Electric Power Steering Sensor Market

Electric Power Steering Sensor Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701121 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Electric Power Steering Sensor Market Size

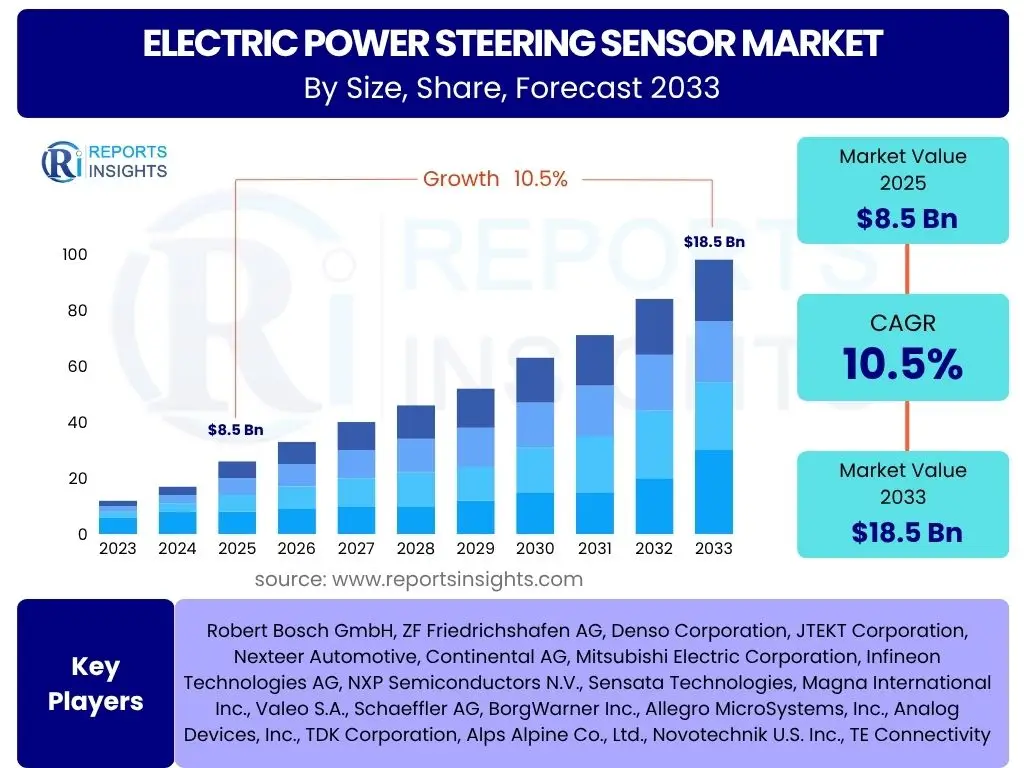

According to Reports Insights Consulting Pvt Ltd, The Electric Power Steering Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2033. The market is estimated at USD 8.5 Billion in 2025 and is projected to reach USD 18.5 Billion by the end of the forecast period in 2033. This growth is primarily driven by the escalating adoption of Electric Power Steering (EPS) systems in passenger and commercial vehicles, replacing traditional hydraulic steering systems due to their superior fuel efficiency, reduced maintenance, and integration capabilities with advanced driver-assistance systems (ADAS).

The transition towards electric vehicles (EVs) and hybrid vehicles further propels the demand for EPS systems and consequently, EPS sensors. These sensors are critical components that detect steering wheel position and torque, providing essential feedback to the EPS control unit for precise power assistance. The increasing global focus on vehicle safety, enhanced driving comfort, and stringent emission regulations are pivotal factors contributing to the robust expansion of the electric power steering sensor market.

Key Electric Power Steering Sensor Market Trends & Insights

The Electric Power Steering Sensor market is undergoing significant transformation, driven by technological advancements, evolving automotive landscapes, and increasing consumer demands for safer and more efficient vehicles. Key trends indicate a shift towards higher precision, miniaturization, and seamless integration with complex vehicle architectures. Users frequently inquire about the impact of ADAS and autonomous driving on sensor development, the role of sensor fusion, and the adoption rates of different sensor technologies like torque and position sensors in various vehicle types.

Another area of interest revolves around the materials used in sensor manufacturing, durability under harsh automotive conditions, and the potential for cost reduction through mass production. The ongoing electrification of the automotive industry necessitates sensors capable of operating efficiently in diverse electric powertrain environments, leading to innovations in electromagnetic compatibility and robustness. Furthermore, the push for lighter vehicle components to improve fuel economy is influencing sensor design, favoring compact and lightweight solutions.

- Increasing integration of EPS sensors with Advanced Driver-Assistance Systems (ADAS) and autonomous driving functionalities.

- Development of high-precision, miniaturized torque and position sensors for enhanced steering accuracy and packaging efficiency.

- Growing adoption of sensor fusion techniques to improve reliability and redundancy in steering control.

- Shift towards Hall-effect and magnetoresistive (MR) technologies for improved accuracy and durability compared to traditional optical encoders.

- Expansion of steer-by-wire systems, reducing mechanical linkages and increasing reliance on advanced sensor feedback.

- Rising demand for robust and resilient sensors capable of operating across diverse environmental conditions and temperatures.

AI Impact Analysis on Electric Power Steering Sensor

The integration of Artificial Intelligence (AI) into automotive systems profoundly impacts the Electric Power Steering Sensor market by enhancing data processing, predictive capabilities, and overall system intelligence. Users frequently express interest in how AI can improve sensor accuracy, enable predictive maintenance, and contribute to the evolution of autonomous driving features. AI algorithms are crucial for interpreting the vast amounts of data generated by EPS sensors, allowing for more nuanced and responsive steering assistance tailored to real-time driving conditions and driver input.

AI's influence extends to optimizing sensor performance by filtering noise, compensating for drift, and ensuring reliability over the vehicle's lifespan. It facilitates advanced diagnostics, predicting potential sensor failures before they occur, thereby improving vehicle uptime and reducing maintenance costs. Furthermore, in the context of autonomous vehicles, AI-powered control units leverage EPS sensor data to execute precise steering maneuvers, pathway planning, and obstacle avoidance, transforming the role of these sensors from mere data providers to integral components of intelligent decision-making systems.

- AI-driven algorithms enhance the accuracy and responsiveness of EPS control systems by optimizing sensor data interpretation.

- Predictive analytics powered by AI enables early detection of sensor degradation or failure, facilitating proactive maintenance.

- AI contributes to adaptive steering assistance, allowing the EPS system to dynamically adjust steering feel based on driving conditions and driver behavior.

- Machine learning models improve sensor calibration and compensation for environmental variations, ensuring consistent performance.

- AI facilitates the development of more sophisticated autonomous driving features by integrating EPS sensor data with other vehicle sensors for comprehensive environmental understanding.

Key Takeaways Electric Power Steering Sensor Market Size & Forecast

The Electric Power Steering Sensor market is poised for substantial growth, driven by the global automotive industry's continuous evolution towards electrification, automation, and enhanced safety features. Users often seek clear insights into the primary growth drivers, the significance of the shift from hydraulic to electric steering, and the long-term implications for automotive component suppliers. The robust Compound Annual Growth Rate (CAGR) projected reflects the indispensable role of these sensors in modern vehicles, particularly with the proliferation of Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS).

The forecast highlights a significant increase in market valuation, underscoring the expanding adoption of EPS systems across various vehicle segments. This growth is not merely volumetric but also qualitative, as sensor technology advances to meet stricter performance, reliability, and integration requirements. The market's trajectory is strongly linked to innovations in automotive electronics, software, and integrated vehicle control systems, positioning EPS sensors as a critical component in the future of mobility.

- The Electric Power Steering Sensor market is projected to reach USD 18.5 Billion by 2033, demonstrating robust expansion.

- A CAGR of 10.5% indicates strong growth, primarily fueled by the global transition to electric and hybrid vehicles.

- Increased adoption of ADAS and autonomous driving technologies directly correlates with higher demand for high-precision EPS sensors.

- OEMs are increasingly prioritizing fuel efficiency and reduced emissions, driving the widespread integration of EPS systems over hydraulic alternatives.

- Technological advancements in sensor design, including miniaturization and enhanced durability, are key factors sustaining market growth.

- The market's future is closely tied to advancements in automotive software and integrated vehicle control systems.

Electric Power Steering Sensor Market Drivers Analysis

The widespread adoption of Electric Power Steering (EPS) systems in modern vehicles is a primary driver for the Electric Power Steering Sensor market. Unlike traditional hydraulic power steering, EPS systems offer significant advantages in terms of fuel efficiency, reduced maintenance, and simplified vehicle packaging. This shift is globally observed across various vehicle segments, from compact passenger cars to heavy commercial vehicles, as manufacturers prioritize energy conservation and operational cost reduction. The inherent benefits of EPS, such as variable steering assistance and easy integration with other electronic systems, make it a preferred choice for automotive designers.

Furthermore, the escalating demand for Advanced Driver-Assistance Systems (ADAS) and the progression towards autonomous driving capabilities profoundly impact the EPS sensor market. ADAS features like Lane Keeping Assist (LKA), Park Assist, and Adaptive Cruise Control (ACC) heavily rely on precise steering control, which is facilitated by accurate feedback from EPS sensors. As vehicles become more autonomous, the criticality of these sensors for safe and reliable operation increases exponentially. The need for high-resolution and low-latency sensor data becomes paramount to ensure the safe and efficient execution of complex driving maneuvers by autonomous systems.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing adoption of Electric Power Steering (EPS) systems in vehicles | +2.5% | Global, particularly Asia Pacific & Europe | Short to Mid-term (2025-2029) |

| Rising demand for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles | +2.0% | North America, Europe, China, Japan | Mid to Long-term (2027-2033) |

| Stringent fuel efficiency and emission regulations | +1.5% | Europe, North America, China | Short to Mid-term (2025-2030) |

| Growth in Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) production | +2.2% | Global, especially China, Europe, North America | Mid to Long-term (2026-2033) |

Electric Power Steering Sensor Market Restraints Analysis

The high initial cost associated with the research, development, and manufacturing of advanced Electric Power Steering (EPS) sensors presents a significant restraint for market expansion. Producing sensors that meet stringent automotive standards for accuracy, durability, and reliability requires substantial investment in sophisticated materials, complex manufacturing processes, and rigorous testing protocols. This elevated cost can deter some automotive manufacturers, particularly those focusing on budget-segment vehicles, from adopting the latest sensor technologies, thereby limiting market penetration for premium sensor solutions. The continuous need for innovation to stay competitive also adds to the financial burden on sensor manufacturers.

Another crucial restraint is the complexity involved in integrating these high-precision sensors into various vehicle platforms and ensuring seamless compatibility with diverse Electronic Control Units (ECUs) and vehicle network architectures. Each vehicle model may have unique requirements concerning sensor placement, communication protocols, and environmental resilience, necessitating extensive customization and validation. This complexity can lead to prolonged development cycles, increased engineering costs, and potential delays in new vehicle launches. Furthermore, ensuring electromagnetic compatibility (EMC) in an increasingly electronic vehicle environment adds another layer of technical challenge and cost, as sensors must perform reliably without interference from other vehicle systems.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High initial cost of advanced EPS sensor technology | -0.8% | Global, particularly emerging economies | Short to Mid-term (2025-2028) |

| Complexity of sensor integration and calibration across diverse vehicle platforms | -0.7% | Global, especially OEMs with diverse portfolios | Mid-term (2026-2031) |

| Supply chain vulnerabilities and raw material price volatility | -0.5% | Global, impacting all manufacturers | Short-term (2025-2027) |

| Technological obsolescence due to rapid innovation cycles | -0.4% | Global, impacting R&D investment | Long-term (2029-2033) |

Electric Power Steering Sensor Market Opportunities Analysis

The burgeoning market for Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) presents a significant growth opportunity for Electric Power Steering (EPS) sensor manufacturers. Unlike internal combustion engine (ICE) vehicles that traditionally used hydraulic power steering, EVs and HEVs are inherently designed with electric powertrains, making EPS systems a natural and more efficient fit. The absence of an engine-driven hydraulic pump in EVs and HEVs necessitates the use of electric steering for power assistance, directly driving demand for sophisticated and reliable EPS sensors. As global EV adoption accelerates due to environmental concerns and government incentives, the market for these specialized sensors will expand proportionally.

Furthermore, the continuous advancements in sensor technology, including miniaturization, enhanced precision, and improved durability, open new avenues for market penetration. Innovations such as advanced Hall-effect sensors, magnetoresistive (MR) sensors, and contactless sensing solutions offer superior performance and longer lifespans, addressing previous limitations of traditional sensor designs. These technological leaps enable the integration of EPS sensors into more complex and space-constrained vehicle designs, including modular platforms and urban mobility solutions. The development of software-defined vehicles also creates opportunities for sensor manufacturers to offer highly customizable and upgradeable sensor solutions that can adapt to evolving software functionalities and performance requirements over the vehicle's lifecycle.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid growth of Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) markets | +1.8% | Global, particularly China, Europe, North America | Short to Long-term (2025-2033) |

| Technological advancements in sensor design and materials (e.g., Hall-effect, MR sensors) | +1.5% | Global, R&D focused regions like Germany, Japan, US | Mid to Long-term (2027-2033) |

| Expansion into new mobility solutions (e.g., robotaxis, last-mile delivery vehicles) | +1.0% | Urban centers, developed markets | Long-term (2029-2033) |

| Development of steer-by-wire and integrated chassis control systems | +1.2% | Global, R&D hubs | Mid to Long-term (2028-2033) |

Electric Power Steering Sensor Market Challenges Impact Analysis

Ensuring the reliability and functional safety of Electric Power Steering (EPS) sensors in diverse and demanding automotive environments poses a significant challenge for manufacturers. Sensors are exposed to extreme temperatures, vibrations, electromagnetic interference, and moisture, all of which can degrade performance or lead to catastrophic failure. Meeting stringent automotive safety standards, such as ISO 26262 for functional safety, requires extensive validation, redundancy measures, and robust design principles to mitigate risks. Any sensor malfunction in a safety-critical system like steering can have severe consequences, making reliability a paramount concern. This necessitates continuous investment in advanced testing methodologies and material science to produce sensors that can withstand the rigors of automotive operation over a vehicle's entire lifespan.

The intense competitive landscape and pricing pressures within the automotive supply chain also present a considerable challenge to EPS sensor manufacturers. As the market matures and more players enter, the pressure to reduce manufacturing costs while maintaining high quality increases. This often leads to thinner profit margins and necessitates continuous innovation in cost-effective production techniques, without compromising sensor performance or safety. Furthermore, managing complex global supply chains for specialized raw materials and electronic components, particularly in the face of geopolitical instability or natural disasters, adds another layer of complexity. Manufacturers must also navigate rapidly evolving technological standards and consumer expectations, requiring agile development processes and flexible manufacturing capabilities to remain competitive and meet market demands efficiently.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Ensuring functional safety and high reliability in harsh automotive environments | -0.6% | Global, affecting R&D and manufacturing | Ongoing (2025-2033) |

| Intense pricing pressure and competitive market landscape | -0.9% | Global, especially high-volume markets | Short to Mid-term (2025-2030) |

| Managing complex global supply chains and component availability | -0.7% | Global, impacting production schedules | Short-term (2025-2027) |

| Rapid technological evolution and need for constant R&D investment | -0.5% | Global, influencing long-term strategy | Long-term (2028-2033) |

Electric Power Steering Sensor Market - Updated Report Scope

This report provides a comprehensive analysis of the global Electric Power Steering Sensor market, offering detailed insights into market size, growth drivers, restraints, opportunities, and challenges. It covers an extensive forecast period from 2025 to 2033, with historical data from 2019 to 2023, providing a robust foundation for strategic decision-making. The scope encompasses detailed segmentation by sensor type, vehicle type, sales channel, and application, alongside a thorough regional analysis. The report highlights emerging trends, the impact of advanced technologies like AI and ADAS, and profiles key market players to offer a holistic view of the competitive landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.5 Billion |

| Growth Rate | 10.5% CAGR |

| Number of Pages | 257 |

| Key Trends | >|

| Segments Covered | >|

| Key Companies Covered | Robert Bosch GmbH, ZF Friedrichshafen AG, Denso Corporation, JTEKT Corporation, Nexteer Automotive, Continental AG, Mitsubishi Electric Corporation, Infineon Technologies AG, NXP Semiconductors N.V., Sensata Technologies, Magna International Inc., Valeo S.A., Schaeffler AG, BorgWarner Inc., Allegro MicroSystems, Inc., Analog Devices, Inc., TDK Corporation, Alps Alpine Co., Ltd., Novotechnik U.S. Inc., TE Connectivity |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Electric Power Steering Sensor market is segmented across various dimensions to provide a granular understanding of its dynamics, adoption patterns, and growth opportunities. These segmentations are critical for stakeholders to identify niche markets, tailor product development, and formulate targeted strategies. The market is primarily analyzed by sensor type, encompassing torque and position sensors which are fundamental to EPS operation. Further segmentation by vehicle type, including passenger cars and commercial vehicles, highlights the diverse application areas and varying requirements across different automotive segments.

The sales channel segmentation distinguishes between OEM and aftermarket sales, reflecting the primary sales avenues and revenue streams for sensor manufacturers. Moreover, the market is categorized by application, detailing the usage of EPS sensors in different EPS system configurations such as C-EPS, P-EPS, and R-EPS, as well as their crucial role in advanced functionalities like ADAS and autonomous driving. This comprehensive segmentation allows for a detailed assessment of market trends, competitive landscapes, and regional consumption patterns within each specific category, providing valuable insights for strategic planning.

- By Type: Torque Sensor, Position Sensor (Angle Sensor, Rotary Sensor), Current Sensor

- By Vehicle Type: Passenger Vehicles (Compact, Mid-size, Luxury), Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- By Sales Channel: Original Equipment Manufacturer (OEM), Aftermarket

- By Application: Column-Assist Electric Power Steering (C-EPS), Pinion-Assist Electric Power Steering (P-EPS), Rack-Assist Electric Power Steering (R-EPS), Advanced Driver-Assistance Systems (ADAS), Autonomous Driving

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to robust automotive production, particularly in China, Japan, India, and South Korea. Rapid urbanization, increasing disposable incomes, and the swift adoption of EVs contribute significantly to market expansion. Government initiatives promoting domestic manufacturing and EV sales further bolster demand for EPS sensors in the region.

- Europe: A mature market with strong emphasis on vehicle safety, emission reduction, and advanced automotive technologies. Germany, France, and the UK are key contributors, driven by stringent regulations, a high concentration of premium automotive manufacturers, and early adoption of ADAS and autonomous driving features. The robust growth of the European EV market also fuels demand.

- North America: Exhibits significant growth, propelled by the rising demand for SUVs and light trucks, increasing electrification of vehicles, and substantial investments in autonomous driving technologies. The US, being a major automotive market, leads innovation and adoption of advanced vehicle systems, creating a strong market for EPS sensors.

- Latin America: An emerging market with moderate growth, influenced by improving economic conditions, increasing vehicle parc, and gradual adoption of modern automotive technologies. Brazil and Mexico are key markets, benefiting from foreign investments in automotive manufacturing.

- Middle East and Africa (MEA): A nascent market with growth potential driven by increasing vehicle sales, infrastructure development, and a gradual shift towards more technologically advanced vehicles. Governments focusing on diversifying economies and modernizing transportation systems are key factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Power Steering Sensor Market.- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Denso Corporation

- JTEKT Corporation

- Nexteer Automotive

- Continental AG

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Sensata Technologies

- Magna International Inc.

- Valeo S.A.

- Schaeffler AG

- BorgWarner Inc.

- Allegro MicroSystems, Inc.

- Analog Devices, Inc.

- TDK Corporation

- Alps Alpine Co., Ltd.

- Novotechnik U.S. Inc.

- TE Connectivity

Frequently Asked Questions

What is an Electric Power Steering Sensor and how does it function?

An Electric Power Steering (EPS) sensor is a critical component in modern vehicle steering systems that measures the torque applied to the steering wheel by the driver or the angular position of the steering column. This data is transmitted to the EPS control unit, which then calculates the appropriate amount of electric motor assistance needed to ease steering. The sensor's real-time input ensures precise and variable steering assistance, enhancing driver comfort and vehicle handling, especially at different speeds.

What are the primary types of Electric Power Steering Sensors used in vehicles?

The primary types of EPS sensors are torque sensors and position (or angle) sensors. Torque sensors measure the twisting force applied to the steering shaft, indicating the driver's steering effort. Position sensors, on the other hand, determine the exact rotational angle of the steering wheel or column. Both types provide essential data for the EPS system to deliver accurate and responsive power assistance, often working in conjunction for redundancy and enhanced precision.

How do Electric Power Steering Sensors contribute to Advanced Driver-Assistance Systems (ADAS) and autonomous driving?

EPS sensors are fundamental to ADAS features like Lane Keeping Assist (LKA), Park Assist, and Adaptive Cruise Control, as they provide the crucial feedback loop for electronic steering control. In autonomous driving, these sensors enable the vehicle's computer to precisely control steering angles and torque without human intervention, ensuring accurate lane following, obstacle avoidance, and safe navigation. Their high precision and reliability are indispensable for the safe and effective operation of these advanced systems.

What are the key factors driving the growth of the Electric Power Steering Sensor market?

Key growth drivers include the increasing global adoption of Electric Power Steering (EPS) systems over traditional hydraulic ones due to fuel efficiency and reduced maintenance. The rapid expansion of the Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) markets, stringent global fuel efficiency and emission regulations, and the escalating demand for Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies are also significant contributors.

What challenges do manufacturers face in the Electric Power Steering Sensor market?

Manufacturers face challenges such as the high initial cost of developing and integrating advanced sensor technologies, which demands significant R&D investment. Ensuring functional safety and high reliability of sensors in harsh automotive environments, including extreme temperatures and vibrations, is another critical hurdle. Additionally, intense pricing pressures within the competitive automotive supply chain and managing complex global supply chains pose continuous challenges for profitability and production efficiency.