Healthcare IT Outsourcing Market

Healthcare IT Outsourcing Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700989 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Healthcare IT Outsourcing Market Size

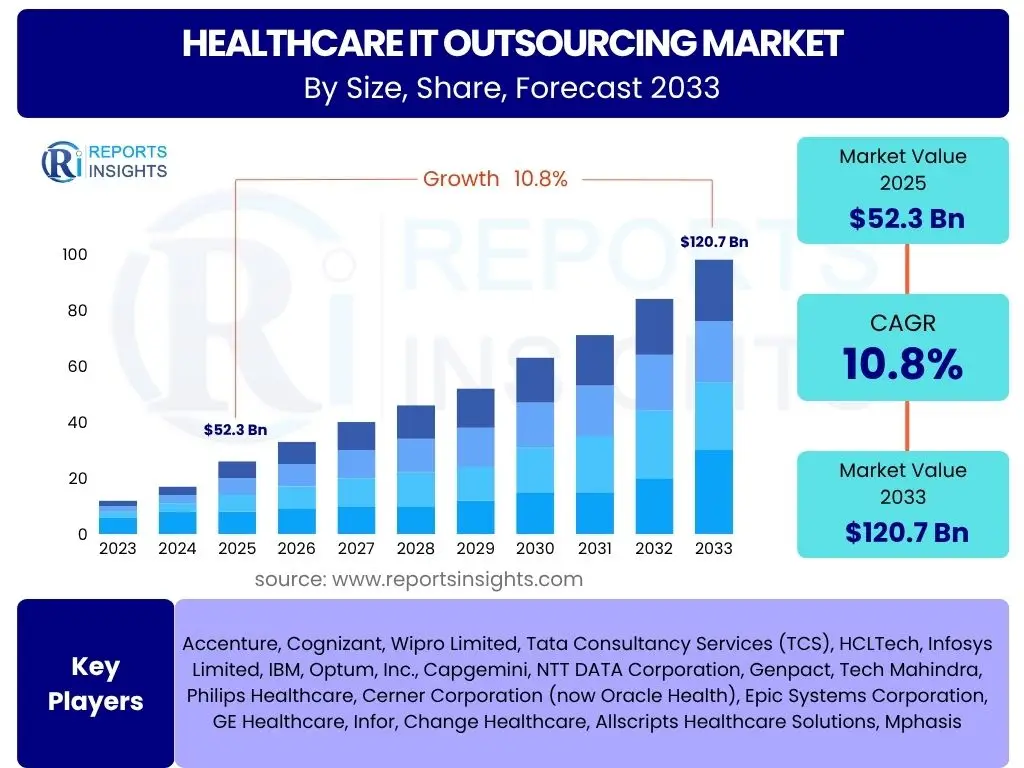

According to Reports Insights Consulting Pvt Ltd, The Healthcare IT Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2025 and 2033. This robust growth trajectory is primarily driven by the increasing pressure on healthcare organizations to reduce operational costs, enhance efficiency, and access specialized technological expertise that may not be available in-house. The shift towards value-based care models, coupled with the escalating demand for advanced digital solutions, further propels market expansion.

The market is estimated at USD 52.3 billion in 2025, reflecting a significant base built on the industry's ongoing digital transformation initiatives. Healthcare providers and payers are increasingly relying on external partners for managing complex IT infrastructures, developing innovative applications, and ensuring stringent regulatory compliance, leading to substantial market valuation at the onset of the forecast period.

By the end of the forecast period in 2033, the market is projected to reach USD 120.7 billion. This substantial increase underscores the sustained and growing reliance on outsourcing for critical IT functions within the healthcare ecosystem. Factors such as the widespread adoption of telehealth, the integration of artificial intelligence and machine learning, and the burgeoning need for robust cybersecurity solutions are expected to be key catalysts for this projected growth, solidifying the market's trajectory towards significant expansion.

Key Healthcare IT Outsourcing Market Trends & Insights

The healthcare IT outsourcing market is undergoing significant transformation, shaped by evolving technological landscapes and shifting industry demands. Common inquiries from users often revolve around the most impactful trends influencing this sector, particularly concerning digital innovation, data management, and the optimization of healthcare delivery. There is keen interest in how cloud adoption, data analytics, and the increasing complexity of regulatory frameworks are driving outsourcing decisions, as organizations seek to leverage external expertise for efficiency and compliance.

Users frequently ask about the role of specialized IT services, such as cybersecurity and advanced analytics, in the outsourcing paradigm. The growing recognition that in-house IT departments may lack the resources or specific skill sets required to navigate these intricate areas is a recurrent theme. Furthermore, the push towards interoperability and seamless data exchange across diverse healthcare systems presents both opportunities and challenges, making outsourcing an attractive option for achieving these complex integration goals.

- Increased adoption of cloud-based solutions for scalability and cost efficiency.

- Rising demand for specialized cybersecurity services due to escalating data breaches.

- Growing focus on data analytics and AI-driven insights for improved patient outcomes.

- Expansion of telehealth and remote patient monitoring IT support services.

- Emphasis on interoperability and seamless data exchange across healthcare systems.

- Shift towards value-based care models driving demand for predictive analytics and population health management solutions.

- Leveraging outsourcing for core IT infrastructure management to free up internal resources.

AI Impact Analysis on Healthcare IT Outsourcing

The integration of Artificial Intelligence (AI) is fundamentally reshaping the healthcare IT outsourcing landscape, prompting numerous questions from stakeholders regarding its practical implications and future trajectory. Users are frequently concerned about how AI will automate routine IT tasks, thereby potentially reducing the need for traditional manual outsourcing services, and conversely, how it will create new opportunities for specialized AI development and management outsourcing. The conversation often extends to the ethical considerations, data privacy implications, and the need for robust AI governance frameworks when outsourcing AI-centric projects.

Another prevalent area of inquiry centers on AI's capacity to enhance efficiency and accuracy in areas like medical coding, claims processing, and diagnostic support, leading healthcare organizations to seek outsourcing partners with deep AI expertise. There is also significant interest in understanding how AI can be leveraged for predictive analytics in disease management, patient flow optimization, and operational efficiency, necessitating a strong partnership with outsourced IT providers capable of implementing and managing these sophisticated systems. The overarching theme is a duality: AI as a disruptor to existing outsourcing models, yet simultaneously a powerful enabler of new, high-value outsourcing opportunities.

- Automation of routine IT tasks (e.g., helpdesk, infrastructure monitoring) reducing basic outsourcing demand but increasing need for complex AI management.

- Enhanced data analysis and predictive modeling outsourcing for population health management and clinical decision support.

- Development and deployment of AI-powered solutions for medical imaging analysis, drug discovery, and personalized medicine outsourced to specialized firms.

- Increased demand for AI ethics and governance consulting services to ensure responsible AI implementation in healthcare.

- Outsourcing of AI model training, validation, and maintenance for continuous improvement and regulatory compliance.

- Shift in skill requirements for IT outsourcing providers, emphasizing data science, machine learning engineering, and AI integration expertise.

- Cost reduction in specific administrative processes (e.g., claims, coding) through AI automation, driving outsourcing towards higher-value strategic IT functions.

Key Takeaways Healthcare IT Outsourcing Market Size & Forecast

The primary insights derived from the Healthcare IT Outsourcing market size and forecast data reveal a sector poised for substantial and sustained expansion. Users consistently seek to understand the underlying drivers of this growth, the magnitude of the market's potential, and the strategic implications for both healthcare providers and outsourcing vendors. A key takeaway is the accelerating trend of healthcare organizations divesting non-core IT functions to external experts, driven by a confluence of cost pressures, regulatory complexities, and the rapid pace of technological innovation.

Furthermore, the forecast highlights a significant shift towards more specialized and advanced IT outsourcing services, moving beyond basic infrastructure management to encompass areas such as cybersecurity, artificial intelligence integration, and sophisticated data analytics. This evolution signifies a maturing market where value addition and strategic partnerships are becoming paramount. The projected growth underscores the critical role outsourcing will play in enabling healthcare providers to achieve digital transformation goals, enhance patient care delivery, and navigate a dynamically evolving industry landscape effectively.

- The market is on a robust growth trajectory, expected to more than double in value by 2033.

- Cost optimization remains a primary driver for outsourcing, particularly in light of increasing operational expenses for healthcare entities.

- There is a notable shift towards specialized outsourcing services, including AI, cybersecurity, and advanced analytics, moving beyond traditional IT support.

- Regulatory compliance and data security are increasingly central to outsourcing decisions, driving demand for expert third-party services.

- The market's expansion is intrinsically linked to the broader digital transformation efforts within the healthcare industry.

- Geographic diversification in outsourcing partnerships is evident, with emerging economies becoming attractive hubs for service delivery.

Healthcare IT Outsourcing Market Drivers Analysis

The growth of the healthcare IT outsourcing market is propelled by a confluence of powerful drivers, primarily stemming from the intrinsic challenges and evolving demands within the healthcare sector. Organizations are increasingly confronting pressures to reduce operational expenditures while simultaneously enhancing service quality and patient outcomes. This necessitates leveraging external expertise and technological capabilities that may be expensive or difficult to maintain in-house, making outsourcing an economically viable and strategically sound solution.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Pressure for Cost Reduction & Operational Efficiency | +2.5% | Global, particularly North America, Europe | Short- to Mid-term (2025-2029) |

| Shortage of Skilled IT Professionals in Healthcare | +1.8% | Global, acute in developed economies (US, UK, Germany) | Mid- to Long-term (2026-2033) |

| Increasing Adoption of Digital Health Solutions (Telehealth, EHRs) | +2.2% | Global, high in North America, Europe, emerging in APAC | Short- to Mid-term (2025-2030) |

| Complex Regulatory & Compliance Requirements (HIPAA, GDPR) | +1.5% | North America, Europe | Ongoing (2025-2033) |

| Focus on Core Competencies by Healthcare Providers | +1.0% | Global | Mid- to Long-term (2026-2033) |

| Technological Advancements (AI, Cloud, Cybersecurity) | +1.8% | Global | Ongoing (2025-2033) |

Healthcare IT Outsourcing Market Restraints Analysis

Despite its significant growth prospects, the healthcare IT outsourcing market faces several inherent restraints that can temper its expansion. These challenges often revolve around critical concerns such as data security, regulatory compliance, and the complexities associated with vendor management. The sensitive nature of patient health information makes any perceived or actual breach a major deterrent, requiring outsourcing partners to adhere to exceptionally stringent security protocols and compliance frameworks, which can increase operational complexities and costs for both parties.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Data Security and Privacy Concerns | -1.8% | Global, particularly North America, Europe | Ongoing (2025-2033) |

| Compliance with Stringent Healthcare Regulations (HIPAA, GDPR) | -1.5% | North America, Europe, specific national regulations globally | Ongoing (2025-2033) |

| Vendor Management and Quality Control Issues | -1.2% | Global | Short- to Mid-term (2025-2029) |

| Potential for Vendor Lock-in and Switching Costs | -0.8% | Global | Mid- to Long-term (2027-2033) |

| Communication Barriers and Cultural Differences | -0.5% | Cross-border outsourcing scenarios | Ongoing (2025-2033) |

| Integration Challenges with Existing IT Systems | -1.0% | Global | Short- to Mid-term (2025-2030) |

Healthcare IT Outsourcing Market Opportunities Analysis

The healthcare IT outsourcing market is replete with significant opportunities driven by the rapid evolution of digital health technologies and the increasing strategic importance of data. As healthcare organizations grapple with mounting data volumes, the demand for sophisticated analytics and robust cybersecurity measures presents a substantial avenue for growth. Outsourcing partners capable of delivering cutting-edge solutions in areas such as AI-driven diagnostics, predictive analytics for population health, and comprehensive data security frameworks are well-positioned to capitalize on these emerging needs.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expanding Market for Telehealth & Remote Patient Monitoring Support | +1.5% | Global, high in North America, Europe | Short- to Mid-term (2025-2030) |

| Growing Demand for AI/ML-Powered Healthcare Solutions | +2.0% | Global, particularly developed markets | Mid- to Long-term (2026-2033) |

| Increased Focus on Cybersecurity Services | +1.8% | Global | Ongoing (2025-2033) |

| Adoption of Cloud-based Solutions and Hybrid IT Models | +1.2% | Global | Short- to Mid-term (2025-2030) |

| Big Data Analytics & Business Intelligence for Population Health | +1.0% | Global, high in North America, Europe | Mid- to Long-term (2027-2033) |

| Digital Transformation Initiatives in Emerging Economies | +0.8% | Asia Pacific, Latin America, MEA | Mid- to Long-term (2028-2033) |

Healthcare IT Outsourcing Market Challenges Impact Analysis

The healthcare IT outsourcing market, while promising, is not without its significant challenges that can impact its growth trajectory. The dynamic and complex regulatory landscape, characterized by evolving data privacy laws like HIPAA and GDPR, poses a persistent hurdle, requiring outsourcing providers to maintain rigorous compliance frameworks. Moreover, ensuring seamless integration of outsourced systems with existing legacy IT infrastructure within healthcare organizations remains a complex technical and operational challenge, often leading to delays and increased costs if not managed meticulously.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Navigating Complex and Evolving Regulatory Landscape | -1.5% | Global, particularly North America, Europe | Ongoing (2025-2033) |

| Ensuring Seamless Integration with Legacy Systems | -1.0% | Global | Short- to Mid-term (2025-2030) |

| Managing Cyber Threats and Data Breaches | -1.8% | Global | Ongoing (2025-2033) |

| Talent Shortage in Specialized IT Areas (e.g., AI, Cloud Security) | -0.8% | Global, acute in developed economies | Mid- to Long-term (2026-2033) |

| Difficulty in Measuring ROI for Outsourced IT Services | -0.7% | Global | Short- to Mid-term (2025-2029) |

| Maintaining Quality of Service and Accountability | -0.5% | Global | Ongoing (2025-2033) |

Healthcare IT Outsourcing Market - Updated Report Scope

This report offers an in-depth analysis of the global Healthcare IT Outsourcing market, providing a comprehensive overview of its current landscape, historical performance, and future growth projections. It meticulously details market size, trends, drivers, restraints, opportunities, and challenges, leveraging robust methodologies and extensive primary and secondary research. The scope encompasses detailed segmentation across various service types, applications, and end-use industries, alongside a thorough regional analysis. Furthermore, the report provides strategic insights into the competitive landscape, profiling key market players and their strategies, designed to assist stakeholders in making informed business decisions and identifying high-growth avenues within the sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 52.3 Billion |

| Market Forecast in 2033 | USD 120.7 Billion |

| Growth Rate | 10.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, Cognizant, Wipro Limited, Tata Consultancy Services (TCS), HCLTech, Infosys Limited, IBM, Optum, Inc., Capgemini, NTT DATA Corporation, Genpact, Tech Mahindra, Philips Healthcare, Cerner Corporation (now Oracle Health), Epic Systems Corporation, GE Healthcare, Infor, Change Healthcare, Allscripts Healthcare Solutions, Mphasis |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Healthcare IT Outsourcing market is extensively segmented to provide a granular view of its diverse components, reflecting the specialized needs of various stakeholders within the healthcare ecosystem. These segmentations allow for a comprehensive understanding of how different service types are adopted, across which applications they are primarily utilized, and by what end-use entities. This detailed breakdown aids in identifying key areas of growth, emerging service demands, and the prevalent deployment models that define the market's operational landscape.

- Service Type: Infrastructure Management Services, Application Management Services, IT Consulting Services, Business Process Outsourcing (BPO), Operational Support, Network Services, Helpdesk Services, Others.

- Application: Provider IT Outsourcing (EHR/EMR, Revenue Cycle Management, Population Health Management, Clinical IT Systems, Practice Management Systems), Payer IT Outsourcing (Claims Processing, Member Management, Provider Network Management, Data Analytics, Fraud Detection), Life Sciences IT Outsourcing (Drug Discovery & Development, Clinical Trials Management, R&D IT, Regulatory Compliance, Manufacturing IT).

- End-Use: Hospitals, Clinics & Physician Practices, Pharmaceutical & Biotechnology Companies, Medical Device Companies, Research & Academic Institutions, Payer Organizations (Insurance Companies), Diagnostic & Imaging Centers.

- Deployment Model: On-Premise, Cloud-Based, Hybrid.

Regional Highlights

- North America: Dominates the market share due to high adoption of advanced healthcare IT solutions, stringent regulatory mandates (e.g., HIPAA), and the presence of major healthcare providers and payers. The region is a key innovator in digital health and AI, driving substantial outsourcing demand for specialized services.

- Europe: Exhibits robust growth, driven by increasing digital transformation initiatives in healthcare, rising demand for integrated healthcare systems, and a focus on data privacy regulations (GDPR). Countries like the UK, Germany, and France are significant contributors to the market.

- Asia Pacific (APAC): Emerges as the fastest-growing region, fueled by expanding healthcare infrastructure, increasing healthcare expenditure, and a growing emphasis on cost-effective IT solutions. Countries such as India, China, and Japan are becoming outsourcing hubs and significant consumers of these services.

- Latin America: Demonstrates steady growth, influenced by healthcare reforms, increasing government investments in digital health, and the need to modernize existing IT infrastructure. Brazil and Mexico are leading the regional adoption.

- Middle East and Africa (MEA): Represents an emerging market with substantial potential, driven by significant investments in healthcare infrastructure development, economic diversification efforts, and a rising awareness of the benefits of IT integration in healthcare.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare IT Outsourcing Market.- Accenture

- Cognizant

- Wipro Limited

- Tata Consultancy Services (TCS)

- HCLTech

- Infosys Limited

- IBM

- Optum, Inc.

- Capgemini

- NTT DATA Corporation

- Genpact

- Tech Mahindra

- Philips Healthcare

- Cerner Corporation (now Oracle Health)

- Epic Systems Corporation

- GE Healthcare

- Infor

- Change Healthcare

- Allscripts Healthcare Solutions

- Mphasis

Frequently Asked Questions

Analyze common user questions about the Healthcare IT Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Healthcare IT Outsourcing?

Healthcare IT outsourcing involves delegating IT-related functions, such as infrastructure management, application development, cybersecurity, and data analytics, to third-party service providers. This allows healthcare organizations to reduce operational costs, access specialized expertise, and focus on core patient care.

Why is the Healthcare IT Outsourcing market growing?

The market is growing due to increasing pressure on healthcare providers to lower costs, the escalating demand for advanced digital solutions, the shortage of in-house IT talent, and the complex regulatory environment that necessitates specialized compliance knowledge.

What are the primary benefits of outsourcing IT in healthcare?

Key benefits include significant cost savings, improved operational efficiency, access to specialized technological expertise (e.g., AI, cybersecurity), enhanced data security and compliance, and the ability for healthcare organizations to concentrate resources on patient-centric services.

What are the main risks associated with Healthcare IT Outsourcing?

Major risks include potential data breaches and privacy violations, challenges in maintaining quality control, difficulties in integrating with existing legacy systems, vendor lock-in concerns, and the complexity of managing outsourced relationships while ensuring regulatory adherence.

How is AI impacting Healthcare IT Outsourcing?

AI is transforming healthcare IT outsourcing by automating routine tasks, increasing demand for specialized AI development and management services, enhancing data analysis for predictive insights, and driving the need for expertise in AI ethics and governance. It creates both efficiency gains and new service opportunities.