Ethyl Benzene Market

Ethyl Benzene Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702164 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Ethyl Benzene Market Size

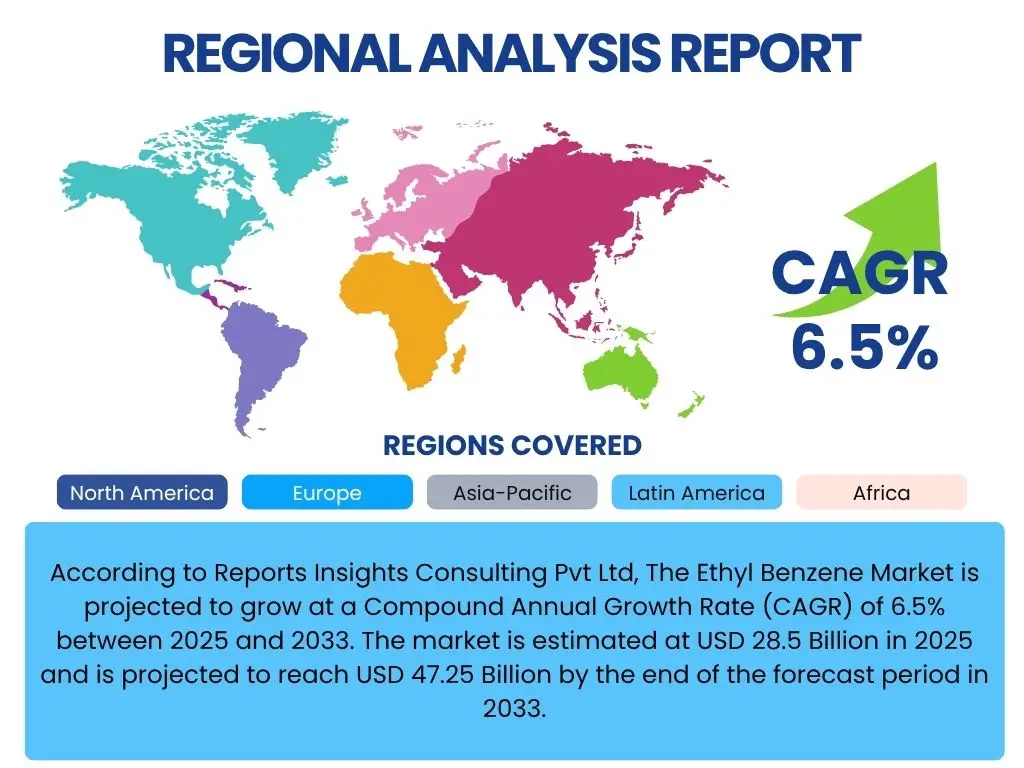

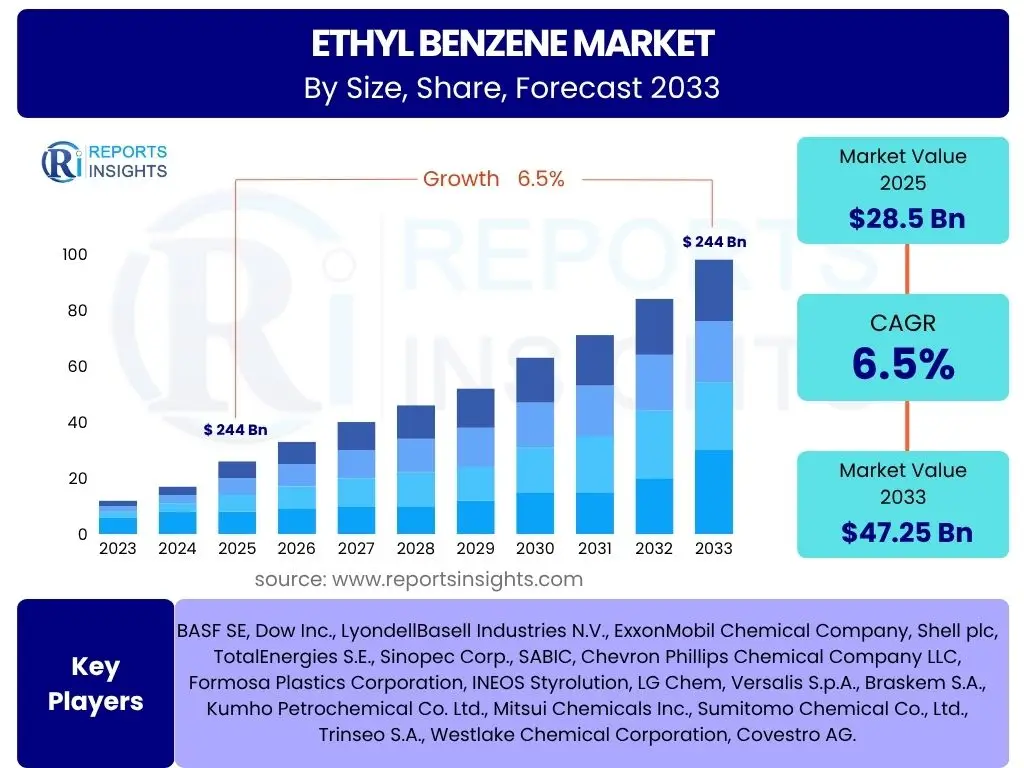

According to Reports Insights Consulting Pvt Ltd, The Ethyl Benzene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2033. The market is estimated at USD 28.5 Billion in 2025 and is projected to reach USD 47.25 Billion by the end of the forecast period in 2033.

Key Ethyl Benzene Market Trends & Insights

Analysis of user inquiries about ethyl benzene market trends indicates a strong interest in understanding the evolving demand landscape, particularly from derivative markets, and the influence of sustainability initiatives. Market participants are keen on identifying technological advancements that enhance production efficiency and reduce environmental impact. Furthermore, there is a consistent focus on the geopolitical factors and raw material price volatility that frequently reshape market dynamics, driving companies to seek more resilient supply chains and diversified sourcing strategies. The increasing awareness regarding circular economy principles and bio-based alternatives also features prominently in user discussions, pointing towards a future where environmental considerations play a more significant role in market development.

Current market trends highlight a robust demand for ethyl benzene, primarily driven by the expanding polystyrene and styrene-butadiene rubber industries. The global surge in packaging, construction activities, and automotive production continues to fuel the consumption of styrene monomer, a key derivative of ethyl benzene. Additionally, there is a growing emphasis on process optimization and energy efficiency in ethyl benzene production facilities, spurred by rising energy costs and stricter environmental regulations. Innovation in catalyst technology and improved production methods are also gaining traction, aiming to enhance yield and reduce operational expenditures, thereby securing the long-term competitiveness of ethyl benzene in the petrochemical landscape.

- Growing demand for styrene monomer from packaging and construction sectors.

- Emphasis on sustainable production processes and green chemistry initiatives.

- Fluctuations in crude oil and natural gas prices influencing production costs.

- Technological advancements in catalyst development for enhanced yield.

- Shifting industrial base towards Asia Pacific, particularly China and India.

- Increasing adoption of ethyl benzene in various niche chemical applications.

- Focus on energy efficiency and carbon footprint reduction in manufacturing.

AI Impact Analysis on Ethyl Benzene

Common user questions regarding AI's impact on the ethyl benzene sector primarily revolve around its potential to revolutionize operational efficiency, enhance predictive maintenance, and optimize supply chain logistics. Users express interest in how AI could lead to more sustainable production processes through real-time data analysis and intelligent control systems. There is also a keen curiosity about AI's role in accelerating research and development for new catalysts or improved reaction pathways, ultimately aiming for cost reduction and increased product purity. The overall sentiment suggests an expectation that AI will bring about significant digital transformation within the traditional chemical manufacturing landscape, albeit with underlying concerns about implementation costs, data security, and workforce adaptation.

The integration of Artificial Intelligence (AI) into ethyl benzene production is poised to bring transformative changes across the value chain. AI algorithms can analyze vast datasets from plant sensors to predict equipment failures, optimize reaction parameters for maximum yield and purity, and manage energy consumption more efficiently. This predictive capability translates into reduced downtime, lower operational costs, and improved safety standards. Furthermore, AI-powered systems can enhance supply chain visibility, enabling better forecasting of demand and managing logistics to minimize waste and optimize inventory levels. In research and development, AI is accelerating the discovery of novel catalysts and process designs, significantly shortening the time-to-market for innovations and fostering a more agile and responsive chemical industry.

- Process Optimization: AI-driven algorithms enhancing reaction efficiency and yield.

- Predictive Maintenance: AI for anticipating equipment failures, reducing downtime.

- Supply Chain Management: Optimizing logistics, inventory, and demand forecasting.

- Quality Control: AI-powered systems for real-time product purity monitoring.

- R&D Acceleration: AI facilitating discovery of new catalysts and process improvements.

- Energy Management: AI tools for optimizing energy consumption in production.

Key Takeaways Ethyl Benzene Market Size & Forecast

Analysis of common user questions regarding the ethyl benzene market size and forecast reveals a primary concern about the trajectory of market growth, driven by its critical role in the production of styrene monomer. Users are keen to understand the underlying factors contributing to this growth, such as the expansion of end-use industries like packaging, construction, and automotive, as well as the impact of evolving global economic conditions. Furthermore, there is significant interest in identifying potential shifts in regional demand and the emergence of new applications that could influence future market dynamics, all while considering the overarching influence of raw material availability and pricing stability.

The ethyl benzene market is set for consistent expansion, primarily fueled by the unwavering demand from the styrene industry, which serves a wide array of downstream applications. This growth trajectory is supported by increasing urbanization, infrastructure development, and consumer spending on durable goods globally. Despite potential challenges from raw material volatility and environmental regulations, strategic investments in production efficiency and diversification into niche applications are expected to sustain market momentum. The market's resilience is further bolstered by ongoing innovation in manufacturing processes aimed at improving sustainability and cost-effectiveness, positioning ethyl benzene as a vital component in the petrochemical value chain for the foreseeable future.

- Robust growth propelled by consistent styrene monomer demand.

- Asia Pacific to remain a dominant region, driven by industrial expansion.

- Technological advancements are crucial for mitigating production costs.

- Market resilience despite raw material price fluctuations.

- Opportunities in sustainable production methods and bio-based alternatives.

Ethyl Benzene Market Drivers Analysis

The primary drivers of the ethyl benzene market are intrinsically linked to the expanding demand for its key derivative, styrene monomer, which forms the backbone of the plastics and elastomers industries. The burgeoning global population, coupled with increasing disposable incomes, is driving consumption across various end-use sectors such as packaging, automotive, construction, and electronics. This sustained demand necessitates robust production of ethyl benzene. Furthermore, continuous urbanization and infrastructure development projects, particularly in emerging economies, are fueling the need for materials like polystyrene and ABS, directly translating into higher demand for ethyl benzene.

Technological advancements in polymerization processes and the development of new applications for styrene-based products also act as significant market drivers. Innovations leading to improved material properties, such as enhanced durability and lightweight characteristics, broaden the scope of application for these derivatives, thereby bolstering ethyl benzene consumption. Additionally, the strategic investments made by major petrochemical companies in expanding production capacities to meet the anticipated future demand further underscore the positive outlook for market growth. The drive for energy efficiency and operational excellence in ethyl benzene production facilities also contributes to its market viability and competitiveness.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing demand for styrene monomer | +2.1% | Global, particularly APAC (China, India) | Short to Long-term (2025-2033) |

| Expansion of packaging and construction industries | +1.8% | Asia Pacific, North America, Europe | Mid to Long-term (2027-2033) |

| Increasing automotive production and lightweighting trends | +1.5% | Asia Pacific, Europe, North America | Mid-term (2026-2030) |

| Technological advancements in ethyl benzene production | +0.8% | Global | Short to Mid-term (2025-2029) |

Ethyl Benzene Market Restraints Analysis

The ethyl benzene market faces significant restraints, primarily stemming from the volatility of crude oil and natural gas prices, which are key feedstocks for its production. Fluctuations in these raw material costs directly impact production expenses, leading to margin erosion for manufacturers and uncertainty in pricing for end-users. This price instability can deter new investments and complicate long-term strategic planning within the industry. Furthermore, the global drive towards decarbonization and sustainable practices is introducing stricter environmental regulations concerning emissions and waste management, imposing additional compliance costs on producers and potentially limiting operational flexibility.

Another major restraint is the increasing competition from alternative materials and processes. While styrene remains the dominant derivative, research into bio-based plastics and other sustainable alternatives, though nascent, poses a long-term threat. Additionally, geopolitical tensions and trade disputes can disrupt global supply chains, leading to raw material shortages or delays in product delivery, thereby impacting market stability. The capital-intensive nature of chemical manufacturing and the extensive regulatory hurdles for setting up new production facilities also act as significant barriers to entry for new players, limiting overall market expansion and innovation from smaller entities.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile raw material prices (crude oil, natural gas) | -1.2% | Global | Short to Long-term (2025-2033) |

| Stringent environmental regulations and compliance costs | -0.9% | Europe, North America, specific Asian countries | Mid to Long-term (2027-2033) |

| Competition from alternative materials and sustainable solutions | -0.5% | Global | Long-term (2030-2033) |

| Geopolitical instability and supply chain disruptions | -0.7% | Global | Short to Mid-term (2025-2028) |

Ethyl Benzene Market Opportunities Analysis

Significant opportunities exist in the ethyl benzene market, particularly through the exploration of novel applications beyond traditional styrene monomer production. While styrene remains dominant, research into new chemical intermediates and specialty chemicals derived from ethyl benzene could unlock untapped market segments. Furthermore, the growing global emphasis on sustainability presents an opportunity for manufacturers to invest in green chemistry initiatives, developing more energy-efficient and environmentally benign production processes. This not only aligns with regulatory trends but also appeals to an increasingly eco-conscious consumer and industrial base, potentially leading to a competitive advantage.

The expansion into emerging economies, notably in Southeast Asia, Latin America, and parts of Africa, offers substantial growth prospects. These regions are undergoing rapid industrialization and urbanization, leading to an increased demand for construction materials, automotive components, and consumer goods, all of which rely heavily on styrene derivatives. Investment in localized production facilities within these growing markets can reduce logistical costs and improve supply chain responsiveness. Additionally, strategic collaborations and partnerships between ethyl benzene producers and end-use industries can foster innovation, streamline product development, and secure long-term supply agreements, thereby solidifying market positions and capitalizing on future demand surges.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of novel applications and specialty chemicals | +1.0% | Global | Mid to Long-term (2028-2033) |

| Investment in sustainable and energy-efficient production technologies | +0.7% | Europe, North America, Japan | Short to Mid-term (2025-2029) |

| Expansion into high-growth emerging economies | +1.3% | Southeast Asia, Latin America, Africa | Mid to Long-term (2027-2033) |

| Strategic collaborations and vertical integration | +0.6% | Global | Short to Mid-term (2025-2030) |

Ethyl Benzene Market Challenges Impact Analysis

The ethyl benzene market faces several inherent challenges that can impede its growth trajectory. One significant challenge is the ongoing pressure from environmental regulatory bodies worldwide to reduce emissions and manage industrial waste more effectively. Compliance with these stringent regulations often necessitates substantial capital investment in new technologies and operational adjustments, which can increase production costs and reduce profit margins. Furthermore, the public perception regarding petrochemicals and plastics, driven by concerns over pollution and waste, can negatively impact demand for styrene-based products, leading to a potential shift towards more sustainable or bio-based alternatives in the long run.

Another critical challenge involves the complex and often unpredictable nature of global supply chains. Geopolitical tensions, natural disasters, or pandemics can lead to disruptions in the supply of critical raw materials or the distribution of finished products, causing price spikes, shortages, and operational bottlenecks. The industry also grapples with intense competition, leading to price wars and compressed profit margins, especially during periods of overcapacity. Moreover, the need for continuous technological innovation to improve efficiency and reduce environmental impact requires significant research and development expenditure, posing a financial burden, particularly for smaller market players. Adapting to these multifaceted challenges while maintaining competitiveness and profitability remains a core concern for ethyl benzene producers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent environmental regulations and sustainability pressures | -0.8% | Global, particularly Europe and North America | Short to Long-term (2025-2033) |

| Supply chain vulnerabilities and geopolitical risks | -0.6% | Global | Short to Mid-term (2025-2029) |

| High capital expenditure for plant upgrades and new technologies | -0.4% | Global | Mid to Long-term (2027-2033) |

| Intense market competition and pricing pressures | -0.3% | Global | Short to Mid-term (2025-2030) |

Ethyl Benzene Market - Updated Report Scope

This report provides an in-depth analysis of the global ethyl benzene market, covering historical performance, current market dynamics, and future growth projections. It meticulously examines market size, growth drivers, restraints, opportunities, and challenges across various segments and key regions. The scope also includes a detailed competitive landscape, profiling leading market players and their strategies, alongside an assessment of emerging trends and the impact of technological advancements such as AI on the industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 47.25 Billion |

| Growth Rate | 6.5% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Inc., LyondellBasell Industries N.V., ExxonMobil Chemical Company, Shell plc, TotalEnergies S.E., Sinopec Corp., SABIC, Chevron Phillips Chemical Company LLC, Formosa Plastics Corporation, INEOS Styrolution, LG Chem, Versalis S.p.A., Braskem S.A., Kumho Petrochemical Co. Ltd., Mitsui Chemicals Inc., Sumitomo Chemical Co., Ltd., Trinseo S.A., Westlake Chemical Corporation, Covestro AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The ethyl benzene market is comprehensively segmented to provide a nuanced understanding of its diverse applications and end-use sectors. This segmentation allows for precise analysis of demand patterns and growth drivers across different industrial verticals. The primary segmentation is by application, with styrene monomer representing the overwhelmingly largest segment due to its widespread use in polymers such as polystyrene, ABS, and SBR. Beyond styrene, ethyl benzene finds use as a solvent in various industrial processes, a component in fuel additives to enhance octane ratings, and as an intermediate in the synthesis of other chemicals, highlighting its versatility in the chemical industry.

Further segmentation by end-use industry delineates the specific sectors driving demand for styrene monomer and, consequently, ethyl benzene. The packaging industry, for instance, relies heavily on polystyrene for food containers and protective packaging. The construction sector utilizes insulation materials and pipes derived from styrene-based polymers. The automotive industry benefits from lightweight and durable ABS plastics, while electronics and consumer goods industries use various styrene derivatives for casings and components. This detailed breakdown by end-use industry provides crucial insights into the market's dependency on global industrial growth and consumer spending trends, helping stakeholders to identify high-growth areas and tailor their strategies accordingly.

- By Application:

- Styrene Monomer

- Solvents

- Fuel Additives

- Chemical Intermediates

- Others (e.g., in paints, coatings)

- By End-Use Industry:

- Packaging (e.g., food containers, protective packaging)

- Construction (e.g., insulation, pipes)

- Automotive (e.g., interior and exterior parts)

- Electronics (e.g., appliance housings, components)

- Consumer Goods (e.g., toys, household items)

- Paints and Coatings

- Adhesives

- Others (e.g., rubber, medical devices)

- By Production Method:

- Liquid-Phase Alkylation (ZSM-5 zeolite catalysts)

- Vapor-Phase Alkylation (Aluminum chloride catalyst)

- Combined Liquid/Vapor Phase Alkylation

Regional Highlights

- Asia Pacific (APAC): Dominates the ethyl benzene market due to rapid industrialization, burgeoning population, and significant investments in infrastructure and manufacturing sectors, particularly in China and India. The region's expanding packaging, automotive, and construction industries are primary drivers of styrene monomer demand, positioning APAC as the largest and fastest-growing market. Emerging economies like Vietnam, Indonesia, and Thailand are also contributing to the regional growth.

- North America: Represents a mature yet stable market for ethyl benzene, driven by consistent demand from the automotive, construction, and electronics industries. The region benefits from technological advancements in production processes and a focus on sustainable manufacturing. Shale gas availability provides a competitive advantage in terms of raw material costs for some producers.

- Europe: Characterized by stringent environmental regulations and a strong emphasis on sustainability, which drives innovation in green production technologies. Demand is stable, with growth primarily coming from specialty applications and advanced materials. The region is also focusing on recycling and circular economy initiatives for plastics, which may influence long-term demand dynamics.

- Latin America: Exhibiting moderate growth, primarily influenced by economic recovery and industrial development in countries like Brazil and Mexico. The packaging and construction sectors are key consumers of ethyl benzene derivatives in this region. Investment in petrochemical infrastructure is gradually expanding, contributing to market expansion.

- Middle East and Africa (MEA): Emerging as a significant region for petrochemical production due to abundant and cost-effective feedstock availability (crude oil and natural gas). Countries like Saudi Arabia and UAE are expanding their chemical manufacturing capacities, aiming to diversify their economies, which is expected to boost ethyl benzene production and consumption in the coming years, catering to both domestic and export markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethyl Benzene Market.- BASF SE

- Dow Inc.

- LyondellBasell Industries N.V.

- ExxonMobil Chemical Company

- Shell plc

- TotalEnergies S.E.

- Sinopec Corp.

- SABIC

- Chevron Phillips Chemical Company LLC

- Formosa Plastics Corporation

- INEOS Styrolution

- LG Chem

- Versalis S.p.A.

- Braskem S.A.

- Kumho Petrochemical Co. Ltd.

- Mitsui Chemicals Inc.

- Sumitomo Chemical Co., Ltd.

- Trinseo S.A.

- Westlake Chemical Corporation

- Covestro AG

Frequently Asked Questions

What is ethyl benzene primarily used for?

Ethyl benzene is predominantly used as a chemical intermediate in the production of styrene monomer (SM), which is a crucial building block for various plastics and resins. These include polystyrene (PS), acrylonitrile butadiene styrene (ABS), styrene-butadiene rubber (SBR), and unsaturated polyester resins (UPR), widely utilized in packaging, construction, automotive, and electronics industries.

What are the key drivers for the ethyl benzene market growth?

The primary drivers include the escalating global demand for styrene monomer and its derivatives, fueled by growth in end-use industries such as packaging, construction, and automotive. Rapid urbanization, increasing disposable incomes, and the expansion of infrastructure projects in emerging economies further bolster this demand, alongside ongoing advancements in production technologies.

What are the main challenges faced by the ethyl benzene market?

Key challenges involve the volatility of raw material prices (crude oil and natural gas), which directly impacts production costs and profitability. Stringent environmental regulations, increasing pressure for sustainable manufacturing practices, and potential disruptions in global supply chains due to geopolitical events also pose significant obstacles to market growth and stability.

Which region dominates the ethyl benzene market?

The Asia Pacific (APAC) region currently holds the largest share of the ethyl benzene market. This dominance is attributed to robust industrial growth, rapid urbanization, extensive manufacturing activities, and significant investments in petrochemical production capacities, particularly in countries like China, India, and Southeast Asian nations, driving immense demand for styrene derivatives.

How is artificial intelligence (AI) impacting the ethyl benzene industry?

AI is transforming the ethyl benzene industry by optimizing production processes, enhancing predictive maintenance for equipment, and improving supply chain management through advanced analytics. AI applications are also accelerating research and development for new catalysts and more efficient reaction pathways, contributing to reduced operational costs, increased yield, and improved sustainability within manufacturing facilities.