Automotive Active Purge Pump Market

Automotive Active Purge Pump Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704524 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Automotive Active Purge Pump Market Size

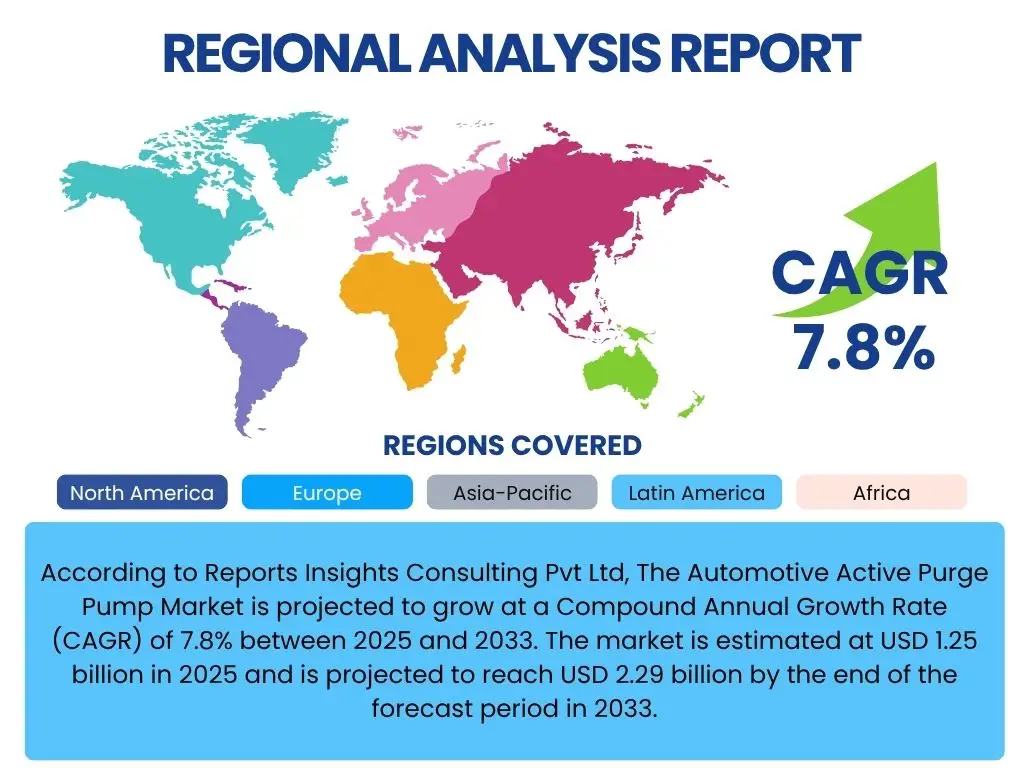

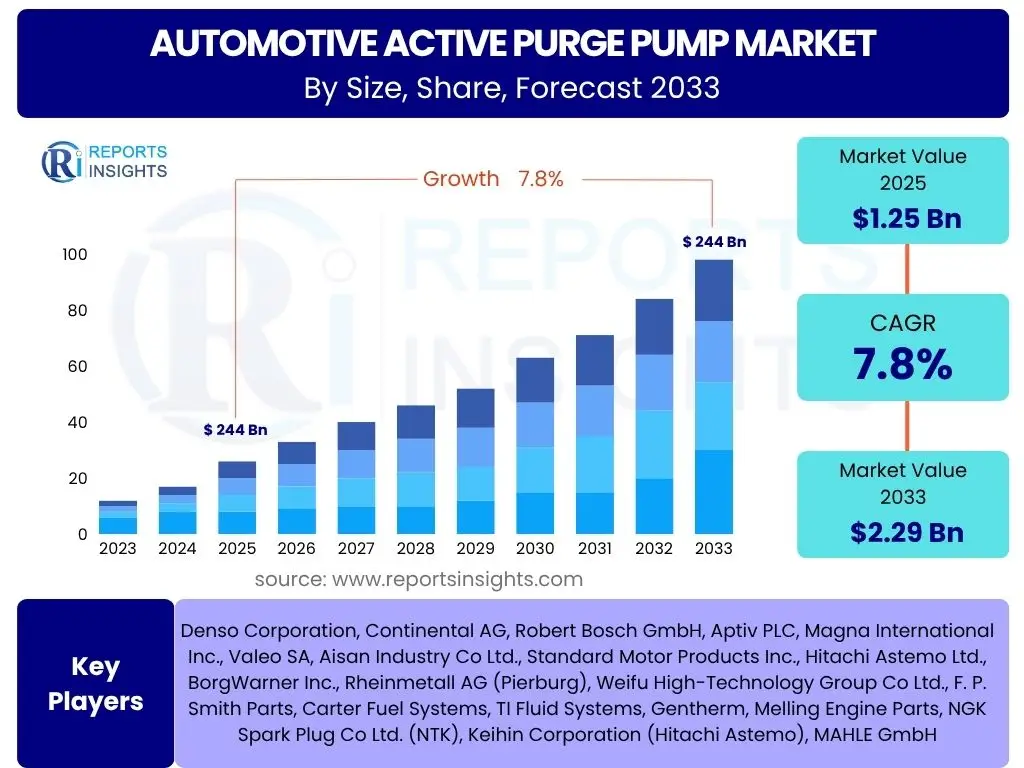

According to Reports Insights Consulting Pvt Ltd, The Automotive Active Purge Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 1.25 billion in 2025 and is projected to reach USD 2.29 billion by the end of the forecast period in 2033.

Key Automotive Active Purge Pump Market Trends & Insights

The Automotive Active Purge Pump market is experiencing dynamic shifts driven by evolving automotive technologies and increasingly stringent environmental regulations. Key inquiries often focus on how innovations in material science, sensor technology, and connectivity are shaping the next generation of purge pumps, moving beyond traditional mechanical systems towards more integrated and efficient electronic solutions. Furthermore, the industry is keenly observing the impact of the global shift towards hybrid and electric vehicles, evaluating how these new powertrain architectures influence the design, demand, and overall market trajectory for components critical to gasoline vapor management.

Market participants and end-users are also highly interested in the implications of global emission standards, such as Euro 7 and CAFE regulations, which compel manufacturers to enhance the efficiency of their evaporative emission control systems. This regulatory pressure is a primary catalyst for innovation, pushing for active purge pumps that offer superior performance, durability, and diagnostic capabilities. Insights also highlight a growing emphasis on modular designs and compact solutions that can be seamlessly integrated into diverse vehicle platforms, addressing space constraints and reducing overall vehicle weight. The aftermarket segment is also demonstrating significant potential, fueled by the rising global vehicle parc and the need for replacement and upgrade solutions for older vehicles.

- Miniaturization and integration of purge pumps into more comprehensive fuel system modules, reducing complexity and footprint.

- Development of smart active purge pumps featuring integrated sensors for real-time diagnostics and enhanced performance monitoring.

- Increasing adoption of lightweight and durable materials, such as advanced plastics and composites, to improve fuel efficiency and product longevity.

- Emphasis on highly efficient vapor recovery systems to meet stringent global evaporative emission standards, driving demand for advanced purge pump designs.

- Growing influence of hybrid vehicle architectures, requiring purge pumps optimized for intermittent engine operation and sophisticated fuel vapor management.

AI Impact Analysis on Automotive Active Purge Pump

User inquiries concerning AI's influence on the Automotive Active Purge Pump market primarily revolve around the potential for enhanced operational efficiency, predictive maintenance, and optimized performance. There is significant interest in how artificial intelligence algorithms can process real-time sensor data from purge pumps to identify anomalies, predict potential failures before they occur, and optimize purge cycles based on driving conditions, fuel type, and environmental factors. This intelligent approach aims to not only extend the lifespan of the component but also ensure consistent compliance with emission standards throughout the vehicle's operational life.

Another key area of curiosity is AI's role in the manufacturing and supply chain of active purge pumps. Users are interested in how AI can be leveraged for quality control, demand forecasting, and inventory management, leading to more resilient and cost-effective production processes. Furthermore, the integration of AI with broader vehicle diagnostic systems is a significant theme, suggesting a future where purge pump performance is seamlessly monitored and adjusted as part of a holistic, AI-driven vehicle health management system. The overarching expectation is that AI will transform these components from passive devices into intelligent, self-optimizing elements of the vehicle's powertrain.

- Predictive maintenance capabilities enabled by AI analyzing operational data to forecast potential purge pump failures, reducing downtime and maintenance costs.

- Optimization of purge cycles through AI algorithms that adapt pump operation based on real-time vehicle performance, environmental conditions, and fuel vapor levels, enhancing efficiency and emissions control.

- Enhanced diagnostic accuracy and troubleshooting via AI-powered systems that quickly identify root causes of evaporative emission system malfunctions.

- Improved manufacturing efficiency and quality control by using AI for anomaly detection in production lines and optimizing assembly processes for active purge pumps.

- Data-driven design improvements, where AI analyzes field performance data to inform the development of next-generation, more robust and efficient purge pump designs.

Key Takeaways Automotive Active Purge Pump Market Size & Forecast

Analyzing common user inquiries regarding the Automotive Active Purge Pump market size and forecast reveals a consistent focus on the primary drivers of growth, potential limiting factors, and the overall trajectory of innovation within the segment. Users frequently seek to understand the long-term impact of regulatory mandates on emission control, particularly how these will shape demand for advanced purge pump technologies. There is also significant interest in identifying the regions poised for the most substantial growth, driven by increasing vehicle production and the adoption of stricter environmental policies.

The insights derived indicate that technological advancements aimed at improving fuel efficiency and reducing evaporative emissions will continue to be a dominant force, leading to sustained market expansion. While the transition towards Battery Electric Vehicles (BEVs) presents a long-term challenge, the continued dominance of Internal Combustion Engine (ICE) and Hybrid Electric Vehicles (HEVs) in the short to mid-term ensures a robust market. Key takeaways underscore the importance of strategic partnerships, investment in research and development, and agile manufacturing capabilities for companies seeking to capitalize on market opportunities and navigate evolving industry landscapes effectively.

- The market's growth is predominantly driven by global governmental regulations aimed at curbing automotive evaporative emissions, particularly from gasoline-powered vehicles.

- Significant growth is anticipated in emerging economies, especially in Asia Pacific, due to increasing vehicle production and tightening emission standards.

- Technological innovation focusing on improved efficiency, durability, and integration with advanced engine management systems is crucial for market competitiveness.

- The increasing adoption of hybrid electric vehicles (HEVs) presents a unique growth avenue, as these vehicles still require sophisticated fuel vapor management systems.

- While the long-term shift towards battery electric vehicles (BEVs) poses a future challenge, the robust demand from the gasoline and hybrid vehicle segments ensures steady market expansion through 2033.

Automotive Active Purge Pump Market Drivers Analysis

The Automotive Active Purge Pump market is primarily propelled by a confluence of stringent environmental regulations, technological advancements in vehicle systems, and the ongoing demand for improved fuel efficiency. Governments worldwide are imposing stricter emission standards, such as Euro 6/7, EPA Tier 3, and China 6, which necessitate highly efficient evaporative emission control systems in gasoline-powered vehicles. Active purge pumps play a critical role in recovering fuel vapors from the evaporative emission control (EVAP) system and feeding them back into the engine for combustion, thereby reducing harmful volatile organic compound (VOC) emissions into the atmosphere.

Beyond regulatory compliance, the increasing global production of internal combustion engine (ICE) vehicles and the burgeoning market for hybrid electric vehicles (HEVs) contribute significantly to market expansion. Even as electrification gains momentum, hybrid vehicles, which combine an electric motor with a gasoline engine, continue to require sophisticated fuel vapor management systems, ensuring a sustained demand for active purge pumps. Furthermore, advancements in vehicle electronics and engine control units (ECUs) enable more precise and optimized operation of purge pumps, leading to enhanced performance and efficiency, which in turn drives adoption among automotive manufacturers aiming for superior vehicle performance and reduced environmental impact.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Emission Regulations | +2.5% | Global (Europe, North America, APAC) | 2025-2033 |

| Increasing Production of Gasoline and Hybrid Vehicles | +1.8% | APAC, North America, Europe | 2025-2030 |

| Growing Focus on Fuel Efficiency and Performance | +1.5% | Global | 2025-2033 |

| Technological Advancements in Fuel Vapor Management Systems | +1.0% | Europe, North America, Japan | 2025-2033 |

| Rising Vehicle Parc and Aftermarket Demand | +1.0% | Global, especially emerging markets | 2028-2033 |

Automotive Active Purge Pump Market Restraints Analysis

Despite the positive growth trajectory, the Automotive Active Purge Pump market faces several significant restraints that could impede its expansion. One of the most prominent challenges is the accelerating global shift towards Battery Electric Vehicles (BEVs), which do not require gasoline evaporative emission control systems and, consequently, have no need for active purge pumps. As more countries and automotive manufacturers commit to electrification targets, the long-term demand for these components in new vehicle production will gradually diminish, posing a structural challenge to market players.

Furthermore, the manufacturing cost and complexity associated with integrating advanced active purge pump systems can be a restraint, particularly for entry-level or budget-conscious vehicle segments. Fluctuations in raw material prices, such as those for specialized plastics, metals, and electronic components, can also impact production costs and profit margins for manufacturers. The necessity for high precision, reliability, and integration with sophisticated engine control units adds to the overall system complexity, which can be a barrier to rapid adoption or cost reduction initiatives. Moreover, the aftermarket segment, while a source of demand, can be impacted by the availability of lower-cost, less-advanced alternatives or counterfeit products, affecting the market for high-quality, OEM-grade active purge pumps.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Accelerated Shift Towards Battery Electric Vehicles (BEVs) | -2.0% | Global (Europe, China, North America) | 2028-2033 |

| High Manufacturing and Integration Costs | -1.2% | Global | 2025-2030 |

| Fluctuations in Raw Material Prices | -0.8% | Global | 2025-2028 |

| Complexity of System Design and Calibration | -0.7% | Global | 2025-2033 |

| Aftermarket Competition from Lower-Cost Alternatives | -0.5% | Emerging Markets, Global Aftermarket | 2025-2033 |

Automotive Active Purge Pump Market Opportunities Analysis

Significant opportunities exist within the Automotive Active Purge Pump market, primarily driven by the ongoing need for advanced evaporative emission control in hybrid vehicles and the potential for next-generation pump designs. The rapid growth of the hybrid electric vehicle (HEV) segment, particularly plug-in hybrids (PHEVs), offers a substantial avenue for market expansion. These vehicles, while partially electrified, still rely on gasoline engines and require highly sophisticated and robust active purge pumps that can operate efficiently under intermittent engine run conditions, necessitating specific design optimizations and integration strategies.

Furthermore, continuous innovation in sensor technology, material science, and electronic controls opens doors for developing more efficient, compact, and durable purge pumps. Opportunities also arise from the aftermarket segment, where the vast installed base of gasoline and hybrid vehicles globally creates a sustained demand for replacement and upgrade components. Manufacturers can also explore customization and application-specific solutions, tailoring purge pump designs to meet the unique requirements of different vehicle segments, engine types, and regional emission standards, thereby carving out niche markets and enhancing competitive advantage. Lastly, the integration of smart diagnostic capabilities and predictive maintenance features into purge pumps represents a lucrative opportunity to add value and enhance product appeal for OEMs and end-users.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Hybrid Electric Vehicle (HEV) Production | +1.8% | Global (Europe, Asia Pacific, North America) | 2025-2033 |

| Development of Next-Generation, Smart Purge Pumps | +1.5% | North America, Europe, Japan | 2025-2030 |

| Expanding Aftermarket and Replacement Demand | +1.0% | Global (Emerging Economies) | 2025-2033 |

| Integration with Advanced Vehicle Diagnostics Systems | +0.8% | Europe, North America, China | 2028-2033 |

| Customization for Specific Vehicle Platforms and Regulations | +0.7% | Global | 2025-2033 |

Automotive Active Purge Pump Market Challenges Impact Analysis

The Automotive Active Purge Pump market navigates several formidable challenges that demand strategic responses from market participants. One significant challenge stems from the intense competitive landscape, characterized by numerous established players and new entrants vying for market share. This high level of competition often leads to price pressure, compelling manufacturers to innovate while simultaneously managing costs, which can impact profitability and investment in research and development.

Moreover, the inherent complexity of integrating purge pump systems with diverse engine architectures and evolving vehicle electronic control units (ECUs) presents a technical hurdle. Ensuring seamless compatibility, optimal performance across varied driving conditions, and adherence to stringent onboard diagnostic (OBD) requirements can be technically demanding and time-consuming. Supply chain disruptions, often triggered by geopolitical events, raw material shortages, or global pandemics, also pose a recurring challenge, affecting production schedules and increasing operational costs. Furthermore, adapting to the rapid pace of technological change and keeping pace with dynamic regulatory frameworks globally requires continuous innovation and significant capital expenditure, placing a burden on companies to remain agile and forward-thinking.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition and Price Pressure | -1.5% | Global | 2025-2033 |

| Complexity of System Integration and Calibration | -1.0% | Global | 2025-2030 |

| Supply Chain Volatility and Raw Material Shortages | -0.8% | Global | 2025-2028 |

| Rapid Technological Obsolescence and Innovation Cycles | -0.7% | North America, Europe, Japan | 2028-2033 |

| Compliance with Evolving Global Regulatory Standards | -0.5% | Global | 2025-2033 |

Automotive Active Purge Pump Market - Updated Report Scope

This comprehensive market research report delves into the Automotive Active Purge Pump market, providing an in-depth analysis of its current landscape, historical performance, and future growth projections. The scope encompasses detailed segmentation across various parameters, offering granular insights into market dynamics, key trends, and the competitive environment. It provides strategic intelligence for stakeholders, enabling informed decision-making based on robust data and expert analysis.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.25 billion |

| Market Forecast in 2033 | USD 2.29 billion |

| Growth Rate | 7.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Denso Corporation, Continental AG, Robert Bosch GmbH, Aptiv PLC, Magna International Inc., Valeo SA, Aisan Industry Co Ltd., Standard Motor Products Inc., Hitachi Astemo Ltd., BorgWarner Inc., Rheinmetall AG (Pierburg), Weifu High-Technology Group Co Ltd., F. P. Smith Parts, Carter Fuel Systems, TI Fluid Systems, Gentherm, Melling Engine Parts, NGK Spark Plug Co Ltd. (NTK), Keihin Corporation (Hitachi Astemo), MAHLE GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Automotive Active Purge Pump market is extensively segmented to provide a granular understanding of its diverse components and drivers. This segmentation allows for a precise analysis of market dynamics across different technologies, vehicle applications, and sales channels, enabling stakeholders to identify specific growth areas and tailor their strategies accordingly. By dissecting the market based on these critical parameters, the report offers valuable insights into consumer preferences, technological shifts, and supply chain intricacies across the global automotive industry.

The primary segmentation distinguishes between the type of active purge pump, categorizing them into electric and mechanical variants, reflecting the evolution of pump technology. Further crucial segmentation is by vehicle type, differentiating between passenger vehicles and various commercial vehicle segments, as each has distinct requirements and market sizes. The sales channel segmentation, encompassing OEM and aftermarket, highlights the different routes to market for manufacturers. Finally, the segmentation by engine type, primarily gasoline and hybrid, underscores the market's dependence on traditional and transitional powertrain technologies, providing a clear picture of where demand originates.

- By Type:

- Electric Active Purge Pump: These pumps utilize an electric motor for precise control over vapor flow, offering higher efficiency and integration with advanced electronic control units.

- Mechanical Active Purge Pump: Driven by engine vacuum, these are often simpler in design but may offer less precise control compared to electric variants.

- By Vehicle Type:

- Passenger Vehicles:

- Compact Cars

- Mid-size Cars

- Luxury Cars

- SUVs (Sport Utility Vehicles)

- Vans

- Commercial Vehicles:

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Passenger Vehicles:

- By Sales Channel:

- OEM (Original Equipment Manufacturer): Sales directly to automotive manufacturers for new vehicle assembly.

- Aftermarket: Sales of replacement parts through distributors, retailers, and service centers for vehicle maintenance and repair.

- By Engine Type:

- Gasoline: Vehicles primarily powered by gasoline internal combustion engines.

- Hybrid: Vehicles that combine a gasoline engine with an electric motor, including mild hybrids, full hybrids, and plug-in hybrids.

Regional Highlights

The global Automotive Active Purge Pump market exhibits diverse growth patterns across various regions, influenced by factors such as vehicle production volumes, emission regulations, and economic development. North America and Europe represent mature markets characterized by stringent environmental mandates and a strong presence of leading automotive manufacturers. These regions are drivers of innovation, consistently demanding advanced and highly efficient purge pump solutions to comply with evolving standards like Euro 7 and CARB regulations.

Asia Pacific (APAC) stands out as the fastest-growing region, primarily driven by the burgeoning automotive industries in countries like China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and the expansion of vehicle fleets, coupled with the gradual implementation of stricter emission norms, are fueling significant demand for active purge pumps in this region. Latin America, the Middle East, and Africa (MEA) are also emerging as markets with considerable potential, largely due to rising vehicle penetration, ongoing infrastructure development, and the eventual adoption of more sophisticated emission control technologies, although at a slower pace than developed markets.

- North America: A mature market with high adoption rates, driven by stringent EPA and CARB emission standards and a robust automotive manufacturing base.

- Europe: Characterized by strong regulatory pressure (e.g., Euro 6/7) and a focus on advanced technology and fuel efficiency, leading to sustained demand for high-performance purge pumps.

- Asia Pacific (APAC): The fastest-growing region, fueled by expanding vehicle production, increasing disposable incomes, and the gradual tightening of emission regulations in countries like China, India, and ASEAN nations.

- Latin America: Experiencing growth due to increasing vehicle sales and developing automotive industries, with gradual adoption of emission control technologies.

- Middle East and Africa (MEA): Emerging markets with potential growth, influenced by rising vehicle ownership and the future implementation of more comprehensive emission control frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Active Purge Pump Market.- Denso Corporation

- Continental AG

- Robert Bosch GmbH

- Aptiv PLC

- Magna International Inc.

- Valeo SA

- Aisan Industry Co Ltd.

- Standard Motor Products Inc.

- Hitachi Astemo Ltd.

- BorgWarner Inc.

- Rheinmetall AG (Pierburg)

- Weifu High-Technology Group Co Ltd.

- F. P. Smith Parts

- Carter Fuel Systems

- TI Fluid Systems

- Gentherm

- Melling Engine Parts

- NGK Spark Plug Co Ltd. (NTK)

- Keihin Corporation (Hitachi Astemo)

- MAHLE GmbH

Frequently Asked Questions

Analyze common user questions about the Automotive Active Purge Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an automotive active purge pump?

An automotive active purge pump is a crucial component within a vehicle's evaporative emission control (EVAP) system, primarily found in gasoline-powered and hybrid vehicles. Its main function is to draw fuel vapors from the charcoal canister and direct them into the engine's intake manifold for combustion. Unlike passive systems, an active purge pump actively controls the flow of these vapors, ensuring efficient fuel vapor recovery and minimizing harmful volatile organic compound (VOC) emissions into the atmosphere, thereby helping vehicles meet stringent environmental regulations.

Why is the automotive active purge pump market growing?

The market for automotive active purge pumps is experiencing growth primarily due to the increasing stringency of global emission regulations. Governments worldwide are implementing stricter standards for evaporative emissions, compelling automotive manufacturers to integrate advanced vapor recovery systems into their vehicles. Additionally, the sustained production of gasoline internal combustion engine (ICE) vehicles and the rising popularity of hybrid electric vehicles (HEVs), which still require sophisticated fuel vapor management, are significant drivers of market expansion. Technological advancements improving pump efficiency and durability also contribute to this growth.

How do emission regulations impact the active purge pump market?

Emission regulations are the primary catalyst for innovation and demand in the active purge pump market. Standards such as Euro 6/7, EPA Tier 3, and China 6 mandate highly efficient control of fuel vapor emissions. These regulations necessitate the development and adoption of active purge pumps that can precisely manage vapor flow, ensuring minimal environmental impact. As these regulations become more stringent globally, the demand for advanced, highly reliable, and compliant active purge pump technologies continues to increase, directly influencing market size and product development priorities.

What is the role of technology and AI in active purge pumps?

Technology plays a pivotal role in enhancing the efficiency and intelligence of active purge pumps. Modern designs incorporate advanced sensors, electronic controls, and lightweight materials for improved performance, durability, and integration with the vehicle's engine management system. Artificial intelligence (AI) is emerging as a transformative force, enabling features like predictive maintenance, where AI algorithms analyze pump data to forecast potential failures, optimizing purge cycles in real-time based on driving conditions, and enhancing overall diagnostic capabilities. This integration allows for more precise and adaptive fuel vapor management, contributing to both environmental compliance and vehicle reliability.

What are the future prospects for the automotive active purge pump market given the rise of EVs?

The future prospects for the automotive active purge pump market are nuanced. While the long-term global shift towards Battery Electric Vehicles (BEVs), which do not require purge pumps, presents a significant challenge and will eventually lead to a decline in demand for new vehicles, the market is expected to remain robust in the short to mid-term. This is due to the continued high production of gasoline-powered vehicles and, more importantly, the sustained growth of hybrid electric vehicles (HEVs) globally, which still rely on active purge pumps for evaporative emission control. Opportunities in the aftermarket for replacement parts will also continue to support the market, ensuring its relevance for the foreseeable future, even as the automotive industry transitions.