Family Office Market

Family Office Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704473 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Family Office Market Size

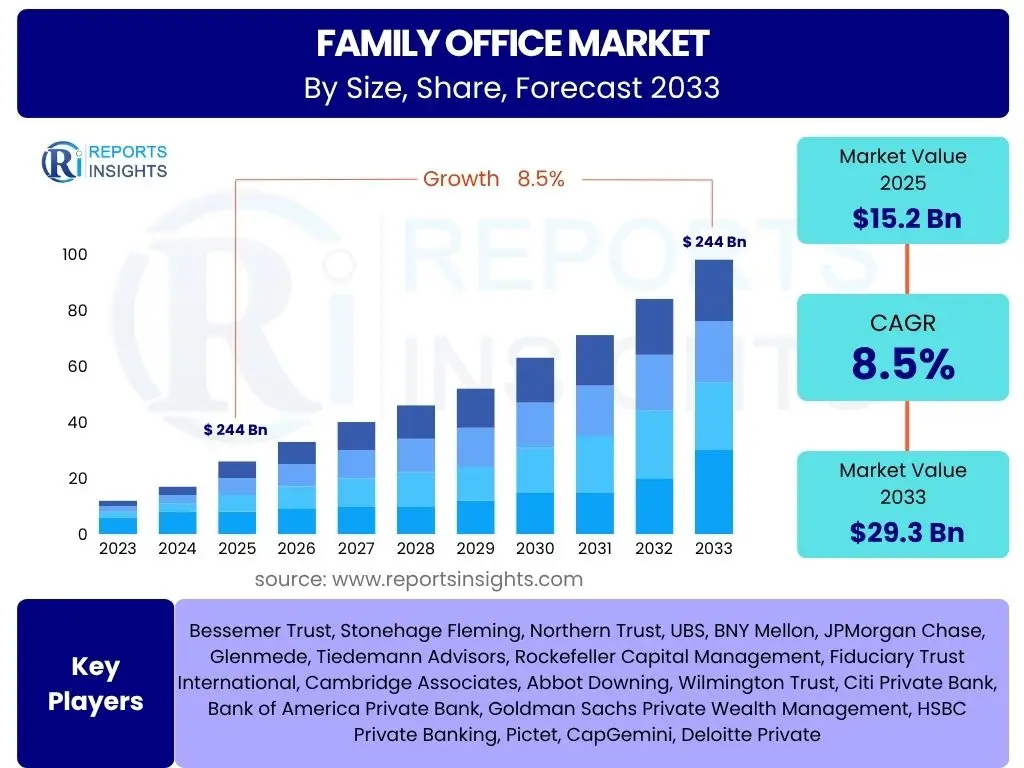

According to Reports Insights Consulting Pvt Ltd, The Family Office Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 15.2 Billion in 2025 and is projected to reach USD 29.3 Billion by the end of the forecast period in 2033. This robust growth is attributed to the increasing creation of wealth globally, particularly among ultra-high-net-worth individuals (UHNWIs), who seek sophisticated and comprehensive solutions for managing their complex financial and non-financial assets. The inherent need for privacy, bespoke services, and integrated wealth management strategies drives the sustained expansion of this specialized market segment.

Key Family Office Market Trends & Insights

The Family Office market is currently experiencing a dynamic shift, driven by evolving client expectations, technological advancements, and a complex global financial landscape. A significant trend involves the increasing demand for integrated services beyond traditional investment management, encompassing areas such as philanthropy, succession planning, lifestyle management, and family governance. Clients are seeking holistic solutions that address both their financial and personal objectives, leading family offices to expand their service offerings and expertise.

Another prominent insight reveals a growing emphasis on sustainable and impact investing. Ultra-high-net-worth individuals are increasingly aligning their portfolios with environmental, social, and governance (ESG) principles, not only for ethical considerations but also for perceived long-term financial resilience. This shift necessitates family offices to develop sophisticated capabilities in identifying, evaluating, and managing ESG-compliant investments. Furthermore, intergenerational wealth transfer is a critical factor shaping the market, as younger generations often bring different investment philosophies and expectations, requiring family offices to adapt their communication and advisory approaches.

Technological adoption, particularly in data analytics, cybersecurity, and client relationship management (CRM), is becoming indispensable for operational efficiency and enhanced service delivery. Family offices are leveraging digital tools to streamline processes, improve reporting transparency, and provide more personalized client experiences. Geopolitical shifts and regulatory changes also continually influence investment strategies and compliance requirements, pushing family offices to maintain agile and globally informed operational frameworks to navigate market complexities effectively.

- Holistic Service Expansion: Beyond investment management, including family governance, philanthropy, and lifestyle services.

- Sustainable and Impact Investing: Increasing allocation to ESG-compliant assets and socially responsible investments.

- Intergenerational Wealth Transfer: Focus on educating and engaging next-gen beneficiaries, adapting to their unique financial goals and values.

- Digital Transformation: Adoption of advanced technologies for data analytics, cybersecurity, reporting, and client engagement.

- Cybersecurity Fortification: Enhanced measures to protect sensitive client data and financial assets from evolving cyber threats.

- Increased Regulatory Scrutiny: Navigating complex and evolving global regulatory frameworks for compliance and risk management.

- Direct and Co-Investments: Greater appetite for direct equity participation and co-investment opportunities alongside other family offices or private equity firms.

- Talent Management: Challenges and strategies for attracting and retaining specialized professionals with diverse expertise.

AI Impact Analysis on Family Office

The integration of Artificial Intelligence (AI) within the Family Office sector is poised to significantly transform operational efficiencies, decision-making processes, and client service capabilities. Common inquiries from family office principals and executives often revolve around how AI can enhance investment performance, streamline back-office operations, and improve risk management. AI algorithms are increasingly being explored for their capacity to analyze vast datasets, identify complex market patterns, and provide predictive insights, thereby supporting more informed and potentially lucrative investment strategies. This shift aims to move beyond traditional quantitative analysis to more dynamic, real-time evaluations of market opportunities and risks.

Beyond investment analytics, AI's influence extends deeply into the operational framework of family offices. User questions frequently highlight the potential for AI-driven automation in tasks such as portfolio reconciliation, compliance monitoring, and personalized reporting, which can free up human capital to focus on higher-value client interactions and strategic advisory roles. The implementation of AI tools can dramatically reduce manual errors and improve the speed of critical financial processes, leading to significant cost efficiencies and enhanced accuracy. However, concerns regarding data privacy, algorithmic bias, and the ethical implications of AI deployment are also prevalent, underscoring the need for robust governance frameworks and transparent AI models.

Ultimately, the consensus among family office stakeholders is that AI will not replace human expertise but rather augment it, enabling advisors to offer more bespoke, data-driven advice and anticipatory solutions. The adoption of AI is viewed as a strategic imperative for family offices looking to maintain a competitive edge, deliver superior client experiences, and navigate the intricate challenges of modern wealth management. The focus is on leveraging AI to deepen client relationships through personalized insights and proactive service, ensuring that technology serves as an enabler for human-centric wealth management rather than a substitute.

- Enhanced Investment Analytics: AI supports sophisticated data analysis for predictive insights and optimized portfolio construction.

- Operational Efficiency: Automation of routine tasks like reconciliation, compliance checks, and reporting, freeing up human resources.

- Personalized Client Experience: AI-driven insights enable bespoke financial planning and communication strategies.

- Risk Management: Improved identification and mitigation of financial, market, and operational risks through AI-powered monitoring.

- Cybersecurity Fortification: AI-driven threat detection and response systems enhance protection of sensitive data.

- Succession Planning Optimization: AI can analyze complex family dynamics and wealth structures to aid in long-term legacy planning.

Key Takeaways Family Office Market Size & Forecast

The Family Office market is poised for substantial growth over the next decade, reflecting a global surge in ultra-high-net-worth individuals and a heightened demand for integrated, bespoke wealth management solutions. A primary takeaway is the accelerating rate at which single-family offices (SFOs) and multi-family offices (MFOs) are expanding their services beyond traditional investment management to include complex areas such as family governance, philanthropy, and lifestyle management. This evolution underscores the shift from purely financial management to a more holistic approach to wealth preservation and enhancement across generations.

Furthermore, the forecast highlights the increasing sophistication required from family offices in navigating a highly volatile and complex global economic environment. The integration of advanced technologies, particularly in data analytics and artificial intelligence, is becoming critical for maintaining a competitive edge and delivering superior client outcomes. These technologies enable more precise risk assessment, personalized investment strategies, and streamlined operational efficiencies, positioning technology adoption as a non-negotiable aspect of future growth.

Finally, the market's trajectory is strongly influenced by demographic shifts, including the impending intergenerational transfer of wealth and the rising prominence of younger, tech-savvy beneficiaries with a keen interest in sustainable and impact investing. Family offices that successfully adapt to these evolving client needs, embrace digital transformation, and offer comprehensive, customized services are best positioned to capitalize on the significant growth opportunities presented by the burgeoning global wealth landscape.

- Significant Market Expansion: Driven by increasing global wealth and complex client needs, indicating a robust growth trajectory.

- Service Diversification: A clear trend towards broader offerings beyond traditional financial management, including non-financial aspects.

- Technology Integration: Critical for operational efficiency, advanced analytics, and personalized client engagement.

- Generational Shift: Adapting to the distinct values and investment preferences of the next generation of wealth holders.

- Global Market Relevance: While mature markets lead, emerging economies present significant untapped potential.

Family Office Market Drivers Analysis

The Family Office market is experiencing robust growth driven by several key factors. One significant driver is the sustained increase in global ultra-high-net-worth (UHNW) wealth, leading to a greater demand for sophisticated and personalized wealth management solutions that extend beyond traditional banking services. As wealth compounds and families become more dispersed geographically, the need for a centralized, comprehensive entity to manage complex financial, legal, and philanthropic affairs becomes paramount. This growing complexity naturally leads families to seek the dedicated and integrated services offered by family offices, which are uniquely positioned to handle multi-generational wealth transfer and intricate family dynamics.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increase in Global UHNW Wealth | +2.1% | Global, Particularly Asia Pacific and North America | Long-term (2025-2033) |

| Demand for Holistic Wealth Management | +1.8% | Global, Developed Markets Leading | Mid-term (2025-2029) |

| Intergenerational Wealth Transfer | +1.5% | North America, Europe, Asia Pacific | Long-term (2025-2033) |

| Regulatory Complexity and Tax Optimization | +1.0% | Global, High Tax Jurisdictions | Ongoing (2025-2033) |

Family Office Market Restraints Analysis

Despite its significant growth potential, the Family Office market faces several inherent restraints that can temper its expansion. A primary challenge is the high operational cost associated with establishing and maintaining a family office, particularly a single-family office (SFO). These costs include specialized talent acquisition, advanced technology infrastructure, legal and compliance fees, and office overheads, making it a viable option only for a select segment of the ultra-wealthy. This high barrier to entry limits the market's reach to a broader pool of high-net-worth individuals who might otherwise benefit from such services.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Operational Costs and Overhead | -1.2% | Global, Particularly Smaller Family Offices | Ongoing (2025-2033) |

| Talent Acquisition and Retention Challenges | -0.9% | Global, Especially for Specialized Roles | Mid-term (2025-2029) |

| Cybersecurity Risks and Data Privacy Concerns | -0.7% | Global | Ongoing (2025-2033) |

| Regulatory Scrutiny and Compliance Burden | -0.5% | Europe, North America | Ongoing (2025-2033) |

Family Office Market Opportunities Analysis

The Family Office market is rich with opportunities stemming from evolving client preferences, technological advancements, and untapped geographic potential. A significant opportunity lies in the burgeoning interest in sustainable, responsible, and impact investing (SRI/ESG). As younger generations inherit wealth, their focus on values-aligned portfolios presents a substantial avenue for family offices to expand their offerings and differentiate themselves by developing expertise in ESG integration, impact measurement, and philanthropic advisory services. This aligns with a broader societal shift towards conscious capitalism and offers a compelling value proposition beyond traditional financial returns.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth of Sustainable and Impact Investing (ESG) | +1.7% | Global, Developed Markets Leading | Mid to Long-term (2026-2033) |

| Technological Integration (AI, Blockchain) | +1.4% | Global, Innovator Regions | Short to Mid-term (2025-2029) |

| Expansion in Emerging Markets (Asia Pacific, MEA) | +1.3% | Asia Pacific, Middle East & Africa | Long-term (2027-2033) |

| Increased Demand for Co-Investment Structures | +1.0% | Global | Mid-term (2025-2029) |

Family Office Market Challenges Impact Analysis

The Family Office market, while dynamic, faces several significant challenges that require strategic navigation to maintain growth and client satisfaction. A critical challenge is the intense competition from alternative wealth management providers, including private banks, independent wealth advisors, and institutional asset managers, who are increasingly offering services that overlap with those traditionally provided by family offices. This competitive landscape puts pressure on family offices to continually innovate their service models, demonstrate unique value propositions, and justify their often higher fee structures to retain and attract clients.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition from Alternative Providers | -1.0% | Global, Developed Markets | Ongoing (2025-2033) |

| Evolving Client Expectations (Digitalization, Personalization) | -0.8% | Global | Ongoing (2025-2033) |

| Geopolitical Instability and Economic Volatility | -0.6% | Global | Short to Mid-term (2025-2028) |

| Maintaining Family Harmony and Succession Planning | -0.4% | Global | Long-term (2025-2033) |

Family Office Market - Updated Report Scope

This report provides an in-depth analysis of the global Family Office market, covering market sizing, growth projections, key trends, drivers, restraints, opportunities, and challenges from 2025 to 2033. It encompasses a comprehensive assessment of the market's segmentation by type, asset under management, services, and regional presence, alongside a detailed profiling of leading market participants. The scope also includes an AI impact analysis, illustrating how artificial intelligence is transforming various facets of family office operations and client engagement.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 29.3 Billion |

| Growth Rate | 8.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Bessemer Trust, Stonehage Fleming, Northern Trust, UBS, BNY Mellon, JPMorgan Chase, Glenmede, Tiedemann Advisors, Rockefeller Capital Management, Fiduciary Trust International, Cambridge Associates, Abbot Downing, Wilmington Trust, Citi Private Bank, Bank of America Private Bank, Goldman Sachs Private Wealth Management, HSBC Private Banking, Pictet, CapGemini, Deloitte Private |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Family Office market is extensively segmented to provide a granular view of its diverse landscape and operational models. These segmentations allow for a detailed understanding of market dynamics, client preferences, and service specializations across different types of family offices, asset scales, and service offerings. Analyzing these distinct segments is crucial for identifying targeted growth opportunities and developing bespoke strategies for market penetration and expansion.

- By Type: This segment differentiates between Single-Family Offices (SFOs), which serve one ultra-high-net-worth family, and Multi-Family Offices (MFOs), which cater to multiple families, offering shared resources and expertise. The emerging Virtual Family Office model, leveraging technology to provide services remotely, is also gaining traction.

- By Asset Under Management (AUM): Categorization based on the value of assets managed provides insights into the scale of operations and the typical client base. This ranges from family offices managing below USD 100 Million, to those handling assets exceeding USD 1 Billion, reflecting varying levels of complexity and service depth.

- By Services: This comprehensive segmentation covers the wide array of services provided by family offices. It includes core financial services like Investment Management, Financial Planning, Tax Management, and Estate Planning, alongside non-financial services such as Philanthropy Management, Legal Services, Risk Management, Lifestyle Management, Family Governance & Education, Succession Planning, and Concierge Services. The breadth of services offered highlights the holistic nature of family office engagement.

- By Geographic Presence: This segment examines whether family offices primarily serve domestic clients or have an International reach, indicating their global operational capabilities and client diversification strategies.

Regional Highlights

- North America: Dominates the global Family Office market due to a high concentration of ultra-high-net-worth individuals, sophisticated financial infrastructure, and a well-established culture of wealth management. The region shows strong adoption of advanced technologies and a high demand for integrated services.

- Europe: A mature market with a long history of private wealth management and family offices, particularly in countries like Switzerland, the UK, and Germany. The region emphasizes robust regulatory compliance, cross-border wealth management, and a growing interest in sustainable investing.

- Asia Pacific (APAC): Represents the fastest-growing region for the Family Office market, driven by rapid wealth creation, particularly in China, India, and Southeast Asian economies. The region is characterized by a strong entrepreneurial spirit and an increasing need for professional wealth preservation and succession planning.

- Latin America: An emerging market for family offices, with growing wealth in countries like Brazil and Mexico. Demand is driven by the need for capital preservation, diversification, and navigating complex local economic and political landscapes.

- Middle East and Africa (MEA): Experiencing significant growth, fueled by oil wealth and economic diversification initiatives. Countries like UAE and Saudi Arabia are becoming hubs for family offices, focusing on real estate, private equity, and bespoke investment solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Family Office Market.- Bessemer Trust

- Stonehage Fleming

- Northern Trust

- UBS

- BNY Mellon

- JPMorgan Chase

- Glenmede

- Tiedemann Advisors

- Rockefeller Capital Management

- Fiduciary Trust International

- Cambridge Associates

- Abbot Downing

- Wilmington Trust

- Citi Private Bank

- Bank of America Private Bank

- Goldman Sachs Private Wealth Management

- HSBC Private Banking

- Pictet

- CapGemini

- Deloitte Private

Frequently Asked Questions

What is a Family Office?

A Family Office is a private company that manages the financial and investment needs of a single affluent family (Single-Family Office) or multiple affluent families (Multi-Family Office), often extending to non-financial services like family governance, philanthropy, and lifestyle management.

What services do Family Offices typically offer?

Family Offices provide a comprehensive suite of services including investment management, financial planning, estate planning, tax management, legal coordination, philanthropy advisory, risk management, and family governance, tailored to the specific needs of ultra-high-net-worth individuals and their families.

How do Family Offices differ from traditional wealth management firms?

Family Offices offer a more integrated, bespoke, and often multi-generational approach compared to traditional wealth management firms. They provide a broader range of services, including non-financial aspects, a higher degree of personalization, and dedicated staff focused solely on the family's interests, emphasizing long-term wealth preservation and legacy.

What is the future outlook for the Family Office market?

The Family Office market is projected for robust growth, driven by increasing global wealth, complex client needs, and the rising demand for holistic, personalized wealth management solutions. Key growth factors include intergenerational wealth transfer, technological adoption, and the growing interest in sustainable investing.

How is AI impacting Family Offices?

AI is transforming Family Offices by enhancing investment analytics, automating operational tasks for greater efficiency, improving risk management, and enabling more personalized client experiences. It serves as a tool to augment human expertise, providing data-driven insights and streamlining complex processes.