Electrical Switchgear Market

Electrical Switchgear Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702281 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Electrical Switchgear Market Size

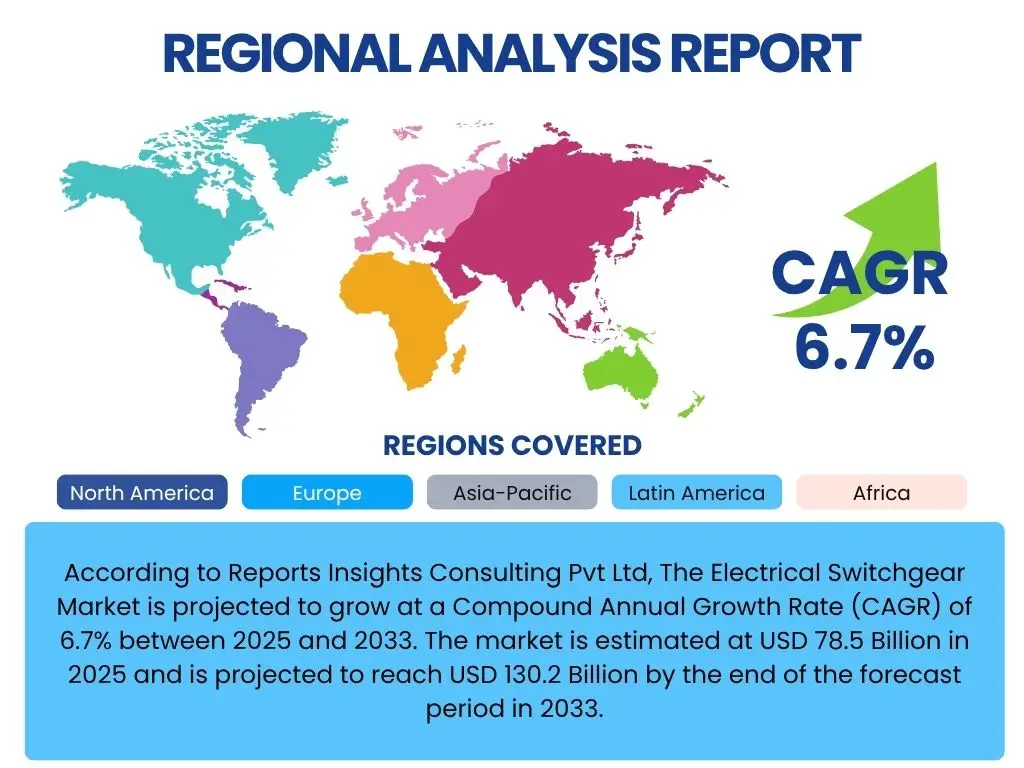

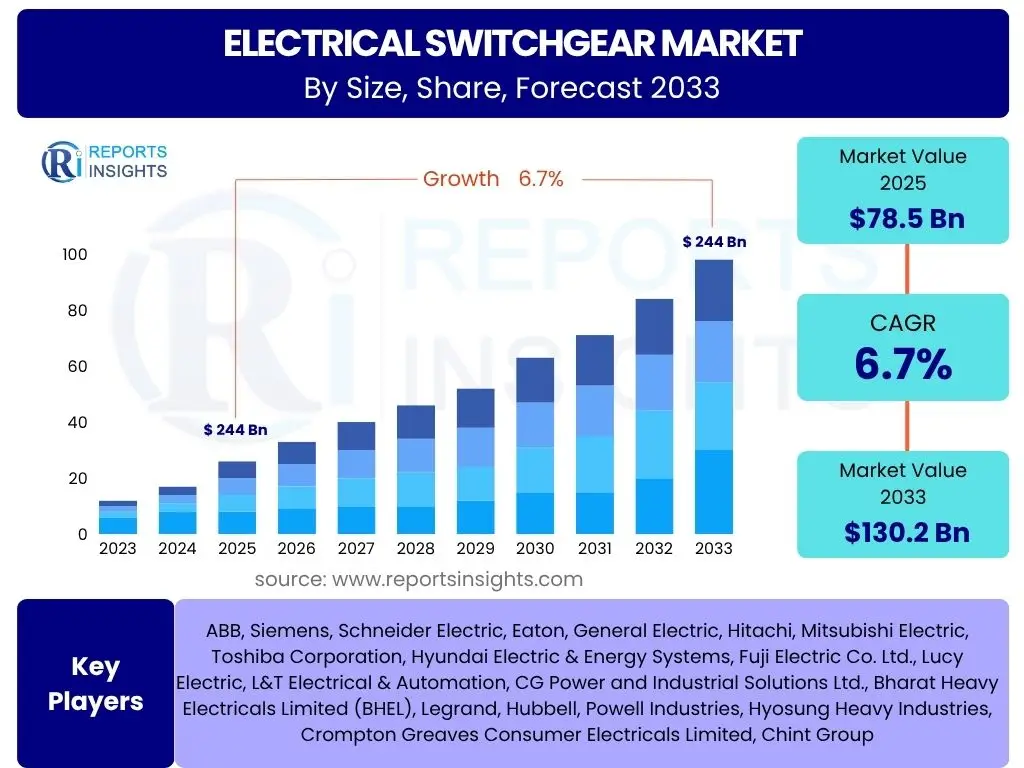

According to Reports Insights Consulting Pvt Ltd, The Electrical Switchgear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2033. The market is estimated at USD 78.5 Billion in 2025 and is projected to reach USD 130.2 Billion by the end of the forecast period in 2033.

Key Electrical Switchgear Market Trends & Insights

The electrical switchgear market is experiencing transformative shifts driven by global energy transitions and technological advancements. Key trends indicate a robust demand for more efficient, reliable, and intelligent power distribution solutions. The integration of renewable energy sources into existing grids necessitates advanced switchgear capable of managing bidirectional power flow and ensuring grid stability. Furthermore, the push for smart grid infrastructure is accelerating the adoption of digital switchgear, which offers enhanced monitoring, control, and automation capabilities.

Emerging economies are witnessing significant investments in grid expansion and modernization, fueled by rapid industrialization and urbanization. This creates a substantial market for both traditional and advanced switchgear solutions. Concurrently, developed nations are focusing on upgrading aging infrastructure and enhancing grid resilience against outages and cyber threats, leading to increased demand for robust and secure switchgear. The emphasis on environmental sustainability is also propelling the development and adoption of eco-friendly insulation technologies, moving away from SF6 gas in favor of solid or vacuum-insulated alternatives.

- Digitalization and Smart Grid Integration: Increasing adoption of digital control and monitoring systems for enhanced grid efficiency and reliability.

- Renewable Energy Integration: Growing demand for switchgear compatible with solar, wind, and other renewable energy sources, supporting grid decentralization.

- Eco-friendly Switchgear Solutions: Shift towards SF6-free and sustainable insulation materials to reduce environmental impact.

- Asset Management and Predictive Maintenance: Utilization of advanced analytics and IoT for proactive monitoring and maintenance of switchgear assets.

- Modular and Compact Designs: Preference for space-saving and easily deployable switchgear solutions, particularly in urban areas and industrial settings.

- Cybersecurity in Grid Infrastructure: Heightened focus on securing digital switchgear against cyber threats to ensure grid integrity.

- Modernization of Aging Infrastructure: Significant investments in replacing and upgrading outdated switchgear in developed economies.

AI Impact Analysis on Electrical Switchgear

The integration of Artificial Intelligence (AI) is set to profoundly reshape the electrical switchgear landscape, addressing critical operational challenges and unlocking new efficiencies. AI-driven analytics can transform maintenance strategies from reactive to predictive, enabling operators to foresee potential failures in switchgear components long before they occur. This capability minimizes downtime, extends equipment lifespan, and significantly reduces operational costs by optimizing maintenance schedules and resource allocation. Furthermore, AI algorithms can analyze vast datasets from grid operations, identifying patterns and anomalies that indicate impending issues or opportunities for performance optimization, leading to more resilient and intelligent power distribution networks.

Beyond maintenance, AI is enhancing the intelligence of switchgear within smart grid architectures. AI-powered systems can facilitate real-time load balancing, optimize power flow, and manage complex bidirectional power exchanges inherent in grids with high renewable energy penetration. This contributes to greater grid stability and efficiency. Additionally, AI applications extend to improving the design and manufacturing processes of switchgear, potentially leading to faster prototyping, more customized solutions, and higher quality control. As the industry moves towards more autonomous and self-healing grids, AI will be an indispensable tool for enhancing the overall reliability, security, and sustainability of electrical power systems.

- Predictive Maintenance: AI algorithms analyze sensor data to predict equipment failures, reducing downtime and maintenance costs.

- Optimized Grid Management: AI enhances real-time load balancing, fault detection, and power flow optimization in smart grids.

- Enhanced Cybersecurity: AI-driven anomaly detection systems strengthen the security of digital switchgear against cyber threats.

- Automated Operations: AI enables more autonomous control and decision-making within switchgear systems, improving response times.

- Efficient Design and Manufacturing: AI tools assist in optimizing switchgear design, material selection, and production processes for greater efficiency.

- Energy Management Optimization: AI helps in optimizing energy consumption and distribution based on demand patterns and renewable energy availability.

Key Takeaways Electrical Switchgear Market Size & Forecast

The electrical switchgear market is poised for significant expansion, driven by foundational global trends such as urbanization, industrial growth, and the accelerating transition to clean energy. The projected compound annual growth rate indicates a healthy market trajectory, reflecting continuous investment in power infrastructure worldwide. A primary driver of this growth is the increasing demand for electricity, particularly in developing economies, which necessitates robust and reliable power distribution and control mechanisms. Furthermore, the global imperative to integrate renewable energy sources like solar and wind into national grids is creating a substantial need for advanced switchgear capable of managing variable and distributed power generation.

Technological innovation plays a pivotal role in shaping the market's future, with a strong emphasis on smart and digital switchgear solutions. These advancements promise enhanced efficiency, predictive capabilities, and improved grid resilience, aligning with smart grid initiatives globally. While challenges such as high initial costs and complex regulatory landscapes exist, the overarching trend points towards a modernization of power infrastructure, presenting numerous opportunities for market participants. The long-term forecast remains positive, underpinned by ongoing governmental support for grid upgrades and the growing adoption of sustainable energy practices.

- Robust Market Growth: The market is projected for substantial growth, driven by increasing global electricity demand and infrastructure development.

- Strategic Investments: Significant investments in smart grid technologies and renewable energy integration are propelling market expansion.

- Technological Evolution: Transition towards digital, intelligent, and eco-friendly switchgear solutions is a key growth enabler.

- Grid Modernization Focus: Developed nations prioritize upgrading aging infrastructure, ensuring stable demand for advanced switchgear.

- Emerging Market Potential: Rapid industrialization and urbanization in developing regions present lucrative growth opportunities.

Electrical Switchgear Market Drivers Analysis

The global electrical switchgear market is fundamentally driven by a confluence of macroeconomic and technological factors. Rapid urbanization and industrialization, particularly across Asia Pacific and parts of Africa, are creating an unprecedented demand for reliable electricity infrastructure. This necessitates the deployment of new power generation, transmission, and distribution systems, with switchgear forming a critical component in ensuring safe and efficient power flow. Governments worldwide are investing heavily in grid modernization projects to enhance reliability, reduce transmission losses, and integrate diverse energy sources, further fueling market expansion.

A significant driver is the global energy transition, characterized by the increasing adoption of renewable energy sources such as solar and wind power. These intermittent energy sources require sophisticated switchgear to manage grid stability, balance supply and demand, and facilitate bidirectional power flow. The development of smart grid initiatives, aimed at creating more intelligent and resilient power networks, also directly contributes to the demand for advanced digital and automated switchgear. Additionally, the replacement and upgrade of aging electrical infrastructure in developed economies, coupled with growing concerns over energy efficiency and sustainability, are continuously stimulating market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Infrastructure Development & Urbanization | +1.5% | Asia Pacific, Africa, Latin America | Long-term |

| Growing Electricity Demand | +1.3% | Global | Ongoing |

| Integration of Renewable Energy Sources | +1.2% | Europe, North America, Asia Pacific | Medium-to-Long-term |

| Smart Grid Initiatives & Digitalization | +1.0% | Global | Medium-term |

| Modernization of Aging Grid Infrastructure | +0.8% | North America, Europe | Long-term |

Electrical Switchgear Market Restraints Analysis

While the electrical switchgear market demonstrates strong growth potential, it also faces several notable restraints that could temper its expansion. One significant challenge is the high initial capital investment required for installing advanced switchgear systems. This cost barrier can be particularly restrictive for developing economies or smaller utilities with limited financial resources, potentially delaying or scaling down necessary infrastructure upgrades. The complexity involved in integrating new, intelligent switchgear into existing, often heterogeneous, grid architectures also presents a technical and financial hurdle, requiring substantial planning and skilled labor.

Furthermore, the market is susceptible to global economic downturns and geopolitical instabilities, which can lead to reduced industrial activity, delayed infrastructure projects, and fluctuating raw material prices. Stringent regulatory frameworks and environmental compliance standards, while necessary for safety and sustainability, can increase manufacturing costs and extend product development cycles, posing challenges for manufacturers. The long operational lifespan of traditional switchgear means that replacement cycles can be extended, leading to slower market adoption rates for newer technologies unless there are compelling efficiency or regulatory drivers for immediate upgrades.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment | -0.9% | Developing Regions | Short-to-Medium-term |

| Complex Regulatory Compliance & Standards | -0.7% | Europe, North America | Ongoing |

| Economic Volatility & Project Delays | -0.6% | Global | Short-term |

| Supply Chain Disruptions | -0.5% | Global | Short-to-Medium-term |

Electrical Switchgear Market Opportunities Analysis

The electrical switchgear market is rich with opportunities stemming from evolving energy landscapes and technological advancements. A significant avenue for growth lies in the increasing global emphasis on environmental sustainability, which drives the demand for eco-friendly switchgear solutions. The shift away from SF6 gas, a potent greenhouse gas commonly used in insulation, towards vacuum, solid, or clean-air insulated switchgear presents substantial innovation and market penetration opportunities. This transition is not only driven by regulatory pressures but also by corporate sustainability goals and consumer preferences for greener technologies.

Moreover, the expansion of microgrids and distributed power generation systems offers a specialized market niche. As more communities and industries seek energy independence and resilience, the need for localized switchgear solutions that can manage varied power sources, storage, and loads becomes critical. The ongoing development of IoT (Internet of Things) and advanced sensor technologies opens doors for integrating sophisticated monitoring, diagnostics, and control features into switchgear, enabling predictive maintenance and enhancing grid intelligence. Furthermore, the massive untapped potential in emerging economies, coupled with initiatives to electrify rural areas and expand industrial capacities, provides long-term growth prospects for switchgear manufacturers and service providers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Adoption of Eco-friendly Switchgear (SF6-free) | +1.0% | Europe, North America, Global | Medium-to-Long-term |

| Growth of Microgrids and Distributed Generation | +0.9% | North America, Europe, Asia Pacific | Medium-to-Long-term |

| IoT and Digital Integration for Smart Switchgear | +0.8% | Global | Medium-term |

| Expansion in Emerging Economies (Rural Electrification) | +1.2% | Asia, Africa, Latin America | Long-term |

| Retrofitting and Upgrading Existing Infrastructure | +0.7% | Developed Nations | Ongoing |

Electrical Switchgear Market Challenges Impact Analysis

Despite its promising outlook, the electrical switchgear market confronts several significant challenges that demand strategic responses from industry players. One major concern is the inherent complexity of integrating diverse and often proprietary systems within modern smart grids. Achieving seamless interoperability between new digital switchgear and legacy infrastructure, as well as with various communication protocols and software platforms, remains a considerable technical hurdle. This complexity can lead to higher integration costs, extended deployment times, and potential compatibility issues, impacting overall project timelines and budgets.

Another pressing challenge is the escalating threat of cyberattacks targeting critical infrastructure, including digital switchgear. As switchgear becomes increasingly connected and intelligent, its vulnerability to malicious cyber activities grows, potentially leading to widespread power outages, data breaches, or operational disruptions. Ensuring robust cybersecurity measures, from secure hardware and software to comprehensive network protection, is paramount but adds to the cost and complexity of development and deployment. Furthermore, intense price competition among manufacturers, coupled with volatile raw material costs and the need to meet stringent environmental regulations, puts continuous pressure on profit margins and necessitates ongoing innovation in cost-effective and sustainable solutions.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Cybersecurity Threats to Digital Infrastructure | -0.6% | Global | Ongoing |

| High Competition & Price Pressures | -0.5% | Global | Ongoing |

| Technological Obsolescence & Rapid Innovation Cycles | -0.4% | Developed Markets | Medium-term |

| Skilled Workforce Shortage for Advanced Systems | -0.3% | Global | Long-term |

Electrical Switchgear Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Electrical Switchgear Market, offering detailed insights into its current size, historical performance, and future growth projections from 2025 to 2033. It meticulously examines key market trends, significant drivers, inherent restraints, emerging opportunities, and prevailing challenges that shape the industry landscape. The report also includes a thorough impact analysis of Artificial Intelligence on the market, segment-wise breakdowns, and regional highlights, ensuring a holistic understanding for stakeholders. Furthermore, it profiles leading market players, offering competitive intelligence and strategic insights.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 78.5 Billion |

| Market Forecast in 2033 | USD 130.2 Billion |

| Growth Rate | 6.7% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, Schneider Electric, Eaton, General Electric, Hitachi, Mitsubishi Electric, Toshiba Corporation, Hyundai Electric & Energy Systems, Fuji Electric Co. Ltd., Lucy Electric, L&T Electrical & Automation, CG Power and Industrial Solutions Ltd., Bharat Heavy Electricals Limited (BHEL), Legrand, Hubbell, Powell Industries, Hyosung Heavy Industries, Crompton Greaves Consumer Electricals Limited, Chint Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The electrical switchgear market is comprehensively segmented to provide a granular understanding of its diverse components and applications. These segments enable a detailed analysis of market dynamics, growth drivers, and opportunities across various dimensions, including voltage levels, insulation types, product categories, and end-use industries. Each segment reflects specific technological requirements, application scenarios, and regional market preferences, contributing uniquely to the overall market landscape.

The segmentation by voltage highlights the distinct requirements for power distribution at different scales, from low voltage applications in residential and commercial buildings to high voltage systems used in transmission networks. Insulation type segmentation is crucial for understanding technological advancements and environmental considerations, particularly the shift towards SF6-free alternatives. Product type segmentation identifies the demand for specific components like circuit breakers and relays, which are fundamental to switchgear functionality. Lastly, the end-use industry segmentation provides insights into the primary sectors driving demand, from large-scale utilities and heavy industries to renewable energy projects and transportation.

- By Voltage:

- Low Voltage (LV): Primarily used in residential, commercial, and light industrial applications.

- Medium Voltage (MV): Essential for industrial plants, commercial buildings, and distribution substations.

- High Voltage (HV): Critical for power transmission and large-scale industrial use.

- By Insulation Type:

- Air Insulated Switchgear (AIS): Traditional and widely used, cost-effective.

- Gas Insulated Switchgear (GIS): Compact, reliable, and suitable for confined spaces.

- Vacuum Insulated Switchgear (VIS): Environmentally friendly, long lifespan, low maintenance.

- Oil Insulated Switchgear (OIS): Older technology, still used in specific applications.

- Solid Insulated Switchgear (SIS): Emerging eco-friendly option, compact, maintenance-free.

- Hybrid Switchgear: Combines AIS and GIS technologies for optimal performance.

- By Product Type:

- Circuit Breakers: Protect electrical circuits from damage caused by overcurrent or short circuit.

- Relays: Detect faults and initiate circuit breaker operation.

- Switches: Connect or disconnect electrical circuits.

- Fuses: Overcurrent protective devices.

- Disconnectors: Isolate sections of circuits for maintenance.

- Control Panels: House control and protection devices.

- Others: Includes instrument transformers, surge arresters, etc.

- By End-Use Industry:

- Utilities: Power generation, transmission, and distribution companies.

- Industrial: Oil & Gas, Mining, Manufacturing & Processing, Chemical & Petrochemical, Metals & Mining.

- Residential & Commercial: Infrastructure development, data centers, public and private buildings.

- Transportation: Railways, metros, electric vehicles charging infrastructure.

- Renewable Energy: Solar farms, wind farms, hydro power plants.

Regional Highlights

- Asia Pacific (APAC): Dominates the electrical switchgear market, primarily driven by rapid industrialization, extensive urbanization, and substantial investments in power infrastructure development across countries like China, India, and Southeast Asian nations. The growing demand for electricity to support economic expansion, coupled with government initiatives for grid modernization and rural electrification, positions APAC as the fastest-growing and largest market. The region is also a hub for renewable energy deployment, further boosting switchgear demand.

- Europe: A mature market characterized by stringent environmental regulations and a strong focus on renewable energy integration and smart grid initiatives. European countries are leading the adoption of SF6-free switchgear and advanced digital solutions to enhance grid stability, efficiency, and sustainability. Investments in upgrading aging infrastructure and cross-border grid interconnections also contribute significantly to market growth.

- North America: Driven by grid modernization efforts aimed at improving reliability, resilience, and efficiency of the existing power infrastructure. The region sees significant investment in smart grid technologies, renewable energy integration, and replacement of outdated switchgear. Demand is also fueled by industrial expansion, commercial building construction, and a focus on energy security.

- Middle East and Africa (MEA): Emerging as a high-growth region due to extensive infrastructure development projects, including smart cities, industrial zones, and new power generation capacities. Countries in the Gulf Cooperation Council (GCC) are investing heavily in expanding their electricity networks and diversifying energy sources, creating substantial opportunities for switchgear deployment. Electrification initiatives in various African countries also contribute to market growth.

- Latin America: The market is influenced by ongoing economic development, urbanization, and increasing industrialization, leading to a rising demand for electricity. Investments in renewable energy projects, particularly hydro and solar power, alongside efforts to expand and modernize existing grids, are key drivers for the switchgear market in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Switchgear Market.- ABB

- Siemens

- Schneider Electric

- Eaton

- General Electric

- Hitachi

- Mitsubishi Electric

- Toshiba Corporation

- Hyundai Electric & Energy Systems

- Fuji Electric Co. Ltd.

- Lucy Electric

- L&T Electrical & Automation

- CG Power and Industrial Solutions Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- Legrand

- Hubbell

- Powell Industries

- Hyosung Heavy Industries

- Crompton Greaves Consumer Electricals Limited

- Chint Group

Frequently Asked Questions

What is the projected growth rate for the Electrical Switchgear Market?

The Electrical Switchgear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2033, reaching USD 130.2 Billion by 2033.

What are the primary drivers of the Electrical Switchgear Market?

Key drivers include global infrastructure development, increasing electricity demand, integration of renewable energy sources, smart grid initiatives, and the modernization of aging power infrastructure.

How is AI impacting the Electrical Switchgear Market?

AI is transforming the market through enhanced predictive maintenance, optimized grid management, improved cybersecurity, automated operations, and more efficient design and manufacturing processes for switchgear systems.

Which region holds the largest share in the Electrical Switchgear Market?

Asia Pacific (APAC) currently holds the largest market share, driven by rapid industrialization, urbanization, and significant investments in power infrastructure and renewable energy projects.

What are the key types of electrical switchgear in the market?

The market segments by voltage (Low, Medium, High Voltage), insulation type (Air, Gas, Vacuum, Oil, Solid, Hybrid Insulated Switchgear), and product type (Circuit Breakers, Relays, Switches, Fuses, Disconnectors, Control Panels, among others).