Abaca Fiber Market

Abaca Fiber Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700732 | Last Updated : July 27, 2025 |

Format : ![]()

![]()

![]()

![]()

Abaca Fiber Market Size

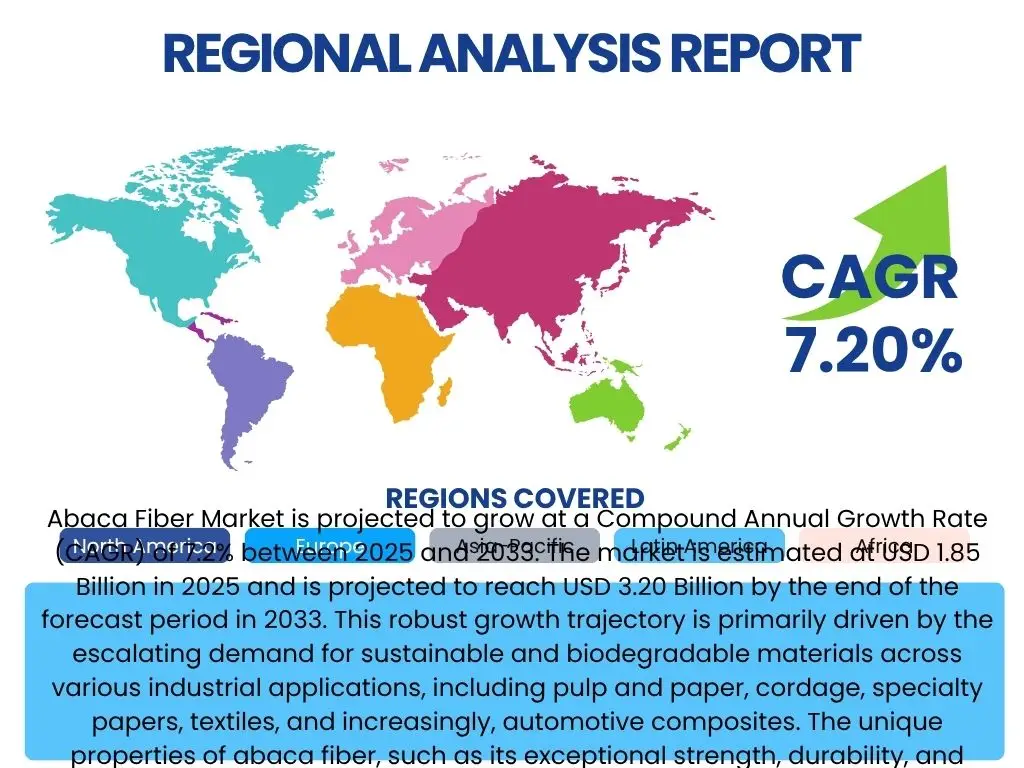

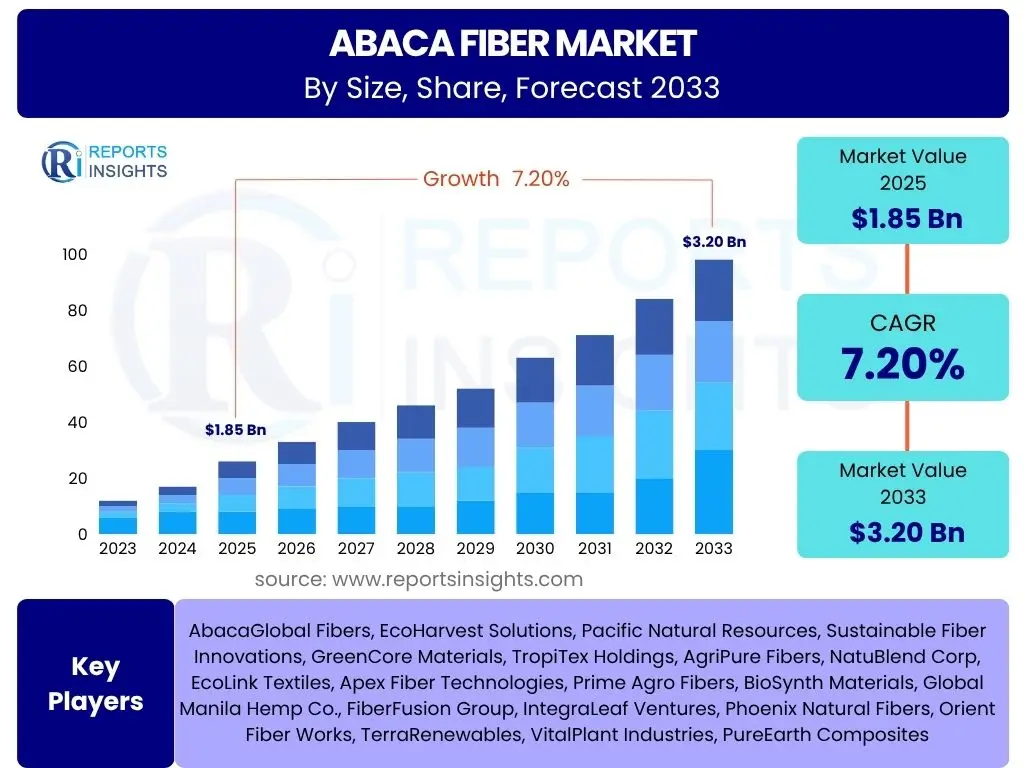

Abaca Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2033. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 3.20 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating demand for sustainable and biodegradable materials across various industrial applications, including pulp and paper, cordage, specialty papers, textiles, and increasingly, automotive composites. The unique properties of abaca fiber, such as its exceptional strength, durability, and resistance to saltwater degradation, position it as a superior natural alternative to synthetic fibers, underpinning its expanding market valuation.

The market expansion is further propelled by rising environmental consciousness among consumers and industries, leading to a shift towards eco-friendly products. Government initiatives and regulatory frameworks supporting the use of bio-based materials also contribute significantly to market growth. Additionally, advancements in processing technologies for abaca fiber are enabling its integration into high-performance applications, broadening its utility and fostering new revenue streams. The inherent versatility of abaca allows for its incorporation into diverse product formulations, from high-strength ropes to lightweight automotive components, signifying a broad and resilient demand base.

Key Abaca Fiber Market Trends & Insights

Common user inquiries regarding abaca fiber market trends often revolve around its sustainability credentials, emerging applications beyond traditional uses, and the impact of technological innovation on its cultivation and processing. Users are keen to understand how global sustainability initiatives are shaping demand for natural fibers like abaca, and what new industries are integrating this versatile material. There is also significant interest in how advancements in material science and agricultural practices are enhancing the fiber's properties and yield, contributing to its competitive edge against synthetic alternatives. Furthermore, the market's resilience to supply chain disruptions and price volatility, given its geographically concentrated cultivation, is a recurring theme of concern and analysis.

The market is experiencing a significant shift towards the adoption of abaca fiber in advanced composite materials, especially within the automotive and construction sectors, driven by its lightweight yet high-strength characteristics and superior environmental profile. There is a discernible trend towards circular economy principles, where abaca fiber's biodegradability and renewability are highly valued, positioning it as a preferred material for manufacturers aiming to reduce their carbon footprint. Additionally, research and development efforts are increasingly focused on enhancing abaca's flame retardancy and water resistance through natural treatments, expanding its suitability for more demanding applications and further solidifying its market position as a high-performance natural fiber.

- Escalating demand for eco-friendly and biodegradable materials across industries.

- Diversification of abaca fiber applications into automotive composites, geotextiles, and specialized packaging.

- Technological advancements in fiber extraction and processing to improve quality and reduce costs.

- Increasing investment in sustainable abaca cultivation practices and fair trade initiatives.

- Growing consumer awareness and preference for natural, responsibly sourced products.

- Integration of abaca into advanced textiles for enhanced durability and performance.

AI Impact Analysis on Abaca Fiber

User queries concerning the impact of Artificial Intelligence (AI) on the Abaca Fiber market primarily focus on its potential to revolutionize cultivation, optimize processing efficiency, and enhance supply chain management. Stakeholders are keen to understand how AI can lead to more sustainable farming practices, improve fiber quality consistency, and predict market fluctuations to ensure stable supply and pricing. The key themes emerging from these questions include the application of AI in precision agriculture for abaca plants, its role in automated quality assessment during processing, and its potential for predictive analytics to forecast demand and manage inventories more effectively. There is also an underlying expectation that AI could mitigate some of the traditional challenges associated with natural fiber production, such as disease detection and yield optimization.

AI technologies are poised to significantly enhance the operational efficiency and sustainability of the abaca fiber industry. In cultivation, AI-driven precision agriculture can monitor plant health, optimize irrigation, and detect diseases early, leading to higher yields and reduced resource consumption. During processing, AI-powered systems can enable automated sorting and quality control, ensuring consistent fiber grades and minimizing waste. Furthermore, AI's analytical capabilities can be leveraged for advanced market forecasting, helping producers and buyers anticipate demand shifts, manage inventory, and mitigate price volatility. This integration of AI is expected to lead to a more resilient, efficient, and data-driven abaca value chain, making the fiber more competitive on a global scale.

- Precision agriculture application for optimizing abaca cultivation yields and resource use.

- AI-driven automated quality control and sorting of abaca fibers during processing.

- Predictive analytics for demand forecasting, market trend analysis, and supply chain optimization.

- Early detection of plant diseases and pests through AI-powered image recognition for improved crop health.

- Enhancement of traceability and transparency in the abaca supply chain using blockchain integrated with AI.

Key Takeaways Abaca Fiber Market Size & Forecast

Common user questions regarding key takeaways from the Abaca Fiber market size and forecast often highlight the drivers of growth, significant regional contributions, and the role of innovation in market expansion. Users seek clarity on the most impactful factors propelling the market forward, such as sustainability trends and new application areas. There is also interest in understanding which geographical regions are expected to be frontrunners in both production and consumption, and how technological advancements are expected to reshape the industry's landscape over the forecast period. The overall sentiment is a desire to grasp the fundamental growth narrative and identify critical investment opportunities and potential challenges within this evolving market.

The abaca fiber market is poised for substantial growth, primarily fueled by the global impetus towards environmentally friendly materials and the fiber's intrinsic superior properties. Its expansion into diversified applications beyond traditional cordage and paper, particularly within the advanced composites and automotive sectors, represents a significant growth vector. Asia Pacific is projected to maintain its dominance as a key production hub, with increasing demand from both established and emerging industrial economies within the region. Continued research and development efforts aimed at enhancing processing efficiency and exploring novel applications will be crucial in sustaining this upward trajectory, while navigating challenges related to supply chain stability and climate change impacts on cultivation remains imperative for long-term resilience.

- Strong market growth is underpinned by rising demand for sustainable and natural fibers.

- Diversification into high-value applications like automotive interiors and advanced composites is a key driver.

- Asia Pacific is expected to remain the leading region for both production and consumption.

- Technological advancements in processing and cultivation will enhance efficiency and expand utility.

- Challenges related to climate change impacts on supply and market price stability require strategic mitigation.

Abaca Fiber Market Drivers Analysis

The Abaca Fiber market is significantly propelled by a confluence of factors, foremost among them being the increasing global demand for sustainable and biodegradable materials. As environmental regulations tighten and consumer awareness regarding ecological footprints rises, industries are actively seeking natural alternatives to synthetic products. Abaca fiber, with its exceptional strength, durability, and renewability, perfectly aligns with these sustainability goals, driving its adoption across various sectors from packaging to automotive. This fundamental shift towards eco-conscious consumption patterns is creating a robust pull for abaca fiber, ensuring its sustained market expansion as companies prioritize greener supply chains and product development.

Furthermore, the versatility of abaca fiber is unlocking new application avenues, extending its reach beyond conventional uses. Innovations in composite materials, where abaca can replace fiberglass or carbon fiber, are particularly noteworthy, offering lightweight and strong solutions for the automotive, marine, and construction industries. The textile sector is also exploring abaca for durable and sustainable fabrics, while its use in high-quality specialty papers continues to be a stable demand source. These diversified applications not only broaden the market base but also reduce reliance on any single industry, creating a more resilient and dynamic market for abaca fiber globally. Continued research and development into enhancing its properties and exploring novel uses are expected to further accelerate its market penetration.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Sustainable & Biodegradable Materials | +1.8% | Global, particularly Europe & North America | 2025-2033 |

| Expansion of Abaca Fiber into New Application Areas (e.g., Composites, Automotive) | +1.5% | Asia Pacific, Europe, North America | 2025-2033 |

| Increasing Focus on Eco-friendly Packaging Solutions | +0.9% | Global, especially developed economies | 2026-2033 |

| Technological Advancements in Fiber Processing & Extraction | +0.7% | Key producing regions (e.g., Philippines, Ecuador) | 2027-2033 |

Abaca Fiber Market Restraints Analysis

Despite its promising growth trajectory, the Abaca Fiber market faces several notable restraints that could temper its expansion. One significant challenge is the inherent dependency on specific geographic regions for cultivation, primarily the Philippines and Ecuador. This concentration of supply makes the market vulnerable to localized climate events, natural disasters, and geopolitical instabilities, which can lead to supply chain disruptions and volatile raw material prices. Such price fluctuations and supply uncertainties can deter potential industrial buyers who require consistent and predictable material costs for their manufacturing processes, thus limiting broader adoption of abaca fiber as a primary raw material over more stable, albeit less sustainable, alternatives.

Another key restraint is the labor-intensive nature of abaca cultivation and initial processing, which can contribute to higher production costs compared to synthetic fibers. The traditional methods of harvesting and decorticating abaca require significant manual labor, which can be costly and less efficient than mechanized processes. While efforts are being made to automate certain aspects, widespread adoption of advanced machinery is slow due to economic and logistical barriers in major producing regions. Furthermore, competition from other natural fibers, such as jute, hemp, and sisal, which might offer lower price points or more established supply chains in certain regions, also poses a competitive threat, necessitating continuous innovation and differentiation for abaca to maintain its market edge.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Geographical Concentration of Production & Supply Chain Vulnerability | -0.8% | Global, particularly reliant industries | 2025-2033 |

| Volatile Raw Material Prices Due to External Factors | -0.6% | Global market, impacts industrial buyers | 2025-2033 |

| Competition from Synthetic Fibers and Other Natural Fibers | -0.4% | Global, across all application segments | 2025-2033 |

| Labor-Intensive Cultivation & Processing Methods | -0.3% | Key producing regions (e.g., Philippines, Ecuador) | 2025-2030 |

Abaca Fiber Market Opportunities Analysis

The Abaca Fiber market is poised for significant opportunities driven by the burgeoning demand for sustainable solutions across diverse industries. One key opportunity lies in the continuous expansion into high-growth, high-value applications such as advanced composites for automotive and aerospace. As manufacturers strive to reduce vehicle weight for fuel efficiency and embrace greener materials, abaca fiber's strength-to-weight ratio and biodegradability make it an ideal candidate to replace synthetic components. This shift represents a substantial market opening, allowing abaca to transition from a niche material to a mainstream industrial input, especially with ongoing innovations in composite manufacturing techniques that optimize natural fiber integration.

Another promising opportunity lies in the development of new value-added products and derivatives from abaca. This includes exploring its potential in biomedical applications, advanced filtration systems, and smart textiles, where its unique properties can offer distinct advantages. Furthermore, investments in research and development for improved cultivation techniques, such as disease-resistant varieties and precision agriculture, present opportunities to enhance yield and quality, thereby increasing supply stability and reducing production costs. Strategic partnerships between growers, processors, and end-users can also foster innovation and create robust supply chains, unlocking new markets and ensuring the long-term viability and growth of the abaca fiber industry. The increasing consumer preference for transparent and ethically sourced materials also creates an opportunity for brands to highlight abaca's sustainable origin.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Untapped Potential in High-Performance Composites (Automotive, Marine, Aerospace) | +1.2% | Europe, North America, Asia Pacific | 2025-2033 |

| Development of New Value-Added Products and Derivatives | +0.9% | Global, R&D intensive regions | 2026-2033 |

| Increased Adoption in Sustainable Packaging Solutions | +0.7% | Global, especially developed markets | 2025-2033 |

| Investments in Sustainable Farming Practices & Enhanced Yields | +0.5% | Key producing regions (e.g., Philippines, Ecuador) | 2027-2033 |

Abaca Fiber Market Challenges Impact Analysis

The Abaca Fiber market faces significant challenges, primarily stemming from its agricultural origins and the impacts of climate change. Abaca cultivation is highly susceptible to extreme weather events, such as typhoons, prolonged droughts, or excessive rainfall, particularly in its primary growing regions. These climatic fluctuations can severely impact crop yields, leading to supply shortages and subsequent price spikes, thereby undermining market stability. The vulnerability to climate-induced disruptions necessitates substantial investment in resilient farming practices and diversification of cultivation areas, which can be capital-intensive and time-consuming. Such environmental dependencies pose an ongoing threat to the consistent supply required by industrial consumers, who often seek reliability in their raw material sourcing.

Another critical challenge involves the limited availability of standardized quality grades and the variability inherent in natural fibers. Unlike synthetic alternatives, abaca fiber quality can vary significantly based on cultivation practices, processing methods, and regional characteristics. This lack of standardization can pose difficulties for manufacturers requiring precise and consistent material properties for their advanced applications, potentially increasing processing costs and quality control efforts. Furthermore, the market faces challenges related to inadequate research and development funding for genetic improvement of abaca varieties or for scaling up mechanized harvesting and decortication technologies. Addressing these issues requires concerted efforts across the value chain, from farmers and processors to governments and research institutions, to ensure the long-term competitiveness and broader industrial acceptance of abaca fiber.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Impact of Climate Change on Cultivation & Yield Volatility | -0.7% | Key producing regions, Global supply chain | 2025-2033 |

| Lack of Standardized Quality & Consistency in Fiber Grades | -0.5% | Global, affects industrial adoption | 2025-2033 |

| Limited Mechanization in Harvesting & Processing | -0.4% | Key producing regions (e.g., Philippines, Ecuador) | 2025-2030 |

| Supply Chain Transparency & Ethical Sourcing Concerns | -0.3% | Global, impacts consumer and brand perception | 2026-2033 |

Abaca Fiber Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Abaca Fiber market, covering historical data from 2019 to 2023, current market estimations for 2024, and detailed forecasts up to 2033. The scope encompasses a thorough examination of market size, growth drivers, restraints, opportunities, and challenges across various segments and key regions. It also includes an extensive assessment of competitive landscapes, highlighting the strategic profiles of leading market players, technological advancements, and emerging trends that are shaping the industry's future. This report serves as a vital resource for stakeholders seeking actionable insights into the abaca fiber market's dynamics and potential investment avenues.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.20 Billion |

| Growth Rate | 7.2% CAGR |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | AbacaGlobal Fibers, EcoHarvest Solutions, Pacific Natural Resources, Sustainable Fiber Innovations, GreenCore Materials, TropiTex Holdings, AgriPure Fibers, NatuBlend Corp, EcoLink Textiles, Apex Fiber Technologies, Prime Agro Fibers, BioSynth Materials, Global Manila Hemp Co., FiberFusion Group, IntegraLeaf Ventures, Phoenix Natural Fibers, Orient Fiber Works, TerraRenewables, VitalPlant Industries, PureEarth Composites |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Abaca Fiber market is meticulously segmented to provide a granular understanding of its diverse applications, product forms, and end-use industries, enabling a comprehensive market analysis. This segmentation illuminates the varied demand drivers and growth opportunities across different sectors, reflecting the fiber's versatility and expanding utility. By dissecting the market along these key dimensions, the report offers detailed insights into specific niche markets and broader industrial trends, allowing stakeholders to identify key areas of investment and strategic focus. Each segment is analyzed for its current market share, projected growth rate, and the specific factors influencing its trajectory, providing a complete picture of the abaca fiber value chain.

The segmentation also highlights the evolving landscape of abaca fiber utilization, moving beyond traditional applications to embrace high-tech and sustainable industrial uses. Understanding these segments is crucial for market participants to tailor their product offerings, marketing strategies, and supply chain logistics to meet the specific requirements of each sector. The detailed breakdown provides a roadmap for innovation and market expansion, demonstrating where abaca fiber is gaining significant traction and where further development efforts can yield the most impactful returns. This comprehensive segmentation analysis serves as a foundational element for strategic decision-making within the global abaca fiber market.

- By Application:

- Pulp and Paper (Specialty Paper, Filter Paper, Tea Bags, Currency Paper)

- Cordage and Twine (Ropes, Marine Cables, Fishing Nets)

- Textile and Apparel (Fabrics, Clothing, Accessories)

- Automotive Interiors (Door Panels, Headliners, Seat Backs)

- Composites (Construction, Marine, Consumer Goods)

- Handicrafts and Arts

- Others (Geotextiles, Filtration, Biomedical)

- By Product Form:

- Raw Fiber

- Pulp

- Yarn

- Fabric

- By End-Use Industry:

- Construction

- Automotive

- Marine

- Agriculture

- Consumer Goods

- Packaging

- Others

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East & Africa (MEA)

Regional Highlights

- Asia Pacific: Dominates the global Abaca Fiber market, primarily driven by major producing countries like the Philippines and Ecuador, which account for a significant portion of global supply. The region is also a substantial consumer due to strong domestic demand from paper, textile, and handicrafts industries, alongside increasing adoption in emerging automotive and construction sectors. Continuous government support for abaca cultivation and processing further cements its leadership.

- Europe: A key growth region, characterized by stringent environmental regulations and a strong emphasis on sustainability, which fuels the demand for natural and biodegradable materials. European industries, particularly automotive, construction, and specialized packaging, are increasingly integrating abaca fiber into their products to meet eco-design standards and consumer preferences for greener alternatives. Significant research and development activities in bio-composites also drive regional demand.

- North America: Exhibits growing demand for abaca fiber, primarily influenced by the automotive industry's pursuit of lightweight and sustainable materials for vehicle components. The region's increasing focus on eco-friendly packaging and consumer products also contributes to market expansion. Investments in sustainable manufacturing practices and a growing awareness of natural fiber benefits are key drivers in this region.

- Latin America: While a notable producer, especially Ecuador, the region also presents emerging opportunities for increased domestic consumption of abaca fiber in various applications. Efforts to enhance processing capabilities and expand export markets are key regional trends.

- Middle East & Africa (MEA): Represents an nascent market for abaca fiber, with potential for future growth as industrialization and sustainability initiatives gain traction. Limited but growing applications in packaging, construction, and textiles could emerge as the region diversifies its material sourcing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Abaca Fiber Market.- AbacaGlobal Fibers

- EcoHarvest Solutions

- Pacific Natural Resources

- Sustainable Fiber Innovations

- GreenCore Materials

- TropiTex Holdings

- AgriPure Fibers

- NatuBlend Corp

- EcoLink Textiles

- Apex Fiber Technologies

- Prime Agro Fibers

- BioSynth Materials

- Global Manila Hemp Co.

- FiberFusion Group

- IntegraLeaf Ventures

- Phoenix Natural Fibers

- Orient Fiber Works

- TerraRenewables

- VitalPlant Industries

- PureEarth Composites

Frequently Asked Questions

Analyze common user questions about the Abaca Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Abaca Fiber and its primary uses?

Abaca fiber, also known as Manila hemp, is a natural fiber extracted from the leaf sheath of the abaca plant, native to the Philippines. Renowned for its exceptional strength, durability, and resistance to saltwater, its primary uses include marine cordage, specialty papers (e.g., tea bags, currency paper), textiles, and increasingly, high-performance composite materials for automotive and construction industries.

Why is Abaca Fiber considered a sustainable material?

Abaca fiber is highly sustainable because it is a renewable resource, biodegradable, andrequires minimal chemical processing. The abaca plant helps prevent soil erosion and contributes to biodiversity, making it an environmentally friendly alternative to synthetic fibers. Its cultivation typically involves less intensive farming practices compared to other crops.

What are the key drivers for the Abaca Fiber market growth?

Key drivers include the escalating global demand for sustainable and biodegradable materials, the fiber's expanding applications in high-performance industries like automotive composites and specialty papers, and increasing consumer and industry preference for eco-friendly products. Technological advancements in processing also enhance its versatility and cost-effectiveness.

Which regions are major producers and consumers of Abaca Fiber?

The Philippines and Ecuador are the dominant global producers of Abaca Fiber. Asia Pacific is the leading region for both production and consumption, driven by its large textile and paper industries. Europe and North America are significant consumption markets, primarily due to their demand for abaca in sustainable composites, specialized industrial applications, and eco-friendly consumer goods.

What are the emerging applications of Abaca Fiber?

Emerging applications for abaca fiber include lightweight automotive components (e.g., dashboards, door panels), advanced composite materials for marine and construction sectors, geotextiles for erosion control, and high-tech textiles for durable apparel. Its use is also expanding in sustainable packaging and various filtration systems due to its robust and natural properties.