Alcohol Spirit Market

Alcohol Spirit Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_704071 | Last Updated : August 05, 2025 |

Format : ![]()

![]()

![]()

![]()

Alcohol Spirit Market Size

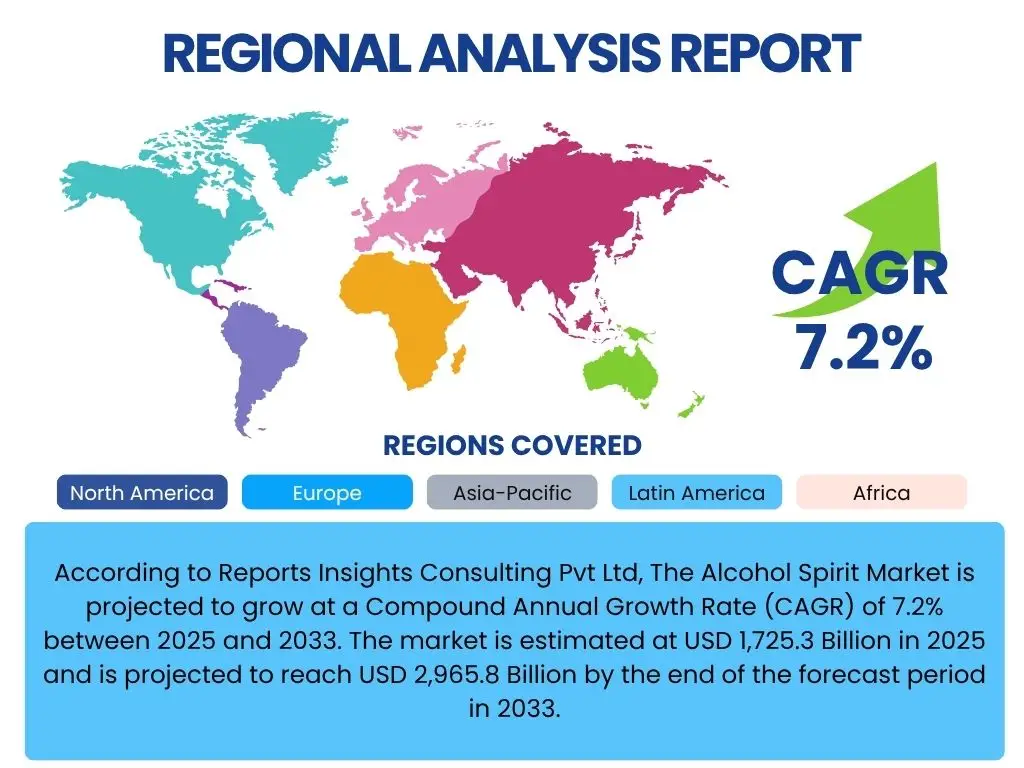

According to Reports Insights Consulting Pvt Ltd, The Alcohol Spirit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2033. The market is estimated at USD 1,725.3 Billion in 2025 and is projected to reach USD 2,965.8 Billion by the end of the forecast period in 2033.

Key Alcohol Spirit Market Trends & Insights

Consumers frequently inquire about the evolving landscape of the alcohol spirit market, focusing on shifts in consumption patterns, product innovation, and market dynamics. Key areas of interest include the rise of premiumization, the growing demand for craft and artisanal spirits, and the increasing influence of health and wellness trends impacting traditional alcohol consumption. Furthermore, the role of e-commerce and digital engagement in shaping purchasing habits is a prominent theme in user questions, alongside the impact of sustainability and ethical sourcing on brand perception and consumer choice.

The market is witnessing a significant trend towards product diversification, with manufacturers exploring new flavor profiles, lower ABV options, and innovative ready-to-drink (RTD) formats to cater to a broader consumer base. There is also a notable shift in consumption occasions, with a greater emphasis on at-home consumption and a decline in traditional on-trade channels, although this is expected to rebalance. Consumers are increasingly seeking unique experiences and personalized products, driving demand for limited editions, bespoke offerings, and transparent ingredient sourcing.

Geographically, emerging markets present substantial growth opportunities, driven by rising disposable incomes and changing lifestyles, while mature markets continue to focus on value-added products and brand loyalty. The integration of technology, from supply chain optimization to consumer engagement, is also a critical underlying trend that underpins many of these market shifts, influencing everything from production efficiency to marketing strategies.

- Premiumization and Super-Premiumization: Increasing consumer willingness to pay more for high-quality, exclusive spirits.

- Craft and Artisanal Spirits Movement: Growing demand for unique, small-batch spirits with distinct heritage and production methods.

- Low- and No-Alcohol Options: Expansion of non-alcoholic and low-alcohol spirit alternatives catering to health-conscious consumers.

- Ready-to-Drink (RTD) Cocktails: Rapid growth in convenience-driven, pre-mixed alcoholic beverages.

- E-commerce and Direct-to-Consumer (DTC) Sales: Accelerated adoption of online retail channels for alcohol purchases.

- Flavor Innovation and Experimentation: Introduction of diverse and adventurous flavor profiles across spirit categories.

- Sustainability and Ethical Sourcing: Increased consumer preference for brands with environmentally friendly and socially responsible practices.

- Experiential Consumption: Focus on unique drinking experiences, including mixology, cocktail culture, and home entertaining.

AI Impact Analysis on Alcohol Spirit

User queries regarding AI's influence on the alcohol spirit market frequently revolve around its potential to revolutionize production processes, enhance supply chain efficiency, and personalize consumer experiences. There is significant interest in how AI can optimize everything from raw material sourcing and distillation to quality control and distribution. Consumers and industry professionals alike are exploring AI's role in predicting market trends, understanding consumer preferences, and developing innovative products tailored to niche demands.

The integration of AI extends beyond operational efficiencies, deeply impacting marketing and sales strategies. Questions often highlight AI's capacity for advanced data analytics, enabling brands to create highly targeted advertising campaigns and dynamic pricing models. Furthermore, the potential for AI-powered virtual assistants and augmented reality experiences in retail environments or direct-to-consumer platforms is a recurring theme, suggesting a shift towards more interactive and engaging consumer touchpoints.

Concerns also emerge around the ethical implications of AI, particularly concerning data privacy and the potential for job displacement in traditional roles. However, the overarching sentiment is one of optimistic exploration, with a clear recognition that AI will be a transformative force, enabling greater precision, personalization, and responsiveness within the dynamic alcohol spirit industry. The focus remains on leveraging AI to drive competitive advantage and meet evolving consumer expectations.

- Supply Chain Optimization: AI-driven predictive analytics for inventory management, logistics, and demand forecasting.

- Personalized Marketing: AI algorithms for targeted advertising, content delivery, and consumer segmentation based on purchase history and preferences.

- New Product Development: AI-assisted research and development for creating novel flavor profiles and spirit formulations.

- Quality Control and Assurance: AI-powered sensors and imaging for real-time monitoring of distillation processes and product quality.

- Consumer Behavior Prediction: Machine learning models to anticipate future trends and purchasing patterns.

- Automated Distilleries: Robotics and AI for enhanced efficiency and precision in production.

- Retail Analytics: AI insights into sales data, foot traffic, and customer journeys to optimize store layouts and promotions.

Key Takeaways Alcohol Spirit Market Size & Forecast

User inquiries about the alcohol spirit market size and forecast consistently seek a concise understanding of its growth trajectory, the underlying factors driving this expansion, and the most significant opportunities for stakeholders. The primary interest lies in comprehending the overall market valuation, its projected growth rate, and the key regions or segments that are expected to contribute most substantially to this expansion. This reflects a need for clear, actionable insights to inform strategic decisions and investment priorities within the industry.

A central takeaway is the market's robust and sustained growth, driven by a confluence of evolving consumer preferences, increasing disposable incomes in emerging economies, and continuous product innovation. The forecast indicates a significant increase in market value, signaling healthy demand and expansion opportunities across various spirit categories. This sustained growth trajectory positions the alcohol spirit sector as an attractive domain for both established players and new entrants seeking to capitalize on shifting consumer tastes.

Furthermore, the data highlights the importance of adapting to dynamic consumption trends, such as the premiumization trend and the rise of e-commerce, which are pivotal in shaping future market success. Stakeholders should recognize the dual importance of traditional market strengths and embracing digital transformation to unlock the full potential of the market's forecasted expansion. Strategic focus on innovation, sustainable practices, and targeted regional development will be crucial for capturing market share.

- Significant Market Expansion: The alcohol spirit market is projected for substantial growth, reaching nearly USD 3 trillion by 2033.

- Steady CAGR: A Compound Annual Growth Rate of 7.2% indicates consistent and healthy market progression.

- Premiumization as a Driver: Consumer preference for high-end spirits will be a key factor in value growth.

- Emerging Markets: Asia Pacific and Latin America are anticipated to be major contributors to market expansion.

- Digital Transformation: E-commerce and direct-to-consumer models will increasingly shape market distribution and consumer access.

- Innovation Focus: Continuous product development in flavors, formats (RTD), and low/no-alcohol options will sustain market vibrancy.

Alcohol Spirit Market Drivers Analysis

The global alcohol spirit market is propelled by a multitude of factors, chief among them being the rising disposable incomes across various economies, particularly in developing regions. As consumer spending power increases, there is a corresponding shift towards premium and super-premium spirit categories, indicating a move from volume consumption to value-driven purchases. This trend is further amplified by rapid urbanization, which exposes a larger population to diverse lifestyles and international beverage trends, fostering a culture of social drinking and experimentation with different spirit types.

Changing consumer preferences are also a significant driver, with a notable inclination towards craft and artisanal spirits that offer unique flavor profiles, provenance, and storytelling. The demand for ready-to-drink (RTD) cocktails and flavored spirits is surging, driven by convenience and a desire for varied taste experiences, especially among younger demographics. Furthermore, the burgeoning e-commerce sector has significantly expanded market reach, allowing consumers unprecedented access to a wide array of products and brands, circumventing traditional distribution limitations and facilitating discovery.

The global tourism and hospitality sectors, following post-pandemic recovery, continue to boost on-trade consumption. Events, festivals, and the general return to social gatherings contribute to increased demand for spirits in bars, restaurants, and hotels. Additionally, continuous innovation in packaging, marketing, and the introduction of limited editions and personalized offerings keep the market dynamic and attract new consumers while retaining existing ones, ensuring sustained growth across various segments.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Disposable Income | +1.8% | Asia Pacific, Latin America, Middle East | Long-term (2025-2033) |

| Premiumization Trend | +1.5% | North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

| Growth of E-commerce Channels | +1.2% | Global, particularly urban areas | Mid-term (2025-2030) |

| Changing Consumer Preferences (Craft, RTD, Flavored) | +1.0% | North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

| Increased Socialization & Tourism | +0.8% | Global, particularly post-pandemic recovery regions | Short to Mid-term (2025-2028) |

Alcohol Spirit Market Restraints Analysis

Despite robust growth, the alcohol spirit market faces several significant restraints that could temper its expansion. Stringent government regulations, including high excise duties, taxes, and restrictive advertising policies, represent a primary hurdle. These regulations vary significantly by country and can impede market entry, raise operational costs, and limit consumer outreach, particularly in regions with strong public health mandates against alcohol consumption. The complexity of navigating diverse regulatory frameworks often creates market fragmentation and adds to compliance burdens for global players.

Growing health consciousness among consumers is another considerable restraint. There is an increasing societal emphasis on healthier lifestyles, leading some consumers to reduce or abstain from alcohol consumption. This trend has fueled the growth of the non-alcoholic and low-alcohol beverage categories, posing direct competition to traditional spirits. Concerns related to the long-term health effects of alcohol, coupled with awareness campaigns, may lead to a sustained decline in per capita consumption in certain demographics or regions.

Furthermore, economic downturns and inflationary pressures can negatively impact discretionary spending, including premium alcohol purchases. In times of economic uncertainty, consumers may trade down to more affordable options or reduce overall consumption. The illicit alcohol trade also presents a pervasive challenge, undermining legitimate market sales, posing public health risks due to unregulated production, and depriving governments of tax revenue. This parallel market directly competes with and devalues legal alcohol sales, particularly in regions with high taxation or weak enforcement.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Government Regulations & Taxation | -1.2% | Europe, Asia (e.g., India, Southeast Asia), Middle East | Long-term (2025-2033) |

| Rising Health Consciousness & Non-Alcoholic Alternatives | -1.0% | North America, Europe, parts of Asia | Long-term (2025-2033) |

| Economic Volatility & Inflationary Pressures | -0.7% | Global, particularly emerging markets | Short to Mid-term (2025-2027) |

| Illicit Alcohol Trade | -0.5% | Developing Economies (e.g., Africa, parts of Asia) | Long-term (2025-2033) |

Alcohol Spirit Market Opportunities Analysis

The alcohol spirit market is ripe with opportunities that can further accelerate its growth trajectory. Emerging markets, particularly in Asia Pacific and Latin America, present vast untapped potential. These regions are characterized by rapidly growing middle classes, increasing urbanization, and evolving consumer preferences, leading to higher disposable incomes and a greater willingness to experiment with diverse and premium spirit categories. Local producers and international brands alike can capitalize on these demographic shifts by tailoring products to regional tastes and expanding their distribution networks.

Product diversification and innovation remain a perennial opportunity. The success of low- and no-alcohol spirits, ready-to-drink (RTD) cocktails, and unique flavored variants demonstrates a strong market appetite for new and convenient options. Brands that invest in research and development to introduce novel ingredients, sustainable packaging, or innovative consumption experiences can capture new consumer segments and revitalize existing ones. This extends to leveraging digital platforms for product launches, virtual tastings, and direct-to-consumer sales, which streamline the path to market and enhance brand engagement.

Furthermore, the increasing focus on sustainability and ethical sourcing offers a significant competitive advantage. Consumers are increasingly valuing brands that demonstrate environmental responsibility, fair labor practices, and transparent supply chains. Companies adopting eco-friendly production methods, sustainable packaging, and supporting local communities can build stronger brand loyalty and appeal to a growing segment of conscientious consumers. Strategic partnerships and mergers & acquisitions also provide avenues for market consolidation, expanded geographical reach, and portfolio diversification, enabling companies to quickly adapt to market shifts and achieve economies of scale.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion in Emerging Markets | +1.5% | Asia Pacific, Latin America, Africa | Long-term (2025-2033) |

| Product Diversification (Low/No-ABV, RTD) | +1.3% | Global, particularly North America, Europe | Mid to Long-term (2025-2033) |

| E-commerce & Digital Marketing Expansion | +1.0% | Global | Mid-term (2025-2030) |

| Focus on Sustainability & Ethical Practices | +0.8% | North America, Europe, Oceania | Long-term (2025-2033) |

| Strategic Partnerships & Acquisitions | +0.7% | Global | Short to Mid-term (2025-2028) |

Alcohol Spirit Market Challenges Impact Analysis

The alcohol spirit market faces several intricate challenges that demand proactive strategies from industry players. One persistent challenge is the volatility of raw material prices, such as grains, fruits, and botanicals, which are susceptible to climatic conditions, geopolitical events, and global supply chain disruptions. This fluctuation directly impacts production costs and profit margins, forcing manufacturers to either absorb higher costs or pass them on to consumers, potentially affecting market competitiveness. Geopolitical instability and trade disputes further complicate international supply chains, leading to delays and increased logistical expenses.

Another significant challenge stems from the ever-shifting consumer preferences and the intense competition from alternative beverages. The market is saturated with a vast array of choices, including non-alcoholic options, craft beers, and specialty wines, all vying for consumer attention and share of wallet. Maintaining brand loyalty amidst this fierce competition requires continuous innovation, substantial marketing investment, and a deep understanding of evolving tastes, which can be resource-intensive for companies of all sizes.

Additionally, the proliferation of counterfeit products, particularly in emerging markets, poses a severe threat to brand integrity, consumer safety, and legitimate revenue streams. These illicit products not only dilute brand value but also expose consumers to health risks due to unregulated production. Finally, adapting to diverse and constantly evolving regulatory landscapes across different countries, particularly concerning advertising, distribution, and product labeling, presents a compliance burden that can hinder market expansion and operational efficiency for global brands.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Raw Material Price Volatility & Supply Chain Disruptions | -0.9% | Global | Short to Mid-term (2025-2028) |

| Shifting Consumer Preferences & Intense Competition | -0.8% | Global | Long-term (2025-2033) |

| Counterfeit Products & Illicit Trade | -0.6% | Asia, Africa, Latin America | Long-term (2025-2033) |

| Evolving Regulatory Landscape & Compliance Burden | -0.5% | Global, particularly highly regulated markets | Long-term (2025-2033) |

Alcohol Spirit Market - Updated Report Scope

This market research report offers an in-depth analysis of the Alcohol Spirit Market, providing a comprehensive overview of its current state, historical performance, and future projections. The report delves into key market trends, growth drivers, restraints, opportunities, and challenges, offering actionable insights for stakeholders. It extensively covers market segmentation by product type, distribution channel, and quality, alongside a detailed regional analysis and profiles of leading industry players, providing a holistic perspective on the market dynamics from 2019 through 2033.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1,725.3 Billion |

| Market Forecast in 2033 | USD 2,965.8 Billion |

| Growth Rate | 7.2% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Diageo Plc, Pernod Ricard, Bacardi Limited, Beam Suntory Inc., Brown-Forman Corporation, LVMH Moet Hennessy Louis Vuitton, Davide Campari-Milano N.V., Remy Cointreau SA, Suntory Holdings Limited, Constellation Brands Inc., Jose Cuervo (Becle), Kweichow Moutai Co. Ltd., Wuliangye Yibin Co. Ltd., Thai Beverage Public Company Limited, Gruppo Campari, Absolut Company, The Patron Spirits Company, Heaven Hill Brands, Mast-Jagermeister SE, Sazerac Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The alcohol spirit market is highly fragmented, necessitating a detailed segmentation analysis to fully comprehend its dynamics and identify distinct growth avenues. Segmentation by type, such as whiskey, vodka, rum, gin, tequila, brandy, and liqueurs, allows for a granular understanding of consumer preferences within each category, revealing which spirits are gaining traction due to innovation or changing social trends. The performance of each spirit type is influenced by regional traditions, marketing efforts, and evolving cocktail culture, making this classification crucial for product development and market positioning.

Distribution channels, encompassing both on-trade (bars, restaurants, hotels) and off-trade (supermarkets, liquor stores, online retail), significantly shape market access and consumer purchasing behavior. The accelerated shift towards online retail, particularly following global events, has transformed how spirits are bought and sold, creating new opportunities for direct-to-consumer models and digital marketing. Analyzing these channels helps identify optimal routes to market and investment priorities for logistics and sales infrastructure.

Furthermore, segmentation by quality (standard, premium, super-premium, ultra-premium) reflects the clear trend towards premiumization, indicating a consumer willingness to invest in higher-quality spirits for special occasions or connoisseurship. This segment drives higher revenue per unit and is a key focus for brand building and value creation. Coupled with packaging innovations and the rise of flavored spirits, these segmentations collectively paint a comprehensive picture of the market's intricate structure, enabling targeted strategies and maximizing market penetration across diverse consumer groups.

- By Type:

- Whiskey: Scotch, Irish, American (Bourbon, Rye), Canadian, Japanese, Others.

- Vodka: Flavored, Unflavored.

- Rum: White, Gold, Dark, Spiced, Flavored.

- Gin: London Dry, Plymouth, Old Tom, Contemporary, Flavored.

- Tequila: Blanco, Reposado, Anejo, Extra Anejo, Cristalino.

- Brandy: Cognac, Armagnac, Grape Brandy, Fruit Brandy.

- Liqueurs: Cream Liqueurs, Fruit Liqueurs, Herbal Liqueurs, Coffee Liqueurs, Other Liqueurs.

- Others: Absinthe, Schnapps, Soju, Mezcal, Cachaça, etc.

- By Distribution Channel:

- On-trade: Bars, Restaurants, Hotels, Clubs.

- Off-trade: Supermarkets, Hypermarkets, Liquor Stores, Convenience Stores, Online Retail.

- By Quality:

- Standard

- Premium

- Super-Premium

- Ultra-Premium

- By Packaging:

- Bottles (Glass, Plastic)

- Cans

- Pouches

- Miniatures

- Bag-in-Box (for certain liqueurs/cocktails)

- By Flavor:

- Unflavored

- Flavored

Regional Highlights

- North America: This region is a mature yet dynamic market, characterized by strong demand for premium and super-premium spirits, particularly whiskey and tequila. The craft spirits movement has a significant presence, with a burgeoning number of micro-distilleries offering unique and artisanal products. E-commerce penetration for alcohol sales is rapidly expanding, driven by convenience and wider product availability. Health and wellness trends are also influencing product innovation, leading to a rise in low- and no-alcohol spirit options and ready-to-drink cocktails. Canada and the United States are key contributors, with evolving regulatory landscapes impacting market access and growth strategies.

- Europe: Europe represents a significant market for traditional spirits like whiskey, brandy, and gin, with a strong emphasis on heritage and craftsmanship. Western European countries, such as the UK, Germany, and France, are major consumers and producers, showcasing strong trends in premiumization and experimental mixology. Southern Europe maintains robust demand for regional specialties like brandy and aperitifs. The market also sees growth in sustainable and organic spirits, aligning with consumer values. Regulatory complexities around advertising and taxation vary across the continent, posing unique challenges for market players.

- Asia Pacific (APAC): This region is projected to be the fastest-growing market, driven by increasing disposable incomes, rapid urbanization, and a growing youth demographic. Countries like China and India are experiencing a surge in demand for international spirit brands, alongside robust consumption of traditional local spirits. The adoption of Western drinking habits, coupled with a booming middle class, fuels the demand for a diverse range of spirits, from whiskey to vodka and liqueurs. E-commerce and digital engagement are transforming distribution and marketing in this fragmented but high-potential market.

- Latin America: The market in Latin America is characterized by strong local spirit categories, such as Tequila and Cachaça, alongside growing consumption of imported spirits. Rising tourism and economic development in key countries like Brazil, Mexico, and Argentina are contributing to market expansion. Premiumization is a notable trend, particularly among younger consumers who are open to experimenting with new flavors and international brands. Distribution networks are expanding, though infrastructure challenges and varying regulatory frameworks present opportunities for localized strategies.

- Middle East and Africa (MEA): This region presents a mixed landscape. The Middle East, influenced by tourism and expatriate populations, shows increasing demand for premium spirits, especially in countries with more liberal alcohol policies. Africa, particularly South Africa and Nigeria, offers substantial growth potential due to a large youth population and improving economic conditions, though the market is often challenged by illicit trade and restrictive regulations in some areas. The rise of international hotel chains and increasing disposable incomes are key drivers for the legitimate market in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alcohol Spirit Market.- Diageo Plc

- Pernod Ricard

- Bacardi Limited

- Beam Suntory Inc.

- Brown-Forman Corporation

- LVMH Moet Hennessy Louis Vuitton

- Davide Campari-Milano N.V.

- Remy Cointreau SA

- Suntory Holdings Limited

- Constellation Brands Inc.

- Jose Cuervo (Becle)

- Kweichow Moutai Co. Ltd.

- Wuliangye Yibin Co. Ltd.

- Thai Beverage Public Company Limited

- Gruppo Campari

- Absolut Company

- The Patron Spirits Company

- Heaven Hill Brands

- Mast-Jagermeister SE

- Sazerac Company

Frequently Asked Questions

What is the current market size and projected growth of the alcohol spirit market?

The global alcohol spirit market is estimated at USD 1,725.3 Billion in 2025 and is projected to reach USD 2,965.8 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.2%. This robust growth is driven by rising disposable incomes, urbanization, and evolving consumer preferences for premium and diverse spirit categories.

What are the primary drivers influencing the alcohol spirit market's expansion?

Key drivers include the increasing trend of premiumization, a growing demand for craft and artisanal spirits, the rapid expansion of e-commerce and direct-to-consumer sales channels, and changing consumer lifestyles leading to increased social drinking. Additionally, rising disposable incomes in emerging economies and continuous product innovation contribute significantly to market growth.

How are consumer preferences evolving within the alcohol spirit industry?

Consumers are increasingly seeking higher-quality, unique, and authentic spirit experiences, driving the premiumization trend. There's also a growing demand for flavored spirits, ready-to-drink (RTD) cocktails, and low- or no-alcohol alternatives, reflecting a desire for convenience, variety, and health consciousness. Sustainability and ethical sourcing are also becoming important considerations for purchasing decisions.

What role does technology, particularly AI, play in the alcohol spirit market?

Artificial intelligence (AI) is transforming the alcohol spirit market by optimizing supply chain management, enabling personalized marketing and sales strategies, and assisting in new product development through flavor profile analysis. AI also enhances quality control in production and provides predictive insights into consumer behavior and market trends, leading to greater efficiency and innovation across the industry.

What challenges does the alcohol spirit market face?

The market faces challenges such as stringent government regulations and high taxation in various regions, which can restrict growth. Rising health consciousness among consumers, leading to increased interest in non-alcoholic alternatives, poses competition. Additionally, the volatility of raw material prices, supply chain disruptions, and the prevalence of counterfeit products are significant hurdles that impact profitability and brand integrity.