Fixed Tilt Solar PV Market

Fixed Tilt Solar PV Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700022 | Last Updated : July 22, 2025 |

Format : ![]()

![]()

![]()

![]()

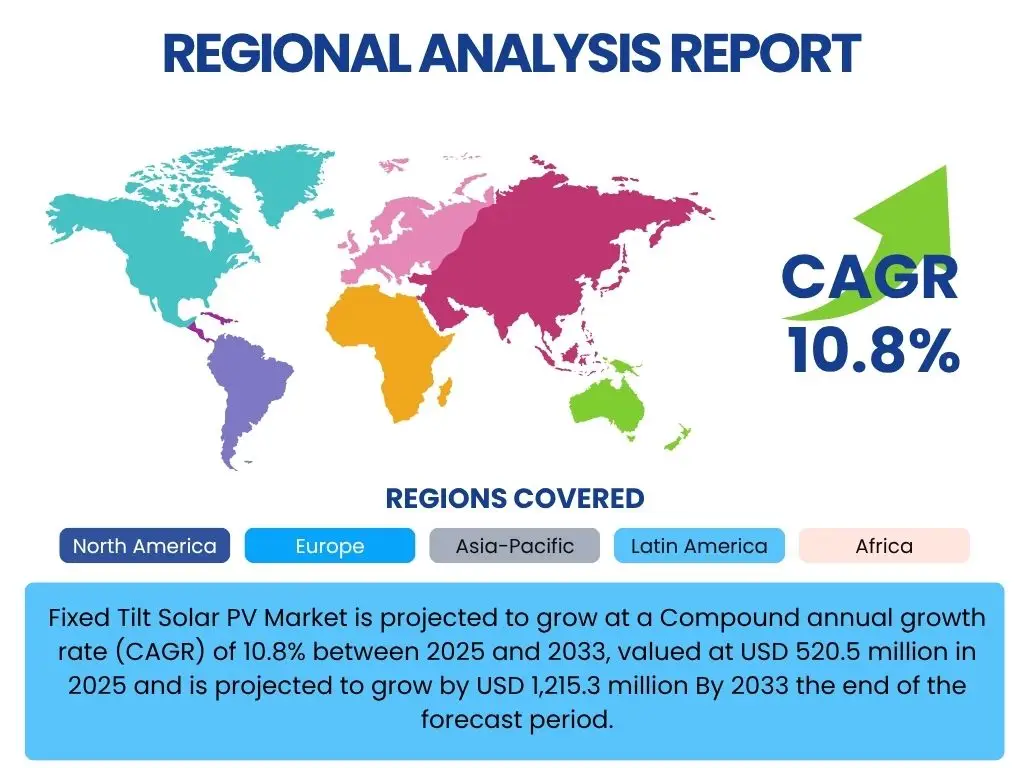

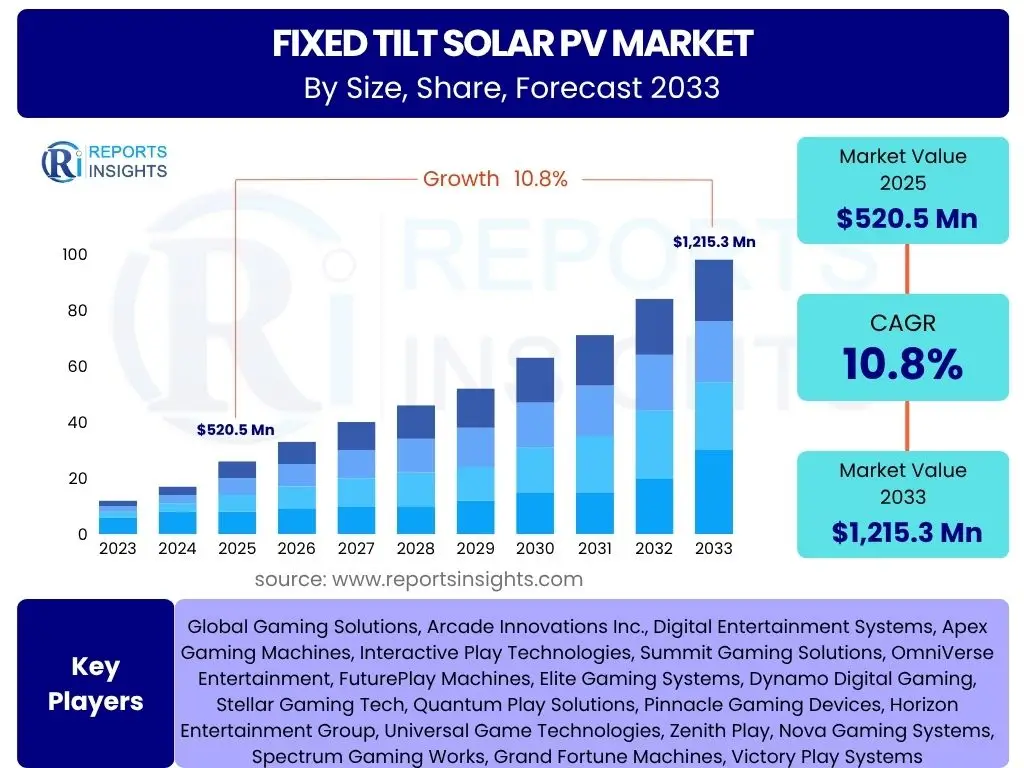

Fixed Tilt Solar PV Market is projected to grow at a Compound annual growth rate (CAGR) of 10.8% between 2025 and 2033, valued at USD 520.5 million in 2025 and is projected to grow by USD 1,215.3 million By 2033 the end of the forecast period.

Key Fixed Tilt Solar PV Market Trends & Insights

The Fixed Tilt Solar PV Market is currently shaped by a confluence of evolving technological advancements, shifting economic landscapes, and robust policy frameworks. A primary trend driving market expansion is the persistent decline in the cost of solar photovoltaic modules and balance of system components, making solar energy increasingly competitive with traditional power sources. This cost reduction, coupled with improvements in panel efficiency and durability, enhances the economic viability of fixed tilt installations, particularly in large-scale utility projects where simplicity and reliability are paramount. Furthermore, there is a growing emphasis on optimizing fixed tilt systems through advanced design software and bifacial module integration, allowing for higher energy yields from static arrays.

Another significant trend is the expansion of solar deployment into diverse climatic zones and terrains, necessitating resilient and adaptable fixed tilt solutions. Governments worldwide are reinforcing their commitments to renewable energy through supportive policies, including tax incentives, subsidies, and renewable energy mandates, which provide a stable regulatory environment for investment in fixed tilt projects. The market also observes a trend towards larger utility-scale deployments, where the inherent simplicity and lower maintenance requirements of fixed tilt systems offer operational advantages. Alongside this, the integration of digital twins and predictive analytics for monitoring and maintenance is emerging as a critical trend, ensuring optimal performance and longevity of these installations over their lifecycle.

- Continued reduction in solar module and balance of system costs.

- Improvements in PV panel efficiency and material durability.

- Growing adoption of bifacial modules for enhanced energy yield in fixed arrays.

- Increased investment in utility-scale fixed tilt solar farms.

- Expansion of solar deployment into diverse geographical regions.

- Supportive government policies and renewable energy targets.

- Advancements in solar project design and simulation software.

- Emergence of digital monitoring and predictive maintenance solutions.

AI Impact Analysis on Fixed Tilt Solar PV

Artificial Intelligence (AI) is rapidly transforming various facets of the Fixed Tilt Solar PV market, primarily by enhancing operational efficiency, optimizing energy output, and streamlining project development. In the pre-installation phase, AI-powered algorithms can analyze vast datasets of topographical, meteorological, and environmental information to precisely determine optimal site selection for fixed tilt arrays, accounting for factors like insolation, shading, and land topography to maximize energy generation. This not only improves the predictability of project performance but also reduces the risk associated with site-specific challenges. During the design phase, AI tools facilitate automated layout optimization, ensuring the most efficient arrangement of panels to minimize land usage and inter-row shading, leading to higher energy density and overall system output from fixed structures.

Post-installation, AI plays a crucial role in the operation and maintenance (O&M) of fixed tilt solar farms. Predictive maintenance models, leveraging machine learning, analyze real-time performance data from inverters and modules to identify potential failures or degradation patterns before they impact energy production. This allows for proactive interventions, reducing downtime and maintenance costs significantly for static systems. Furthermore, AI-driven forecasting models provide highly accurate predictions of solar power generation, which is vital for grid integration and energy trading, helping grid operators manage the intermittency of solar power more effectively. The application of AI also extends to quality control during manufacturing and construction, ensuring higher reliability and longevity of fixed tilt components, thus bolstering the overall attractiveness and investment security of fixed tilt solar projects.

- Optimized site selection and array layout design through AI algorithms.

- Enhanced predictive maintenance capabilities for reduced downtime.

- Improved energy yield forecasting for better grid integration.

- Automated anomaly detection in solar panel performance.

- Streamlined project development and risk assessment.

- AI-driven quality control in manufacturing and construction.

- Data-driven decision-making for fixed tilt asset management.

Key Takeaways Fixed Tilt Solar PV Market Size & Forecast

- The global Fixed Tilt Solar PV market is poised for substantial growth, projected to achieve a market value of USD 1,215.3 million by 2033.

- This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 10.8% from 2025 to 2033.

- Utility-scale applications are anticipated to remain the dominant segment, driven by large-scale renewable energy infrastructure projects.

- Asia Pacific is expected to maintain its leadership as the largest market, fueled by strong government support and rapid energy demand.

- The declining costs of PV modules and balance of system components are key enablers of market expansion.

- Increased focus on energy independence and carbon emission reduction strategies globally will further stimulate market development.

- Technological advancements in module efficiency and smart monitoring systems are contributing to the economic attractiveness of fixed tilt installations.

Fixed Tilt Solar PV Market Drivers Analysis

The Fixed Tilt Solar PV Market is significantly propelled by a combination of economic incentives, environmental imperatives, and technological advancements that collectively enhance the appeal and feasibility of solar energy deployment. Government policies and financial incentives, such as tax credits, subsidies, and feed-in tariffs, play a pivotal role in reducing the initial capital outlay for solar projects, making fixed tilt installations more accessible and financially viable for a broader range of investors and developers. This regulatory support provides a stable framework for market growth, encouraging long-term investments in renewable energy infrastructure. Concurrently, the continuous decline in the manufacturing costs of solar photovoltaic modules and balance of system components has drastically improved the economic competitiveness of solar power compared to fossil fuels, positioning fixed tilt systems as an economically attractive option for utility-scale and commercial applications where simplicity and cost-effectiveness are prioritized.

Moreover, the escalating global demand for electricity, driven by industrialization, urbanization, and population growth, necessitates diverse and sustainable energy sources, with fixed tilt solar PV offering a reliable and scalable solution. Rising environmental concerns regarding climate change and air pollution are further accelerating the transition towards clean energy, with solar power being a cornerstone of decarbonization efforts worldwide. This push for sustainability is often mandated by international agreements and national renewable energy targets, compelling countries and corporations to adopt solar technologies. Lastly, advancements in solar panel efficiency, material science (e.g., bifacial technology), and improved manufacturing processes are leading to higher energy yields and longer operational lifespans for fixed tilt systems, bolstering their overall return on investment and solidifying their position as a leading choice for renewable energy generation.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Falling PV Module and Balance of System Costs | +3.2% | Global, particularly Asia Pacific (China, India) and North America | Short to Medium Term (2025-2029) |

| Supportive Government Policies and Incentives | +2.8% | Europe (Germany, Spain), North America (USA), Asia Pacific (India, Australia) | Medium to Long Term (2026-2033) |

| Increasing Global Electricity Demand and Energy Security Concerns | +2.5% | Asia Pacific, Latin America, Middle East & Africa | Medium to Long Term (2027-2033) |

| Growing Environmental Concerns and Decarbonization Goals | +2.0% | Global, with strong focus in Europe and Developed Economies | Long Term (2028-2033) |

| Technological Advancements in PV Efficiency and Durability | +1.8% | Global, impacting manufacturing hubs and project developers | Short to Medium Term (2025-2030) |

| Simplicity and Low Maintenance of Fixed Tilt Systems | +1.5% | Emerging Markets, Utility-Scale Projects Globally | Medium Term (2026-2031) |

Fixed Tilt Solar PV Market Restraints Analysis

Despite its robust growth trajectory, the Fixed Tilt Solar PV Market faces several significant restraints that could temper its expansion and influence investment decisions. One primary challenge is the substantial upfront capital investment required for large-scale solar projects, including the cost of land acquisition, modules, inverters, and civil works. While component costs have decreased, the sheer scale of utility-scale fixed tilt installations still necessitates considerable financial outlay, potentially posing a barrier for smaller developers or regions with limited access to financing. Furthermore, the land-intensive nature of solar farms, particularly fixed tilt systems which generally require more space per megawatt than tracking systems, can lead to land availability issues and environmental concerns, especially in densely populated areas or regions with competing land uses such as agriculture.

Another critical restraint is the inherent intermittency of solar power generation, which relies on sunlight availability and is subject to daily and seasonal variations, as well as weather conditions. This variability creates challenges for grid integration and stability, requiring significant investment in grid modernization, energy storage solutions, or flexible backup power, which can add to the overall cost and complexity of solar deployment. Policy and regulatory uncertainties, including sudden changes in renewable energy targets, incentive programs, or permitting processes, can also deter investors by introducing unforeseen risks and reducing the long-term predictability of returns. Additionally, supply chain disruptions, fluctuating raw material prices (e.g., polysilicon, steel), and global trade tensions can lead to increased component costs and project delays, impacting the financial viability and timely completion of fixed tilt solar projects.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Capital Expenditure | -2.8% | Global, particularly developing economies with limited financing access | Medium Term (2025-2030) |

| Land Availability and Site Constraints | -2.5% | Europe, Asia (densely populated regions), Environmentally sensitive areas | Long Term (2027-2033) |

| Intermittency of Solar Power and Grid Integration Challenges | -2.2% | Global, especially regions with weak grid infrastructure | Medium to Long Term (2026-2033) |

| Policy and Regulatory Uncertainties | -1.9% | Countries with unstable political environments or frequent policy changes | Short to Medium Term (2025-2028) |

| Supply Chain Disruptions and Raw Material Price Volatility | -1.7% | Global, particularly countries reliant on specific component imports | Short Term (2025-2027) |

| Competition from Other Renewable and Conventional Energy Sources | -1.5% | Regions with diverse energy portfolios (e.g., hydro, wind, nuclear) | Long Term (2028-2033) |

Fixed Tilt Solar PV Market Opportunities Analysis

The Fixed Tilt Solar PV Market is brimming with compelling opportunities that are set to further accelerate its growth and diversify its applications. A significant opportunity lies in the continued integration of solar PV with energy storage systems, such as batteries. This synergy addresses the intermittency of solar power, making it a more reliable and dispatchable energy source, thus expanding its utility for both grid-scale and off-grid applications. As battery costs decline and efficiency improves, hybrid solar-plus-storage solutions become increasingly attractive, offering stable power supply and enhanced grid resilience. Furthermore, the expansion into emerging markets, particularly in Asia, Africa, and Latin America, presents vast untapped potential. These regions often face rapidly increasing energy demand, have abundant solar resources, and are increasingly prioritizing clean energy development, making them fertile ground for large-scale fixed tilt solar projects.

Technological innovations, such as the widespread adoption of bifacial solar modules and advancements in inverter technology, offer opportunities to significantly increase energy yield from fixed tilt installations without requiring additional land. Bifacial modules, which capture sunlight from both sides, can boost generation by a considerable percentage, making fixed tilt systems even more efficient and economically viable. The growing trend of corporate renewable energy procurement, driven by sustainability goals and the desire for stable energy costs, is also creating a substantial market for utility-scale fixed tilt power purchase agreements (PPAs). These corporate PPAs provide long-term revenue streams for solar developers, de-risking investments. Lastly, the development of smart grid technologies and digitalization of energy systems presents opportunities for fixed tilt solar to be seamlessly integrated into modernized grids, optimizing energy flow, and enhancing overall system efficiency and reliability.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with Energy Storage Systems | +3.5% | Global, especially regions with high renewable penetration or grid instability | Medium to Long Term (2026-2033) |

| Expansion into Emerging Markets and Developing Economies | +3.0% | Asia Pacific (Southeast Asia, India), Latin America, Middle East & Africa | Short to Medium Term (2025-2030) |

| Advancements in Bifacial Module Technology | +2.7% | Global, particularly large-scale utility projects | Short to Medium Term (2025-2029) |

| Growing Corporate Renewable Energy Procurement (PPAs) | +2.3% | North America, Europe, parts of Asia Pacific (e.g., Australia) | Medium Term (2026-2031) |

| Development of Green Hydrogen Production via Solar | +1.8% | Europe, Australia, Middle East, specific industrial zones | Long Term (2029-2033) |

| Decentralized and Hybrid Power Solutions | +1.5% | Remote areas, islands, industrial parks globally | Medium Term (2027-2032) |

Fixed Tilt Solar PV Market Challenges Impact Analysis

While opportunities abound, the Fixed Tilt Solar PV Market is also navigating several intrinsic and extrinsic challenges that demand strategic responses from industry players and policymakers. One significant challenge pertains to grid infrastructure limitations and congestion. As more solar capacity, especially from large-scale fixed tilt farms, comes online, existing grid infrastructure in many regions may not be adequately equipped to handle the increased influx of intermittent renewable energy without significant upgrades. This can lead to curtailment of solar output, transmission bottlenecks, and increased grid instability, thereby hindering further project development and profitability. Another hurdle is the complexity and often lengthy process of obtaining permits and regulatory approvals for solar projects. Bureaucratic delays, stringent environmental assessments, and varying local regulations across different jurisdictions can significantly extend project timelines and inflate development costs, particularly for large utility-scale fixed tilt installations.

Furthermore, managing public perception and local opposition to large-scale solar farms can pose a considerable challenge. Concerns related to visual impact, land use changes, and potential impacts on local ecosystems often lead to community resistance, delaying or even derailing projects. The availability of skilled labor for the installation, operation, and maintenance of solar PV systems is another growing concern, especially as the industry scales rapidly. A shortage of trained professionals can lead to increased labor costs and quality control issues. Lastly, the industry is susceptible to external shocks such as global economic downturns, trade disputes, and geopolitical instability, which can disrupt supply chains, impact financing availability, and introduce market volatility. These challenges necessitate collaborative efforts among stakeholders to ensure sustainable growth and effective deployment of fixed tilt solar PV technology.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Grid Infrastructure Limitations and Congestion | -2.9% | Global, particularly developed economies with aging grids and high solar penetration | Medium to Long Term (2026-2033) |

| Permitting and Regulatory Hurdles | -2.6% | North America, Europe, countries with fragmented regulatory frameworks | Short to Medium Term (2025-2029) |

| Public Acceptance and NIMBY (Not In My Backyard) Syndrome | -2.3% | Densely populated regions, areas with strong environmental advocacy | Medium Term (2026-2031) |

| Skilled Labor Shortages and Workforce Development | -2.0% | Global, especially rapidly expanding solar markets | Medium Term (2027-2032) |

| Financing Access and Investment Risk Perception | -1.8% | Emerging economies, regions with economic instability | Short to Medium Term (2025-2028) |

| Vulnerability to Extreme Weather Events | -1.5% | Regions prone to hurricanes, hail, extreme heat, or heavy snowfall | Long Term (2028-2033) |

Fixed Tilt Solar PV Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Fixed Tilt Solar PV Market, encompassing historical data, current market dynamics, and future projections. The report offers critical insights into market size, growth trends, key drivers, restraints, opportunities, and challenges influencing the industry landscape. It delves into detailed segmentation analysis by component, application, and end-use, alongside a thorough regional assessment to pinpoint lucrative investment pockets. Furthermore, the study profiles leading market players, offering a competitive landscape view and strategic insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 520.5 million |

| Market Forecast in 2033 | USD 1,215.3 million |

| Growth Rate | 10.8% from 2025 to 2033 |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Longi Solar, JinkoSolar, Trina Solar, JA Solar, Canadian Solar, Hanwha Q Cells, First Solar, Risen Energy, GCL System Integration, SunPower, SMA Solar Technology, Enphase Energy, SolarEdge Technologies, Array Technologies, Nextracker, Soltec, Arctech Solar, PV Hardware, Sungrow Power Supply, REC Solar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Fixed Tilt Solar PV Market is meticulously segmented to provide a granular understanding of its diverse components, applications, and technological varieties, enabling stakeholders to pinpoint specific areas of growth and investment. This detailed breakdown facilitates a clearer view of market dynamics across various categories, highlighting the unique contributions and growth trajectories of each segment. Understanding these segmentations is crucial for developing targeted strategies and optimizing market penetration efforts.

The market is broadly categorized by Component, which includes the essential building blocks of any solar installation. The Application segment delineates the primary end-uses where fixed tilt systems are deployed, from large power plants to smaller scale installations. Furthermore, the End-Use segment provides a deeper dive into the specific sectors benefiting from this technology beyond general power generation. Lastly, the Type segment differentiates between the various solar panel technologies predominantly used in fixed tilt configurations, acknowledging their varying efficiencies and cost structures.

- By Component:

- PV Modules: The core power-generating units, encompassing both monocrystalline and polycrystalline silicon panels, as well as thin-film technologies. This segment covers the most significant cost component of a solar PV system.

- Inverters: Devices converting direct current (DC) generated by solar panels into alternating current (AC) usable by the grid or appliances.

- Mounting Structures: The frameworks (racks, foundations) that hold the solar panels at a fixed tilt angle, crucial for structural integrity and optimal sun exposure.

- Balance of System (BoS): All other components apart from modules and inverters, including cabling, electrical boxes, monitoring systems, and other necessary hardware for a complete PV system.

- By Application:

- Utility-Scale: Large-scale ground-mounted solar power plants typically exceeding 1 megawatt, supplying electricity directly to the national or regional grid. These projects often utilize fixed tilt designs due to their cost-effectiveness and scalability.

- Commercial & Industrial (C&I): Installations on commercial buildings, industrial facilities, or dedicated land, ranging from a few kilowatts to several megawatts, primarily for self-consumption or feeding excess power to the grid.

- Residential: Smaller installations on residential rooftops or properties, generally under 20 kilowatts, designed to offset household electricity consumption.

- By End-Use:

- Power Generation: The primary end-use, referring to the large-scale production of electricity for grid supply or direct industrial consumption.

- Agriculture: Applications such as agrivoltaics (solar panels over crops), solar water pumping for irrigation, or power for farm operations.

- Water Pumping: Dedicated solar systems used for pumping water in remote areas or for specific irrigation needs, often in off-grid contexts.

- Others: Includes diverse applications such as telecommunications stations, remote electrification, street lighting, and specialized off-grid power solutions.

- By Type:

- Crystalline Silicon Solar PV:

- Monocrystalline: High-efficiency solar cells made from a single crystal of silicon, known for their sleek appearance and space-saving qualities.

- Polycrystalline: Solar cells made from multiple silicon crystals, generally more cost-effective than monocrystalline but slightly less efficient.

- Thin-Film Solar PV: Solar cells made by depositing one or more thin layers of photovoltaic material onto a substrate, offering flexibility and potentially lower manufacturing costs for certain niche applications, though less common in large fixed tilt utility projects due to lower efficiency.

- Crystalline Silicon Solar PV:

Regional Highlights

- Asia Pacific (APAC): The Asia Pacific region stands as the undisputed leader in the Fixed Tilt Solar PV market, driven by robust renewable energy targets, rapidly expanding electricity demand, and declining project costs. Countries like China and India are at the forefront, with massive utility-scale deployments fueled by government incentives and significant manufacturing capabilities. Australia and Japan are also major contributors, investing heavily in large solar farms to meet decarbonization goals and ensure energy security. The region benefits from abundant solar irradiation and strong policy support for clean energy transition.

- North America: North America represents a mature yet dynamic market, with the United States and Canada leading the adoption of fixed tilt solar PV. Growth is primarily propelled by federal and state-level tax credits, renewable portfolio standards, and corporate commitments to clean energy. The simplicity and cost-effectiveness of fixed tilt systems make them attractive for large-scale utility projects across sunbelt states. Investment in grid modernization and energy storage integration further enhances the market's potential in this region.

- Europe: Europe is a key market, driven by ambitious climate targets, a strong push for energy independence from fossil fuels, and well-established incentive mechanisms. Countries such as Germany, Spain, Italy, and the Netherlands are actively deploying fixed tilt solar arrays, particularly in southern regions with high insolation. The focus here is on grid integration, hybridization with other renewables, and optimizing land use through advanced technologies like bifacial modules, contributing to significant capacity additions.

- Latin America: Latin America is an emerging high-growth region for fixed tilt solar PV, characterized by vast untapped solar resources and a pressing need for affordable and reliable electricity. Countries like Brazil, Chile, Mexico, and Argentina are witnessing significant investments in large-scale solar projects, often supported by public-private partnerships and renewable energy auctions. The straightforward installation and lower maintenance of fixed tilt systems are particularly appealing in remote or rural areas lacking grid access.

- Middle East and Africa (MEA): The MEA region is poised for substantial growth in fixed tilt solar PV, leveraging its exceptional solar irradiation levels and rising energy demand. Driven by ambitious diversification strategies away from fossil fuels, countries such as Saudi Arabia, UAE, and Egypt are embarking on monumental solar projects. In Africa, off-grid and mini-grid solutions using fixed tilt systems are addressing energy access challenges in underserved communities, providing reliable and decentralized power.

Top Key Players:

The market research report covers the analysis of key stake holders of the Fixed Tilt Solar PV Market. Some of the leading players profiled in the report include -:- Longi Solar

- JinkoSolar

- Trina Solar

- JA Solar

- Canadian Solar

- Hanwha Q Cells

- First Solar

- Risen Energy

- GCL System Integration

- SunPower

- SMA Solar Technology

- Enphase Energy

- SolarEdge Technologies

- Array Technologies

- Nextracker

- Soltec

- Arctech Solar

- PV Hardware

- Sungrow Power Supply

- REC Solar

Frequently Asked Questions:

What is Fixed Tilt Solar PV?

Fixed Tilt Solar PV refers to solar photovoltaic systems where the solar panels are mounted at a stationary, predetermined angle and orientation to maximize energy capture from the sun. Unlike tracking systems that adjust to follow the sun's path, fixed tilt systems remain in a static position, offering simplicity in design, lower installation costs, and reduced maintenance requirements. They are widely used in utility-scale solar farms, commercial installations, and residential rooftop projects where maximizing lifetime energy yield for a fixed investment is a priority.

What are the primary advantages of Fixed Tilt Solar PV systems?

The key advantages of Fixed Tilt Solar PV systems include lower initial capital expenditure due to simpler mechanical design and fewer moving parts, resulting in reduced installation costs. They also boast higher reliability and lower maintenance requirements compared to tracking systems, leading to reduced operational expenses over their lifespan. Furthermore, their straightforward design simplifies logistics and construction, making them a cost-effective and robust solution for various solar energy applications, especially large-scale projects where economies of scale are significant.

How does the Fixed Tilt Solar PV market outlook appear for the coming years?

The Fixed Tilt Solar PV market is projected to experience substantial growth in the coming years, driven by the ongoing decline in solar component costs, strong government support through policies and incentives, and increasing global electricity demand. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 10.8% between 2025 and 2033, reaching a value of USD 1,215.3 million by 2033. This growth is further bolstered by advancements in solar panel efficiency and the increasing adoption of bifacial modules, which enhance the energy output of fixed arrays.

Which regions are leading the growth in the Fixed Tilt Solar PV market?

Asia Pacific (APAC) is currently the dominant region in the Fixed Tilt Solar PV market, with significant contributions from countries like China, India, and Australia, driven by ambitious renewable energy targets and large-scale utility projects. North America, particularly the United States, also holds a strong position due to favorable tax incentives and corporate renewable energy commitments. Europe, with its strong climate goals and established green energy policies, remains a key market, while Latin America and the Middle East & Africa are emerging as high-growth regions owing to abundant solar resources and rising energy needs.

What is the impact of Artificial Intelligence (AI) on Fixed Tilt Solar PV systems?

Artificial Intelligence significantly impacts Fixed Tilt Solar PV systems by optimizing various stages from project development to operation. AI enhances site selection and array layout design by analyzing complex data for maximum energy yield. During operation, AI-powered predictive maintenance identifies potential faults in components, minimizing downtime and reducing operational costs. Moreover, AI improves energy forecasting, facilitating better grid integration and energy management, thereby increasing the overall efficiency and profitability of fixed tilt solar installations.