Acetic Acid Market

Acetic Acid Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702727 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Acetic Acid Market Size

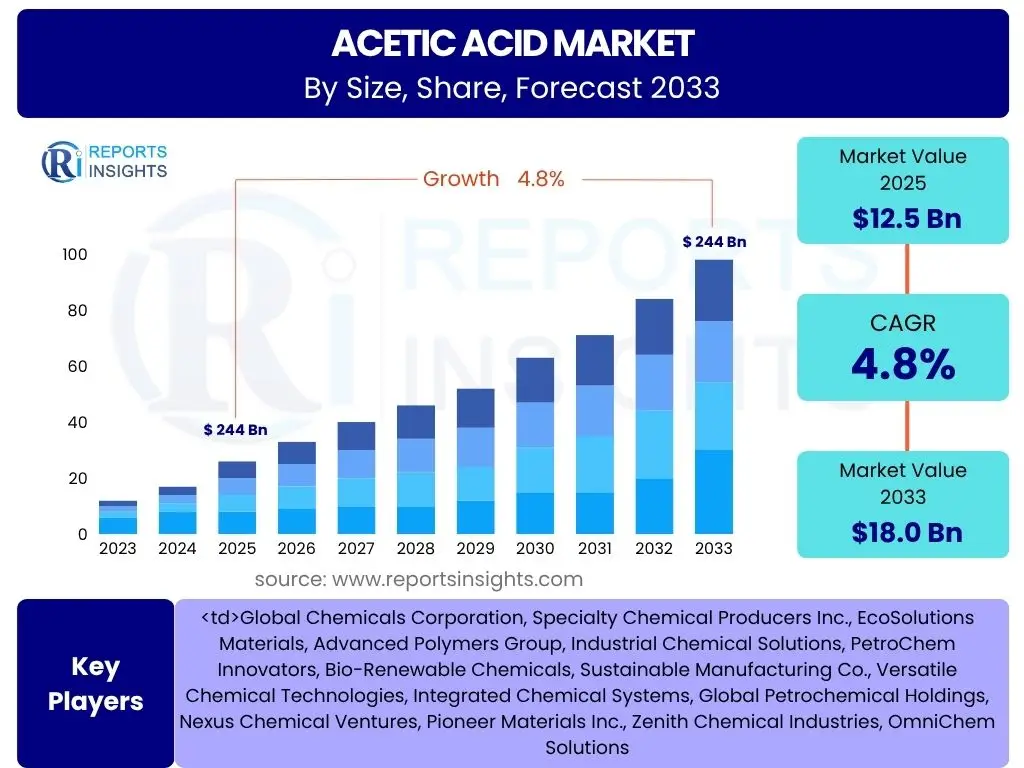

According to Reports Insights Consulting Pvt Ltd, The Acetic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2033. The market is estimated at USD 12.5 Billion in 2025 and is projected to reach USD 18.0 Billion by the end of the forecast period in 2033.

Key Acetic Acid Market Trends & Insights

Current market discourse frequently addresses the evolving landscape of acetic acid consumption and production. User inquiries often center on shifts in application demand, particularly the ongoing expansion within the vinyl acetate monomer (VAM) and purified terephthalic acid (PTA) sectors. There is also significant interest in sustainable production methods, including bio-based acetic acid, and the impact of regional industrialization on supply and demand dynamics. The shift towards higher-value applications and specialty chemical synthesis is a recurring theme in market trend analyses.

Furthermore, questions arise regarding the influence of fluctuating raw material costs, primarily methanol and natural gas, on overall production economics and market pricing. Stakeholders are keen to understand how geopolitical factors and trade policies might reshape supply chains and competitive landscapes. The integration of advanced process technologies aimed at enhancing efficiency and reducing environmental footprints also represents a key area of inquiry, reflecting a broader industry push towards operational excellence and sustainability.

- Increasing demand for Vinyl Acetate Monomer (VAM) and Purified Terephthalic Acid (PTA).

- Growing adoption of bio-based acetic acid production methods.

- Expansion of end-use industries such as packaging, textiles, and pharmaceuticals.

- Focus on process optimization and energy efficiency in manufacturing.

- Regional shifts in production capacity and consumption patterns, particularly in Asia Pacific.

AI Impact Analysis on Acetic Acid

User questions regarding the impact of Artificial Intelligence (AI) on the acetic acid market primarily revolve around efficiency gains, predictive capabilities, and supply chain optimization. Stakeholders are keen to understand how AI can enhance manufacturing processes, reduce operational costs, and improve product quality. There is a strong interest in AI's role in predictive maintenance for complex chemical plants, optimizing energy consumption, and fine-tuning reaction parameters to maximize yield and purity.

Moreover, inquiries frequently touch upon AI's potential in demand forecasting and supply chain management within the chemical industry. The ability to analyze vast datasets for market trends, raw material price fluctuations, and logistics can significantly improve decision-making. AI is also seen as a tool for accelerating research and development, particularly in discovering new catalytic processes or optimizing existing ones for more sustainable production pathways, thereby offering a competitive edge.

- Process optimization and control in acetic acid manufacturing facilities.

- Predictive maintenance for equipment, reducing downtime and operational costs.

- Enhanced supply chain management through advanced demand forecasting and logistics optimization.

- Acceleration of research and development for new catalysts and sustainable production methods.

- Improved quality control and consistency in product output.

Key Takeaways Acetic Acid Market Size & Forecast

Analyses of user inquiries regarding key takeaways from the acetic acid market size and forecast reveal a consistent focus on growth drivers, regional market dynamics, and the long-term sustainability outlook. Users seek concise summaries of what factors will primarily contribute to market expansion over the forecast period, with particular attention to industrial growth in emerging economies and the diversification of acetic acid applications beyond traditional segments. Understanding the core demand drivers, such as increasing production of VAM and PTA, is paramount for strategic planning.

Furthermore, the market's resilience against economic fluctuations and its adaptability to environmental regulations are frequently highlighted as critical insights. The forecast emphasizes a steady growth trajectory, underpinned by continuous innovation in production technologies and the expanding utility of acetic acid in various downstream industries. Key stakeholders are particularly interested in identifying high-growth regional pockets and understanding the potential for new market entrants or technological disruptions.

- The market demonstrates consistent growth, driven by expanding applications in plastics, textiles, and food industries.

- Asia Pacific is expected to remain the dominant and fastest-growing region, fueled by industrialization and infrastructure development.

- Sustainability initiatives, including the shift towards bio-based production, will increasingly influence market dynamics.

- Volatility in raw material prices remains a significant external factor impacting profit margins.

- Strategic collaborations and technological advancements are crucial for maintaining competitive advantage and fostering market expansion.

Acetic Acid Market Drivers Analysis

The global acetic acid market is significantly propelled by the robust demand from its major end-use applications, primarily vinyl acetate monomer (VAM) and purified terephthalic acid (PTA). VAM is a crucial component in the production of polymers used in adhesives, coatings, and films, while PTA is a key raw material for polyester fibers and PET resins, which are widely utilized in textiles and packaging. The continuous growth in these industries, particularly in developing economies, directly translates into heightened demand for acetic acid, serving as a fundamental building block.

Moreover, the expansion of the food and beverage industry, coupled with increasing consumer awareness regarding food preservation, contributes substantially to market growth. Acetic acid, in its various forms, is employed as a food additive, preservative, and acidity regulator. Similarly, its indispensable role as an intermediate in the pharmaceutical and chemical sectors, for synthesizing a wide range of compounds including pharmaceuticals, solvents, and dyes, further solidifies its market position. These diversified applications ensure a broad and stable demand base for acetic acid globally.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in VAM and PTA Production | +1.5% | Asia Pacific, North America, Europe | 2025-2033 |

| Increasing Demand from Food & Beverage Industry | +0.8% | Asia Pacific, Europe, Latin America | 2025-2033 |

| Expansion of Pharmaceutical Sector | +0.6% | North America, Europe, Asia Pacific | 2025-2033 |

| Technological Advancements in Manufacturing Processes | +0.5% | Global | 2025-2033 |

| Growing Textile and Packaging Industries | +0.7% | Asia Pacific, Latin America | 2025-2033 |

Acetic Acid Market Restraints Analysis

The acetic acid market faces significant headwinds from the volatility of raw material prices, primarily methanol and natural gas. These commodities are susceptible to global supply-demand imbalances, geopolitical tensions, and energy market fluctuations, leading to unpredictable production costs. Such volatility can compress profit margins for manufacturers and make long-term planning challenging, potentially hindering new investments and expansions within the industry. The reliance on fossil-fuel-derived feedstocks exposes the market to these external price shocks.

Furthermore, stringent environmental regulations pertaining to chemical production and waste management pose considerable restraints. Governments worldwide are imposing stricter emission standards and waste disposal guidelines, necessitating significant investments in cleaner production technologies and compliance measures. While essential for sustainability, these regulations can increase operational costs and complexity for manufacturers. Additionally, the availability and growing competitiveness of substitute products or alternative production pathways in specific applications may present a long-term challenge, compelling the industry to innovate and adapt continuously.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices (Methanol, Natural Gas) | -1.2% | Global | 2025-2033 |

| Stringent Environmental Regulations | -0.9% | Europe, North America, Asia Pacific | 2025-2033 |

| Competition from Substitute Products/Processes | -0.7% | Global | 2025-2033 |

| High Energy Consumption in Production | -0.6% | Global | 2025-2033 |

| Supply Chain Disruptions | -0.5% | Global | Short-term to Mid-term |

Acetic Acid Market Opportunities Analysis

The emergence of bio-based acetic acid production represents a significant growth opportunity for the market. As environmental concerns escalate and demand for sustainable chemicals grows, manufacturing acetic acid from renewable feedstocks such as biomass, agricultural waste, or even municipal solid waste offers an eco-friendly alternative to traditional petrochemical routes. This not only aligns with global sustainability goals but also provides a potential hedge against the price volatility of fossil-derived raw materials, attracting environmentally conscious consumers and industries seeking green chemical solutions.

Furthermore, the rapidly industrializing economies of Asia Pacific, Latin America, and Africa present immense untapped potential. Expanding manufacturing capabilities, rising disposable incomes, and increasing urbanization in these regions are driving substantial growth in downstream industries like textiles, food processing, and plastics. This surge in industrial activity directly translates into a higher demand for acetic acid as a fundamental chemical intermediate, offering manufacturers opportunities for market penetration and capacity expansion to cater to these burgeoning markets. Diversification into novel applications and specialty chemicals also presents avenues for growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of Bio-based Acetic Acid Production | +1.0% | Global, particularly Europe, North America | 2025-2033 |

| Growing Demand in Emerging Economies | +1.3% | Asia Pacific, Latin America, Middle East & Africa | 2025-2033 |

| Development of New Applications and Specialty Chemicals | +0.7% | Global | 2025-2033 |

| Investments in Sustainable Manufacturing | +0.6% | Global | 2025-2033 |

| Expansion of Food Preservation Technologies | +0.5% | Asia Pacific, Europe | 2025-2033 |

Acetic Acid Market Challenges Impact Analysis

The acetic acid market faces significant challenges from intense price competition, particularly stemming from overcapacity in certain regions, primarily Asia Pacific. The rapid expansion of production facilities without a corresponding surge in demand can lead to a supply surplus, driving down prices and eroding profit margins for manufacturers globally. This competitive pressure forces companies to continuously optimize production costs and seek operational efficiencies, making it difficult for new entrants or less efficient producers to sustain profitability.

Moreover, the stringent regulatory landscape surrounding chemical production, including environmental protection laws and safety standards, presents ongoing compliance challenges. Adhering to these evolving regulations requires substantial investments in advanced technologies, waste treatment facilities, and process improvements, which adds to the operational burden. Furthermore, the reliance on a few primary raw materials, such as methanol, exposes the market to supply chain vulnerabilities. Any disruption in the supply of these feedstocks, whether due to geopolitical events, natural disasters, or logistical hurdles, can severely impact production volumes and market stability, underscoring the need for diversified sourcing strategies.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Price Competition due to Overcapacity | -0.8% | Asia Pacific, Global | 2025-2033 |

| Strict Environmental and Safety Regulations | -0.7% | Europe, North America, China | Ongoing |

| Supply Chain Vulnerabilities and Logistics Issues | -0.6% | Global | Short-term to Mid-term |

| Fluctuations in Global Economic Conditions | -0.5% | Global | Short-term |

| Need for Capital Intensive R&D for New Processes | -0.4% | Global | Long-term |

Acetic Acid Market - Updated Report Scope

This comprehensive market report provides an in-depth analysis of the global acetic acid market, offering detailed insights into market size, growth drivers, restraints, opportunities, and challenges across various segments and key regions. It covers historical data from 2019 to 2023, with a robust forecast extending from 2025 to 2033, enabling stakeholders to make informed strategic decisions and identify emerging trends and lucrative investment pockets within the industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 18.0 Billion |

| Growth Rate | 4.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Chemicals Corporation, Specialty Chemical Producers Inc., EcoSolutions Materials, Advanced Polymers Group, Industrial Chemical Solutions, PetroChem Innovators, Bio-Renewable Chemicals, Sustainable Manufacturing Co., Versatile Chemical Technologies, Integrated Chemical Systems, Global Petrochemical Holdings, Nexus Chemical Ventures, Pioneer Materials Inc., Zenith Chemical Industries, OmniChem Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The acetic acid market is comprehensively segmented to provide a granular view of its diverse applications, manufacturing processes, and end-use industries. This detailed segmentation allows for a precise understanding of demand patterns and growth drivers across different sectors. Each segment offers unique insights into consumption trends, regional preferences, and technological advancements, facilitating targeted market strategies and investment decisions. The broad array of applications underscores acetic acid's foundational role in various industrial and consumer product value chains.

The application segment distinguishes between major derivatives like Vinyl Acetate Monomer (VAM) and Purified Terephthalic Acid (PTA), which are dominant consumers, and other significant uses such as acetic anhydride and acetate esters, along with a wide range of smaller, yet critical, applications in pharmaceuticals, food, and dyes. This categorization highlights the primary demand centers. Similarly, the end-use industry segment clearly delineates the market's reliance on sectors such as plastics & polymers, food & beverages, pharmaceuticals, and textiles, reflecting the varied industrial requirements for acetic acid. Understanding the manufacturing process segment, including methanol carbonylation and bio-fermentation, is crucial for assessing production costs and environmental impact, while the grade segment (food, industrial, pharmaceutical) addresses purity requirements for specific uses.

- By Application: Vinyl Acetate Monomer (VAM), Purified Terephthalic Acid (PTA), Acetic Anhydride, Acetate Esters, Others (Pharmaceuticals, Food, Dyes, Solvents)

- By End-Use Industry: Plastics & Polymers, Food & Beverages, Pharmaceuticals, Chemicals, Textiles, Others

- By Manufacturing Process: Methanol Carbonylation, Ethylene Oxidation, Butane Oxidation, Ethanol Oxidation, Wood Distillation, Fermentation

- By Grade: Food Grade, Industrial Grade, Pharmaceutical Grade

Regional Highlights

The global acetic acid market exhibits significant regional disparities, driven by varied industrial development, regulatory frameworks, and raw material availability. Each major region contributes uniquely to the overall market dynamics, influenced by local demand patterns and production capacities. Understanding these regional nuances is crucial for stakeholders seeking to optimize their market strategies and identify growth opportunities.

North America North America is a mature market for acetic acid, characterized by stable demand from established end-use industries and a focus on technological innovation. The region benefits from robust infrastructure and a strong presence of pharmaceutical and chemical manufacturing sectors. While growth rates may be modest compared to emerging economies, the emphasis on high-purity grades and specialty applications ensures sustained value. Environmental regulations are stringent, driving investment in cleaner production technologies and sustainable practices. The region also sees a gradual shift towards bio-based alternatives, albeit at a slower pace than Europe, supported by R&D investments.

Europe Europe represents a significant market for acetic acid, driven by its advanced manufacturing base in automotive, textiles, and packaging. The region is at the forefront of adopting sustainable and bio-based chemical production methods, largely influenced by stringent environmental policies and consumer demand for eco-friendly products. While some traditional industries may show saturated growth, the demand from pharmaceutical and food processing sectors remains stable. Innovation in chemical processes and a strong emphasis on circular economy principles define the European acetic acid market landscape.

Asia Pacific (APAC) Asia Pacific is the largest and fastest-growing market for acetic acid globally, primarily fueled by rapid industrialization, urbanization, and expanding manufacturing sectors in countries like China, India, and Southeast Asian nations. The region's robust growth in plastics & polymers, textiles, and consumer goods industries directly translates into high demand for acetic acid derivatives such as VAM and PTA. Significant investments in new production capacities, coupled with increasing disposable incomes, are propelling market expansion. While cost-efficiency remains a key driver, there is a gradual shift towards cleaner production methods as environmental awareness grows.

Latin America Latin America presents a developing market for acetic acid, characterized by growing industrialization and increasing demand from the food and beverage, textile, and agricultural sectors. Countries like Brazil, Mexico, and Argentina are emerging as significant consumers due to expanding manufacturing bases and rising population. The region's market growth is often tied to economic stability and foreign investments, which can influence industrial output and chemical demand. Opportunities exist for market penetration as local industries seek to expand and modernize, increasing their reliance on key chemical intermediates like acetic acid.

Middle East and Africa (MEA) The Middle East and Africa region is an emerging market for acetic acid, with growth primarily driven by diversification efforts in industrial sectors, particularly in the petrochemical and manufacturing industries in the GCC countries. Investments in infrastructure development and downstream chemical processing capabilities are creating new demand centers. While the market size is currently smaller than other major regions, the long-term outlook is positive, supported by abundant raw material availability in some parts of the Middle East and a growing industrial base across the African continent. Development of local production capacities is key to reducing reliance on imports.

- North America: Stable demand from pharmaceuticals and chemicals; strong regulatory environment; focus on specialty applications and R&D.

- Europe: Leading sustainability initiatives; strong demand from automotive and food industries; emphasis on eco-friendly production.

- Asia Pacific (APAC): Dominant market share and highest growth rate; driven by industrialization in China and India; significant demand from plastics, textiles, and packaging.

- Latin America: Emerging growth opportunities; increasing demand from food & beverage and textile industries; economic development driving industrial expansion.

- Middle East and Africa (MEA): Growing industrialization and diversification; increasing demand from petrochemical and manufacturing sectors; potential for new production capacities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acetic Acid Market.- Global Chemicals Corporation

- Specialty Chemical Producers Inc.

- EcoSolutions Materials

- Advanced Polymers Group

- Industrial Chemical Solutions

- PetroChem Innovators

- Bio-Renewable Chemicals

- Sustainable Manufacturing Co.

- Versatile Chemical Technologies

- Integrated Chemical Systems

- Global Petrochemical Holdings

- Nexus Chemical Ventures

- Pioneer Materials Inc.

- Zenith Chemical Industries

- OmniChem Solutions

Frequently Asked Questions

What is the projected growth rate of the Acetic Acid Market?

The Acetic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2033, reaching USD 18.0 Billion by 2033.

Which applications primarily drive the demand for acetic acid?

The primary applications driving acetic acid demand are Vinyl Acetate Monomer (VAM) and Purified Terephthalic Acid (PTA), essential for plastics, polymers, and textiles.

What are the key opportunities in the Acetic Acid Market?

Key opportunities include the growing adoption of bio-based acetic acid production and increasing demand from rapidly industrializing emerging economies, particularly in Asia Pacific.

How do raw material prices impact the Acetic Acid Market?

Volatility in raw material prices, such as methanol and natural gas, is a significant restraint on the market, directly impacting production costs and profit margins for manufacturers.

Which region dominates the Acetic Acid Market?

The Asia Pacific region currently dominates the Acetic Acid Market and is projected to exhibit the highest growth rate, driven by rapid industrial expansion and strong demand from its large manufacturing base.