Flax Fiber Market

Flax Fiber Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703062 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Flax Fiber Market Size

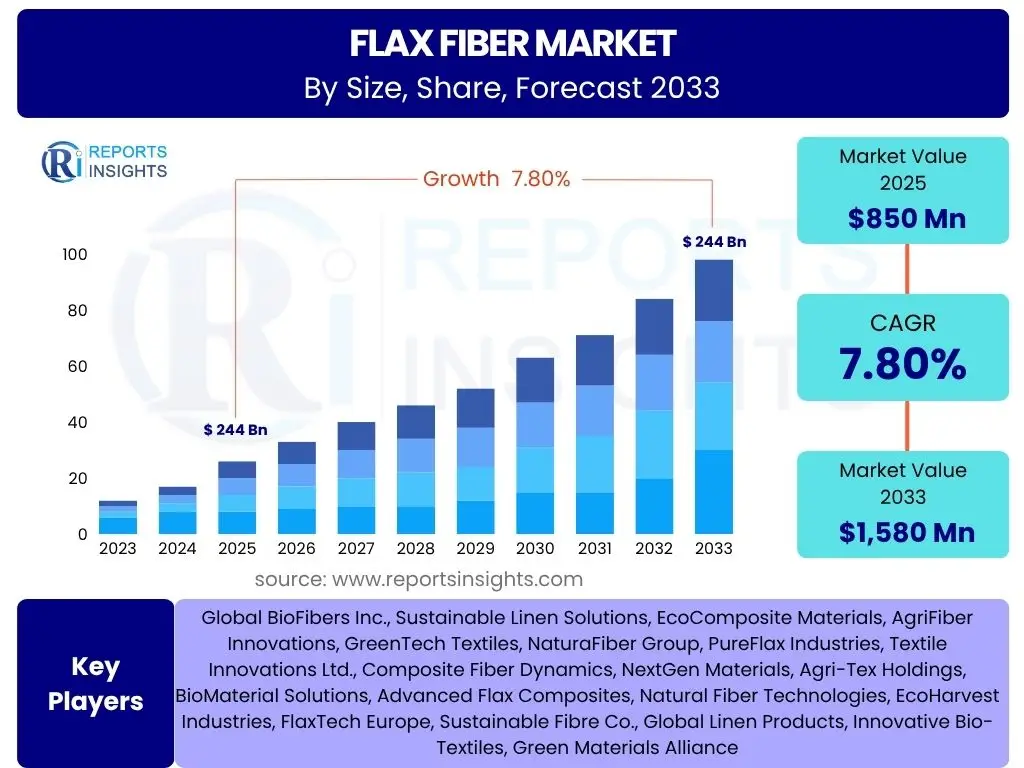

According to Reports Insights Consulting Pvt Ltd, The Flax Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 850 million in 2025 and is projected to reach USD 1,580 million by the end of the forecast period in 2033.

Key Flax Fiber Market Trends & Insights

The global flax fiber market is experiencing a significant shift driven by an escalating demand for sustainable and eco-friendly materials across various industries. Consumers and manufacturers alike are increasingly prioritizing natural fibers due to heightened environmental awareness and the pressing need to reduce reliance on synthetic alternatives. This paradigm shift is not only influencing material selection in traditional sectors like textiles but also catalyzing innovation in emerging applications, positioning flax fiber as a versatile and environmentally responsible choice for future material development.

Technological advancements in flax cultivation, processing, and application are further accelerating its market penetration. Innovations in retting techniques, decortication processes, and fiber modification are improving the quality, consistency, and applicability of flax fiber, making it competitive with conventional materials. Furthermore, the push towards a circular economy model encourages the adoption of bio-based materials like flax, which offer biodegradability and a lower carbon footprint, thereby fostering a positive growth trajectory for the market.

- Growing integration of flax fiber in bio-composite materials for automotive, construction, and wind energy sectors, driven by lightweighting and sustainability goals.

- Increasing adoption of flax fiber in the textile industry for sustainable fashion and home furnishings, responding to consumer demand for natural and eco-conscious products.

- Emergence of technical textiles utilizing flax fiber for enhanced performance in industrial filtration, geotextiles, and medical applications.

- Advancements in enzymatic and mechanical retting processes reducing environmental impact and improving fiber quality consistency.

- Expansion of research and development into novel applications, including insulation materials, paper products, and packaging solutions.

AI Impact Analysis on Flax Fiber

The integration of Artificial Intelligence (AI) across the flax fiber value chain presents transformative opportunities for optimizing production, enhancing quality, and improving market responsiveness. Users frequently inquire about AI's potential to address challenges such as yield variability, processing inefficiencies, and market demand fluctuations. AI-driven solutions are expected to empower farmers with precision agriculture tools, allowing for optimized cultivation practices that improve fiber yield and quality while minimizing resource consumption. This includes predictive analytics for soil health, pest detection, and irrigation management, ensuring more consistent and higher-grade flax harvests.

Further along the supply chain, AI can revolutionize flax processing by enabling automated quality grading, defect detection, and optimization of retting and decortication processes. This leads to reduced waste, increased efficiency, and improved fiber consistency, which are critical for high-performance applications. Moreover, AI's capability in market forecasting and supply chain optimization allows for better inventory management, demand prediction, and strategic resource allocation, ensuring that the supply of flax fiber aligns seamlessly with evolving market needs. The synergy between AI and material science research is also expected to accelerate the development of new flax-based products and applications, unlocking further growth potential.

- Precision agriculture powered by AI for optimizing flax cultivation, improving yield, and ensuring consistent fiber quality through data-driven insights.

- Automated quality control and grading of flax fibers using AI-powered vision systems, enhancing efficiency and reducing human error in sorting.

- Supply chain optimization through AI algorithms that predict demand, manage inventory, and streamline logistics, leading to reduced waste and improved responsiveness.

- Accelerated research and development of new flax fiber composites and applications by utilizing AI for material property prediction and design optimization.

- Enhanced market forecasting and trend analysis, enabling stakeholders to make informed decisions regarding production volumes and investment strategies.

Key Takeaways Flax Fiber Market Size & Forecast

The Flax Fiber Market is poised for substantial growth over the forecast period, driven primarily by the escalating global emphasis on sustainability and the increasing demand for bio-based materials. The market's projected compound annual growth rate underscores a robust expansion, indicating a significant shift from synthetic alternatives towards natural and biodegradable options. This strong growth trajectory is further supported by the diversification of flax fiber applications beyond traditional textiles into high-growth sectors such as automotive, construction, and advanced composites, where its lightweight, strength, and environmental benefits are highly valued.

Investors and industry stakeholders should recognize the long-term potential of this market, particularly considering the ongoing innovations in processing technologies that are making flax fiber more competitive and versatile. The market's resilience is also bolstered by evolving regulatory landscapes that favor eco-friendly materials, coupled with a rising consumer preference for sustainable products. These factors combine to create a compelling environment for sustained market expansion, presenting lucrative opportunities for companies involved in flax cultivation, processing, and end-product manufacturing.

- The market is set for robust growth, driven by global sustainability trends and demand for natural fibers.

- Significant expansion is expected in non-traditional applications like bio-composites for automotive and construction.

- Technological advancements in processing are enhancing flax fiber quality and expanding its range of uses.

- Increasing consumer and regulatory preference for eco-friendly materials is a key market accelerator.

- Europe and Asia Pacific are anticipated to remain major contributors to market growth and innovation.

Flax Fiber Market Drivers Analysis

The flax fiber market's growth is propelled by several potent drivers, primarily centered around the global sustainability agenda. As industries and consumers alike become more environmentally conscious, the demand for natural, renewable, and biodegradable materials like flax fiber is surging. This driver is multifaceted, encompassing a desire to reduce carbon footprints, minimize reliance on fossil-based resources, and address concerns about microplastic pollution from synthetic fibers. Concurrently, the expansion of the composite materials industry, particularly in sectors requiring lightweight and high-strength alternatives, is creating new avenues for flax fiber. Its excellent strength-to-weight ratio and acoustic properties make it an attractive reinforcement material.

Moreover, increasing awareness among manufacturers and end-users regarding flax fiber's inherent properties, such as durability, breathability, and moisture-wicking capabilities, is fostering its adoption in diverse applications. This includes not just textiles but also insulation, paper, and even medical applications. Complementing these demand-side drivers, supportive government policies and environmental regulations in various regions are actively promoting the use of bio-based materials through incentives, research funding, and stringent standards for emissions and waste. These regulations encourage industries to transition towards more sustainable production practices, thus bolstering the demand for flax fiber.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing demand for sustainable and eco-friendly materials across industries. | +2.5% | Global (Europe, North America, Asia Pacific) | Short- to Long-Term |

| Expansion of the composite materials industry, particularly in automotive and construction. | +1.8% | Europe, North America, China | Mid- to Long-Term |

| Rising awareness of flax fiber's inherent properties and benefits (durability, breathability). | +1.5% | Europe, North America, Japan | Short- to Mid-Term |

| Supportive government policies and environmental regulations promoting bio-based materials. | +1.0% | European Union, United States, Canada | Mid- to Long-Term |

| Innovation in processing technologies leading to improved fiber quality and consistency. | +0.8% | France, Belgium, Netherlands, China | Mid- to Long-Term |

Flax Fiber Market Restraints Analysis

Despite its significant growth potential, the flax fiber market faces several restraints that could impede its expansion. One primary challenge is the relatively high production cost of flax fiber compared to synthetic alternatives like polyester or fiberglass. The labor-intensive nature of flax cultivation, especially traditional retting methods, and the specialized processing machinery required, contribute to higher manufacturing expenses. This cost disparity can make it challenging for flax fiber to compete purely on price in certain bulk applications, even with its superior environmental profile. Furthermore, the market faces intense competition from other natural fibers, such as cotton, jute, and hemp, each vying for market share based on cost, availability, and specific performance characteristics.

Another significant restraint is the fluctuating price of raw materials, largely dependent on agricultural yields which are susceptible to climatic variations and disease outbreaks. This volatility can introduce unpredictability into the supply chain, affecting pricing stability and long-term planning for manufacturers. Additionally, the limited industrial processing infrastructure in some emerging regions, coupled with a lack of standardized quality metrics across the global supply chain, can hinder consistent supply and widespread adoption. These factors collectively necessitate strategic investments in infrastructure, standardization efforts, and cost-reduction technologies to fully unlock the market's potential.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High production costs compared to synthetic and some other natural fibers. | -1.2% | Global | Short- to Mid-Term |

| Fluctuating raw material prices due to agricultural yield variability and climate dependency. | -0.9% | Global (especially Europe) | Short-Term |

| Competition from established synthetic fibers and other natural alternatives (e.g., cotton, jute). | -0.7% | Global | Mid-Term |

| Limited industrial processing infrastructure and standardization in certain regions. | -0.5% | Asia Pacific, Latin America, MEA | Mid- to Long-Term |

| Technical challenges in achieving consistent fiber quality for high-performance applications. | -0.4% | Global | Short- to Mid-Term |

Flax Fiber Market Opportunities Analysis

The flax fiber market is rich with opportunities, primarily stemming from continuous research and development efforts aimed at expanding its application scope. Innovations in material science are enabling flax fiber to be effectively integrated into advanced composites for high-performance applications, including aerospace, sports equipment, and medical devices, where its lightweight and specific strength properties offer a distinct advantage. Furthermore, the growing trend of circular economy initiatives and bio-economy models presents a significant opportunity for flax fiber, given its inherent biodegradability and recyclability. Companies are increasingly seeking sustainable alternatives that align with circular principles, positioning flax fiber as a frontrunner.

Untapped markets in developing economies, particularly in Asia Pacific and Latin America, represent substantial growth avenues. As these regions experience rapid industrialization and a rising middle class, there is an increasing demand for sustainable and high-quality materials. Moreover, the development of specialized flax fiber grades with tailored properties (e.g., enhanced fire retardancy, improved moisture resistance) through advanced breeding and processing techniques can unlock niche markets. Finally, the potential for integrating flax fiber with smart manufacturing processes, including additive manufacturing and automated assembly, offers opportunities for increased efficiency, cost reduction, and the creation of innovative products, thereby driving further market penetration and value creation.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Research and development into novel, high-performance applications (e.g., aerospace, medical devices). | +1.5% | Global (Europe, North America) | Mid- to Long-Term |

| Untapped markets and growing adoption in emerging economies (e.g., Asia Pacific, Latin America). | +1.3% | China, India, Brazil, Southeast Asia | Mid- to Long-Term |

| Development of specialized flax fiber grades with enhanced properties for niche applications. | +1.0% | Global | Short- to Mid-Term |

| Integration with circular economy initiatives and sustainable product design. | +0.8% | European Union, North America | Mid- to Long-Term |

| Technological advancements in cultivation and processing reducing costs and improving efficiency. | +0.7% | France, Belgium, Netherlands, China | Mid- to Long-Term |

Flax Fiber Market Challenges Impact Analysis

The flax fiber market faces distinct challenges that can impact its growth trajectory. The inherent variability in fiber quality, largely influenced by climate conditions, soil type, and retting processes, remains a significant hurdle. This inconsistency can make it difficult for manufacturers to achieve uniform performance in end-products, particularly for precision applications, leading to potential quality control issues and hindering widespread adoption. Addressing this requires advanced farming techniques and standardized processing, which are still evolving. Furthermore, the global supply chain for flax fiber can be fragmented, involving numerous small-scale farmers and processors, which can complicate sourcing, logistics, and quality assurance for large-scale industrial buyers.

Another challenge involves the need for extensive education and awareness among end-users and manufacturers about the specific benefits and processing requirements of flax fiber. Compared to widely known synthetic materials, flax fiber's unique properties and handling considerations are less understood, which can impede its integration into new product designs and manufacturing lines. Moreover, managing the end-of-life solutions for flax fiber products, particularly composites, presents a challenge, as current recycling infrastructures are not fully equipped for bio-composites. Overcoming these challenges will require collaborative efforts across the value chain, focusing on standardization, infrastructure development, and market education to unlock the fiber's full potential.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Variability in fiber quality due to climate dependence and traditional retting methods. | -1.0% | Global (Cultivation Regions) | Short- to Mid-Term |

| Supply chain fragmentation and lack of standardized quality metrics for global trade. | -0.8% | Global | Mid-Term |

| Need for significant investment in advanced processing technologies to improve consistency and reduce costs. | -0.6% | Global | Mid- to Long-Term |

| Educating end-users and manufacturers about the specific benefits and processing requirements of flax fiber. | -0.5% | Global | Short- to Mid-Term |

| Developing efficient end-of-life and recycling solutions for flax fiber products, especially composites. | -0.4% | Europe, North America | Long-Term |

Flax Fiber Market - Updated Report Scope

This comprehensive report delves into the intricate dynamics of the global flax fiber market, providing an in-depth analysis of its size, growth trajectories, and influential factors. It offers a detailed examination of market segmentation by fiber type, application, and end-use industry, alongside a robust regional analysis. The report aims to furnish stakeholders with actionable insights into key market trends, competitive landscapes, and future opportunities, facilitating informed strategic decision-making within this evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 850 million |

| Market Forecast in 2033 | USD 1,580 million |

| Growth Rate | 7.8% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global BioFibers Inc., Sustainable Linen Solutions, EcoComposite Materials, AgriFiber Innovations, GreenTech Textiles, NaturaFiber Group, PureFlax Industries, Textile Innovations Ltd., Composite Fiber Dynamics, NextGen Materials, Agri-Tex Holdings, BioMaterial Solutions, Advanced Flax Composites, Natural Fiber Technologies, EcoHarvest Industries, FlaxTech Europe, Sustainable Fibre Co., Global Linen Products, Innovative Bio-Textiles, Green Materials Alliance |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The flax fiber market is extensively segmented to provide a granular understanding of its diverse applications and consumer bases. These segmentations allow for a detailed analysis of specific growth drivers, challenges, and opportunities within each category, offering a comprehensive view of market dynamics. Understanding these divisions is crucial for stakeholders to identify lucrative niches, tailor product development, and formulate targeted market entry strategies. The breakdown by type, application, and end-use industry highlights the versatility of flax fiber and its increasing integration across a multitude of sectors, driven by its unique properties and growing sustainability appeal.

- By Type:

- Long Fiber: Primarily used in high-quality textiles (linen fabrics, apparel) and specific composite applications requiring superior strength and aesthetic appeal.

- Short Fiber: More versatile, used in non-woven materials, paper, insulation, and lower-grade composites, often offering a cost-effective solution.

- By Application:

- Textiles: Encompasses traditional linen apparel, home furnishings (bedding, upholstery), and a growing segment of technical textiles for industrial and performance wear.

- Composites: A rapidly expanding segment for automotive interiors (dashboard, door panels), construction (insulation, non-structural elements), wind energy blades, and sports equipment due to its lightweight and high strength-to-weight ratio.

- Paper Industry: Used in specialty papers, banknotes, and high-quality artistic papers due to its strength and durability.

- Insulation: Employed in building insulation for its thermal and acoustic properties, offering an eco-friendly alternative.

- Medical: Niche applications in medical textiles and biodegradable implants, leveraging its natural compatibility and non-allergenic properties.

- Other Industrial Applications: Includes filtration materials, geotextiles, and specialized packaging solutions.

- By End-Use Industry:

- Automotive: For lightweighting and interior components, driven by fuel efficiency and sustainability targets.

- Building & Construction: For insulation, panels, and non-load-bearing structures, promoting green building practices.

- Textile & Apparel: For sustainable fashion and home textiles, meeting consumer demand for natural products.

- Packaging: For biodegradable packaging materials, reducing plastic waste.

- Sports & Leisure: For sporting goods (e.g., skis, rackets) due to excellent strength-to-weight ratio and vibration damping.

- Healthcare: For non-woven medical disposables and advanced wound care.

- Furniture: For upholstery, padding, and structural components in eco-friendly furniture designs.

Regional Highlights

- Europe: Dominates the global flax fiber market, particularly due to its long-standing tradition of flax cultivation and processing, especially in countries like France, Belgium, and the Netherlands. The region benefits from established textile industries, a strong emphasis on sustainability, and supportive EU policies promoting bio-based materials, driving innovation and adoption across various industries including automotive and construction.

- Asia Pacific (APAC): Emerging as a significant growth region, driven by rapid industrialization, increasing environmental awareness, and a growing manufacturing base in countries like China and India. The rising demand for sustainable products in consumer goods and the expansion of the automotive and construction sectors are fueling market expansion, with potential for increased cultivation and processing capabilities.

- North America: Exhibiting steady growth, primarily influenced by rising consumer preference for natural and eco-friendly products, coupled with increasing adoption of flax fiber in the automotive and building & construction sectors for lightweighting and green building initiatives. Research and development activities focused on advanced composites are also contributing to market expansion.

- Latin America: An emerging market with significant growth potential, particularly in countries like Brazil, where increasing environmental consciousness and growing industrial sectors are driving interest in sustainable materials. The region presents opportunities for both cultivation expansion and new application development.

- Middle East & Africa (MEA): Currently a smaller market, but shows promise with increasing awareness of sustainable practices and potential for local cultivation in certain areas. Growth in this region is expected to be slower but steady, driven by infrastructure development and a gradual shift towards eco-friendly materials in construction and consumer goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flax Fiber Market.- Global BioFibers Inc.

- Sustainable Linen Solutions

- EcoComposite Materials

- AgriFiber Innovations

- GreenTech Textiles

- NaturaFiber Group

- PureFlax Industries

- Textile Innovations Ltd.

- Composite Fiber Dynamics

- NextGen Materials

- Agri-Tex Holdings

- BioMaterial Solutions

- Advanced Flax Composites

- Natural Fiber Technologies

- EcoHarvest Industries

- FlaxTech Europe

- Sustainable Fibre Co.

- Global Linen Products

- Innovative Bio-Textiles

- Green Materials Alliance

Frequently Asked Questions

What is flax fiber primarily used for?

Flax fiber is a versatile natural material primarily used in textiles for linen fabrics (apparel, home furnishings), and increasingly in bio-composites for automotive, construction, and wind energy applications. It also finds use in paper, insulation, and specialty industrial products due to its strength and sustainability.

Why is flax fiber considered sustainable?

Flax fiber is highly sustainable because it is a renewable resource that requires less water and pesticides compared to other natural fibers like cotton. It is biodegradable, recyclable, and its cultivation can improve soil health. Its processing also has a lower environmental footprint than synthetic fibers.

What are the main challenges facing the flax fiber market?

Key challenges include higher production costs compared to synthetic alternatives, fluctuating raw material prices due to climate variability, and the need for standardized quality control. Additionally, fragmented supply chains and limited processing infrastructure in some regions pose hurdles to widespread adoption.

How is AI impacting the flax fiber industry?

AI is transforming the flax fiber industry through precision agriculture for optimized cultivation and yield prediction. It also enhances quality control with automated grading, optimizes supply chains, and accelerates research and development for new applications by predicting material properties and facilitating design.

Which regions are key players in the flax fiber market?

Europe, particularly countries like France, Belgium, and the Netherlands, is the dominant region due to its historical expertise and strong textile industry. Asia Pacific, driven by China and India, is a rapidly growing market, while North America also shows significant adoption, especially in automotive and construction sectors.