Direct Digital Control Device Market

Direct Digital Control Device Market Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_707477 | Last Updated : September 08, 2025 |

Format : ![]()

![]()

![]()

![]()

Direct Digital Control Device Market Size

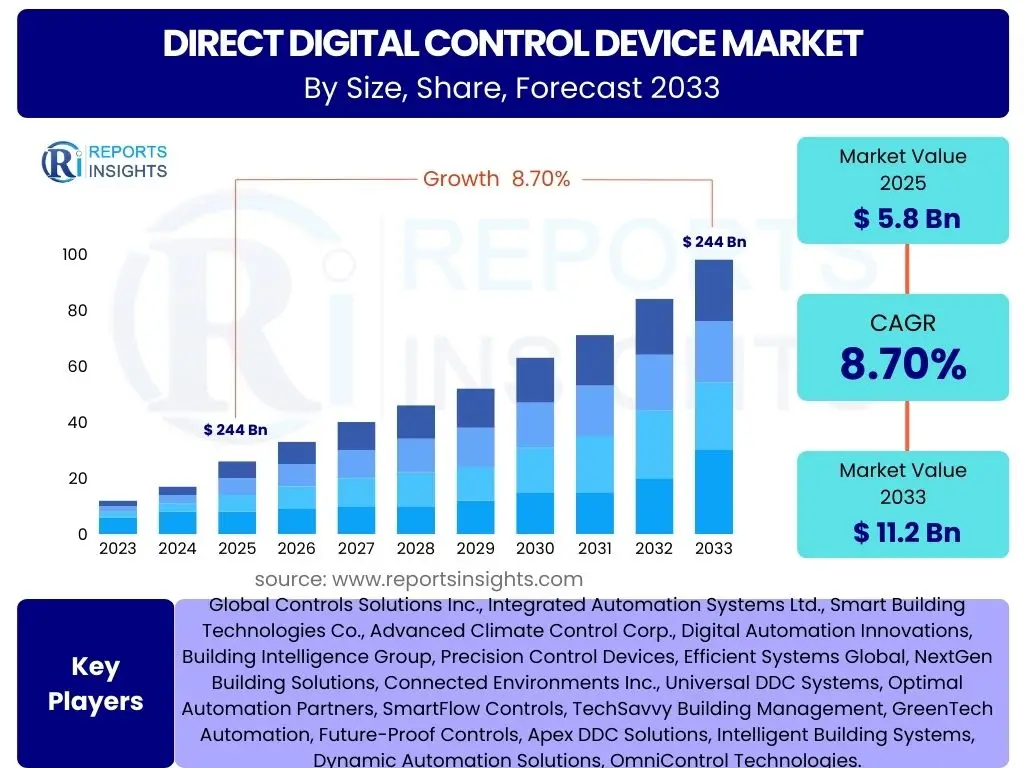

According to Reports Insights Consulting Pvt Ltd, The Direct Digital Control Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2033. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Key Direct Digital Control Device Market Trends & Insights

The Direct Digital Control (DDC) device market is undergoing significant transformation, driven by an increasing emphasis on smart infrastructure and energy efficiency. Users frequently inquire about the latest technological advancements and the overarching shifts in market dynamics. A prominent trend involves the deeper integration of DDC systems with the Internet of Things (IoT), enabling more sophisticated data collection and real-time operational adjustments. This integration allows for a higher degree of automation and predictive capabilities, moving beyond traditional scheduled operations to dynamic, responsive building management.

Another key insight is the growing adoption of cloud-based DDC solutions, which offer enhanced accessibility, scalability, and remote management capabilities. This trend addresses the demand for more flexible and less capital-intensive building automation solutions, particularly for distributed portfolios or smaller commercial properties. Furthermore, there is a clear push towards interoperability and open protocols, as end-users seek to avoid vendor lock-in and create more unified building ecosystems. This includes the wider acceptance of standards like BACnet and LonWorks, facilitating seamless communication between diverse building systems and DDC devices.

Sustainability initiatives are also profoundly influencing the DDC market. With stricter environmental regulations and corporate sustainability goals, DDC systems are increasingly viewed as essential tools for optimizing energy consumption, reducing carbon footprints, and improving indoor environmental quality. This focus on green building practices is not only a regulatory imperative but also a significant economic driver, as efficient DDC implementations can lead to substantial operational cost savings over the long term, attracting investment from various sectors.

- IoT integration for enhanced real-time data and automation

- Increased adoption of cloud-based DDC for scalability and remote access

- Emphasis on open protocols and interoperability standards (e.g., BACnet, LonWorks)

- Growing demand for energy-efficient and sustainable building solutions

- Shift towards predictive maintenance and fault detection capabilities

AI Impact Analysis on Direct Digital Control Device

The integration of Artificial Intelligence (AI) into Direct Digital Control (DDC) systems represents a paradigm shift, frequently prompting questions about its potential benefits, operational implications, and associated challenges. AI's primary impact on DDC is the transition from rule-based automation to intelligent, adaptive control. By leveraging machine learning algorithms, DDC systems can analyze vast quantities of data from sensors, building occupancy patterns, weather forecasts, and energy prices to make proactive, optimized decisions. This enables dynamic adjustments to HVAC, lighting, and other building systems that surpass the efficiency achievable with traditional programming, leading to significant energy savings and improved occupant comfort.

Furthermore, AI enhances the predictive capabilities of DDC devices. Rather than merely reacting to conditions, AI-powered DDC can predict equipment failures, identify suboptimal operational patterns, and even anticipate occupant needs. This shift towards predictive maintenance minimizes downtime, extends asset lifespan, and reduces emergency repair costs, thereby improving the overall operational efficiency of buildings. Concerns often raised by users include data privacy, the complexity of implementing and maintaining AI algorithms, and the need for a skilled workforce capable of managing these advanced systems. However, the long-term benefits in terms of resource optimization and operational intelligence typically outweigh these initial hurdles.

Generative AI is also beginning to show promise in DDC by assisting in the design and optimization of control strategies, potentially automating the complex programming tasks traditionally performed by engineers. This could significantly reduce commissioning times and improve the accuracy of initial system setups. While still in nascent stages for direct DDC application, generative capabilities could revolutionize how control sequences are developed, tested, and deployed, making DDC systems more accessible and adaptable to evolving building requirements. The ethical considerations and reliability of AI-driven autonomous decisions remain key discussion points within the industry, yet the trajectory towards more intelligent and self-optimizing DDC is clear.

- Enhanced energy optimization through predictive analytics and adaptive control

- Proactive fault detection and predictive maintenance for equipment longevity

- Improved occupant comfort and indoor air quality through intelligent environmental adjustments

- Automation of complex control logic generation and optimization tasks

- Potential for reduced commissioning times and operational costs

Key Takeaways Direct Digital Control Device Market Size & Forecast

A primary takeaway from the Direct Digital Control Device market size and forecast analysis is the consistent and robust growth trajectory anticipated over the next decade. Users frequently seek concise summaries of market vitality and the factors underpinning its expansion. The projected increase from USD 5.8 Billion in 2025 to USD 11.2 Billion by 2033, at an 8.7% CAGR, underscores the critical role DDC systems are expected to play in modern infrastructure. This growth is not merely incremental but reflective of a fundamental shift towards intelligent, energy-efficient, and sustainable building management solutions across diverse sectors globally.

Another crucial insight is the accelerating integration of DDC with advanced technologies such as IoT, AI, and cloud computing. These integrations are not just enhancing the capabilities of DDC devices but also expanding their addressable market by offering more comprehensive, scalable, and data-driven solutions. The market is moving beyond basic automation towards predictive intelligence, offering building owners and operators unprecedented control and optimization opportunities. This technological evolution is a key driver for new installations and significant upgrades of existing systems, ensuring sustained demand throughout the forecast period.

Furthermore, the market's resilience is bolstered by the increasing stringency of energy efficiency regulations and the growing global commitment to decarbonization and smart city initiatives. These external pressures, combined with the inherent benefits of DDC in reducing operational costs and environmental impact, create a compelling value proposition that will continue to drive adoption. Geographically, while established markets like North America and Europe will see steady growth driven by retrofits and technological upgrades, emerging economies in Asia Pacific and Latin America are poised for rapid expansion due to new construction and rapid urbanization, highlighting a truly global growth opportunity.

- Significant and stable market expansion projected through 2033.

- Technological convergence (IoT, AI, cloud) as a primary growth catalyst.

- Strong demand driven by energy efficiency mandates and smart building trends.

- Emerging markets contributing substantially to global growth.

- Focus on operational cost reduction and sustainability driving adoption across sectors.

Direct Digital Control Device Market Drivers Analysis

The Direct Digital Control (DDC) Device market is propelled by a confluence of powerful drivers that underscore its increasing importance in modern infrastructure. A paramount driver is the global imperative for enhanced energy efficiency and sustainability in buildings. With rising energy costs and stricter environmental regulations, building owners and facility managers are actively seeking solutions that can optimize energy consumption, reduce carbon footprints, and achieve green building certifications. DDC systems, by providing precise control over HVAC, lighting, and other energy-intensive systems, directly address these needs, offering measurable savings and environmental benefits.

Another significant driver is the rapid proliferation of smart building initiatives and the broader adoption of the Internet of Things (IoT) in commercial and industrial sectors. DDC devices are fundamental components of smart building ecosystems, enabling seamless connectivity, data exchange, and integrated management of various building functions. The demand for intelligent buildings that can adapt to occupant needs, respond to real-time conditions, and facilitate centralized control is fostering the expansion of DDC implementations. This integration with IoT platforms unlocks advanced analytics and automation capabilities, further enhancing the appeal of DDC solutions.

Finally, the operational benefits derived from DDC systems, such as improved occupant comfort, enhanced operational efficiency, and reduced maintenance costs, serve as strong market drivers. By offering granular control, DDC systems can maintain optimal indoor environmental quality, contributing to higher productivity and satisfaction among occupants. Predictive maintenance capabilities, facilitated by DDC data, allow for proactive servicing of equipment, minimizing downtime and extending asset lifespans. These tangible operational advantages provide a compelling return on investment, incentivizing widespread adoption across diverse end-use sectors including commercial, industrial, and even residential applications.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Energy Efficiency & Sustainability | +2.5% | Global, particularly Europe & North America | Mid-to-Long Term |

| Rapid Adoption of Smart Building & IoT Technologies | +2.0% | North America, Asia Pacific | Short-to-Mid Term |

| Increasing Operational Cost Savings & ROI | +1.8% | All Regions | Short-to-Long Term |

| Stringent Building Codes & Regulations | +1.5% | Europe, North America, parts of Asia Pacific | Long Term |

| Aging Infrastructure & Retrofit Opportunities | +1.2% | Developed Economies | Mid-to-Long Term |

Direct Digital Control Device Market Restraints Analysis

Despite its significant growth potential, the Direct Digital Control (DDC) Device market faces several restraints that could impede its expansion. One primary challenge is the high initial capital investment required for DDC system installation. For many small and medium-sized enterprises (SMEs) or existing older buildings, the upfront cost of DDC hardware, software, and installation can be prohibitive, acting as a significant barrier to adoption. While the long-term operational savings are substantial, the initial expenditure often deters potential users, particularly in regions with tighter budgetary constraints.

Another notable restraint is the complexity associated with the integration of DDC systems with legacy building infrastructure. Many existing buildings utilize older, proprietary control systems that are not easily compatible with modern DDC technologies. Retrofitting these buildings requires significant investment in terms of hardware upgrades, software integration, and specialized technical expertise, leading to extended project timelines and increased costs. The lack of standardized communication protocols across diverse building systems also exacerbates these integration challenges, creating interoperability hurdles that can complicate seamless DDC deployment.

Furthermore, the market is constrained by a shortage of skilled professionals capable of designing, installing, commissioning, and maintaining advanced DDC systems. The sophisticated nature of DDC technology, coupled with its convergence with IT and IoT, demands specialized knowledge in areas such as control engineering, network security, and data analytics. This talent gap can lead to slower adoption rates, inefficient system operation, and increased reliance on external consultants, adding to the overall cost and complexity for end-users. Cybersecurity concerns also pose a growing restraint, as connected DDC systems become potential targets for cyberattacks, necessitating robust security measures and ongoing vigilance.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment Costs | -1.5% | Developing Economies, SMEs | Short-to-Mid Term |

| Complexity of Integration with Legacy Systems | -1.2% | Developed Economies with older infrastructure | Mid Term |

| Lack of Skilled Workforce | -1.0% | Global, particularly emerging markets | Long Term |

| Cybersecurity Risks and Data Privacy Concerns | -0.8% | Global | Short-to-Long Term |

| Perceived Long Payback Period for Certain Applications | -0.7% | Various Sectors | Short-to-Mid Term |

Direct Digital Control Device Market Opportunities Analysis

Significant opportunities are emerging within the Direct Digital Control (DDC) Device market, promising to fuel its sustained growth. One key area of opportunity lies in the burgeoning demand for retrofitting and upgrading existing commercial and institutional buildings. A vast number of older structures worldwide operate with outdated or inefficient control systems, presenting a substantial market for modern DDC solutions that can deliver immediate energy savings and operational improvements. The increasing awareness among building owners about the long-term economic and environmental benefits of DDC upgrades is driving this segment, offering a lucrative avenue for market players.

Another major opportunity stems from the rapid expansion of smart city initiatives and large-scale infrastructure projects, particularly in developing regions. These projects inherently require advanced building management systems to ensure efficiency, safety, and sustainability. DDC devices, as foundational components for intelligent urban environments, are experiencing heightened demand within new construction projects, smart hospitals, smart campuses, and integrated commercial complexes. This trend is especially pronounced in Asia Pacific, where urbanization rates are high and significant investments are being made in greenfield developments and modernized public infrastructure.

Furthermore, the continuous innovation in DDC technology, particularly the integration of Artificial Intelligence (AI), Machine Learning (ML), and cloud computing, is creating new market avenues. AI-powered DDC offers advanced capabilities such as predictive maintenance, fault detection and diagnostics, and autonomous optimization, moving beyond traditional control logic. This technological evolution allows DDC systems to offer higher value propositions, including enhanced operational efficiency, reduced human intervention, and improved resource management. The development of more user-friendly interfaces and modular, scalable DDC solutions also opens up opportunities in the small and medium-sized building segments, which have historically been underserved by complex building automation systems.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Retrofitting & Upgrading Existing Buildings | +1.8% | Developed Economies (North America, Europe) | Mid-to-Long Term |

| Expansion in Smart Cities & New Construction Projects | +1.5% | Asia Pacific, Middle East & Africa | Short-to-Long Term |

| Integration of AI, ML, and Cloud-based Solutions | +1.3% | Global | Mid-to-Long Term |

| Growth in Green Building Certifications & Standards | +1.0% | Global | Long Term |

| Untapped Market in Small & Medium-Sized Buildings | +0.9% | All Regions | Mid Term |

Direct Digital Control Device Market Challenges Impact Analysis

The Direct Digital Control Device market, while expanding, confronts several inherent challenges that demand strategic responses from market participants. A significant challenge revolves around the interoperability of DDC systems with diverse building management systems (BMS) and equipment from various vendors. The lack of universal standards and the prevalence of proprietary protocols can lead to integration complexities, limiting the ability of DDC systems to communicate seamlessly with all installed devices. This fragmentation hinders comprehensive building automation and can increase installation and maintenance costs, posing a hurdle for widespread adoption and creating vendor lock-in scenarios.

Another critical challenge is the escalating concern over cybersecurity threats and data privacy within interconnected building ecosystems. As DDC systems become more networked and integrated with IT infrastructure, they present potential vulnerabilities that malicious actors could exploit. Breaches could lead to operational disruptions, data theft, or even physical damage to building assets. Ensuring robust cybersecurity measures, including encryption, access control, and regular security updates, is paramount but also adds to the cost and complexity of DDC deployment and management. Addressing these security concerns while maintaining system accessibility and functionality is a delicate balance.

Furthermore, the rapid pace of technological advancements, particularly in areas like IoT, AI, and connectivity, presents both an opportunity and a challenge. While these innovations drive market growth, they also lead to rapid product obsolescence, requiring continuous investment in research and development from manufacturers and frequent upgrades from end-users. Keeping up with these evolving technologies, adapting existing infrastructure, and ensuring future-proof solutions become complex tasks. Additionally, economic downturns or fluctuations in construction activity can directly impact DDC market demand, as building automation investments are often tied to capital expenditure cycles. This introduces a degree of market volatility that requires careful planning and diversified strategies from key players.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Interoperability and Standardization Issues | -1.3% | Global | Long Term |

| Growing Cybersecurity Risks | -1.0% | Global | Short-to-Long Term |

| Rapid Technological Obsolescence | -0.9% | Global | Mid Term |

| Economic Volatility & Construction Sector Dependence | -0.8% | Regional variations | Short Term |

| User Acceptance and Training Requirements | -0.6% | All Regions | Mid Term |

Direct Digital Control Device Market - Updated Report Scope

This report provides a comprehensive analysis of the Direct Digital Control (DDC) Device market, offering detailed insights into market size, growth drivers, restraints, opportunities, and challenges across various segments and regions. It encompasses a thorough examination of current market trends, the impact of emerging technologies such as Artificial Intelligence, and strategic profiles of key market players, providing a holistic view for stakeholders seeking to understand and capitalize on market dynamics from 2025 to 2033.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 8.7% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Controls Solutions Inc., Integrated Automation Systems Ltd., Smart Building Technologies Co., Advanced Climate Control Corp., Digital Automation Innovations, Building Intelligence Group, Precision Control Devices, Efficient Systems Global, NextGen Building Solutions, Connected Environments Inc., Universal DDC Systems, Optimal Automation Partners, SmartFlow Controls, TechSavvy Building Management, GreenTech Automation, Future-Proof Controls, Apex DDC Solutions, Intelligent Building Systems, Dynamic Automation Solutions, OmniControl Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Direct Digital Control (DDC) Device market is meticulously segmented to provide a granular understanding of its diverse landscape and growth opportunities. This segmentation considers various aspects, including the type of components utilized, the specific applications they serve, the end-user sectors adopting these systems, and the underlying connectivity technologies. Analyzing these segments helps in identifying key revenue streams, market penetration rates, and areas ripe for innovation and investment. The detailed breakdown provides stakeholders with targeted insights to develop effective strategies for different market niches and consumer needs.

- By Component:

- Hardware (Controllers, Sensors, Actuators, Communication Modules)

- Software (Building Management Systems (BMS), Energy Management Software, Analytics & Optimization Platforms)

- Services (Installation, Maintenance & Support, Consulting & Design)

- By Application:

- Heating, Ventilation, and Air Conditioning (HVAC) Control

- Lighting Control

- Security & Access Control

- Energy Management

- Fire and Life Safety Systems

- By End-User:

- Commercial (Office Buildings, Retail & Shopping Centers, Healthcare Facilities, Hospitality, Educational Institutions)

- Industrial (Manufacturing Plants, Data Centers)

- Residential (Smart Homes, Multi-Family Residential)

- By Connectivity:

- Wired

- Wireless

Regional Highlights

- North America: This region is a leading market for DDC devices, driven by a high adoption rate of smart building technologies, stringent energy efficiency regulations, and significant investments in commercial and institutional infrastructure upgrades. The presence of key market players and a robust technological ecosystem further solidify its dominance, with a strong emphasis on retrofit projects.

- Europe: Characterized by strong governmental mandates for green buildings and energy conservation, Europe exhibits substantial growth in the DDC market. Countries like Germany, the UK, and France are at the forefront, pushing for sustainable building practices and smart city initiatives, thereby creating a fertile ground for DDC system deployment and innovation.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC is fueled by rapid urbanization, massive infrastructure development, and increasing awareness of energy management in developing economies such as China, India, and Southeast Asian countries. The burgeoning construction sector and smart city projects are major catalysts for DDC adoption in this region.

- Latin America: This region presents emerging opportunities for DDC growth, primarily driven by increasing foreign investments in commercial and industrial construction, coupled with a growing focus on energy efficiency. Brazil and Mexico are key markets showing steady adoption of DDC technologies as awareness and infrastructure improve.

- Middle East and Africa (MEA): Significant investments in mega-projects, smart cities, and diverse commercial developments, particularly in the GCC countries, are propelling the DDC market in MEA. The region's need for advanced climate control solutions in challenging environments and a push towards sustainable development further contribute to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct Digital Control Device Market.- Global Controls Solutions Inc.

- Integrated Automation Systems Ltd.

- Smart Building Technologies Co.

- Advanced Climate Control Corp.

- Digital Automation Innovations

- Building Intelligence Group

- Precision Control Devices

- Efficient Systems Global

- NextGen Building Solutions

- Connected Environments Inc.

- Universal DDC Systems

- Optimal Automation Partners

- SmartFlow Controls

- TechSavvy Building Management

- GreenTech Automation

- Future-Proof Controls

- Apex DDC Solutions

- Intelligent Building Systems

- Dynamic Automation Solutions

- OmniControl Technologies

Frequently Asked Questions

Analyze common user questions about the Direct Digital Control Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Direct Digital Control (DDC) Device?

A Direct Digital Control (DDC) device is an electronic controller that uses a microprocessor to manage and automate mechanical and electrical systems in buildings, such as HVAC, lighting, and security. It directly receives input signals from sensors, processes data digitally, and sends output signals to actuators to control equipment, optimizing building performance and energy efficiency.

How does DDC improve building energy efficiency?

DDC systems enhance energy efficiency by providing precise, real-time control over building systems. They enable optimized scheduling, occupancy-based control, demand-response capabilities, and detailed energy monitoring, which collectively minimize wasted energy from heating, cooling, and lighting, leading to significant utility cost reductions.

What are the primary benefits of implementing DDC systems?

The key benefits of DDC implementation include substantial energy savings, improved occupant comfort through precise environmental control, reduced operational and maintenance costs via predictive analytics, enhanced indoor air quality, centralized monitoring and control, and increased flexibility and adaptability for future building modifications.

What are the main challenges in adopting DDC technology?

Key challenges in DDC adoption involve the high initial capital investment, complex integration with existing legacy systems, a shortage of skilled personnel for installation and maintenance, and growing concerns related to cybersecurity risks due to increased connectivity and potential vulnerabilities.

What is the future outlook for the Direct Digital Control Device market?

The future outlook for the DDC market is highly positive, driven by continued integration with IoT, AI, and cloud computing for advanced analytics and autonomous control. The market is expected to expand significantly due to global smart city initiatives, increasing demand for sustainable buildings, and the growing emphasis on operational efficiency and occupant well-being.