Digital Lending Platform Market

Digital Lending Platform Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703462 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Digital Lending Platform Market Size

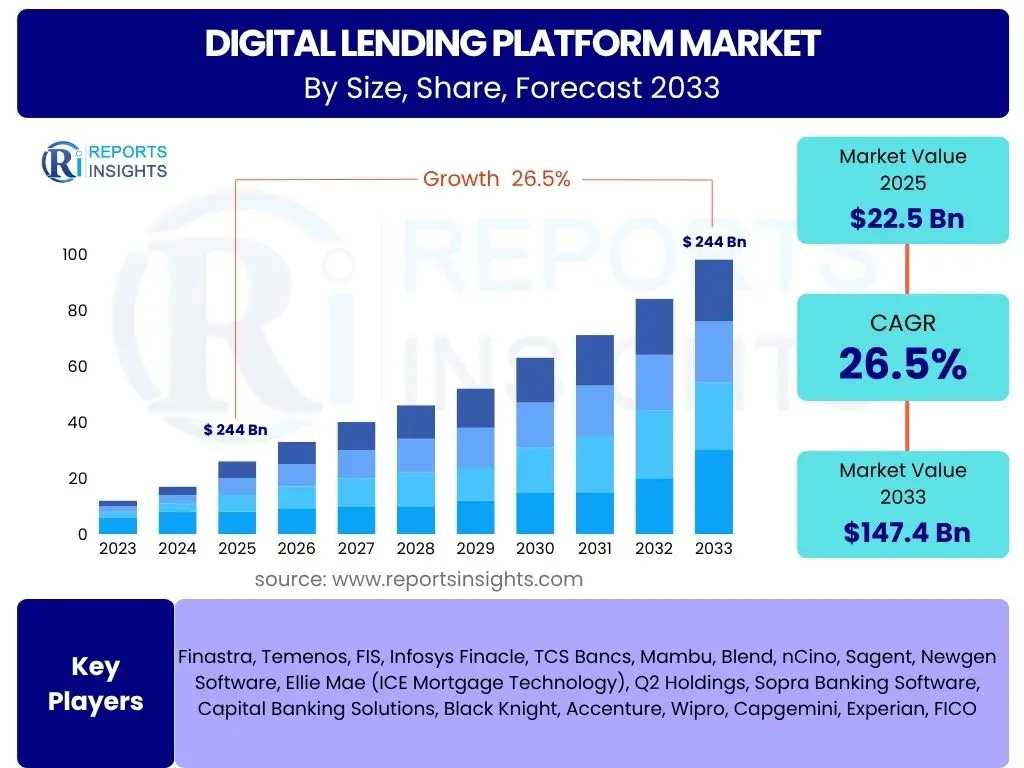

According to Reports Insights Consulting Pvt Ltd, The Digital Lending Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 26.5% between 2025 and 2033. The market is estimated at USD 22.5 billion in 2025 and is projected to reach USD 147.4 billion by the end of the forecast period in 2033.

Key Digital Lending Platform Market Trends & Insights

The digital lending platform market is undergoing a profound transformation, driven by an increasing demand for seamless and expedited access to credit. Key trends indicate a significant shift from traditional lending models to more agile, data-driven, and customer-centric approaches. Users are increasingly seeking insights into how technological advancements, particularly in areas like artificial intelligence and cloud computing, are shaping the future of loan origination, underwriting, and servicing. The emphasis is on efficiency, personalization, and risk management through innovative solutions.

Another prevalent area of interest concerns the expansion of digital lending into new demographics and market segments, including small and medium-sized enterprises (SMEs) and underserved populations. The rise of embedded finance, where lending services are seamlessly integrated into non-financial platforms, represents a major paradigm shift. Furthermore, regulatory landscapes continue to evolve, compelling platforms to prioritize compliance while simultaneously fostering innovation. These dynamics collectively define the strategic direction and growth vectors of the digital lending ecosystem.

- Rise of Embedded Finance: Lending services integrated directly into e-commerce, ERPs, and other platforms.

- Hyper-Personalization of Loan Products: Leveraging data analytics for tailored offerings and customer experiences.

- Cloud-Native Platform Adoption: Increased shift to scalable, flexible, and cost-efficient cloud infrastructure.

- Focus on End-to-End Digital Journeys: Streamlining loan application, approval, and disbursement processes.

- Enhanced Data Security and Privacy: Prioritization of robust cybersecurity measures and compliance with data protection regulations.

- Expansion into Underserved Markets: Reaching individuals and SMEs previously excluded from traditional finance.

- Sustainable and Responsible Lending: Growing emphasis on environmental, social, and governance (ESG) factors in lending decisions.

AI Impact Analysis on Digital Lending Platform

Common user questions regarding AI's impact on digital lending platforms frequently center on its capabilities in enhancing operational efficiency, improving credit risk assessment, and personalizing customer experiences. Users are particularly interested in how AI-driven analytics can unlock deeper insights from vast datasets, enabling more accurate and rapid lending decisions. Concerns often revolve around the ethical implications of AI, such as bias in algorithms, data privacy, and the need for explainable AI to ensure transparency and trust in automated processes. The expectation is that AI will continue to revolutionize the underwriting process, moving beyond traditional credit scores to incorporate alternative data points for a more holistic view of borrower creditworthiness.

Moreover, there is significant interest in AI's role in automating various stages of the lending lifecycle, from lead generation and application processing to fraud detection and debt collection. This automation is anticipated to reduce manual errors, accelerate turnaround times, and lower operational costs. As digital lending platforms mature, AI is seen as a critical enabler for scalability, allowing lenders to process a higher volume of applications with greater precision. The integration of machine learning models for predictive analytics, anomaly detection, and customer behavior forecasting is expected to provide a competitive edge, driving both market growth and improved financial inclusion.

- Enhanced Credit Underwriting: AI algorithms analyze diverse data for more accurate risk assessments and faster decisions.

- Automated Fraud Detection: Machine learning identifies suspicious patterns and anomalies to prevent fraudulent activities.

- Personalized Customer Experiences: AI-driven insights enable tailored product recommendations and customized interactions.

- Operational Efficiency: Automation of routine tasks like document verification and application processing reduces costs and turnaround times.

- Predictive Analytics for Default Rates: AI models forecast potential loan defaults, aiding proactive risk management.

- Improved Debt Collection Strategies: AI optimizes collection efforts by identifying optimal communication channels and timings.

- Algorithmic Bias Mitigation: Ongoing efforts to develop fair and unbiased AI models for equitable lending.

Key Takeaways Digital Lending Platform Market Size & Forecast

Users frequently inquire about the overarching implications of the digital lending platform market's substantial growth trajectory. Key takeaways indicate a robust and expanding market driven by technological innovation, evolving consumer expectations, and increasing penetration into untapped markets. The forecast of significant expansion underscores the industry's shift towards digital-first strategies, where efficiency, accessibility, and speed are paramount. This growth is not merely quantitative but also reflects a qualitative evolution in how financial services are delivered, making credit more democratic and readily available.

The market's future is characterized by a continued embrace of advanced analytics and artificial intelligence, which will further refine credit risk models and personalize lending experiences. Furthermore, strategic partnerships between traditional financial institutions and agile fintech companies are expected to accelerate innovation and market reach. For stakeholders, these insights highlight critical investment opportunities in technology infrastructure, data security, and compliance frameworks, positioning the digital lending sector as a cornerstone of the modern financial landscape.

- Substantial Growth Projection: The market is set for exponential growth, reaching USD 147.4 billion by 2033.

- Technology as a Core Enabler: AI, cloud, and big data are central to market expansion and competitive differentiation.

- Customer-Centric Evolution: Emphasis on seamless, personalized, and rapid lending experiences.

- Increased Financial Inclusion: Digital platforms are reaching previously underserved individuals and businesses.

- Strategic Investment Opportunities: Growth fuels demand for advanced lending software, security solutions, and compliance tools.

- Shifting Business Models: Rise of embedded finance and Banking-as-a-Service (BaaS) influencing market dynamics.

- Regulatory Adaptation: Continued need for agile compliance strategies in a rapidly evolving legislative environment.

Digital Lending Platform Market Drivers Analysis

The proliferation of internet and smartphone penetration globally has significantly democratized access to financial services, creating a fertile ground for digital lending platforms. As consumers and businesses increasingly conduct their transactions online, the expectation for immediate and convenient access to credit has surged, directly fueling the demand for digital lending solutions. The traditional banking sector's slower, often cumbersome processes have further propelled the shift towards agile digital platforms that can offer rapid approvals and disbursements. This fundamental shift in consumer behavior and technological readiness is a primary driver for market expansion.

Furthermore, supportive regulatory frameworks in various regions, aimed at fostering financial inclusion and innovation, have created an enabling environment for digital lenders. Governments and financial authorities are recognizing the potential of these platforms to address credit gaps and stimulate economic growth, leading to policies that encourage digital transformation within the financial sector. The inherent scalability and cost-efficiency of digital models, coupled with their ability to leverage alternative data for credit assessment, allow them to serve a broader demographic more effectively than conventional lenders, further accelerating market adoption.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Smartphone & Internet Penetration | +5.5% | Asia Pacific, Latin America, Africa | 2025-2033 |

| Growing Demand for Faster & Convenient Loans | +4.8% | North America, Europe, Asia Pacific | 2025-2033 |

| Digital Transformation in Financial Services | +4.2% | Global | 2025-2033 |

| Rising Adoption of Cloud-Based Solutions | +3.9% | North America, Europe | 2025-2033 |

| Expansion of E-commerce & Online Transactions | +3.5% | Asia Pacific, Latin America | 2025-2033 |

Digital Lending Platform Market Restraints Analysis

Despite the robust growth, the digital lending platform market faces significant restraints, primarily stemming from concerns around data security and privacy. The handling of sensitive financial and personal information by these platforms makes them prime targets for cyberattacks, leading to a constant need for substantial investment in cybersecurity infrastructure. Breaches of data can severely erode consumer trust, leading to user churn and reputational damage. Regulatory bodies globally are also imposing stricter data protection laws, such as GDPR and CCPA, which necessitate complex compliance efforts and can increase operational costs for platforms, particularly those operating across multiple jurisdictions.

Another major restraint is the evolving and fragmented regulatory landscape across different countries and even within regions. Digital lending is a relatively new domain, and regulations are often reactive, leading to uncertainty and the need for constant adaptation. This regulatory ambiguity can hinder market entry for new players and complicate expansion for existing ones, as compliance requirements vary significantly. Additionally, the inherent resistance from traditional financial institutions, coupled with high initial investment costs for developing sophisticated digital platforms and the challenge of establishing trust with a wary consumer base, pose considerable headwinds to market acceleration.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Cybersecurity & Data Privacy Concerns | -3.0% | Global | 2025-2033 |

| Evolving & Fragmented Regulatory Landscape | -2.5% | Europe, Asia Pacific | 2025-2033 |

| Resistance from Traditional Financial Institutions | -2.0% | North America, Europe | 2025-2030 |

| Lack of Digital Literacy in Certain Demographics | -1.8% | Emerging Economies | 2025-2033 |

| High Implementation and Maintenance Costs | -1.5% | Global (SMEs, Smaller Lenders) | 2025-2033 |

Digital Lending Platform Market Opportunities Analysis

The digital lending platform market presents significant opportunities, particularly in addressing the financial needs of the unbanked and underbanked populations globally. A substantial portion of the world's population lacks access to formal financial services, and digital lending platforms, with their lower operational costs and ability to leverage alternative data for credit assessment, are uniquely positioned to serve this vast market. This includes individuals and small businesses in emerging economies who often lack traditional credit histories but demonstrate creditworthiness through other digital footprints. Expanding into these segments not only promotes financial inclusion but also unlocks new revenue streams for market players.

Another major opportunity lies in the continued integration of advanced technologies like blockchain for enhanced transparency, security, and efficiency in lending processes, and the deeper adoption of AI and machine learning for hyper-personalization of financial products. The trend towards embedded finance, where lending options are seamlessly integrated into non-financial platforms like e-commerce sites or ERP systems, also represents a substantial growth avenue. This allows lenders to reach customers at their point of need, reducing friction and improving conversion rates. Furthermore, the increasing acceptance of digital identities and open banking initiatives provides a fertile ground for developing innovative and interconnected lending solutions.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Serving Unbanked & Underbanked Populations | +4.0% | Asia Pacific, Latin America, Africa | 2025-2033 |

| Integration of Embedded Finance Models | +3.7% | Global | 2025-2033 |

| Leveraging Blockchain for Enhanced Security & Transparency | +3.2% | Global | 2028-2033 |

| Expansion into Business-to-Business (B2B) Lending | +2.9% | North America, Europe | 2025-2033 |

| Partnerships with Traditional Financial Institutions | +2.5% | Global | 2025-2033 |

Digital Lending Platform Market Challenges Impact Analysis

The digital lending platform market faces a prominent challenge in maintaining robust cybersecurity measures against increasingly sophisticated cyber threats. As more financial transactions and sensitive customer data migrate online, the risk of data breaches, phishing attacks, and ransomware escalates, demanding continuous and significant investment in security infrastructure and protocols. A single security incident can not only result in financial losses but also severely damage customer trust and brand reputation, impacting long-term market growth. This ongoing battle against cybercriminals requires platforms to be constantly vigilant and adaptive.

Another significant challenge is the intense and growing competition within the market. The relatively low barrier to entry for some digital lending models has attracted a multitude of fintech startups, challenger banks, and even traditional financial institutions adapting their services. This crowded landscape leads to pricing pressures, increased marketing costs for customer acquisition, and a constant need for innovation to differentiate offerings. Furthermore, ensuring regulatory compliance across diverse and often evolving legal frameworks poses a complex hurdle, requiring dedicated legal and compliance teams. The dynamic nature of regulations, particularly concerning data privacy, consumer protection, and anti-money laundering (AML), means platforms must remain agile to avoid penalties and operate legally across various jurisdictions.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Cybersecurity Threats & Data Breaches | -2.8% | Global | 2025-2033 |

| Intense Market Competition | -2.4% | North America, Europe, Asia Pacific | 2025-2033 |

| Complex & Evolving Regulatory Compliance | -2.2% | Europe, Asia Pacific | 2025-2033 |

| Customer Acquisition & Retention Costs | -1.9% | Global | 2025-2033 |

| Integration with Legacy Systems for Traditional Lenders | -1.7% | North America, Europe | 2025-2030 |

Digital Lending Platform Market - Updated Report Scope

This report provides a comprehensive analysis of the Digital Lending Platform Market, covering historical data from 2019 to 2023, with detailed market size estimations for 2025 and projections up to 2033. It offers deep insights into market dynamics, including key drivers, restraints, opportunities, and challenges influencing industry growth. The scope encompasses a thorough segmentation analysis by component, deployment, end-user, loan type, and technology, along with a regional breakdown to highlight key market performances and trends across major geographies. The report further identifies and profiles leading market players, offering a holistic view of the competitive landscape and strategic developments within the digital lending ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 22.5 billion |

| Market Forecast in 2033 | USD 147.4 billion |

| Growth Rate | 26.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Finastra, Temenos, FIS, Infosys Finacle, TCS Bancs, Mambu, Blend, nCino, Sagent, Newgen Software, Ellie Mae (ICE Mortgage Technology), Q2 Holdings, Sopra Banking Software, Capital Banking Solutions, Black Knight, Accenture, Wipro, Capgemini, Experian, FICO |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Digital Lending Platform market is meticulously segmented to provide a granular view of its diverse landscape and growth drivers. These segmentations allow for a detailed analysis of market dynamics across various dimensions, including the type of offerings (software vs. services), deployment models (on-premise vs. cloud), specific end-user categories (ranging from large banks to individual borrowers), the nature of the loans being facilitated, and the underlying technological innovations powering these platforms. Understanding these segments is crucial for identifying niche opportunities, assessing competitive intensity, and formulating targeted market strategies for stakeholders aiming to capitalize on the digital transformation of lending.

- By Component:

- Software: Includes modules for Loan Origination, Loan Servicing, Collection, Risk & Compliance Management, and other functionalities supporting the lending lifecycle.

- Services: Comprises Consulting, Integration & Implementation, and ongoing Support & Maintenance services, vital for platform adoption and optimization.

- By Deployment:

- On-Premise: Traditional deployment where software is installed and run on local servers.

- Cloud: Includes public, private, and hybrid cloud models, offering scalability, flexibility, and reduced infrastructure costs.

- By End-User:

- Banks: Traditional financial institutions leveraging digital platforms for modernized lending operations.

- Credit Unions: Cooperative financial organizations adopting digital solutions for member services.

- NBFCs (Non-Banking Financial Companies): Specialized lending entities with a high propensity for digital adoption.

- FinTechs: Agile technology-driven companies disrupting traditional lending with innovative platforms.

- Individuals: Direct-to-consumer lending platforms catering to personal financial needs.

- Small & Medium Enterprises (SMEs): Platforms tailored to provide business loans and credit facilities to SMEs.

- By Loan Type:

- Personal Loans: Unsecured loans for individual consumer needs.

- Business Loans: Credit facilities designed for corporate and entrepreneurial purposes.

- Mortgage Loans: Loans for real estate purchases, processed digitally.

- Auto Loans: Financing for vehicle acquisitions.

- Student Loans: Educational financing facilitated through digital channels.

- Others: Includes niche loan products like micro-loans, peer-to-peer loans, etc.

- By Technology:

- Artificial Intelligence (AI): For advanced analytics, personalization, and automation.

- Machine Learning (ML): Subset of AI used for predictive modeling and risk assessment.

- Blockchain: For secure, transparent, and immutable record-keeping and smart contracts.

- Cloud Computing: Foundation for scalable and flexible platform infrastructure.

- API Integration: Enables seamless connectivity with third-party services and data sources.

- Big Data Analytics: Processing and interpreting large datasets for insights and decision-making.

Regional Highlights

- North America: This region is a dominant force in the digital lending platform market, characterized by early technology adoption, a mature fintech ecosystem, and significant investment in AI and cloud solutions. The presence of major technology providers and a strong demand for rapid and convenient loan processing by both consumers and businesses drives continuous innovation. The US, in particular, leads in platform development and market size due to its dynamic financial sector and increasing regulatory support for digital finance.

- Europe: The European market is rapidly expanding, fueled by open banking initiatives, increasing regulatory harmonization (like PSD2), and a growing focus on financial inclusion. Countries such as the UK, Germany, and the Nordic nations are at the forefront of adopting digital lending technologies, driven by a strong consumer preference for digital services and the emergence of numerous challenger banks and fintech startups. However, regulatory fragmentation across the EU can pose challenges.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, propelled by vast unbanked and underbanked populations, rapid smartphone penetration, and expanding e-commerce activities. Emerging economies like China, India, and Southeast Asian countries are witnessing explosive growth in digital lending, driven by a strong need for accessible credit and government initiatives promoting digital payments and financial services. The region is also a hub for innovation in mobile-first lending solutions.

- Latin America: This region is experiencing substantial growth in digital lending, primarily due to efforts to bridge financial inclusion gaps and the increasing adoption of digital technologies by a young, tech-savvy population. Countries like Brazil and Mexico are seeing significant investments in fintech, as traditional banking access remains limited for many. Digital lending platforms offer crucial credit avenues to SMEs and individuals in these markets.

- Middle East and Africa (MEA): While still developing, the MEA market for digital lending platforms is gaining momentum, particularly in countries like the UAE, Saudi Arabia, and South Africa. This growth is driven by government visions for digital transformation, increasing internet penetration, and a rising demand for alternative financing solutions. Opportunities exist in serving underbanked populations and Islamic finance segments through digital channels, though regulatory frameworks are still maturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Lending Platform Market.- Finastra

- Temenos

- FIS

- Infosys Finacle

- TCS Bancs

- Mambu

- Blend

- nCino

- Sagent

- Newgen Software

- Ellie Mae (ICE Mortgage Technology)

- Q2 Holdings

- Sopra Banking Software

- Capital Banking Solutions

- Black Knight

- Accenture

- Wipro

- Capgemini

- Experian

- FICO

Frequently Asked Questions

What is a Digital Lending Platform?

A Digital Lending Platform is a software-based solution that automates and streamlines various stages of the loan lifecycle, from application and credit assessment to approval, disbursement, and servicing. These platforms leverage technologies like AI, cloud computing, and big data to offer faster, more efficient, and personalized lending experiences compared to traditional methods.

How does AI impact the Digital Lending Platform market?

AI significantly impacts the Digital Lending Platform market by enhancing credit underwriting accuracy, automating fraud detection, personalizing loan products, and improving operational efficiency through process automation. AI-driven insights enable lenders to make faster, data-backed decisions and manage risk more effectively, leading to increased market growth and financial inclusion.

What are the key benefits of using Digital Lending Platforms?

Key benefits include faster loan approval and disbursement times, enhanced customer experience through simplified application processes, reduced operational costs due to automation, improved accuracy in credit risk assessment, and increased accessibility to credit for a broader range of borrowers, including underserved segments.

What are the main challenges faced by Digital Lending Platforms?

The main challenges include ensuring robust cybersecurity and data privacy in an environment of increasing cyber threats, navigating complex and evolving regulatory landscapes across different jurisdictions, managing intense market competition, and addressing the high initial implementation and ongoing maintenance costs for sophisticated platforms.

What is the future outlook for the Digital Lending Platform Market?

The future outlook for the Digital Lending Platform Market is highly positive, projecting substantial growth driven by continued technological advancements, increasing demand for digital financial services, and the expansion into new geographic and demographic markets. The market is expected to become more integrated, personalized, and efficient, with a strong focus on embedded finance and sustainable lending practices.