Test and Measurement Equipment Market

Test and Measurement Equipment Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700262 | Last Updated : July 23, 2025 |

Format : ![]()

![]()

![]()

![]()

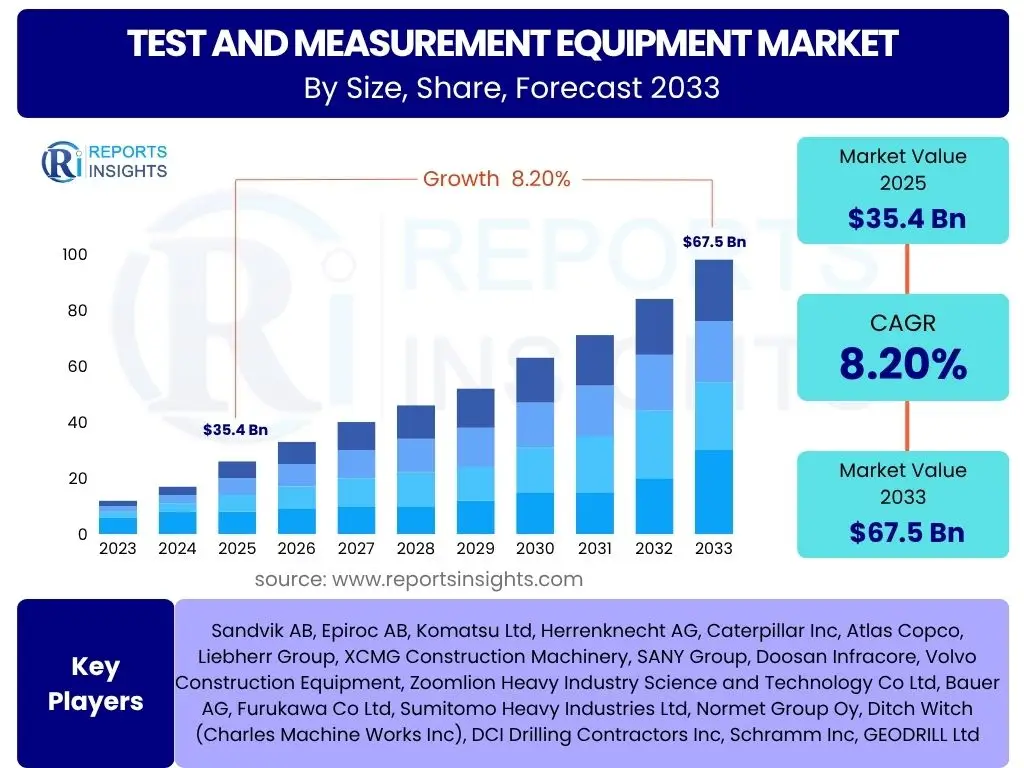

Test and Measurement Equipment Market is projected to grow at a Compound annual growth rate (CAGR) of 8.2% between 2025 and 2033, current valued at USD 35.4 Billion in 2025 and is projected to grow by USD 67.5 Billion by 2033 the end of the forecast period.

Key Test and Measurement Equipment Market Trends & Insights

The Test and Measurement (T&M) Equipment Market is currently undergoing transformative changes, driven by rapid technological advancements and evolving industry demands. Key trends shaping this market include the pervasive integration of the Internet of Things (IoT) across various sectors, demanding more sophisticated and connected testing solutions for smart devices and complex systems. The global rollout of 5G infrastructure is another significant driver, necessitating advanced RF and millimeter-wave test equipment to ensure network performance and reliability. Furthermore, the burgeoning electric vehicle (EV) industry is fueling demand for specialized battery testing, power electronics evaluation, and functional safety testing equipment. The increasing adoption of Industry 4.0 principles, such as automation and digitalization in manufacturing, is leading to a greater need for automated test systems and real-time data analysis capabilities. Miniaturization of electronic components and the development of new materials are also pushing the boundaries for precise and sensitive measurement tools. These trends collectively underscore a shift towards more intelligent, integrated, and high-precision T&M solutions.

- Widespread IoT device proliferation driving demand for integrated testing.

- Global 5G network deployment increasing need for advanced RF test solutions.

- Accelerated electric vehicle (EV) production requiring specialized battery and power electronics testing.

- Industry 4.0 adoption leading to demand for automated and intelligent test systems.

- Emphasis on miniaturization and high-frequency applications necessitating precise measurement tools.

AI Impact Analysis on Test and Measurement Equipment

Artificial Intelligence (AI) is poised to revolutionize the Test and Measurement Equipment Market by enhancing capabilities across the entire testing lifecycle, from design validation to maintenance. The integration of AI algorithms enables predictive maintenance for test equipment itself, reducing downtime and improving operational efficiency through the analysis of historical performance data and anomaly detection. For the devices under test, AI facilitates more intelligent and automated test sequences, optimizing test coverage and significantly reducing test times, particularly for complex systems like autonomous vehicles or intricate semiconductor designs. Furthermore, AI-driven data analytics allows for deeper insights into test results, identifying subtle patterns, root causes of failures, and optimizing product performance before physical prototypes are even built. Smart calibration routines leveraging AI can improve accuracy and reduce manual intervention, ensuring consistent measurement integrity. The advent of AI also supports the development of self-optimizing test benches that can adapt to new test scenarios and learn from previous results, paving the way for highly autonomous testing environments. This integration transforms T&M equipment from mere data collectors into intelligent decision-making tools.

- AI-driven predictive maintenance enhancing equipment uptime and reliability.

- Automated test sequence generation and optimization for faster, more comprehensive testing.

- Advanced data analytics providing deeper insights into product performance and failure patterns.

- Smart calibration improving accuracy and reducing manual intervention.

- Development of self-optimizing test benches for adaptive testing environments.

Key Takeaways Test and Measurement Equipment Market Size & Forecast

- The Test and Measurement Equipment Market is projected to reach USD 67.5 Billion by 2033, growing from USD 35.4 Billion in 2025.

- A robust Compound Annual Growth Rate (CAGR) of 8.2% is expected between 2025 and 2033.

- Key drivers include global 5G rollout, increasing adoption of electric vehicles, and advancements in Industry 4.0.

- Asia Pacific is anticipated to remain a dominant region due to its significant manufacturing base and technological investments.

- The market is seeing significant innovation in AI integration, enabling more intelligent and automated testing solutions.

- Opportunities are emerging from the development of advanced technologies such as 6G, quantum computing, and renewable energy.

- Challenges include the high cost of advanced equipment and managing rapid technological obsolescence.

- The market is segmented by product type, end-use industry, application, and component, indicating diverse growth avenues.

Test and Measurement Equipment Market Drivers Analysis

The Test and Measurement Equipment Market is significantly propelled by several macro and microeconomic factors that necessitate precise, reliable, and efficient testing solutions across various industries. The global surge in electronics manufacturing, fueled by increased consumer demand for smart devices and industrial automation, inherently drives the need for sophisticated T&M equipment to ensure quality and performance. Furthermore, the rapid and extensive deployment of 5G telecommunication networks worldwide requires a new generation of high-frequency and bandwidth-capable test equipment for development, deployment, and maintenance. The ongoing transformation towards Industry 4.0, characterized by digitalization, automation, and interconnected systems, mandates advanced sensors and analytical instruments for process control and quality assurance in manufacturing. The burgeoning electric vehicle (EV) industry, alongside the broader automotive sector's shift towards autonomous and connected vehicles, demands specialized T&M solutions for battery testing, power electronics, sensor validation, and in-vehicle network analysis. Finally, continuous and substantial investments in research and development across sectors like aerospace, defense, healthcare, and semiconductors are fundamental drivers, as cutting-edge innovations invariably require equally advanced testing capabilities for validation and commercialization. These drivers collectively create a sustained demand for innovative and higher-performance test and measurement solutions.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Global 5G Network Deployment | +1.5% to +2.0% | Asia Pacific, North America, Europe | Short to Mid-term (2025-2030) |

| Proliferation of IoT Devices & Smart Electronics | +1.0% to +1.5% | Global, particularly Asia Pacific, North America | Mid to Long-term (2025-2033) |

| Growth in Electric Vehicle (EV) Manufacturing | +0.8% to +1.2% | Europe, Asia Pacific, North America | Mid-term (2025-2031) |

| Increasing R&D Investments Across Industries | +0.7% to +1.0% | North America, Europe, Asia Pacific | Long-term (2025-2033) |

| Industry 4.0 and Industrial Automation Adoption | +0.6% to +0.9% | Europe, Asia Pacific, North America | Mid to Long-term (2026-2033) |

Test and Measurement Equipment Market Restraints Analysis

Despite the robust growth drivers, the Test and Measurement Equipment Market faces several significant restraints that could impede its full potential. One primary restraint is the inherently high initial investment cost associated with advanced T&M equipment, particularly for specialized or high-precision instruments. This significant capital outlay can be a barrier for smaller enterprises or those in developing regions, limiting market penetration and broader adoption. Furthermore, the global supply chain disruptions, exacerbated by geopolitical tensions and unforeseen events, continue to pose a challenge, leading to delays in component availability, increased manufacturing costs, and longer lead times for delivering equipment to end-users. The increasing complexity of modern electronic systems and communication technologies often requires highly skilled personnel to operate and interpret results from sophisticated T&M equipment. A shortage of such skilled labor in various regions can hinder efficient utilization and adoption of advanced solutions. Moreover, stringent regulatory compliance and the need for frequent calibration and maintenance add to the operational costs and complexity for end-users, potentially slowing down investment cycles. These restraints necessitate innovative financing models, robust supply chain strategies, and comprehensive training programs to mitigate their impact on market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment Cost | -0.8% to -1.2% | Global, particularly emerging economies | Long-term (2025-2033) |

| Global Supply Chain Disruptions | -0.6% to -1.0% | Global | Short to Mid-term (2025-2028) |

| Shortage of Skilled Professionals | -0.5% to -0.8% | North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

| Complex Regulatory & Compliance Requirements | -0.3% to -0.6% | Europe, North America | Mid-term (2025-2030) |

Test and Measurement Equipment Market Opportunities Analysis

The Test and Measurement Equipment Market is rich with untapped potential, driven by the emergence of groundbreaking technologies and the expansion into new application areas. A significant opportunity lies in the research and development surrounding next-generation communication technologies, such as 6G. As the successor to 5G, 6G will require entirely new spectrum bands, higher frequencies, and more complex modulation schemes, necessitating revolutionary test equipment for its development and deployment. The global shift towards renewable energy sources, including solar, wind, and hydrogen, presents a growing need for advanced T&M solutions to ensure the efficiency, reliability, and safety of power generation, transmission, and storage systems. Moreover, the nascent field of quantum computing and quantum communication, though still in early stages, will demand highly precise and specialized measurement tools for validating quantum states, entanglement, and qubit performance, opening up a niche but high-value market. The rapid advancements in the medical device industry, particularly in diagnostics, imaging, and wearable health technologies, also create a continuous demand for highly accurate, miniature, and compliant T&M solutions for product development and quality assurance. These opportunities signify new frontiers for innovation and market expansion for T&M equipment manufacturers, prompting investments in R&D and strategic partnerships to capitalize on these evolving needs.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Emergence of 6G Technology Research & Development | +1.2% to +1.8% | North America, Asia Pacific, Europe | Mid to Long-term (2028-2033) |

| Expansion of Renewable Energy Sector | +0.9% to +1.4% | Global | Mid-term (2026-2032) |

| Advancements in Quantum Computing & Communication | +0.7% to +1.1% | North America, Europe, select Asia Pacific regions | Long-term (2030-2033) |

| Growth in Advanced Medical Device Manufacturing | +0.6% to +0.9% | North America, Europe, Asia Pacific | Mid to Long-term (2025-2033) |

Test and Measurement Equipment Market Challenges Impact Analysis

The Test and Measurement Equipment Market faces several intricate challenges that demand strategic responses from industry players to sustain growth and innovation. One critical challenge is the rapid pace of technological obsolescence. As industries like semiconductors, telecommunications, and automotive evolve at an unprecedented rate, T&M equipment can quickly become outdated, requiring continuous investment in research and development to keep pace and compelling end-users to frequently upgrade their instruments. This cycle can strain budgets and create a perception of diminishing long-term value. Another significant concern is cybersecurity, particularly as T&M equipment becomes more networked and integrated with IT systems. Protecting sensitive test data and intellectual property from cyber threats is paramount, requiring robust security features embedded in the equipment and software. Furthermore, achieving global standardization for test procedures and equipment protocols remains a complex challenge, especially with the diversification of technologies and regional regulatory variations. Lack of universal standards can lead to interoperability issues, increased testing complexity, and higher costs for companies operating internationally. Finally, environmental regulations, particularly concerning energy consumption, material sourcing, and waste disposal for electronic equipment, present growing compliance challenges. Manufacturers must innovate to create more sustainable products and processes, which can involve significant R&D and manufacturing adjustments. Addressing these challenges effectively will be crucial for navigating the evolving market landscape and ensuring long-term success.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Technological Obsolescence | -0.9% to -1.3% | Global | Long-term (2025-2033) |

| Cybersecurity Threats to Connected Equipment | -0.7% to -1.0% | Global | Mid to Long-term (2025-2033) |

| Lack of Global Standardization | -0.5% to -0.8% | Global, varying by industry | Long-term (2025-2033) |

| Increasing Environmental Regulations & Compliance | -0.4% to -0.7% | Europe, North America, parts of Asia Pacific | Mid-term (2025-2030) |

Test and Measurement Equipment Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Test and Measurement Equipment Market, offering crucial insights into its current state and future growth trajectory. The report covers detailed market dynamics, including key drivers, restraints, opportunities, and challenges influencing market expansion. It presents a meticulous segmentation analysis across various product types, end-use industries, applications, and components, providing a granular view of market performance. Furthermore, the report features an extensive regional analysis, highlighting growth prospects and competitive landscapes across major geographic areas. It also includes an exhaustive profiling of leading market players, detailing their strategies, product portfolios, and recent developments to offer a complete understanding of the competitive environment. This report serves as an invaluable resource for stakeholders, investors, and decision-makers seeking to capitalize on emerging trends and make informed strategic choices in the evolving Test and Measurement Equipment sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 35.4 Billion |

| Market Forecast in 2033 | USD 67.5 Billion |

| Growth Rate | 8.2% CAGR from 2025 to 2033 |

| Number of Pages | 257 |

| Key Trends | |

| Segments Covered | |

| Key Companies Covered | Rohde & Schwarz, Keysight Technologies, Anritsu, Advantest, National Instruments, Teledyne FLIR, Fortive, Yokogawa Electric, EXFO, VIAVI Solutions, Chronos Technology, GW Instek, Keithley Instruments, Ametek, Mitutoyo, Spirent Communications, Leader Electronics, Tabor Electronics, Rigol Technologies, ADLINK Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Test and Measurement Equipment Market is comprehensively segmented to provide a detailed understanding of its diverse components and their respective growth trajectories. This segmentation allows for targeted analysis of market opportunities and challenges across various product categories, industrial applications, and functional uses. Each segment reflects unique demand patterns and technological requirements, contributing to the overall market dynamics.

By Product Type: This segment includes a wide array of instruments essential for various testing and measurement tasks. Oscilloscopes are crucial for observing waveform signals, while Spectrum Analyzers are vital for analyzing signal characteristics in the frequency domain. Network Analyzers are used for characterizing RF and microwave components and circuits, and Signal Generators produce various electrical signals for testing. Digital Multimeters offer basic electrical measurements, whereas Logic Analyzers capture and display digital signals. Power Meters measure electrical power, RF Test Equipment handles radio frequency applications, and Wireless Test Equipment is specific to wireless communication technologies. Calibrators ensure the accuracy of other instruments, and "Others" encompass specialized and niche equipment not covered by the primary categories.

- Oscilloscopes

- Spectrum Analyzers

- Network Analyzers

- Signal Generators

- Digital Multimeters

- Logic Analyzers

- Power Meters

- RF Test Equipment

- Wireless Test Equipment

- Calibrators

- Others

By End-Use Industry: This segmentation highlights the primary sectors that heavily rely on test and measurement equipment for their operations. The Automotive industry utilizes T&M for vehicle diagnostics, component testing, and autonomous driving system validation. Aerospace & Defense demands highly reliable equipment for avionics, radar systems, and component testing in harsh environments. IT & Telecommunications is driven by network infrastructure development, 5G deployment, and data center testing. Consumer Electronics requires testing for product quality, performance, and compliance for devices like smartphones and wearables. Healthcare uses T&M for medical device development, diagnostics, and patient monitoring systems. Industrial applications cover manufacturing, process control, and automation. Education & Research institutions use equipment for scientific studies and academic training. The Semiconductor industry relies on T&M for wafer testing, chip design validation, and quality control. Energy & Utilities uses equipment for power grid management, renewable energy system testing, and electrical safety.

- Automotive

- Aerospace & Defense

- IT & Telecommunications

- Consumer Electronics

- Healthcare

- Industrial

- Education & Research

- Semiconductor

- Energy & Utilities

By Application: This segment focuses on the specific functions or phases where test and measurement equipment is deployed. Manufacturing & Production Test involves in-line and end-of-line testing to ensure product quality and operational efficiency. Research & Development (R&D) applications utilize T&M for prototype validation, new technology development, and experimental analysis. Field Installation & Maintenance covers on-site testing for equipment setup, troubleshooting, and routine maintenance of systems. Quality Control & Inspection ensures that products meet specified standards and requirements throughout the production process. Calibration is critical for maintaining the accuracy and reliability of all measurement instruments, ensuring traceability to national and international standards.

- Manufacturing & Production Test

- Research & Development

- Field Installation & Maintenance

- Quality Control & Inspection

- Calibration

By Component: This segmentation categorizes the market based on the constituent parts of a T&M solution. Hardware includes the physical instruments and devices used for measurements. Software encompasses the programs and applications that control the hardware, analyze data, and provide user interfaces. Services cover calibration, maintenance, repair, training, and consulting related to test and measurement equipment, providing essential support for equipment lifecycle management and optimal performance.

- Hardware

- Software

- Services

Regional Highlights

The global Test and Measurement Equipment Market exhibits varying dynamics across key geographical regions, each contributing significantly to the overall market growth through distinct drivers and technological advancements. Understanding these regional nuances is crucial for strategic market positioning and investment decisions.

-

Asia Pacific (APAC): This region is anticipated to be the dominant and fastest-growing market for test and measurement equipment. The robust growth is primarily driven by the presence of a vast manufacturing base, particularly in countries like China, South Korea, Japan, and India. These countries are global hubs for consumer electronics, automotive production, and semiconductor manufacturing, all of which demand extensive T&M solutions. Rapid urbanization, increasing R&D investments, and aggressive rollout of 5G infrastructure further bolster market expansion in APAC. Government initiatives supporting local manufacturing and technological innovation also play a crucial role in accelerating adoption.

-

North America: A highly mature and technologically advanced market, North America maintains a significant share due to strong investments in research and development, particularly in aerospace & defense, IT & telecommunications, and advanced electronics. The region is at the forefront of adopting new technologies like 5G, IoT, and electric vehicles, necessitating cutting-edge test solutions. A robust ecosystem of leading T&M equipment manufacturers and a strong focus on high-precision and automated testing contribute to its continued prominence. The presence of major semiconductor foundries and design houses also drives consistent demand.

-

Europe: Europe represents a stable and innovative market, driven by its strong automotive industry, particularly in Germany, and significant advancements in industrial automation (Industry 4.0). Strict regulatory standards for product quality and safety also compel industries to invest in high-quality test and measurement equipment. Countries like Germany, France, and the UK are key contributors, with ongoing research in telecommunications, renewable energy, and medical devices further fueling market demand. The region’s focus on sustainable manufacturing and advanced engineering fosters continuous innovation in T&M solutions.

-

Latin America: This region is an emerging market with gradual growth, primarily driven by increasing industrialization, infrastructure development, and expanding telecommunications networks. Countries like Brazil and Mexico are witnessing rising investments in automotive and electronics manufacturing, contributing to the demand for T&M equipment. While smaller in market share compared to mature economies, the region presents long-term growth opportunities as economic development continues and technological adoption increases across various sectors.

-

Middle East & Africa (MEA): The MEA market for test and measurement equipment is experiencing growth driven by investments in telecommunications infrastructure, oil and gas exploration, and diversification efforts in non-oil sectors. Countries in the Gulf Cooperation Council (GCC) are particularly active in large-scale construction projects and smart city initiatives, which require advanced testing capabilities. While still a smaller market, ongoing economic development and increasing foreign direct investments are gradually expanding the need for modern T&M solutions across various industries.

Top Key Players:

The market research report covers the analysis of key stake holders of the Test and Measurement Equipment Market. Some of the leading players profiled in the report include -- Rohde & Schwarz

- Keysight Technologies

- Anritsu

- Advantest

- National Instruments

- Teledyne FLIR

- Fortive

- Yokogawa Electric

- EXFO

- VIAVI Solutions

- Chronos Technology

- GW Instek

- Keithley Instruments

- Ametek

- Mitutoyo

- Spirent Communications

- Leader Electronics

- Tabor Electronics

- Rigol Technologies

- ADLINK Technology

Frequently Asked Questions:

What is the Test and Measurement Equipment Market size?

The Test and Measurement Equipment Market was valued at USD 35.4 Billion in 2025 and is projected to reach USD 67.5 Billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 8.2% during the forecast period.

What are the main drivers for the Test and Measurement Equipment Market?

Key drivers include the global rollout of 5G networks, the rapid expansion of IoT devices and smart electronics, significant growth in electric vehicle (EV) manufacturing, and increasing research and development investments across various industries. The widespread adoption of Industry 4.0 principles and industrial automation also fuels demand.

How is AI impacting the Test and Measurement Equipment Market?

Artificial Intelligence (AI) is transforming the market by enabling predictive maintenance for equipment, automating and optimizing test sequences for complex systems, providing advanced data analytics for deeper insights, enhancing smart calibration, and supporting the development of self-optimizing test benches.

Which regions are key players in the Test and Measurement Equipment Market?

Asia Pacific is a dominant and rapidly growing region due to its extensive manufacturing base and technological investments. North America and Europe are also significant players, driven by strong R&D, technological innovation, and advanced industrial sectors.

What are the emerging trends in the Test and Measurement Equipment Market?

Emerging trends include the increasing integration of IoT and 5G technologies in testing, the rising demand from the electric vehicle and automotive electronics sectors, the adoption of Industry 4.0 automation and digitalization, and a continuous focus on miniaturization and higher precision in measurement tools.