Testing, Inspection, and Certification Market

Testing, Inspection, and Certification Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700023 | Last Updated : July 22, 2025 |

Format : ![]()

![]()

![]()

![]()

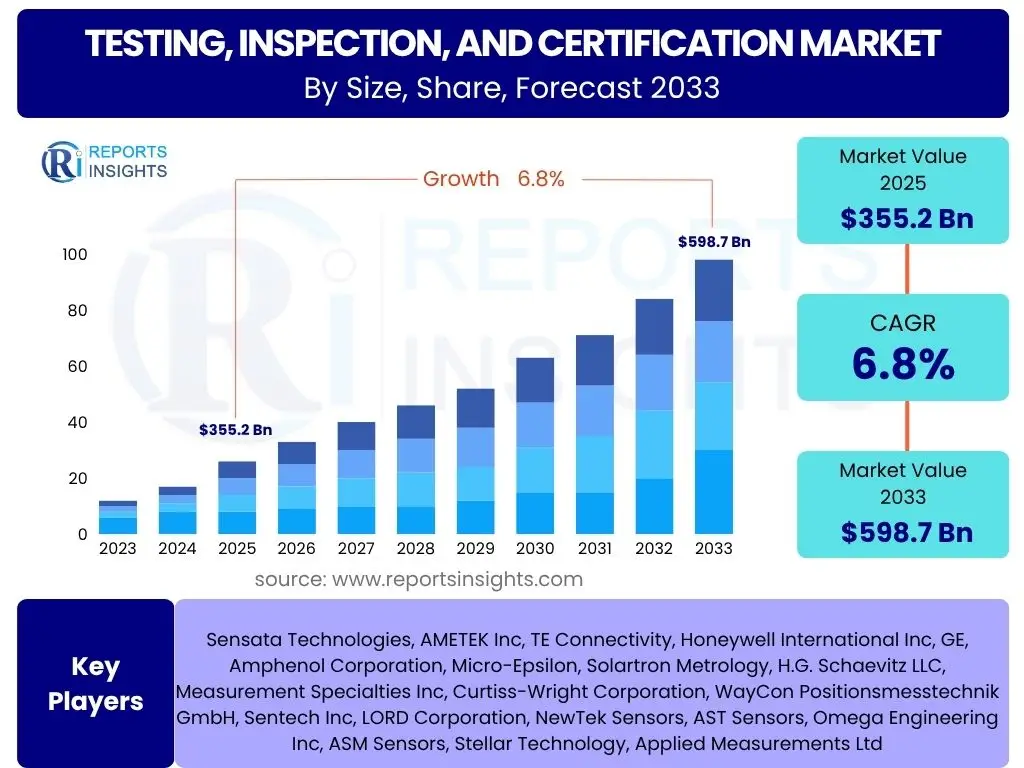

Testing, Inspection, and Certification Market is projected to grow at a Compound annual growth rate (CAGR) of 6.8% between 2025 and 2033, valued at USD 355.2 Billion in 2025 and is projected to grow by USD 598.7 Billion by 2033 the end of the forecast period.

Key Testing, Inspection, and Certification Market Trends & Insights

The Testing, Inspection, and Certification (TIC) market is undergoing significant transformation, driven by an evolving regulatory landscape, rapid technological advancements, and increasing emphasis on quality, safety, and sustainability across industries. Key trends indicate a shift towards digitalization, automation, and the integration of advanced analytics, enabling more efficient and precise service delivery. Businesses are increasingly seeking comprehensive TIC solutions to navigate complex global supply chains and stringent compliance requirements, fostering a demand for integrated and innovative offerings. The market also observes a growing focus on niche sectors and emerging technologies, signaling a diversification of service portfolios by leading players to maintain competitive advantage.

- Digital transformation and automation of TIC processes.

- Increasing adoption of remote inspection and IoT-enabled testing.

- Growing demand for sustainability and environmental compliance services.

- Rising complexity of global supply chains necessitating robust verification.

- Stricter regulatory frameworks across diverse industrial sectors.

- Focus on cybersecurity and data integrity in TIC operations.

- Emergence of new testing areas for advanced materials and technologies.

- Consolidation and strategic partnerships among market players.

AI Impact Analysis on Testing, Inspection, and Certification

Artificial intelligence (AI) is poised to revolutionize the Testing, Inspection, and Certification (TIC) market by enhancing efficiency, accuracy, and predictive capabilities across various service offerings. AI-powered analytics can process vast amounts of data from inspections and tests, identifying anomalies and trends that human analysis might miss, thereby improving the precision of certifications. Machine learning algorithms facilitate predictive maintenance, allowing for proactive intervention before equipment failure, which is crucial in asset integrity management. Furthermore, AI enables the automation of routine inspection tasks, such as visual inspections using computer vision, significantly reducing manual labor, accelerating turnaround times, and minimizing human error, ultimately leading to more robust and cost-effective TIC services.

- Enhanced data analysis for improved accuracy in testing results.

- Automation of routine inspection tasks through computer vision and robotics.

- Predictive maintenance capabilities for asset integrity management.

- Fraud detection and anomaly identification in certification processes.

- Optimization of resource allocation and scheduling for inspections.

- Development of smart quality control systems for manufacturing.

- Personalized risk assessment and compliance strategies.

- Reduction in operational costs and faster service delivery.

Key Takeaways Testing, Inspection, and Certification Market Size & Forecast

- The global Testing, Inspection, and Certification (TIC) market is projected for substantial growth, indicating a robust upward trajectory.

- Forecasts show a Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033, reflecting consistent market expansion.

- The market is estimated to reach a valuation of USD 355.2 Billion in 2025, underscoring its significant current economic footprint.

- By 2033, the market is anticipated to grow to USD 598.7 Billion, demonstrating substantial long-term potential and increased demand for TIC services.

- This growth is primarily fueled by escalating regulatory complexities, technological advancements, and a heightened global focus on product safety and quality across industries.

Testing, Inspection, and Certification Market Drivers Analysis

The Testing, Inspection, and Certification (TIC) market is primarily propelled by the escalating complexity of global regulations and an unwavering commitment to quality and safety across various industrial sectors. Governments and international bodies are continuously introducing more stringent standards and mandates for product performance, environmental impact, and occupational health, compelling businesses to seek professional TIC services for compliance. This regulatory imperative acts as a foundational driver, ensuring that products and processes meet required benchmarks before market entry or operation.

Technological advancements also play a crucial role, as the emergence of new materials, production methods, and digital technologies necessitates sophisticated testing and certification protocols. Industries such as automotive (with electric vehicles), aerospace, and electronics require specialized TIC services to validate the performance, reliability, and safety of innovative components and systems. Furthermore, the increasing complexity of global supply chains demands rigorous checks at multiple stages, from raw material sourcing to final product delivery, creating a pervasive need for independent third-party verification to mitigate risks and ensure transparency.

Growing consumer awareness regarding product quality, safety, and sustainability further fuels market expansion. Consumers are more informed and demand higher standards from manufacturers, often preferring products that bear reputable certifications. This heightened consumer expectation, coupled with the rising risk of product liability issues and reputational damage for non-compliant businesses, incentivizes companies to invest in comprehensive TIC solutions to build trust and maintain market competitiveness. The drive towards digitalization and automation within industries is also a significant accelerator, as it requires TIC providers to offer more efficient, data-driven, and integrated services.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Regulatory Compliance and Standards | +2.1% | Global, particularly Europe and North America | Long-term (2025-2033) |

| Globalization of Trade and Supply Chains | +1.7% | Global, especially Asia Pacific and developing economies | Medium-term (2025-2030) |

| Technological Advancements and Industry 4.0 | +1.5% | North America, Europe, select APAC countries | Long-term (2025-2033) |

| Rising Consumer Awareness and Safety Concerns | +1.0% | Developed economies, increasing in emerging markets | Medium-term (2025-2030) |

| Growing Emphasis on Sustainability and ESG Compliance | +0.5% | Europe, North America, rapidly growing in APAC | Long-term (2025-2033) |

Testing, Inspection, and Certification Market Restraints Analysis

Despite robust growth drivers, the Testing, Inspection, and Certification (TIC) market faces several significant restraints that could impede its full potential. One primary challenge is the substantial capital investment required for establishing and maintaining state-of-the-art testing facilities and advanced equipment. This high upfront cost, coupled with ongoing expenses for calibration, maintenance, and technological upgrades, can be a barrier to entry for new players and a financial burden for smaller organizations, limiting market expansion and innovation in certain segments.

Another key restraint is the acute shortage of highly skilled professionals and specialized technical experts within the TIC industry. The rapid evolution of technologies and the increasing complexity of regulatory frameworks necessitate a workforce with advanced knowledge in diverse fields, including artificial intelligence, cybersecurity, materials science, and specific industry standards. The scarcity of such talent, coupled with the challenges in recruiting and retaining these experts, can lead to service delivery delays, compromise quality, and constrain the ability of TIC providers to meet growing market demand, particularly in niche or emerging areas.

Furthermore, the fragmented nature of the global regulatory landscape and the lack of universal standards across different regions and countries present a notable impediment. Companies operating internationally often face the arduous task of complying with multiple, sometimes conflicting, sets of regulations and certifications. This regulatory disparity can lead to increased operational complexities, higher costs, and longer lead times for products entering diverse markets, thereby adding friction to the TIC process and potentially slowing market adoption in certain cross-border trade scenarios. The challenge of maintaining absolute impartiality and independence, particularly when offering both consulting and certification services, also poses a reputational risk that can restrain market trust.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Operational Costs | -0.9% | Global, particularly for specialized testing | Long-term (2025-2033) |

| Shortage of Skilled Professionals and Technical Experts | -0.7% | Global, prominent in developed and rapidly industrializing nations | Medium-term (2025-2030) |

| Varying and Fragmented Regulatory Landscape | -0.6% | Global, especially for cross-border trade | Long-term (2025-2033) |

| Maintaining Impartiality and Preventing Conflicts of Interest | -0.3% | Global, critical for industry trust | Long-term (2025-2033) |

Testing, Inspection, and Certification Market Opportunities Analysis

The Testing, Inspection, and Certification (TIC) market is rich with opportunities, primarily driven by the continuous emergence of new and disruptive technologies. The proliferation of IoT devices, artificial intelligence, blockchain, and advanced robotics presents significant avenues for TIC providers to develop innovative testing methodologies and certification standards. For instance, IoT integration allows for real-time monitoring and predictive maintenance, creating new service lines for asset integrity and performance verification. AI and machine learning can enhance data analysis for faster, more accurate results and automate complex inspection processes, unlocking efficiencies and new service possibilities.

A burgeoning area of opportunity lies in the increasing global focus on environmental sustainability, climate change, and corporate social responsibility (CSR). As industries strive to meet ambitious carbon emission reduction targets and adhere to strict environmental, social, and governance (ESG) criteria, there is a growing demand for specialized TIC services. This includes carbon footprint verification, green building certifications, circular economy assessments, and sustainability reporting assurance. TIC providers can leverage their expertise to help companies validate their green claims, demonstrate compliance with ESG mandates, and enhance their brand reputation, thereby tapping into a high-growth segment driven by both regulatory pressure and consumer preference.

Furthermore, the expansion into untapped and emerging markets, particularly in Asia Pacific, Latin America, and Africa, represents a substantial growth opportunity. These regions are experiencing rapid industrialization, urbanization, and increasing regulatory maturity, leading to a burgeoning demand for reliable TIC services across various sectors like infrastructure, automotive, and consumer goods. TIC companies can establish strategic partnerships, acquire local expertise, and tailor their offerings to cater to the unique regulatory frameworks and industrial needs of these regions, positioning themselves for long-term expansion and market share capture. The demand for personalized and integrated TIC solutions across the value chain also presents an opportunity for comprehensive service offerings.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of New Technologies (IoT, AI, Blockchain, Remote Inspection) | +1.8% | Global, particularly in technologically advanced regions | Long-term (2025-2033) |

| Growing Demand for Green, Sustainable, and ESG-Related TIC Services | +1.5% | Europe, North America, increasing rapidly in APAC | Long-term (2025-2033) |

| Expansion into Emerging Markets and Untapped Sectors | +1.2% | Asia Pacific, Latin America, Middle East & Africa | Medium-term (2025-2030) |

| Integration of TIC Services Across the Product Lifecycle | +0.8% | Global, especially in complex manufacturing and supply chains | Medium-term (2025-2030) |

Testing, Inspection, and Certification Market Challenges Impact Analysis

The Testing, Inspection, and Certification (TIC) market faces notable challenges, one of the most pressing being the rapid pace of technological change. As industries evolve with innovations like Industry 4.0, advanced materials, and complex digital systems, TIC providers must continuously invest in new equipment, develop sophisticated methodologies, and update their expertise. This constant need for adaptation and investment to keep pace with cutting-edge technologies can be resource-intensive and create a significant barrier, especially for smaller players. Failure to adapt quickly can render services obsolete, impacting competitiveness and market relevance.

Cybersecurity risks present another critical challenge, particularly as TIC services become increasingly digitalized and interconnected. The integrity and confidentiality of testing data, inspection reports, and certification records are paramount. Any breach or compromise of this sensitive information could lead to severe financial penalties, reputational damage, and loss of trust. TIC providers must invest heavily in robust cybersecurity infrastructure and protocols to protect their own systems and their clients' data, a non-trivial task given the evolving threat landscape and the sophistication of cyberattacks.

Moreover, maintaining impartiality and managing potential conflicts of interest remain a persistent challenge in the TIC sector. As TIC companies expand their service portfolios to include consulting, advisory, and training alongside core testing and certification activities, there is an inherent risk of perceived or actual bias. Ensuring strict ethical guidelines, robust internal controls, and clear separation between different service lines is essential to uphold the industry's credibility and the validity of its certifications. Any lapse in this regard can severely undermine the trust that clients and regulators place in TIC services, potentially dampening market growth.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Technological Evolution and Need for Continuous Investment | -0.8% | Global, affecting all regions equally | Long-term (2025-2033) |

| Cybersecurity Threats and Data Integrity Concerns | -0.6% | Global, critical for digitalized services | Long-term (2025-2033) |

| Maintaining Impartiality and Preventing Conflicts of Interest | -0.5% | Global, crucial for industry reputation | Long-term (2025-2033) |

| Talent Acquisition and Retention in Specialized Fields | -0.4% | Global, particularly in emerging tech hubs | Medium-term (2025-2030) |

Testing, Inspection, and Certification Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Testing, Inspection, and Certification (TIC) market, offering insights into its current dynamics, historical performance, and future growth projections. The report outlines key market drivers, restraints, opportunities, and challenges influencing the industry landscape, alongside a detailed segmentation analysis. It aims to equip stakeholders with critical information to make informed strategic decisions, covering market size, growth rates, competitive landscape, and regional dynamics.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 355.2 Billion |

| Market Forecast in 2033 | USD 598.7 Billion |

| Growth Rate | 6.8% from 2025 to 2033 |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | SGS, Bureau Veritas, Intertek, DNV, TUV SUD, TUV Rheinland, Eurofins Scientific, DEKRA, UL Solutions, Applus+, LRQA, Element Materials Technology, ALS Limited, TIC Council, Kiwa, RINA, Control Union, Mistras Group, Lloyd's Register, NDT Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Testing, Inspection, and Certification (TIC) market is meticulously segmented to provide a granular view of its diverse components and their respective growth trajectories. These segments help in understanding the specific demands and applications of TIC services across various industries and operational models. The breakdown ensures a comprehensive analysis, allowing businesses to pinpoint areas of highest growth potential and identify specialized service requirements.

- By Service Type: This segment categorizes the market based on the fundamental nature of the services provided.

- Testing: Involves laboratory or field-based evaluations of products, materials, or systems against specific standards or specifications to determine performance, quality, and safety characteristics.

- Inspection: Encompasses visual examinations, measurements, and non-destructive testing to verify conformity to codes, standards, design specifications, or client requirements, often conducted during manufacturing, construction, or operational phases.

- Certification: Refers to the process by which an independent third-party organization provides written assurance that a product, process, system, or person conforms to specified requirements, standards, or regulations.

- By Sourcing Type: This segment differentiates based on how companies acquire TIC services.

- In-house: Refers to the TIC activities performed by a company's own internal departments or facilities.

- Outsourced: Involves engaging external, independent third-party TIC providers for specialized services.

- By End-use Industry: This crucial segmentation highlights the diverse sectors that utilize TIC services, each with unique regulatory demands and technical requirements.

- Automotive: Includes testing and certification for vehicles, components, electric vehicles (EVs), and autonomous driving systems, covering safety, emissions, and performance.

- Aerospace & Defense: Focuses on rigorous testing and certification for aircraft components, systems, and defense equipment to ensure safety, reliability, and airworthiness.

- Consumer Goods & Retail: Covers a wide array of products like textiles, electronics, toys, and appliances, ensuring their safety, quality, and compliance with consumer protection laws.

- Construction & Infrastructure: Pertains to the testing and inspection of materials, structures, and processes in building, civil engineering, roads, and bridges to ensure structural integrity and safety.

- Energy & Power: Encompasses services for oil & gas, renewable energy (solar, wind), nuclear power, and conventional power generation, focusing on asset integrity, environmental compliance, and safety.

- Food & Agriculture: Includes testing for food safety, quality, nutritional content, traceability, and agricultural product certification to meet health and trade standards.

- Healthcare & Pharmaceuticals: Involves stringent testing and certification for medical devices, pharmaceuticals, and healthcare facilities to ensure efficacy, safety, and regulatory compliance.

- Industrial Manufacturing: Provides TIC services for machinery, industrial equipment, and manufacturing processes, covering quality control, safety, and performance validation.

- IT & Telecommunications: Focuses on cybersecurity testing, software validation, network performance, and compliance for telecommunication infrastructure and IT systems.

- Public Sector & Governments: Involves TIC services for public projects, government procurement, and regulatory enforcement.

- Chemicals & Materials: Pertains to the testing of chemical products, raw materials, and advanced materials for composition, purity, safety, and performance characteristics.

- Marine & Offshore: Covers inspection and certification for ships, offshore platforms, and marine equipment to ensure safety, environmental compliance, and operational integrity.

- By Application: This segment details the specific areas where TIC services are applied.

- Product Testing: Direct testing of manufactured goods for compliance.

- System Certification: Certification of management systems like ISO 9001 (quality) or ISO 14001 (environmental).

- Asset Integrity Management: Ensuring the reliability and safety of physical assets over their lifecycle.

- Calibration Services: Verifying the accuracy of measurement instruments.

- Factory Inspections: On-site assessment of manufacturing facilities.

- Vendor Audits: Evaluation of supplier capabilities and compliance.

- Risk Management: Assessment and mitigation of operational and compliance risks.

Regional Highlights

The global Testing, Inspection, and Certification (TIC) market exhibits distinct growth patterns and opportunities across various geographical regions, driven by differing regulatory environments, industrialization rates, and technological adoption levels. Understanding these regional dynamics is crucial for strategic market engagement and investment.

- Asia Pacific (APAC): This region is anticipated to be the fastest-growing market for TIC services, primarily driven by rapid industrialization, increasing manufacturing activities, and growing awareness regarding product quality and safety standards. Countries like China and India are witnessing a surge in domestic and international trade, leading to a greater demand for third-party verification. Additionally, the region's expanding consumer base and evolving regulatory frameworks, particularly in areas like food safety, automotive, and electronics, are significant contributors to market expansion. Investments in smartinfrastructure and renewable energy also necessitate robust TIC services.

- Europe: Europe remains a mature yet highly significant market for TIC, characterized by stringent regulatory frameworks, particularly in the automotive, environmental, and healthcare sectors. The European Union's comprehensive directives on product safety, environmental protection, and occupational health and safety drive consistent demand for compliance services. The region is also at the forefront of adopting advanced technologies like Industry 4.0 and AI in TIC operations, fostering innovation. The strong emphasis on sustainability and ESG compliance further bolsters the demand for specialized TIC services related to carbon footprint verification and green certifications.

- North America: North America is a prominent market, largely driven by a robust industrial base, advanced technological adoption, and a strong regulatory landscape, particularly in the United States. Key sectors such as aerospace, automotive, oil and gas, and healthcare heavily rely on TIC services for product conformity, asset integrity, and operational safety. The region also exhibits a high adoption rate of digital TIC solutions, including remote inspections and data analytics, reflecting a move towards efficiency and precision. Consumer advocacy and strict liability laws further reinforce the need for comprehensive TIC services to ensure product safety and quality.

- Latin America, Middle East, and Africa (LAMEA): These regions represent emerging markets with significant growth potential. Latin America is seeing increased demand due to growing industrialization, infrastructure development, and rising foreign direct investment, particularly in mining, agriculture, and energy. The Middle East is driven by large-scale infrastructure projects, diversification efforts away from oil and gas, and a growing tourism sector, all requiring robust quality and safety assurances. Africa's market is nascent but growing, fueled by increasing investment in manufacturing, energy, and agriculture, along with developing regulatory structures that are progressively aligning with international standards, creating new opportunities for TIC providers.

Top Key Players:

The market research report covers the analysis of key stake holders of the Testing, Inspection, and Certification Market. Some of the leading players profiled in the report include -- SGS

- Bureau Veritas

- Intertek

- DNV

- TUV SUD

- TUV Rheinland

- Eurofins Scientific

- DEKRA

- UL Solutions

- Applus+

- LRQA

- Element Materials Technology

- ALS Limited

- Kiwa

- RINA

- Control Union

- Mistras Group

- Lloyd's Register

- TIC Council

- CSA Group

Frequently Asked Questions:

What is Testing, Inspection, and Certification (TIC)?

Testing, Inspection, and Certification (TIC) refers to a range of services that ensure the quality, safety, and compliance of products, systems, and services across various industries. Testing involves determining product performance against standards, inspection involves verifying conformity through examination, and certification involves independent third-party assurance of compliance with specific regulations or standards. These services help minimize risks, ensure quality, and promote market access by verifying adherence to national and international standards.

Why is the Testing, Inspection, and Certification (TIC) market growing?

The TIC market is experiencing robust growth due to several key factors. These include the increasing complexity of global regulatory frameworks, which mandate higher standards for product quality and safety; the rapid pace of technological advancements necessitating new testing protocols; the globalization of supply chains requiring rigorous third-party verification; and growing consumer awareness regarding product safety, quality, and environmental sustainability. Additionally, the industrial push towards digitalization and automation further drives demand for advanced TIC solutions.

How does AI impact the Testing, Inspection, and Certification (TIC) industry?

Artificial intelligence significantly impacts the TIC industry by enhancing efficiency, accuracy, and predictive capabilities. AI enables advanced data analysis for more precise testing results, automates routine inspections through computer vision and robotics, and facilitates predictive maintenance for asset integrity management. It also aids in fraud detection and optimizes resource allocation, leading to faster service delivery, reduced operational costs, and improved overall reliability of TIC processes.

Which regions are key players in the Testing, Inspection, and Certification market?

Key regions in the Testing, Inspection, and Certification market include North America, Europe, and Asia Pacific. Europe and North America are mature markets driven by stringent regulations and advanced technological adoption. Asia Pacific is the fastest-growing region, fueled by rapid industrialization, expanding manufacturing sectors, and increasing regulatory awareness, particularly in countries like China and India.

What are the primary challenges faced by the TIC market?

The primary challenges confronting the TIC market include the rapid pace of technological change, which demands continuous investment in new equipment and expertise; the increasing threat of cybersecurity risks to data integrity; the ongoing need to maintain impartiality and prevent conflicts of interest; and the global shortage of highly skilled professionals and technical experts required for specialized testing and certification services.