Edible Animal Fat Market

Edible Animal Fat Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702099 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Edible Animal Fat Market Size

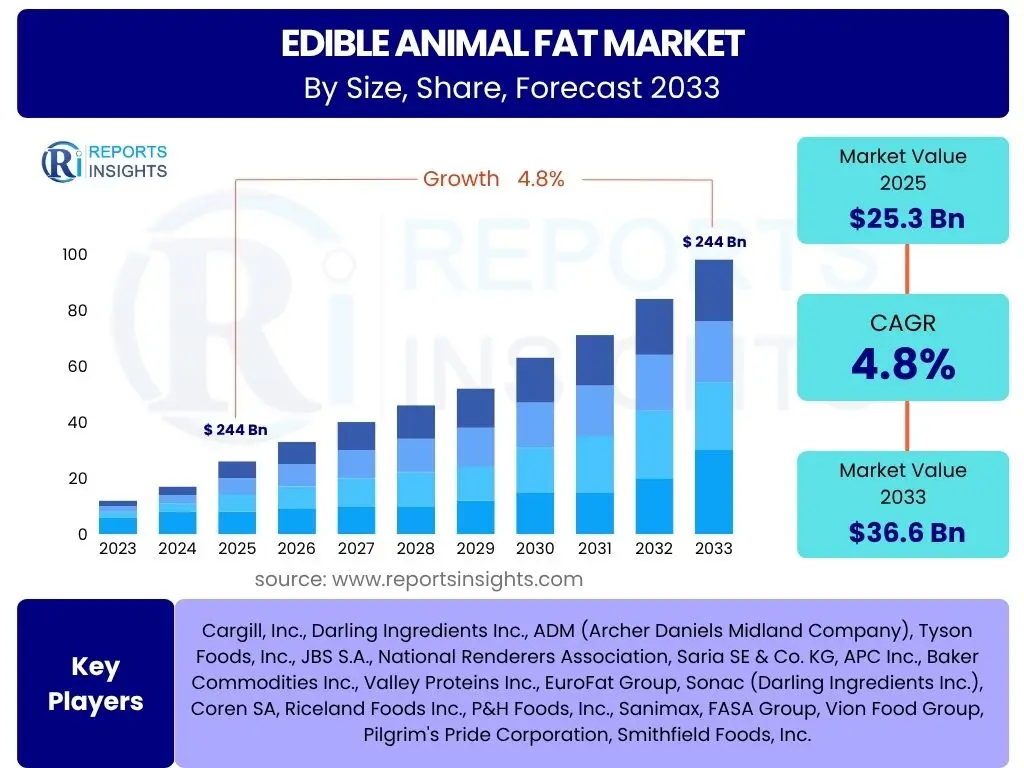

According to Reports Insights Consulting Pvt Ltd, The Edible Animal Fat Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2033. The market is estimated at USD 25.3 Billion in 2025 and is projected to reach USD 36.6 Billion by the end of the forecast period in 2033.

Key Edible Animal Fat Market Trends & Insights

The Edible Animal Fat market is experiencing dynamic shifts, driven by evolving consumer preferences and technological advancements. A significant trend involves a growing appreciation for traditional and natural ingredients, with consumers seeking authenticity and depth of flavor in their food products. This has led to renewed interest in animal fats like lard and tallow, particularly within artisanal and gourmet food sectors, as well as among specific dietary communities such as keto and paleo adherents who value their unique nutritional profiles and culinary versatility.

Another crucial insight pertains to the increasing focus on sustainability and ethical sourcing within the food industry. Consumers and food manufacturers are paying closer attention to the provenance of ingredients, including animal fats. This trend encourages suppliers to adopt more transparent and environmentally responsible practices in their rendering and processing operations, which can influence purchasing decisions and market positioning. Furthermore, the integration of animal fats into a wider array of processed foods and functional food applications is expanding their market reach beyond traditional uses, contributing to diversified demand.

The market also observes a notable trend in product innovation, where manufacturers are exploring new formulations and applications for animal fats. This includes creating specialized blends, enhancing texture and shelf-life in baked goods, and utilizing their unique flavor profiles in savory applications. The ability of animal fats to contribute to a "clean label" image, being less processed than many hydrogenated vegetable oils, further positions them favorably in a market increasingly wary of artificial additives.

- Renewed consumer interest in traditional and natural ingredients, emphasizing flavor and authenticity.

- Growing demand from specific dietary trends such as keto and paleo lifestyles.

- Increased focus on sustainable and ethically sourced animal fats across the supply chain.

- Diversification of applications into processed foods, functional foods, and gourmet products.

- Technological advancements in rendering and purification processes improving product quality and shelf-life.

- Premiumization of specialty animal fats for high-end culinary and bakery applications.

AI Impact Analysis on Edible Animal Fat

Artificial Intelligence holds significant potential to revolutionize various facets of the Edible Animal Fat market, addressing key operational and strategic challenges. In terms of supply chain management, AI-driven predictive analytics can forecast demand fluctuations with greater accuracy, optimizing inventory levels and reducing waste from raw material sourcing to final product distribution. This precision can minimize spoilage of raw animal trimmings and enhance the efficiency of rendering facilities, leading to better resource utilization and cost savings.

Moreover, AI can profoundly impact quality control and product consistency. Machine learning algorithms can analyze vast datasets from rendering processes, identifying optimal temperatures, pressures, and filtration techniques to ensure the highest quality and purity of animal fats. Automated visual inspection systems powered by AI can detect contaminants or inconsistencies, ensuring compliance with stringent food safety standards. This not only enhances product reliability but also builds greater consumer trust in the quality of animal fat ingredients.

Beyond operational efficiencies, AI offers opportunities for innovation in new product development and market analysis. AI can analyze consumer preferences and culinary trends to identify novel applications or blends of animal fats that cater to emerging demands. It can also help companies understand market dynamics, competitive landscapes, and regional preferences more deeply, enabling data-driven decisions for expansion and strategic positioning. The integration of AI can lead to a more agile, efficient, and responsive Edible Animal Fat industry.

- Predictive analytics for optimized raw material sourcing and demand forecasting, reducing waste.

- Enhanced quality control and consistency through AI-powered sensory analysis and automated inspection.

- Optimization of rendering processes for improved yield, purity, and energy efficiency.

- Development of smart supply chain logistics for real-time tracking and temperature management.

- AI-driven insights for new product formulation and identification of emerging market niches.

- Automated compliance monitoring with food safety regulations and quality standards.

Key Takeaways Edible Animal Fat Market Size & Forecast

The Edible Animal Fat market demonstrates robust and consistent growth, underscored by a projected CAGR of 4.8% through 2033. This positive trajectory indicates a sustained demand for these traditional ingredients across a variety of applications, driven by both established culinary practices and evolving dietary preferences. The market's expansion is not merely a reflection of increasing population but also a testament to the versatile functional properties of animal fats, which are increasingly valued in both industrial food production and artisanal cooking.

A significant takeaway from the market forecast is the resilience of edible animal fats in the face of competition from plant-based alternatives and health-related perceptions. While these factors present ongoing challenges, the market's growth is supported by a niche but expanding segment of consumers and food manufacturers who appreciate the unique texture, flavor, and mouthfeel that animal fats impart. This resilience highlights the importance of traditional culinary heritage and the continuous exploration of animal fats in innovative food formulations.

Furthermore, the forecast suggests that strategic investment in research and development, particularly concerning sustainable sourcing and advanced processing technologies, will be crucial for capitalizing on future opportunities. The ability to address consumer concerns regarding health, ethics, and environmental impact will distinguish market leaders and drive further growth. The market is poised for continued expansion, with a strong emphasis on balancing traditional values with modern consumer expectations and sustainable practices.

- The market is poised for steady expansion, projecting a healthy CAGR through 2033.

- Diverse applications across bakery, confectionery, and processed foods are key growth drivers.

- Increasing consumer appreciation for natural ingredients and rich flavor profiles supports demand.

- Sustainable sourcing and ethical production practices are becoming critical differentiators.

- Technological advancements in processing will continue to enhance product quality and versatility.

Edible Animal Fat Market Drivers Analysis

The Edible Animal Fat market is propelled by several fundamental drivers that underscore its sustained growth and relevance in the food industry. A primary factor is the increasing demand for processed and convenience foods globally. Animal fats are indispensable ingredients in many processed products, including snacks, ready meals, and frozen foods, providing desirable texture, flavor, and extending shelf life. As urbanization and busy lifestyles drive the consumption of these foods, the demand for animal fats proportionally increases.

Another significant driver is the resurgence of traditional and authentic culinary practices. Chefs and home cooks are rediscovering the unique flavor and superior cooking properties of fats like lard and tallow, moving away from highly refined vegetable oils for specific applications. This trend is further amplified by the popularity of high-fat, low-carbohydrate diets such as keto and paleo, which encourage the consumption of natural animal fats for their nutritional benefits and satiety. These dietary shifts create a dedicated consumer base that actively seeks out edible animal fats.

Additionally, the functional versatility of edible animal fats plays a crucial role in their market expansion. They are highly valued for their ability to contribute to rich mouthfeel, flaky textures in baked goods, and enhanced flavor profiles in savory dishes. Their unique melting points and crystalline structures make them ideal for specific industrial applications that cannot be easily replicated by other fats. The ongoing innovation in food product development, leveraging these unique properties, continues to broaden the application scope for animal fats.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Processed and Convenience Foods | +1.2% | Asia Pacific, North America, Europe | Short to Mid-term (2025-2030) |

| Resurgence of Traditional and Artisanal Cooking | +0.8% | North America, Europe, select APAC regions | Mid-term (2027-2033) |

| Functional Versatility in Food Processing and Bakery | +1.0% | Global | Long-term (2025-2033) |

| Increased Adoption in Keto and Paleo Diets | +0.6% | North America, Europe | Short to Mid-term (2025-2030) |

| Expanding Foodservice Sector and HoReCa Demand | +0.7% | Global, particularly emerging economies | Mid to Long-term (2027-2033) |

Edible Animal Fat Market Restraints Analysis

Despite its growth, the Edible Animal Fat market faces significant restraints that could impede its expansion. One of the primary challenges is the persistent public perception regarding the health implications of saturated fats. Decades of dietary recommendations have linked saturated fat consumption with cardiovascular diseases, leading to consumer apprehension and a general preference for leaner protein sources and unsaturated fats. This health concern, even with evolving scientific understanding, continues to influence consumer choices and regulatory guidelines, impacting the market negatively.

Another considerable restraint comes from the increasing competition from plant-based alternatives. The burgeoning market for vegan and vegetarian products, driven by health, ethical, and environmental concerns, offers a wide array of plant-based fats and oils that mimic the functional properties of animal fats. These alternatives, often marketed as healthier or more sustainable, directly compete with edible animal fats, particularly in sectors like bakery, confectionery, and processed foods. The rapid innovation in plant-based fat technology further intensifies this competition.

Furthermore, volatility in raw material prices and the complexities of the supply chain pose significant challenges. The availability and cost of animal raw materials (e.g., pork, beef, poultry trimmings) are subject to various factors including livestock diseases, feed costs, geopolitical events, and climate change, leading to unpredictable fluctuations. These price volatilities can impact profit margins for rendering companies and food manufacturers, making long-term planning and stable pricing difficult. Regulatory hurdles related to animal welfare, food safety, and environmental impact of rendering operations also add to the operational complexities and costs for market players.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Negative Consumer Perception of Saturated Fats | -0.9% | North America, Europe | Long-term (2025-2033) |

| Increasing Competition from Plant-Based Fats | -1.1% | Global | Short to Mid-term (2025-2030) |

| Volatility in Raw Material Prices and Supply | -0.7% | Global | Short-term (2025-2027) |

| Stringent Food Safety and Animal Welfare Regulations | -0.5% | Europe, North America | Mid-term (2027-2033) |

| Ethical and Environmental Concerns over Animal Agriculture | -0.6% | Europe, North America | Long-term (2025-2033) |

Edible Animal Fat Market Opportunities Analysis

Significant opportunities exist within the Edible Animal Fat market, primarily driven by product innovation and diversification into new applications. The development of specialized or blended animal fats, tailored for specific functional requirements in various food matrices, presents a lucrative avenue. This includes creating low-trans fat animal fats, fractionated fats with specific melting profiles, or blends with other oils to achieve desired textures and flavors. Such innovations can address concerns about saturated fat while still leveraging the unique culinary advantages of animal fats, thereby expanding their market appeal beyond traditional uses.

Emerging markets, particularly in Asia Pacific, Latin America, and parts of Africa, offer substantial growth potential. Rapid urbanization, increasing disposable incomes, and the expansion of the food processing and foodservice sectors in these regions are driving higher consumption of a wide range of food products, including those that incorporate animal fats. These markets often have strong culinary traditions that utilize animal fats, making their adoption in modern food production more culturally acceptable and integrated. Investing in localized production and distribution networks in these regions can unlock significant market share.

Furthermore, the growing interest in sustainable and circular economy models presents a unique opportunity for edible animal fat producers. As a co-product of the meat industry, rendering animal fats contributes to minimizing waste and maximizing the value of livestock. Marketing animal fats as a sustainable, natural ingredient derived from a circular economy approach can resonate strongly with environmentally conscious consumers and manufacturers. Developing certified sustainable sourcing programs and transparent supply chains can create a competitive advantage and differentiate products in the market, appealing to a broader segment of conscientious buyers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Product Innovation and Development of Specialized Fats | +1.1% | Global | Mid to Long-term (2027-2033) |

| Expansion into Emerging Markets (APAC, LatAm) | +1.0% | Asia Pacific, Latin America | Long-term (2025-2033) |

| Growth in Functional Food and Nutraceutical Applications | +0.9% | North America, Europe | Mid-term (2027-2033) |

| Leveraging Sustainable and Circular Economy Narratives | +0.8% | Global | Long-term (2025-2033) |

| Premiumization and Niche Market Development | +0.7% | North America, Europe | Short to Mid-term (2025-2030) |

Edible Animal Fat Market Challenges Impact Analysis

The Edible Animal Fat market faces several persistent challenges that require strategic responses from market participants. A significant hurdle is the ongoing consumer perception regarding the healthfulness of animal fats, particularly concerning their saturated fat content. Despite scientific nuances, mainstream dietary advice often encourages limiting saturated fat, which can deter a large segment of consumers. This challenge necessitates robust educational campaigns and product innovations that address health concerns while highlighting the unique benefits and responsible consumption of animal fats.

Another major challenge lies in managing the supply chain, which is inherently linked to the meat industry. Factors such as livestock health issues (e.g., African Swine Fever, Avian Flu), feed price fluctuations, and global trade policies can lead to significant volatility in the availability and cost of raw materials for rendering. These disruptions can impact production stability and profitability for manufacturers, requiring agile sourcing strategies and diversified supply channels to mitigate risks. Furthermore, regulatory landscapes concerning food safety, animal welfare, and environmental impact are becoming increasingly stringent, imposing higher compliance costs and operational complexities on producers.

The competitive landscape, particularly with the rapid growth of plant-based alternatives and novel food ingredients, also presents a substantial challenge. Manufacturers of plant-based fats are continually innovating to match the functional properties of animal fats, often with a perceived advantage in terms of health and sustainability claims. This intense competition necessitates continuous innovation in the animal fat sector, focusing on improving product quality, developing new applications, and effectively communicating the value proposition of animal fats to maintain and expand market share against evolving consumer preferences and rival products.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving Consumer Perception and Dietary Shifts | -0.8% | Global, particularly developed markets | Long-term (2025-2033) |

| Supply Chain Volatility and Raw Material Availability | -0.7% | Global | Short to Mid-term (2025-2030) |

| Intensifying Competition from Plant-Based Alternatives | -1.0% | Global | Mid-term (2027-2033) |

| Stringent Regulatory Compliance and Standards | -0.6% | Europe, North America | Long-term (2025-2033) |

| Ethical Sourcing and Animal Welfare Concerns | -0.5% | Europe, North America | Long-term (2025-2033) |

Edible Animal Fat Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Edible Animal Fat market, offering critical insights into its current landscape, historical performance, and future growth trajectories. The scope encompasses detailed market sizing, trend analysis, growth drivers, restraints, opportunities, and challenges influencing the industry across various segments and key geographical regions. It aims to equip stakeholders with actionable intelligence for strategic decision-making and market positioning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.3 Billion |

| Market Forecast in 2033 | USD 36.6 Billion |

| Growth Rate | 4.8% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc., Darling Ingredients Inc., ADM (Archer Daniels Midland Company), Tyson Foods, Inc., JBS S.A., National Renderers Association, Saria SE & Co. KG, APC Inc., Baker Commodities Inc., Valley Proteins Inc., EuroFat Group, Sonac (Darling Ingredients Inc.), Coren SA, Riceland Foods Inc., P&H Foods, Inc., Sanimax, FASA Group, Vion Food Group, Pilgrim's Pride Corporation, Smithfield Foods, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Edible Animal Fat market is broadly segmented to provide a detailed understanding of its diverse components and consumption patterns. These segments help in identifying specific demand drivers, competitive landscapes, and growth opportunities across various product types, applications, forms, sources, and distribution channels. The comprehensive segmentation offers granular insights into where growth is most prominent and where strategic investments can yield maximum returns, aiding both manufacturers and investors in their market strategies.

- By Type: This segment categorizes edible animal fats based on their primary source and composition, including Lard (from pork), Tallow (from beef and mutton), Butterfat (from dairy), Poultry Fat (from chicken, duck, turkey), and Other animal fats (e.g., from lamb, goat). Each type possesses unique characteristics, affecting their application and market value.

- By Application: This segmentation highlights the diverse uses of edible animal fats across various industries. Key applications include Bakery (for texture and flavor in pastries, bread, and cookies), Confectionery (in chocolates, candies, and glazes), Savory Snacks (chips, extruded snacks), Processed Foods (ready meals, frozen foods, sauces), HoReCa (Hotels, Restaurants, Cafes), Animal Feed, Cosmetics (as emollients), Biofuel production, and Other industrial uses.

- By Form: Edible animal fats are available in different physical states for various applications. This segment differentiates between Solid forms (e.g., block lard, hardened tallow) and Liquid forms (e.g., rendered fats, clarified butterfat) based on their processing and intended use.

- By Source: This segment delineates the primary animal sources from which the fats are derived, crucial for understanding supply dynamics and consumer preferences. Categories include Pork, Beef, Poultry, and Dairy, reflecting the major livestock industries contributing to fat production.

- By Distribution Channel: This segment outlines the various avenues through which edible animal fats reach end-users. It includes Business-to-Business (B2B) sales, which typically involve bulk supply to food manufacturers and foodservice providers, and Business-to-Consumer (B2C) channels, which encompass retail sales through Supermarkets/Hypermarkets, Convenience Stores, Online Retail platforms, and Specialty Stores catering to specific consumer needs.

Regional Highlights

- North America: This region exhibits a mature market with a strong demand from the processed food and foodservice sectors. Consumer interest in traditional cooking and specific dietary trends (keto, paleo) is driving the niche market for artisanal and premium animal fats. Innovation in sustainable sourcing and advanced processing technologies is also prominent here.

- Europe: Characterized by strong culinary traditions where animal fats are integral, coupled with increasing consumer awareness about healthy eating and sustainability. Western European countries are focusing on high-quality, traceable animal fats, while Eastern Europe continues to show consistent demand for traditional applications. Strict regulatory frameworks for food safety and animal welfare influence market dynamics.

- Asia Pacific (APAC): The largest and fastest-growing market, driven by a large population, rising disposable incomes, and rapid urbanization. Traditional culinary practices heavily incorporate animal fats in countries like China, India, and Southeast Asian nations. The expanding food processing industry and increasing consumption of meat and processed foods are key contributors to market growth.

- Latin America: This region presents significant growth potential, fueled by a growing food processing sector and strong cultural culinary heritage where animal fats are commonly used. Economic development and increasing industrialization are leading to higher demand for processed food products, creating opportunities for market expansion.

- Middle East and Africa (MEA): Emerging market with increasing demand for processed foods due to changing dietary habits and urbanization. While consumption is currently lower than other regions, the expanding tourism sector and growing investment in food manufacturing are expected to drive future growth in edible animal fat usage, particularly in savory applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Edible Animal Fat Market.- Cargill, Inc.

- Darling Ingredients Inc.

- ADM (Archer Daniels Midland Company)

- Tyson Foods, Inc.

- JBS S.A.

- National Renderers Association

- Saria SE & Co. KG

- APC Inc.

- Baker Commodities Inc.

- Valley Proteins Inc.

- EuroFat Group

- Sonac (Darling Ingredients Inc.)

- Coren SA

- Riceland Foods Inc.

- P&H Foods, Inc.

- Sanimax

- FASA Group

- Vion Food Group

- Pilgrim's Pride Corporation

- Smithfield Foods, Inc.

Frequently Asked Questions

What is the projected growth rate for the Edible Animal Fat Market?

The Edible Animal Fat Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2033, reaching an estimated USD 36.6 Billion by 2033.

What are the primary drivers of the Edible Animal Fat Market?

Key drivers include the growing demand for processed and convenience foods, a resurgence in traditional and artisanal cooking, the functional versatility of animal fats in various food applications, and increasing adoption in specific dietary trends like keto and paleo.

How do health concerns impact the Edible Animal Fat Market?

Persistent consumer perceptions regarding the saturated fat content in animal fats act as a significant restraint. However, ongoing product innovation and a focus on natural, less processed ingredients are helping to counterbalance these concerns, particularly in niche markets.

Which regions are key contributors to the Edible Animal Fat Market?

Asia Pacific (APAC) is the largest and fastest-growing region due to population growth and culinary traditions, while North America and Europe maintain significant market shares driven by processed food demand and increasing interest in traditional ingredients.

What opportunities exist for innovation in edible animal fats?

Opportunities lie in developing specialized or blended animal fats for specific functional requirements, expanding into emerging markets, leveraging sustainable sourcing narratives, and exploring applications in functional foods and nutraceuticals to meet evolving consumer demands.