FinTech Service Market

FinTech Service Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703677 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

FinTech Service Market Size

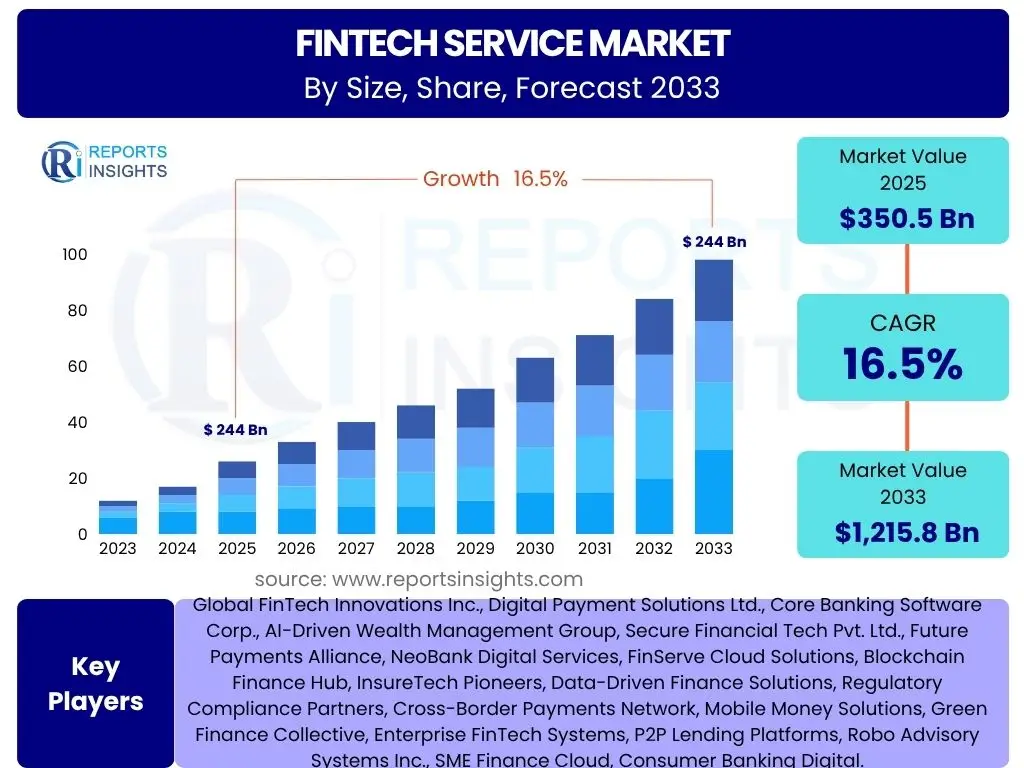

According to Reports Insights Consulting Pvt Ltd, The FinTech Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2025 and 2033. The market is estimated at USD 350.5 Billion in 2025 and is projected to reach USD 1,215.8 Billion by the end of the forecast period in 2033.

Key FinTech Service Market Trends & Insights

The FinTech Service market is undergoing a significant transformation driven by evolving consumer expectations and technological advancements. Key trends indicate a strong move towards embedded finance, where financial services are seamlessly integrated into non-financial platforms, enhancing user experience and expanding reach. This integration simplifies transactions and makes financial interactions more intuitive for consumers and businesses alike. Furthermore, the rise of digital-only banks and challenger banks continues to disrupt traditional banking models by offering agile, customer-centric services with lower overheads.

Another prominent trend is the increasing adoption of hyper-personalization, leveraging data analytics and artificial intelligence to offer tailored financial products and advice. This shift caters to individual needs, improving customer loyalty and engagement. The regulatory landscape is also adapting, with open banking initiatives becoming more prevalent globally, fostering greater competition and innovation by allowing secure data sharing between financial institutions and third-party providers. This ecosystem approach is paving the way for more collaborative financial services.

Finally, the growing focus on environmental, social, and governance (ESG) factors is influencing FinTech development, leading to the emergence of "Green FinTech" solutions. These innovations support sustainable investments, carbon footprint tracking, and ethical financial practices, aligning with broader societal demands for responsible business conduct. Blockchain and distributed ledger technologies continue to mature, offering new possibilities for secure, transparent, and efficient transactions, especially in cross-border payments and digital asset management, although regulatory clarity remains a key area of development.

- Embedded Finance Integration: Seamless financial services within non-financial platforms.

- Hyper-Personalization: Data-driven tailored financial products and advice.

- Open Banking & APIs: Fostering data sharing and innovation across the ecosystem.

- Digital-Only Banking: Expansion of agile, customer-centric challenger banks.

- Blockchain & Digital Assets: Growing adoption in payments and asset management.

- Green FinTech: Solutions supporting sustainable investments and ESG principles.

- AI and Machine Learning Adoption: Enhancing fraud detection, risk management, and customer service.

AI Impact Analysis on FinTech Service

Artificial intelligence is profoundly reshaping the FinTech Service landscape by enabling unprecedented levels of automation, personalization, and risk management. Users frequently inquire about AI's role in streamlining back-office operations, automating customer support through chatbots, and enhancing fraud detection capabilities. AI driven algorithms can analyze vast datasets to identify suspicious patterns in real-time, significantly reducing financial crime and improving security for consumers and institutions. This capability addresses a primary concern for users regarding the safety and integrity of digital financial transactions.

Beyond security, users are keen on understanding how AI contributes to personalized financial experiences. AI powers sophisticated recommendation engines that offer tailored investment advice, credit products, and budgeting tools based on individual spending habits and financial goals. This bespoke approach moves away from one-size-fits-all services, fostering greater financial inclusion and empowering users with intelligent insights. The impact extends to credit scoring, where AI can assess creditworthiness using a wider range of data points than traditional methods, potentially expanding access to credit for underserved populations.

The operational efficiency gains from AI are also a significant theme of interest, particularly concerning cost reduction and scalability for FinTech firms. Automated compliance checks, predictive analytics for market trends, and optimized resource allocation are areas where AI offers substantial benefits. However, user concerns also revolve around data privacy, algorithmic bias, and the transparency of AI decision-making processes, highlighting the need for robust ethical guidelines and regulatory frameworks as AI adoption in FinTech continues to accelerate.

- Enhanced Fraud Detection: Real-time analysis of transaction patterns for anomaly detection.

- Personalized Financial Advice: AI-driven recommendations for investments and budgeting.

- Automated Customer Support: Chatbots and virtual assistants for instant query resolution.

- Improved Credit Scoring: Broader data analysis for more inclusive credit assessments.

- Operational Efficiency: Automation of compliance, back-office tasks, and risk management.

- Predictive Analytics: Forecasting market trends and customer behavior.

- Robo-Advisors: Automated investment management and portfolio optimization.

Key Takeaways FinTech Service Market Size & Forecast

The FinTech Service market is poised for robust expansion, driven by continuous innovation and increasing digital penetration globally. A primary takeaway is the significant projected growth in market size, reflecting a fundamental shift in how financial services are consumed and delivered. This expansion is not merely quantitative but also indicative of deepening technological integration across all facets of finance, from payments and lending to wealth management and insurance. The market's trajectory suggests that traditional financial institutions will need to accelerate their digital transformation efforts to remain competitive, while new entrants will continue to challenge established norms with agile and technologically advanced offerings.

A crucial insight is the accelerating pace of digital adoption among consumers and businesses, particularly in emerging economies, where mobile-first strategies are leapfrogging traditional banking infrastructure. This trend underscores the importance of accessible, user-friendly, and secure digital platforms. Furthermore, the forecast emphasizes the growing influence of artificial intelligence, blockchain, and data analytics as foundational technologies underpinning future FinTech advancements. These technologies are enabling more efficient, personalized, and secure financial transactions, which are becoming non-negotiable expectations for modern consumers.

Finally, the market forecast highlights the critical role of supportive regulatory environments and collaborative ecosystems in fostering growth. Open banking frameworks, sandboxes for innovation, and clear guidelines for emerging technologies are essential for the FinTech sector to thrive responsibly. The continued convergence of technology, finance, and consumer behavior will define the competitive landscape, making agility, customer-centricity, and a strong focus on security and compliance paramount for success in this dynamic market.

- Significant Market Expansion: Projected growth to over USD 1.2 Trillion by 2033.

- Digital Adoption Surge: Increased reliance on digital financial platforms globally.

- Technological Integration: AI, blockchain, and data analytics as core enablers.

- Customer-Centric Innovation: Emphasis on personalized and seamless financial experiences.

- Regulatory Evolution: Importance of supportive frameworks like open banking.

- Ecosystem Collaboration: Partnerships between FinTechs and traditional institutions.

- Focus on Security & Compliance: Addressing cybersecurity and data privacy concerns remains critical.

FinTech Service Market Drivers Analysis

The FinTech Service market is significantly driven by the accelerating global digital transformation and the increasing penetration of smartphones and internet connectivity. Consumers are increasingly accustomed to digital interactions in all aspects of life, leading to a higher demand for convenient, on-demand financial services accessible via mobile devices. This shift in consumer behavior away from traditional banking channels has created a fertile ground for FinTech innovations that offer superior user experience and accessibility, particularly in regions with limited physical banking infrastructure.

Another major driver is the growing need for financial inclusion, especially in emerging economies where a substantial portion of the population remains unbanked or underserved by traditional financial institutions. FinTech solutions, such as mobile payment platforms, micro-lending apps, and digital wallets, provide accessible and affordable financial services to these populations, thereby expanding the potential customer base for FinTech companies. Supportive government initiatives and regulatory frameworks, like open banking regulations and digital identity programs, are also playing a pivotal role in fostering a more competitive and innovative financial ecosystem, encouraging the development and adoption of new FinTech solutions.

Furthermore, advancements in core technologies such as artificial intelligence, machine learning, blockchain, and big data analytics are continuously enhancing the capabilities and efficiency of FinTech services. These technologies enable better fraud detection, personalized financial advice, automated compliance, and more secure and transparent transactions, which in turn drives adoption. The cost-effectiveness and operational efficiencies offered by FinTech solutions, compared to traditional banking models, also act as a strong incentive for businesses and consumers to switch, accelerating market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Smartphone & Internet Penetration | +2.1% | Global, particularly APAC & Latin America | Short to Mid-Term (2025-2029) |

| Growing Demand for Digital & Mobile Payments | +1.8% | Global | Short to Long-Term (2025-2033) |

| Rising Need for Financial Inclusion | +1.5% | Emerging Markets, Africa, Southeast Asia | Mid to Long-Term (2027-2033) |

| Advancements in AI, ML, & Blockchain Technologies | +2.3% | Global | Short to Long-Term (2025-2033) |

| Supportive Regulatory Frameworks & Government Initiatives | +1.2% | Europe, North America, India, Brazil | Mid-Term (2026-2030) |

| Cost Efficiency & Operational Benefits for Businesses | +1.0% | Global (B2B FinTech) | Short to Mid-Term (2025-2029) |

| Evolution of E-commerce and Online Retail | +0.9% | Global | Short to Mid-Term (2025-2029) |

FinTech Service Market Restraints Analysis

Despite the rapid growth, the FinTech Service market faces significant restraints, primarily centered around cybersecurity concerns and data privacy. As financial transactions increasingly move online and sensitive personal information is handled by digital platforms, the risk of data breaches, hacking, and fraud escalates. This inherent vulnerability undermines consumer trust and can lead to substantial financial losses and reputational damage for FinTech providers, thereby inhibiting broader adoption, especially among less digitally-savvy demographics or those with high-security expectations.

Another critical restraint is the complex and evolving regulatory landscape. FinTech operates across various financial services domains, each governed by a myriad of national and international regulations concerning consumer protection, anti-money laundering (AML), know-your-customer (KYC), and data governance. Compliance with these diverse and often stringent rules can be costly, time-consuming, and resource-intensive, particularly for smaller FinTech startups. The lack of harmonized global regulations further complicates cross-border operations, posing a significant barrier to market expansion and innovation.

Furthermore, resistance from traditional financial institutions and their established market dominance represents a notable restraint. While many incumbents are now embracing digital transformation, their extensive customer bases, regulatory experience, and deep pockets allow them to offer competitive services or acquire promising FinTech startups. This can create a challenging environment for new entrants seeking to carve out market share. Additionally, a lingering lack of digital literacy in certain demographics, coupled with a general preference for traditional banking methods among older generations or those in rural areas, can slow the pace of FinTech adoption, limiting market reach.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Cybersecurity Threats & Data Privacy Concerns | -1.9% | Global | Short to Long-Term (2025-2033) |

| Complex & Evolving Regulatory Landscape | -1.7% | Global, particularly Europe & North America | Short to Mid-Term (2025-2030) |

| Lack of Interoperability & Standardization | -0.8% | Global | Mid-Term (2027-2031) |

| Resistance from Traditional Financial Institutions | -0.7% | Developed Markets | Short to Mid-Term (2025-2029) |

| Digital Literacy & Trust Deficit in Certain Demographics | -0.6% | Rural Areas, Elderly Populations | Long-Term (2030-2033) |

| High Capital Requirements for Scaling | -0.5% | Global (Startups) | Short to Mid-Term (2025-2029) |

FinTech Service Market Opportunities Analysis

The FinTech Service market presents numerous opportunities for growth and innovation, particularly through expanding financial inclusion in underserved markets. Regions with large unbanked and underbanked populations, such as parts of Africa, Latin America, and Southeast Asia, represent vast untapped markets. Mobile-first FinTech solutions, including digital wallets, microfinance platforms, and remittances, can bridge the gap in access to essential financial services, driving both social impact and significant market expansion for providers willing to tailor their offerings to local needs and infrastructure.

Another significant opportunity lies in the burgeoning B2B FinTech sector. As businesses increasingly digitalize their operations, there is a growing demand for specialized FinTech solutions that streamline corporate payments, supply chain finance, expense management, and treasury operations. This segment offers higher average transaction values and the potential for long-term contracts, making it attractive for FinTech providers to develop niche solutions that enhance efficiency and reduce costs for enterprises of all sizes. The integration of AI and blockchain in B2B FinTech is further opening avenues for innovative solutions like automated reconciliation and transparent supply chain financing.

Furthermore, the emergence of new technological paradigms, such as Web3, decentralized finance (DeFi), and the metaverse, offers long-term growth opportunities. While still nascent and subject to regulatory uncertainties, these technologies could fundamentally reshape how assets are owned, transferred, and managed, creating entirely new financial ecosystems. Investing in research and development in these areas could position FinTech companies at the forefront of the next wave of financial innovation. Additionally, the increasing global focus on sustainability and ESG factors creates a distinct opportunity for "Green FinTech" solutions that facilitate sustainable investing, carbon accounting, and ethical financial product development, aligning with evolving investor and consumer values.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Underserved & Emerging Markets | +2.5% | Africa, Latin America, Southeast Asia, India | Mid to Long-Term (2027-2033) |

| Growth of B2B FinTech Solutions | +1.8% | Global | Short to Mid-Term (2025-2030) |

| Integration of Decentralized Finance (DeFi) & Web3 | +1.5% | Global | Long-Term (2029-2033) |

| Personalized & Hyper-Segmented Offerings | +1.2% | Developed Markets | Short to Mid-Term (2025-2029) |

| ESG & Green FinTech Development | +1.0% | Global | Mid to Long-Term (2027-2033) |

| Strategic Partnerships with Traditional Financial Institutions | +0.9% | Global | Short to Mid-Term (2025-2029) |

| Leveraging Data Analytics for Predictive Insights | +0.8% | Global | Short to Long-Term (2025-2033) |

FinTech Service Market Challenges Impact Analysis

The FinTech Service market faces significant challenges, particularly intense competition from both incumbent financial institutions and a rapidly growing number of agile startups. This crowded landscape necessitates constant innovation and differentiation to capture and retain market share. New entrants must not only offer superior user experiences and technologically advanced solutions but also contend with the deep pockets, established brand loyalty, and regulatory expertise of traditional banks. This fierce rivalry often leads to pricing pressures and increasing marketing costs, impacting profitability and sustainability for many FinTech players.

Another prominent challenge is talent acquisition and retention, specifically for skilled professionals in areas like artificial intelligence, blockchain development, cybersecurity, and data science. The specialized nature of FinTech demands a unique blend of financial acumen and technological expertise, and the global shortage of such talent can hinder product development, scaling efforts, and overall innovation. Competition for these professionals is not only from other FinTechs but also from major tech companies, leading to inflated salary expectations and a constant struggle to build and maintain high-performing teams.

Furthermore, scaling infrastructure to meet rapidly increasing user demands and ensuring robust cybersecurity measures while maintaining regulatory compliance presents a complex operational challenge. As FinTech companies grow, they must invest heavily in scalable cloud infrastructure, advanced security protocols, and sophisticated compliance technologies, which can be capital-intensive. Maintaining consumer trust, especially in the wake of high-profile data breaches or service disruptions in the broader digital economy, remains an ongoing challenge that requires continuous investment in security, transparency, and reliable customer service. Geopolitical instability and economic downturns can also impact investment in FinTech and consumer spending habits, posing additional external challenges.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition & Market Saturation | -1.5% | Developed Markets, Global | Short to Long-Term (2025-2033) |

| Talent Acquisition & Retention | -1.0% | Global | Short to Mid-Term (2025-2030) |

| Scaling Infrastructure & Technology | -0.9% | Global | Short to Mid-Term (2025-2029) |

| Maintaining Consumer Trust & Data Security | -0.8% | Global | Short to Long-Term (2025-2033) |

| Navigating Geopolitical & Economic Volatility | -0.7% | Global | Short-Term (2025-2027) |

| Profitability & Monetization Strategies | -0.6% | Global (Startups) | Mid to Long-Term (2028-2033) |

FinTech Service Market - Updated Report Scope

This report provides an in-depth analysis of the FinTech Service market, offering a comprehensive overview of its current size, growth trajectories, and future outlook. It encapsulates detailed market segmentation, competitive landscape analysis, and regional insights, covering key trends, drivers, restraints, opportunities, and challenges influencing market dynamics. The scope includes an assessment of AI's transformative impact and strategic recommendations for stakeholders navigating this evolving sector. The report aims to deliver actionable intelligence for informed decision-making across the FinTech ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 1,215.8 Billion |

| Growth Rate | 16.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global FinTech Innovations Inc., Digital Payment Solutions Ltd., Core Banking Software Corp., AI-Driven Wealth Management Group, Secure Financial Tech Pvt. Ltd., Future Payments Alliance, NeoBank Digital Services, FinServe Cloud Solutions, Blockchain Finance Hub, InsureTech Pioneers, Data-Driven Finance Solutions, Regulatory Compliance Partners, Cross-Border Payments Network, Mobile Money Solutions, Green Finance Collective, Enterprise FinTech Systems, P2P Lending Platforms, Robo Advisory Systems Inc., SME Finance Cloud, Consumer Banking Digital. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The FinTech Service market is extensively segmented by service type, technology, application, and end-user, reflecting the diverse range of offerings and underlying technological foundations within the industry. This granular segmentation allows for a detailed understanding of market dynamics in specific niches, highlighting areas of high growth and emerging opportunities. Each segment represents a distinct value proposition, catering to varied consumer and business needs, from facilitating seamless digital transactions to automating complex financial operations.

- By Service Type: This segment encompasses the core offerings of FinTech.

- Payments, including digital wallets, mobile payments, and cross-border remittances, represent the largest and most widely adopted segment.

- Lending covers peer-to-peer (P2P) lending, online mortgages, and small and medium-sized enterprise (SME) lending, democratizing access to credit.

- Wealth Management includes robo-advisors and online brokerage platforms, making investment advice accessible.

- Personal Finance focuses on budgeting apps and credit scoring tools, empowering individuals.

- InsurTech innovates insurance processes through personalized policies and streamlined claims.

- RegTech addresses compliance and risk management challenges with technological solutions.

- Blockchain & Cryptocurrency represents a distinct segment for decentralized finance and digital assets.

- Cybersecurity in FinTech focuses on protecting digital financial infrastructure.

- By Technology: This segment details the technological backbone of FinTech.

- Artificial Intelligence (AI) and Machine Learning (ML) are crucial for personalization, fraud detection, and automation.

- Blockchain provides secure and transparent ledger systems for transactions.

- Big Data Analytics enables deep insights into consumer behavior and market trends.

- Cloud Computing offers scalable and flexible infrastructure for FinTech operations.

- Biometrics enhances security through identity verification.

- Robotics Process Automation (RPA) automates repetitive back-office tasks.

- By Application: This segment defines the end-use sectors.

- Consumer Banking focuses on retail customers.

- Commercial Banking caters to businesses.

- Investment Banking deals with capital markets.

- Retail Finance includes point-of-sale financing and consumer loans.

- Enterprise Solutions cover bespoke FinTech for large corporations.

- By End-User: This segment distinguishes between primary users.

- Individuals represent the vast consumer market.

- Businesses are segmented into Small and Medium-sized Enterprises (SMEs) and Large Enterprises, each with unique FinTech needs.

Regional Highlights

- North America: Leads the FinTech market with high innovation, substantial venture capital investment, and a mature digital infrastructure. The U.S. remains a global hub for FinTech development, particularlyin payments, lending, and enterprise FinTech, driven by a strong consumer adoption of digital services and a dynamic startup ecosystem. Canada also shows steady growth, focusing on open banking initiatives and regulatory sandboxes.

- Europe: Characterized by strong regulatory support, notably Open Banking (PSD2), which fosters innovation and competition. The UK, Germany, and the Nordic countries are key players, with London maintaining its position as a major FinTech center. Emphasis on data privacy (GDPR) and cross-border harmonization of financial services drives specific FinTech solutions.

- Asia Pacific (APAC): The fastest-growing region, propelled by massive digital adoption, a large unbanked population, and supportive government initiatives in countries like China, India, Singapore, and Australia. Mobile-first strategies dominate, especially in payments and remittances. Significant investment in AI and blockchain FinTech is observed, catering to rapidly expanding middle classes and digital-native populations.

- Latin America: Experiencing rapid FinTech growth, driven by a significant unbanked population and increasing smartphone penetration. Brazil and Mexico are leading the charge with innovative payment solutions, digital banks, and lending platforms aimed at financial inclusion. Regulatory frameworks are evolving to support this growth while addressing market stability.

- Middle East and Africa (MEA): A burgeoning FinTech market fueled by government-led digitalization agendas, a young and tech-savvy population, and a push for economic diversification away from traditional industries. The UAE, Saudi Arabia, and South Africa are emerging as FinTech hubs, focusing on digital payments, remittances, and Islamic FinTech. Financial inclusion remains a significant growth driver in many African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FinTech Service Market.- Global FinTech Innovations Inc.

- Digital Payment Solutions Ltd.

- Core Banking Software Corp.

- AI-Driven Wealth Management Group

- Secure Financial Tech Pvt. Ltd.

- Future Payments Alliance

- NeoBank Digital Services

- FinServe Cloud Solutions

- Blockchain Finance Hub

- InsurTech Pioneers

- Data-Driven Finance Solutions

- Regulatory Compliance Partners

- Cross-Border Payments Network

- Mobile Money Solutions

- Green Finance Collective

- Enterprise FinTech Systems

- P2P Lending Platforms

- Robo Advisory Systems Inc.

- SME Finance Cloud

- Consumer Banking Digital

Frequently Asked Questions

What is the projected growth rate of the FinTech Service market?

The FinTech Service market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2025 and 2033, indicating a rapid expansion driven by digital transformation and evolving consumer demands.

How will AI impact the future of FinTech services?

AI is set to revolutionize FinTech by enhancing fraud detection, enabling hyper-personalized financial products, automating customer service, and optimizing risk management, leading to more efficient and secure financial operations.

What are the primary drivers of the FinTech Service market?

Key drivers include increasing smartphone and internet penetration, growing demand for digital payments, the need for greater financial inclusion, advancements in AI and blockchain, and supportive regulatory environments globally.

What are the main challenges facing the FinTech Service market?

Major challenges encompass cybersecurity threats, complex and evolving regulatory landscapes, intense market competition, the difficulty of acquiring specialized talent, and the imperative to maintain consumer trust and data privacy.

Which regions are leading the adoption and innovation in FinTech?

North America and Europe are significant innovation hubs with established markets. Asia Pacific is the fastest-growing region due to high digital adoption and large underserved populations, while Latin America and MEA are rapidly emerging markets.