Hexamine for Industrial Use Market

Hexamine for Industrial Use Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701028 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Hexamine for Industrial Use Market Size

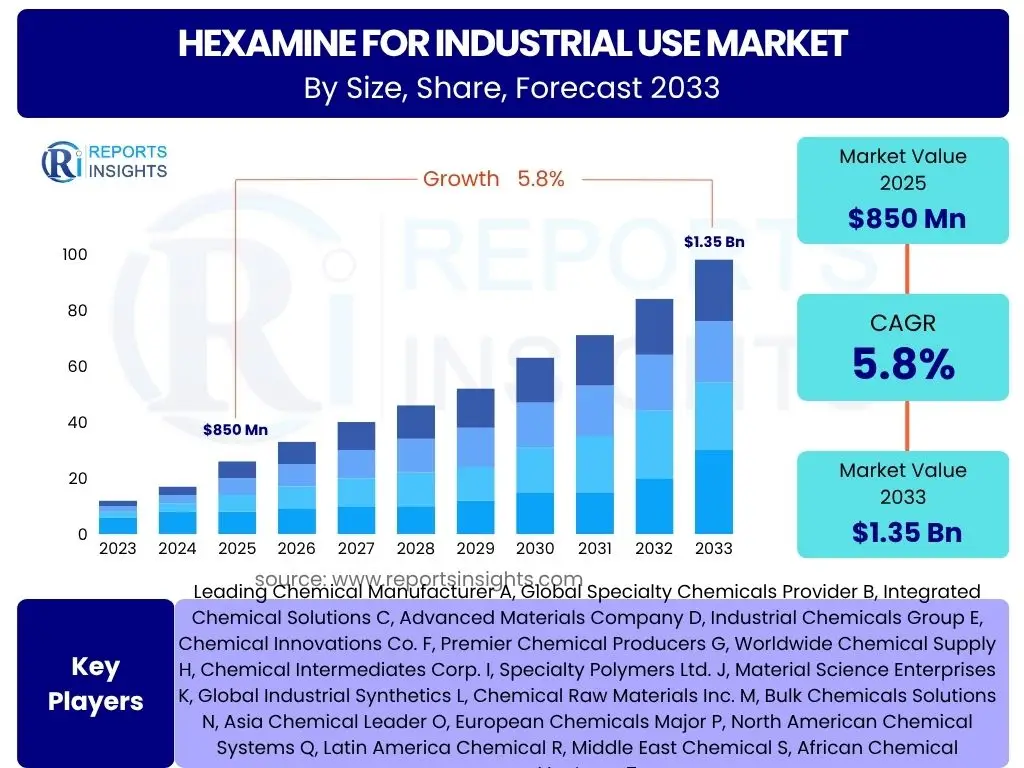

According to Reports Insights Consulting Pvt Ltd, The Hexamine for Industrial Use Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. This robust growth is primarily driven by expanding applications across various industrial sectors, including the increasing demand for phenolic resins in automotive and construction, and the rising adoption of rubber additives in tire manufacturing. The market is estimated at USD 850 million in 2025 and is projected to reach USD 1.35 billion by the end of the forecast period in 2033, indicating significant expansion and investment opportunities for stakeholders.

The market's trajectory reflects a stable yet consistent demand for hexamine as a crucial intermediate and additive. Factors such as industrialization in emerging economies, coupled with continuous advancements in material science requiring high-performance additives, contribute to this steady growth. Furthermore, the pharmaceutical sector's reliance on hexamine for certain drug formulations and the consistent demand from the explosives industry also underpin the market's foundational strength, ensuring sustained growth throughout the forecast period.

Key Hexamine for Industrial Use Market Trends & Insights

User inquiries frequently center on the evolving landscape of industrial chemical markets, specifically concerning sustainability, supply chain resilience, and application diversification for compounds like hexamine. The hexamine for industrial use market is currently experiencing notable shifts driven by environmental regulations, technological advancements, and a renewed focus on supply chain localization. These dynamics are reshaping production methodologies, influencing product formulations, and opening avenues for novel applications while emphasizing eco-friendly practices and operational efficiency.

- Growing emphasis on sustainable production processes and green chemistry initiatives to reduce environmental footprint.

- Increased demand for higher purity hexamine grades driven by stringent quality requirements in pharmaceutical and specialized chemical applications.

- Shifting manufacturing hubs towards Asia-Pacific due to lower production costs and increasing industrial output in the region.

- Development of bio-based or alternative curing agents to partially substitute hexamine, although their widespread adoption remains limited due to cost and performance considerations.

- Strengthening of global supply chains to enhance resilience against geopolitical disruptions and raw material price volatility.

- Integration of advanced manufacturing technologies, including process automation and data analytics, to optimize hexamine production and quality control.

AI Impact Analysis on Hexamine for Industrial Use

User queries regarding artificial intelligence (AI) in industrial chemical markets often revolve around its potential to optimize manufacturing processes, enhance supply chain predictability, and accelerate research and development. In the hexamine for industrial use sector, AI is emerging as a transformative tool, offering unprecedented capabilities for predictive maintenance, quality control, and demand forecasting. Its application can lead to significant operational efficiencies, reduced waste, and improved product consistency, thereby impacting the overall profitability and competitiveness of market players.

The implementation of AI algorithms in hexamine production facilities can enable real-time monitoring of chemical reactions, precise control over synthesis parameters, and identification of anomalies before they lead to costly disruptions. Furthermore, AI-powered analytics can process vast datasets related to raw material prices, logistics, and end-use market demand, providing invaluable insights for strategic decision-making. This technological integration is expected to drive down production costs and enhance market responsiveness, fostering a more agile and efficient industrial ecosystem.

- AI-driven process optimization for enhanced yield and reduced energy consumption in hexamine manufacturing.

- Predictive maintenance analytics for manufacturing equipment, minimizing downtime and optimizing operational lifespan.

- Enhanced supply chain management through AI-powered demand forecasting and logistics optimization, ensuring timely delivery and inventory efficiency.

- AI in quality control, using machine vision and data analytics to detect impurities or inconsistencies in hexamine products.

- Accelerated R&D for novel hexamine derivatives or alternative formulations through AI-driven molecular modeling and simulation.

- Market trend prediction and competitive intelligence leveraging AI to analyze vast datasets from market reports, news, and social media.

Key Takeaways Hexamine for Industrial Use Market Size & Forecast

Common user questions regarding market forecasts emphasize understanding the primary growth drivers, potential challenges, and key areas of investment. The hexamine for industrial use market is set for consistent growth, primarily fueled by its indispensable role in the production of phenolic resins for the construction and automotive sectors, and as a crucial vulcanization accelerator in the rubber industry. Despite potential raw material volatility and environmental scrutiny, the market's fundamental applications ensure a stable demand outlook.

The forecast period suggests that while mature markets will exhibit steady growth, emerging economies in Asia-Pacific will likely spearhead expansion due to rapid industrialization and infrastructure development. Stakeholders should focus on operational efficiencies, sustainable practices, and strategic partnerships to capitalize on this growth. Diversification into niche applications and investment in R&D for high-purity grades also represent significant opportunities for competitive advantage.

- The market is projected for steady growth, driven by consistent demand from its primary end-use industries.

- Asia-Pacific will remain the most dynamic region due to increasing industrial activities and infrastructure development.

- Innovation in sustainable production methods and high-purity hexamine grades will be critical for market differentiation.

- Raw material price fluctuations and environmental regulations pose ongoing challenges requiring adaptive strategies.

- Strategic collaborations and vertical integration can enhance supply chain resilience and market positioning.

- Investments in research and development for new applications and enhanced product performance are key to long-term growth.

Hexamine for Industrial Use Market Drivers Analysis

The hexamine for industrial use market is propelled by several key drivers, predominantly stemming from the sustained demand across its major application sectors. The increasing consumption of phenolic resins in various industries, robust growth in the rubber sector, and its integral role in specialized chemical processes continue to underpin market expansion. These drivers are intrinsically linked to global industrial output, economic development, and technological advancements that necessitate hexamine's unique properties.

Additionally, the properties of hexamine, such as its excellent curing agent capabilities, corrosion inhibition, and formaldehyde donor characteristics, make it indispensable for numerous industrial formulations. The ongoing infrastructure development projects worldwide, particularly in developing economies, further stimulate demand for materials utilizing hexamine, thereby acting as a significant market catalyst. Furthermore, the pharmaceutical industry's specific requirements for hexamine also contribute to its steady market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Phenolic Resins | +1.5% | Global, particularly Asia-Pacific (China, India), North America | Mid-term to Long-term (2025-2033) |

| Expansion of Rubber Industry | +1.2% | Global, with strong growth in Asia-Pacific (China, India), Europe | Mid-term (2025-2030) |

| Increasing Use in Explosives & Defense | +0.8% | North America, Europe, Middle East | Short-term to Mid-term (2025-2029) |

| Pharmaceutical Applications Growth | +0.7% | Global, specifically North America, Europe, India | Mid-term to Long-term (2026-2033) |

| Industrialization in Emerging Economies | +1.0% | Asia-Pacific (Southeast Asia), Latin America, Africa | Long-term (2027-2033) |

Hexamine for Industrial Use Market Restraints Analysis

Despite its critical industrial applications, the hexamine market faces several restraints that could temper its growth trajectory. Key among these are the volatility in raw material prices, particularly formaldehyde and ammonia, which are essential precursors for hexamine synthesis. Such fluctuations can significantly impact production costs and profit margins for manufacturers, leading to price instability in the end-user markets and potentially dampening demand.

Furthermore, stringent environmental regulations concerning formaldehyde emissions and the overall chemical manufacturing process pose considerable challenges. Compliance with these regulations often necessitates significant investments in pollution control technologies and process modifications, increasing operational expenditures. The emergence of alternative chemicals or processes in some applications, though limited, also presents a long-term restraint, requiring continuous innovation from hexamine producers to maintain market relevance.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Raw Material Price Volatility (Formaldehyde, Ammonia) | -1.3% | Global, particularly Asia-Pacific (China), Europe | Short-term to Mid-term (2025-2028) |

| Stringent Environmental Regulations | -1.0% | Europe, North America, specific regions in Asia-Pacific | Mid-term to Long-term (2026-2033) |

| Supply Chain Disruptions & Logistics Costs | -0.8% | Global, affecting all major trade routes | Short-term to Mid-term (2025-2027) |

| Development of Substitute Materials/Processes | -0.5% | Specific application segments globally | Long-term (2028-2033) |

| Energy Price Fluctuations | -0.6% | Global, impacting manufacturing costs significantly | Short-term (2025-2026) |

Hexamine for Industrial Use Market Opportunities Analysis

The hexamine for industrial use market presents several promising opportunities for growth and diversification. One significant avenue lies in the increasing demand for high-purity hexamine grades driven by the expanding pharmaceutical sector and specialized chemical industries, where stringent quality and safety standards are paramount. This creates a niche market for manufacturers capable of producing superior-grade products, commanding higher profit margins.

Furthermore, the exploration of new applications beyond traditional uses, such as in advanced materials or emerging chemical processes, offers substantial growth potential. Investment in research and development for sustainable production methods and the utilization of bio-based raw materials can also open new market segments and improve the industry's environmental profile, aligning with global sustainability goals. The rapid industrialization and urbanization in developing regions further provide fertile ground for market expansion, driven by increased infrastructure and manufacturing activities.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Demand for High-Purity Hexamine in Pharma | +0.9% | North America, Europe, India, China | Mid-term to Long-term (2026-2033) |

| New Applications in Advanced Materials | +0.7% | Global, focus on R&D strong regions | Long-term (2028-2033) |

| Investment in Sustainable Production Methods | +0.6% | Europe, North America, Japan | Mid-term to Long-term (2027-2033) |

| Expansion in Emerging Economies' Infrastructure | +1.1% | Asia-Pacific (Southeast Asia), Latin America, Africa | Mid-term to Long-term (2025-2033) |

| Strategic Partnerships & Mergers | +0.5% | Global, consolidating market share | Short-term to Mid-term (2025-2029) |

Hexamine for Industrial Use Market Challenges Impact Analysis

The hexamine for industrial use market contends with several notable challenges that can impede its growth and operational stability. One primary concern is the intense competition within the market, which can lead to price wars and reduced profit margins, especially for manufacturers with less diversified product portfolios or those operating on a smaller scale. This competitive pressure necessitates continuous cost optimization and product innovation.

Another significant challenge stems from the fluctuating availability and pricing of key raw materials such as formaldehyde and ammonia. Geopolitical tensions, natural disasters, or unexpected plant shutdowns can disrupt the supply chain, leading to production bottlenecks and increased operational costs. Furthermore, the increasing public and regulatory scrutiny regarding chemical safety and environmental impact requires manufacturers to invest heavily in compliance and sustainable practices, adding to the financial burden and complexity of operations.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition & Price Pressure | -1.0% | Global, particularly competitive regions like China, Europe | Short-term to Mid-term (2025-2028) |

| Supply Chain Vulnerabilities & Raw Material Scarcity | -0.9% | Global, impacting regions reliant on imports | Short-term (2025-2026) |

| Regulatory Compliance Costs & Complexity | -0.8% | Europe, North America, Japan | Mid-term to Long-term (2026-2033) |

| Technological Obsolescence in Production | -0.4% | Legacy manufacturers in mature markets | Long-term (2029-2033) |

| High Energy Consumption & Cost | -0.7% | Global, impacting energy-intensive production | Short-term to Mid-term (2025-2027) |

Hexamine for Industrial Use Market - Updated Report Scope

This report provides an exhaustive analysis of the Hexamine for Industrial Use market, encompassing historical data, current market dynamics, and future projections. It delves into market sizing, growth drivers, restraints, opportunities, and challenges, offering a holistic view of the industry landscape. The scope includes a detailed segmentation by application, grade, and form, alongside a comprehensive regional analysis to identify key growth pockets and strategic initiatives by leading market participants. The report aims to furnish stakeholders with actionable insights for informed decision-making and strategic planning within the hexamine industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 850 Million |

| Market Forecast in 2033 | USD 1.35 Billion |

| Growth Rate | 5.8% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Leading Chemical Manufacturer A, Global Specialty Chemicals Provider B, Integrated Chemical Solutions C, Advanced Materials Company D, Industrial Chemicals Group E, Chemical Innovations Co. F, Premier Chemical Producers G, Worldwide Chemical Supply H, Chemical Intermediates Corp. I, Specialty Polymers Ltd. J, Material Science Enterprises K, Global Industrial Synthetics L, Chemical Raw Materials Inc. M, Bulk Chemicals Solutions N, Asia Chemical Leader O, European Chemicals Major P, North American Chemical Systems Q, Latin America Chemical R, Middle East Chemical S, African Chemical Ventures T |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The hexamine for industrial use market is comprehensively segmented based on its diverse applications, the specific grades required for various end-uses, and its physical forms available in the market. This segmentation provides a granular view of market dynamics, revealing demand patterns, growth pockets, and the competitive landscape within each sub-segment. Understanding these segments is crucial for market players to tailor their product offerings, optimize production, and identify high-growth opportunities, enabling a more targeted approach to market penetration and expansion.

Each segment's performance is influenced by unique industry trends, regulatory frameworks, and technological advancements. For instance, the pharmaceutical grade segment demands stringent quality controls and purity, while the industrial grade for resin manufacturing focuses on cost-efficiency and consistent performance in bulk applications. Analyzing these segments individually helps to accurately forecast demand and identify areas for strategic investment, ensuring that market players can effectively navigate the complexities of the hexamine market.

- By Application

- Phenolic Resins: Primarily used as a curing agent in the production of various phenolic resins, widely applied in automotive, construction, and electrical industries.

- Rubber Additives: Functions as a vulcanization accelerator and adhesion promoter in the manufacturing of tires, conveyor belts, and other rubber products.

- Vulcanization Accelerators

- Adhesion Promoters

- Pharmaceuticals: Utilized as an active pharmaceutical ingredient (API) for urinary tract infections and as an excipient in some drug formulations.

- Explosives: Key component in the synthesis of RDX (cyclotrimethylenetrinitramine) and other powerful military and industrial explosives.

- Dyes: Employed in the production of certain dyes and pigments.

- Agriculture: Finds application as a slow-release nitrogen fertilizer and in some pesticide formulations.

- Disinfectants: Used in the formulation of some disinfectants and antiseptic agents due to its formaldehyde-releasing properties.

- Others: Includes niche applications in corrosion inhibitors, fire retardants, photographic chemicals, and analytical reagents.

- By Grade

- Industrial Grade: Standard purity hexamine for bulk industrial applications such as resins and rubber.

- Pharmaceutical Grade: High-purity hexamine meeting stringent pharmaceutical standards for medicinal uses.

- Reagent Grade: Highly pure hexamine used in laboratory and analytical applications.

- By Form

- Powder: Most common form, widely used due to ease of handling and solubility.

- Liquid Solution: Hexamine dissolved in water, preferred for specific applications requiring liquid dispensing.

- Granules: Pelletized form, offering advantages in reduced dust and improved flowability for certain industrial processes.

Regional Highlights

The global hexamine for industrial use market exhibits distinct regional dynamics, influenced by varying levels of industrialization, regulatory landscapes, and end-use industry growth. Asia-Pacific stands out as the dominant and fastest-growing region, driven by its robust manufacturing sector and extensive infrastructure development. Europe and North America represent mature markets with stable demand and a strong emphasis on regulatory compliance and sustainable production. Latin America, the Middle East, and Africa are emerging as significant growth hubs, fueled by increasing industrial output and diversification efforts.

- Asia Pacific (APAC): Dominates the market share due to rapid industrialization, burgeoning automotive and construction sectors in countries like China, India, Japan, and South Korea. The region benefits from lower production costs and increasing domestic demand for hexamine across various applications.

- Europe: A mature market characterized by stringent environmental regulations and a focus on high-quality and specialty chemical applications. Germany, France, and the UK are key contributors, with steady demand from the automotive, rubber, and pharmaceutical industries.

- North America: Exhibits stable demand driven by established automotive, construction, and defense industries. The region focuses on technological advancements and regulatory adherence, with the United States being the primary market.

- Latin America: Showing promising growth due to industrial expansion, particularly in Brazil and Mexico. Increased investments in infrastructure and manufacturing are stimulating demand for hexamine.

- Middle East and Africa (MEA): Emerging market with growing industrial activities, especially in construction and mining sectors. Investments in chemical manufacturing and diversification away from oil economies are contributing to hexamine demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hexamine for Industrial Use Market.- Leading Chemical Manufacturer A

- Global Specialty Chemicals Provider B

- Integrated Chemical Solutions C

- Advanced Materials Company D

- Industrial Chemicals Group E

- Chemical Innovations Co. F

- Premier Chemical Producers G

- Worldwide Chemical Supply H

- Chemical Intermediates Corp. I

- Specialty Polymers Ltd. J

- Material Science Enterprises K

- Global Industrial Synthetics L

- Chemical Raw Materials Inc. M

- Bulk Chemicals Solutions N

- Asia Chemical Leader O

- European Chemicals Major P

- North American Chemical Systems Q

- Latin America Chemical R

- Middle East Chemical S

- African Chemical Ventures T

Frequently Asked Questions

Analyze common user questions about the Hexamine for Industrial Use market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is hexamine primarily used for in industrial applications?

Hexamine is primarily used as a curing agent for phenolic resins, a vulcanization accelerator and adhesion promoter in the rubber industry, and a key intermediate in the production of pharmaceuticals and explosives. Its versatility stems from its ability to release formaldehyde and ammonia under specific conditions.

What is the projected growth rate for the Hexamine for Industrial Use Market?

The Hexamine for Industrial Use Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033, driven by sustained demand from its core application sectors and industrial expansion in emerging economies.

Which regions are key contributors to the Hexamine for Industrial Use Market?

Asia Pacific is the leading and fastest-growing region due to its robust manufacturing base and infrastructure development. North America and Europe are mature markets with stable demand, while Latin America, the Middle East, and Africa show promising growth.

What are the main drivers of growth for hexamine in industrial use?

Key drivers include the expanding demand for phenolic resins in the automotive and construction industries, growth in the global rubber sector, increasing pharmaceutical applications, and industrialization in emerging economies.

What challenges does the Hexamine for Industrial Use Market face?

The market faces challenges such as volatility in raw material prices (formaldehyde, ammonia), stringent environmental regulations concerning emissions, intense market competition, and potential supply chain disruptions.