FinTech Investment Market

FinTech Investment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701095 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

FinTech Investment Market Size

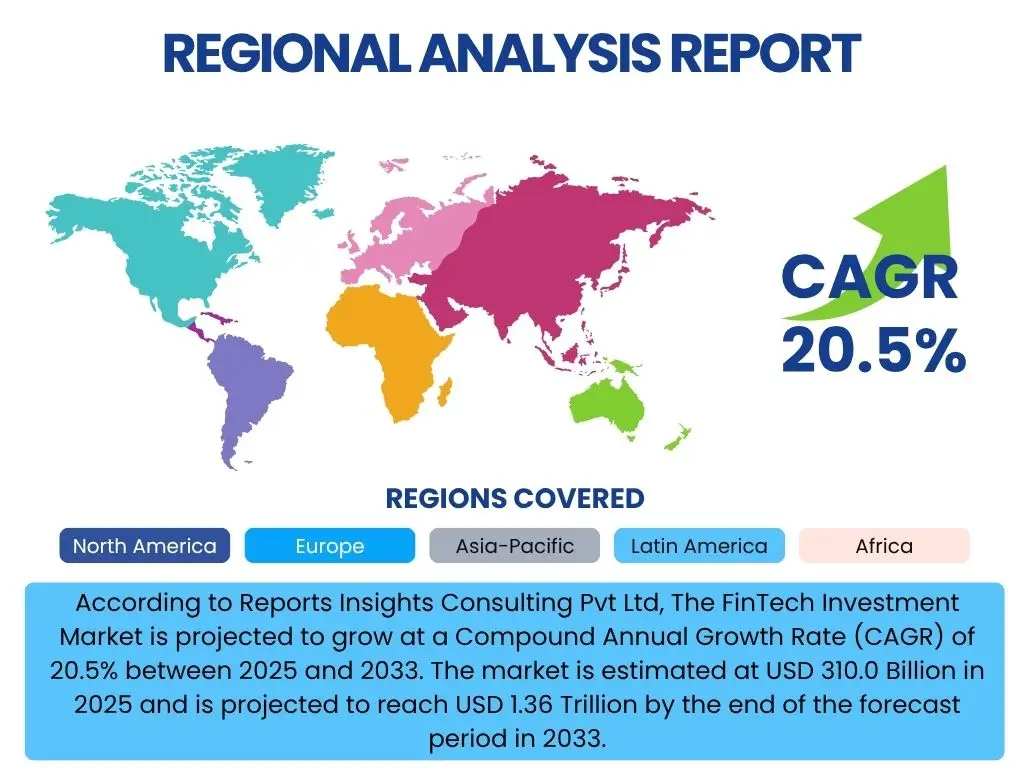

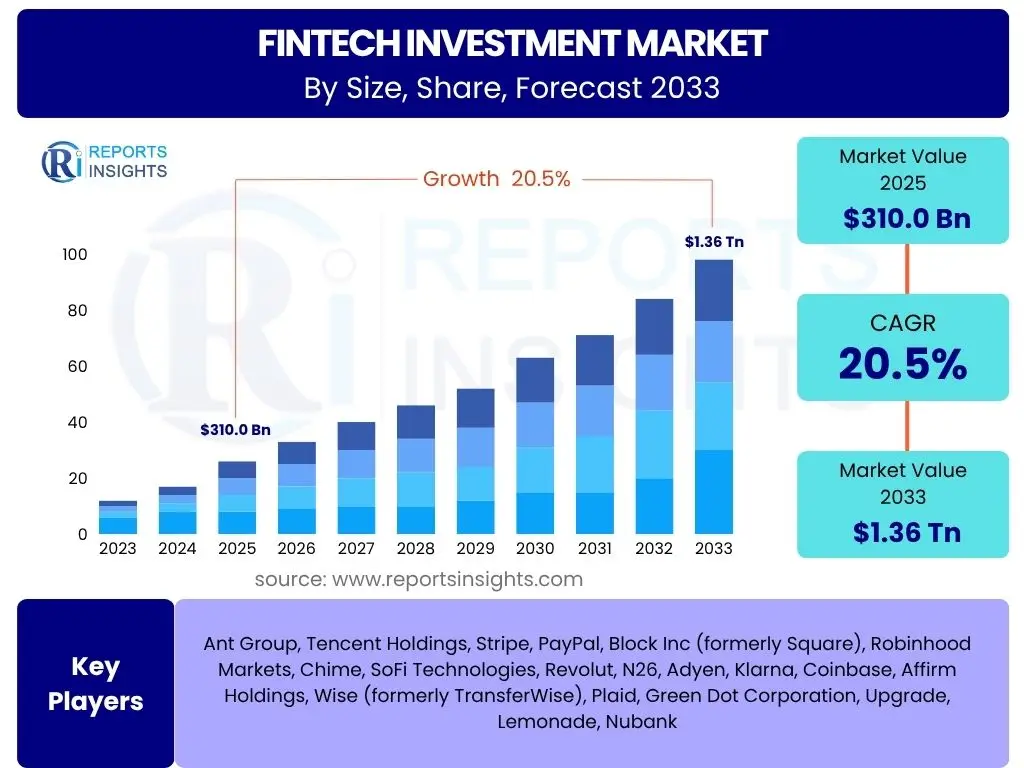

According to Reports Insights Consulting Pvt Ltd, The FinTech Investment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2025 and 2033. The market is estimated at USD 310.0 Billion in 2025 and is projected to reach USD 1.36 Trillion by the end of the forecast period in 2033.

Key FinTech Investment Market Trends & Insights

The FinTech investment landscape is dynamically evolving, driven by an accelerating digital transformation and the increasing sophistication of financial technologies. Key inquiries from market participants often revolve around the sustainability of growth, the emergence of disruptive business models, and the sectors attracting the most significant capital inflows. Investors are particularly keen on understanding how innovation in areas like embedded finance, open banking, and decentralized finance (DeFi) is reshaping traditional financial services and creating new avenues for value creation. Furthermore, the emphasis on regulatory technology (RegTech) and environmental, social, and governance (ESG) factors within FinTech is gaining prominence, reflecting a broader shift towards responsible and compliant innovation.

Current trends indicate a maturation of the FinTech ecosystem, moving beyond nascent stages to a more integrated and impactful role within the global economy. Investment decisions are increasingly guided by the ability of FinTech solutions to address critical pain points, enhance customer experience, and offer scalable efficiencies. The convergence of financial services with other industries, such as e-commerce and healthcare, through embedded finance solutions, represents a significant trend, allowing financial products to be seamlessly integrated into non-financial platforms. This integration not only broadens the reach of financial services but also creates new data streams that can be leveraged for hyper-personalized offerings, driving further innovation and investment.

- Rise of Embedded Finance: Seamless integration of financial services into non-financial platforms.

- Increased Adoption of AI and Machine Learning: Powering personalized services, fraud detection, and automated advice.

- Decentralized Finance (DeFi) and Blockchain Innovation: Shifting focus from speculative assets to practical applications.

- ESG Investing in FinTech: Growing emphasis on sustainable and ethical financial technology solutions.

- Cross-Border Payments Transformation: Leveraging technology for faster, cheaper, and more transparent transactions.

- Open Banking and API-driven Ecosystems: Facilitating data sharing and collaboration among financial entities.

AI Impact Analysis on FinTech Investment

Market inquiries concerning Artificial Intelligence's (AI) influence on FinTech investment frequently center on its potential to revolutionize operational efficiency, risk management, and customer engagement, alongside concerns regarding data privacy and ethical implications. Investors are keen to understand how AI can drive exponential growth by enabling sophisticated data analytics for informed decision-making, automating complex processes, and delivering highly personalized financial products. There is also significant interest in AI's role in enhancing cybersecurity measures and combating financial fraud, which are critical areas for investor confidence. Conversely, questions often arise about the scalability of AI solutions, the cost of implementation, and the regulatory frameworks required to govern AI's pervasive use in finance, highlighting a dual perspective of immense opportunity coupled with inherent challenges.

The integration of AI within FinTech is profoundly reshaping investment strategies, moving beyond mere efficiency gains to enabling entirely new business models. Predictive analytics powered by AI allows investors to identify emerging market trends, evaluate startup potential with greater accuracy, and optimize portfolio performance. For FinTech companies, AI facilitates advanced algorithmic trading, hyper-personalization of financial advice (robo-advisors), and superior credit scoring models, democratizing access to financial services and driving inclusion. However, the reliance on vast datasets for AI training also raises significant questions about data bias, algorithmic transparency, and the potential for systemic risks, prompting a demand for robust governance and responsible AI development within the FinTech investment ecosystem. The long-term expectation is that AI will continue to be a primary catalyst for innovation, attracting substantial investment due to its transformative potential across all facets of financial technology.

- Enhanced Data Analytics and Predictive Modeling: AI provides deeper insights for investment decisions and risk assessment.

- Automated Due Diligence and Deal Sourcing: Algorithms identify potential investments and streamline evaluation processes.

- Hyper-Personalized Financial Products: AI enables customized offerings in wealth management, lending, and insurance.

- Improved Fraud Detection and Cybersecurity: Advanced AI models enhance security protocols and detect suspicious activities.

- Operational Efficiency and Cost Reduction: AI automates routine tasks, optimizing back-office operations and customer support.

- Algorithmic Trading and Portfolio Optimization: AI drives more sophisticated and responsive trading strategies.

Key Takeaways FinTech Investment Market Size & Forecast

Analysis of common user questions regarding the FinTech Investment market size and forecast reveals a strong interest in understanding the underlying drivers of its projected growth, the resilience of the market against economic fluctuations, and the specific segments poised for the most significant expansion. Users are particularly focused on deciphering whether the current growth trajectory is sustainable, what macroeconomic factors could influence future investment trends, and how technological advancements are expected to reshape the market landscape over the forecast period. There is a clear demand for insights into the long-term viability of different FinTech sub-sectors and the potential for new market entrants to disrupt established players, signaling a forward-looking perspective focused on strategic positioning.

The FinTech Investment market is set for robust expansion, driven by continuous digital adoption, supportive regulatory frameworks, and a global demand for more accessible and efficient financial services. The significant projected growth from USD 310.0 Billion in 2025 to USD 1.36 Trillion by 2033, at a CAGR of 20.5%, underscores the profound transformation underway in the financial sector. This growth is not merely volumetric but also indicative of deepening integration of FinTech solutions into everyday life and business operations. Key takeaways emphasize the critical role of innovation, particularly in AI, blockchain, and embedded finance, as well as the increasing importance of strategic partnerships between traditional financial institutions and FinTech innovators to unlock new market opportunities and achieve scalable growth.

- Exponential Growth Trajectory: The market is projected for substantial expansion, reaching USD 1.36 Trillion by 2033.

- Innovation as a Core Catalyst: Continuous technological advancements, especially in AI and blockchain, are primary growth drivers.

- Diversification of Investment: Capital inflows are broadening across various FinTech sub-sectors, including RegTech and InsurTech.

- Increasing Digital Adoption: Global shift towards digital payments and financial services fuels market expansion.

- Strategic Collaborations: Partnerships between traditional banks and FinTechs are becoming vital for market penetration and innovation.

- Focus on Emerging Markets: Developing economies present significant untapped potential for FinTech investment and adoption.

FinTech Investment Market Drivers Analysis

The FinTech Investment market is primarily driven by a confluence of technological advancements, evolving consumer behaviors, and supportive regulatory environments. The rapid pace of digital transformation across industries has created a fertile ground for FinTech innovations, as businesses and individuals increasingly seek more efficient, transparent, and accessible financial services. This digital shift is further propelled by the widespread adoption of smartphones and internet penetration, which enable new delivery channels for financial products. Furthermore, the rising demand for personalized financial solutions and real-time transactions is compelling both established financial institutions and new market entrants to invest heavily in FinTech capabilities, driving substantial capital into the sector.

Government initiatives and progressive regulatory frameworks in many regions also play a crucial role in fostering FinTech growth by creating sandboxes for innovation, promoting open banking standards, and addressing consumer protection concerns. These initiatives reduce market entry barriers for innovative startups and encourage further investment. The increasing awareness and acceptance of digital payments, coupled with the unbanked and underbanked populations in emerging markets, represent vast untapped opportunities that attract significant investment. Additionally, the inherent inefficiencies and high operational costs of traditional financial systems provide a strong incentive for FinTech solutions that promise greater cost-effectiveness and scalability, making them attractive targets for both venture capital and corporate investments.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Digital Transformation and Smartphone Penetration | +5.5% | Global, particularly Asia Pacific, Latin America | Short to Mid-term (2025-2029) |

| Growing Demand for Digital Payments and Contactless Solutions | +4.8% | Global, particularly North America, Europe | Short to Mid-term (2025-2029) |

| Supportive Regulatory Frameworks and Government Initiatives (e.g., Open Banking) | +3.2% | Europe, Asia Pacific (Singapore, Hong Kong), UK | Mid to Long-term (2027-2033) |

| Increasing Adoption of Emerging Technologies (AI, Blockchain, Cloud) | +4.0% | Global | Mid to Long-term (2027-2033) |

| Demand for Financial Inclusion in Emerging Markets | +3.0% | Africa, Southeast Asia, Latin America | Mid to Long-term (2028-2033) |

FinTech Investment Market Restraints Analysis

Despite its significant growth potential, the FinTech Investment market faces several notable restraints that can impede its expansion and deter potential investors. One of the primary concerns revolves around regulatory uncertainty and the evolving nature of financial compliance. As FinTech innovations often push the boundaries of existing regulations, companies frequently encounter fragmented or unclear legal frameworks, making it challenging to scale operations across different jurisdictions. This regulatory complexity increases operational costs and introduces legal risks, which can make investment propositions less attractive, especially for larger institutional investors seeking predictability and stability.

Another significant restraint is the inherent cybersecurity risk associated with handling vast amounts of sensitive financial data. High-profile data breaches in the past have heightened concerns among consumers and regulators about the security of digital financial platforms. FinTech companies must invest heavily in robust cybersecurity infrastructure and protocols, which can be a substantial financial burden, particularly for startups. Furthermore, intense competition from well-established traditional financial institutions, which are increasingly investing in their own digital capabilities or acquiring FinTech startups, poses a competitive challenge. Economic volatility, such as inflation or recessionary pressures, can also lead to a more cautious investment climate, impacting the availability of venture capital and the valuation of FinTech companies.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Regulatory Uncertainty and Compliance Burden | -3.5% | Global, particularly Europe (PSD2, MiFID II), US (State-specific laws) | Short to Mid-term (2025-2028) |

| Cybersecurity Risks and Data Privacy Concerns | -3.0% | Global | Continuous |

| Intense Competition from Traditional Banks and Tech Giants | -2.8% | Global | Mid-term (2026-2030) |

| Economic Volatility and Access to Capital | -2.5% | Global | Short-term (2025-2026) |

| High Customer Acquisition Costs and Trust Issues | -2.0% | Global | Mid-term (2027-2031) |

FinTech Investment Market Opportunities Analysis

The FinTech Investment market is ripe with opportunities, driven by several emerging trends and unmet market needs. One significant opportunity lies in the burgeoning market for embedded finance, where financial services are seamlessly integrated into non-financial platforms, such as e-commerce, automotive, or healthcare. This allows for contextual and convenient access to payments, lending, or insurance, creating new revenue streams and expanding the reach of financial services to broader customer segments. The increasing adoption of digital currencies and blockchain technology, beyond speculative investments, also presents an opportunity for innovative solutions in cross-border payments, supply chain finance, and asset tokenization, attracting substantial capital into the decentralized finance (DeFi) space.

Furthermore, emerging markets, particularly in Asia Pacific, Latin America, and Africa, represent immense untapped potential due to their large unbanked and underbanked populations, coupled with high mobile penetration. These regions offer a fertile ground for FinTech companies to deliver basic financial services, micro-lending, and digital payment solutions. The growing global emphasis on Environmental, Social, and Governance (ESG) factors is also opening new avenues for FinTech investments, as companies develop solutions that promote sustainable finance, impact investing, and transparent reporting. Niche market specialization, such as FinTech solutions for specific industries (e.g., agriculture, real estate) or demographic groups (e.g., Gen Z, gig economy workers), offers targeted growth opportunities for investors seeking differentiated returns.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of Embedded Finance and Banking-as-a-Service (BaaS) | +4.2% | Global, particularly North America, Europe | Mid to Long-term (2027-2033) |

| Untapped Potential in Emerging Markets (Financial Inclusion) | +3.8% | Asia Pacific, Latin America, Middle East & Africa | Long-term (2028-2033) |

| Growth of Decentralized Finance (DeFi) and Web3 Applications | +3.5% | Global | Mid to Long-term (2027-2033) |

| Integration of ESG Principles into Financial Products | +2.9% | Europe, North America | Mid-term (2026-2030) |

| Demand for Niche and Specialized FinTech Solutions | +2.5% | Global | Short to Mid-term (2025-2029) |

FinTech Investment Market Challenges Impact Analysis

The FinTech Investment market, while exhibiting robust growth, is not without its share of significant challenges that can impact investment decisions and market stability. One primary challenge is the persistent issue of regulatory complexity and fragmentation across various jurisdictions. FinTech companies often struggle to navigate differing licensing requirements, data protection laws, and consumer protection regulations from one country or region to another. This necessitates significant legal and compliance expenditure, creating barriers to international scaling and potentially deterring investors who prefer simpler, more unified regulatory landscapes.

Another critical challenge is the intense competition for talent within the FinTech sector. The demand for skilled professionals in areas such as AI, blockchain development, cybersecurity, and data science far outstrips supply, leading to high recruitment and retention costs. This talent crunch can slow down innovation and product development, impacting a company's ability to achieve its growth targets. Furthermore, scalability issues, particularly for startups, pose a significant hurdle. Building robust, secure, and scalable technological infrastructure that can handle rapid user growth and transaction volumes requires substantial upfront investment and expertise. This, combined with the increasing cost of customer acquisition in a crowded market, can strain financial resources and extend the path to profitability, making some FinTech ventures less appealing for certain types of investors.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Talent Acquisition and Retention in Specialized Fields | -3.2% | Global, particularly developed markets | Continuous |

| Scalability Issues and Infrastructure Costs for Startups | -2.8% | Global | Short to Mid-term (2025-2029) |

| Navigating Complex and Evolving Regulatory Compliance | -2.5% | Global, particularly highly regulated regions | Continuous |

| Mitigating Cybersecurity Threats and Data Breaches | -2.0% | Global | Continuous |

| Establishing Trust and Overcoming Incumbent Inertia | -1.8% | Global | Mid to Long-term (2027-2033) |

FinTech Investment Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global FinTech Investment market, encompassing its current size, historical performance, and future growth projections from 2025 to 2033. It offers detailed insights into key market trends, the transformative impact of Artificial Intelligence, and a thorough examination of the drivers, restraints, opportunities, and challenges shaping the industry. The scope extends to a granular segmentation analysis across various technologies, investment types, applications, and end-users, alongside regional highlights emphasizing key country-level developments. Furthermore, the report profiles leading market players, offering strategic intelligence for stakeholders seeking to navigate and capitalize on the evolving FinTech landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 310.0 Billion |

| Market Forecast in 2033 | USD 1.36 Trillion |

| Growth Rate | 20.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Ant Group, Tencent Holdings, Stripe, PayPal, Block Inc (formerly Square), Robinhood Markets, Chime, SoFi Technologies, Revolut, N26, Adyen, Klarna, Coinbase, Affirm Holdings, Wise (formerly TransferWise), Plaid, Green Dot Corporation, Upgrade, Lemonade, Nubank |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The FinTech Investment market is extensively segmented to provide a granular view of its diverse landscape, reflecting the varied technological applications, investment modalities, and target end-users. This segmentation allows for a detailed understanding of which areas are attracting the most capital, identifying emerging niches, and assessing the maturity of different FinTech sub-sectors. Analyzing these segments helps investors pinpoint high-growth opportunities and tailor their strategies to specific market demands, ranging from cutting-edge AI-driven solutions to foundational digital payment infrastructures, ensuring comprehensive market coverage.

The segmentation also highlights the evolving nature of FinTech, moving beyond traditional banking services into specialized applications like InsurTech and RegTech, which address specific industry needs. By examining investment types, from early-stage venture capital to strategic mergers and acquisitions, the report illuminates the different phases of capital deployment and market consolidation. Furthermore, the breakdown by end-user categories, including individuals, small businesses, and large enterprises, underscores the widespread adoption of FinTech solutions across various economic actors, indicating a broad and sustained demand for innovative financial technologies.

- By Technology:

- Artificial Intelligence (AI)

- Blockchain

- Cloud Computing

- Big Data Analytics

- Internet of Things (IoT)

- Others

- By Investment Type:

- Venture Capital (VC)

- Private Equity (PE)

- Mergers & Acquisitions (M&A)

- Debt Financing

- Angel Investment

- Initial Public Offerings (IPOs)

- By Application:

- Digital Payments

- Wealth Management & Robo-Advisory

- Lending & Crowdfunding

- InsurTech

- RegTech

- Blockchain & Cryptocurrency

- Personal Finance Management

- Enterprise Solutions

- By End-User:

- Individuals (Consumers)

- Businesses

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Financial Institutions

Regional Highlights

- North America: A mature and dominant market for FinTech investment, characterized by a robust venture capital ecosystem, high adoption of digital payments, and significant innovation in areas like AI-driven wealth management and blockchain. The United States leads in deal volume and value, with strong hubs in Silicon Valley, New York, and emerging centers like Miami.

- Europe: Witnessing strong growth, particularly driven by open banking initiatives (PSD2), supportive regulatory sandboxes, and a burgeoning ecosystem for embedded finance and neobanks. The UK, Germany, France, and the Nordics are key investment destinations, focusing on sustainable finance and cross-border payments.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive digital adoption, a large unbanked population, and government support for digital transformation. China and India are powerhouses in mobile payments and lending, while Singapore, Australia, and Japan are strong in enterprise FinTech, InsurTech, and blockchain.

- Latin America: Experiencing rapid expansion in FinTech adoption and investment, driven by financial inclusion initiatives, high smartphone penetration, and a young, digitally native population. Brazil, Mexico, and Colombia are leading markets, with significant growth in digital payments, lending, and challenger banks.

- Middle East and Africa (MEA): An emerging market with significant growth potential, particularly in digital payments, remittances, and Sharia-compliant FinTech solutions. Government initiatives to diversify economies away from oil, coupled with a large unbanked population, are attracting increasing foreign investment into countries like UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FinTech Investment Market.- Ant Group

- Tencent Holdings

- Stripe

- PayPal

- Block Inc (formerly Square)

- Robinhood Markets

- Chime

- SoFi Technologies

- Revolut

- N26

- Adyen

- Klarna

- Coinbase

- Affirm Holdings

- Wise (formerly TransferWise)

- Plaid

- Green Dot Corporation

- Upgrade

- Lemonade

- Nubank

Frequently Asked Questions

Analyze common user questions about the FinTech Investment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the FinTech Investment Market?

The FinTech Investment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2025 and 2033, indicating robust expansion.

How is AI impacting FinTech investment strategies?

AI is significantly impacting FinTech investment by enhancing data analytics, automating due diligence, enabling hyper-personalized financial products, improving fraud detection, and optimizing operational efficiencies.

What are the primary drivers of growth in the FinTech Investment Market?

Key drivers include rapid digital transformation, increasing smartphone penetration, growing demand for digital payments, supportive regulatory frameworks, and the widespread adoption of advanced technologies like AI and blockchain.

Which regions are leading in FinTech investment?

North America and Europe currently lead in FinTech investment, while Asia Pacific is the fastest-growing region, showcasing significant expansion due to high digital adoption and supportive governmental initiatives.

What are the main challenges facing the FinTech Investment Market?

Major challenges include navigating complex and fragmented regulatory environments, intense competition for specialized talent, addressing cybersecurity risks, and achieving scalability for rapidly growing FinTech solutions.