

- Europe: Europe stands out due to its comprehensive and robust regulatory framework, particularly the General Data Protection Regulation (GDPR) and the Waste Electrical and Electronic Equipment (WEEE) Directive. These regulations impose strict requirements for data protection and e-waste management, fostering a mature ITAD market focused on compliance, sustainability, and circular economy principles. Germany, the UK, and France are key contributors, driven by strong environmental consciousness and corporate governance.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the ITAD market, fueled by rapid industrialization, increasing digitalization, and the expansion of IT infrastructure across countries like China, India, Japan, and Australia. While regulatory landscapes are still developing in some areas, growing awareness of data security and environmental impact, coupled with a booming IT sector, presents significant growth opportunities. The region is seeing increased investment in data centers and cloud services, further driving ITAD demand.

- Latin America: This region is an emerging market for ITAD, with increasing IT adoption and a growing emphasis on data protection and environmental regulations. Brazil and Mexico are leading the adoption, driven by foreign investments and the need for secure asset disposition. The market here is characterized by a gradual shift from informal recycling to professional ITAD services as regulatory frameworks mature and corporate awareness grows.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth in the ITAD market, primarily driven by increasing digitalization initiatives, particularly in Gulf Cooperation Council (GCC) countries. Growing investments in smart cities, data centers, and diverse industries are generating a rising volume of IT assets. While environmental regulations are still evolving in many parts of the region, the demand for secure data destruction is escalating due to rising cybersecurity concerns and global business practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the IT Asset Disposition Market.

- Sims Lifecycle Services

- Iron Mountain

- TES-AMM

- Arrow Value Recovery

- Blancco Technology Group

- Cascade Asset Management

- Dell Technologies

- Hewlett Packard Enterprise

- IBM

- LifeSpan International

- E-waste Systems Inc.

- Sipi Asset Recovery

- Apto Solutions

- Liquid Technology

- GreenCitizen

- Sunnking

- X-Terra Sustainable Solutions

- Dataserv GmbH

- CompuCom Systems Inc.

- GEEP (Global Electric Electronic Processing Inc.)

Frequently Asked Questions

What is IT Asset Disposition (ITAD)?

IT Asset Disposition (ITAD) is the business process built around securely and responsibly disposing of obsolete or unwanted IT equipment in a way that is environmentally sound and compliant with data privacy regulations. It encompasses services like data sanitization, physical destruction, asset recovery, remarketing, recycling, and reverse logistics.

Why is ITAD important for businesses?

ITAD is crucial for businesses to protect sensitive data, comply with stringent data privacy laws (e.g., GDPR, CCPA), adhere to environmental regulations (e.g., WEEE), and demonstrate corporate social responsibility. Proper ITAD mitigates risks of data breaches, avoids regulatory fines, and promotes sustainability through responsible recycling and reuse.

What are the primary benefits of professional ITAD services?

The primary benefits include enhanced data security by ensuring complete data destruction, guaranteed regulatory compliance, reduced environmental impact through ethical recycling and refurbishment, potential financial returns from remarketed assets, and improved operational efficiency by outsourcing complex disposition processes.

How do ITAD providers ensure data security?

ITAD providers ensure data security through a combination of certified data sanitization methods (wiping to government standards), physical destruction techniques (shredding, degaussing), and a secure chain of custody. They also provide detailed audit trails and certificates of destruction to verify data eradication.

What types of assets are typically handled in ITAD?

ITAD services typically handle a wide range of IT assets including laptops, desktops, servers, storage devices (HDDs, SSDs), mobile devices (smartphones, tablets), networking equipment, printers, monitors, and various data center components. Emerging asset types like IoT devices are also increasingly included.