Critical Mineral Raw Material Market

Critical Mineral Raw Material Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705225 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Critical Mineral Raw Material Market Size

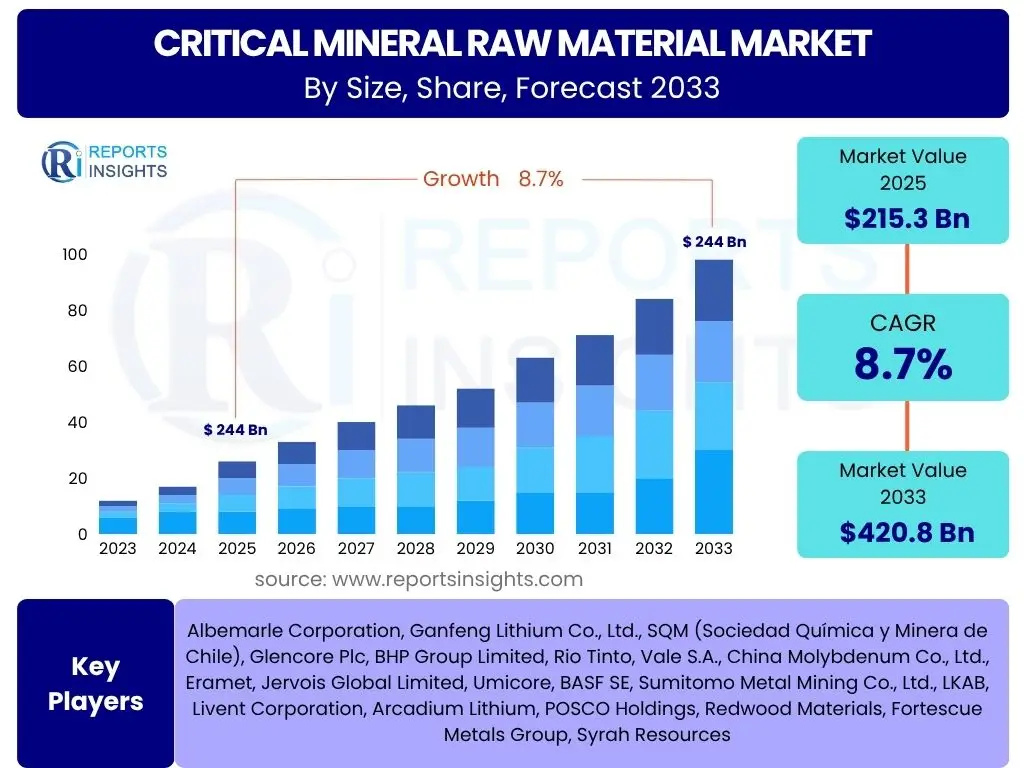

According to Reports Insights Consulting Pvt Ltd, The Critical Mineral Raw Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2033. The market is estimated at USD 215.3 Billion in 2025 and is projected to reach USD 420.8 Billion by the end of the forecast period in 2033.

Key Critical Mineral Raw Material Market Trends & Insights

The Critical Mineral Raw Material market is currently characterized by a confluence of accelerating demand, geopolitical realignments, and technological innovation. Users frequently inquire about the forces reshaping global supply chains, the impact of sustainability mandates, and the emergence of new technologies for extraction and processing. Key insights reveal a robust push towards diversification of supply, driven by national security concerns and the imperative to de-risk dependencies on concentrated sources. Furthermore, the market is experiencing a significant pivot towards circular economy principles, with increasing investment in recycling and urban mining initiatives to supplement primary production.

Technological advancements, particularly in electric vehicle battery chemistry and renewable energy infrastructure, are not only driving demand but also influencing the specific types of critical minerals that are gaining prominence. The industry is also grappling with the dual challenge of meeting escalating demand while adhering to stringent environmental, social, and governance (ESG) standards. This has led to a focus on more sustainable mining practices and responsible sourcing throughout the value chain, a topic of growing interest among stakeholders and consumers alike. The market's future trajectory is deeply intertwined with global energy transition policies and the pace of industrial decarbonization.

- Accelerated demand from Electric Vehicles (EVs) and renewable energy sectors.

- Increased focus on supply chain diversification and resilience to mitigate geopolitical risks.

- Significant investments in recycling technologies and urban mining to foster a circular economy.

- Growing emphasis on Environmental, Social, and Governance (ESG) standards in mineral sourcing and production.

- Technological advancements driving new extraction methods and processing efficiencies.

AI Impact Analysis on Critical Mineral Raw Material

Common user questions regarding AI's impact on the Critical Mineral Raw Material market typically revolve around its potential to optimize various stages of the value chain, from exploration and mining to processing and supply chain logistics. Stakeholders are keen to understand how artificial intelligence can enhance efficiency, reduce costs, and improve environmental performance. There is also considerable interest in AI's role in addressing resource scarcity, predicting market fluctuations, and ensuring more sustainable practices, balanced with concerns about data security, algorithmic bias, and the need for a skilled workforce capable of deploying and managing these advanced systems.

AI technologies, including machine learning, predictive analytics, and computer vision, are increasingly being adopted across the critical minerals sector. In exploration, AI algorithms can analyze vast datasets of geological, geophysical, and geochemical information to identify promising new deposits with greater accuracy and speed, significantly reducing the time and cost associated with traditional exploration methods. For mining operations, AI-powered automation and optimization tools are enhancing productivity, improving safety protocols, and enabling more precise extraction, minimizing waste. Furthermore, AI is proving invaluable in refining processes by optimizing parameters for higher yield and purity, and in supply chain management for real-time tracking, demand forecasting, and risk assessment, ultimately fostering a more resilient and efficient critical mineral ecosystem.

- Enhanced mineral exploration through predictive analytics and geological modeling, leading to faster discovery.

- Optimization of mining operations, including autonomous equipment deployment and predictive maintenance, for improved efficiency and safety.

- Increased processing and refining efficiencies by optimizing chemical reactions and material separation.

- Improved supply chain management, logistics, and demand forecasting through advanced analytics.

- Facilitation of sustainable practices by monitoring environmental impacts and optimizing resource use.

Key Takeaways Critical Mineral Raw Material Market Size & Forecast

The Critical Mineral Raw Material market is poised for substantial growth over the forecast period, driven primarily by the global energy transition and increasing demand from high-tech industries. A key takeaway is the undeniable link between the market's expansion and the accelerating adoption of electric vehicles and renewable energy technologies, which are highly dependent on minerals like lithium, cobalt, nickel, and rare earth elements. This growth trajectory underscores the strategic importance of critical minerals for national economies and technological advancement, highlighting the imperative for secure and diversified supply chains to support future industrial development.

Another significant insight is the escalating geopolitical competition for critical mineral resources, which is influencing investment patterns, trade policies, and international collaborations. Countries are increasingly prioritizing domestic sourcing and the establishment of strategic reserves to mitigate supply risks. The forecast also emphasizes the growing role of recycling and urban mining as complementary sources, moving beyond a purely extractive model towards a more circular approach. This shift is not only driven by environmental considerations but also by the economic viability of recovering valuable materials from end-of-life products, ultimately contributing to long-term market stability and resource security.

- Significant market expansion anticipated due to increasing global demand for electric vehicles and renewable energy.

- Enhanced focus on securing diversified and resilient supply chains to counteract geopolitical volatilities.

- Rising importance of recycling and urban mining as critical components of future supply strategies.

- Continuous technological innovation shaping extraction, processing, and application of critical minerals.

- ESG compliance and sustainable sourcing are becoming non-negotiable for market participants.

Critical Mineral Raw Material Market Drivers Analysis

The global shift towards sustainable energy systems represents a foundational driver for the Critical Mineral Raw Material market. As nations commit to reducing carbon emissions, the deployment of renewable energy technologies such as solar panels, wind turbines, and energy storage solutions escalates dramatically. These technologies are inherently mineral-intensive, requiring significant quantities of rare earth elements, copper, lithium, cobalt, and nickel, among others. The sheer scale of planned renewable energy infrastructure projects worldwide ensures a sustained and increasing demand for these essential raw materials, pushing mining and processing industries to expand capacities and develop new sources. This energy transition is not merely a policy objective but a profound economic transformation creating immense demand pull for critical minerals.

Beyond the energy sector, the pervasive digitalization and technological advancement across various industries further amplify demand. The burgeoning consumer electronics market, including smartphones, laptops, and advanced computing systems, relies heavily on critical minerals for components like microchips, capacitors, and specialized alloys. Similarly, the aerospace and defense sectors require high-performance materials derived from critical minerals for their unique properties, such as strength-to-weight ratio and heat resistance. The expansion of 5G networks, artificial intelligence, and advanced manufacturing (e.g., additive manufacturing) also contribute significantly, as these innovations necessitate a steady supply of specialized mineral inputs. This broad industrial application ensures diverse and robust demand channels for critical mineral raw materials, insulating the market from over-reliance on any single sector.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global Energy Transition & EV Adoption | +2.5% | Global, particularly China, Europe, North America | Long-term (2025-2033) |

| Advancements in Electronics & Digitalization | +1.8% | Asia Pacific, North America, Europe | Medium-term (2025-2030) |

| Increased Government Strategic Initiatives | +1.5% | North America, Europe, Australia, Japan | Medium-term (2025-2030) |

| Technological Innovation in Material Science | +1.0% | Global, R&D hubs in advanced economies | Long-term (2027-2033) |

Critical Mineral Raw Material Market Restraints Analysis

One of the primary restraints impacting the Critical Mineral Raw Material market is the significant geopolitical and supply chain risks associated with concentrated production. A large proportion of critical minerals are mined, processed, or refined in a limited number of countries, creating vulnerabilities to geopolitical tensions, trade disputes, and supply disruptions. This concentration leads to inherent instability in global supply, making the market susceptible to sudden price spikes and shortages if a major producing region faces political unrest, natural disasters, or export restrictions. The lack of diversified sources for key minerals forces downstream industries to rely heavily on these few suppliers, increasing their exposure to external shocks and hindering long-term planning and investment.

Environmental and social concerns also pose a substantial restraint, driving increased regulatory scrutiny and community opposition to new mining projects. The extraction and processing of critical minerals can be energy-intensive and produce significant waste, leading to land degradation, water pollution, and habitat destruction. Public awareness and activism regarding the environmental footprint of mining operations, coupled with concerns over labor practices and indigenous rights, are leading to stricter environmental regulations and lengthy permitting processes. These factors can delay project development, increase operational costs, and even lead to the cancellation of proposed mines, thereby limiting the growth of primary supply and creating bottlenecks in the market. The industry faces mounting pressure to adopt more sustainable and responsible mining practices, which often entails higher upfront investment and operational expenses.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Geopolitical Risks & Supply Chain Concentration | -1.2% | Global, particularly reliant economies | Medium-term (2025-2030) |

| Environmental & Social Governance (ESG) Hurdles | -0.9% | Global, particularly Europe, North America | Long-term (2025-2033) |

| High Capital Costs & Long Lead Times for New Projects | -0.7% | Global | Long-term (2025-2033) |

| Price Volatility of Raw Materials | -0.5% | Global | Short-term (2025-2027) |

Critical Mineral Raw Material Market Opportunities Analysis

The circular economy model, particularly through enhanced recycling and urban mining, presents a significant opportunity for the Critical Mineral Raw Material market. As the lifespan of critical mineral-containing products like EV batteries, electronics, and renewable energy components concludes, a vast untapped resource emerges. Technologies for recovering and refining these minerals from waste streams are rapidly advancing, offering a more sustainable and potentially less capital-intensive alternative to traditional mining. Investment in specialized recycling facilities not only reduces reliance on primary extraction but also mitigates environmental impact and provides a more localized, secure supply. This shift allows for the re-integration of valuable materials back into the production cycle, creating a more resilient and resource-efficient supply chain.

Another major opportunity lies in the exploration and development of new, unconventional sources and extraction technologies. This includes initiatives like deep-sea mining, though controversial, holds immense potential for vast mineral deposits. More immediately, the extraction of critical minerals from geothermal brines, wastewater, or even coal waste offers promising avenues for diversification. Furthermore, advancements in beneficiation techniques, such as artificial intelligence-driven sorting and novel chemical processes, can improve extraction yields from existing mines or previously uneconomical deposits. These innovative approaches can unlock new reserves, reduce the environmental footprint of extraction, and broaden the geographical distribution of critical mineral production, thereby enhancing global supply security and market stability.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Advanced Recycling & Urban Mining | +1.8% | Europe, North America, Japan, South Korea | Long-term (2027-2033) |

| Diversification of Supply Sources & New Extraction Technologies | +1.5% | Africa, Latin America, Australia, North America | Long-term (2028-2033) |

| Government Incentives for Domestic Production | +1.2% | North America, Europe, Australia | Medium-term (2025-2030) |

| Strategic Partnerships & International Collaborations | +0.9% | Global | Medium-term (2025-2030) |

Critical Mineral Raw Material Market Challenges Impact Analysis

A significant challenge for the Critical Mineral Raw Material market stems from the complex and often lengthy regulatory approval processes for new mining and processing projects. Obtaining the necessary permits involves navigating a labyrinth of environmental assessments, land-use approvals, indigenous consultations, and social impact studies, which can collectively take many years, if not decades. These delays not only escalate project costs due to prolonged development phases but also create uncertainty for investors, hindering the timely expansion of supply to meet burgeoning demand. The evolving nature of environmental regulations and increasing public scrutiny further complicate this landscape, requiring companies to invest significantly in compliance and stakeholder engagement, which ultimately impacts market responsiveness and growth potential.

Another critical challenge is the inherent technological and economic barriers to extracting and refining certain critical minerals. Many critical minerals are found in low concentrations within complex ore bodies, making their extraction technically challenging and energy-intensive. Furthermore, the downstream refining processes for some minerals, like rare earth elements, involve intricate chemical separation techniques that are both costly and environmentally sensitive. Scaling up these technologies to meet global demand while maintaining economic viability and environmental compliance remains a significant hurdle. The lack of readily available, economically viable processing capacity outside of a few dominant regions creates bottlenecks in the supply chain, adding to the overall cost and complexity of bringing critical minerals to market.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complex Regulatory & Permitting Landscape | -0.8% | Global, particularly developed economies | Long-term (2025-2033) |

| Technological & Economic Barriers to Extraction/Refining | -0.7% | Global | Long-term (2025-2033) |

| Skilled Labor Shortages & Talent Acquisition | -0.6% | Global, particularly Western economies | Medium-term (2025-2030) |

| Infrastructure Deficiencies in Emerging Mining Regions | -0.5% | Africa, Latin America, parts of Asia | Medium-term (2025-2030) |

Critical Mineral Raw Material Market - Updated Report Scope

This report provides a comprehensive analysis of the Critical Mineral Raw Material Market, delving into its current dynamics, growth trajectory, and future outlook from 2025 to 2033. It encompasses a detailed examination of market size estimations, historical trends, and future growth projections, considering the multifaceted factors that influence market expansion and contraction. The scope also includes a granular breakdown by various segments, highlighting key types of critical minerals, their end-use applications, and their regional distribution, offering a holistic view for strategic decision-making and investment planning within the evolving global critical minerals landscape.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 215.3 Billion |

| Market Forecast in 2033 | USD 420.8 Billion |

| Growth Rate | 8.7% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, Ganfeng Lithium Co., Ltd., SQM (Sociedad Química y Minera de Chile), Glencore Plc, BHP Group Limited, Rio Tinto, Vale S.A., China Molybdenum Co., Ltd., Eramet, Jervois Global Limited, Umicore, BASF SE, Sumitomo Metal Mining Co., Ltd., LKAB, Livent Corporation, Arcadium Lithium, POSCO Holdings, Redwood Materials, Fortescue Metals Group, Syrah Resources |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Critical Mineral Raw Material market is broadly segmented by type, end-use industry, application, and form, reflecting the diverse nature of these essential resources and their wide-ranging industrial applications. Each segment represents distinct market dynamics, supply-demand balances, and growth trajectories, influenced by technological advancements, regulatory frameworks, and geopolitical factors. Understanding these segmentations is crucial for stakeholders to identify specific growth areas, assess competitive landscapes, and formulate targeted strategies within this complex global market, allowing for a more granular analysis of market opportunities and challenges across the value chain.

- By Type:

- Lithium

- Cobalt

- Nickel

- Graphite

- Rare Earth Elements (Neodymium, Praseodymium, Dysprosium, Terbium, etc.)

- Copper

- Manganese

- Palladium

- Platinum

- Tin

- Zinc

- Tantalum

- Niobium

- Titanium

- Vanadium

- By End-Use Industry:

- Electric Vehicle (EV) Batteries

- Grid-Scale Energy Storage

- Consumer Electronics

- Aerospace & Defense

- Renewable Energy Infrastructure (Solar PV, Wind Turbines)

- Medical Devices

- Industrial Catalysts

- Specialty Alloys & Magnets

- Chemical & Petrochemical

- By Application:

- Battery Manufacturing

- Semiconductor Production

- High-Performance Magnetics

- Catalytic Converters

- Lightweight Structural Materials

- Additive Manufacturing

- Superalloys

- By Form:

- Ores

- Concentrates

- Refined Metals

- Chemical Compounds

Regional Highlights

- North America: The region is increasingly focusing on domestic critical mineral supply chain resilience, driven by government initiatives like the Inflation Reduction Act in the US and Canada's Critical Minerals Strategy. Significant investment is directed towards exploration, processing, and recycling to reduce reliance on foreign imports, particularly for EV batteries and defense applications.

- Europe: Europe is actively pursuing strategic autonomy in critical minerals through the European Raw Materials Alliance (ERMA). Efforts are concentrated on enhancing domestic mining, establishing new processing facilities, and expanding recycling capacities, aligning with ambitious decarbonization targets and the growth of its EV manufacturing base.

- Asia Pacific (APAC): APAC remains the dominant region in critical mineral processing and consumption, particularly China, which holds a significant share in rare earth element refining and lithium processing. The region also hosts major EV and electronics manufacturing hubs, driving substantial demand. Countries like Australia, Indonesia, and the Philippines are key raw material suppliers, while South Korea and Japan are investing in supply chain diversification and recycling technologies.

- Latin America: Rich in natural resources, particularly lithium (Chile, Argentina, Bolivia – the "Lithium Triangle") and copper, Latin America is a crucial region for primary critical mineral supply. The region is witnessing increased foreign investment in mining projects, though political stability and environmental regulations often pose challenges and influence the pace of development.

- Middle East and Africa (MEA): MEA holds vast untapped critical mineral reserves, including cobalt (DRC), lithium, and rare earth elements. While historically focused on oil and gas, several countries are now actively exploring and developing their critical mineral potential. Investments in infrastructure and processing capabilities are gradually increasing, positioning the region as a future significant supplier, despite facing challenges related to governance and security in some areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Critical Mineral Raw Material Market.- Albemarle Corporation

- Ganfeng Lithium Co., Ltd.

- SQM (Sociedad Química y Minera de Chile)

- Glencore Plc

- BHP Group Limited

- Rio Tinto

- Vale S.A.

- China Molybdenum Co., Ltd.

- Eramet

- Jervois Global Limited

- Umicore

- BASF SE

- Sumitomo Metal Mining Co., Ltd.

- LKAB

- Livent Corporation

- Arcadium Lithium

- POSCO Holdings

- Redwood Materials

- Fortescue Metals Group

- Syrah Resources

Frequently Asked Questions

What are critical minerals and why are they important?

Critical minerals are raw materials essential for modern technologies and economic development, whose supply is at risk of disruption. They are vital for sectors such as renewable energy, electric vehicles, defense, and electronics, enabling the transition to a green economy and ensuring national security.

How is the demand for critical minerals projected to grow?

Demand is projected to grow significantly, driven primarily by the global energy transition, particularly the rapid adoption of electric vehicles and the expansion of renewable energy infrastructure. Estimates indicate a substantial increase in consumption for key minerals like lithium, cobalt, and rare earth elements over the next decade.

What are the main challenges facing the critical mineral supply chain?

Key challenges include geopolitical risks due to concentrated production, environmental and social governance (ESG) concerns, high capital costs and long lead times for new projects, and the technological complexities associated with extraction and refining of specific minerals.

What role does recycling play in the critical mineral market?

Recycling is emerging as a crucial component of the critical mineral supply chain, offering opportunities to recover valuable materials from end-of-life products like batteries and electronics. It helps diversify supply, reduce reliance on primary mining, and contributes to a more circular and sustainable economy.

Which regions are key players in the critical mineral raw material market?

Key regions include Asia Pacific (dominant in processing and consumption), North America and Europe (focused on domestic supply resilience), Latin America (major source of lithium and copper), and Africa (significant untapped reserves of various critical minerals).