Buy Now Pay Later Platform Market

Buy Now Pay Later Platform Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705928 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Buy Now Pay Later Platform Market Size

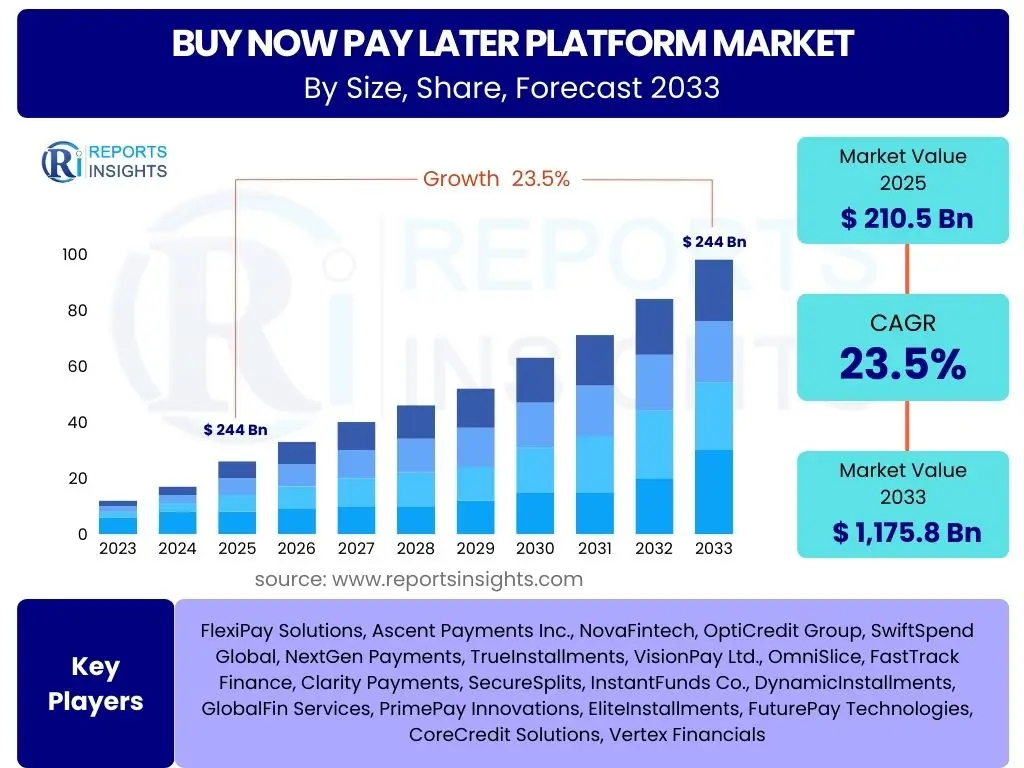

According to Reports Insights Consulting Pvt Ltd, The Buy Now Pay Later Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 23.5% between 2025 and 2033. The market is estimated at USD 210.5 Billion in 2025 and is projected to reach USD 1,175.8 Billion by the end of the forecast period in 2033.

Key Buy Now Pay Later Platform Market Trends & Insights

The Buy Now Pay Later (BNPL) market is experiencing rapid evolution driven by changing consumer payment preferences and technological advancements. User inquiries frequently highlight the shift towards flexible, interest-free payment options, especially among younger demographics who prefer alternatives to traditional credit cards. The integration of BNPL services directly into e-commerce checkout processes is a significant trend, simplifying transactions and enhancing the customer experience. Furthermore, the expansion of BNPL into new sectors beyond retail, such as healthcare, travel, and services, indicates a broadening application scope and increased market penetration. Regulatory scrutiny and the need for robust credit assessment models are also emerging as critical trends shaping the industry's future, ensuring sustainable growth and consumer protection.

Another prominent trend observed in the BNPL sector is the increasing demand for hyper-personalized payment plans and transparent fee structures. Consumers are becoming more discerning, seeking options that align precisely with their financial capabilities and spending habits. This has led to the development of diverse BNPL products, including those with varying installment periods, deferred payment options, and subscription-based models. The convergence of BNPL with other fintech innovations, such as open banking and digital wallets, is creating a more integrated payment ecosystem. This synergy is expected to unlock new functionalities and enhance user convenience, further solidifying BNPL's position as a mainstream payment method globally. The growing adoption of mobile-first strategies by BNPL providers also underscores the importance of accessibility and user-friendly interfaces in driving market growth.

- Growing consumer preference for flexible payment options over traditional credit.

- Seamless integration of BNPL into e-commerce checkout flows.

- Expansion of BNPL services into diverse sectors beyond retail, including healthcare and travel.

- Increasing regulatory focus on consumer protection and responsible lending practices.

- Development of hyper-personalized payment plans and transparent fee structures.

- Convergence of BNPL with digital wallets and open banking technologies.

- Mobile-first strategies driving accessibility and user experience.

AI Impact Analysis on Buy Now Pay Later Platform

User questions related to AI's impact on Buy Now Pay Later platforms frequently revolve around enhanced fraud detection, improved credit risk assessment, and personalized consumer experiences. Users are keen to understand how AI can make BNPL services safer and more efficient, reducing defaults while optimizing lending decisions. There is also significant interest in AI's role in automating customer service and streamlining operational processes, anticipating that these advancements will lead to lower operational costs and better user satisfaction. The general expectation is that AI will be a transformative force, enabling BNPL providers to scale rapidly while maintaining financial stability and offering tailored services.

Another key theme in user queries concerns the ethical implications of AI in BNPL, particularly regarding algorithmic bias in credit scoring and data privacy. Consumers are increasingly aware of how their data is used and expect transparency in AI-driven decision-making processes. Providers are consequently focusing on developing explainable AI models and robust data governance frameworks to build trust and comply with emerging data protection regulations. The potential for AI to predict consumer spending patterns and proactively offer relevant BNPL options is also a topic of interest, suggesting a future where BNPL services are not just reactive payment solutions but proactive financial planning tools. This predictive capability, powered by AI, could significantly enhance customer loyalty and market share for early adopters.

- Enhanced fraud detection and prevention through advanced anomaly detection.

- Improved and real-time credit risk assessment using machine learning algorithms.

- Personalized payment plans and offers based on AI-driven behavioral analytics.

- Automated customer support and dispute resolution via AI-powered chatbots.

- Optimization of operational efficiency and cost reduction through process automation.

- Predictive analytics for consumer spending patterns and proactive service offerings.

- Development of explainable AI models to address ethical concerns and regulatory compliance.

Key Takeaways Buy Now Pay Later Platform Market Size & Forecast

The core takeaways from the Buy Now Pay Later Platform market size and forecast consistently highlight its robust growth trajectory and increasing consumer adoption. User inquiries often seek clarity on the sustainability of this growth and the primary factors fueling it. The market's significant projected expansion, driven by digital transformation and evolving consumer financial habits, signals a fundamental shift away from traditional credit models, especially for smaller, discretionary purchases. This indicates a resilient and expanding market with considerable future potential, attracting significant investment and innovation. The forecast underscores that BNPL is not merely a fleeting trend but a foundational change in the payment landscape.

Furthermore, the market's strong Compound Annual Growth Rate (CAGR) emphasizes the rapid pace of adoption across diverse demographics and geographic regions. Key insights reveal that convenience, financial flexibility, and the absence of interest charges (for on-time payments) are paramount drivers. The market is also benefiting from the increased penetration of e-commerce and the willingness of retailers to integrate BNPL options to boost sales conversions. While regulatory landscapes are evolving, the underlying demand for accessible and manageable payment solutions remains high, positioning BNPL platforms as crucial facilitators of modern commerce. The projected market value by 2033 reinforces the notion that BNPL is poised to become a dominant force in global consumer finance.

- The BNPL market demonstrates exceptional growth potential with a high projected CAGR.

- Digital transformation and e-commerce expansion are primary growth catalysts.

- Consumer demand for flexible, interest-free payment solutions remains robust.

- BNPL is transforming consumer credit and purchasing behavior globally.

- Significant investment and innovation are expected to continue driving market evolution.

- The market is adapting to evolving regulatory frameworks to ensure sustainable growth.

Buy Now Pay Later Platform Market Drivers Analysis

The burgeoning adoption of e-commerce platforms globally serves as a foundational driver for the Buy Now Pay Later market. As online shopping continues its exponential growth, consumers increasingly seek convenient and flexible payment solutions that align with the digital shopping experience. BNPL offers an attractive alternative to traditional credit cards, particularly for younger demographics and those hesitant to incur high-interest debt, by breaking down purchases into manageable, interest-free installments. This ease of payment directly contributes to higher conversion rates for online retailers and improves the overall shopping experience, thereby fueling the demand for BNPL services. The seamless integration of BNPL options at the checkout stage has become a crucial factor in driving spontaneous purchases and increasing average order values, solidifying its position within the digital commerce ecosystem.

Another significant driver is the increasing financial literacy and digital penetration across emerging economies. As more individuals gain access to smartphones and internet services, their exposure to digital financial solutions expands, leading to greater acceptance of innovative payment methods like BNPL. Furthermore, the rising cost of living and stagnant wages in many regions compel consumers to seek flexible financing options for everyday purchases, making BNPL an appealing choice. The strategic partnerships between BNPL providers and a wide array of merchants, spanning various sectors from fashion to electronics and healthcare, also plays a pivotal role. These partnerships expand the accessibility and utility of BNPL services, embedding them deeper into the consumer purchasing journey and further accelerating market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Surge in E-commerce Adoption | +1.8% | Global, particularly Asia Pacific, North America | Short to Mid-term (2025-2030) |

| Preference for Flexible & Interest-Free Payments | +1.5% | Global, all age groups | Short to Long-term (2025-2033) |

| Exclusion from Traditional Credit Systems | +1.2% | Emerging Economies, Underserved Populations | Mid-term (2027-2033) |

| Merchant Benefits (Increased Conversions & AOV) | +0.9% | Global, all merchant types | Short to Mid-term (2025-2030) |

Buy Now Pay Later Platform Market Restraints Analysis

One of the primary restraints on the Buy Now Pay Later market's growth is the escalating regulatory scrutiny and the evolving legal landscape surrounding consumer credit. Governments and financial watchdogs worldwide are increasingly concerned about the potential for consumers to accumulate unmanageable debt, the lack of robust affordability checks, and inadequate consumer protection mechanisms within the BNPL framework. This has led to the introduction of stricter regulations, including requirements for comprehensive credit reporting, interest rate caps, and transparent disclosure of terms and conditions. Compliance with these diverse and often complex regulations can significantly increase operational costs for BNPL providers, potentially slowing down expansion into new markets and reducing profit margins, thereby impacting the overall CAGR.

Another significant restraint is the increasing competition from traditional credit card companies and other financial service providers that are now entering the flexible payment space. Many established banks are launching their own installment payment options, leveraging their existing customer bases, regulatory compliance infrastructure, and deep pockets. This heightened competition can lead to price wars, reduced fees, and increased marketing expenditures, ultimately eroding the profitability of standalone BNPL platforms. Furthermore, negative publicity surrounding consumer debt issues, such as late fees or the impact on credit scores, can deter potential users and lead to a decline in trust, posing a significant challenge to market penetration. The perception of BNPL as contributing to overspending or financial difficulty represents a substantial hurdle for continued widespread adoption.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Regulatory Scrutiny & Compliance Costs | -1.2% | Global, particularly UK, Australia, US, EU | Short to Mid-term (2025-2030) |

| Risk of Consumer Over-Indebtedness | -0.8% | Global, vulnerable consumer segments | Mid to Long-term (2027-2033) |

| Competition from Traditional Financial Institutions | -0.7% | Developed Markets, established banking regions | Short to Mid-term (2025-2030) |

| Negative Publicity & Consumer Trust Issues | -0.5% | Global, general public perception | Short-term (2025-2027) |

Buy Now Pay Later Platform Market Opportunities Analysis

The vast untapped potential in emerging markets presents a significant growth opportunity for Buy Now Pay Later platforms. Many consumers in regions like Southeast Asia, Latin America, and Africa have limited access to traditional credit facilities, making BNPL an accessible and attractive alternative for managing purchases. As digital infrastructure improves and smartphone penetration increases in these areas, BNPL providers can leverage this growing digital-first consumer base. Tailoring BNPL products to suit local economic conditions, cultural spending habits, and regulatory frameworks will be crucial for successful market penetration, offering substantial growth avenues away from the saturated developed markets. The rising middle class in these regions, coupled with a booming e-commerce sector, creates a fertile ground for BNPL expansion.

Another compelling opportunity lies in the diversification of BNPL services beyond general retail into specialized, higher-value sectors. Industries such as healthcare (for elective procedures, dental work, or medication), education (for course fees or learning materials), and travel (for flights or hotel bookings) often involve larger transactions that consumers may struggle to pay upfront. Integrating BNPL options in these sectors allows consumers to manage significant expenses more flexibly, while providers can tap into new, high-value revenue streams. Furthermore, the integration of advanced data analytics and Artificial Intelligence (AI) can enhance risk assessment, personalize offerings, and improve customer engagement. Leveraging AI to identify new market niches and optimize product delivery will be key to unlocking long-term growth and competitive advantage in the evolving BNPL landscape.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets (e.g., LATAM, SEA, Africa) | +1.7% | Latin America, Southeast Asia, Africa | Mid to Long-term (2027-2033) |

| Diversification into High-Value Sectors (Healthcare, Travel, Education) | +1.4% | Global, particularly Developed Markets | Mid-term (2027-2030) |

| Integration with Advanced Technologies (AI, Open Banking) | +1.1% | Global, Tech-Forward Regions | Short to Mid-term (2025-2030) |

| Partnerships with Large Retailers & Financial Institutions | +0.9% | Global, Key Commercial Hubs | Short-term (2025-2027) |

Buy Now Pay Later Platform Market Challenges Impact Analysis

One of the significant challenges facing the Buy Now Pay Later market is the inherent risk of loan defaults and credit losses, particularly during economic downturns or periods of high inflation. While BNPL offers convenience, the ease of access can lead to consumers overextending themselves, making it difficult to meet repayment obligations. Unlike traditional credit products, many BNPL providers initially offered less stringent credit checks, which could expose them to higher default rates. Managing these risks effectively requires sophisticated underwriting models and proactive communication with consumers, but the potential for increased loan losses remains a persistent concern for the financial health and sustainability of BNPL providers. This challenge is magnified by the typically small profit margins on individual transactions, making cumulative defaults particularly impactful.

Another critical challenge is the intense and growing competition within the BNPL space itself, as well as from established financial institutions. The market has become increasingly crowded with numerous players vying for market share, leading to a race to offer more attractive terms, lower fees, and wider merchant networks. This competitive pressure can compress profit margins, increase customer acquisition costs, and make it difficult for new entrants or smaller players to differentiate themselves. Furthermore, adapting to the rapidly evolving regulatory landscape across different jurisdictions presents a complex and costly hurdle. Each country or region may introduce unique compliance requirements related to lending practices, consumer data protection, and reporting standards, demanding significant legal and technological investments from BNPL platforms operating on a global or multi-regional scale. Staying abreast of and adhering to these diverse regulations is a continuous operational burden.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Default Rates and Credit Risk Management | -1.5% | Global, economically sensitive regions | Short to Mid-term (2025-2030) |

| Intense Competitive Landscape | -1.0% | Developed Markets, highly saturated regions | Short to Mid-term (2025-2030) |

| Evolving Regulatory Environment & Compliance Complexity | -0.9% | Global, particularly mature financial markets | Mid-term (2027-2033) |

| Data Security and Privacy Concerns | -0.6% | Global, highly regulated data protection regions | Short to Long-term (2025-2033) |

Buy Now Pay Later Platform Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Buy Now Pay Later Platform Market, offering granular insights into its size, growth drivers, restraints, opportunities, and challenges. It covers market segmentation by various parameters, regional dynamics, competitive landscape, and the impact of emerging technologies like AI. The scope aims to equip stakeholders with actionable intelligence for strategic decision-making and understanding future market trajectories.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 210.5 Billion |

| Market Forecast in 2033 | USD 1,175.8 Billion |

| Growth Rate | 23.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | FlexiPay Solutions, Ascent Payments Inc., NovaFintech, OptiCredit Group, SwiftSpend Global, NextGen Payments, TrueInstallments, VisionPay Ltd., OmniSlice, FastTrack Finance, Clarity Payments, SecureSplits, InstantFunds Co., DynamicInstallments, GlobalFin Services, PrimePay Innovations, EliteInstallments, FuturePay Technologies, CoreCredit Solutions, Vertex Financials |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Buy Now Pay Later (BNPL) platform market is meticulously segmented to provide a comprehensive understanding of its diverse components and their respective growth drivers. This granular analysis allows stakeholders to identify key opportunities and tailor strategies for specific market niches. The segmentation primarily considers the offering type (platform vs. services), the nature of payment installments (interest-free, interest-bearing, deferred), the broad range of end-use industries leveraging BNPL, and the various channels through which these services are delivered, highlighting the multifaceted nature of the market. This detailed breakdown enables a deeper understanding of consumer preferences and industry-specific adoption patterns.

Further segmentation explores the specific payment models prevalent in the market, such as the popular "Pay-in-4" or "Pay-in-30" options, alongside traditional monthly installments. This helps in dissecting consumer behavior based on repayment flexibility and purchase size. Understanding these segments is crucial for BNPL providers to develop targeted products and for merchants to select the most appropriate BNPL partners that align with their customer base and product offerings. The dynamic interplay between these segments significantly influences overall market growth and competitive dynamics, with each segment exhibiting unique growth potential and challenges. The ability to navigate these segments effectively is paramount for sustained success in the rapidly evolving BNPL landscape.

- By Offering: Platform, Services

- By Type: Interest-Free Installments, Interest-Bearing Installments, Deferred Payments

- By End-Use Industry:

- Retail & E-commerce (Fashion & Apparel, Electronics, Home Goods, Beauty & Personal Care, Other Retail)

- Healthcare

- Travel & Tourism

- Automotive

- Education

- Others

- By Channel:

- Online (E-commerce Websites, Mobile Apps)

- Point of Sale (POS) Terminals

- By Payment Model: Pay-in-4, Pay-in-30, Monthly Installments, Others

Regional Highlights

- North America: This region is a dominant force in the Buy Now Pay Later market, driven by high digital penetration, a robust e-commerce ecosystem, and strong consumer adoption of flexible payment solutions. The United States, in particular, leads in market size and innovation, with a large proportion of tech-savvy consumers and a competitive landscape featuring numerous domestic and international BNPL providers. Canada also contributes significantly, showing steady growth in BNPL usage across various retail sectors. The mature financial infrastructure and the widespread acceptance of digital payments further bolster the market's expansion in this region. Regulatory discussions are ongoing, aiming to strike a balance between fostering innovation and ensuring consumer protection.

- Europe: Europe represents a rapidly expanding market for BNPL platforms, characterized by diverse regulatory environments and varying levels of consumer awareness across countries. The Nordic countries, Germany, and the UK have shown early and strong adoption, propelled by a preference for cashless transactions and the popularity of online shopping. Southern and Eastern European countries are catching up, driven by increasing e-commerce penetration and a younger demographic seeking alternatives to traditional credit. The fragmented regulatory landscape within the EU poses both challenges and opportunities, with efforts to standardize consumer credit rules potentially shaping the market's future growth trajectory. Innovation in open banking and digital identity verification is also accelerating BNPL adoption here.

- Asia Pacific (APAC): The APAC region is poised for remarkable growth in the BNPL market, fueled by its immense population, burgeoning e-commerce sector, and rapidly expanding digital infrastructure. Countries like Australia, India, Indonesia, and Southeast Asian nations are emerging as key growth hubs. A significant portion of the population in these regions is underserved by traditional banking and credit services, making BNPL an attractive and accessible financing option. The increasing smartphone penetration and the rise of mobile-first payment habits are pivotal drivers. Cultural nuances and varied consumer trust levels necessitate tailored BNPL solutions, but the sheer scale of the consumer base presents unparalleled opportunities for market expansion.

- Latin America: This region is witnessing a rapid surge in BNPL adoption, primarily due to a large unbanked or underbanked population and a growing e-commerce market. Countries like Brazil, Mexico, and Colombia are at the forefront of this trend, where consumers are keen on flexible payment methods that bypass traditional credit requirements. High inflation rates in some countries also make installment payments particularly appealing, helping consumers manage their purchasing power. While regulatory frameworks are still evolving, the strong demand for accessible credit alternatives positions Latin America as a high-potential market for BNPL platforms looking for significant growth.

- Middle East and Africa (MEA): The MEA region is an emerging yet high-potential market for Buy Now Pay Later platforms. Growth is driven by increasing internet penetration, a young demographic, and government initiatives promoting digital economies. The Gulf Cooperation Council (GCC) countries are leading the adoption due to high disposable incomes and a tech-savvy population, while North African and Sub-Saharan African countries are seeing gradual but consistent growth as financial inclusion initiatives expand. Religious considerations in some areas also favor interest-free payment models, making BNPL a culturally aligned financial solution. The expansion of e-commerce and the rise of local fintech ecosystems are vital for market development in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Buy Now Pay Later Platform Market.- FlexiPay Solutions

- Ascent Payments Inc.

- NovaFintech

- OptiCredit Group

- SwiftSpend Global

- NextGen Payments

- TrueInstallments

- VisionPay Ltd.

- OmniSlice

- FastTrack Finance

- Clarity Payments

- SecureSplits

- InstantFunds Co.

- DynamicInstallments

- GlobalFin Services

- PrimePay Innovations

- EliteInstallments

- FuturePay Technologies

- CoreCredit Solutions

- Vertex Financials

Frequently Asked Questions

What is the projected growth rate of the Buy Now Pay Later Platform Market?

The Buy Now Pay Later Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 23.5% between 2025 and 2033, indicating robust expansion.

How large is the BNPL market expected to be by 2033?

The BNPL market is estimated at USD 210.5 Billion in 2025 and is projected to reach USD 1,175.8 Billion by the end of the forecast period in 2033.

What are the primary drivers of the Buy Now Pay Later market?

Key drivers include the surge in e-commerce adoption, increasing consumer preference for flexible and interest-free payment options, and merchant benefits such as increased conversion rates and average order values.

What challenges does the BNPL market face?

Major challenges include high default rates and credit risk management, intense competitive landscape, and the complexities of evolving regulatory environments across different regions.

How is AI impacting the Buy Now Pay Later industry?

AI is significantly enhancing fraud detection, improving credit risk assessment, enabling personalized payment plans, and automating customer support, thereby driving efficiency and tailored experiences.