Healthcare CRO Market

Healthcare CRO Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705334 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Healthcare CRO Market Size

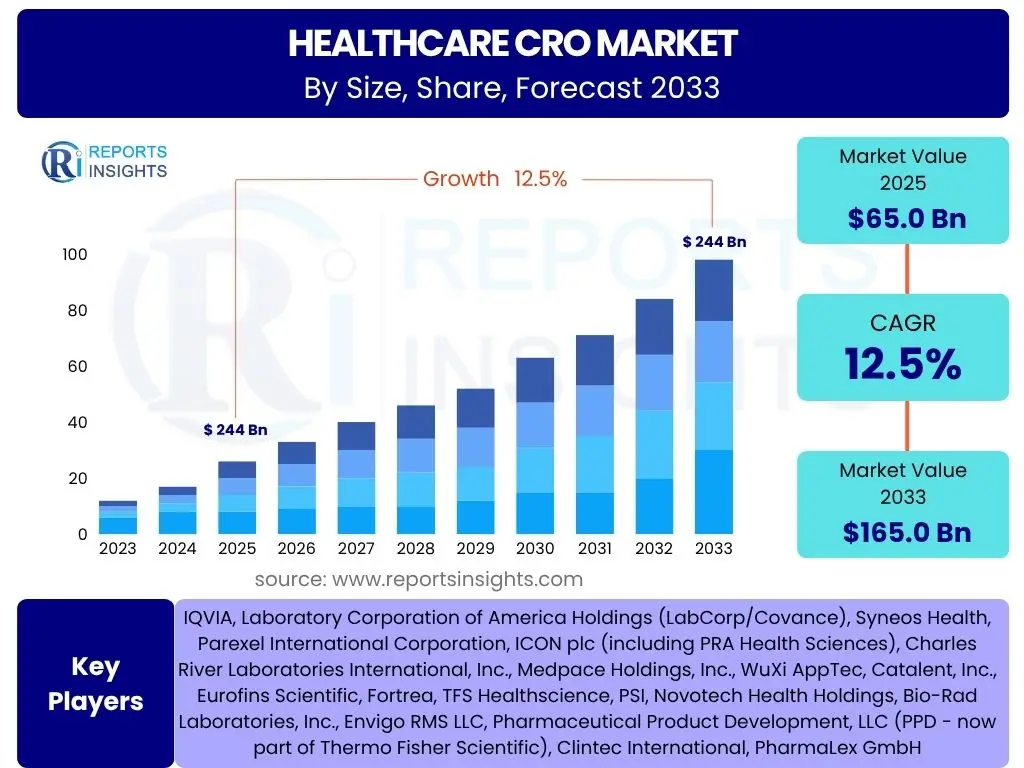

According to Reports Insights Consulting Pvt Ltd, The Healthcare CRO Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2033. The market is estimated at USD 65.0 Billion in 2025 and is projected to reach USD 165.0 Billion by the end of the forecast period in 2033.

Key Healthcare CRO Market Trends & Insights

Users frequently inquire about the evolving landscape of the Healthcare CRO market, seeking to understand the transformative shifts influencing its growth and operational dynamics. The primary areas of interest revolve around the adoption of new technologies, the increasing complexity of drug development, and the expansion into new therapeutic areas. There is a strong emphasis on how CROs are adapting to regulatory changes, demand for specialized services, and the push towards more efficient and patient-centric clinical trials. These inquiries highlight a market that is not only expanding in size but also in its sophistication and strategic importance within the broader healthcare ecosystem.

Another common query concerns the geographical distribution of growth and the emergence of specific regions as key hubs for clinical research. Stakeholders are keen to understand where investments are flowing, the impact of local regulatory frameworks, and the potential for new market entrants. The drive for cost-efficiency without compromising quality is a recurring theme, pushing CROs towards innovative operational models and global partnerships. This collective curiosity underscores a dynamic industry undergoing significant evolution, driven by both intrinsic sector needs and external market forces.

- Increasing R&D expenditure by pharmaceutical and biotechnological companies globally.

- Growing demand for specialized services in complex therapeutic areas like oncology, rare diseases, and gene therapies.

- Rising adoption of decentralized clinical trials (DCTs) and hybrid models.

- Integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and big data analytics in clinical trial design and execution.

- Expansion of CRO operations into emerging markets due to cost advantages and diverse patient populations.

- Focus on patient-centric approaches to improve recruitment, retention, and overall trial experience.

- Consolidation of the CRO industry through mergers and acquisitions to enhance service offerings and global reach.

- Growing emphasis on real-world evidence (RWE) and real-world data (RWD) in drug development and post-market surveillance.

AI Impact Analysis on Healthcare CRO

Common user questions related to the impact of AI on Healthcare CROs primarily revolve around its ability to enhance efficiency, reduce costs, and accelerate drug development timelines. Stakeholders are interested in how AI is being leveraged for predictive analytics in patient recruitment, optimizing trial design, and streamlining data management processes. There is significant curiosity about AI's potential to identify novel drug targets, analyze vast genomic datasets, and improve the accuracy of clinical trial outcomes, ultimately leading to faster regulatory approvals and market entry for new therapies. Furthermore, inquiries often touch upon the challenges associated with AI adoption, such as data privacy concerns, the need for robust validation protocols, and the integration of AI tools with existing IT infrastructures.

Another area of focus for users is the long-term strategic implications of AI for the CRO business model. This includes questions about workforce reskilling, the evolution of service offerings, and the competitive advantage gained by early AI adopters. Concerns are also raised regarding the ethical considerations of AI in clinical research and the regulatory frameworks required to govern its use. The collective sentiment suggests an industry on the cusp of significant technological transformation, where AI is viewed as a critical enabler for overcoming traditional bottlenecks in drug discovery and development, promising a future of more intelligent, efficient, and precise clinical research operations.

- Accelerated drug discovery and development timelines through AI-powered target identification and lead optimization.

- Enhanced precision in clinical trial design, including optimized patient stratification and protocol development.

- Improved patient recruitment and retention using predictive analytics to identify eligible candidates and reduce dropout rates.

- Streamlined data management and analysis, enabling faster insights from complex and large datasets.

- Automated tasks in regulatory submissions and quality control, reducing human error and increasing compliance.

- Development of digital biomarkers and companion diagnostics for more personalized medicine approaches.

- Predictive modeling for drug efficacy and safety, leading to earlier identification of potential issues.

- Operational efficiency gains across various CRO services, contributing to cost reduction and resource optimization.

Key Takeaways Healthcare CRO Market Size & Forecast

Common user questions regarding key takeaways from the Healthcare CRO market size and forecast often center on the primary factors driving its substantial growth and what this implies for investment and strategic planning. There is a keen interest in understanding the underlying dynamics, such as the increasing R&D expenditure by pharmaceutical and biotechnology companies and the growing trend towards outsourcing non-core activities. Users seek to identify the most lucrative segments and geographic regions for future expansion and innovation, highlighting a desire for actionable insights to inform business decisions and market entry strategies. The forecast suggests a robust and sustained expansion, primarily fueled by the accelerating pace of drug development and the rising complexity of clinical trials, necessitating specialized CRO expertise.

Furthermore, inquiries frequently address the resilience of the market against potential headwinds and the role of technological advancements in sustaining its growth trajectory. The integration of advanced analytics, artificial intelligence, and digital platforms is viewed as critical for enhancing operational efficiency and delivering superior outcomes. These questions reflect a broader understanding among stakeholders that the CRO market is not merely growing in volume but also evolving in its capabilities and strategic importance to the global healthcare industry. The consistent double-digit CAGR underscores a market poised for significant value creation, driven by both fundamental industry needs and transformational innovation.

- The Healthcare CRO market is experiencing robust growth, driven by increasing pharmaceutical R&D spending and the shift towards outsourcing.

- Significant market expansion is anticipated, with projections indicating a substantial increase in market valuation by 2033.

- Technological advancements, particularly in AI and data analytics, are pivotal in shaping the future growth and efficiency of CRO services.

- Complex therapeutic areas and the demand for specialized expertise are key drivers for CRO service diversification.

- Emerging markets are set to contribute significantly to market growth, offering new opportunities for global CRO expansion.

Healthcare CRO Market Drivers Analysis

The Healthcare CRO market is primarily driven by the escalating research and development (R&D) investments within the pharmaceutical and biotechnology sectors. As drug discovery becomes increasingly complex and capital-intensive, companies are increasingly relying on CROs to streamline clinical trials, manage regulatory processes, and accelerate time-to-market for new therapies. This trend is amplified by the growing prevalence of chronic and lifestyle diseases globally, necessitating continuous innovation in drug development. CROs offer specialized expertise, cost efficiencies, and access to diverse patient populations, making them indispensable partners in the drug development pipeline.

Furthermore, the shift towards personalized medicine and complex biologics, alongside the expansion into niche therapeutic areas like orphan diseases and gene therapies, demands highly specialized scientific and operational capabilities that many pharmaceutical companies find challenging to maintain in-house. CROs, with their broad service portfolios and therapeutic area expertise, are uniquely positioned to meet these evolving demands. Regulatory complexities across different geographies also compel pharmaceutical companies to leverage CROs' deep understanding of local and international compliance standards, further solidifying their role as essential enablers of global drug development.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing R&D Expenditure by Pharma & Biotech | +3.5% | Global, particularly North America, Europe, APAC | Short to Long-term (2025-2033) |

| Growing Outsourcing Trend for Clinical Trials | +2.8% | Global, especially US, UK, India, China | Short to Mid-term (2025-2029) |

| Rising Complexity of Drug Development & Regulations | +2.3% | Global, with emphasis on EU and US FDA guidelines | Mid to Long-term (2027-2033) |

| Technological Advancements (e.g., AI, Decentralized Trials) | +2.0% | Global, particularly developed economies | Mid to Long-term (2027-2033) |

| Increasing Prevalence of Chronic & Infectious Diseases | +1.9% | Global, particularly high-population countries | Short to Mid-term (2025-2029) |

| Demand for Specialized Expertise & Niche Therapies | +1.5% | Global, particularly US, Europe, Japan | Mid to Long-term (2028-2033) |

Healthcare CRO Market Restraints Analysis

Despite robust growth, the Healthcare CRO market faces several notable restraints that could temper its expansion. One significant challenge is the stringent regulatory landscape, which imposes complex compliance requirements and often leads to prolonged approval processes. Variations in regulatory guidelines across different countries can further complicate multi-regional trials, increasing operational overheads and the risk of delays. The need for continuous adaptation to evolving regulations, such as those related to data privacy (e.g., GDPR, HIPAA), adds a layer of complexity and cost to CRO operations.

Another major restraint is the escalating cost of drug development and clinical trials themselves. While CROs aim to offer cost efficiencies, the overall financial burden of bringing a new drug to market remains substantial, impacting the budgets of pharmaceutical clients and potentially limiting the volume of outsourced projects. Additionally, the shortage of skilled professionals, particularly in specialized therapeutic areas or advanced data analytics, poses a significant operational hurdle. Recruiting and retaining highly qualified scientists, clinicians, and data specialists is a persistent challenge, potentially affecting the quality and timeliness of service delivery within the CRO industry.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent and Evolving Regulatory Frameworks | -1.2% | Global, especially Europe, North America | Short to Long-term (2025-2033) |

| High Cost of Clinical Trials and Drug Development | -0.9% | Global | Short to Mid-term (2025-2029) |

| Shortage of Skilled Professionals & Talent Retention | -0.8% | Global, particularly developed economies | Mid to Long-term (2027-2033) |

| Data Privacy and Cybersecurity Concerns | -0.7% | Global, particularly Europe, North America | Short to Mid-term (2025-2029) |

| Intellectual Property Protection Risks | -0.5% | Global, particularly emerging markets | Mid to Long-term (2028-2033) |

Healthcare CRO Market Opportunities Analysis

The Healthcare CRO market is poised for significant opportunities, particularly from the burgeoning growth in emerging markets. Countries in Asia Pacific, Latin America, and the Middle East offer attractive prospects due to large, diverse patient populations, lower operational costs, and increasing government support for healthcare R&D. These regions represent untapped potential for patient recruitment and clinical trial execution, allowing CROs to expand their global footprint and offer more competitive pricing to clients. Establishing a strong presence in these areas can lead to substantial market share gains and diversification of revenue streams.

Another key opportunity lies in the continued advancements in personalized medicine, gene therapies, and cell therapies. These highly specialized areas require sophisticated clinical trial designs, advanced analytical capabilities, and unique regulatory pathways, which only expert CROs can effectively navigate. As the pharmaceutical pipeline increasingly focuses on these innovative modalities, CROs that invest in relevant expertise, technology, and infrastructure will gain a significant competitive advantage. The adoption of digital health solutions, including decentralized clinical trials and real-world evidence integration, also presents a substantial opportunity for CROs to enhance efficiency, improve patient engagement, and deliver richer data insights, thereby transforming traditional trial methodologies.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets (APAC, LatAm, MEA) | +2.5% | Asia Pacific (China, India), Latin America (Brazil), MEA | Short to Long-term (2025-2033) |

| Growth of Personalized Medicine & Gene/Cell Therapies | +2.0% | Global, particularly North America, Europe | Mid to Long-term (2027-2033) |

| Increasing Adoption of Digital Health Solutions & DCTs | +1.8% | Global, particularly developed markets | Short to Mid-term (2025-2030) |

| Strategic Partnerships and Collaborations | +1.5% | Global | Short to Long-term (2025-2033) |

| Focus on Real-World Evidence (RWE) Generation | +1.2% | Global | Mid to Long-term (2028-2033) |

Healthcare CRO Market Challenges Impact Analysis

The Healthcare CRO market faces significant challenges, notably the difficulty in patient recruitment and retention for clinical trials. Many trials struggle to enroll a sufficient number of eligible patients within specified timelines, leading to delays and increased costs. Factors contributing to this challenge include increasingly specific inclusion/exclusion criteria, geographic limitations, patient burden, and competition for patients across multiple trials. Ensuring high patient retention rates throughout the study duration is equally challenging, as dropouts can compromise data integrity and statistical power, necessitating extended timelines or additional recruitment efforts.

Another critical challenge is the intense competition within the CRO landscape, characterized by a mix of large, full-service CROs and numerous smaller, specialized providers. This competitive environment puts pressure on pricing, necessitates continuous innovation in service offerings, and demands high-quality performance to retain clients. Furthermore, managing the vast amounts of diverse data generated from clinical trials, including ensuring data quality, integration from various sources, and compliance with privacy regulations, remains a substantial operational hurdle. Cybersecurity threats to sensitive patient and trial data also represent an ongoing concern, requiring robust protective measures and significant investment.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Patient Recruitment & Retention Difficulties | -1.5% | Global | Short to Long-term (2025-2033) |

| Intense Competition and Pricing Pressures | -1.0% | Global | Short to Mid-term (2025-2029) |

| Data Management, Quality, and Integration Issues | -0.8% | Global | Mid to Long-term (2027-2033) |

| Cybersecurity Risks and Data Breaches | -0.7% | Global | Short to Mid-term (2025-2030) |

| Maintaining Quality Control and Compliance Across Diverse Sites | -0.6% | Global | Long-term (2028-2033) |

Healthcare CRO Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Healthcare Contract Research Organization (CRO) market, encompassing historical data, current market dynamics, and future growth projections from 2025 to 2033. It offers a detailed examination of market size, trends, drivers, restraints, opportunities, and challenges influencing the industry's trajectory. The scope extends to a granular segmentation analysis based on services, therapeutic areas, and end-users, providing a holistic view of market segments and their respective growth potentials. Furthermore, the report highlights regional market performances and profiles key players, delivering actionable insights for stakeholders seeking to navigate and capitalize on opportunities within this evolving market.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 65.0 Billion |

| Market Forecast in 2033 | USD 165.0 Billion |

| Growth Rate | 12.5% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | IQVIA, Laboratory Corporation of America Holdings (LabCorp/Covance), Syneos Health, Parexel International Corporation, ICON plc (including PRA Health Sciences), Charles River Laboratories International, Inc., Medpace Holdings, Inc., WuXi AppTec, Catalent, Inc., Eurofins Scientific, Fortrea, TFS Healthscience, PSI, Novotech Health Holdings, Bio-Rad Laboratories, Inc., Envigo RMS LLC, Pharmaceutical Product Development, LLC (PPD - now part of Thermo Fisher Scientific), Clintec International, PharmaLex GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Healthcare CRO market is comprehensively segmented to provide a detailed understanding of its diverse components and growth opportunities. The segmentation by service type reflects the broad spectrum of outsourcing capabilities, ranging from early-stage pre-clinical research and laboratory testing to all phases of clinical trials, alongside specialized services like data management, regulatory affairs, and medical writing. This granular view allows for an analysis of which specific services are experiencing higher demand and innovation, driven by factors such as trial complexity and technological advancements. Understanding these service segments is crucial for both CROs looking to refine their offerings and clients seeking optimal partners.

Further segmentation by therapeutic area highlights the increasing specialization within the CRO industry, with significant demand observed in high-growth fields such as oncology, central nervous system disorders, and rare diseases. The rising prevalence of these conditions globally, coupled with the complexity of developing treatments for them, necessitates CROs with deep domain expertise and advanced technological capabilities. Lastly, the market is segmented by end-user, differentiating between pharmaceutical and biopharmaceutical companies, medical device companies, and academic & research institutions. This distinction reveals varied needs and procurement strategies, offering insights into client-specific growth dynamics and partnership models within the Healthcare CRO ecosystem.

- By Service:

- Clinical Research Services:

- Phase I Clinical Trial Services

- Phase II Clinical Trial Services

- Phase III Clinical Trial Services

- Phase IV Clinical Trial Services

- Pre-clinical Services

- Laboratory Services:

- Bioanalytical Testing

- Central Laboratory Services

- Consulting Services

- Data Management Services

- Biostatistics

- Regulatory Affairs

- Medical Writing

- Site Management

- Patient Recruitment Services

- Clinical Research Services:

- By Therapeutic Area:

- Oncology

- Cardiovascular Diseases

- Central Nervous System (CNS) Disorders

- Infectious Diseases

- Metabolic Disorders

- Immunology

- Rare Diseases

- Respiratory Disorders

- Others (e.g., Dermatology, Gastroenterology)

- By End-User:

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Academic & Research Institutions

Regional Highlights

- North America: Dominates the Healthcare CRO market share, primarily due to the presence of a large number of pharmaceutical and biotechnology companies, substantial R&D investments, advanced healthcare infrastructure, and favorable regulatory environment (e.g., FDA). The United States is the largest market within this region, leading in clinical trials and technological adoption.

- Europe: Represents a significant market share, driven by a strong presence of pharmaceutical giants, increasing R&D spending, and supportive government initiatives for drug development. Countries like the UK, Germany, France, and Switzerland are key contributors, benefiting from well-established research ecosystems and robust academic collaborations.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate during the forecast period. This growth is attributed to lower operational costs, a large and diverse patient pool, increasing healthcare expenditure, improving regulatory frameworks, and government initiatives promoting clinical research in countries like China, India, Japan, and South Korea.

- Latin America: Emerging as a high-growth region for clinical trials, offering cost advantages and diverse patient populations. Countries such as Brazil, Mexico, and Argentina are witnessing increased CRO activity, particularly for Phase II and Phase III trials.

- Middle East and Africa (MEA): Shows nascent but growing opportunities in the Healthcare CRO market. Increasing healthcare investments, rising prevalence of chronic diseases, and efforts to modernize healthcare infrastructure are fostering a conducive environment for clinical research, particularly in countries like Saudi Arabia and UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Healthcare CRO Market.- IQVIA

- Laboratory Corporation of America Holdings (LabCorp/Covance)

- Syneos Health

- Parexel International Corporation

- ICON plc (including PRA Health Sciences)

- Charles River Laboratories International, Inc.

- Medpace Holdings, Inc.

- WuXi AppTec

- Catalent, Inc.

- Eurofins Scientific

- Fortrea

- TFS Healthscience

- PSI

- Novotech Health Holdings

- Bio-Rad Laboratories, Inc.

- Envigo RMS LLC

- Pharmaceutical Product Development, LLC (PPD - now part of Thermo Fisher Scientific)

- Clintec International

- PharmaLex GmbH

Frequently Asked Questions

What is the projected growth rate of the Healthcare CRO market?

The Healthcare CRO market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2033, reaching an estimated USD 165.0 Billion by 2033.

How is AI transforming the Healthcare CRO industry?

AI is significantly impacting the Healthcare CRO industry by accelerating drug discovery, optimizing clinical trial design, improving patient recruitment through predictive analytics, streamlining data management, and automating regulatory tasks, leading to enhanced efficiency and reduced costs.

What are the primary drivers for the growth of the Healthcare CRO market?

Key drivers include increasing R&D expenditure by pharmaceutical and biotech companies, the growing trend of outsourcing clinical research, the rising complexity of drug development, and technological advancements like AI and decentralized trials.

Which therapeutic areas are experiencing significant growth in CRO services?

Significant growth in CRO services is observed in complex therapeutic areas such as Oncology, Central Nervous System (CNS) Disorders, Rare Diseases, and areas related to Personalized Medicine and Gene/Cell Therapies, driven by high R&D focus and specialized needs.

What are the key challenges faced by CROs?

Key challenges for CROs include difficulties in patient recruitment and retention, intense market competition and pricing pressures, complex data management and integration issues, and the need to address cybersecurity risks and stringent regulatory compliance across diverse global sites.