Enterprise High Performance Computing Market

Enterprise High Performance Computing Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704996 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Enterprise High Performance Computing Market Size

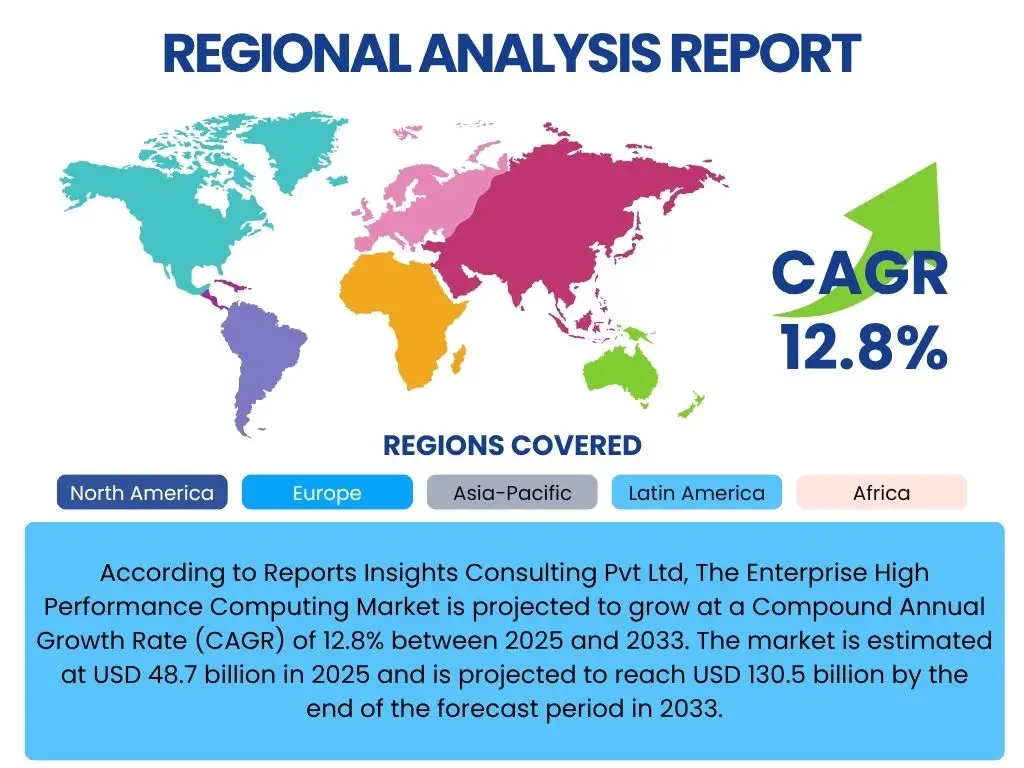

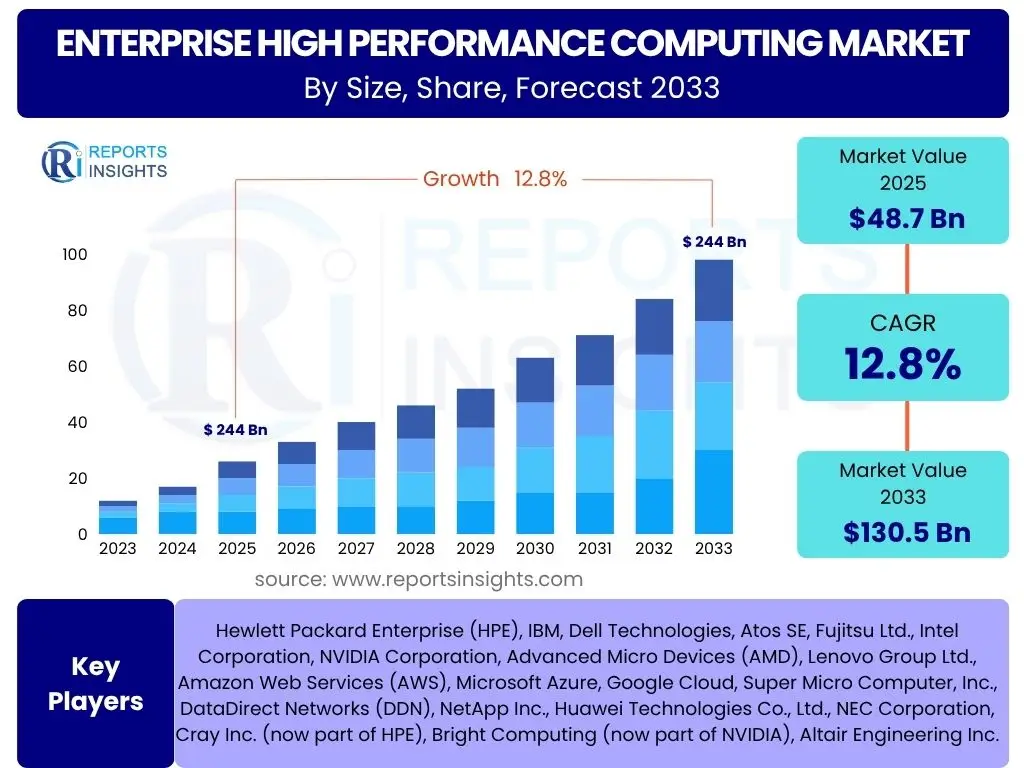

According to Reports Insights Consulting Pvt Ltd, The Enterprise High Performance Computing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2025 and 2033. The market is estimated at USD 48.7 billion in 2025 and is projected to reach USD 130.5 billion by the end of the forecast period in 2033.

Key Enterprise High Performance Computing Market Trends & Insights

The Enterprise High Performance Computing (HPC) market is experiencing transformative shifts driven by technological advancements and evolving enterprise needs. A primary trend is the accelerating adoption of cloud-based HPC solutions, which democratize access to powerful computing resources without the burden of significant capital expenditure on on-premise infrastructure. This shift is particularly appealing to small and medium-sized enterprises (SMEs) and those requiring burst capacity for specialized workloads, offering flexibility and scalability previously unattainable. Concurrently, the integration of Artificial intelligence (AI) and Machine Learning (ML) workloads is profoundly shaping the HPC landscape, as these data-intensive applications require immense computational power for training and inference, pushing the boundaries of existing HPC architectures.

Another significant trend involves the increasing focus on specialized hardware accelerators, such as Graphics Processing Units (GPUs), Field-Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs). These accelerators are becoming indispensable for handling the parallel processing demands of AI, big data analytics, and complex scientific simulations, offering superior performance and energy efficiency compared to traditional CPUs alone. Furthermore, the imperative for energy efficiency and sustainability is driving innovation in HPC system design, prompting the development of more power-efficient components and advanced cooling solutions. Enterprises are seeking greener HPC solutions not only for environmental responsibility but also to reduce operational costs associated with power consumption.

The convergence of HPC with edge computing is also emerging as a pivotal trend. As data generation increasingly occurs at the periphery of networks, the need to process and analyze this data closer to its source is growing. Edge HPC enables real-time insights, reduces latency, and minimizes bandwidth requirements for data transfer to central data centers. This paradigm is particularly relevant for applications in manufacturing, autonomous vehicles, and smart cities. Finally, the market is seeing a growing emphasis on tailored HPC solutions for specific vertical industries, such as life sciences, financial services, and automotive, indicating a maturation of the market where generic solutions are being supplanted by highly optimized, domain-specific offerings that address unique computational challenges and regulatory requirements.

- Growing adoption of cloud HPC for flexibility and scalability.

- Deep integration of AI and Machine Learning workloads requiring specialized compute.

- Increased demand for specialized hardware accelerators (GPUs, FPGAs, ASICs).

- Strong emphasis on energy efficiency and sustainable HPC solutions.

- Convergence of HPC with edge computing for real-time local processing.

- Development of industry-specific HPC solutions for vertical markets.

- Maturing software ecosystems and middleware for easier HPC deployment and management.

AI Impact Analysis on Enterprise High Performance Computing

User inquiries regarding the impact of AI on Enterprise High Performance Computing frequently revolve around how AI workloads are reshaping HPC infrastructure, the symbiotic relationship between AI and traditional scientific computing, and the challenges associated with integrating AI into existing HPC environments. Users are particularly interested in understanding if AI will completely transform HPC architectures, the extent to which specialized AI hardware will proliferate, and the implications for data storage, networking, and software stacks. There is a clear expectation that AI will be a primary driver of future HPC growth, but also concerns about the complexity and cost of supporting these demanding new workloads, alongside traditional simulation and modeling tasks.

The analysis indicates that AI's impact is not merely additive but fundamentally transformative for Enterprise HPC. AI, especially deep learning, demands massive parallel processing capabilities, driving the widespread adoption of GPUs and other accelerators as standard components within HPC clusters. This shift necessitates re-evaluating network topologies, storage solutions, and cooling systems to accommodate higher power densities and data transfer rates. Moreover, AI workloads are pushing the boundaries of data management, requiring solutions that can handle petabytes of data for training and provide rapid access for inference, leading to increased investment in high-performance storage systems and intelligent data tiering strategies.

Furthermore, the integration of AI is fostering a convergence between traditional HPC simulations and AI-driven analytics. Enterprises are increasingly leveraging AI to accelerate scientific discovery, optimize engineering designs, and enhance data analysis workflows within HPC environments. This synergy is leading to the development of new hybrid computing paradigms and sophisticated software frameworks that seamlessly combine simulation, modeling, and AI techniques. However, this also presents challenges related to workforce skills, as a new generation of HPC professionals with expertise in both traditional computational science and AI/ML is required to effectively manage and utilize these complex, integrated systems. The evolving software ecosystem, including frameworks like TensorFlow and PyTorch, also needs to be optimized for HPC environments to ensure efficient resource utilization and scalability for enterprise-grade AI applications.

- Significant increase in demand for computational power, driving HPC infrastructure expansion.

- Proliferation of specialized AI hardware (GPUs, NPUs, ASICs) becoming standard in HPC.

- Enhanced data processing and analytics capabilities within enterprise HPC environments.

- Acceleration of AI model training and inference through parallel processing.

- Emergence of hybrid workloads combining traditional simulations with AI/ML.

- Increased complexity in data management and storage solutions for large AI datasets.

- Development of new software stacks and optimization of AI frameworks for HPC.

- Potential for HPC to enable entirely new AI applications and services.

Key Takeaways Enterprise High Performance Computing Market Size & Forecast

User queries regarding the key takeaways from the Enterprise High Performance Computing market size and forecast consistently point towards an interest in the market's overall health, its primary growth engines, and its strategic importance for businesses across various sectors. There is a notable focus on identifying the most lucrative segments and regions, as well as understanding the long-term viability and disruptive potential of HPC technologies. Users seek concise insights that summarize the market's trajectory and highlight critical factors influencing its expansion and evolution, allowing for informed strategic planning and investment decisions.

Analysis of the Enterprise HPC market reveals a robust and sustained growth trajectory, primarily fueled by the exponential increase in data generation and the escalating demand for sophisticated analytical capabilities across diverse industries. The forecast indicates that HPC is no longer confined to traditional scientific and academic research but has become an indispensable tool for competitive advantage in commercial enterprises. Key industries such as financial services, manufacturing, healthcare, and energy are increasingly relying on HPC for critical operations ranging from risk assessment and product design to drug discovery and geological modeling, underscoring its foundational role in modern business innovation and operational efficiency.

A significant takeaway is the ongoing democratization of HPC through cloud-based offerings and the development of more user-friendly software interfaces. This trend is broadening the accessibility of HPC to a wider array of enterprises, including those with limited IT budgets or in-house expertise, thereby expanding the market's potential reach. Furthermore, the synergy between HPC and emerging technologies like AI, quantum computing, and edge computing is creating new avenues for growth and application, ensuring that the market remains dynamic and responsive to future technological shifts. This convergence positions Enterprise HPC as a critical enabler for digital transformation and advanced problem-solving, promising continued high investment and innovation throughout the forecast period.

- The Enterprise HPC market is poised for substantial growth, driven by data explosion and AI integration.

- Cloud-based HPC solutions are democratizing access, expanding the market reach beyond traditional users.

- Strategic investment in HPC is critical for competitive advantage across key industrial sectors.

- Convergence with emerging technologies like AI and edge computing will fuel long-term market expansion.

Enterprise High Performance Computing Market Drivers Analysis

The Enterprise High Performance Computing (HPC) market is propelled by several potent drivers, primarily stemming from the increasing complexity of data and the imperative for accelerated decision-making across industries. The sheer volume, velocity, and variety of data generated daily necessitate powerful computational resources that traditional systems cannot handle. Enterprises are leveraging HPC to extract actionable insights from big data, enabling advanced analytics, fraud detection, customer behavior prediction, and more precise scientific research. This escalating demand for robust data processing capabilities forms a foundational driver for market expansion.

Another significant driver is the widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) across various business functions. Training complex AI models, particularly deep neural networks, requires immense computational throughput and parallel processing power, which HPC systems are uniquely designed to provide. As more enterprises integrate AI into their operations for tasks like image recognition, natural language processing, and predictive maintenance, the demand for underlying HPC infrastructure will continue to surge. Furthermore, the persistent need for faster and more accurate simulations and modeling in industries such as automotive, aerospace, life sciences, and financial services continues to bolster the HPC market. These industries rely on HPC to shorten product development cycles, optimize designs, and mitigate risks, thereby enhancing their competitive edge.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Proliferation of Big Data and Advanced Analytics | +3.5% | Global, particularly North America, APAC | 2025-2033 (Long-term) |

| Accelerated Adoption of AI and Machine Learning | +4.0% | Global, particularly North America, Europe, China | 2025-2033 (Long-term) |

| Increasing Demand for Complex Simulations & Modeling | +2.8% | North America, Europe, Japan, South Korea | 2025-2033 (Long-term) |

| Growth of Cloud-Based HPC Services | +2.5% | Global, particularly SMEs in emerging markets | 2025-2030 (Medium-term) |

| Technological Advancements in Processor Architectures | +1.5% | Global | 2025-2033 (Ongoing) |

Enterprise High Performance Computing Market Restraints Analysis

Despite robust growth, the Enterprise High Performance Computing (HPC) market faces several significant restraints that could temper its expansion. One of the primary barriers to adoption, especially for smaller and medium-sized enterprises (SMEs), is the remarkably high initial investment required to procure and deploy HPC infrastructure. This includes not only the cost of powerful servers, specialized processors, and high-speed networking but also the substantial expenditure on dedicated cooling systems and power infrastructure. Such prohibitive upfront costs can deter potential users, limiting the market to large enterprises or those with specific, critical computational needs.

Another considerable restraint is the inherent complexity associated with managing and operating HPC systems. These environments demand highly specialized technical expertise for deployment, configuration, maintenance, and optimization. Shortages of skilled personnel, including HPC architects, system administrators, and computational scientists, can significantly impede the effective utilization of HPC resources and increase operational overheads. Furthermore, the substantial energy consumption of HPC clusters poses both an operational cost burden and an environmental concern, especially as enterprises increasingly prioritize sustainability initiatives. The escalating electricity bills and the carbon footprint of powerful computing systems can be a disincentive for investment, particularly in regions with high energy costs or stringent environmental regulations. Concerns related to data security and privacy in distributed HPC environments, especially when utilizing cloud-based services, also act as a restraint. Enterprises are often hesitant to move highly sensitive data to external or shared infrastructures due to potential vulnerabilities and compliance issues, creating a demand for robust security measures that add to the overall complexity and cost.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Total Cost of Ownership (TCO) | -2.0% | Global, particularly SMEs | 2025-2030 (Medium-term) |

| Complexity of Management and Lack of Skilled Personnel | -1.5% | Global | 2025-2033 (Long-term) |

| Significant Energy Consumption and Environmental Concerns | -1.0% | Europe, North America | 2025-2033 (Long-term) |

| Data Security and Privacy Concerns | -0.8% | Global, particularly highly regulated industries | 2025-2033 (Long-term) |

Enterprise High Performance Computing Market Opportunities Analysis

The Enterprise High Performance Computing (HPC) market presents several compelling opportunities for growth and innovation. One significant area lies in the expansion of HPC-as-a-Service (HPCaaS) offerings. As enterprises increasingly seek operational flexibility and cost efficiency, the ability to access scalable HPC resources on demand through cloud providers or specialized HPCaaS vendors eliminates the need for large upfront capital expenditures and reduces the burden of managing complex on-premise infrastructure. This model democratizes access to HPC, opening up new market segments, especially for small and medium-sized businesses that traditionally could not afford or manage their own HPC systems.

Another key opportunity emerges from the growing integration of HPC with edge computing. As industries like manufacturing, smart cities, and autonomous vehicles generate massive amounts of data at the edge, there is an increasing need for real-time processing and analysis close to the data source. Deploying compact, energy-efficient HPC capabilities at the edge enables faster decision-making, reduces latency, and optimizes bandwidth usage by minimizing data transfer to centralized data centers. This convergence creates new use cases and expands the applicability of HPC into distributed environments. Furthermore, the development of specialized HPC solutions tailored for specific vertical industries offers a significant growth avenue. As enterprises in sectors such as financial services, healthcare, energy exploration, and materials science face unique computational challenges, the demand for highly optimized hardware and software stacks that address their specific workflows and regulatory requirements is increasing. Providers who can offer deep domain expertise and customized HPC solutions will find substantial opportunities for market penetration and differentiation, driving increased adoption and value creation within these specialized verticals.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of HPC-as-a-Service (HPCaaS) | +2.0% | Global, particularly North America, Europe, APAC (emerging markets) | 2025-2033 (Long-term) |

| Integration with Edge Computing for Real-time Analytics | +1.8% | North America, Europe, China | 2027-2033 (Long-term) |

| Development of Industry-Specific HPC Solutions | +1.5% | Global, focused on key industrial hubs | 2025-2033 (Long-term) |

| Advancements in Quantum Computing Integration | +0.7% | North America, Europe, Japan | 2029-2033 (Long-term, nascent) |

Enterprise High Performance Computing Market Challenges Impact Analysis

The Enterprise High Performance Computing (HPC) market faces distinct challenges that can impede its growth and widespread adoption. One critical challenge is the persistent shortage of skilled professionals capable of designing, deploying, and managing complex HPC environments. The intricate nature of HPC systems, which often involve parallel programming, specialized hardware architectures, and sophisticated software stacks, requires a highly specialized skill set that is not readily available in the general IT workforce. This scarcity can lead to higher operational costs, delayed deployments, and suboptimal utilization of expensive HPC resources, thereby hindering enterprises from fully leveraging their investments.

Another significant challenge revolves around the sheer complexity of data management within HPC ecosystems. Modern HPC workloads generate and process petabytes of data, demanding robust, high-speed storage solutions and efficient data transfer mechanisms. Managing this vast amount of data, ensuring its integrity, security, and accessibility across distributed systems, and optimizing I/O performance are formidable tasks. This complexity can lead to bottlenecks, increased operational overheads, and potential data integrity issues, which can undermine the efficiency and reliability of HPC operations. Furthermore, achieving interoperability between diverse hardware components, software frameworks, and cloud platforms within hybrid HPC environments presents a substantial challenge. Enterprises often operate with a mix of on-premise infrastructure, various cloud services, and specialized accelerators, making it difficult to ensure seamless integration and efficient workload migration. The lack of universal standards and the proprietary nature of some technologies complicate this integration, leading to potential vendor lock-in and increased development efforts. Finally, the relentless pursuit of energy efficiency remains a pressing concern for HPC, as power consumption directly impacts operational costs and environmental sustainability. While advancements are being made, maintaining high performance while minimizing energy footprint continues to be a balancing act, particularly for exascale computing and large-scale data centers.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Shortage of Skilled HPC Professionals | -1.2% | Global | 2025-2033 (Long-term) |

| Data Management and Storage Complexity | -1.0% | Global | 2025-2033 (Long-term) |

| Interoperability and Integration Issues in Hybrid Environments | -0.9% | Global | 2025-2030 (Medium-term) |

| Maintaining Energy Efficiency with Increasing Performance | -0.7% | Global, particularly Europe, North America | 2025-2033 (Long-term) |

Enterprise High Performance Computing Market - Updated Report Scope

This comprehensive market research report on the Enterprise High Performance Computing (HPC) market provides an in-depth analysis of market dynamics, growth drivers, restraints, opportunities, and challenges. It offers a detailed segmentation analysis by component, deployment, industry vertical, and region, along with competitive landscape assessment and strategic profiles of key market participants. The report aims to deliver actionable insights to stakeholders, enabling informed decision-making for market entry, expansion strategies, and investment prioritization within the dynamic global HPC ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 48.7 billion |

| Market Forecast in 2033 | USD 130.5 billion |

| Growth Rate | 12.8% |

| Number of Pages | 267 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Hewlett Packard Enterprise (HPE), IBM, Dell Technologies, Atos SE, Fujitsu Ltd., Intel Corporation, NVIDIA Corporation, Advanced Micro Devices (AMD), Lenovo Group Ltd., Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Super Micro Computer, Inc., DataDirect Networks (DDN), NetApp Inc., Huawei Technologies Co., Ltd., NEC Corporation, Cray Inc. (now part of HPE), Bright Computing (now part of NVIDIA), Altair Engineering Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Enterprise High Performance Computing market is meticulously segmented to provide a granular view of its diverse components and applications, enabling a comprehensive understanding of market dynamics and potential growth areas. This segmentation highlights the various facets of the HPC ecosystem, from the foundational hardware and intricate software layers to the flexible deployment models and critical industry applications. Understanding these segments is crucial for identifying key investment opportunities and strategic partnerships across the value chain, facilitating targeted product development and market penetration strategies for vendors, and enabling enterprises to select the most appropriate HPC solutions for their specific needs.

The segmentation by component differentiates between the physical infrastructure (hardware), the operational and analytical tools (software), and the supporting professional and managed services. Hardware encompasses the powerful servers, specialized storage solutions, high-speed networking devices, and crucial accelerators that form the backbone of any HPC system. Software includes everything from the core operating systems and middleware that manage parallel processing to the specialized development tools and AI/ML frameworks that enable specific workloads. Services ensure the efficient deployment, maintenance, and optimization of these complex systems. The deployment model segmentation, including on-premise, cloud, and hybrid HPC, reflects the evolving preferences of enterprises seeking flexibility, scalability, and cost efficiency. Finally, the segmentation by industry vertical underscores the broad applicability of HPC across a multitude of sectors, each leveraging high-performance computing to solve unique and complex problems, from scientific discovery to financial modeling.

- By Component:

- Hardware: Servers, Supercomputers, Storage Solutions, Networking Devices, Accelerators.

- Software: HPC Middleware, Development Tools, Schedulers and Orchestration Tools, System Management Software, Parallel File System Software, AI/ML Frameworks.

- Services: Managed Services, Professional Services, Training & Education.

- By Deployment:

- On-Premise HPC

- Cloud HPC (HPC-as-a-Service)

- Hybrid HPC

- By Industry Vertical:

- Academic & Research Institutions

- Government & Defense

- Manufacturing

- Healthcare & Life Sciences

- Financial Services

- Oil & Gas

- Retail & Consumer Goods

- Media & Entertainment

- Others

Regional Highlights

- North America: Dominates the Enterprise HPC market due to early adoption of advanced technologies, presence of major HPC vendors, significant R&D investments, and strong demand from key industries like defense, financial services, and healthcare. The region also leads in cloud HPC adoption.

- Europe: A strong market driven by robust governmental funding for scientific research, advanced manufacturing, and automotive industries. Countries like Germany, France, and the UK are key contributors, focusing on exascale initiatives and sustainable HPC solutions.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, fueled by rapid industrialization, increasing government investments in supercomputing infrastructure, and growing adoption of AI and big data analytics in countries like China, Japan, South Korea, and India. Manufacturing and life sciences sectors are significant drivers.

- Latin America: Emerging market with increasing adoption, particularly in oil & gas exploration, academic research, and government sectors. Growth is steady but slower compared to developed regions, with Brazil and Mexico leading the adoption.

- Middle East and Africa (MEA): Growing interest in HPC, primarily driven by investments in the oil & gas sector, smart city initiatives, and diversification efforts in economies like Saudi Arabia and UAE. Research and development in academic institutions also contribute to market growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise High Performance Computing Market.- Hewlett Packard Enterprise (HPE)

- IBM

- Dell Technologies

- Atos SE

- Fujitsu Ltd.

- Intel Corporation

- NVIDIA Corporation

- Advanced Micro Devices (AMD)

- Lenovo Group Ltd.

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud

- Super Micro Computer, Inc.

- DataDirect Networks (DDN)

- NetApp Inc.

- Huawei Technologies Co., Ltd.

- NEC Corporation

- Bright Computing (now part of NVIDIA)

- Altair Engineering Inc.

Frequently Asked Questions

Analyze common user questions about the Enterprise High Performance Computing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Enterprise High Performance Computing (HPC)?

Enterprise HPC refers to the use of supercomputers and computer clusters to solve complex computational problems within commercial and governmental organizations, enabling advanced simulations, data analysis, and AI workloads that require massive processing power.

How is cloud computing impacting the HPC market?

Cloud computing is democratizing HPC by offering scalable, on-demand access to high-performance resources without significant upfront investment, making it accessible to a broader range of enterprises and fostering hybrid HPC deployment models.

Which industries are the primary adopters of Enterprise HPC?

Key industries adopting Enterprise HPC include manufacturing (automotive, aerospace), healthcare and life sciences (drug discovery, genomics), financial services (risk analysis, algorithmic trading), government and defense, and oil and gas.

What are the main drivers of growth in the Enterprise HPC market?

The market is primarily driven by the explosion of big data, the increasing adoption of AI and Machine Learning, the need for faster and more complex simulations, and the growing availability of cloud-based HPC solutions.

What are the challenges faced by the Enterprise HPC market?

Major challenges include the high initial investment costs, the complexity of managing HPC systems, the shortage of skilled professionals, significant energy consumption, and ensuring robust data security and privacy.