Satellite Hub System Market

Satellite Hub System Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702329 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Satellite Hub System Market Size

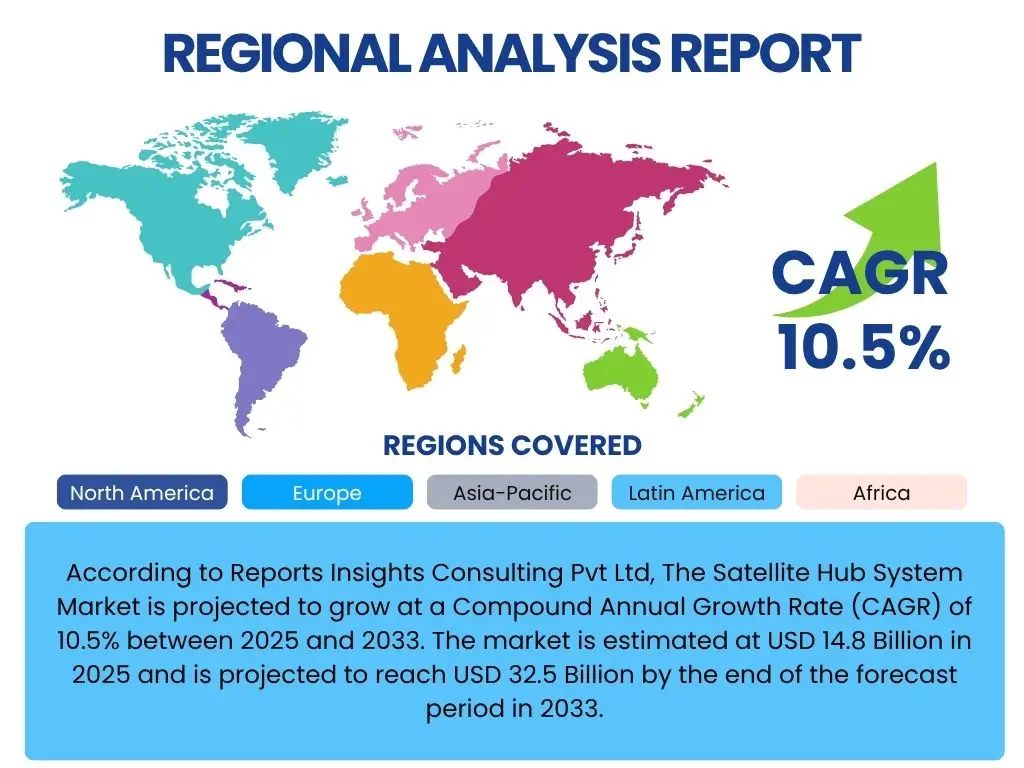

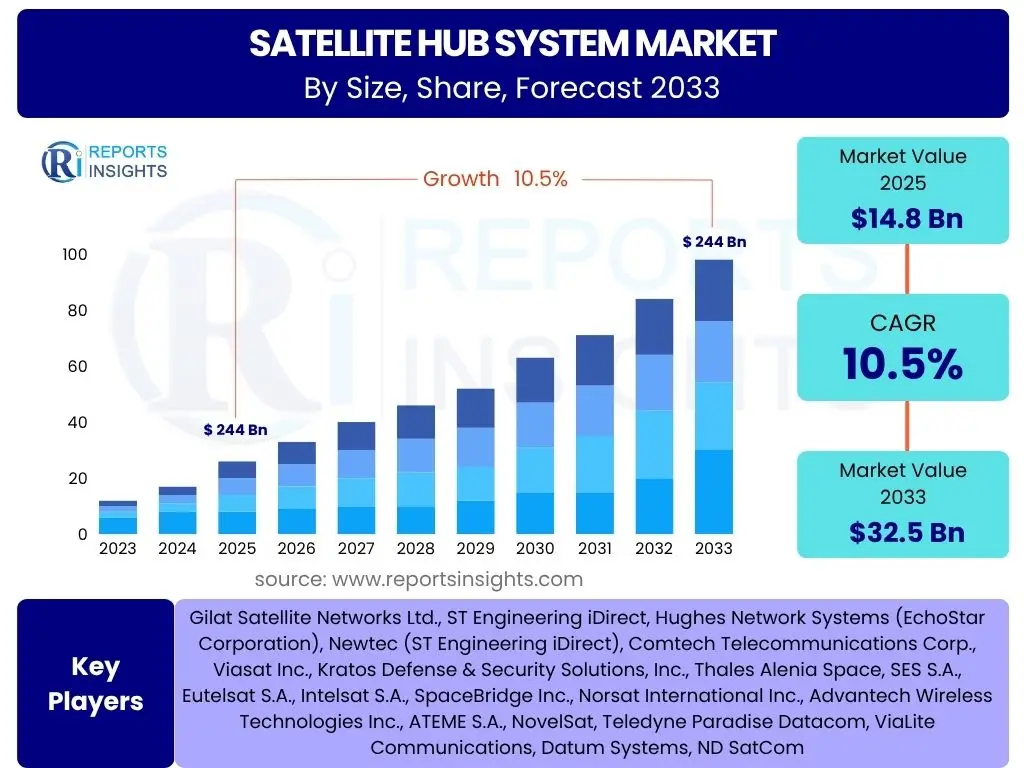

According to Reports Insights Consulting Pvt Ltd, The Satellite Hub System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2033. The market is estimated at USD 14.8 Billion in 2025 and is projected to reach USD 32.5 Billion by the end of the forecast period in 2033.

Key Satellite Hub System Market Trends & Insights

The Satellite Hub System market is experiencing significant transformation driven by advancements in satellite technology and increasing demand for global connectivity. Key trends include the proliferation of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations, which necessitate more sophisticated and flexible ground segment infrastructure, including advanced hub systems capable of managing high-throughput and low-latency communications. There is a growing emphasis on software-defined networking (SDN) and network function virtualization (NFV) within satellite ground segments, enabling greater agility, scalability, and efficiency in hub operations. The integration of 5G networks and the expansion of IoT applications are also fueling the demand for robust satellite hub systems that can provide reliable backhaul and data processing capabilities across diverse sectors.

Another prominent trend is the increasing adoption of cloud-based solutions for managing satellite ground operations and data processing. This shift allows for more dynamic resource allocation, reduced operational expenditures, and enhanced data analytics capabilities. Furthermore, the market is witnessing a move towards multi-orbit and multi-band interoperability within hub systems, as operators seek to leverage the strengths of different satellite types (geostationary, LEO, MEO) and frequency bands to deliver optimized services. Cybersecurity remains a critical concern, leading to the development of more resilient and secure hub architectures. The overall market trajectory indicates a strong shift towards more intelligent, autonomous, and integrated satellite communication ecosystems.

- Proliferation of LEO and MEO satellite constellations driving demand for advanced ground segment infrastructure.

- Increased adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) for operational agility.

- Integration of satellite systems with 5G networks and IoT ecosystems for enhanced global connectivity.

- Growing trend towards cloud-based ground segment operations and data processing.

- Emphasis on multi-orbit and multi-band interoperability within satellite hub systems.

- Development of enhanced cybersecurity measures for resilient satellite ground operations.

- Shift towards intelligent and autonomous network management within hub systems.

AI Impact Analysis on Satellite Hub System

The integration of Artificial Intelligence (AI) is set to revolutionize Satellite Hub Systems by enhancing operational efficiency, optimizing resource allocation, and improving service delivery. Users frequently inquire about how AI can automate complex network management tasks, predict potential system failures, and dynamically adjust satellite bandwidth based on real-time demand. AI algorithms can process vast amounts of telemetry data from satellites and ground equipment, enabling predictive maintenance, anomaly detection, and proactive problem resolution, thereby minimizing downtime and maximizing network uptime. This capability is particularly crucial for the management of large and dynamic LEO/MEO constellations, where manual intervention is impractical.

Furthermore, AI plays a pivotal role in optimizing spectrum utilization and mitigating interference, allowing satellite hub systems to make more efficient use of available frequencies. Users also show interest in AI's potential for intelligent traffic management, quality of service (QoS) optimization, and advanced cybersecurity threat detection. AI-driven analytics can identify patterns in network usage, allowing for optimized routing and allocation of resources to meet specific application requirements. For instance, AI can dynamically prioritize critical communications or reconfigure network paths to bypass congested areas, ensuring seamless data flow. The technology also strengthens security postures by identifying and neutralizing cyber threats in real-time, providing an indispensable layer of protection against sophisticated attacks on vital communication infrastructure.

- Automated network management and resource optimization, reducing operational expenditure and manual intervention.

- Predictive maintenance and anomaly detection for ground equipment and satellite links, enhancing system reliability.

- Real-time traffic management and Quality of Service (QoS) optimization for diverse applications.

- Enhanced spectrum utilization and interference mitigation through intelligent algorithms.

- Advanced cybersecurity threat detection and response capabilities, bolstering network security.

- Dynamic bandwidth allocation and intelligent routing based on demand and network conditions.

- Improved data analytics and insights from satellite telemetry for better decision-making.

Key Takeaways Satellite Hub System Market Size & Forecast

The Satellite Hub System market is poised for substantial growth over the next decade, driven by the escalating global demand for ubiquitous connectivity and the rapid expansion of satellite constellations beyond traditional geostationary orbits. A key takeaway is the significant projected increase in market valuation, reflecting a robust investment in ground infrastructure necessary to support the evolving satellite communication landscape. This growth is underpinned by advancements in technology, particularly in areas like software-defined networks and cloud integration, which are making satellite services more adaptable and cost-effective for a wider range of applications and end-users.

Another crucial insight is that the market's trajectory will be heavily influenced by both technological innovation and strategic regional deployments. While traditional regions like North America and Europe remain strongholds, emerging economies in Asia Pacific, Latin America, and the Middle East & Africa are set to contribute significantly to market expansion due to increasing internet penetration and government initiatives. The continuous development of new satellite services, including direct-to-device connectivity and enhanced IoT solutions, will further solidify the market's upward trend, emphasizing the critical role of sophisticated hub systems in delivering these next-generation capabilities.

- Strong projected market growth, driven by expanding satellite constellations and increasing global connectivity demands.

- Significant investment in ground infrastructure, including advanced hub systems, is crucial for market expansion.

- Technological advancements in SDN, NFV, and cloud integration are key enablers for market growth.

- Emerging economies are anticipated to be significant growth drivers alongside established markets.

- The market is shifting towards supporting a wider array of satellite services, including direct-to-device and IoT.

- Increasing focus on efficiency, flexibility, and security in hub system design and operations.

Satellite Hub System Market Drivers Analysis

The Satellite Hub System market is profoundly influenced by several key drivers that are propelling its growth and technological evolution. A primary driver is the exponentially increasing global demand for high-speed internet connectivity, particularly in remote and underserved areas, which often lack adequate terrestrial infrastructure. This demand is further amplified by the proliferation of bandwidth-intensive applications such as streaming video, cloud computing, and advanced enterprise communications, necessitating robust and scalable satellite backhaul solutions. The ongoing deployment of thousands of new LEO and MEO satellites, forming megaconstellations, inherently requires a corresponding expansion and upgrade of ground segment infrastructure, including sophisticated hub systems, to manage the increased data traffic and connectivity demands.

Additionally, the burgeoning adoption of IoT devices and the rollout of 5G networks globally are creating significant opportunities for satellite hub systems. Satellites offer an unparalleled advantage in providing ubiquitous connectivity for IoT sensors deployed across vast geographical areas, from smart agriculture to maritime logistics, requiring centralized hub capabilities for data aggregation and processing. Similarly, satellite backhaul is becoming a vital component for extending 5G coverage to rural and remote regions, ensuring continuous and reliable connectivity where fiber or microwave links are impractical. Government initiatives and defense spending on secure and resilient satellite communications also contribute significantly, as these sectors rely heavily on advanced satellite hub systems for mission-critical operations, disaster response, and national security.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Surge in Global Demand for High-Speed Connectivity | +2.1% | Global, particularly emerging markets | 2025-2033 (Long-term) |

| Deployment of LEO & MEO Satellite Megaconstellations | +1.8% | Global, North America, Europe, Asia Pacific | 2025-2030 (Medium-term) |

| Expansion of IoT and 5G Network Rollouts | +1.5% | Global, Asia Pacific, North America, Europe | 2026-2033 (Long-term) |

| Increasing Need for Secure & Resilient Communications (Defense, Government) | +1.2% | North America, Europe, Middle East | 2025-2033 (Long-term) |

| Technological Advancements in Satellite Technology (HTS, VHTS) | +1.0% | Global | 2025-2030 (Medium-term) |

| Growing Adoption of Cloud-Based Ground Segment Solutions | +0.9% | North America, Europe, Asia Pacific | 2027-2033 (Long-term) |

Satellite Hub System Market Restraints Analysis

Despite significant growth drivers, the Satellite Hub System market faces several restraints that could impede its full potential. A primary concern is the substantial capital expenditure required for establishing and upgrading satellite ground infrastructure, including hub systems. The high initial investment in specialized hardware, software, and real estate for ground stations can be a barrier for new entrants and can slow down the adoption of advanced technologies by smaller service providers. This high cost is compounded by the need for continuous investment in research and development to keep pace with rapidly evolving satellite technologies and communication standards, leading to a long return on investment period.

Another significant restraint is the complexity of regulatory frameworks and spectrum allocation policies across different countries and regions. Navigating a fragmented regulatory landscape, obtaining necessary licenses, and adhering to diverse national and international communication laws can be time-consuming and costly, potentially delaying market entry or expansion for satellite service providers. Furthermore, the inherent technical complexity of designing, deploying, and maintaining sophisticated satellite hub systems, which involve integrating various hardware and software components from multiple vendors, poses a challenge. This complexity requires a highly skilled workforce, which is often in short supply, and can lead to operational challenges and increased maintenance costs, thereby impacting the overall market growth.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Expenditure & Operational Costs | -1.5% | Global, particularly developing regions | 2025-2033 (Long-term) |

| Complex Regulatory & Spectrum Allocation Frameworks | -1.3% | Global, especially highly regulated markets | 2025-2030 (Medium-term) |

| Technical Complexity and Integration Challenges | -1.0% | Global | 2025-2030 (Medium-term) |

| Scarcity of Skilled Workforce & Technical Expertise | -0.8% | Global | 2026-2033 (Long-term) |

| Cybersecurity Threats and Data Privacy Concerns | -0.7% | Global | 2025-2033 (Long-term) |

| Competition from Terrestrial Communication Networks | -0.5% | Urban areas, developed regions | 2025-2030 (Medium-term) |

Satellite Hub System Market Opportunities Analysis

The Satellite Hub System market presents significant growth opportunities driven by emerging technological advancements and evolving connectivity demands. A major opportunity lies in the burgeoning market for Non-Terrestrial Networks (NTN) integration, particularly with 5G and future 6G cellular standards. This integration allows satellite hub systems to serve as crucial backhaul for mobile networks in unserved or underserved areas, extending cellular coverage globally and enabling new applications like direct-to-device communication, thereby expanding the potential customer base for satellite services beyond traditional enterprise users.

Another key opportunity stems from the increasing demand for High Throughput Satellite (HTS) and Very High Throughput Satellite (VHTS) services across various applications such as commercial aviation, maritime, and oil & gas exploration. These services require highly advanced and scalable hub systems capable of managing massive data volumes and complex network architectures, creating a strong market for upgrades and new deployments. Furthermore, the development of software-defined ground segments and virtualization technologies offers opportunities for service providers to build more agile, flexible, and cost-efficient hub solutions, attracting new investments and fostering innovation in operational models. The expanding market for IoT and M2M communications also provides a lucrative niche, as satellite hub systems are essential for collecting, processing, and distributing data from a vast array of remote sensors and devices globally.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration with 5G and Non-Terrestrial Networks (NTN) | +1.8% | Global, Asia Pacific, North America | 2026-2033 (Long-term) |

| Growing Demand for High Throughput Satellite (HTS) Services | +1.5% | Global, particularly Maritime, Aviation, Energy sectors | 2025-2030 (Medium-term) |

| Development of Software-Defined Ground Segment Architectures | +1.3% | Global, North America, Europe | 2027-2033 (Long-term) |

| Expansion into New Verticals (e.g., Autonomous Vehicles, Disaster Recovery) | +1.1% | Global | 2028-2033 (Long-term) |

| Increased Adoption in Emerging Markets for Digital Inclusion | +1.0% | Asia Pacific, Latin America, Africa | 2025-2033 (Long-term) |

| Advancements in AI/ML for Network Automation & Optimization | +0.9% | Global | 2027-2033 (Long-term) |

Satellite Hub System Market Challenges Impact Analysis

The Satellite Hub System market faces several inherent challenges that require innovative solutions and strategic planning. One significant challenge is managing the increasing complexity and interoperability demands arising from the proliferation of multi-orbit and multi-band satellite constellations. Hub systems must seamlessly integrate with satellites operating in LEO, MEO, and GEO orbits, often across different frequency bands (Ka, Ku, C, X-band), which introduces considerable technical hurdles in design, implementation, and network management. Ensuring efficient handovers between satellites in dynamic LEO/MEO networks and maintaining consistent service quality across diverse platforms adds layers of complexity that impact development cycles and operational costs.

Another major challenge is the constant threat of cyberattacks and the imperative to ensure robust cybersecurity for critical communication infrastructure. Satellite hub systems are prime targets due to their central role in network operations and data flow, making them vulnerable to sophisticated cyber threats that could compromise data integrity, network availability, or even national security. Furthermore, spectrum congestion, particularly in sought-after frequency bands, presents a continuous challenge for satellite operators. As more satellites and terrestrial services compete for limited spectrum resources, ensuring efficient and interference-free operation of hub systems becomes increasingly difficult, potentially limiting capacity expansion and service quality in dense operational environments. The rapid pace of technological obsolescence in both satellite and ground segment hardware also poses a challenge, requiring significant and frequent investments in upgrades to maintain competitive advantages and support next-generation services.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complexity of Multi-Orbit and Multi-Band Interoperability | -1.2% | Global | 2025-2030 (Medium-term) |

| Ensuring Robust Cybersecurity Against Evolving Threats | -1.1% | Global | 2025-2033 (Long-term) |

| Spectrum Congestion and Interference Management | -0.9% | Global, particularly dense operational areas | 2025-2033 (Long-term) |

| High Research & Development Costs and Rapid Technological Obsolescence | -0.8% | Global | 2025-2030 (Medium-term) |

| Standardization and Harmonization Across Global Networks | -0.7% | Global | 2026-2033 (Long-term) |

| Integration with Legacy Systems and Infrastructure | -0.6% | Global, particularly mature markets | 2025-2030 (Medium-term) |

Satellite Hub System Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the Satellite Hub System market, examining its current landscape, future growth trajectories, and key influencing factors. It covers market size and forecast from 2025 to 2033, including historical data from 2019 to 2023, to offer a complete understanding of market dynamics. The study delves into various market segments, including components, applications, end-users, and frequency bands, providing granular insights into their respective contributions and growth potential. It also includes an extensive regional analysis, highlighting major market players and their strategies, along with a detailed impact assessment of drivers, restraints, opportunities, and challenges affecting the industry.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 14.8 Billion |

| Market Forecast in 2033 | USD 32.5 Billion |

| Growth Rate | 10.5% CAGR |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Gilat Satellite Networks Ltd., ST Engineering iDirect, Hughes Network Systems (EchoStar Corporation), Newtec (ST Engineering iDirect), Comtech Telecommunications Corp., Viasat Inc., Kratos Defense & Security Solutions, Inc., Thales Alenia Space, SES S.A., Eutelsat S.A., Intelsat S.A., SpaceBridge Inc., Norsat International Inc., Advantech Wireless Technologies Inc., ATEME S.A., NovelSat, Teledyne Paradise Datacom, ViaLite Communications, Datum Systems, ND SatCom |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Satellite Hub System market is extensively segmented to provide a detailed understanding of its diverse components and applications. This segmentation highlights the various technological solutions, service delivery models, and end-user requirements that collectively drive market dynamics. By breaking down the market into its core elements, this analysis offers granular insights into specific growth areas and investment opportunities within the broader satellite communication ecosystem.

Understanding these segments is critical for stakeholders to identify niche markets, develop targeted strategies, and align their offerings with specific industry needs. For instance, the distinction between hardware, software, and services components reveals where technological innovation and service delivery models are creating the most value. Similarly, analyzing the market by application areas such as broadcasting or broadband, and by end-user industries ranging from telecommunications to government, provides a comprehensive view of how satellite hub systems are being deployed and utilized across various sectors, enabling more precise market forecasting and strategic planning.

- By Component

- Hardware (Antennas, Modems, Routers, Servers, Power Amplifiers, Converters, Other Equipment)

- Software (Network Management Software, Orchestration Software, Data Analytics Software)

- Services (Installation & Integration, Maintenance & Support, Managed Services)

- By Application

- Broadcasting (TV & Radio Distribution, Content Contribution)

- Broadband (Consumer Broadband, Enterprise Broadband, Backhaul for Terrestrial Networks)

- Enterprise Connectivity (Corporate Networks, SCADA, POS)

- Mobile Satellite Services (Maritime, Aeronautical, Land Mobile)

- Government & Defense (Secure Communications, ISR, Border Security)

- Oil & Gas

- Mining

- Other Industrial Applications

- By End-User

- Telecommunication Companies

- Internet Service Providers

- Broadcasting & Media Organizations

- Government & Military

- Maritime

- Aviation

- Energy & Utilities

- Enterprise (Corporate, Retail, Logistics)

- By Frequency Band

- C-band

- Ku-band

- Ka-band

- X-band

- L-band

- Other Bands (e.g., Q/V-band)

- By Orbit Type

- Geostationary Earth Orbit (GEO)

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

Regional Highlights

- North America: This region is a dominant market due to early adoption of advanced satellite technologies, significant defense spending on satellite communications, and the presence of major satellite operators and ground segment providers. The demand for broadband connectivity in remote areas and the deployment of LEO constellations are key growth drivers.

- Europe: Characterized by strong government and military applications, maritime communications, and increasing adoption of satellite broadband, Europe represents a mature but growing market. Regulatory support for satellite services and investment in next-generation satellite technologies also contribute to its market share.

- Asia Pacific (APAC): Expected to witness the highest growth rate, driven by massive investments in digital infrastructure, increasing internet penetration in developing economies, and the rising demand for satellite broadband in rural and remote areas. Countries like China, India, and Australia are leading the expansion.

- Latin America: This region presents significant opportunities due to increasing demand for connectivity in underserved areas, growth in the oil & gas sector, and rising adoption of satellite services for enterprise communication and broadcasting. Brazil and Mexico are key markets.

- Middle East and Africa (MEA): Emerging as a high-growth region, fueled by expanding telecom infrastructure, increasing demand for reliable communication in remote and conflict zones, and growing investments in satellite broadband for digital inclusion and smart city initiatives. Government and defense sectors are significant contributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite Hub System Market.- Gilat Satellite Networks Ltd.

- ST Engineering iDirect

- Hughes Network Systems (EchoStar Corporation)

- Comtech Telecommunications Corp.

- Viasat Inc.

- Kratos Defense & Security Solutions, Inc.

- Thales Alenia Space

- SES S.A.

- Eutelsat S.A.

- Intelsat S.A.

- SpaceBridge Inc.

- Norsat International Inc.

- Advantech Wireless Technologies Inc.

- ATEME S.A.

- NovelSat

- Teledyne Paradise Datacom

- ViaLite Communications

- Datum Systems

- ND SatCom

- Speedcast

Frequently Asked Questions

Analyze common user questions about the Satellite Hub System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Satellite Hub System?

A Satellite Hub System, also known as a VSAT Hub or Satellite Gateway, is the central ground infrastructure that manages and controls communication with a network of remote satellite terminals. It comprises antennas, modems, routers, servers, and software, enabling the processing, routing, and management of data traffic between satellite networks and terrestrial networks like the internet or corporate intranets.

Why is the Satellite Hub System Market growing?

The market is growing primarily due to the escalating global demand for ubiquitous internet connectivity, especially in remote and underserved areas, coupled with the rapid deployment of new LEO and MEO satellite megaconstellations. Additionally, the increasing integration of satellite communications with 5G networks, IoT applications, and the need for secure government and defense communications are significant drivers.

How does AI impact Satellite Hub Systems?

AI significantly impacts Satellite Hub Systems by enabling automated network management, predictive maintenance, and real-time resource optimization. It enhances efficiency in spectrum utilization, improves Quality of Service (QoS) through intelligent traffic routing, and bolsters cybersecurity by rapidly detecting and responding to threats, reducing operational costs and maximizing network uptime.

What are the key challenges in the Satellite Hub System Market?

Key challenges include the high capital expenditure for deployment and upgrades, the complexity of integrating multi-orbit and multi-band satellite systems, navigating fragmented regulatory frameworks and spectrum allocation policies, and ensuring robust cybersecurity against evolving threats. Additionally, the scarcity of a skilled workforce and rapid technological obsolescence pose ongoing challenges.

Which regions are key players in the Satellite Hub System Market?

North America and Europe are established markets with significant technological advancements and defense spending. Asia Pacific is emerging as a high-growth region due to increasing internet penetration and digital infrastructure investments. Latin America and the Middle East & Africa are also showing considerable growth driven by expanding connectivity needs and government initiatives.