3D Printing in Automotive Market

3D Printing in Automotive Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705171 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

3D Printing in Automotive Market Size

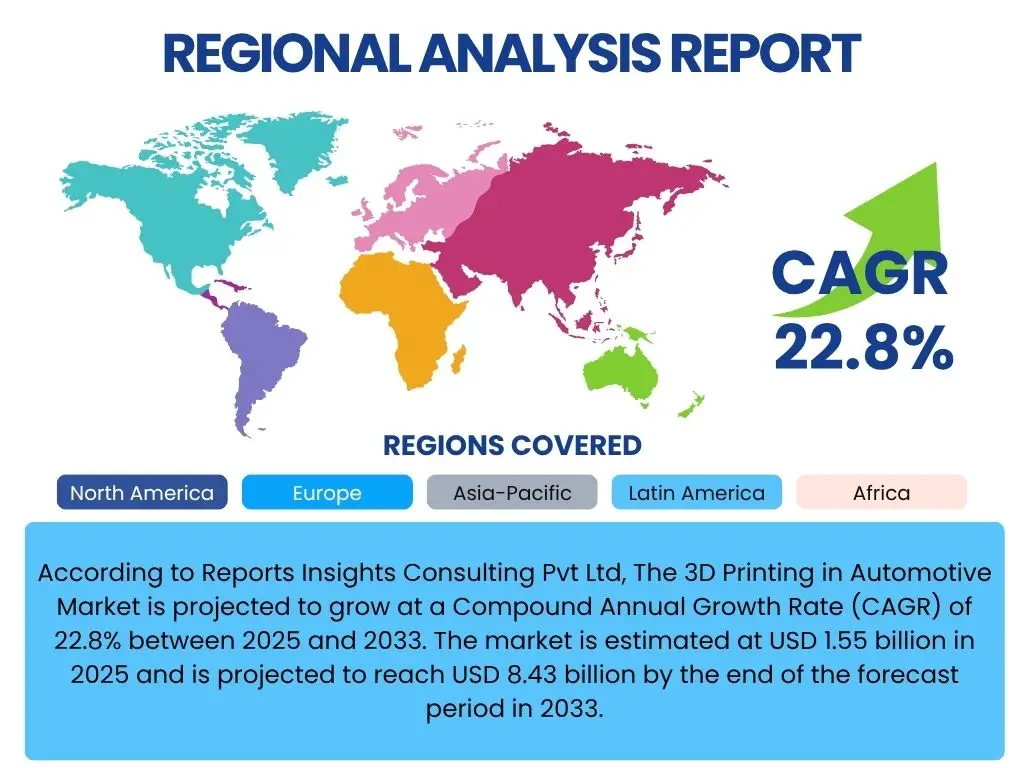

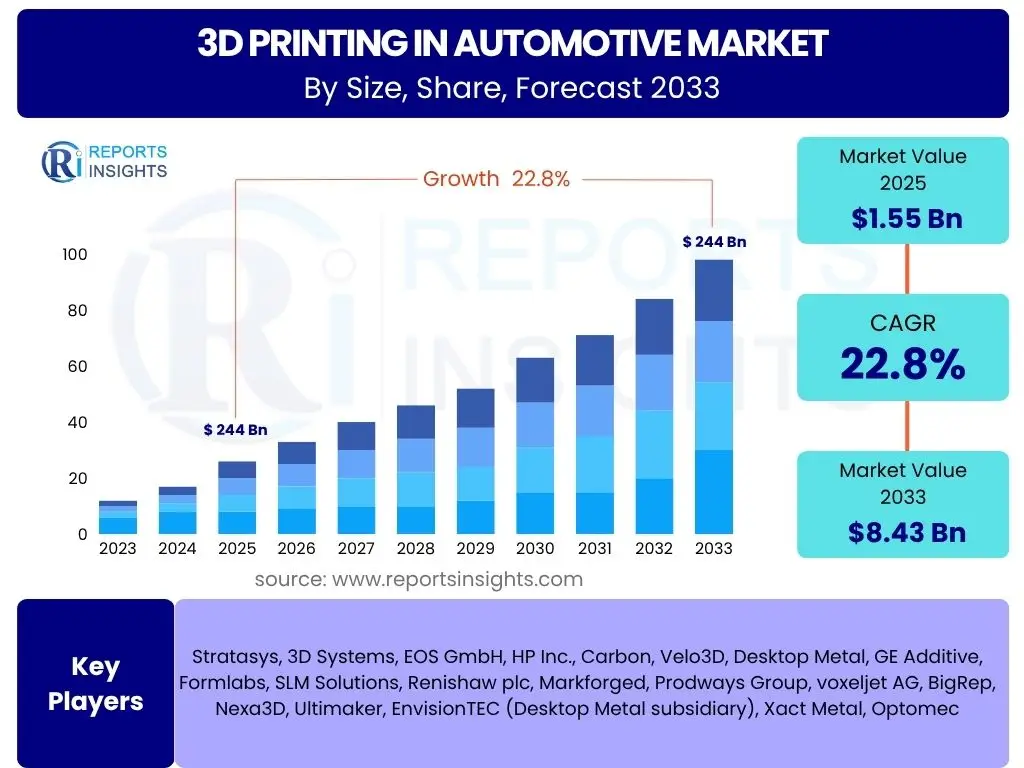

According to Reports Insights Consulting Pvt Ltd, The 3D Printing in Automotive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.8% between 2025 and 2033. The market is estimated at USD 1.55 billion in 2025 and is projected to reach USD 8.43 billion by the end of the forecast period in 2033.

Key 3D Printing in Automotive Market Trends & Insights

User inquiries frequently highlight the transformative shifts occurring within the 3D printing in automotive sector. A prominent trend involves the increasing shift from pure prototyping to end-part production, driven by advancements in materials and printer capabilities. This enables manufacturers to produce lightweight, complex, and customized components directly for vehicles, addressing evolving consumer demands and regulatory requirements for fuel efficiency and emissions reduction. Furthermore, there is a growing emphasis on supply chain resilience and localization, with additive manufacturing offering a viable solution for on-demand production and reducing reliance on distant supply chains.

Another significant insight gathered from user questions points to the accelerating integration of 3D printing across the entire automotive product lifecycle, from initial design and rapid prototyping to tooling, jigs, fixtures, and increasingly, functional end-use parts. The market is also witnessing a surge in the adoption of advanced materials, including high-performance polymers and sophisticated metal alloys, which are critical for meeting the stringent performance and safety standards of the automotive industry. The focus on sustainability is also driving the adoption of 3D printing, as it minimizes material waste and enables lighter vehicle components, contributing to better fuel economy or extended battery range in electric vehicles.

- Shift from prototyping and tooling to direct end-part production.

- Increased adoption of high-performance polymers and advanced metal alloys.

- Growing demand for lightweight vehicle components to improve fuel efficiency and EV range.

- Rise of customized and personalized automotive parts.

- Integration into agile manufacturing and localized supply chains.

- Expansion of on-demand manufacturing for spare and aftermarket parts.

- Focus on sustainable manufacturing practices and waste reduction.

AI Impact Analysis on 3D Printing in Automotive

Common user questions regarding AI's impact on 3D printing in automotive reveal a strong interest in how artificial intelligence can optimize various stages of the additive manufacturing workflow. Users are keen to understand how AI can enhance design processes, specifically through generative design, which allows for the creation of intricate, performance-optimized geometries that are otherwise impossible to achieve with traditional methods. There is also significant curiosity about AI's role in process control, enabling real-time monitoring and adjustments during printing to improve part quality and reduce failure rates.

Furthermore, user queries frequently touch upon AI's potential in material development and optimization for 3D printing. AI algorithms can analyze vast datasets to predict material properties, identify optimal compositions, and even design new materials tailored for specific automotive applications. The integration of AI for predictive maintenance of 3D printers and post-processing automation also emerges as a key area of interest, promising increased uptime, reduced operational costs, and higher throughput. Overall, the sentiment is that AI will be a critical enabler for scaling 3D printing beyond niche applications into more widespread automotive production, addressing complexities and enhancing efficiency.

- Generative design for optimized part geometry and performance.

- AI-driven process optimization and real-time print monitoring for quality control.

- Accelerated material discovery and characterization using machine learning.

- Predictive maintenance for 3D printing equipment, enhancing uptime.

- Automated post-processing and quality inspection through computer vision.

- Supply chain optimization and demand forecasting for additive manufacturing.

- Reduced design iterations and faster time-to-market for new components.

Key Takeaways 3D Printing in Automotive Market Size & Forecast

User queries frequently seek concise summaries and critical insights from market size and forecast data, highlighting a need to understand the fundamental drivers behind projected growth. A primary takeaway is the significant expansion predicted for the 3D printing in automotive market, indicating a strong industry embrace of additive manufacturing technologies beyond initial adoption phases. This growth is underpinned by the increasing recognition of 3D printing's capabilities in enabling lightweighting, mass customization, and supply chain agility, all of which are paramount in the evolving automotive landscape driven by electric vehicles and autonomous technologies.

Another crucial insight gleaned from user questions is the expanding application scope within the automotive sector. While prototyping remains foundational, the forecast indicates a substantial shift towards direct manufacturing of end-use parts, tooling, and specialized components. This transition is expected to be a primary catalyst for market value appreciation, as the value per part significantly increases with functional components. Furthermore, the forecast implicitly underscores the growing investment in advanced materials and sophisticated 3D printing systems, reflecting an industry-wide commitment to leveraging these technologies for competitive advantage and sustainable manufacturing practices.

- Substantial market growth projected, indicating mature adoption beyond early stages.

- Primary growth drivers include lightweighting, customization, and supply chain resilience.

- Increasing shift from prototyping to production of functional end-use components.

- Significant value creation expected from direct manufacturing applications.

- Underlying trends include investment in advanced materials and sophisticated printing systems.

3D Printing in Automotive Market Drivers Analysis

The 3D Printing in Automotive market is propelled by several robust drivers that underscore its increasing integration and value proposition within the industry. A key driver is the relentless pursuit of lightweight vehicle designs, which directly contributes to improved fuel efficiency for internal combustion engine vehicles and extended range for electric vehicles. Additive manufacturing excels at creating complex, optimized geometries that are lighter yet structurally sound. Another significant factor is the escalating demand for vehicle customization and personalization, allowing manufacturers to offer bespoke components and interior elements that cater to individual consumer preferences without incurring prohibitive tooling costs or extensive lead times associated with traditional manufacturing methods.

Furthermore, the automotive industry's increasing emphasis on agile manufacturing processes and localized production capabilities acts as a powerful driver. 3D printing facilitates rapid iteration of designs, accelerates product development cycles, and enables on-demand production of spare parts or low-volume components, thereby enhancing supply chain flexibility and reducing logistical complexities. The advent and rapid adoption of electric vehicles (EVs) also serve as a crucial driver, as their unique design requirements and emphasis on battery range and thermal management often benefit immensely from the design freedom and material possibilities offered by additive manufacturing, such as specialized cooling channels or optimized battery casings.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Demand for Lightweight Vehicle Components | +5.5% | Global, particularly Europe, North America, APAC | Short to Long-term (2025-2033) |

| Growing Emphasis on Vehicle Customization & Personalization | +4.8% | North America, Europe, Asia Pacific (High-end markets) | Mid to Long-term (2027-2033) |

| Shift towards Agile Manufacturing & Localized Production | +4.2% | Global, post-pandemic supply chain disruptions | Short to Mid-term (2025-2029) |

| Increased Adoption of Electric Vehicles (EVs) | +5.0% | Global, especially China, Europe, North America | Short to Long-term (2025-2033) |

| Advancements in 3D Printing Materials & Technologies | +3.5% | Global (Innovation hubs like Germany, US, Japan) | Continuous (2025-2033) |

3D Printing in Automotive Market Restraints Analysis

Despite its significant growth potential, the 3D Printing in Automotive market faces several restraints that can impede its broader adoption and scalability. One primary restraint is the high initial investment required for sophisticated 3D printing equipment, including industrial-grade printers, specialized software, and post-processing machinery. This substantial upfront cost can be a barrier for smaller automotive suppliers or those with limited capital, despite the long-term benefits and cost savings offered by the technology. Furthermore, the operational expenses, including specialized material costs and energy consumption, can also be considerable, impacting the overall cost-effectiveness for mass production scenarios compared to traditional methods.

Another significant restraint concerns the limited availability of production-ready materials that meet the stringent performance, durability, and safety standards required for automotive applications. While advancements are being made, the material palette for additive manufacturing is still narrower than that for conventional manufacturing processes, particularly for certain high-stress or extreme-environment components. Additionally, the relatively slower production speeds of many industrial 3D printing processes, especially for larger parts or high-volume manufacturing, remain a challenge. This can limit their direct applicability in high-volume production lines where cycle times are critical, often relegating 3D printing to prototyping, tooling, or low-volume specialized parts rather than widespread integration into assembly lines.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment & Operational Costs | -3.0% | Global, especially emerging markets | Short to Mid-term (2025-2029) |

| Limited Material Selection for Mass Production | -2.5% | Global | Mid-term (2027-2031) |

| Scalability & Production Speed Limitations | -3.2% | Global, relevant for high-volume manufacturing | Short to Mid-term (2025-2030) |

| Lack of Standardized Processes & Certification | -1.8% | Global (Regulatory bodies) | Long-term (2028-2033) |

| Intellectual Property and Data Security Concerns | -1.0% | Global, especially for digital manufacturing | Continuous (2025-2033) |

3D Printing in Automotive Market Opportunities Analysis

The 3D Printing in Automotive market is ripe with opportunities that can significantly accelerate its expansion and broader adoption. One prominent opportunity lies in the increasing integration of additive manufacturing for mass customization and personalization in vehicle interiors and exteriors. As consumer demand for unique features and bespoke designs grows, 3D printing offers a cost-effective and agile solution to produce low-volume, highly customized components, moving beyond the traditional limitations of mass production. This includes personalized trim, dashboard elements, seat components, and aerodynamic enhancements, opening new revenue streams for OEMs and suppliers.

Another significant opportunity is the expansion into distributed manufacturing and on-demand production of spare parts and aftermarket components. This approach can drastically reduce inventory costs, mitigate supply chain disruptions, and ensure the rapid availability of parts, particularly for older or specialized vehicle models. The ability to print parts closer to the point of need can also lead to reduced logistics costs and a lower carbon footprint. Furthermore, the continuous development of advanced materials, including composites with enhanced properties and multi-material printing capabilities, presents a lucrative avenue for creating higher-performance, more durable, and functionally integrated automotive components, expanding the range of feasible applications for additive manufacturing in critical systems.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Mass Customization & Personalization of Vehicles | +4.5% | Europe, North America, High-growth Asian markets | Mid to Long-term (2027-2033) |

| Distributed Manufacturing & On-Demand Spare Parts Production | +3.8% | Global, especially mature automotive markets | Short to Mid-term (2025-2030) |

| Development of Advanced & Multi-functional Materials | +4.0% | Global (R&D hubs) | Continuous (2025-2033) |

| Integration into Electric Vehicle (EV) Component Production | +5.2% | Global EV manufacturing hubs (China, Europe, US) | Short to Long-term (2025-2033) |

| Post-processing Automation & Workflow Optimization | +2.5% | Global | Mid-term (2027-2031) |

3D Printing in Automotive Market Challenges Impact Analysis

The 3D Printing in Automotive market faces distinct challenges that require strategic solutions to unlock its full potential. A significant challenge is achieving the required production speed and volume for integration into high-throughput automotive manufacturing lines. While 3D printing excels in complex geometries and customization, its relative slowness compared to traditional mass production techniques like injection molding or stamping limits its application to high-volume, critical components. This bottleneck demands further innovation in printer speed, multi-laser systems, and parallel processing to become a viable alternative for mainstream production.

Another critical challenge revolves around the cost of materials and equipment, particularly for industrial-scale adoption. While material prices for some advanced polymers and metal powders have decreased, they still remain higher than traditional manufacturing feedstocks, impacting the economic feasibility for large-scale part production. Furthermore, the need for robust quality assurance and standardization processes is a pervasive challenge. Ensuring consistent part quality, repeatability, and adherence to rigorous automotive industry standards (e.g., for safety-critical components) requires advanced in-situ monitoring, comprehensive testing, and certified workflows, which are still evolving in the additive manufacturing ecosystem. Addressing these challenges is crucial for 3D printing to transition from a niche technology to a foundational element in automotive manufacturing.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Production Speed and Volume for Mass Manufacturing | -2.8% | Global, particularly high-volume manufacturing regions | Short to Mid-term (2025-2030) |

| Cost-effectiveness for Large-Scale Production | -2.0% | Global | Mid-term (2027-2032) |

| Quality Assurance, Repeatability & Certification | -2.5% | Global (Industry standards & regulatory bodies) | Continuous (2025-2033) |

| Talent Shortage & Skill Gap in Additive Manufacturing | -1.5% | Global, particularly developed economies | Long-term (2028-2033) |

| Integration with Existing Automotive Production Workflows | -1.2% | Global | Mid-term (2027-2031) |

3D Printing in Automotive Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the 3D Printing in Automotive market, covering historical data, current market dynamics, and future projections. It segments the market by technology, material, application, vehicle type, and end-user, offering granular insights into each category's growth trajectory and market share. The report also includes a detailed regional analysis, highlighting key opportunities and challenges across major geographical markets. Furthermore, it examines the competitive landscape, profiling key market players and their strategic initiatives, alongside an impact analysis of artificial intelligence on the industry's evolution. The scope is designed to equip stakeholders with actionable intelligence for strategic decision-making in this rapidly evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 8.43 Billion |

| Growth Rate | 22.8% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Stratasys, 3D Systems, EOS GmbH, HP Inc., Carbon, Velo3D, Desktop Metal, GE Additive, Formlabs, SLM Solutions, Renishaw plc, Markforged, Prodways Group, voxeljet AG, BigRep, Nexa3D, Ultimaker, EnvisionTEC (Desktop Metal subsidiary), Xact Metal, Optomec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The 3D Printing in Automotive market is comprehensively segmented to provide a granular understanding of its diverse applications and technological adoption. These segments allow for a detailed analysis of market dynamics, identifying specific areas of growth, emerging technologies, and key end-user preferences. The segmentation highlights the versatility of 3D printing across various stages of automotive manufacturing, from initial concept development to final part production and aftermarket support. Understanding these distinct segments is crucial for stakeholders to identify lucrative opportunities and tailor their strategies to specific market needs and technological requirements within the automotive ecosystem.

- By Technology: Stereolithography (SLA), Selective Laser Sintering (SLS), Fused Deposition Modeling (FDM), Multi Jet Fusion (MJF), Material Jetting, Binder Jetting, Direct Metal Laser Sintering (DMLS), Electron Beam Melting (EBM)

- By Material: Polymers (ABS, PLA, Nylon, PEEK, Polycarbonate), Metals (Aluminum, Steel, Titanium Alloys, Nickel Alloys), Composites, Ceramics

- By Application: Prototyping & Tooling (Jigs, Fixtures, Molds), Manufacturing of Components (Interior Parts, Exterior Parts, Under-the-Hood Components, Chassis Components, Powertrain Components), Aftermarket & Spare Parts

- By Vehicle Type: Passenger Cars, Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles), Electric Vehicles, Luxury & Performance Vehicles

- By End User: Original Equipment Manufacturers (OEMs), Tier 1 Suppliers, Aftermarket & Service Providers, Research & Development Institutions

Regional Highlights

- North America: This region is a significant market due to the strong presence of major automotive OEMs and Tier 1 suppliers, alongside extensive research and development activities in additive manufacturing. The focus on rapid prototyping, customized components, and lightweighting for fuel efficiency and EV range drives adoption. High investment in advanced manufacturing technologies and the demand for personalized vehicles also contribute to market growth.

- Europe: A leading region in automotive innovation, Europe demonstrates robust adoption of 3D printing, particularly in Germany's strong automotive sector. Emphasis on sustainable manufacturing, stringent emission regulations driving lightweight designs, and significant R&D in materials and processes contribute to its growth. The region is also at the forefront of luxury and high-performance vehicle customization, where 3D printing offers distinct advantages.

- Asia Pacific (APAC): This region is poised for rapid growth, driven by the expanding automotive manufacturing base in countries like China, Japan, India, and South Korea. The increasing production of electric vehicles, coupled with growing demand for cost-effective prototyping and localized supply chains, fuels the market. Government initiatives supporting advanced manufacturing and a large consumer base are key factors.

- Latin America: While a smaller market, Latin America shows increasing potential, particularly in countries like Brazil and Mexico, which have established automotive manufacturing hubs. The growth is primarily driven by the need for cost-efficient prototyping, tooling, and aftermarket parts, along with rising domestic demand for personalized vehicles.

- Middle East and Africa (MEA): This region is in the nascent stages of adopting 3D printing in automotive but offers emerging opportunities. Focus on economic diversification, industrialization initiatives, and localized manufacturing strategies in countries like UAE and Saudi Arabia are expected to drive future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Printing in Automotive Market.- Stratasys

- 3D Systems

- EOS GmbH

- HP Inc.

- Carbon

- Velo3D

- Desktop Metal

- GE Additive

- Formlabs

- SLM Solutions

- Renishaw plc

- Markforged

- Prodways Group

- voxeljet AG

- BigRep

- Nexa3D

- Ultimaker

- Xact Metal

- Optomec

Frequently Asked Questions

Analyze common user questions about the 3D Printing in Automotive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is 3D printing in the automotive industry?

3D printing in the automotive industry involves using additive manufacturing technologies to create components layer by layer. This includes prototyping, tooling (jigs, fixtures, molds), and increasingly, the direct production of end-use parts for vehicles, ranging from interior elements to critical engine components and lightweight structures.

What are the main benefits of 3D printing for automotive manufacturers?

Key benefits include rapid prototyping and iteration, significant weight reduction for improved fuel efficiency/EV range, design freedom for complex geometries, mass customization, reduced tooling costs, accelerated product development cycles, and enhanced supply chain flexibility for on-demand parts and localized production.

What materials are commonly used in automotive 3D printing?

Common materials include high-performance polymers (e.g., ABS, Nylon, PEEK, Polycarbonate), various metal alloys (e.g., aluminum, steel, titanium, nickel), and advanced composites. The selection depends on the specific application, requiring properties like strength, heat resistance, durability, or flexibility.

Is 3D printing used for mass production in automotive?

Currently, 3D printing is primarily used for prototyping, tooling, and low-volume, high-value functional components. While advancements are being made in speed and cost-effectiveness, it is not yet widely adopted for high-volume mass production compared to traditional methods like injection molding, but its role in distributed and on-demand manufacturing is growing.

How does 3D printing impact the future of electric vehicles (EVs)?

3D printing is crucial for EVs by enabling lightweight battery enclosures, optimized cooling channels for thermal management, and consolidated part designs that reduce assembly complexity. It facilitates the rapid development of unique EV components and allows for greater design freedom, contributing to improved range and performance.