Blockchain Technology Market

Blockchain Technology Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705869 | Last Updated : August 17, 2025 |

Format : ![]()

![]()

![]()

![]()

Blockchain Technology Market Size

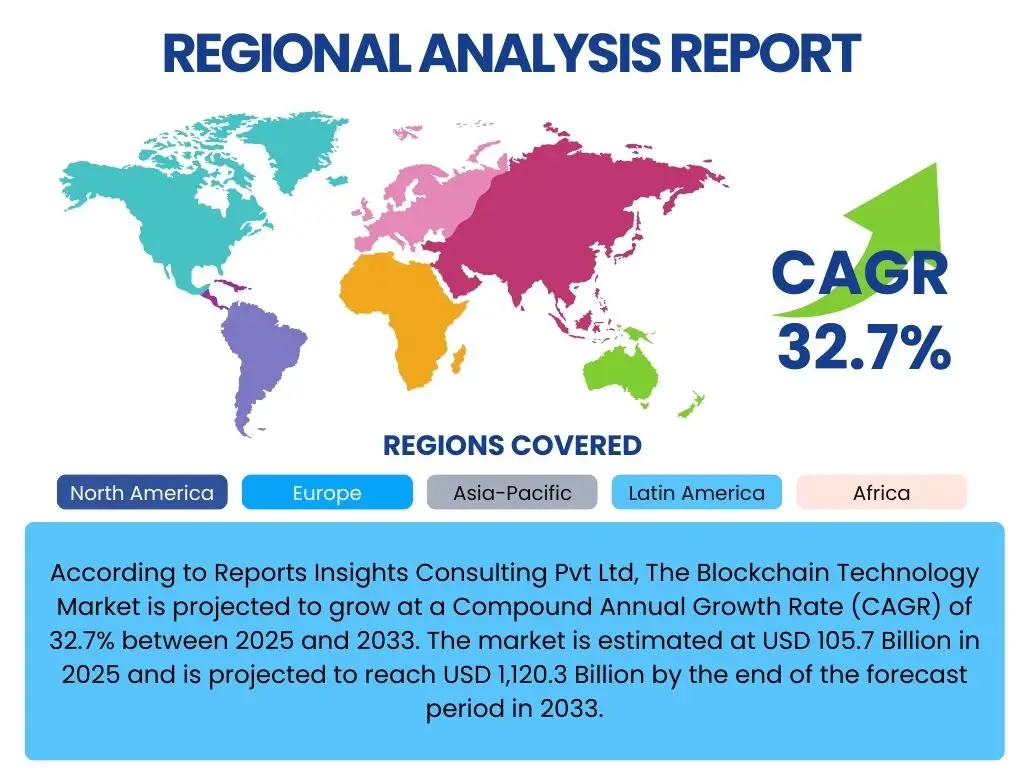

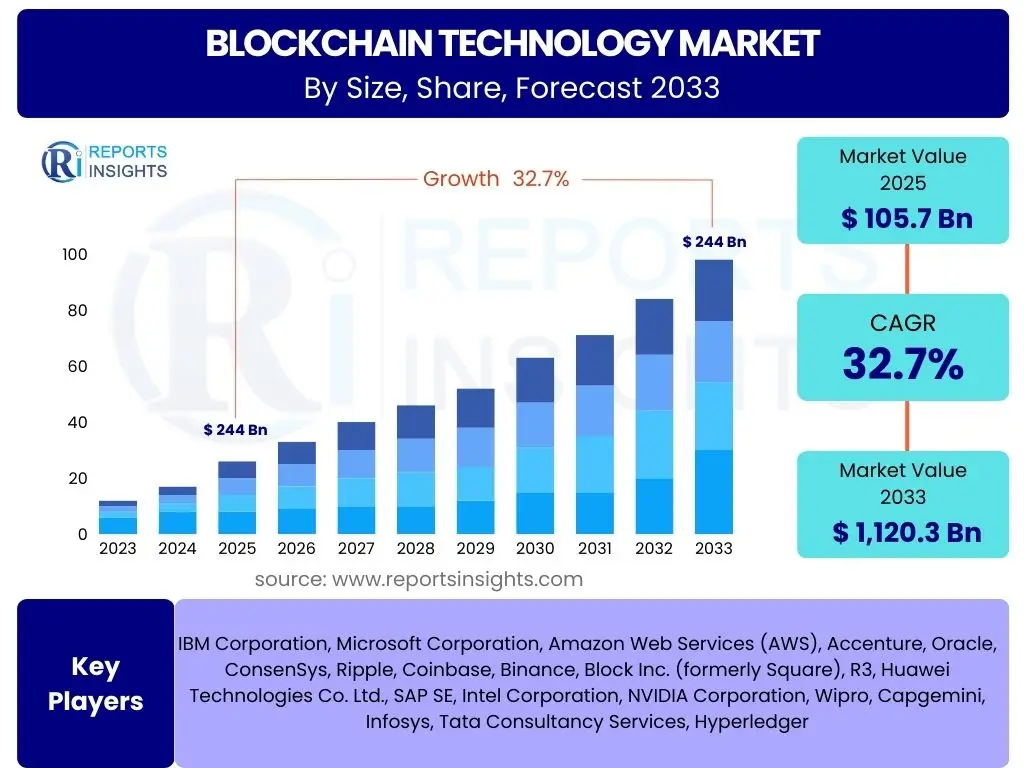

According to Reports Insights Consulting Pvt Ltd, The Blockchain Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 32.7% between 2025 and 2033. The market is estimated at USD 105.7 Billion in 2025 and is projected to reach USD 1,120.3 Billion by the end of the forecast period in 2033.

Key Blockchain Technology Market Trends & Insights

The Blockchain Technology market is currently shaped by several transformative trends, reflecting its ongoing evolution from a niche technology to a mainstream infrastructure component. A primary driver is the increasing adoption of decentralized finance (DeFi) protocols and non-fungible tokens (NFTs), which have democratized access to financial services and revolutionized digital ownership, respectively. These applications are pushing the boundaries of what blockchain can achieve beyond cryptocurrency, fostering innovation in areas such as digital identity, supply chain provenance, and intellectual property management. The mainstream integration of these concepts highlights a growing public awareness and acceptance of blockchain's potential.

Another significant trend is the growing emphasis on enterprise blockchain solutions and private/consortium networks. Businesses are increasingly recognizing the value of blockchain for enhancing transparency, efficiency, and security across their operations, particularly in sectors like supply chain, healthcare, and finance. This shift from purely public, permissionless blockchains to more controlled, permissioned environments reflects the need for regulatory compliance, data privacy, and higher transaction throughput in corporate settings. Furthermore, the development of interoperability solutions and cross-chain bridges is a critical trend, addressing the fragmentation within the blockchain ecosystem and enabling seamless asset and data transfer between different blockchain networks.

Finally, the market is witnessing a strong push towards sustainability and energy efficiency, particularly in response to environmental concerns related to proof-of-work consensus mechanisms. The transition to more eco-friendly alternatives like proof-of-stake (PoS) and the development of "green blockchain" initiatives are gaining traction. This trend is crucial for broader institutional adoption and aligns with global sustainability goals. Coupled with this, regulatory clarity is slowly emerging in various jurisdictions, providing a more stable environment for innovation and investment, further accelerating the market's growth and integration into traditional economic frameworks.

- Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) expanding beyond niche markets.

- Increased enterprise adoption of permissioned and hybrid blockchain solutions for business processes.

- Development of interoperability protocols and cross-chain bridges to foster ecosystem connectivity.

- Shift towards more energy-efficient and sustainable blockchain consensus mechanisms.

- Emergence of regulatory frameworks providing greater clarity and stability for blockchain ventures.

- Growth of Web3 infrastructure and applications, integrating blockchain with the next generation of the internet.

- Tokenization of real-world assets (RWAs) for increased liquidity and fractional ownership.

AI Impact Analysis on Blockchain Technology

The intersection of Artificial Intelligence (AI) and Blockchain Technology is emerging as a powerful synergy, with each technology offering unique capabilities that enhance the other. Users are frequently querying how AI can optimize blockchain operations, from improving smart contract efficiency and security to predicting network congestion and enabling more intelligent data analysis on distributed ledgers. AI's analytical prowess can be leveraged to identify vulnerabilities in blockchain code, automate auditing processes, and provide predictive insights into market trends for decentralized applications. This integration promises to make blockchain networks more robust, efficient, and user-friendly, addressing some of the inherent challenges of scalability and security.

Conversely, blockchain technology provides a crucial layer of trust, transparency, and immutability for AI systems, addressing growing concerns around data provenance, algorithmic bias, and accountability. Users are interested in how blockchain can secure AI models and their training data, ensuring data integrity and preventing tampering or unauthorized access. This is particularly relevant for verifiable AI outcomes, where the audit trail of data used and decisions made by an AI model can be securely recorded on a blockchain. The combination can also facilitate decentralized AI marketplaces, allowing for the secure and transparent exchange of AI models, datasets, and computational resources, fostering a more equitable and verifiable AI ecosystem.

The key themes emerging from user inquiries include the potential for AI-driven automation of blockchain processes, enhanced security through AI-powered threat detection, and the creation of more intelligent and responsive decentralized applications (dApps). There are also expectations that this convergence will drive innovation in new application areas such as autonomous decentralized organizations (DAOs), self-sovereign identity management, and advanced supply chain optimization. While challenges like data privacy and processing large datasets on-chain remain, the collaborative potential of AI and blockchain is seen as a cornerstone for future technological advancements, promising to unlock unprecedented levels of efficiency, trust, and intelligence across various industries.

- AI enhances blockchain through predictive analytics for network optimization and congestion management.

- AI improves smart contract auditing and security by identifying vulnerabilities and automating code reviews.

- Blockchain secures AI models and data by ensuring immutability, transparency, and verifiable provenance of datasets.

- Decentralized AI marketplaces powered by blockchain enable secure and fair exchange of AI assets.

- AI can optimize blockchain consensus mechanisms for better efficiency and energy consumption.

- Blockchain provides an immutable ledger for AI's decision-making processes, enhancing accountability and explainability.

- Integration can lead to more sophisticated decentralized applications (dApps) and autonomous systems.

Key Takeaways Blockchain Technology Market Size & Forecast

The Blockchain Technology market is poised for exponential growth over the forecast period, reflecting its increasing maturity and widespread application across diverse sectors. A primary takeaway is the significant projected increase in market valuation, underscoring the growing confidence from both enterprises and consumers in blockchain's transformative capabilities. This growth is not merely speculative but is driven by tangible use cases that deliver measurable benefits, such as enhanced operational efficiency, improved data security, and reduced transactional costs. The market's upward trajectory signifies a foundational shift in how industries manage data, conduct transactions, and establish trust in digital environments.

Another crucial insight is that while financial services remain a dominant segment, the growth is increasingly diversified across other verticals including supply chain, healthcare, media, and government. This broad adoption indicates that blockchain is evolving beyond its cryptocurrency origins to become a versatile tool for various business challenges. The continued investment in research and development, particularly in scalability solutions, interoperability, and user-friendly interfaces, is also a key factor driving this optimistic forecast. These advancements are addressing historical limitations, making blockchain more accessible and practical for mass deployment.

Ultimately, the market forecast highlights a transition from experimental pilot projects to full-scale commercial deployments, signaling a long-term commitment to blockchain integration by major industry players. The robust Compound Annual Growth Rate (CAGR) reinforces the notion that blockchain is no longer a nascent technology but a critical infrastructure component set to redefine digital interactions and economic models. The market's resilience against economic uncertainties and its adaptability to emerging technological trends further solidify its promising outlook, positioning blockchain as a cornerstone of future digital economies.

- The Blockchain Technology market is projected for substantial growth, indicating strong confidence and adoption.

- Market expansion is driven by tangible benefits in operational efficiency, security, and cost reduction across sectors.

- Diversification of blockchain applications beyond financial services into supply chain, healthcare, and other industries.

- Continuous innovation in scalability, interoperability, and user experience is fueling market acceleration.

- Transition from pilot projects to widespread commercial deployment marks a significant maturity phase.

- Long-term investment and integration strategies by major enterprises are cementing blockchain's future role.

- The technology is becoming a critical infrastructure component, reshaping digital economies globally.

Blockchain Technology Market Drivers Analysis

The expansion of the Blockchain Technology market is propelled by a confluence of powerful drivers, primarily the escalating demand for enhanced transparency and security across digital transactions and data management. Businesses and consumers alike are seeking immutable records and verifiable processes, which blockchain inherently provides, mitigating risks associated with fraud and unauthorized data manipulation. This intrinsic security feature is particularly compelling for industries dealing with sensitive information or high-value assets, driving significant investment and adoption across the financial, healthcare, and supply chain sectors. The ability to establish trust without intermediaries reduces operational complexities and costs, making blockchain an attractive solution for modern digital infrastructure.

Another significant driver is the increasing adoption of blockchain in cross-border payments and remittances. Traditional international payment systems are often slow, expensive, and opaque. Blockchain-based solutions offer near real-time settlements, lower transaction fees, and greater transparency, directly addressing pain points for both individuals and businesses engaging in global trade. This efficiency gain is critical for fostering global commerce and financial inclusion, prompting financial institutions and fintech companies to actively explore and implement blockchain-enabled payment networks. The decentralized nature of these systems also reduces reliance on central authorities, offering a more resilient and accessible global financial infrastructure.

Furthermore, the growing interest in digital identity management and the tokenization of assets are pivotal drivers. Blockchain offers a secure and self-sovereign approach to identity, allowing individuals to control their personal data and verify credentials without relying on centralized databases. This has profound implications for privacy, security, and user experience across various online services. Simultaneously, the ability to tokenize real-world assets (RWAs) like real estate, art, and commodities into digital tokens on a blockchain unlocks new avenues for liquidity, fractional ownership, and investment. This innovation is attracting significant capital and reshaping traditional asset markets, democratizing access to investments and creating new economic models.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Transparency & Security | +5.5% | Global | Mid-term to Long-term |

| Growing Adoption in Cross-border Payments & Remittances | +4.8% | Emerging Economies, Global Financial Hubs | Short-term to Mid-term |

| Rising Interest in Digital Identity & Asset Tokenization | +4.2% | North America, Europe, Asia Pacific | Mid-term to Long-term |

| Advancements in Supply Chain Management Solutions | +3.9% | Asia Pacific, Europe | Mid-term |

| Increasing Institutional Investment & Corporate Adoption | +3.5% | Global | Short-term to Mid-term |

Blockchain Technology Market Restraints Analysis

Despite its significant growth potential, the Blockchain Technology market faces several notable restraints that could temper its expansion. One of the most prominent challenges is regulatory uncertainty and the lack of a harmonized legal framework across different jurisdictions. The varied and often conflicting approaches to regulating cryptocurrencies, digital assets, and decentralized applications create an unpredictable environment for businesses and investors. This regulatory fragmentation can deter large-scale enterprise adoption, increase compliance costs, and stifle innovation, as companies struggle to navigate complex and evolving legal landscapes, particularly for cross-border operations. The absence of clear guidelines slows down mainstream integration and limits the full potential of blockchain applications.

Scalability issues remain a significant technical restraint for many blockchain networks, especially public, permissionless ones. While various solutions like sharding, layer-2 protocols, and sidechains are being developed, the inherent limitations in processing high volumes of transactions per second continue to be a barrier for applications requiring enterprise-grade throughput, such as high-frequency trading or mass consumer interactions. This often leads to network congestion, increased transaction fees, and slower processing times, which can undermine the efficiency benefits that blockchain promises. Addressing these technical bottlenecks is crucial for broader adoption across industries that demand instantaneous and voluminous data processing.

Furthermore, the high energy consumption associated with certain blockchain consensus mechanisms, particularly Proof-of-Work (PoW), has emerged as a significant environmental concern. This not only contributes to carbon emissions but also increases operational costs, making some blockchain networks less viable for sustainable long-term use. While the industry is actively transitioning towards more energy-efficient alternatives like Proof-of-Stake (PoS), the public perception and existing infrastructure for PoW-based systems present a hurdle. Additionally, the shortage of skilled blockchain professionals, including developers, security experts, and legal specialists, limits the pace of innovation and deployment, creating a talent gap that hinders market growth and the effective implementation of complex blockchain solutions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Regulatory Uncertainty & Lack of Harmonized Frameworks | -3.0% | Global, particularly emerging markets | Mid-term |

| Scalability & Performance Limitations of Networks | -2.5% | Global | Short-term to Mid-term |

| High Energy Consumption & Environmental Concerns (PoW) | -2.0% | Global | Mid-term |

| Lack of Interoperability Between Disparate Blockchains | -1.8% | Global | Mid-term |

| Shortage of Skilled Blockchain Professionals | -1.5% | Global | Short-term to Mid-term |

Blockchain Technology Market Opportunities Analysis

The Blockchain Technology market is ripe with opportunities for expansion and innovation, driven by evolving technological landscapes and increasing digital transformation initiatives. A significant opportunity lies in the continued growth and adoption of Central Bank Digital Currencies (CBDCs). As governments worldwide explore and pilot digital versions of their national currencies, blockchain technology provides the underlying infrastructure for secure, efficient, and transparent issuance and management of CBDCs. This shift could usher in a new era of financial infrastructure, potentially revolutionizing domestic and international payments, enhancing monetary policy tools, and fostering financial inclusion, thereby creating massive opportunities for blockchain solution providers.

Another compelling opportunity resides in the burgeoning metaverse and Web3 ecosystem. Blockchain is foundational to the concept of a decentralized internet, offering mechanisms for digital ownership (NFTs), virtual economies, and self-sovereign identity within virtual worlds. As immersive digital experiences become more prevalent, the demand for blockchain-powered infrastructure to manage digital assets, verify identities, and facilitate secure transactions in the metaverse will surge. This opens up vast potential for new business models, applications, and services that seamlessly blend the physical and digital realms, extending blockchain's reach beyond traditional enterprise applications into new frontiers of digital interaction and commerce.

Furthermore, the increasing demand for blockchain-as-a-service (BaaS) and customizable enterprise solutions presents a substantial opportunity. Many organizations lack the in-house expertise or resources to develop and manage their own blockchain infrastructure. BaaS platforms offer simplified access to blockchain capabilities, allowing businesses to integrate distributed ledger technology into their existing systems with minimal friction. This model democratizes access to blockchain, enabling a wider range of companies, including SMEs, to leverage its benefits without significant upfront investment or technical complexity. This service-oriented approach accelerates adoption across various industries, creating a steady revenue stream for platform providers and fostering a more accessible blockchain ecosystem.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of Central Bank Digital Currencies (CBDCs) | +4.7% | Global, particularly advanced economies & China | Mid-term to Long-term |

| Growth of Metaverse & Web3 Ecosystems | +4.0% | North America, Asia Pacific, Europe | Mid-term to Long-term |

| Increasing Demand for Blockchain-as-a-Service (BaaS) | +3.8% | Global | Short-term to Mid-term |

| Tokenization of Real-World Assets (RWAs) | +3.5% | Global Financial Hubs | Mid-term to Long-term |

| Focus on Sustainable & Green Blockchain Solutions | +3.2% | Europe, North America | Short-term to Mid-term |

Blockchain Technology Market Challenges Impact Analysis

The Blockchain Technology market, while rapidly expanding, is confronted by several significant challenges that could hinder its full potential and widespread adoption. One critical challenge is the inherent complexity associated with developing, deploying, and integrating blockchain solutions. The steep learning curve for developers, the nascent tooling ecosystem, and the difficulty in integrating distributed ledger technology with legacy IT systems often translate into high implementation costs and prolonged development cycles for enterprises. This complexity not only acts as a barrier to entry for many organizations but also contributes to a shortage of skilled professionals, exacerbating the challenges of scaling blockchain initiatives across various industries.

Another major hurdle is the persistent issue of security vulnerabilities and the perception of risk, despite blockchain's foundational cryptographic security. While the underlying cryptographic principles are robust, the implementation of smart contracts and decentralized applications can introduce bugs, leading to significant financial losses from hacks and exploits. High-profile incidents, such as flash loan attacks or protocol vulnerabilities, erode public trust and deter institutional investment. Ensuring the immutability and security of data on a blockchain is paramount, but the reliance on human-coded smart contracts introduces an attack surface that requires continuous auditing and robust security practices, a challenge that needs to be addressed consistently to foster widespread confidence.

Furthermore, interoperability between different blockchain networks remains a substantial challenge. The fragmented nature of the blockchain ecosystem, with numerous independent protocols and platforms, limits the seamless transfer of assets and data across chains. This lack of interoperability hinders the creation of truly global, interconnected decentralized applications and restricts the overall utility of the technology for complex multi-party interactions. While cross-chain solutions are in development, achieving seamless and secure communication between diverse blockchains is a complex technical feat. Addressing this fragmentation is crucial for the blockchain ecosystem to mature into a cohesive and universally accessible infrastructure, capable of supporting complex, interconnected digital economies.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Complexity & Integration Challenges with Legacy Systems | -2.8% | Global | Short-term to Mid-term |

| Security Vulnerabilities & Risks of Smart Contract Exploits | -2.3% | Global | Ongoing |

| Lack of Interoperability Between Different Blockchain Networks | -2.0% | Global | Mid-term |

| User Experience & Adoption Barriers for General Public | -1.7% | Global | Short-term to Mid-term |

| Data Privacy Concerns on Public Blockchains | -1.5% | Europe (GDPR-focused), Global | Mid-term |

Blockchain Technology Market - Updated Report Scope

This report provides an in-depth analysis of the global Blockchain Technology market, offering a comprehensive overview of its current landscape, key trends, drivers, restraints, and opportunities. It segments the market by component, type, application, industry vertical, and region, providing detailed insights into each category. The study includes a competitive analysis of leading market players, assessing their strategies, product portfolios, and market presence to deliver a holistic understanding of the industry dynamics and future growth prospects. The report aims to equip stakeholders with actionable intelligence for strategic decision-making in this rapidly evolving technological domain.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 105.7 Billion |

| Market Forecast in 2033 | USD 1,120.3 Billion |

| Growth Rate | 32.7% |

| Number of Pages | 255 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | IBM Corporation, Microsoft Corporation, Amazon Web Services (AWS), Accenture, Oracle, ConsenSys, Ripple, Coinbase, Binance, Block Inc. (formerly Square), R3, Huawei Technologies Co. Ltd., SAP SE, Intel Corporation, NVIDIA Corporation, Wipro, Capgemini, Infosys, Tata Consultancy Services, Hyperledger |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Blockchain Technology market is meticulously segmented to provide a granular view of its diverse applications and areas of growth. This segmentation helps in understanding the various facets of blockchain deployment, from the underlying infrastructure to specific industry use cases. The market is primarily divided by component, distinguishing between the foundational platforms that enable blockchain networks and the services that support their implementation and maintenance. This distinction highlights the comprehensive ecosystem that supports blockchain adoption, catering to both developers and enterprises seeking to leverage this technology.

Further segmentation by type differentiates between public, private, hybrid, and consortium blockchains, reflecting the varied architectural choices driven by considerations of decentralization, privacy, and control. Public blockchains, known for their transparency and immutability, cater to open networks like cryptocurrencies, while private and consortium blockchains are favored by enterprises requiring permissioned access and greater governance. The application-based segmentation showcases the wide array of solutions blockchain offers, including digital identity, payments, smart contracts, and supply chain management, among others. This illustrates the versatility of blockchain in addressing diverse business challenges across multiple sectors.

Finally, the market is segmented by industry vertical, covering key sectors such as Banking, Financial Services, and Insurance (BFSI), IT & Telecommunications, Government, Healthcare, and Retail. This vertical-specific analysis underscores how blockchain is being tailored to meet the unique demands and regulatory requirements of each industry, driving tailored solutions and fostering specialized ecosystems. Together, these segmentations provide a detailed roadmap of the Blockchain Technology market, illuminating growth pockets and strategic opportunities for stakeholders across the entire value chain.

- By Component:

- Platform

- Services

- By Type:

- Public Blockchain

- Private Blockchain

- Hybrid Blockchain

- Consortium Blockchain

- By Application:

- Digital Identity

- Payments

- Smart Contracts

- Supply Chain Management

- Exchanges

- Others (e.g., Voting, Healthcare, Media & Entertainment)

- By Industry Vertical:

- Banking, Financial Services, & Insurance (BFSI)

- IT & Telecommunications

- Government & Public Sector

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing

- Media & Entertainment

- Real Estate

- Transportation & Logistics

- Others (e.g., Energy & Utilities, Automotive)

Regional Highlights

- North America: This region holds a significant share of the blockchain technology market, driven by high adoption rates of advanced technologies, a robust presence of key market players, and substantial investments in blockchain startups. The increasing use of blockchain in financial services, supply chain, and healthcare, coupled with a supportive regulatory environment in certain areas, propels market growth. The United States, in particular, leads in innovation and enterprise-level deployments.

- Europe: Europe is a rapidly growing market for blockchain, characterized by increasing regulatory clarity in several countries (e.g., Switzerland, Malta, UK, Germany) and a strong focus on data privacy and digital identity. The region sees considerable adoption in BFSI, automotive, and logistics sectors, with initiatives like the European Blockchain Services Infrastructure (EBSI) fostering cross-border applications and public sector engagement.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive digital transformation initiatives, government support for blockchain innovation (e.g., China's national blockchain strategy, India's focus on digital payments), and a large unbanked population benefiting from financial inclusion solutions. Countries like China, India, South Korea, and Singapore are key contributors, with significant investments in supply chain, trade finance, and digital currencies.

- Latin America: This region exhibits emerging growth, primarily driven by the need for more efficient cross-border payments, financial inclusion, and combating inflation through cryptocurrency adoption in some economies. Countries like Brazil, Mexico, and Argentina are exploring blockchain for remittances, supply chain transparency, and digital asset management, though regulatory uncertainties remain a challenge.

- Middle East and Africa (MEA): The MEA region is increasingly embracing blockchain, particularly in the UAE (Dubai's blockchain strategy), Saudi Arabia, and South Africa. Drivers include smart city initiatives, oil and gas supply chain optimization, and efforts to diversify economies away from traditional resources through technological advancement. Investments in fintech and government services leveraging blockchain are notable.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blockchain Technology Market.- IBM Corporation

- Microsoft Corporation

- Amazon Web Services (AWS)

- Accenture

- Oracle

- ConsenSys

- Ripple

- Coinbase

- Binance

- Block Inc. (formerly Square)

- R3

- Huawei Technologies Co. Ltd.

- SAP SE

- Intel Corporation

- NVIDIA Corporation

- Wipro

- Capgemini

- Infosys

- Tata Consultancy Services

- Hyperledger

Frequently Asked Questions

Analyze common user questions about the Blockchain Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is blockchain technology and how does it work?

Blockchain technology is a decentralized, distributed ledger system that records transactions across multiple computers. Each transaction, or "block," is cryptographically linked to the previous one, forming an immutable chain. This distributed nature ensures transparency, security, and resistance to tampering without the need for a central authority, making it ideal for verifiable record-keeping.

What is the current market size and projected growth for blockchain technology?

The Blockchain Technology Market is estimated at USD 105.7 Billion in 2025 and is projected to reach USD 1,120.3 Billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 32.7% between 2025 and 2033. This substantial growth is driven by increasing adoption across various industries for enhanced security, transparency, and efficiency.

What are the primary applications of blockchain technology?

Blockchain technology has diverse applications beyond cryptocurrencies, including secure cross-border payments, transparent supply chain management, verifiable digital identity solutions, immutable smart contracts for automated agreements, and the tokenization of real-world assets. It is increasingly used in healthcare, real estate, and media for secure data management and ownership verification.

What are the main challenges hindering blockchain adoption?

Key challenges for blockchain adoption include regulatory uncertainty and inconsistent legal frameworks across jurisdictions, scalability limitations of current networks, the high energy consumption of certain consensus mechanisms, the complexity of integrating blockchain with existing legacy systems, and a shortage of skilled professionals to develop and manage solutions.

How does AI impact blockchain technology, and vice versa?

AI enhances blockchain by improving smart contract efficiency, optimizing network performance, and bolstering security through predictive analytics. Conversely, blockchain provides transparency, immutability, and data provenance for AI, addressing concerns about algorithmic bias and ensuring the integrity of AI models and their training data. This synergy creates more intelligent, secure, and trustworthy decentralized systems.