Ski Wax Market

Ski Wax Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700245 | Last Updated : July 23, 2025 |

Format : ![]()

![]()

![]()

![]()

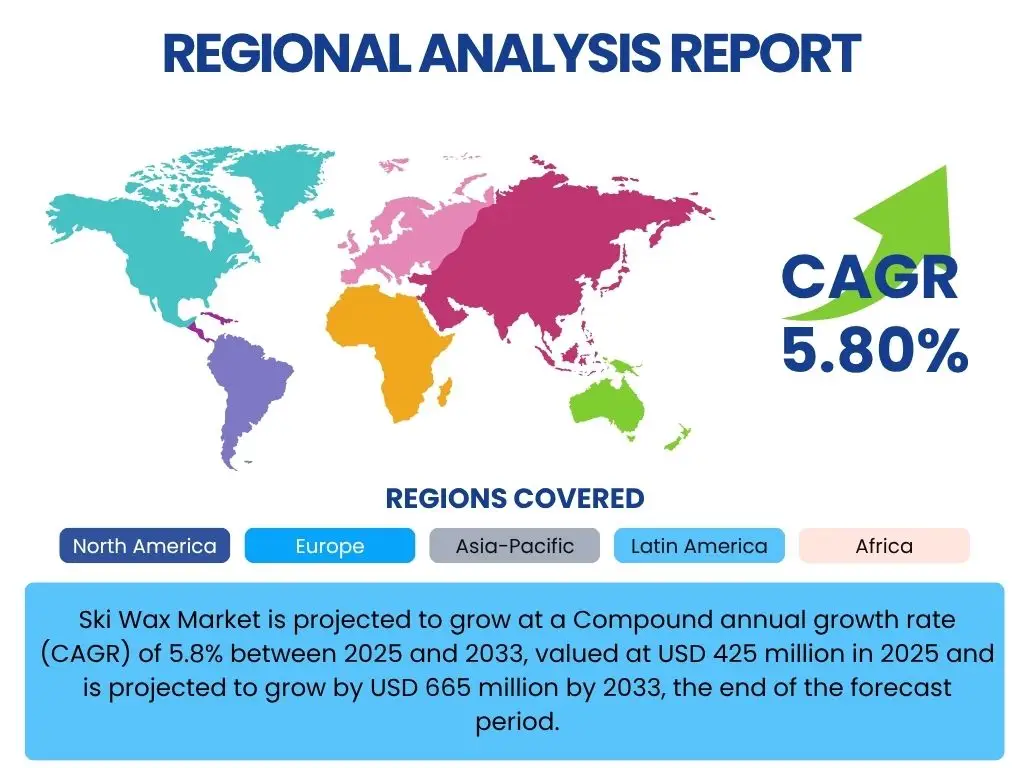

Ski Wax Market is projected to grow at a Compound annual growth rate (CAGR) of 5.8% between 2025 and 2033, current valued at USD 425 million in 2025 and is projected to grow by USD 665 million by 2033, the end of the forecast period.

Key Ski Wax Market Trends & Insights

The global ski wax market is currently shaped by several dynamic trends, reflecting evolving consumer preferences, technological advancements, and increasing environmental consciousness within the winter sports industry. These trends are collectively influencing product development, distribution strategies, and overall market growth trajectories.

- Shift towards eco-friendly and biodegradable wax formulations due to environmental regulations and consumer demand.

- Increasing adoption of fluorocarbon-free waxes driven by health and environmental concerns.

- Growth in demand for specialized waxes catering to specific snow conditions, temperatures, and disciplines (e.g., alpine, Nordic, snowboarding).

- Rising popularity of Do-It-Yourself (DIY) wax application among enthusiasts, leading to demand for user-friendly products and tools.

- Integration of advanced material science in wax development for enhanced durability and performance.

- Expansion of online retail channels for ski wax, offering wider accessibility and product variety.

AI Impact Analysis on Ski Wax

Artificial Intelligence (AI) is poised to exert a transformative influence across various facets of the ski wax market, from research and development to supply chain management and personalized consumer experiences. The application of AI technologies can optimize processes, enhance product efficacy, and open new avenues for market interaction.

- AI-driven material science research accelerating the development of novel wax formulations and biodegradable alternatives.

- Predictive analytics optimizing inventory management and supply chain logistics for manufacturers and retailers.

- Personalized wax recommendations for consumers based on AI analysis of snow conditions, skier profiles, and equipment types.

- Automated quality control systems ensuring consistency and performance in wax production.

- AI-enhanced digital marketing strategies targeting specific consumer segments with relevant product offerings.

Key Takeaways Ski Wax Market Size & Forecast

- The global ski wax market is anticipated to exhibit consistent growth through the forecast period, driven by sustained interest in winter sports.

- Market valuation is projected to reach USD 665 million by 2033, up from USD 425 million in 2025, indicating a robust expansion.

- The Compound Annual Growth Rate (CAGR) of 5.8% from 2025 to 2033 highlights a steady upward trajectory in market value.

- Growth is significantly influenced by innovations in wax technology and a global shift towards environmentally responsible products.

- Emerging markets and increased participation in recreational skiing are key contributors to the projected market expansion.

Ski Wax Market Drivers Analysis

The ski wax market is propelled by a confluence of factors that stimulate demand and foster innovation. These drivers range from fundamental aspects of winter sports participation to advancements in product technology and changing consumer behaviors. Understanding these catalysts is crucial for identifying growth opportunities and strategizing market penetration. The continuous evolution of skiing and snowboarding as recreational and competitive sports inherently boosts the demand for high-performance maintenance products like ski wax. Furthermore, increasing awareness among enthusiasts about the critical role of proper ski care in enhancing performance, speed, and equipment longevity directly translates into higher consumption of wax products. This growing appreciation for optimized gear performance, coupled with a rising disposable income in key regions, enables consumers to invest in premium and specialized wax formulations.

Technological advancements in chemical formulations also serve as a significant driver. Manufacturers are constantly researching and developing new wax compounds that offer superior glide, durability, and adaptability to various snow conditions and temperatures. The introduction of waxes designed for specific types of snow or levels of humidity, along with user-friendly application methods, attracts a broader consumer base, from amateur skiers to professional athletes. Moreover, the global surge in winter tourism and the expansion of ski resorts in developing regions contribute to a wider accessibility and participation in winter sports, thereby increasing the overall market for ski wax.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Participation in Winter Sports | +1.5% | Global, particularly North America, Europe, and Asia Pacific | Short to Long Term |

| Growing Awareness of Ski Maintenance and Performance | +1.2% | Developed Ski Markets (e.g., Austria, Switzerland, USA, Canada) | Medium Term |

| Technological Advancements in Wax Formulations | +1.0% | Global, driven by innovation hubs in Europe and North America | Long Term |

| Rising Disposable Income and Consumer Spending on Leisure Activities | +0.8% | Emerging Economies and Affluent Regions | Medium to Long Term |

| Expansion of Ski Resorts and Winter Tourism Infrastructure | +0.7% | Asia Pacific (China, South Korea), Eastern Europe, North America | Long Term |

| Influence of Professional Skiing and Snowboarding Competitions | +0.6% | Global, especially regions with strong winter sports culture | Short to Medium Term |

| Growth of Online Retail Channels for Sporting Goods | +0.5% | Global, particularly developed digital economies | Short to Medium Term |

Ski Wax Market Restraints Analysis

Despite its growth potential, the ski wax market faces several significant restraints that could impede its expansion. These limiting factors often stem from environmental concerns, economic sensitivities, and the inherent seasonality of winter sports. The most prominent restraint is the increasing environmental scrutiny over traditional fluorocarbon-based waxes. Concerns regarding the persistence, bioaccumulation, and toxicity of per- and polyfluoroalkyl substances (PFAS), historically used in high-performance waxes, are leading to regulatory bans and consumer backlash. This forces manufacturers to invest heavily in developing less effective but environmentally friendly alternatives, which can be a complex and costly endeavor, potentially impacting product performance perception and market acceptance. The transition away from fluorocarbons presents a substantial challenge for maintaining the performance standards expected by professional and avid skiers, thereby acting as a restraint on market growth until effective alternatives are widely adopted.

Furthermore, the ski wax market is highly susceptible to climate change and unpredictable weather patterns. Reduced snowfall, shorter winter seasons, and fluctuating temperatures in traditional ski regions directly impact the number of active skiing days, subsequently lowering the demand for ski wax. This dependency on natural conditions introduces a high degree of volatility and uncertainty into the market. Economic downturns or recessions can also influence consumer spending on leisure activities, including winter sports, leading to a decline in demand for non-essential items like ski wax. The relatively high cost of premium wax products, especially those with specialized formulations or eco-friendly credentials, can deter price-sensitive consumers. Lastly, the rise of alternative winter sports or leisure activities that do not require extensive equipment maintenance, such as snowshoeing or ice skating, could divert consumer interest and limit the growth of the ski wax market.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Environmental Regulations and Bans on Fluorocarbon Waxes (PFAS) | -1.8% | Europe, North America, Global for professional circuits | Short to Long Term |

| Climate Change and Unpredictable Snowfall Patterns | -1.5% | Global, especially traditional ski regions in Europe and North America | Long Term |

| High Cost of Premium and Specialized Wax Formulations | -0.9% | Global, more pronounced in developing markets | Medium Term |

| Seasonal Nature of Winter Sports and Short Skiing Season | -0.7% | Global | Annual/Seasonal |

| Economic Fluctuations and Reduced Disposable Income | -0.5% | Global, varies by regional economic stability | Short Term |

Ski Wax Market Opportunities Analysis

Despite the existing restraints, the ski wax market presents several compelling opportunities for growth and innovation. These opportunities largely revolve around the development of sustainable products, expansion into new consumer segments, and leveraging digital platforms for enhanced market reach. The most significant opportunity lies in the accelerating demand for eco-friendly and biodegradable wax alternatives. As environmental awareness intensifies and regulations tighten, consumers and professional organizations are actively seeking sustainable solutions. This creates a fertile ground for companies that can innovate and effectively market non-toxic, high-performance waxes derived from natural or recycled materials. Investment in research and development for bio-based waxes that can match or surpass the performance of traditional fluorocarbon waxes represents a major competitive advantage and market expansion pathway. The focus on sustainability can also open doors to new partnerships with environmentally conscious resorts and sporting events, further bolstering market presence.

Another key opportunity is the untapped potential within the recreational skiing segment. While professional and avid skiers are already major consumers, there is a large base of casual skiers and snowboarders who may not regularly wax their equipment or are unaware of its benefits. Educating this segment through user-friendly wax kits, simplified application instructions, and targeted marketing campaigns can significantly expand the customer base. Furthermore, the growth of indoor ski facilities and artificial snow technology offers a consistent, albeit niche, market for ski wax, mitigating some of the challenges posed by unpredictable natural snowfall. The proliferation of digital platforms, including e-commerce websites and social media, provides an excellent channel for direct-to-consumer sales, product demonstrations, and interactive customer engagement. This allows brands to reach a global audience, offer personalized recommendations, and build brand loyalty more effectively than traditional retail channels. Finally, exploring customization services, such as wax blending tailored to specific skier needs or local snow conditions, can create premium offerings and differentiate market players.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development and Adoption of Eco-Friendly and Biodegradable Waxes | +2.0% | Global, particularly strong in Europe and North America | Medium to Long Term |

| Expansion into Recreational and Amateur Skiing Segments | +1.5% | Global, especially emerging ski markets (Asia Pacific) | Short to Medium Term |

| Leveraging E-commerce and Direct-to-Consumer Sales Channels | +1.2% | Global, strongest in digitally advanced regions | Short to Medium Term |

| Innovation in User-Friendly and Quick-Application Wax Products | +1.0% | Global, appealing to general consumer market | Short to Medium Term |

| Growth of Indoor Ski Facilities and Artificial Snow Technology | +0.8% | Urban centers, regions with limited natural snow (e.g., Middle East, China) | Long Term |

| Customization and Personalization of Wax Offerings | +0.7% | Developed ski markets, niche consumer segments | Long Term |

Ski Wax Market Challenges Impact Analysis

The ski wax market faces a distinct set of challenges that require strategic navigation from market participants. These challenges often overlap with the identified restraints but delve deeper into the operational and competitive complexities. The paramount challenge is adapting to and overcoming the stringent regulatory landscape concerning fluorocarbon chemicals. The global movement to ban or restrict PFAS compounds, which were long integral to high-performance ski waxes, forces companies into costly reformulations and re-tooling of manufacturing processes. Ensuring that new, compliant wax products can deliver comparable performance without the banned substances is a significant technical hurdle. Failure to innovate effectively in this area can lead to market share loss, particularly among professional athletes and serious enthusiasts who prioritize marginal performance gains. Moreover, consumer perception and trust must be managed carefully during this transition, as skepticism about the efficacy of non-fluorinated waxes could hinder adoption rates.

Another enduring challenge is the inherent variability of natural snow conditions and the overall dependence on climate. Unlike many other consumer goods markets, demand for ski wax is directly tied to the availability and quality of snow, which is increasingly unpredictable due to global climate change. This leads to fluctuating sales volumes, difficulties in inventory management, and reduced predictability for market planning. Furthermore, the market faces challenges related to consumer education and application complexity. Many recreational skiers may not fully understand the benefits of waxing or find the application process cumbersome, leading to infrequent purchases or reliance on ski shops for services. This limits the potential for direct-to-consumer sales of raw wax products. The proliferation of counterfeit or substandard wax products, especially through informal online channels, poses a threat to brand reputation and can lead to consumer dissatisfaction. Lastly, intense competition within the established market, with numerous brands vying for market share, necessitates continuous innovation and differentiation to maintain relevance and profitability.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Compliance with Evolving Environmental Regulations (PFAS Bans) | -1.9% | Global, with immediate impact in Europe and North America | Short to Long Term |

| Maintaining Performance Standards with Eco-Friendly Alternatives | -1.6% | Global, critical for professional and high-performance segments | Medium to Long Term |

| Vulnerability to Climate Change and Unpredictable Snow Seasons | -1.4% | Global, especially traditional alpine regions | Long Term |

| Consumer Education on Waxing Benefits and Application | -0.8% | Global, particularly in emerging and recreational markets | Medium Term |

| Intense Competition and Market Saturation for Basic Waxes | -0.6% | Global, particularly in developed markets | Short to Medium Term |

| Supply Chain Disruptions and Raw Material Volatility | -0.4% | Global, impacts manufacturing costs and availability | Short Term |

Ski Wax Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global ski wax market, offering critical insights into its current dynamics, historical performance, and future growth trajectory. The report encompasses a detailed segmentation analysis, regional breakdowns, competitive landscape assessment, and identification of key market drivers, restraints, opportunities, and challenges. It serves as an invaluable resource for stakeholders seeking to understand market trends, make informed strategic decisions, and capitalize on emerging opportunities within the winter sports accessories sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 425 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% (CAGR from 2025 to 2033) |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Performance Wax Solutions, EcoGlide Innovations, WinterSport Coatings, Alpine Speed Labs, SnowTech Waxes, Nordic Glide Systems, Precision Wax Works, Summit Surface Technologies, Glacier Performance Products, Trail Blazer Waxes, Evergreen Wax Co., Frostbite Formulations, Apex Ski Care, Polar Performance Waxes, Mountain Glide Solutions, High Country Wax, Winterlude Chemicals, Rapid Glide Systems, The Wax Collective, Core Ski Wax |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The ski wax market is meticulously segmented to provide a granular view of its diverse components, enabling a comprehensive understanding of consumer preferences, product utility, and market dynamics across various categories. This detailed breakdown aids businesses in identifying specific growth niches and tailoring their product offerings and marketing strategies effectively.

- By Type: This segment categorizes ski waxes based on their chemical composition and application method, reflecting technological advancements and environmental shifts. Hydrocarbon waxes, including paraffin and synthetic varieties, form the traditional base. Fluorocarbon waxes, both high and low performance, have historically dominated the high-end market due to superior glide properties, though their market share is declining due to regulatory pressures. Bio-based waxes represent an emerging and rapidly growing segment, driven by sustainability concerns. Further distinctions are made by application consistency such as liquid waxes for quick application, paste waxes for convenience, rub-on waxes for basic use, and hot waxes for optimal performance and durability.

- By Application: This segmentation highlights the primary use cases for ski wax, revealing varied demand patterns across different winter sports disciplines and user levels. Alpine skiing, encompassing downhill and slalom, is a significant application, requiring durable waxes for varied snow conditions. Cross-country skiing, which demands specific glide and kick wax properties, forms another distinct segment. Snowboarding also utilizes ski wax for improved glide and board protection. Additionally, the market is differentiated by user intent into recreational use, catering to casual enthusiasts seeking ease of application and general performance, and professional competition, where highly specialized and performance-critical waxes are essential for competitive advantage.

- By Distribution Channel: This segment outlines the primary avenues through which ski wax products reach consumers, influencing market accessibility and pricing strategies. Specialty sports stores remain a crucial channel, offering expert advice and a wide range of products. Online retail has rapidly gained prominence, providing convenience, competitive pricing, and global reach. Hypermarkets and supermarkets also contribute to sales, particularly for entry-level or universal wax products. Direct sales, including manufacturers selling directly to consumers or ski resorts, represent another channel, often used for bulk purchases or customized solutions. Ski resorts and rentals, which provide waxing services or sell basic waxes, serve as important points of consumption within the market.

- By End-User: This segmentation categorizes the market based on the ultimate consumers of ski wax, indicating diverse needs and purchasing behaviors. Individual consumers, comprising recreational skiers, snowboarders, and serious enthusiasts, form the largest end-user segment, purchasing waxes for personal use and maintenance. Ski resorts and rental operators constitute another significant end-user group, requiring bulk quantities of durable, general-purpose waxes for their rental fleet maintenance and servicing. Professional athletes and teams represent a smaller but high-value segment, demanding top-tier, specialized waxes for competitive performance and often driving innovation in wax technology.

Regional Highlights

The global ski wax market exhibits distinct regional dynamics, largely influenced by geographical factors, climate conditions, the prevalence of winter sports culture, and economic development. Understanding these regional nuances is crucial for strategic market entry and expansion.

- North America: This region stands as a significant market for ski wax, driven by a strong culture of recreational skiing and snowboarding, particularly in the United States and Canada. The vast number of ski resorts, combined with a high disposable income and growing interest in outdoor sports, ensures consistent demand. Professional competitive skiing and snowboarding events also contribute to the market, especially for high-performance wax products. The region is seeing a growing uptake of DIY waxing among enthusiasts, boosting sales of individual wax products and tools.

- Europe: Europe represents the largest and most mature market for ski wax,primarily due to the extensive Alpine regions and Nordic countries with deep-rooted winter sports traditions. Countries like Austria, Switzerland, France, Italy, and Scandinavia are major consumption hubs. The market is highly influenced by professional skiing circuits and stringent environmental regulations, which are accelerating the shift towards fluorocarbon-free and eco-friendly waxes. There is a strong demand for specialized waxes catering to diverse snow conditions across the continent.

- Asia Pacific (APAC): The APAC region is emerging as a rapidly growing market, propelled by increasing participation in winter sports, particularly in countries like Japan, South Korea, and China. Investments in ski infrastructure, coupled with rising disposable incomes and the legacy of recent Winter Olympics, are fueling market expansion. While traditional waxing culture is developing, there is a strong inclination towards convenience-oriented and easy-to-apply waxes. China, with its ambitious plans for winter sports, presents substantial future growth opportunities.

- Latin America: This region constitutes a niche market for ski wax, primarily concentrated in countries with skiable mountain ranges like Chile and Argentina. The demand is seasonal and caters to a smaller, dedicated segment of skiers. Market growth here is modest, dependent on regional tourism and the development of local winter sports communities.

- Middle East and Africa (MEA): The MEA market for ski wax is currently limited, largely driven by indoor ski facilities and a small contingent of expatriates and affluent individuals traveling to international ski destinations. Countries with established indoor ski parks, such as the UAE, represent pockets of demand. The overall regional growth is slow, with minimal natural snow-based skiing.

Top Key Players:

The market research report covers the analysis of key stake holders of the Ski Wax Market. Some of the leading players profiled in the report include -

- Performance Wax Solutions

- EcoGlide Innovations

- WinterSport Coatings

- Alpine Speed Labs

- SnowTech Waxes

- Nordic Glide Systems

- Precision Wax Works

- Summit Surface Technologies

- Glacier Performance Products

- Trail Blazer Waxes

- Evergreen Wax Co.

- Frostbite Formulations

- Apex Ski Care

- Polar Performance Waxes

- Mountain Glide Solutions

- High Country Wax

- Winterlude Chemicals

- Rapid Glide Systems

- The Wax Collective

- Core Ski Wax

Frequently Asked Questions:

What is ski wax and why is it important for skiing performance?

Ski wax is a material applied to the base of skis or snowboards to reduce friction between the base and the snow, enhancing glide and protecting the base material. It is crucial for optimal skiing performance as it allows skiers to maintain speed, achieve smoother glides, and exert less effort. Additionally, wax protects the ski base from wear, oxidation, and damage, extending the life of the equipment. Different waxes are formulated for specific snow temperatures, conditions, and types of skiing, ensuring peak performance in varying environments.

What are the primary types of ski wax available in the market?

The ski wax market primarily offers three main types based on chemical composition: hydrocarbon waxes, fluorocarbon waxes, and bio-based waxes. Hydrocarbon waxes, typically paraffin-based, are widely used for general recreational skiing due to their affordability and ease of application. Fluorocarbon waxes, known for superior water repellency and glide at high speeds, have been popular in racing but are facing phase-outs due to environmental concerns. Bio-based waxes, an emerging category, are developed from natural or biodegradable materials, offering an environmentally friendly alternative while striving to match the performance of traditional waxes. Beyond composition, waxes are also categorized by application method, such as hot wax, liquid wax, paste wax, and rub-on wax.

How does environmental regulation impact the ski wax market?

Environmental regulations significantly impact the ski wax market, primarily through bans and restrictions on fluorocarbon compounds, specifically per- and polyfluoroalkyl substances (PFAS). These chemicals, historically used in high-performance waxes, are identified as persistent pollutants. Regulatory bodies and major ski organizations have begun phasing out their use, particularly in competitive circuits. This forces manufacturers to heavily invest in research and development of non-fluorinated, eco-friendly alternatives. The shift is driving innovation towards bio-based and hydrocarbon-based waxes that meet performance expectations while adhering to environmental safety standards, reshaping product offerings and market dynamics.

What are the key factors to consider when choosing the right ski wax?

Choosing the right ski wax depends on several critical factors to optimize performance. The most important considerations are snow temperature and type (e.g., wet, dry, icy, new, old snow), as waxes are specifically formulated for different conditions. Air temperature and humidity also play a role. Additionally, the type of skiing (alpine, cross-country, snowboarding, recreational, or competitive) influences the choice, with racing often requiring more specialized and performance-specific waxes. The desired outcome, such as glide, durability, or kick (for cross-country), and the preferred application method (hot wax, liquid, paste) should also guide the selection process. Matching these factors ensures maximum efficiency and enjoyment on the slopes.

How is the growth of online retail affecting the ski wax market?

The growth of online retail is profoundly affecting the ski wax market by expanding accessibility, increasing product variety, and influencing pricing strategies. E-commerce platforms allow manufacturers and retailers to reach a wider global audience beyond traditional brick-and-mortar sports stores. This channel offers consumers the convenience of purchasing waxes anytime, anywhere, often with competitive pricing and detailed product information. Online retail also facilitates direct-to-consumer sales, enabling brands to build stronger relationships with their customers and offer personalized recommendations. The digital platform fosters community engagement through reviews and tutorials, further driving informed purchasing decisions and market growth.