Cold Chain Market

Cold Chain Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705996 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Cold Chain Market Size

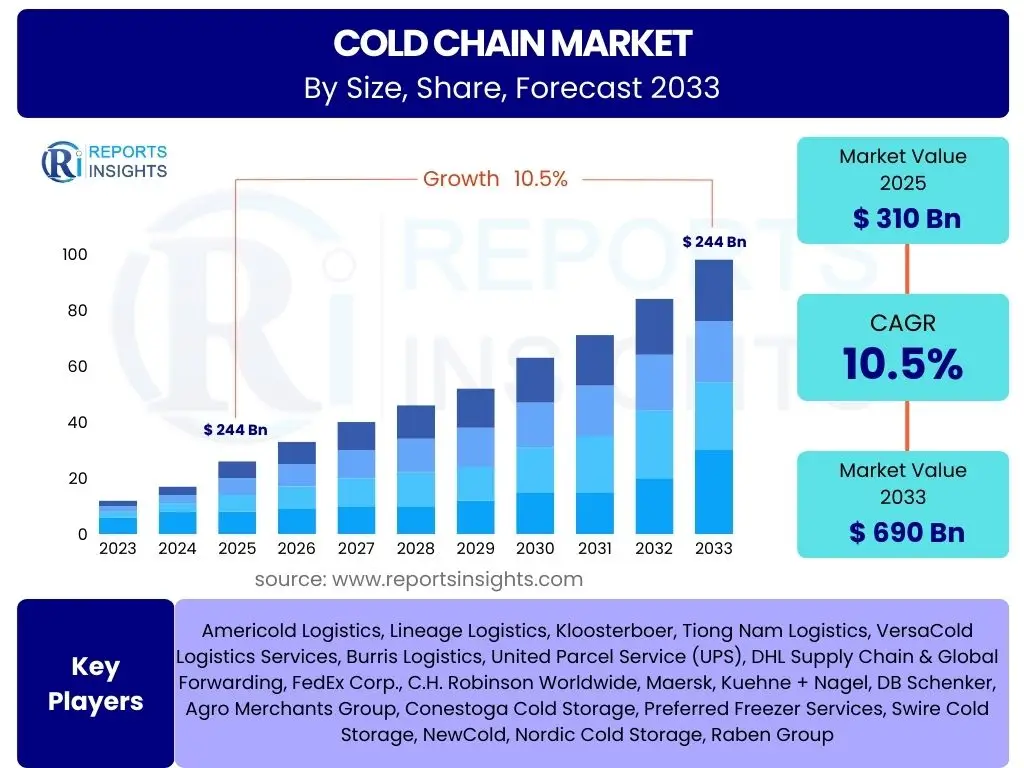

According to Reports Insights Consulting Pvt Ltd, The Cold Chain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2033. The market is estimated at USD 310 Billion in 2025 and is projected to reach USD 690 Billion by the end of the forecast period in 2033.

Key Cold Chain Market Trends & Insights

The Cold Chain market is experiencing significant transformative trends driven by evolving consumer demands, technological advancements, and a heightened focus on product integrity. Common user inquiries often center on how the industry is adapting to new challenges such as supply chain disruptions, the increasing complexity of pharmaceutical logistics, and the urgent need for sustainable practices. Furthermore, there is considerable interest in the integration of digital technologies and automation to enhance efficiency and visibility across the cold chain.

These trends highlight a shift towards more resilient, transparent, and technologically sophisticated cold chain operations. The expansion of e-commerce for perishable goods and the global rise in demand for biopharmaceuticals are compelling companies to invest in advanced infrastructure and innovative solutions, ensuring the safe and efficient transport of temperature-sensitive products from origin to consumption.

- Digitalization and IoT integration for enhanced visibility and tracking.

- Increased focus on sustainable and eco-friendly cold chain solutions.

- Growing demand for specialized logistics in the pharmaceutical and biotech sectors.

- Expansion of e-commerce for perishable food and beverage products.

- Adoption of automation and robotics in cold storage facilities.

- Emphasis on last-mile cold chain delivery solutions.

- Stricter regulatory compliance and quality control standards.

- Diversification of cold chain services to support new product categories.

AI Impact Analysis on Cold Chain

Users frequently inquire about the specific ways Artificial Intelligence (AI) is transforming the cold chain industry, particularly how it addresses operational inefficiencies, reduces waste, and enhances decision-making. The primary themes of these questions revolve around AI's ability to optimize complex logistics, predict potential failures, and automate processes that traditionally rely on manual oversight. There is also interest in AI's role in improving data analysis for better inventory management and demand forecasting, ultimately leading to more agile and responsive supply chains.

AI's influence extends across multiple facets of cold chain operations, offering solutions for real-time monitoring, predictive maintenance of refrigeration equipment, and dynamic route optimization to minimize transit times and fuel consumption. It is expected to significantly mitigate risks associated with temperature excursions and product spoilage, thereby improving overall product quality and safety. Furthermore, AI-powered analytics are becoming crucial for identifying patterns in consumer behavior and environmental factors, enabling more precise demand planning and inventory allocation, and fostering a more intelligent and proactive cold chain ecosystem.

- Predictive analytics for equipment maintenance, minimizing downtime.

- Route optimization and dynamic scheduling for reduced transit times and fuel consumption.

- Enhanced demand forecasting to prevent stockouts and reduce waste.

- Automated quality control and temperature monitoring systems.

- Improved inventory management and traceability across the supply chain.

- Risk mitigation through early detection of deviations and anomalies.

- Optimization of energy consumption in cold storage and transport.

Key Takeaways Cold Chain Market Size & Forecast

Common user questions regarding the cold chain market size and forecast typically seek to understand the overall growth trajectory, the main sectors driving this expansion, and the long-term viability of the industry. Insights reveal a robust and sustained growth outlook, primarily fueled by an escalating global demand for temperature-sensitive products, particularly within the pharmaceutical, food and beverage, and healthcare sectors. The market's resilience is underscored by its essential role in public health and food security, making it a critical infrastructure component.

The forecasted growth highlights the increasing reliance on sophisticated cold chain solutions to ensure product integrity and safety across international borders. Key takeaways also emphasize the industry's continuous evolution through technological adoption, including IoT, AI, and automation, which are pivotal in enhancing efficiency and addressing complex logistical challenges. The expansion into emerging economies and the development of specialized cold chain services for new product categories are further contributing to its optimistic future.

- The cold chain market is poised for substantial and consistent growth through 2033.

- Pharmaceuticals and fresh food sectors are primary growth engines.

- Technological integration, particularly IoT and AI, is crucial for market expansion.

- Emerging markets present significant opportunities for infrastructure development.

- The industry is becoming increasingly vital for global health and food security.

- Sustainability and energy efficiency are growing priorities for market players.

Cold Chain Market Drivers Analysis

The Cold Chain market is propelled by a confluence of macroeconomic and industry-specific factors that are collectively increasing the demand for temperature-controlled logistics. A primary driver is the accelerating global demand for perishable food products, including fresh produce, dairy, and seafood, driven by rising disposable incomes, urbanization, and changing dietary patterns. Concurrently, the burgeoning pharmaceutical and biotechnology industries, with their expanding portfolios of temperature-sensitive vaccines, biologics, and clinical trial materials, necessitate stringent cold chain integrity for efficacy and safety.

Furthermore, the rapid expansion of organized retail and e-commerce platforms, particularly for grocery and ready-to-eat meals, is creating an unprecedented need for efficient last-mile cold chain solutions. Regulatory bodies worldwide are also implementing stricter guidelines for the storage and transportation of temperature-sensitive goods, especially pharmaceuticals and food items, thereby mandating the adoption of robust cold chain practices. Technological advancements, such as IoT-enabled monitoring, predictive analytics, and automation, are also acting as significant enablers, improving the reliability and efficiency of cold chain operations and further stimulating market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Perishable Food and Beverages | +2.5% | Global, particularly Asia Pacific and Latin America | Short to Mid-term (2025-2030) |

| Expansion of the Pharmaceutical and Biotechnology Industries | +2.0% | North America, Europe, emerging APAC markets | Mid to Long-term (2025-2033) |

| Growth of Organized Retail and E-commerce in Food and Healthcare | +1.8% | Global, especially developing economies | Short to Mid-term (2025-2030) |

| Strict Regulatory Compliance for Temperature-Sensitive Products | +1.5% | North America, Europe, increasingly Asia Pacific | Ongoing (2025-2033) |

| Technological Advancements (IoT, AI, Automation) in Logistics | +1.2% | Global | Mid-term (2027-2033) |

Cold Chain Market Restraints Analysis

Despite its significant growth potential, the Cold Chain market faces several restraints that could impede its expansion. One of the most prominent challenges is the high operational and capital investment required to establish and maintain cold chain infrastructure. This includes the cost of specialized refrigerated vehicles, temperature-controlled warehouses, and advanced monitoring systems, which can be prohibitive for new entrants and small-to-medium enterprises, particularly in developing regions.

Furthermore, the energy-intensive nature of refrigeration processes contributes to significant operational expenses and raises environmental concerns regarding carbon emissions. The complexities associated with managing diverse temperature requirements for various products, coupled with the need for highly skilled labor to handle sensitive goods and sophisticated equipment, also present ongoing challenges. Additionally, the fragmented nature of the cold chain logistics landscape in some regions, combined with a lack of standardized regulations, can lead to inefficiencies and increased costs, collectively serving as significant impediments to seamless market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Operational and Capital Investment Costs | -1.5% | Global, particularly for smaller players | Ongoing (2025-2033) |

| Significant Energy Consumption and Environmental Impact | -1.0% | Developed regions with strict emissions targets | Mid to Long-term (2027-2033) |

| Lack of Standardized Infrastructure and Regulations in Emerging Markets | -0.8% | Developing regions (e.g., parts of APAC, LATAM, MEA) | Long-term (2029-2033) |

| Vulnerability to Supply Chain Disruptions and Geopolitical Instability | -0.7% | Global, especially regions with complex trade routes | Short to Mid-term (2025-2030) |

Cold Chain Market Opportunities Analysis

The Cold Chain market is ripe with opportunities driven by global demographic shifts, advancements in life sciences, and the imperative for sustainable practices. A significant opportunity lies in the expansion into emerging economies, where increasing urbanization, rising disposable incomes, and the growth of organized retail are creating substantial demand for robust cold chain infrastructure. These regions often lack sophisticated cold chain networks, presenting a greenfield for investment and technological deployment.

Furthermore, the rapid advancements in biotechnology, including gene therapies, personalized medicine, and complex vaccines, necessitate highly specialized and ultra-low temperature cold chain solutions, opening new lucrative niches for logistics providers. The increasing focus on sustainability and eco-friendly solutions also presents an opportunity for innovation in energy-efficient refrigeration technologies, reusable packaging, and optimized logistics to reduce the carbon footprint. Additionally, the integration of advanced digital technologies like blockchain for enhanced traceability and IoT for real-time monitoring offers avenues for competitive differentiation and improved operational efficiency, attracting new investments and partnerships within the sector.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets with Growing Demand | +2.0% | Asia Pacific, Latin America, Middle East & Africa | Mid to Long-term (2027-2033) |

| Development of Specialized Cold Chain for Biopharmaceuticals and Clinical Trials | +1.8% | North America, Europe, selected Asian markets | Long-term (2029-2033) |

| Adoption of Sustainable and Energy-Efficient Technologies | +1.5% | Global, driven by regulatory and consumer demand | Mid-term (2027-2033) |

| Integration of Advanced Digital Solutions (Blockchain, IoT, AI) for Traceability | +1.2% | Global | Short to Mid-term (2025-2030) |

Cold Chain Market Challenges Impact Analysis

The Cold Chain market faces inherent challenges that demand continuous innovation and strategic adaptation. Maintaining precise temperature integrity across the entire supply chain, from manufacturing to last-mile delivery, remains a critical hurdle. Any deviation can lead to product spoilage, significant financial losses, and potential health risks, particularly for pharmaceuticals and vaccines. This complexity is compounded by diverse product requirements and varying ambient conditions globally, necessitating robust monitoring and rapid response systems.

Furthermore, navigating the intricate web of global and regional regulatory frameworks presents a significant challenge. Compliance with Good Distribution Practices (GDP) for pharmaceuticals, food safety standards, and customs regulations across different jurisdictions requires meticulous documentation, specialized handling, and a thorough understanding of evolving legal landscapes. Other notable challenges include the acute shortage of skilled labor for cold chain operations, the vulnerability of digitalized systems to cybersecurity threats, and the potential impact of extreme weather events on transportation networks, all of which underscore the need for resilient and adaptable cold chain strategies.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Maintaining Strict Temperature Integrity Across Diverse Environments | -1.0% | Global | Ongoing (2025-2033) |

| Navigating Complex and Evolving Global Regulatory Compliance | -0.8% | Europe, North America, rapidly emerging Asia Pacific | Ongoing (2025-2033) |

| Shortage of Skilled Labor and Specialized Workforce | -0.7% | Developed regions, increasingly global | Short to Mid-term (2025-2030) |

| Cybersecurity Risks to Integrated Digital Systems | -0.5% | Global, as digitalization increases | Mid to Long-term (2027-2033) |

Cold Chain Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Cold Chain market, offering a detailed understanding of its current size, historical performance, and future growth projections. It delineates key market trends, analyzes the impact of drivers, restraints, opportunities, and challenges, and provides a thorough segmentation analysis across various categories, including types, technologies, applications, and components. The report also highlights regional dynamics and profiles leading market players, offering strategic insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 310 Billion |

| Market Forecast in 2033 | USD 690 Billion |

| Growth Rate | 10.5% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Americold Logistics, Lineage Logistics, Kloosterboer, Tiong Nam Logistics, VersaCold Logistics Services, Burris Logistics, United Parcel Service (UPS), DHL Supply Chain & Global Forwarding, FedEx Corp., C.H. Robinson Worldwide, Maersk, Kuehne + Nagel, DB Schenker, Agro Merchants Group, Conestoga Cold Storage, Preferred Freezer Services, Swire Cold Storage, NewCold, Nordic Cold Storage, Raben Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Cold Chain market is segmented to provide a granular view of its diverse components and applications, enabling a precise understanding of market dynamics within specific niches. This segmentation helps in identifying high-growth areas, key technological adoptions, and the distinct needs of various end-use industries, facilitating targeted strategic planning and investment. Each segment reflects unique operational requirements, regulatory environments, and technological preferences, contributing to the overall market complexity and growth.

- By Type:

- Refrigerated Storage: Includes cold warehouses, cold rooms, and distribution centers. This segment is foundational, providing static temperature-controlled environments for various products before distribution.

- Refrigerated Transport: Encompasses refrigerated trucks, reefer containers (sea and air freight), and railcars. This segment focuses on maintaining temperature integrity during transit, crucial for perishable goods across distances.

- By Technology:

- Vapor Compression: The most common refrigeration technology, known for its efficiency in various applications.

- Absorption: Less common but gaining traction for specific applications, often used in off-grid or remote locations.

- By Application:

- Food & Beverages: The largest application segment, covering fruits & vegetables, dairy, meat & seafood, bakery & confectionery, and processed foods. Driven by global food trade and evolving consumer diets.

- Pharmaceuticals: A high-growth segment including vaccines, biologics, clinical trial materials, and other temperature-sensitive drugs. Requires stringent temperature control and compliance with Good Distribution Practices (GDP).

- Chemicals: Specialized chemicals and industrial products that require temperature control to prevent degradation or ensure stability.

- Others: Includes floriculture, healthcare equipment, and other niche products requiring cold chain logistics.

- By Component:

- Equipment: Refrigeration systems (compressors, condensers, evaporators), monitoring devices (sensors, data loggers), insulated containers, and specialized packaging.

- Services: Transportation services (road, rail, air, sea), warehousing and storage services, and value-added services such as packaging, labeling, customs clearance, and inventory management.

- By Temperature Range:

- Chilled: Typically 0°C to 15°C, for products like fresh produce, dairy, and some pharmaceuticals.

- Frozen: -18°C to 0°C, for frozen foods, ice cream, and certain medications.

- Cryogenic: Below -150°C, for highly specialized biologics, cell therapies, and critical medical samples, representing a rapidly growing niche.

Regional Highlights

- North America: A mature and technologically advanced cold chain market, characterized by a robust pharmaceutical sector, a sophisticated food distribution network, and early adoption of automation and IoT. The region benefits from stringent regulatory frameworks and significant investment in cold storage infrastructure, particularly for specialty pharmaceuticals and e-commerce fulfillment.

- Europe: Driven by strict food safety and pharmaceutical regulations (like GDP), Europe demonstrates a strong emphasis on sustainable cold chain solutions and technological innovation. The expansion of cross-border trade within the EU and the high demand for high-value biopharmaceuticals are key growth catalysts. Germany, France, and the UK are major contributors.

- Asia Pacific (APAC): Positioned as the fastest-growing region in the cold chain market, fueled by increasing disposable incomes, rapid urbanization, and a burgeoning middle class driving demand for processed and perishable foods. Significant investments in infrastructure development, coupled with a growing pharmaceutical manufacturing base (especially in India and China), are propelling market expansion.

- Latin America: An emerging market with considerable potential, largely driven by the expansion of food exports, particularly fruits, vegetables, and meat products. While facing challenges related to infrastructure gaps and economic volatility, increasing foreign direct investment and rising demand for pharmaceuticals are gradually bolstering cold chain capabilities.

- Middle East and Africa (MEA): This region offers substantial long-term opportunities, particularly due to growing populations, increasing food security concerns, and significant development in the healthcare sector. Investment in cold chain infrastructure is crucial for supporting the import of essential goods and fostering domestic food production and distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Chain Market.- Americold Logistics

- Lineage Logistics

- Kloosterboer

- Tiong Nam Logistics

- VersaCold Logistics Services

- Burris Logistics

- United Parcel Service (UPS)

- DHL Supply Chain & Global Forwarding

- FedEx Corp.

- C.H. Robinson Worldwide

- Maersk

- Kuehne + Nagel

- DB Schenker

- Agro Merchants Group

- Conestoga Cold Storage

- Preferred Freezer Services

- Swire Cold Storage

- NewCold

- Nordic Cold Storage

- Raben Group

Frequently Asked Questions

Analyze common user questions about the Cold Chain market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth of the Cold Chain Market?

The Cold Chain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2033, reaching an estimated USD 690 Billion by 2033 from USD 310 Billion in 2025.

What are the primary drivers of the Cold Chain Market's growth?

Key drivers include the escalating global demand for perishable food and beverages, the rapid expansion of the pharmaceutical and biotechnology industries, the growth of organized retail and e-commerce, and the implementation of stricter regulatory compliance for temperature-sensitive products.

How is Artificial Intelligence (AI) impacting the Cold Chain industry?

AI is significantly impacting the cold chain by enabling predictive analytics for maintenance, optimizing routes and scheduling, enhancing demand forecasting, automating quality control, and improving inventory management and traceability, leading to greater efficiency and reduced waste.

Which regions are exhibiting significant growth in the Cold Chain market?

Asia Pacific (APAC) is the fastest-growing region due to rising demand for perishable goods and pharmaceuticals, coupled with increasing investments in infrastructure. North America and Europe also show sustained growth driven by advanced technology adoption and stringent regulations.

What are the main challenges faced by the Cold Chain industry?

The industry faces challenges such as maintaining precise temperature integrity across the supply chain, navigating complex global regulatory frameworks, addressing the shortage of skilled labor, and mitigating cybersecurity risks to digitalized operations.