Anti Money Laundering Market

Anti Money Laundering Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705336 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Anti Money Laundering Market Size

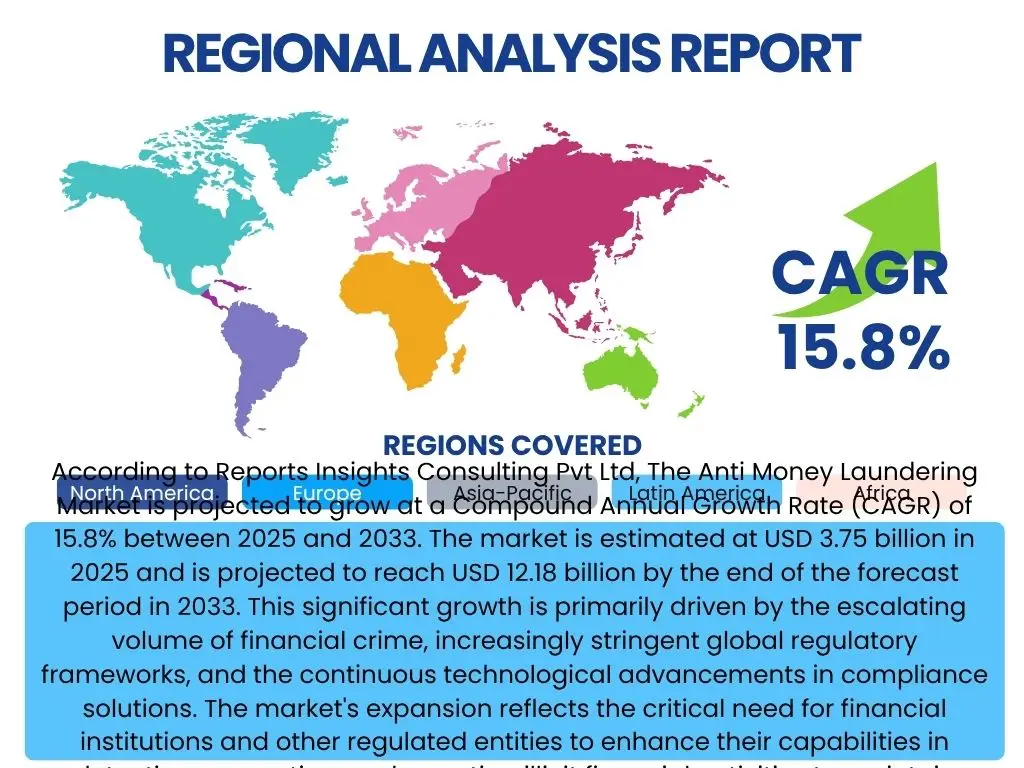

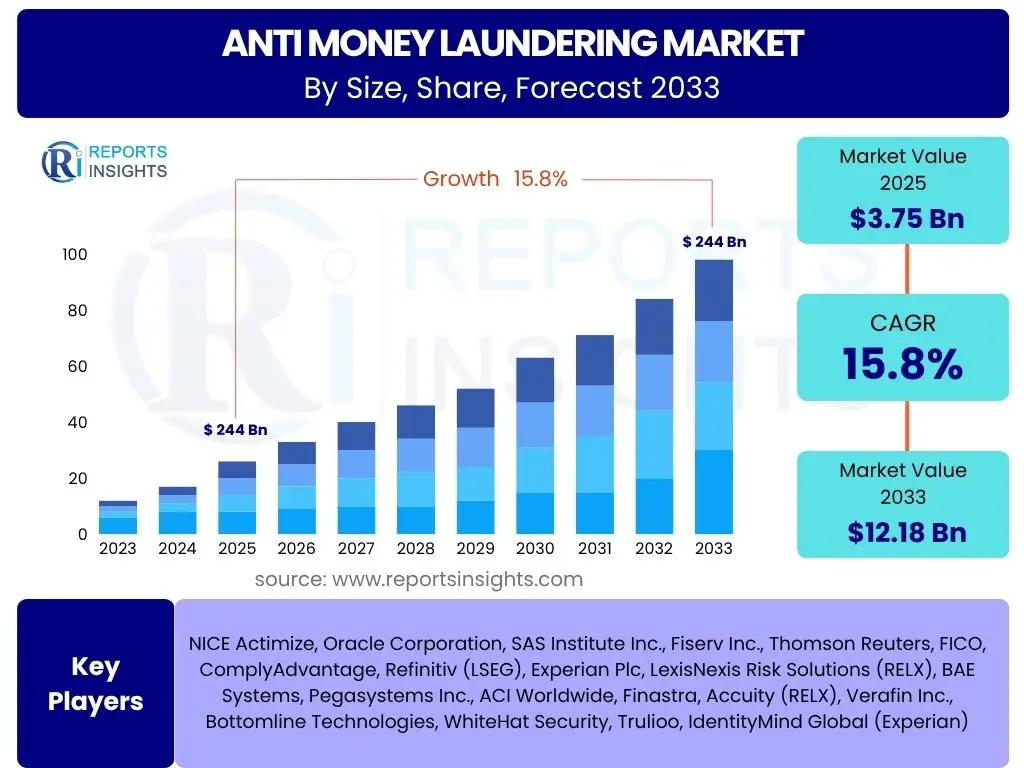

According to Reports Insights Consulting Pvt Ltd, The Anti Money Laundering Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2025 and 2033. The market is estimated at USD 3.75 billion in 2025 and is projected to reach USD 12.18 billion by the end of the forecast period in 2033. This significant growth is primarily driven by the escalating volume of financial crime, increasingly stringent global regulatory frameworks, and the continuous technological advancements in compliance solutions. The market's expansion reflects the critical need for financial institutions and other regulated entities to enhance their capabilities in detecting, preventing, and reporting illicit financial activities to maintain integrity and avoid hefty penalties.

Key Anti Money Laundering Market Trends & Insights

User queries regarding Anti Money Laundering (AML) market trends frequently highlight the shift towards proactive and predictive compliance mechanisms, moving beyond traditional reactive approaches. There is a strong emphasis on leveraging advanced analytics and artificial intelligence to improve the efficiency and effectiveness of AML operations. Users are also keen on understanding the impact of cloud adoption, real-time processing capabilities, and the integration of diverse data sources to achieve a holistic view of financial transactions. Furthermore, the evolving landscape of digital currencies and cross-border payments presents a recurring theme, driving demand for AML solutions that can address these new complexities.

The market is witnessing a profound transformation driven by regulatory convergence and the imperative for financial institutions to reduce operational costs while enhancing compliance efficacy. Institutions are increasingly looking for solutions that offer interoperability and scalability, capable of adapting to rapidly changing regulatory environments and evolving financial crime typologies. The focus is shifting from siloed AML systems to integrated platforms that can provide a comprehensive and unified view of customer risk and transaction behavior, facilitating more accurate and timely decision-making. This trend underscores a broader industry movement towards sophisticated, data-driven compliance strategies.

- Adoption of AI and Machine Learning for enhanced anomaly detection and reduced false positives.

- Shift towards cloud-based AML solutions for scalability, cost-efficiency, and accessibility.

- Increasing demand for real-time transaction monitoring to detect suspicious activities instantly.

- Emergence of RegTech solutions providing agility and automation in regulatory compliance.

- Focus on enhanced Know Your Customer (KYC) and Customer Due Diligence (CDD) through digital identity verification.

- Greater integration of disparate data sources, including open-source intelligence and social media data.

- Development of AML solutions specifically tailored for cryptocurrency and blockchain transactions.

- Emphasis on holistic risk management platforms that combine AML with anti-fraud and cybersecurity.

AI Impact Analysis on Anti Money Laundering

User questions related to the impact of AI on Anti Money Laundering often revolve around its capability to revolutionize traditional AML processes by improving accuracy, efficiency, and speed. Common inquiries include how AI can identify complex patterns that human analysts might miss, its role in reducing false positives, and the potential for predictive analytics in fraud detection. Users also express concerns regarding data privacy, algorithmic bias, and the need for explainable AI to ensure transparency and compliance with regulatory requirements. The discussion frequently highlights the balance between technological advancement and ethical implementation in sensitive financial compliance areas.

Artificial intelligence, encompassing machine learning, natural language processing, and deep learning, is fundamentally transforming the AML landscape by offering unprecedented capabilities in data analysis and risk assessment. AI-powered systems can process vast volumes of transactional data, customer information, and external intelligence with superior speed and precision compared to traditional rule-based systems. This enables financial institutions to move towards more proactive and intelligence-driven AML strategies, identifying emerging threats and adapting to new money laundering typologies more effectively. The deployment of AI also contributes significantly to operational efficiencies by automating repetitive tasks, allowing compliance professionals to focus on complex investigations that require human judgment.

Despite its transformative potential, the integration of AI into AML systems presents several challenges. Ensuring data quality and overcoming data silos are critical prerequisites for effective AI implementation. Furthermore, the "black box" nature of some AI models raises concerns about interpretability and explainability, which are vital for demonstrating compliance to regulators. Addressing these challenges requires robust governance frameworks, ethical guidelines, and continuous model validation to build trust and ensure responsible AI deployment in the highly regulated AML domain. The long-term impact of AI is expected to be a more resilient, adaptive, and efficient global financial system capable of combating increasingly sophisticated financial crimes.

- Enhanced anomaly detection and pattern recognition in large datasets.

- Significant reduction in false positives, leading to operational cost savings.

- Improved predictive analytics for identifying potential future money laundering risks.

- Automation of routine tasks, freeing up human analysts for complex investigations.

- Ability to analyze unstructured data sources, such as news articles and emails.

- Challenges in explainability and transparency of AI decisions for regulatory compliance.

- Ethical concerns regarding data privacy and potential algorithmic bias.

- Requirement for high-quality, diverse datasets for effective AI model training.

- Need for skilled professionals to develop, implement, and manage AI-driven AML solutions.

Key Takeaways Anti Money Laundering Market Size & Forecast

User inquiries about key takeaways from the Anti Money Laundering market size and forecast consistently point towards a future characterized by robust growth, driven by intensifying regulatory pressures and the relentless evolution of financial crime. Users want to understand the overarching trends and the strategic implications for financial institutions. The insights sought often include the critical role of technology in scaling compliance efforts, the increasing complexity of data management, and the imperative for cross-border collaboration in combating global illicit financial flows. The market outlook suggests a sustained upward trajectory, making AML investment a strategic imperative rather than a mere compliance obligation.

The Anti Money Laundering market is set for substantial expansion, with its projected growth indicating a critical and escalating demand for advanced compliance solutions. This upward trend is fundamentally influenced by two primary forces: the continuous tightening of global anti-money laundering regulations and the increasing sophistication of financial criminals. Governments and international bodies are imposing stricter guidelines and heavier penalties, compelling financial institutions to invest significantly in robust AML frameworks. Simultaneously, criminals are leveraging new technologies and complex schemes, necessitating dynamic and intelligent detection and prevention tools. This dual pressure ensures that the AML market will remain a high-growth sector, driven by innovation and regulatory necessity.

A significant takeaway is the pivotal role of technological innovation, particularly in areas like artificial intelligence, machine learning, and blockchain analytics, in shaping the future of AML. These technologies are not merely incremental improvements but represent a paradigm shift in how financial institutions identify, assess, and mitigate risks. The market is also witnessing a greater emphasis on integrated solutions that can provide a holistic view of customer activities across various platforms and jurisdictions, moving away from fragmented systems. This integration, coupled with a focus on data quality and interoperability, will be crucial for institutions aiming to build resilient and future-proof AML programs capable of adapting to an ever-changing threat landscape and regulatory environment.

- Market to experience significant growth, driven by regulatory stringency and rising financial crime.

- Technological advancements, especially AI/ML, are foundational to future AML effectiveness.

- Cloud adoption is accelerating, offering scalable and flexible AML infrastructure.

- Demand for integrated, holistic AML platforms is increasing to combat complex schemes.

- Operational efficiency and cost reduction remain key drivers for adopting new AML technologies.

- The focus is shifting towards proactive, intelligence-driven risk management.

- Cryptocurrency and digital asset AML solutions represent a substantial emerging sub-market.

- Global collaboration and data sharing are becoming increasingly important for cross-border crime prevention.

Anti Money Laundering Market Drivers Analysis

The Anti Money Laundering market is propelled by a confluence of powerful drivers, primarily the intensifying global regulatory landscape and the relentless increase in the volume and sophistication of financial crimes. Governments worldwide are enacting and enforcing stricter AML and Counter-Terrorist Financing (CTF) regulations, often accompanied by significant penalties for non-compliance. This creates an undeniable imperative for financial institutions and other regulated entities to invest in more robust and technologically advanced AML solutions. The sheer scale and complexity of illicit financial flows, including those associated with cybercrime and emerging digital assets, further amplify the demand for sophisticated detection and prevention capabilities, making compliance a non-negotiable aspect of financial operations.

Technological advancements also serve as a crucial driver, as innovations in artificial intelligence, machine learning, big data analytics, and cloud computing offer unprecedented opportunities to enhance the effectiveness and efficiency of AML processes. These technologies enable financial institutions to move beyond traditional rule-based systems, allowing for more dynamic risk assessment, real-time transaction monitoring, and significant reductions in false positives. The digitalization of financial services, encompassing everything from online banking to mobile payments and decentralized finance, broadens the attack surface for financial criminals, compelling institutions to adopt cutting-edge AML technologies to protect their systems and uphold trust.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stricter Regulatory Frameworks & Compliance Obligations | +4.5% | Global, particularly North America, Europe, APAC | Short to Medium-term (2025-2030) |

| Escalating Financial Crime & Illicit Activities | +3.8% | Global, especially emerging economies & cyber-prone regions | Short to Long-term (2025-2033) |

| Technological Advancements in AI, ML & Analytics | +3.0% | Global, high adoption in developed markets | Short to Long-term (2025-2033) |

| Digitalization of Financial Services & New Payment Methods | +2.5% | Global, rapid growth in APAC & Latin America | Short to Medium-term (2025-2030) |

| Increased Focus on Risk-Based Approach (RBA) | +1.0% | Global, emphasized by FATF | Medium-term (2027-2033) |

Anti Money Laundering Market Restraints Analysis

Despite the strong growth drivers, the Anti Money Laundering market faces several significant restraints that could impede its full potential. One of the primary inhibitors is the high initial implementation cost associated with deploying sophisticated AML software and integrating it with existing legacy systems. Many financial institutions, particularly smaller ones or those in developing regions, find these upfront investments prohibitive. Beyond the initial setup, ongoing maintenance, training, and data management expenses further contribute to the financial burden, creating a barrier to entry for advanced solutions. This cost factor often leads to a slower adoption rate for comprehensive AML systems, especially in environments with limited budgets.

Another substantial restraint is the complexity of integrating new AML solutions with diverse, often fragmented, existing IT infrastructures. Financial institutions frequently operate with multiple disparate systems, making seamless integration a challenging and time-consuming endeavor. Furthermore, concerns regarding data privacy and security, particularly with the proliferation of strict regulations like GDPR, present a hurdle. Organizations must navigate the delicate balance between effective data utilization for AML purposes and ensuring compliance with stringent privacy laws, which can lead to cautious or delayed adoption of advanced analytics and cloud-based solutions. The perpetual challenge of managing false positives, while improving, still consumes significant resources and contributes to operational inefficiency, further restraining the full potential of AML solutions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Implementation and Maintenance Costs | -2.0% | Global, more pronounced in developing regions | Short to Medium-term (2025-2030) |

| Complexity of Integration with Legacy Systems | -1.5% | Global, pervasive across financial institutions | Short to Medium-term (2025-2030) |

| Data Privacy and Security Concerns | -1.2% | Global, highly relevant in EU (GDPR) and North America | Short to Long-term (2025-2033) |

| Shortage of Skilled AML Professionals | -1.0% | Global, acute in all major financial hubs | Short to Long-term (2025-2033) |

| High Volume of False Positives | -0.8% | Global | Short to Medium-term (2025-2030) |

Anti Money Laundering Market Opportunities Analysis

The Anti Money Laundering market presents numerous lucrative opportunities driven by technological innovation and evolving financial landscapes. The rapid adoption of cloud-based AML solutions stands out as a significant area of growth, offering scalability, reduced infrastructure costs, and enhanced accessibility for institutions of all sizes. This transition to the cloud facilitates faster deployment and updates, allowing financial entities to remain agile in the face of new threats and regulatory changes. Furthermore, the increasing integration of artificial intelligence and machine learning is creating new avenues for more sophisticated and efficient anomaly detection, moving beyond traditional rule-based systems to deliver more intelligent and adaptive compliance capabilities. These advancements empower institutions to predict and prevent financial crime with greater accuracy.

Another substantial opportunity lies in the burgeoning market for AML solutions tailored to emerging financial technologies, such as cryptocurrencies, blockchain-based assets, and decentralized finance (DeFi). As these digital assets gain mainstream adoption, regulatory bodies are intensifying their focus on preventing their misuse for illicit activities, creating a strong demand for specialized AML and blockchain analytics tools. Moreover, the increasing emphasis on a holistic risk management approach, which integrates AML with fraud detection, cybersecurity, and financial intelligence, opens up opportunities for solution providers offering comprehensive platforms. This integrated approach allows financial institutions to achieve a unified view of risk, optimize resources, and streamline their compliance operations across multiple domains, enhancing overall security and operational efficiency.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of Cloud-based AML Solutions | +3.0% | Global, particularly SMEs & regulated entities seeking scalability | Short to Long-term (2025-2033) |

| Growing Demand for AML in Cryptocurrencies & Digital Assets | +2.5% | Global, prominent in regions with high crypto adoption | Short to Long-term (2025-2033) |

| Integration of AML with Broader Risk & Fraud Management | +2.0% | Global, driven by large financial institutions | Medium-term (2027-2033) |

| Emergence of RegTech & SupTech Solutions | +1.5% | Global, particularly in well-regulated markets | Medium-term (2027-2033) |

| Geographic Expansion into Emerging Markets | +1.0% | APAC, Latin America, MEA | Medium to Long-term (2027-2033) |

Anti Money Laundering Market Challenges Impact Analysis

The Anti Money Laundering market faces persistent challenges that demand continuous innovation and strategic adaptation. One of the most significant hurdles is the rapidly evolving nature of financial crime typologies. Criminals constantly devise new methods to launder money, utilizing emerging technologies, cross-border complexities, and sophisticated layering techniques. This dynamic threat landscape requires AML solutions to be highly adaptive and predictive, moving beyond static rule sets to effectively identify novel patterns of illicit activity. Staying ahead of these evolving schemes puts immense pressure on technology providers and financial institutions alike to update and refine their AML defenses constantly.

Another substantial challenge stems from the fragmented and diverse regulatory landscape across different jurisdictions. While global efforts like FATF provide recommendations, individual countries often implement their own specific AML/CTF laws, leading to a complex web of compliance requirements. For multinational financial institutions, adhering to varied and sometimes conflicting regulations can be an arduous and costly endeavor, necessitating flexible and customizable AML solutions. Furthermore, the presence of data silos within organizations, where customer and transactional data reside in disparate systems, hinders the creation of a unified risk profile, making comprehensive AML analysis difficult. Overcoming these silos and achieving data interoperability is critical for leveraging advanced analytics and AI effectively, but it remains a considerable technical and organizational challenge for many institutions.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Evolving Financial Crime Typologies | -1.5% | Global | Short to Long-term (2025-2033) |

| Regulatory Fragmentation Across Jurisdictions | -1.2% | Global, significant for multinational entities | Short to Long-term (2025-2033) |

| Data Silos & Poor Data Quality | -1.0% | Global, particularly in legacy institutions | Short to Medium-term (2025-2030) |

| Integration with Legacy IT Infrastructure | -0.9% | Global, pervasive in established financial services | Short to Medium-term (2025-2030) |

| Addressing Algorithmic Bias in AI Models | -0.7% | Global, increasing concern in developed markets | Medium to Long-term (2027-2033) |

Anti Money Laundering Market - Updated Report Scope

This market research report provides an exhaustive analysis of the Anti Money Laundering market, encompassing detailed insights into market sizing, growth drivers, restraints, opportunities, and challenges. The scope extends to a comprehensive segmentation analysis by component, deployment, solution, and end-user industry, offering a granular view of market dynamics. Furthermore, the report delves into regional market trends, highlighting key country-level developments and regulatory landscapes impacting market growth. A robust competitive analysis section profiles leading market players, assessing their strategies, product portfolios, and market positioning to offer a holistic understanding of the competitive environment.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.75 Billion |

| Market Forecast in 2033 | USD 12.18 Billion |

| Growth Rate | 15.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | NICE Actimize, Oracle Corporation, SAS Institute Inc., Fiserv Inc., Thomson Reuters, FICO, ComplyAdvantage, Refinitiv (LSEG), Experian Plc, LexisNexis Risk Solutions (RELX), BAE Systems, Pegasystems Inc., ACI Worldwide, Finastra, Accuity (RELX), Verafin Inc., Bottomline Technologies, WhiteHat Security, Trulioo, IdentityMind Global (Experian) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Anti Money Laundering market is meticulously segmented to provide a detailed understanding of its diverse components and applications. This segmentation allows for a granular analysis of market dynamics, revealing specific growth drivers and challenges within each category. The primary segments include components (software and services), deployment models (on-premise and cloud), various solution types that address specific AML needs, and the broad spectrum of end-user industries that utilize these solutions. This comprehensive breakdown highlights the versatility and specialized nature of AML offerings across the global financial ecosystem, reflecting the varied requirements of different stakeholders in combating financial crime.

- By Component:

- Software: Transaction Monitoring, Customer Identity Management, Sanctions Screening, Compliance Management, Case Management, Other AML Software

- Services: Managed Services, Professional Services, Training & Consulting, Implementation & Integration

- By Deployment:

- On-premise

- Cloud

- By Solution:

- Transaction Monitoring

- KYC (Know Your Customer)

- Sanctions Screening & Filtering

- Case Management

- Compliance Management

- Anti-fraud Systems

- Watchlist Management

- By End-user:

- Banks & Financial Institutions

- Insurance Companies

- Securities & Brokerage Firms

- Payment & Fintech Companies

- Government & Law Enforcement Agencies

- Other End-users (e.g., Gaming & Gambling, Real Estate)

Regional Highlights

- North America: Dominates the AML market due to stringent regulatory frameworks, high adoption of advanced technologies, and the presence of major financial hubs. The region demonstrates a strong emphasis on compliance automation and AI-driven solutions to combat increasingly sophisticated financial crimes.

- Europe: A significant market driven by robust AML/CTF directives (e.g., EU AML Directives), a focus on data privacy (GDPR), and a growing RegTech ecosystem. Countries like the UK and Germany are at the forefront of AML innovation and implementation.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, fueled by rapid economic development, increasing digitalization of financial services, and evolving regulatory landscapes in countries like China, India, Singapore, and Australia. The region is a hotbed for fintech innovation and cross-border transactions, leading to higher demand for scalable AML solutions.

- Latin America: Experiencing substantial growth due to increasing financial inclusion, digitalization, and rising awareness of money laundering risks. Governments are gradually strengthening AML regulations, prompting financial institutions to invest in compliance technologies.

- Middle East and Africa (MEA): Emerging as a promising market with growing financial sector sophistication, especially in the GCC countries. The region is investing in modernizing its financial infrastructure and enhancing AML capabilities to align with international standards and combat illicit financing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anti Money Laundering Market.- NICE Actimize

- Oracle Corporation

- SAS Institute Inc.

- Fiserv Inc.

- Thomson Reuters

- FICO

- ComplyAdvantage

- Refinitiv (LSEG)

- Experian Plc

- LexisNexis Risk Solutions (RELX)

- BAE Systems

- Pegasystems Inc.

- ACI Worldwide

- Finastra

- Accuity (RELX)

- Verafin Inc.

- Bottomline Technologies

- WhiteHat Security

- Trulioo

- IdentityMind Global (Experian)

Frequently Asked Questions

What is Anti Money Laundering (AML)?

Anti Money Laundering (AML) refers to a set of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. It involves monitoring financial transactions for suspicious activities, conducting due diligence on customers, and reporting potential money laundering to authorities.

Why is AML compliance important for financial institutions?

AML compliance is crucial for financial institutions to prevent their services from being used for illicit activities, avoid severe regulatory penalties and fines, protect their reputation, and contribute to global efforts in combating financial crime and terrorism financing. Non-compliance can result in billions in fines and significant reputational damage.

How is artificial intelligence (AI) transforming the AML market?

AI is transforming the AML market by enhancing the detection of complex patterns of illicit behavior, significantly reducing false positives, and enabling more efficient processing of vast data volumes. AI-powered systems facilitate predictive analytics, real-time monitoring, and automation of routine tasks, making AML efforts more effective and cost-efficient.

What are the key challenges in the Anti Money Laundering market?

Key challenges in the AML market include the constantly evolving nature of financial crime typologies, regulatory fragmentation across different jurisdictions, the high cost and complexity of integrating new AML solutions with legacy systems, and managing data quality and silos. Additionally, addressing issues like algorithmic bias in AI and a shortage of skilled AML professionals remain significant hurdles.

What are the emerging opportunities in the AML market?

Emerging opportunities in the AML market include the growing adoption of cloud-based solutions for scalability and cost efficiency, the increasing demand for specialized AML tools for cryptocurrencies and digital assets, and the integration of AML with broader risk and fraud management platforms. Furthermore, the development of advanced RegTech solutions offers significant growth potential.