Art Auction Market

Art Auction Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704312 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Art Auction Market Size

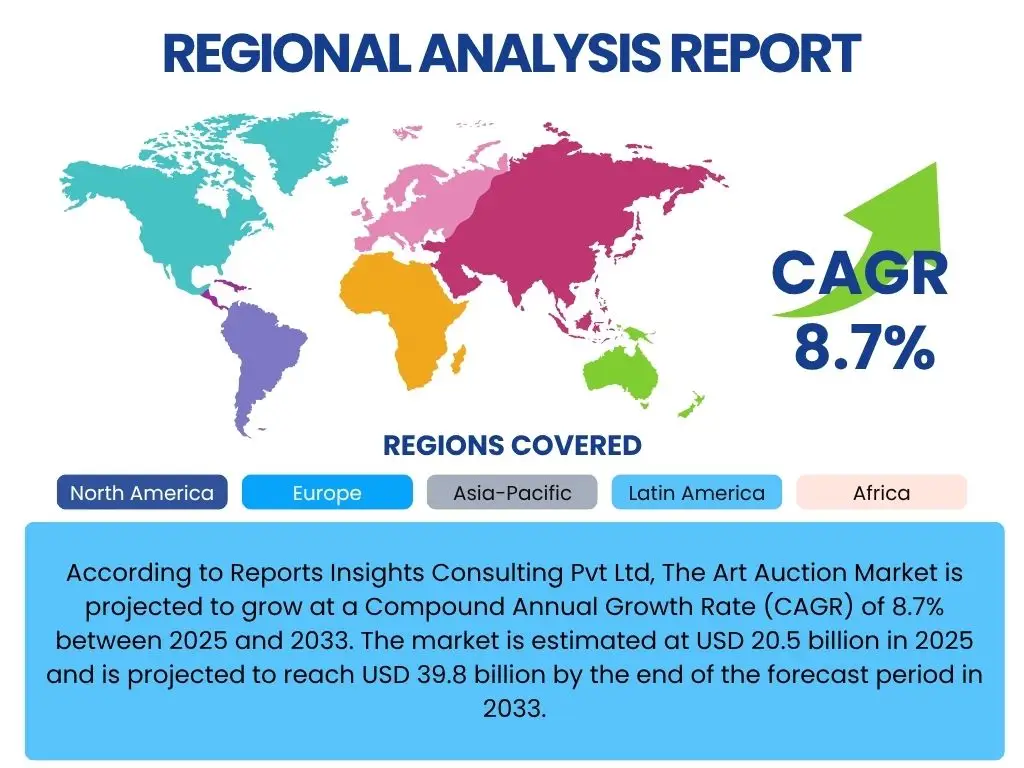

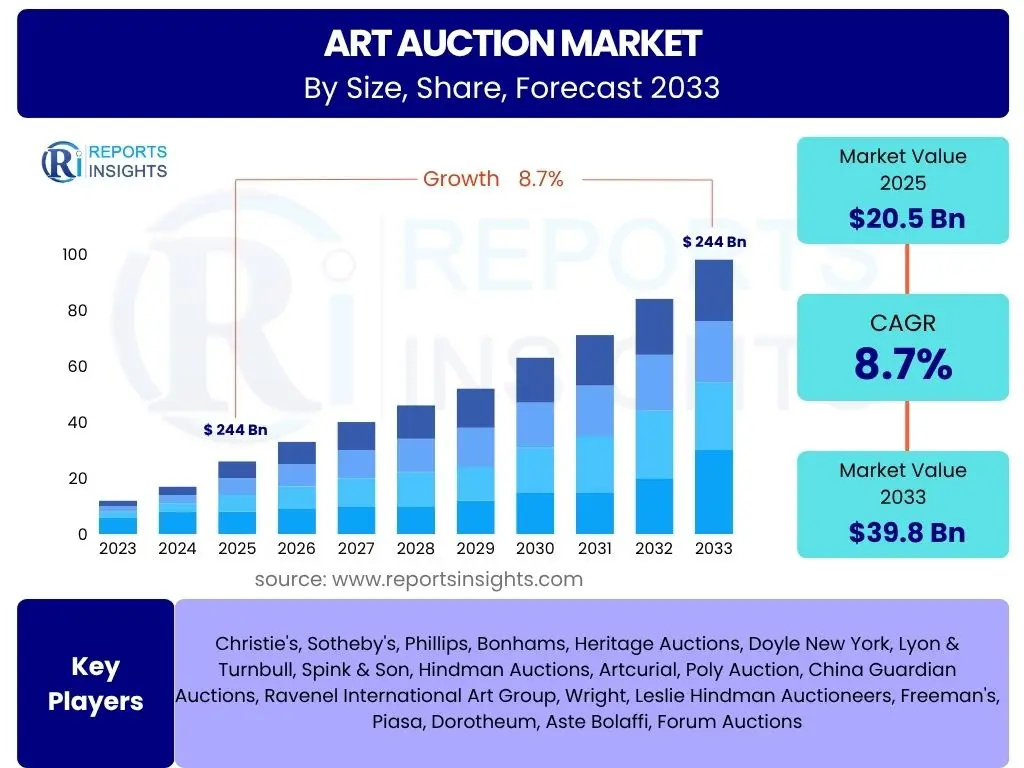

According to Reports Insights Consulting Pvt Ltd, The Art Auction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2033. The market is estimated at USD 20.5 billion in 2025 and is projected to reach USD 39.8 billion by the end of the forecast period in 2033.

Key Art Auction Market Trends & Insights

The global art auction market is undergoing significant transformation, driven by a confluence of technological advancements, evolving collector demographics, and shifts in global economic landscapes. User inquiries frequently highlight the increasing prominence of online auction platforms, which have democratized access to art and expanded the buyer base beyond traditional geographical limits. This digital shift has not only streamlined the bidding process but also introduced new levels of transparency and accessibility, enabling a broader range of collectors, from seasoned connoisseurs to emerging enthusiasts, to participate in high-value transactions. The market is increasingly characterized by a blend of traditional auction house expertise and digital innovation, creating a dynamic environment that caters to diverse purchasing preferences.

Another pervasive trend observed through user questions pertains to the diversification of art forms and the rise of new collecting categories. While traditional segments like Old Masters, Impressionist, and Modern Art continue to command high values, there is growing interest and investment in Contemporary Art, Post-War Art, and increasingly, digital art forms including NFTs. This reflects a broader cultural shift where new generations of collectors are less bound by historical conventions and more attuned to contemporary expressions and investment opportunities in digital assets. Furthermore, sustainability and ethical sourcing in the art market are emerging as critical considerations for buyers and sellers, influencing provenance research and auction house practices. The market is also witnessing a stronger emphasis on private sales and bespoke advisory services, catering to high-net-worth individuals seeking discretion and tailored acquisition strategies.

- Proliferation of online auction platforms and digital-first sales.

- Growing global buyer base, particularly from Asia-Pacific.

- Increased demand for Contemporary and Post-War Art.

- Emergence and integration of Non-Fungible Tokens (NFTs) and digital art.

- Enhanced focus on provenance, authenticity, and ethical practices.

- Shift towards hybrid auction models (online and in-person).

- Rise of private sales and bespoke art advisory services.

- Diversification of collection categories beyond traditional segments.

AI Impact Analysis on Art Auction

User questions related to Artificial Intelligence's impact on the art auction market frequently revolve around its potential to revolutionize authentication, valuation, and market analysis. Many users are curious about how AI algorithms can enhance the efficiency and accuracy of identifying forgeries, a persistent challenge in the art world. The expectation is that AI-powered image recognition and data analysis can process vast amounts of artistic data, historical records, and sales figures to provide more precise provenance tracing and detect anomalies indicative of fraud. Furthermore, there is significant interest in AI's capability to offer more sophisticated valuation models, moving beyond human expert biases to predict market trends and potential sale prices with greater statistical rigor, thereby informing both sellers and buyers more effectively.

Another common theme in user inquiries concerns AI's role in augmenting market reach and personalized client engagement. Users anticipate that AI can optimize marketing strategies by analyzing collector preferences and bidding patterns, leading to highly targeted recommendations for artworks. This could transform the discovery process for collectors, presenting them with pieces that align precisely with their tastes and investment criteria. However, alongside these positive expectations, there are inherent concerns about the ethical implications of AI in art, including potential biases in algorithms, the risk of devaluing human expertise, and the broader philosophical questions about originality and creativity when AI is involved in art creation or appraisal. The balance between leveraging AI for efficiency and preserving the unique human element of art appreciation remains a central point of discussion.

- Enhanced art authentication and provenance verification through image recognition and data analysis.

- Improved valuation models and predictive analytics for market trends and pricing.

- Personalized client engagement and targeted marketing based on collector preferences.

- Automation of cataloging processes and digital archival management.

- Potential for AI to identify emerging artists and market opportunities.

- Challenges regarding data privacy, algorithmic bias, and ethical considerations in art appraisal.

- Risk of devaluing traditional human expertise in connoisseurship.

Key Takeaways Art Auction Market Size & Forecast

Analysis of common user questions regarding the Art Auction market size and forecast reveals a strong interest in understanding the underlying drivers of growth and the long-term sustainability of market expansion. Users frequently inquire about which segments will experience the most significant growth, such as online platforms or specific art categories, and how macroeconomic factors will influence overall market trajectory. A primary takeaway is that the market is poised for sustained growth, primarily propelled by the increasing affluence of new collector bases in emerging economies and the continued digitalization of auction processes. This digital transformation is not merely an incremental change but a fundamental shift that is redefining market accessibility and liquidity, inviting a broader demographic of participants than ever before. Investors and stakeholders are keen to identify the specific segments that are set to outperform the general market, often looking towards contemporary art and digital collectibles as areas of particular potential.

Furthermore, user inquiries often probe the resilience of the art market against economic downturns and geopolitical uncertainties, seeking insights into its stability as an alternative asset class. The forecast suggests that while macroeconomic volatility can introduce short-term fluctuations, the underlying demand for art as both a cultural artifact and an investment remains robust, supported by a growing global wealth pool. Another key takeaway is the increasing importance of transparency and data-driven insights in market decision-making. As the market expands, collectors and investors are demanding more granular data on pricing, sales history, and provenance to inform their acquisition strategies. This necessitates greater sophistication in market reporting and the widespread adoption of standardized data collection practices across the auction ecosystem, reinforcing trust and facilitating more informed investment choices in a market historically characterized by opacity.

- The global art auction market is projected for robust growth, nearing USD 40 billion by 2033.

- Digitalization and online platforms are central to market expansion and accessibility.

- Emerging economies, particularly in Asia, are significant growth engines.

- Contemporary and Post-War art segments are expected to lead growth in value.

- Art is increasingly viewed as a stable alternative asset class amidst economic uncertainty.

- Greater demand for market transparency and data-driven insights for investment decisions.

- Hybrid auction models will continue to dominate, offering flexibility to buyers and sellers.

Art Auction Market Drivers Analysis

The art auction market's expansion is fundamentally driven by the escalating global wealth and the increasing number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) worldwide. As wealth accumulates, particularly in emerging economies, there is a natural gravitation towards luxury assets, and art stands out as a unique investment vehicle that offers both aesthetic pleasure and potential capital appreciation. This demographic shift not only expands the pool of potential buyers but also stimulates demand for a broader range of art categories. Furthermore, the growing accessibility of art market information and the enhanced transparency in auction processes, largely facilitated by digital platforms, empower more individuals to engage confidently in art acquisition, breaking down traditional barriers to entry and fostering a more inclusive market environment.

Technological advancements, particularly the widespread adoption of online auction platforms, represent a pivotal driver for the market. These platforms have significantly broadened the geographical reach of auctions, enabling global participation and reducing the logistical complexities traditionally associated with art transactions. Beyond mere accessibility, digital innovation has also introduced new ways of engaging with art, such as virtual viewing rooms and augmented reality experiences, which enhance the discovery and appreciation process for potential buyers. The continued recognition of art as a legitimate and often uncorrelated alternative investment asset also contributes significantly to market growth. Investors increasingly view art as a portfolio diversification tool, particularly during periods of economic volatility, given its potential for value preservation and long-term appreciation, which attracts both seasoned investors and new entrants seeking stable asset classes.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Wealth and HNWIs | +2.5% | Global, particularly Asia-Pacific, North America | Long-term (2025-2033) |

| Digital Transformation & Online Auction Platforms | +1.8% | Global | Medium to Long-term (2025-2033) |

| Art as an Alternative Investment Asset | +1.5% | North America, Europe, Asia-Pacific | Long-term (2025-2033) |

| Growing Demand for Contemporary & Emerging Art | +1.0% | Global | Medium-term (2025-2030) |

| Increased Art Market Transparency & Data Accessibility | +0.8% | Global | Medium-term (2025-2030) |

Art Auction Market Restraints Analysis

Despite its growth potential, the art auction market faces several significant restraints, with economic uncertainty and geopolitical instability being primary concerns. Periods of economic downturn or recession often lead to a contraction in discretionary spending, which directly impacts the demand for luxury goods such as art. Potential buyers, particularly those new to the market, may defer or reduce their art purchases, affecting auction volumes and prices. Geopolitical conflicts and trade tensions can further exacerbate this by disrupting global wealth flows, reducing investor confidence, and imposing sanctions that restrict cross-border art trade, thereby creating an unpredictable environment for high-value transactions. This sensitivity to macro-economic shifts introduces a degree of volatility that can deter cautious investors and dampen market enthusiasm.

Another notable restraint is the persistent issue of limited transparency and the challenge of art forgery and illicit trafficking. While efforts are being made to enhance transparency, the art market traditionally suffers from a lack of standardized pricing data and provenance verification, which can deter new or less experienced collectors who are wary of valuation ambiguities or risks of acquiring fraudulent works. The high-profile cases of forgery and issues surrounding cultural heritage repatriation also cast a shadow, eroding trust and leading to more stringent due diligence requirements that can slow down transaction processes. Furthermore, high transaction costs, including buyer's premiums, seller's commissions, and additional fees, can act as a barrier to entry, particularly for lower-value art segments or for individuals who are not established in the art collecting community, thereby limiting overall market participation and liquidity for certain price points.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Economic Volatility and Recessions | -1.5% | Global | Short to Medium-term (2025-2028) |

| Issues of Forgery and Illicit Art Trade | -1.0% | Global | Long-term (2025-2033) |

| High Transaction Costs and Fees | -0.8% | Global | Long-term (2025-2033) |

| Limited Market Transparency and Data Availability | -0.7% | Global | Long-term (2025-2033) |

| Regulatory Complexity and Trade Barriers | -0.5% | Europe, Asia-Pacific | Medium-term (2025-2030) |

Art Auction Market Opportunities Analysis

The art auction market is poised for significant opportunities driven by the untapped potential of emerging markets, particularly in Asia-Pacific and the Middle East. These regions are experiencing rapid economic growth and a burgeoning affluent class that is increasingly interested in art as both a cultural asset and an investment. Auction houses and online platforms are expanding their presence in these areas, customizing their offerings to cater to local tastes and investment preferences. This geographical diversification opens up new avenues for sourcing unique artworks and attracting a fresh generation of collectors, thereby expanding the global footprint of the art market beyond its traditional Western centers and fostering new collecting habits and demands that can invigorate the market substantially.

Furthermore, the continuous innovation in digital platforms and the integration of advanced technologies like AI and blockchain present transformative opportunities. Blockchain technology, for instance, offers the potential for immutable provenance records, enhancing transparency and trust, which can significantly mitigate concerns about authenticity and ownership. AI can further refine valuation, personalize client experiences, and automate routine tasks, making the auction process more efficient and accessible. The growing interest in niche and emerging art categories, such as digital art (NFTs), street art, and art from underrepresented regions, also represents a substantial opportunity. These categories attract a younger, tech-savvy demographic and diversify the market beyond conventional blue-chip art, creating new revenue streams and fostering a more dynamic and inclusive art ecosystem that can sustain long-term growth by attracting new collector profiles.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into Emerging Markets (Asia-Pacific, MEA) | +2.0% | Asia-Pacific, Middle East & Africa | Long-term (2025-2033) |

| Integration of Blockchain for Provenance & Authenticity | +1.5% | Global | Medium to Long-term (2026-2033) |

| Growth in Digital Art and NFT Market | +1.2% | Global | Medium-term (2025-2030) |

| Leveraging AI for Market Intelligence and Personalization | +1.0% | Global | Medium to Long-term (2025-2033) |

| Niche Market Development (e.g., Street Art, African Art) | +0.8% | Global, specific regions | Medium-term (2025-2030) |

Art Auction Market Challenges Impact Analysis

The art auction market is confronted by the significant challenge of economic uncertainty and global geopolitical tensions, which can directly influence buyer confidence and discretionary spending. Fluctuations in global stock markets, inflation, and interest rate hikes can lead to a more cautious approach from collectors and investors, potentially delaying or reducing high-value art purchases. Furthermore, geopolitical events such as regional conflicts or trade disputes can disrupt international art movement, impose sanctions, and create an unpredictable environment for cross-border transactions, making it harder for auction houses to source and sell artworks globally. This inherent sensitivity to broader economic and political landscapes presents a continuous challenge in maintaining consistent market growth and stability, as market participants become more risk-averse during turbulent times.

Another critical challenge is the evolving regulatory landscape and the increasing scrutiny over anti-money laundering (AML) and cultural heritage protection. Governments worldwide are implementing stricter regulations to combat illicit financial flows and the trade of stolen artifacts through the art market, requiring auction houses to implement more rigorous due diligence processes for clients and artworks. While essential for market integrity, these regulations can increase operational costs, prolong transaction times, and potentially deter some collectors who prefer anonymity. Additionally, competition from private sales and direct artist-to-buyer platforms poses a growing challenge to traditional auction houses. As artists and collectors seek alternative, potentially more cost-effective, and direct channels, auction houses must continually innovate their service offerings and value propositions to remain competitive and attract premium consignments, adapting their business models to a more diverse and fragmented market landscape.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Economic Slowdown and Inflationary Pressures | -1.8% | Global | Short-term (2025-2027) |

| Regulatory Scrutiny (AML, Cultural Heritage) | -1.2% | Global, particularly EU, UK, US | Long-term (2025-2033) |

| Competition from Private Sales & Art Dealers | -1.0% | Global | Long-term (2025-2033) |

| Maintaining Trust and Combating Forgery in Digital Realm | -0.9% | Global | Medium to Long-term (2025-2033) |

| Talent Retention and Succession in Expert Roles | -0.6% | North America, Europe | Long-term (2025-2033) |

Art Auction Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global art auction market, detailing its current size, historical performance from 2019 to 2023, and a meticulous forecast extending to 2033. The scope encompasses a thorough examination of market dynamics, including key growth drivers, significant restraints, emerging opportunities, and prevailing challenges that shape the industry landscape. Special attention is given to the transformative impact of digital technologies, such as online platforms and the integration of AI and blockchain, on market operations, accessibility, and transparency. The report also addresses evolving collector demographics and their influence on demand for various art categories, from traditional masterpieces to contemporary and digital art forms.

Furthermore, the report dissects the market across multiple segmentations, providing granular insights into categories such as art type (e.g., paintings, sculptures, photography, digital art), auction type (online, live, hybrid), and buyer demographics (e.g., private collectors, institutions, dealers). Regional analysis is a core component, highlighting market performance and unique trends across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, offering a comparative perspective on regional market evolution and growth potential. The competitive landscape is thoroughly assessed, profiling key market players, their strategies, market positioning, and recent developments. This structured approach aims to furnish stakeholders with actionable intelligence for strategic decision-making and investment planning within the dynamic global art auction ecosystem.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 39.8 Billion |

| Growth Rate | 8.7% CAGR |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Christie's, Sotheby's, Phillips, Bonhams, Heritage Auctions, Doyle New York, Lyon & Turnbull, Spink & Son, Hindman Auctions, Artcurial, Poly Auction, China Guardian Auctions, Ravenel International Art Group, Wright, Leslie Hindman Auctioneers, Freeman's, Piasa, Dorotheum, Aste Bolaffi, Forum Auctions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Art Auction Market is meticulously segmented to provide a comprehensive understanding of its diverse components and dynamics. This segmentation facilitates a detailed analysis of distinct market behaviors, preferences, and growth trajectories across various categories. The primary segmentation includes Art Type, which broadly categorizes artworks into traditional forms such as paintings, sculptures, photography, and prints, alongside emerging categories like digital art and NFTs. This classification helps in identifying which art forms are currently driving market value and attracting new collector demographics, reflecting shifts in artistic taste and investment focus. Understanding these nuances is crucial for auction houses and market participants to tailor their offerings and strategies to capture demand in specific segments, from old masters to contemporary avant-garde creations, thereby maximizing their market presence and revenue streams.

Further segmentation by Auction Type, differentiating between traditional live auctions, online-only auctions, and hybrid models, reveals the evolving operational landscape of the art market. The significant shift towards digital platforms has not only democratized access but also influenced transaction volumes and speed. Analyzing Buyer Type, encompassing private collectors, art dealers, institutions, and investors, provides insights into the motivations and purchasing power of different client segments. Moreover, Price Range segmentation, from entry-level to high-end, helps in mapping market liquidity and the distribution of wealth within the art ecosystem. These granular segmentations enable a precise understanding of market niches, growth drivers within specific categories, and the competitive strategies employed by various market players to cater to diverse client needs across the global art auction landscape.

- Art Type: Paintings (Oil, Acrylic, Watercolor), Sculptures, Photography, Prints and Multiples, Drawings, Decorative Arts, Jewellery, Collectibles, Digital Art (NFTs, Generative Art), Antiquities.

- Auction Type: Live Auctions (In-person), Online-Only Auctions, Hybrid Auctions.

- Buyer Type: Private Collectors, Art Dealers and Galleries, Museums and Institutions, Corporations, Investors.

- Price Range: Entry-Level (Below USD 50,000), Mid-Range (USD 50,000 - USD 1 Million), High-End (Above USD 1 Million).

Regional Highlights

- North America: This region maintains its position as a dominant force in the global art auction market, characterized by a mature collector base, a strong presence of major auction houses, and significant disposable income. The United States, in particular, drives much of the market activity, supported by robust institutional demand, a vibrant gallery scene, and early adoption of online auction platforms. The market here is highly diverse, spanning various art periods and genres, with a notable strength in Post-War and Contemporary art. The region also benefits from a well-established infrastructure for art finance and advisory services, attracting both domestic and international consignments. Despite its maturity, the North American market continues to innovate, embracing new technologies and digital marketing strategies to engage a younger generation of collectors.

- Europe: Europe remains a cornerstone of the art auction market, boasting a rich heritage of art collecting and a significant concentration of historical artworks. Countries like the United Kingdom (specifically London), France (Paris), and Germany are key hubs, housing prestigious auction houses and attracting high-value sales. The European market is distinctive for its strong emphasis on Old Masters, Impressionist, and Modern Art, though contemporary art is gaining increasing traction. Regulatory landscapes, particularly around import/export and cultural heritage, significantly influence market dynamics. The region is also at the forefront of implementing stricter anti-money laundering regulations, which, while challenging, are aimed at enhancing transparency and trust. The post-Brexit landscape has introduced some complexities for cross-border trade, prompting auction houses to adapt their operational strategies.

- Asia Pacific (APAC): The Asia Pacific region stands out as the fastest-growing market for art auctions, primarily driven by the expanding wealth of China, Hong Kong, and increasingly, South Korea, Japan, and Southeast Asian nations. This region is characterized by a burgeoning population of high-net-worth individuals who view art as a significant investment and a symbol of cultural identity. While traditional Chinese ink paintings and antiquities command high values, there is a substantial and rapidly growing interest in Western Contemporary art and digital art forms. Hong Kong serves as a vital gateway for international transactions due to its favorable tax policies and strategic location. The digital adoption rate is exceptionally high in APAC, with online auctions and social media influencing buyer behavior significantly. The region's growing affluence and cultural appreciation are set to drive substantial market expansion over the forecast period.

- Latin America: The Latin American art auction market, while smaller in global share, offers unique growth opportunities, particularly in countries like Brazil, Mexico, and Argentina. The market is driven by a passionate collector base with a strong focus on Latin American modern and contemporary art, as well as pre-Columbian and colonial artifacts. Economic fluctuations and political instability can pose challenges, but a resilient local art scene and a growing interest from international buyers in the region's distinctive artistic heritage continue to fuel activity. Online platforms are playing an increasing role in connecting local artists and artworks with a broader global audience, mitigating some of the regional economic volatilities and expanding market reach.

- Middle East and Africa (MEA): The MEA region is emerging as a significant player in the art auction market, propelled by the increasing wealth in Gulf Cooperation Council (GCC) countries such as the UAE (Dubai) and Saudi Arabia. These nations are investing heavily in cultural infrastructure, including museums and art districts, fostering a vibrant art ecosystem. The market here is characterized by a strong demand for regional contemporary art, Islamic art, and international modern art. African art, both traditional and contemporary, is also gaining global recognition, attracting international buyers. The region's strategic location and burgeoning affluent population make it a promising frontier for auction houses seeking new growth avenues, with a particular focus on developing local art markets and promoting regional artists on a global stage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Art Auction Market.- Christie's

- Sotheby's

- Phillips

- Bonhams

- Heritage Auctions

- Doyle New York

- Lyon & Turnbull

- Spink & Son

- Hindman Auctions

- Artcurial

- Poly Auction

- China Guardian Auctions

- Ravenel International Art Group

- Wright

- Leslie Hindman Auctioneers

- Freeman's

- Piasa

- Dorotheum

- Aste Bolaffi

- Forum Auctions

Frequently Asked Questions

Analyze common user questions about the Art Auction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth trajectory of the Art Auction Market?

The Art Auction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% from 2025 to 2033, expanding significantly from an estimated USD 20.5 billion in 2025 to USD 39.8 billion by 2033. This robust growth is primarily driven by increasing global wealth, digitalization, and the emergence of new collector bases in Asia-Pacific.

How is technology, specifically AI and NFTs, impacting art auctions?

Technology is profoundly transforming art auctions. Online platforms enhance accessibility, while AI is being leveraged for improved art authentication, valuation, and personalized client engagement. NFTs represent a new category of digital art, attracting a tech-savvy generation of collectors and diversifying the market, although their long-term impact is still evolving.

Which regions are driving the growth in the global Art Auction Market?

The Asia Pacific region, particularly China and Hong Kong, is the primary driver of growth due to rapid wealth accumulation and a burgeoning collector base. North America and Europe remain mature and significant markets, while the Middle East is also emerging as a key growth area with increasing investment in cultural infrastructure and a growing affluent population.

What are the primary challenges facing the Art Auction Market?

Key challenges include economic volatility, which can reduce discretionary spending on art, and increased regulatory scrutiny related to anti-money laundering (AML) and cultural heritage protection. Additionally, issues of art forgery, maintaining trust, and growing competition from private sales channels pose ongoing challenges for market participants.

What types of art are currently most sought after in auctions?

While traditional categories like Impressionist and Modern Art continue to command high values, there is a significant and growing demand for Contemporary and Post-War Art. Additionally, digital art, including NFTs, and art from emerging regions are gaining considerable traction, attracting new collectors and diversifying market interest.