Dental Glass Powder Market

Dental Glass Powder Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702559 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Dental Glass Powder Market Size

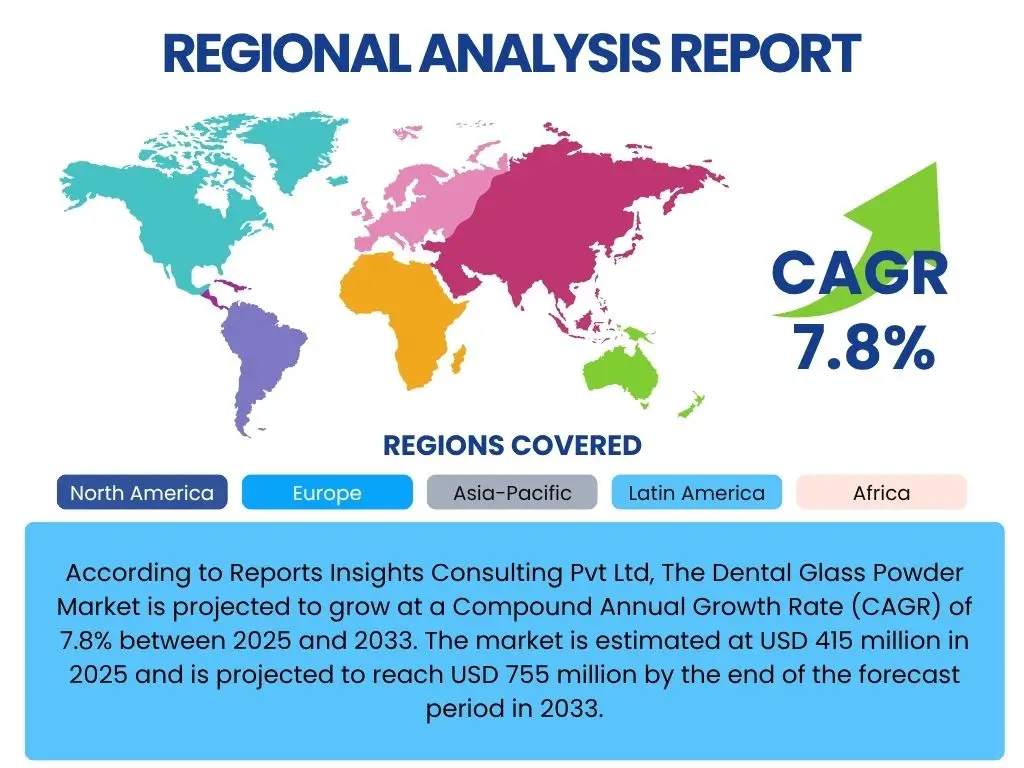

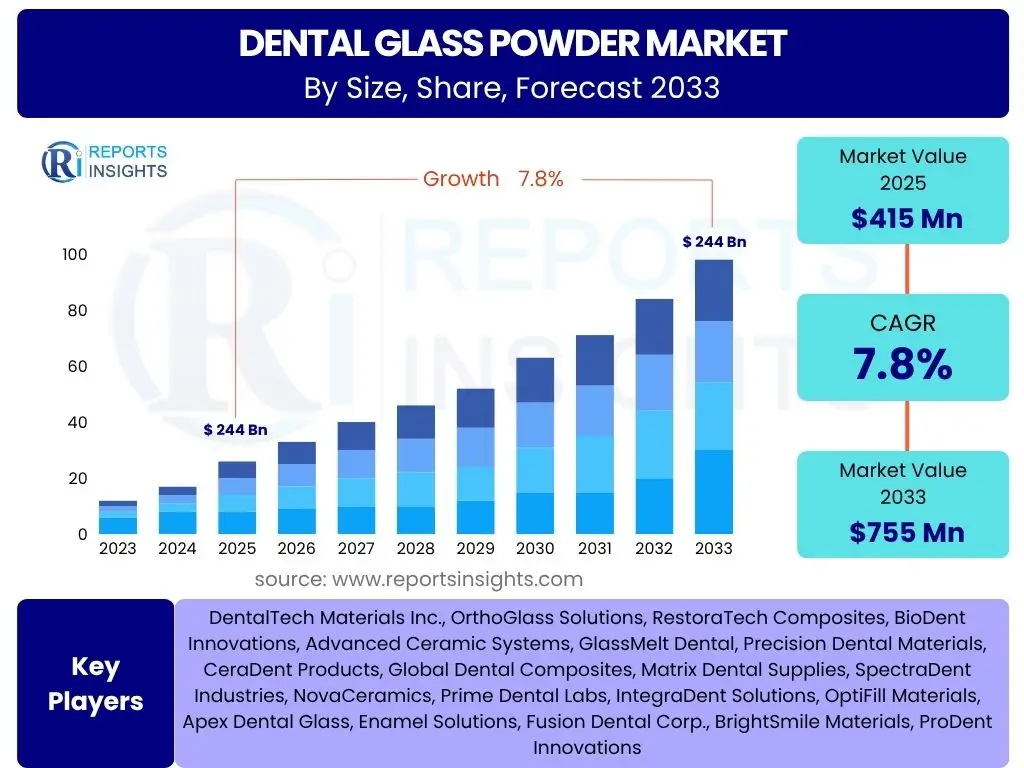

According to Reports Insights Consulting Pvt Ltd, The Dental Glass Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 415 million in 2025 and is projected to reach USD 755 million by the end of the forecast period in 2033.

Key Dental Glass Powder Market Trends & Insights

The dental glass powder market is experiencing dynamic shifts driven by evolving patient demands, technological advancements, and a heightened focus on material biocompatibility and aesthetics. User inquiries frequently highlight the shift towards minimally invasive dentistry and the increasing preference for composite materials, which often incorporate specialized glass powders for enhanced strength and appearance. There is also significant interest in how regulatory changes and the expanding scope of dental procedures are influencing material selection and innovation.

Further insights reveal a growing emphasis on materials that offer superior bonding properties, reduced polymerization shrinkage, and improved optical characteristics to match natural tooth structures. The integration of advanced manufacturing techniques, such as CAD/CAM, is also creating a demand for dental glass powders optimized for digital workflows, allowing for more precise and efficient dental restorations. Additionally, sustainability and the environmental impact of dental materials are emerging as considerations for both manufacturers and practitioners.

- Growing demand for aesthetic dental restorations, driving the use of translucent and tooth-colored glass powders.

- Increased adoption of minimally invasive dentistry techniques, favoring materials that preserve natural tooth structure.

- Technological integration of CAD/CAM systems, necessitating glass powders compatible with digital milling and 3D printing.

- Development of advanced biocompatible and bioactive glass formulations to promote dental health and tissue regeneration.

- Rising prevalence of dental caries and periodontal diseases globally, fueling the need for effective restorative materials.

AI Impact Analysis on Dental Glass Powder

Common user questions regarding AI's impact on dental glass powder often revolve around its potential to revolutionize material design, optimize manufacturing processes, and personalize dental treatments. Users are keen to understand if AI can accelerate the discovery of novel glass compositions with superior properties or enhance the precision and consistency of powder production. The anticipation is that AI could lead to more efficient material development cycles and potentially reduce costs, ultimately benefiting both manufacturers and dental professionals.

AI's influence extends to predictive analytics for material performance, enabling dental material scientists to simulate and forecast how different glass powder compositions will behave under various clinical conditions before physical synthesis. This capability can significantly shorten research and development timelines and minimize experimental failures. Furthermore, AI could play a role in quality control, using machine vision and deep learning algorithms to detect subtle defects in powder morphology or composition, ensuring higher product reliability for end-users in dental clinics and laboratories.

- AI-driven design of novel glass compositions with enhanced mechanical, optical, and biological properties.

- Optimization of manufacturing processes for dental glass powder, leading to improved consistency and reduced waste.

- Predictive analytics for material performance and longevity in various clinical applications.

- Enhanced quality control through AI-powered image analysis for powder morphology and defect detection.

- Personalized material selection based on patient-specific data, guided by AI algorithms for optimal outcomes.

Key Takeaways Dental Glass Powder Market Size & Forecast

Key takeaways from the Dental Glass Powder market size and forecast consistently point to a stable and promising growth trajectory, driven by an aging global population and increasing awareness regarding oral health. User queries frequently focus on understanding the primary factors sustaining this growth and identifying regions poised for significant expansion. The market's resilience is largely attributed to the continuous demand for dental restorative and prosthetic solutions, with dental glass powders forming a foundational component in numerous applications.

The forecast indicates a sustained emphasis on innovation, particularly in developing glass compositions that offer superior aesthetic appeal, improved durability, and enhanced biocompatibility. The market is also being shaped by the integration of digital dentistry workflows, which necessitate materials compatible with advanced CAD/CAM technologies. Consequently, stakeholders are recognizing the importance of investing in research and development to maintain a competitive edge and cater to the evolving needs of the dental industry.

- The dental glass powder market is poised for robust growth, driven by demographic shifts and oral health awareness.

- Innovation in material properties, focusing on aesthetics, durability, and biocompatibility, is a core market driver.

- Digital dentistry adoption, particularly CAD/CAM technologies, is a significant factor influencing product development.

- Asia Pacific is emerging as a high-growth region due to increasing healthcare expenditure and dental tourism.

- Strategic collaborations and product diversification are crucial for companies to capitalize on market opportunities.

Dental Glass Powder Market Drivers Analysis

The dental glass powder market is primarily driven by the escalating global incidence of dental caries and other oral diseases, which necessitate restorative and reconstructive dental procedures. An aging global population further contributes to market expansion, as older individuals are more prone to dental issues requiring interventions that utilize dental glass powders. Additionally, rising disposable incomes in emerging economies are enabling a larger segment of the population to access advanced dental care, thereby increasing the demand for high-quality dental materials.

Technological advancements in dentistry, including the widespread adoption of CAD/CAM systems and the development of new adhesive technologies, are creating a consistent demand for specialized glass powders that are compatible with these modern techniques. Furthermore, the growing aesthetic consciousness among patients drives the preference for tooth-colored restorative materials, where dental glass powders are integral components for achieving natural-looking results. The continuous innovation in material science, leading to glass powders with improved mechanical properties and enhanced biocompatibility, also acts as a significant market accelerator.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Incidence of Dental Caries and Oral Diseases | +1.5% | Global, particularly Asia Pacific & Latin America | Long-term (2025-2033) |

| Increasing Aging Population Worldwide | +1.2% | North America, Europe, East Asia | Long-term (2025-2033) |

| Advancements in Dental Technologies (e.g., CAD/CAM) | +1.0% | North America, Europe, Developed Asia Pacific | Medium-term (2025-2029) |

| Growing Demand for Aesthetic Dental Restorations | +0.8% | Global, particularly affluent regions | Medium-term (2025-2029) |

| Increasing Disposable Income in Emerging Economies | +0.7% | China, India, Brazil, Southeast Asia | Long-term (2025-2033) |

Dental Glass Powder Market Restraints Analysis

Despite the positive growth trajectory, the dental glass powder market faces several significant restraints. The high cost associated with advanced dental procedures, particularly those involving specialized restorative materials, often limits access for a large segment of the global population, especially in developing regions. This financial barrier can lead to delayed or forgone treatments, thereby suppressing the overall demand for dental materials, including glass powders. Furthermore, limited reimbursement policies from public and private health insurance providers for certain aesthetic or non-essential dental procedures can further constrain market growth, as patients may opt for less costly alternatives or postpone treatments.

Another critical restraint is the stringent regulatory approval processes for new dental materials. Manufacturers must navigate complex and time-consuming regulatory pathways, such as those imposed by the FDA in the United States or the MDR in Europe, to bring novel glass powder formulations to market. This not only increases development costs but also extends the time-to-market, potentially stifling innovation. Moreover, the availability of alternative restorative materials like zirconia and ceramics, which offer distinct advantages in certain applications, poses a competitive challenge to dental glass powders. Concerns regarding the long-term durability and potential for wear of some glass-based restorations also influence practitioner choice and patient acceptance, impacting market adoption rates.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Cost of Advanced Dental Procedures | -1.3% | Global, particularly developing nations | Long-term (2025-2033) |

| Stringent Regulatory Approval Processes | -1.0% | North America, Europe | Medium-term (2025-2029) |

| Availability of Alternative Restorative Materials | -0.9% | Global | Long-term (2025-2033) |

| Limited Reimbursement Policies | -0.7% | Europe, parts of North America | Medium-term (2025-2029) |

| Concerns Regarding Material Degradation and Wear | -0.5% | Global | Short-term (2025-2027) |

Dental Glass Powder Market Opportunities Analysis

Significant opportunities exist in the dental glass powder market, particularly through expansion into emerging economies. Countries in Asia Pacific, Latin America, and the Middle East and Africa present untapped potential due to their large populations, improving healthcare infrastructure, and increasing per capita dental expenditure. As these regions experience economic growth and greater awareness of oral health, the demand for quality dental care, and consequently, advanced restorative materials like dental glass powder, is projected to rise substantially.

Furthermore, the continuous innovation in dental material science offers a fertile ground for market growth. The development of new glass compositions with enhanced properties, such as improved bioactivity, superior mechanical strength, or unique aesthetic characteristics, can open up novel applications and expand the market reach. Strategic collaborations between material manufacturers, research institutions, and dental product companies can accelerate the commercialization of these innovations. The growing trend towards personalized dentistry and preventative care also presents an opportunity for specialized glass powders that can be tailored for specific patient needs or utilized in prophylactic treatments, such as fluoride-releasing glass ionomers for caries prevention.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Economies | +1.8% | Asia Pacific, Latin America, MEA | Long-term (2025-2033) |

| Development of Novel Bioactive Glass Formulations | +1.5% | Global | Medium-term (2025-2029) |

| Strategic Collaborations and Partnerships | +1.1% | Global | Medium-term (2025-2029) |

| Increasing Focus on Preventative and Minimally Invasive Dentistry | +0.9% | North America, Europe | Long-term (2025-2033) |

| Growth in Dental Tourism and Specialized Clinics | +0.6% | Emerging markets, specific European countries | Medium-term (2025-2029) |

Dental Glass Powder Market Challenges Impact Analysis

The dental glass powder market faces several inherent challenges that could impede its growth. Intense competition from alternative restorative materials, such as zirconia, lithium disilicate, and composite resins, constantly pressure manufacturers to innovate and differentiate their glass-based products. These alternative materials often offer competitive advantages in terms of strength, aesthetics, or ease of use for specific applications, thereby fragmenting the market and requiring significant investment in research and development for glass powder manufacturers to maintain relevance.

Supply chain disruptions, particularly those related to the sourcing of raw materials or geopolitical events, pose a significant challenge. The production of specialized glass powders relies on a consistent supply of high-purity raw materials, and any volatility in their availability or pricing can impact production costs and lead times. Furthermore, the need for continuous research and development to address evolving clinical needs and patient expectations represents a constant financial and technical burden. Manufacturers must invest heavily to improve mechanical properties, optical characteristics, and biocompatibility, as well as to develop new applications. Moreover, ensuring consistent quality and regulatory compliance across diverse global markets, each with its unique standards and approval processes, remains a complex and resource-intensive challenge for companies operating in this sector.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition from Alternative Materials | -1.4% | Global | Long-term (2025-2033) |

| Supply Chain Volatility and Raw Material Sourcing | -1.1% | Global | Short-term (2025-2027) |

| High R&D Investment for Innovation and Product Upgrades | -0.8% | Global | Long-term (2025-2033) |

| Ensuring Consistent Quality and Regulatory Compliance Across Markets | -0.6% | Global | Medium-term (2025-2029) |

| Price Sensitivity in Certain Regional Markets | -0.4% | Developing Economies | Medium-term (2025-2029) |

Dental Glass Powder Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Dental Glass Powder Market, encompassing historical data from 2019 to 2023, current market conditions in 2024, and detailed forecasts extending to 2033. The scope includes a thorough examination of market size, growth drivers, restraints, opportunities, and challenges affecting the industry. The report segments the market by various types of glass powder, application areas, and end-use sectors, offering granular insights into each category's performance and future potential. Key market trends, the impact of AI, and regional dynamics are also critically assessed to provide a holistic view of the market landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 415 Million |

| Market Forecast in 2033 | USD 755 Million |

| Growth Rate | 7.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | DentalTech Materials Inc., OrthoGlass Solutions, RestoraTech Composites, BioDent Innovations, Advanced Ceramic Systems, GlassMelt Dental, Precision Dental Materials, CeraDent Products, Global Dental Composites, Matrix Dental Supplies, SpectraDent Industries, NovaCeramics, Prime Dental Labs, IntegraDent Solutions, OptiFill Materials, Apex Dental Glass, Enamel Solutions, Fusion Dental Corp., BrightSmile Materials, ProDent Innovations |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The dental glass powder market is extensively segmented to provide a detailed understanding of its various components and their respective contributions to the overall market dynamics. This segmentation facilitates a granular analysis of market trends, consumer preferences, and technological adoption across different product types, application areas, and end-user categories. Understanding these segments is crucial for stakeholders to identify growth opportunities, tailor product offerings, and devise effective market entry strategies.

The market's primary segmentation revolves around the chemical composition of the glass powders, which directly influences their properties and suitability for specific dental applications. Further delineation by application highlights the diverse uses of dental glass powders in both restorative and preventative dentistry, reflecting the breadth of dental procedures that rely on these materials. The end-use segmentation provides insight into the primary consumers of dental glass powders, from large-scale dental hospitals to specialized laboratories and academic institutions, each with unique procurement patterns and material requirements.

- By Type:

- Fluoro-aluminosilicate Glass: Widely used in glass ionomer cements due to fluoride release and good biocompatibility.

- Barium Glass: Often incorporated into composite resins for radiopacity and improved mechanical strength.

- Borosilicate Glass: Utilized for its excellent chemical durability and thermal shock resistance in specific applications.

- Other Glass Types (e.g., Strontium Glass, Zinc Glass): Include various specialized glass compositions tailored for unique performance characteristics.

- By Application:

- Restorative Dentistry: Dominant application, including fillings, crowns, bridges, inlays, and onlays, where glass powders provide strength and aesthetics.

- Prosthetic Dentistry: Used in the fabrication of dentures and as components in dental implants for enhanced integration.

- Orthodontics: Applied in bonding agents and cements for brackets and other orthodontic appliances.

- Preventive Dentistry: Utilized in sealants and varnishes, often with fluoride-releasing properties to prevent caries.

- Other Applications (e.g., Cements, Linings): Encompasses a range of auxiliary dental products and procedures.

- By End-use:

- Dental Hospitals and Clinics: Primary end-users, requiring a broad range of glass powders for diverse patient treatments.

- Dental Laboratories: Utilize glass powders for fabricating custom restorations and prosthetics.

- Academic and Research Institutes: Involved in material research, development, and testing of new glass powder formulations.

- Other End-users (e.g., Specialty Dental Centers): Includes niche dental practices focusing on specific treatments or patient groups.

Regional Highlights

The dental glass powder market exhibits significant regional variations, influenced by factors such as healthcare expenditure, dental tourism, prevalence of oral diseases, and regulatory frameworks. North America currently holds a substantial share of the market, driven by advanced dental infrastructure, high patient awareness regarding oral health, and the rapid adoption of new technologies. The presence of leading dental material manufacturers and a strong focus on aesthetic dentistry further contribute to the region's dominance. The United States and Canada are key contributors within this region, characterized by robust R&D activities and significant investments in dental research.

Europe represents another mature market for dental glass powder, characterized by well-established dental care systems, stringent quality standards, and a high demand for sophisticated dental solutions. Countries such as Germany, France, and the UK are prominent consumers, with a strong emphasis on evidence-based dentistry and high-quality restorative materials. The region's aging population also significantly contributes to the sustained demand for dental prosthetics and restorative procedures, where glass powders are indispensable components.

Asia Pacific is projected to be the fastest-growing region in the forecast period, owing to its vast population, improving economic conditions, and increasing healthcare access. Countries like China, India, and Japan are witnessing a surge in dental clinics and laboratories, coupled with rising disposable incomes that enable greater access to advanced dental treatments. The growing prevalence of dental tourism in several Southeast Asian countries also fuels the demand for high-quality dental materials. Latin America and the Middle East and Africa (MEA) are emerging markets, showing promising growth driven by increasing dental awareness, improving healthcare infrastructure, and government initiatives to enhance oral health services, albeit from a smaller base.

- North America: Dominant market share due to advanced dental infrastructure, high adoption of new technologies, and a strong focus on aesthetic dentistry.

- Europe: Mature market with stable growth, driven by established healthcare systems, stringent quality standards, and an aging population.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, fueled by large populations, improving economies, rising dental tourism, and increasing healthcare expenditure in countries like China and India.

- Latin America: Emerging market with significant growth potential, supported by increasing dental awareness and improving access to dental care.

- Middle East and Africa (MEA): Gradual growth driven by developing healthcare infrastructure and a rising focus on oral health, especially in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Glass Powder Market.- DentalTech Materials Inc.

- OrthoGlass Solutions

- RestoraTech Composites

- BioDent Innovations

- Advanced Ceramic Systems

- GlassMelt Dental

- Precision Dental Materials

- CeraDent Products

- Global Dental Composites

- Matrix Dental Supplies

- SpectraDent Industries

- NovaCeramics

- Prime Dental Labs

- IntegraDent Solutions

- OptiFill Materials

- Apex Dental Glass

- Enamel Solutions

- Fusion Dental Corp.

- BrightSmile Materials

- ProDent Innovations

Frequently Asked Questions

What is dental glass powder primarily used for?

Dental glass powder is a key component in various dental restorative and prosthetic materials, including glass ionomer cements, dental composites, and specialized ceramics. It is primarily used for dental fillings, crowns, bridges, inlays, onlays, and sealants, providing strength, aesthetics, and sometimes fluoride-releasing properties to dental restorations.

What are the main types of dental glass powder available?

The main types of dental glass powder include fluoro-aluminosilicate glass, barium glass, and borosilicate glass. Fluoro-aluminosilicate glass is often used in glass ionomers for its fluoride-releasing capabilities, while barium glass is commonly added to composites for radiopacity. Borosilicate glass offers chemical durability for specific applications.

How do technological advancements influence the dental glass powder market?

Technological advancements, particularly in CAD/CAM dentistry and 3D printing, are significantly influencing the dental glass powder market by driving the demand for materials compatible with digital workflows. Innovations also focus on enhancing the mechanical strength, optical properties, and biocompatibility of glass powders, leading to superior and more aesthetic dental restorations.

Which regions are key contributors to the dental glass powder market growth?

North America and Europe are significant contributors to the dental glass powder market due to established dental infrastructure and high healthcare spending. However, the Asia Pacific region, particularly countries like China and India, is expected to exhibit the fastest growth owing to increasing dental awareness, a large patient pool, and improving access to dental care.

What are the key drivers for the demand for dental glass powder?

The key drivers for the demand for dental glass powder include the rising global incidence of dental caries and other oral diseases, an increasing aging population requiring restorative procedures, growing aesthetic consciousness among patients, and continuous technological advancements in dental materials and procedures.