Helpdesk Outsourcing Market

Helpdesk Outsourcing Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705074 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Helpdesk Outsourcing Market Size

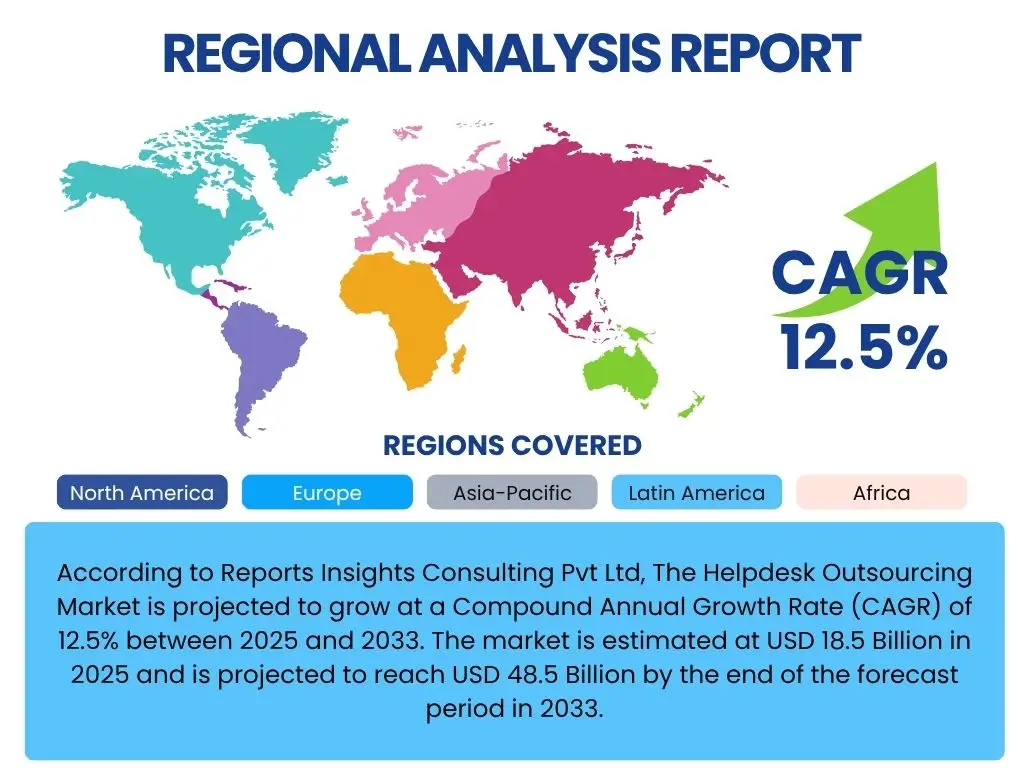

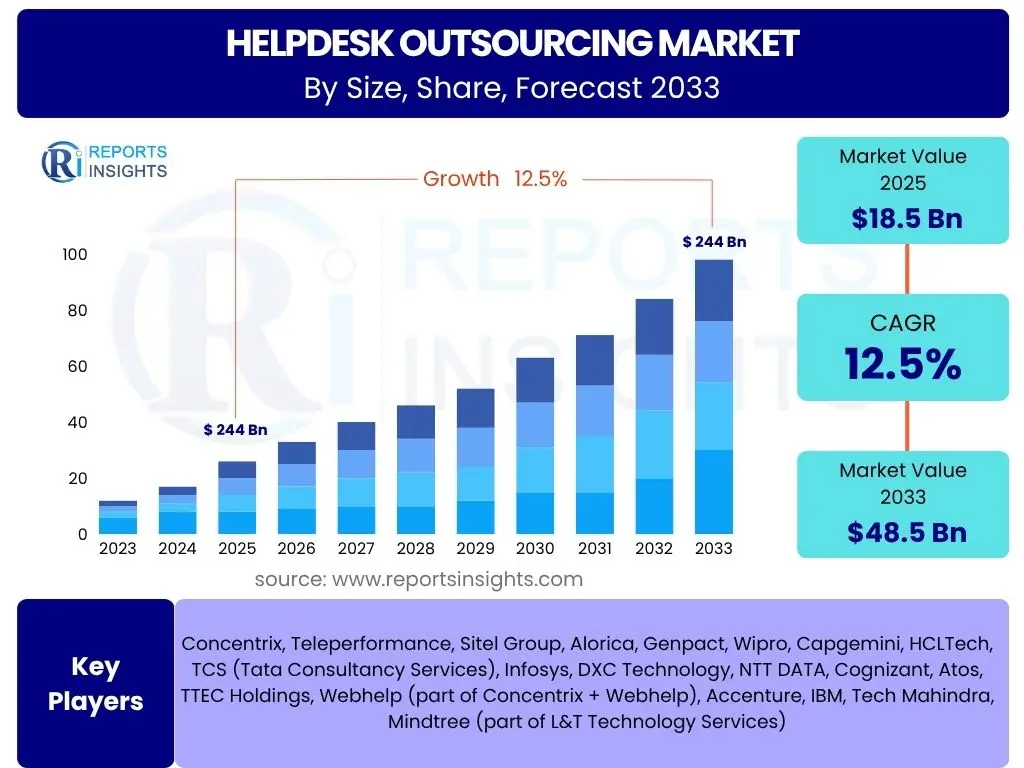

According to Reports Insights Consulting Pvt Ltd, The Helpdesk Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2033. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 48.5 Billion by the end of the forecast period in 2033.

Key Helpdesk Outsourcing Market Trends & Insights

The Helpdesk Outsourcing market is currently shaped by several transformative trends driven by evolving customer expectations, technological advancements, and the global shift towards digital transformation. Organizations are increasingly seeking external partners to manage their support operations, not just for cost efficiencies but also for access to specialized expertise, scalability, and enhanced service quality. The emphasis has shifted from mere reactive problem-solving to proactive customer engagement and experience optimization, leveraging insights derived from support interactions to improve products and services.

A significant trend involves the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) into outsourced helpdesk operations, enabling automation of routine queries and more intelligent routing of complex issues. Furthermore, the demand for multilingual support and 24/7 availability has intensified due to the globalized nature of businesses and customer bases. Companies are also prioritizing partners who can offer comprehensive solutions, including IT support, technical assistance, and customer service, often bundled with advisory services for continuous improvement and innovation.

The market also reflects a growing preference for flexible engagement models, such as hybrid outsourcing, where critical functions are retained in-house while non-core or high-volume tasks are outsourced. This allows businesses to maintain control over strategic aspects of their customer support while benefiting from the operational efficiencies of outsourcing. The focus on data security and compliance, particularly with evolving regulations like GDPR and CCPA, remains paramount, influencing vendor selection and partnership structures in this dynamic market.

- Increased adoption of AI and automation for first-line support.

- Shift towards proactive and predictive customer service models.

- Growing demand for specialized technical support and IT helpdesk services.

- Emphasis on omnichannel support experiences across multiple channels.

- Expansion of global delivery models to provide 24/7 multilingual support.

- Rise of outcome-based and flexible outsourcing contracts.

- Focus on enhanced data security and compliance within outsourced operations.

AI Impact Analysis on Helpdesk Outsourcing

The integration of Artificial Intelligence (AI) is fundamentally reshaping the Helpdesk Outsourcing landscape, moving beyond simple automation to enable more sophisticated and intelligent support solutions. Users frequently inquire about how AI can enhance efficiency, reduce costs, and improve customer satisfaction within an outsourced model. They are keen to understand the practical applications of AI, such as chatbots for instant responses to common queries, virtual assistants for guided troubleshooting, and AI-powered analytics for identifying service gaps and predicting customer needs. The core expectation is that AI will augment human agents, allowing them to focus on complex, high-value interactions rather than replacing them entirely.

Concerns often revolve around the ability of AI to handle nuanced customer emotions, the potential for a depersonalized customer experience, and the significant initial investment required for AI implementation. Users also question the security and privacy implications of feeding vast amounts of customer data into AI systems, especially when managed by a third-party provider. Despite these concerns, there is a strong belief that AI will drive the next wave of innovation in customer service, leading to faster resolution times, improved agent productivity, and more consistent service quality across diverse customer interactions.

The consensus among market participants is that AI's impact is not just about efficiency but also about creating a more intelligent and empathetic customer journey. Outsourcing providers are now tasked with demonstrating their capabilities in deploying AI responsibly, integrating it seamlessly with existing systems, and proving a clear return on investment. The future of helpdesk outsourcing is increasingly intertwined with the strategic deployment of AI, aiming to strike a balance between automation, human expertise, and delivering exceptional customer experiences at scale.

- Automation of routine inquiries via chatbots and virtual assistants.

- Enhanced predictive analytics for identifying customer issues and trends.

- Improved agent efficiency through AI-powered knowledge bases and decision support systems.

- Personalized customer experiences driven by AI-driven insights.

- Potential for cost reduction through optimized resource allocation.

- Challenges in managing complex or emotionally charged customer interactions.

- Increased focus on data security and ethical AI deployment in outsourced services.

Key Takeaways Helpdesk Outsourcing Market Size & Forecast

The Helpdesk Outsourcing market is poised for robust growth, reflecting a sustained strategic shift among businesses to leverage external expertise for their customer and technical support operations. A key takeaway is the accelerating adoption of outsourcing, driven by both traditional cost-saving imperatives and an increasing recognition of the value proposition in accessing specialized skills, advanced technologies, and scalable infrastructure without significant upfront capital expenditure. The market's expansion is indicative of organizations moving beyond viewing helpdesk as a mere cost center, instead seeing it as a critical component for customer retention and brand reputation.

Furthermore, the forecast demonstrates a clear trend towards value-added services within outsourcing agreements. While foundational support remains crucial, demand is rising for providers who can offer proactive support, data analytics, AI integration, and continuous process improvement. This evolution signifies that clients are not just looking for bodies to answer calls but strategic partners who can contribute to overall business objectives, enhance customer journeys, and provide actionable insights from support interactions. The competitive landscape is also evolving, with providers differentiating themselves through industry-specific expertise, technological prowess, and flexible service delivery models.

The significant projected growth underscores the resilience and adaptability of the helpdesk outsourcing sector, particularly in response to global events that necessitate remote work and digital communication. Businesses are increasingly comfortable entrusting their critical support functions to third parties, provided that robust service level agreements (SLAs), data security protocols, and communication frameworks are in place. The market's future will be characterized by greater specialization, deeper technological integration, and a continuous pursuit of operational excellence to meet the dynamic needs of a globally connected customer base.

- Strong projected CAGR driven by cost efficiencies and access to expertise.

- Market shift towards value-added and technologically advanced outsourcing solutions.

- Increasing strategic importance of outsourced helpdesk for customer experience.

- Growing demand for specialized and vertical-specific support services.

- Emphasis on flexible engagement models and scalable infrastructure.

- The market is resilient to economic fluctuations due to its essential nature.

Helpdesk Outsourcing Market Drivers Analysis

The Helpdesk Outsourcing market is primarily propelled by enterprises seeking to reduce operational costs and gain efficiencies in their customer and technical support functions. Outsourcing allows companies to convert fixed costs into variable ones, eliminating the need for in-house infrastructure, training, and staffing expenses. This financial flexibility is particularly appealing to Small and Medium-sized Enterprises (SMEs) and startups, enabling them to access high-quality support services without substantial capital investment. Furthermore, the global talent pool available through outsourcing provides access to skilled professionals at competitive rates, particularly in regions with lower labor costs, enhancing service delivery capabilities.

Another significant driver is the growing complexity of IT environments and consumer demands. As technology evolves rapidly, maintaining an in-house team with diverse and up-to-date technical expertise becomes challenging and expensive. Outsourcing grants businesses immediate access to specialized knowledge, certified professionals, and advanced tools that might be otherwise inaccessible or cost-prohibitive. This specialized expertise ensures higher resolution rates, improved first-call resolution, and ultimately, enhanced customer satisfaction. The ability to scale operations rapidly to meet fluctuating demand, such as during product launches or seasonal peaks, is also a critical advantage offered by outsourcing providers, ensuring uninterrupted service delivery and business continuity.

The strategic focus on core business competencies is also a key impetus for outsourcing helpdesk functions. By entrusting support operations to external experts, organizations can reallocate internal resources and management attention towards their primary business activities, fostering innovation and competitive advantage. The desire to provide 24/7 multilingual support across diverse geographies without the logistical challenges of internal staffing further drives market growth. As businesses expand globally, the need for continuous, consistent, and culturally sensitive customer service becomes paramount, a requirement expertly fulfilled by global outsourcing providers.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Cost Reduction and Operational Efficiency | +2.5% | Global, particularly North America & Europe | Short to Mid-term (2025-2030) |

| Access to Specialized Expertise and Technology | +2.0% | Global, especially APAC & Latin America | Mid to Long-term (2027-2033) |

| Scalability and Flexibility of Operations | +1.8% | Global, high relevance for SMEs | Short to Mid-term (2025-2030) |

| Focus on Core Business Activities | +1.5% | Mature markets (North America, Europe) | Mid-term (2026-2031) |

| Demand for 24/7 Multilingual Support | +1.2% | Global, high relevance for e-commerce | Short to Long-term (2025-2033) |

Helpdesk Outsourcing Market Restraints Analysis

Despite its numerous advantages, the Helpdesk Outsourcing market faces several significant restraints that could impede its growth. Paramount among these is the pervasive concern regarding data security and privacy. Entrusting sensitive customer information and proprietary company data to a third-party vendor raises substantial risks, including potential breaches, unauthorized access, and compliance failures. High-profile data breaches in outsourced environments can severely damage a company's reputation and lead to hefty regulatory fines, making organizations hesitant to fully embrace outsourcing, particularly in highly regulated industries like BFSI and healthcare.

Another critical restraint is the perceived loss of control over service quality and brand image. When helpdesk functions are outsourced, direct oversight over agent training, adherence to brand guidelines, and immediate response to customer feedback can be diminished. This can lead to inconsistencies in service delivery, potentially diluting the customer experience and undermining brand loyalty. Communication barriers, whether linguistic or cultural, between the client organization and the outsourcing provider, as well as between the outsourced agents and end-customers, can further exacerbate these challenges, leading to misunderstandings and inefficient problem resolution.

Furthermore, the risk of vendor lock-in and the complexities involved in switching providers act as deterrents. Once significant processes and systems are integrated with an outsourcing partner, disentangling them can be costly, time-consuming, and disruptive to business operations. This dependency can limit a client's negotiation power and flexibility. Additionally, issues related to service quality, such as inadequate training of outsourced staff, high agent turnover, and a lack of empathy or understanding of specific customer needs, continue to be common complaints that can negatively impact the reputation and adoption of helpdesk outsourcing services.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data Security and Privacy Concerns | -2.2% | Global, particularly Europe & North America | Short to Long-term (2025-2033) |

| Loss of Control over Service Quality and Brand Image | -1.9% | Global | Mid-term (2026-2031) |

| Communication Challenges and Cultural Differences | -1.7% | Global, particularly cross-border outsourcing | Short to Mid-term (2025-2030) |

| Vendor Lock-in and Switching Costs | -1.5% | Global, high for large enterprises | Mid to Long-term (2027-2033) |

| Service Quality and Performance Issues | -1.0% | Global | Short-term (2025-2028) |

Helpdesk Outsourcing Market Opportunities Analysis

The Helpdesk Outsourcing market is brimming with opportunities driven by technological advancements and evolving business needs. A significant area of growth lies in the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) within helpdesk operations. Outsourcing providers who can effectively integrate these technologies to offer intelligent automation, predictive analytics, and personalized customer interactions will gain a competitive edge. This includes developing AI-powered chatbots for first-line support, leveraging ML for intelligent routing and sentiment analysis, and providing data-driven insights to clients for continuous service improvement. The demand for highly specialized technical support in niche industries, such as cybersecurity, cloud computing, and advanced manufacturing, also presents a substantial growth avenue.

The expansion into emerging markets, particularly in Asia Pacific, Latin America, and the Middle East & Africa, represents another compelling opportunity. As businesses in these regions digitalize and expand their customer base, the need for scalable and efficient helpdesk services will grow exponentially. Outsourcing providers with established operations or strategic partnerships in these regions can capitalize on this demand. Furthermore, the global shift towards remote and hybrid work models has amplified the need for robust IT helpdesk support that can cater to geographically dispersed employees, opening new opportunities for providers offering remote IT support and device management services.

Moreover, the focus on enhancing the overall customer experience (CX) rather than just issue resolution is creating new service offerings. Providers who can offer end-to-end CX solutions, encompassing proactive outreach, customer journey mapping, and feedback loop integration, will be highly sought after. This extends to offering value-added services such as customer success management, social media support, and voice of the customer (VoC) analytics. Customization and vertical-specific solutions, tailoring helpdesk services to the unique requirements of industries like healthcare, finance, or retail, also present significant opportunities for differentiation and market penetration, addressing specific regulatory and operational nuances.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration of AI and Advanced Analytics | +2.8% | Global, strong in mature markets | Mid to Long-term (2027-2033) |

| Expansion into Emerging Markets | +2.5% | APAC, Latin America, MEA | Short to Long-term (2025-2033) |

| Focus on Enhanced Customer Experience (CX) | +2.0% | Global | Mid-term (2026-2031) |

| Demand for Vertical-Specific Solutions | +1.8% | Global, niche markets | Mid to Long-term (2027-2033) |

| Growth in Remote IT Support for Hybrid Work | +1.5% | Global | Short to Mid-term (2025-2030) |

Helpdesk Outsourcing Market Challenges Impact Analysis

The Helpdesk Outsourcing market confronts several formidable challenges that require strategic navigation for sustained growth. One primary challenge is ensuring regulatory compliance and adherence to diverse data privacy laws across different regions. As outsourcing becomes increasingly global, providers must navigate complex legal frameworks like GDPR in Europe, CCPA in California, and various country-specific regulations, which can vary significantly in their stringency and requirements. Non-compliance can lead to substantial penalties, reputational damage, and loss of client trust, making it a critical concern for both providers and clients.

Maintaining consistent service quality and cultural alignment across geographically dispersed teams presents another significant hurdle. While outsourcing offers cost benefits, the challenge lies in standardizing training, quality assurance, and customer interaction protocols to ensure a uniform and positive customer experience, regardless of the agent's location. Cultural nuances can impact communication styles and problem-solving approaches, potentially leading to misunderstandings or customer dissatisfaction if not properly managed. High agent attrition rates in some outsourcing hubs also pose a continuous challenge, affecting service continuity, knowledge retention, and overall operational efficiency.

Furthermore, the rapid pace of technological change, particularly the advancements in AI and automation, presents a dual challenge. While these technologies offer immense opportunities, they also necessitate significant investment in infrastructure, talent reskilling, and continuous innovation for outsourcing providers. Keeping pace with evolving software, communication channels, and customer expectations requires agile development and deployment capabilities. Convincing potential clients of the tangible benefits and ROI of advanced helpdesk solutions, especially given the initial investment and integration complexities, also remains a significant sales and marketing challenge for providers in a competitive market.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Regulatory Compliance and Data Privacy Laws | -2.0% | Global, particularly EU and North America | Short to Long-term (2025-2033) |

| Maintaining Consistent Service Quality & Cultural Alignment | -1.8% | Global, cross-border operations | Mid-term (2026-2031) |

| High Agent Attrition and Talent Management | -1.5% | Key outsourcing hubs (e.g., India, Philippines) | Short to Mid-term (2025-2030) |

| Rapid Technological Advancements (e.g., AI integration) | -1.2% | Global | Mid to Long-term (2027-2033) |

| Initial Investment and Integration Complexities | -0.8% | Global, high for new entrants | Short-term (2025-2028) |

Helpdesk Outsourcing Market - Updated Report Scope

This report offers an in-depth analysis of the global Helpdesk Outsourcing market, providing comprehensive insights into its current size, historical performance, and future growth trajectory. It meticulously segments the market by service type, end-use industry, organization size, and deployment model, offering granular data and forecasts for each category. The study also includes a detailed regional analysis, highlighting key market dynamics, growth opportunities, and regulatory landscapes across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The competitive landscape section profiles leading market players, assessing their strategies, product offerings, and market positioning. This report serves as a crucial resource for stakeholders seeking to understand market trends, identify growth drivers and restraints, and make informed strategic decisions in the evolving helpdesk outsourcing industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 48.5 Billion |

| Growth Rate | 12.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Concentrix, Teleperformance, Sitel Group, Alorica, Genpact, Wipro, Capgemini, HCLTech, TCS (Tata Consultancy Services), Infosys, DXC Technology, NTT DATA, Cognizant, Atos, TTEC Holdings, Webhelp (part of Concentrix + Webhelp), Accenture, IBM, Tech Mahindra, Mindtree (part of L&T Technology Services) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Helpdesk Outsourcing market is comprehensively segmented to provide a detailed understanding of its diverse applications and operational models. This segmentation highlights the various types of services offered, the specific industries leveraging these services, the scale of organizations opting for outsourcing, and the technological infrastructure used for service delivery. Analyzing these segments helps identify niche opportunities, understand customer preferences, and tailor service offerings to meet specific market demands, ensuring a granular perspective on market dynamics and growth potential.

- By Service Type: Includes Tier 1 Support (basic issue resolution, FAQs), Tier 2 Support (more complex technical issues, escalations), Tier 3 Support (expert-level problem-solving, deep technical expertise), Technical Support (IT and product-specific technical assistance), Customer Support (general inquiries, order processing, refunds), IT Helpdesk (internal IT support for employees), and Non-IT Helpdesk (support for non-IT functions like HR, finance).

- By End-Use Industry: Covers the primary sectors that utilize helpdesk outsourcing, such as IT & Telecom, BFSI (Banking, Financial Services, and Insurance), Healthcare & Life Sciences, Retail & E-commerce, Government & Public Sector, Manufacturing, Education, and other emerging industries.

- By Organization Size: Distinguishes between Small & Medium-sized Enterprises (SMEs), which often seek cost-effective and scalable solutions, and Large Enterprises, which require comprehensive, globally integrated, and specialized outsourcing services.

- By Deployment Model: Categorizes services based on their operational setup, including On-premise (client-managed infrastructure), Cloud-based (utilizing cloud platforms for scalability and accessibility), and Hybrid (a combination of both models to optimize efficiency and security).

Regional Highlights

- North America: Represents a mature market with high adoption rates, driven by the presence of numerous large enterprises, a strong focus on customer experience, and the continuous integration of advanced technologies like AI and automation. The region commands a significant market share due to its early adoption of outsourcing trends and substantial investments in digital transformation initiatives.

- Europe: Characterized by stringent data privacy regulations (e.g., GDPR) which significantly influence outsourcing strategies. Western European countries are mature markets, while Eastern Europe is emerging as a preferred outsourcing destination due to cost advantages and a skilled workforce. Demand is strong for multilingual support and specialized IT services.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by rapid digitalization, expanding industrialization, and a vast pool of skilled, cost-effective labor in countries like India, the Philippines, and China. Increasing internet penetration and the growth of e-commerce further drive the demand for scalable helpdesk solutions across diverse languages and cultures.

- Latin America: An emerging market for helpdesk outsourcing, offering a compelling blend of competitive labor costs, strong cultural affinity with North American markets, and growing technological infrastructure. Countries like Brazil, Mexico, and Colombia are becoming attractive nearshore destinations, particularly for Spanish and Portuguese language support.

- Middle East and Africa (MEA): Currently represents a smaller but rapidly developing market. Growth is primarily driven by increasing digitalization initiatives, diversification of economies away from oil, and government investments in smart city projects. The region presents significant opportunities for providers specializing in IT infrastructure support and customer service for a growing young, tech-savvy population.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helpdesk Outsourcing Market.- Concentrix

- Teleperformance

- Sitel Group

- Alorica

- Genpact

- Wipro

- Capgemini

- HCLTech

- TCS (Tata Consultancy Services)

- Infosys

- DXC Technology

- NTT DATA

- Cognizant

- Atos

- TTEC Holdings

- Webhelp (part of Concentrix + Webhelp)

- Accenture

- IBM

- Tech Mahindra

- Mindtree (part of L&T Technology Services)

Frequently Asked Questions

What are the primary benefits of outsourcing helpdesk services?

The primary benefits of outsourcing helpdesk services include significant cost reduction by converting fixed operational expenses into variable ones, access to specialized expertise and advanced technologies, enhanced scalability to handle fluctuating demand, and the ability to provide 24/7 multilingual support, allowing in-house teams to focus on core business functions.

How does AI impact the Helpdesk Outsourcing market?

AI significantly impacts the Helpdesk Outsourcing market by enabling automation of routine inquiries via chatbots, enhancing predictive analytics for proactive support, improving agent efficiency with intelligent knowledge bases, and facilitating personalized customer experiences. While it automates basic tasks, its primary role is to augment human agents and provide data-driven insights.

What are the main challenges in helpdesk outsourcing?

Key challenges in helpdesk outsourcing include ensuring data security and compliance with various privacy regulations, maintaining consistent service quality and cultural alignment across different locations, managing potential communication barriers, addressing concerns about vendor lock-in, and mitigating high agent attrition rates in some outsourcing hubs.

Which industries benefit most from helpdesk outsourcing?

Industries that benefit most from helpdesk outsourcing include IT & Telecom due to complex technical issues, BFSI for secure and efficient customer service, Healthcare & Life Sciences for specialized support, Retail & E-commerce for high-volume customer inquiries, and Manufacturing for supply chain and product support. Essentially, any industry requiring scalable and expert customer or technical assistance can benefit.

What is the projected growth rate for the Helpdesk Outsourcing market?

The Helpdesk Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2033. It is estimated at USD 18.5 Billion in 2025 and is forecasted to reach USD 48.5 Billion by the end of 2033, indicating robust expansion driven by increasing demand for efficient and specialized support solutions.