Rolled Ring Market

Rolled Ring Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701442 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Rolled Ring Market Size

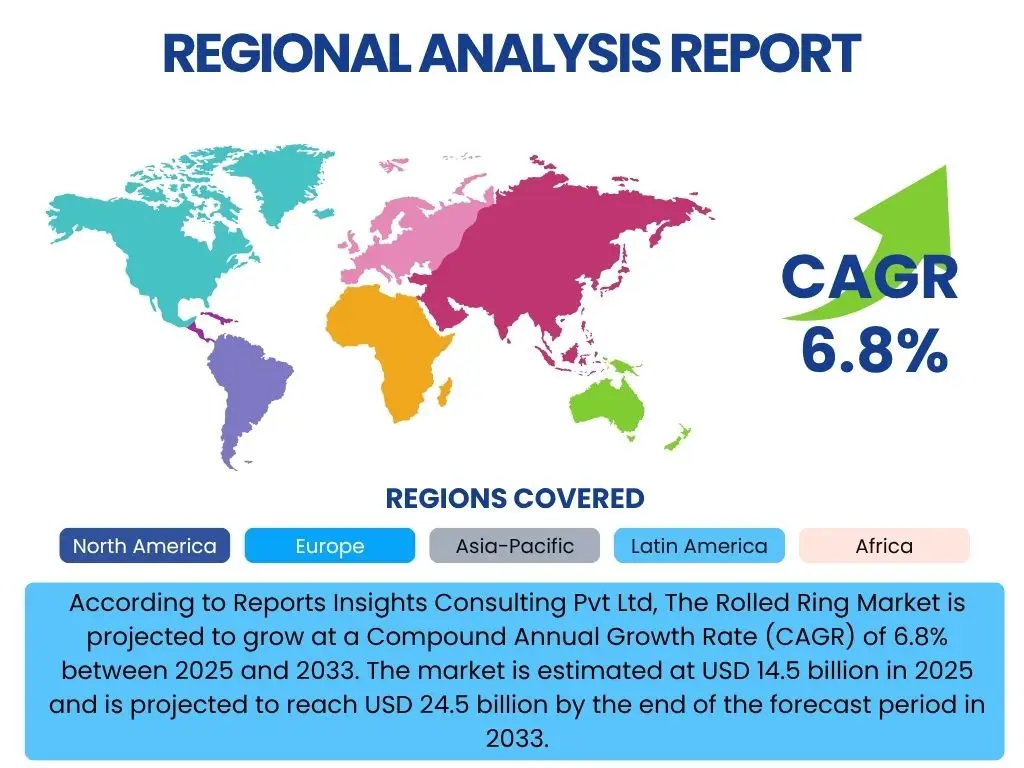

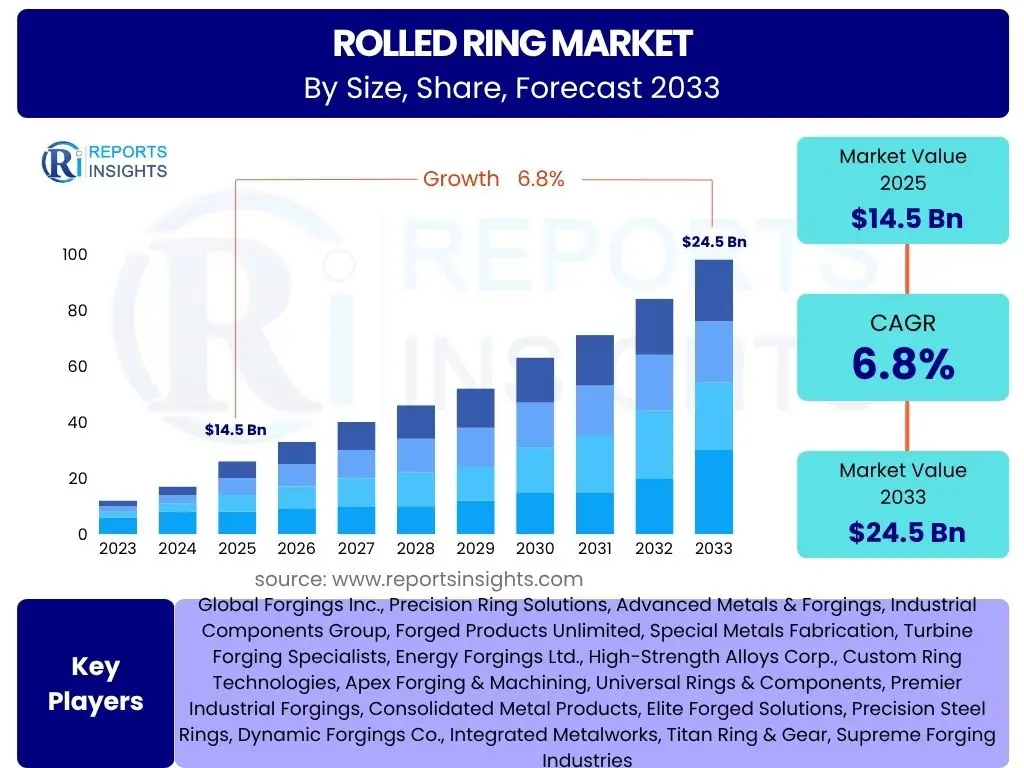

According to Reports Insights Consulting Pvt Ltd, The Rolled Ring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 14.5 billion in 2025 and is projected to reach USD 24.5 billion by the end of the forecast period in 2033.

Key Rolled Ring Market Trends & Insights

The Rolled Ring market is currently experiencing significant shifts driven by advancements in material science and manufacturing processes, alongside evolving demands from key end-use industries. A primary trend involves the increasing adoption of high-performance alloys, such as superalloys and advanced stainless steels, to meet the stringent requirements of aerospace, defense, and power generation sectors for components exhibiting superior strength, corrosion resistance, and thermal stability. This demand is further fueled by the push for lighter, more efficient machinery and infrastructure. Moreover, the integration of automation and digitalization within the manufacturing workflow is optimizing production efficiency and quality control.

Another pivotal trend is the growing emphasis on customization and precision engineering. Customers increasingly require rolled rings with highly specific dimensions, metallurgical properties, and surface finishes for specialized applications, prompting manufacturers to invest in advanced forging and rolling technologies. Furthermore, sustainability initiatives are influencing material selection and production methods, leading to a greater focus on recyclable materials and energy-efficient processes. The expansion of renewable energy infrastructure, particularly wind power and hydropower, is also creating new avenues for high-strength, durable rolled rings in large-scale turbine components and transmission systems, contributing significantly to market expansion.

The market also observes a geographical shift in manufacturing capabilities and consumption patterns. While established markets in North America and Europe continue to innovate and demand high-value specialized products, the Asia Pacific region is witnessing robust growth driven by rapid industrialization, infrastructure development, and burgeoning aerospace and defense expenditures. This regional dynamism is creating competitive pressures, encouraging global manufacturers to establish local production facilities or forge strategic partnerships to cater to diverse regional demands and capitalize on emerging opportunities.

- Increasing demand for high-performance alloys in critical applications.

- Rising adoption of automation and digitalization in manufacturing processes.

- Growing emphasis on customization and precision engineering.

- Expansion of renewable energy infrastructure, particularly wind power.

- Focus on sustainable manufacturing practices and recyclable materials.

- Shifting manufacturing hubs and consumption patterns towards Asia Pacific.

- Integration of advanced non-destructive testing (NDT) techniques for quality assurance.

AI Impact Analysis on Rolled Ring

The integration of Artificial Intelligence (AI) is set to revolutionize various facets of the Rolled Ring market, fundamentally transforming design, manufacturing, and supply chain operations. Users are keenly interested in how AI can enhance operational efficiency, improve product quality, and reduce costs. AI algorithms, particularly machine learning models, can optimize forging and rolling parameters by analyzing vast datasets of material properties, temperature, pressure, and deformation rates. This predictive optimization leads to more consistent product quality, minimizes material waste, and reduces energy consumption during the manufacturing process. Predictive maintenance, another significant application, utilizes AI to monitor equipment health and predict potential failures, thereby reducing downtime and extending machinery lifespan, which is critical for continuous production in heavy industries.

Furthermore, AI significantly impacts quality control and inspection processes. Computer vision systems powered by AI can detect microscopic defects or anomalies on the surface or within the structure of rolled rings with greater speed and accuracy than traditional methods. This ensures that only high-quality components proceed to subsequent stages or reach end-users, enhancing product reliability and safety, especially for critical applications in aerospace and defense. Users also anticipate AI's role in accelerating the research and development of new alloys and materials, as AI can simulate material behaviors under various stress conditions and predict optimal compositions, significantly shortening development cycles for advanced rolled ring products.

Beyond the factory floor, AI's influence extends to supply chain management and demand forecasting. AI-driven analytics can optimize raw material procurement, inventory levels, and logistics, ensuring a smoother and more resilient supply chain. This helps manufacturers navigate volatile raw material markets and respond more effectively to fluctuating customer demands. Moreover, generative AI models could assist in the design phase, proposing innovative geometries and structural designs for rolled rings tailored to specific performance requirements, thereby fostering innovation and competitive differentiation within the market. The overarching expectation is that AI will drive a new era of efficiency, precision, and intelligence across the Rolled Ring value chain.

- Optimization of forging and rolling parameters for enhanced efficiency and quality.

- Implementation of AI-driven predictive maintenance for machinery, reducing downtime.

- Advanced quality control and defect detection through AI-powered computer vision.

- Acceleration of new material development and alloy composition optimization using AI.

- Improved supply chain management, demand forecasting, and inventory optimization.

- Potential for generative AI in innovative rolled ring design and engineering.

- Enhanced energy efficiency and waste reduction in production processes.

Key Takeaways Rolled Ring Market Size & Forecast

The Rolled Ring market is poised for robust growth through 2033, driven primarily by strong demand from key industrial sectors requiring high-performance, durable components. A significant takeaway is the market's resilience and adaptability, evidenced by its continuous innovation in material science and manufacturing technologies to meet increasingly stringent application requirements. The projected growth reflects a global upsurge in infrastructure development, increased defense spending, and a sustained focus on renewable energy projects, all of which are heavy consumers of large, high-quality rolled rings. Furthermore, the market's expansion is not uniform, with emerging economies, particularly in the Asia Pacific region, emerging as critical growth engines.

Another crucial insight is the strategic importance of technological advancements in shaping the market landscape. Investments in automation, AI integration, and advanced metallurgical processes are becoming imperative for manufacturers to maintain competitiveness and address demands for precision and customization. The market's future will largely depend on the ability of key players to innovate in product development, enhance operational efficiencies, and navigate complex supply chain dynamics, including raw material price volatility and environmental regulations. These factors underscore a shift towards more sophisticated manufacturing ecosystems that prioritize both performance and sustainability.

In summary, the Rolled Ring market is set for considerable expansion, with a strong emphasis on specialized applications and technological innovation. Manufacturers are increasingly focusing on adding value through precision engineering, superior material properties, and integrated digital solutions. The forecast suggests that while traditional end-use sectors will remain foundational, new opportunities in emerging industries like offshore wind and advanced aerospace will provide significant impetus for growth. Successfully leveraging these opportunities, alongside managing operational complexities and environmental considerations, will be central to sustained market leadership and profitability over the forecast period.

- The market is projected to grow significantly, reaching USD 24.5 billion by 2033.

- Strong demand from aerospace, defense, power generation, and industrial machinery sectors is a primary driver.

- Technological advancements in material science and manufacturing are critical for market evolution.

- Asia Pacific is expected to be a major growth region due to industrialization and infrastructure development.

- Increased focus on customized, high-precision, and high-performance rolled rings.

- Sustainability and energy efficiency in production are gaining importance.

- AI and automation integration will play a vital role in optimizing manufacturing and quality.

Rolled Ring Market Drivers Analysis

The Rolled Ring market is propelled by a confluence of robust demand from critical end-use industries, ongoing technological advancements, and increasing global infrastructure development. The aerospace and defense sector, characterized by its stringent requirements for high-strength, lightweight, and fatigue-resistant components, is a significant driver, with rolled rings being indispensable for jet engine components, missile casings, and structural elements. Similarly, the power generation industry, including conventional, nuclear, and renewable energy (e.g., wind turbine shafts, generator rings), relies heavily on the durability and reliability of large-diameter rolled rings, especially as investments in renewable energy infrastructure continue to escalate globally.

Furthermore, the growth in heavy industrial machinery, construction equipment, and the oil and gas sector (e.g., flanges, valve bodies, drilling components) consistently fuels the demand for robust and precisely engineered rolled rings capable of withstanding extreme operational conditions. The continuous expansion of urban infrastructure and industrial capabilities worldwide necessitates a steady supply of these foundational components. Material innovation, particularly the development of advanced alloys and superalloys that offer enhanced performance characteristics such as higher strength-to-weight ratios, improved corrosion resistance, and better thermal stability, also acts as a key driver, expanding the applicability and market scope of rolled rings into more demanding environments.

Finally, the increasing adoption of automated and precision manufacturing processes, including hot rolling and ring forging technologies, enables manufacturers to produce more complex geometries and tighter tolerances, meeting the evolving demands of advanced applications. These technological improvements not only enhance product quality but also improve production efficiency and reduce waste, making rolled rings a more cost-effective and reliable solution for a broader range of industrial needs. The convergence of these factors creates a fertile ground for sustained market growth over the forecast period.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Aerospace & Defense Industry | +1.5% | North America, Europe, Asia Pacific | Medium to Long-term (2025-2033) |

| Expansion of Power Generation (Renewable Energy) | +1.2% | Europe, Asia Pacific, North America | Medium to Long-term (2025-2033) |

| Increasing Industrial Machinery & Heavy Equipment Demand | +1.0% | Asia Pacific, North America, Europe | Medium to Long-term (2025-2033) |

| Technological Advancements in Materials & Manufacturing | +0.8% | Global | Short to Long-term (2025-2033) |

| Global Infrastructure Development | +0.7% | Asia Pacific, Latin America, MEA | Medium to Long-term (2025-2033) |

Rolled Ring Market Restraints Analysis

Despite robust growth prospects, the Rolled Ring market faces several significant restraints that could temper its expansion. One primary concern is the volatility of raw material prices, particularly for critical metals such as steel, nickel, chromium, and other alloying elements. Fluctuations in commodity markets, influenced by global supply-demand dynamics, geopolitical events, and trade policies, directly impact the production costs of rolled rings. This unpredictability in material costs can compress profit margins for manufacturers and lead to price instability for end-users, potentially hindering investment in large-scale projects that rely on these components.

Another significant restraint is the high capital expenditure required for setting up and maintaining advanced rolled ring manufacturing facilities. The machinery involved in forging, rolling, heat treatment, and precision machining is highly specialized and expensive. This substantial investment acts as a significant barrier to entry for new players and can limit the expansion capabilities of existing smaller manufacturers. Furthermore, the energy-intensive nature of the manufacturing process, particularly hot rolling and heat treatment, contributes significantly to operational costs. Rising energy prices, influenced by global energy markets and environmental regulations, can therefore exert considerable pressure on manufacturers' profitability and pricing strategies.

Additionally, stringent environmental regulations regarding emissions, waste disposal, and energy consumption pose operational challenges for manufacturers. Compliance with these regulations often necessitates costly upgrades to facilities and processes, adding to the overall cost of production. The availability of skilled labor for operating and maintaining complex machinery, as well as for specialized metallurgical processes, is also a growing concern in many regions, potentially impacting production capacities and efficiency. These combined factors present ongoing challenges that manufacturers must strategically address to ensure sustainable growth within the rolled ring market.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Raw Material Price Volatility | -0.8% | Global | Short to Medium-term (2025-2029) |

| High Capital & Operational Costs | -0.7% | Global | Long-term (2025-2033) |

| Stringent Environmental Regulations | -0.5% | Europe, North America, China | Medium to Long-term (2025-2033) |

| Skilled Labor Shortage | -0.4% | North America, Europe, Japan | Medium to Long-term (2025-2033) |

Rolled Ring Market Opportunities Analysis

The Rolled Ring market is poised to capitalize on several significant opportunities, driven by evolving industrial landscapes and technological advancements. One major opportunity lies in the continued growth of the renewable energy sector, particularly in offshore wind power generation. Large-diameter, high-strength rolled rings are essential components for wind turbine main shafts, bearings, and gearbox systems. As countries globally commit to reducing carbon emissions and investing heavily in green energy infrastructure, the demand for these specialized rings is expected to surge, offering substantial avenues for market expansion, especially for manufacturers capable of producing very large and precise components.

Another key opportunity emerges from the increasing demand for lightweight and high-performance materials in advanced applications, notably in the aerospace and defense industries. The development and commercialization of new superalloys, titanium alloys, and advanced stainless steels require specialized forming techniques, where rolled ring forging often excels in producing superior metallurgical properties and grain structures. This trend opens doors for manufacturers to innovate in material processing and offer higher-value, customized solutions for next-generation aircraft engines, spacecraft, and military equipment, moving beyond standard commodity products into specialized, niche markets.

Furthermore, emerging economies in Asia Pacific, Latin America, and the Middle East continue to present significant growth opportunities. Rapid industrialization, urbanization, and large-scale infrastructure projects in these regions are driving substantial demand for machinery, power generation equipment, and transportation components, all of which utilize rolled rings. Localized manufacturing, strategic partnerships, and tailored product offerings that address regional specificities can enable market players to effectively penetrate and expand their presence in these burgeoning markets. The ongoing focus on industrial upgrades and modernization globally also provides avenues for replacing older components with more efficient and durable rolled rings, creating a consistent replacement market.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Renewable Energy Sector (Wind, Hydro) | +1.3% | Europe, Asia Pacific, North America | Medium to Long-term (2026-2033) |

| Increased Demand for Advanced Materials (Superalloys, Titanium) | +1.0% | North America, Europe, Japan | Medium to Long-term (2025-2033) |

| Expansion in Emerging Economies (Industrialization, Infrastructure) | +0.9% | Asia Pacific, Latin America, MEA | Medium to Long-term (2025-2033) |

| Technological Innovation in Manufacturing Processes | +0.6% | Global | Short to Medium-term (2025-2030) |

Rolled Ring Market Challenges Impact Analysis

The Rolled Ring market faces several inherent challenges that can impact its growth trajectory and competitive landscape. Intense competition from both established global players and regional manufacturers is a primary concern. The market is often characterized by high product customization and strong customer relationships, making it challenging for new entrants to gain significant market share. Moreover, the presence of alternative manufacturing processes, such as casting or traditional forging for certain applications, means that rolled ring manufacturers must continuously demonstrate the superior metallurgical properties, precision, and cost-effectiveness of their products to retain market preference. This competitive pressure often leads to pricing pressures and necessitates ongoing investment in R&D.

Another significant challenge is the complexity of the global supply chain, particularly for raw materials and specialized equipment. Disruptions caused by geopolitical tensions, natural disasters, trade disputes, or pandemics can severely impact the availability and pricing of essential inputs, leading to production delays and increased costs. Manufacturers must navigate intricate logistics, diverse regulatory frameworks, and currency fluctuations, adding layers of complexity to their operations. Ensuring a resilient and diversified supply chain is paramount but remains a constant operational hurdle for market participants.

Furthermore, the high capital investment required for machinery and facilities, coupled with the need for highly skilled labor, presents a substantial barrier to scalability and rapid market response. Training and retaining talent capable of operating advanced forging and rolling equipment, as well as conducting sophisticated metallurgical analysis, is an ongoing challenge in many industrial regions. Adherence to strict quality standards and certifications, especially for critical applications in aerospace and defense, also adds to operational complexity and cost. These multifaceted challenges demand robust strategic planning, continuous innovation, and strong operational excellence from manufacturers to sustain growth and competitive advantage in the Rolled Ring market.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition | -0.9% | Global | Short to Long-term (2025-2033) |

| Supply Chain Disruptions & Volatility | -0.7% | Global | Short to Medium-term (2025-2029) |

| High Entry Barriers & Capital Intensiveness | -0.6% | Global | Long-term (2025-2033) |

| Stringent Quality & Certification Requirements | -0.5% | North America, Europe | Long-term (2025-2033) |

Rolled Ring Market - Updated Report Scope

This comprehensive market research report on the Rolled Ring market provides an in-depth analysis of market size, trends, drivers, restraints, opportunities, and challenges across various segments and key geographies. It offers a strategic outlook on the market's trajectory from 2025 to 2033, incorporating insights from historical data and future projections. The report details the competitive landscape, profiles leading companies, and highlights the impact of emerging technologies like AI. Aimed at industry stakeholders, investors, and decision-makers, it delivers actionable insights to navigate market complexities and capitalize on growth avenues. The scope includes detailed segmentation by material, application, and end-use industry, providing a granular understanding of market dynamics.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 24.5 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Forgings Inc., Precision Ring Solutions, Advanced Metals & Forgings, Industrial Components Group, Forged Products Unlimited, Special Metals Fabrication, Turbine Forging Specialists, Energy Forgings Ltd., High-Strength Alloys Corp., Custom Ring Technologies, Apex Forging & Machining, Universal Rings & Components, Premier Industrial Forgings, Consolidated Metal Products, Elite Forged Solutions, Precision Steel Rings, Dynamic Forgings Co., Integrated Metalworks, Titan Ring & Gear, Supreme Forging Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Rolled Ring market is comprehensively segmented to provide a granular understanding of its dynamics, identifying key sub-markets and their distinct growth drivers. This segmentation allows for targeted strategic planning and investment decisions, reflecting the diverse applications and material requirements across various industries. The primary segmentation categories include material type, application, end-use industry, and manufacturing process, each revealing unique market characteristics and growth opportunities. By analyzing these segments, stakeholders can discern specific demand patterns and technological needs, enabling more precise market positioning and product development.

- By Material: This segment includes Carbon Steel, known for its versatility and cost-effectiveness; Alloy Steel, offering enhanced strength and toughness; Stainless Steel, preferred for its corrosion resistance; Superalloys (Nickel-based, Cobalt-based, Iron-based), critical for high-temperature and extreme environment applications; Aluminum Alloys, valued for their lightweight properties; Titanium Alloys, crucial for aerospace due to high strength-to-weight ratio and corrosion resistance; and other specialized materials.

- By Application: Key applications include Bearings, essential for rotational machinery; Gears, for power transmission; Flanges, for pipe and pressure vessel connections; Pressure Vessels and Power Generation Components (Turbine Shafts, Generator Rotors), demanding high integrity; Heavy Equipment Components; Oil & Gas Components; and Aerospace Components (Engine Casings, Bearing Supports), requiring precision and reliability.

- By End-Use Industry: The market serves diverse sectors such as Aerospace & Defense, requiring high-performance and lightweight solutions; Power Generation (Wind, Thermal, Nuclear, Hydro), demanding large and durable rings; Oil & Gas, for robust and corrosion-resistant parts; Industrial Machinery & Equipment, for various mechanical components; Automotive & Transportation, for drivetrain and structural elements; Construction; Marine; and Mining, all of which rely on the strength and durability of rolled rings.

- By Manufacturing Process: This segment primarily differentiates between Hot Rolled and Cold Rolled processes, each offering distinct advantages in terms of material properties, surface finish, and cost-efficiency for specific applications.

Regional Highlights

- North America: A mature market characterized by high demand from the aerospace and defense sectors, coupled with significant investments in industrial machinery and oil & gas. The region leads in technological innovation and the adoption of advanced materials for high-value applications.

- Europe: A key hub for industrial machinery, automotive, and renewable energy sectors, particularly offshore wind. Stringent quality standards and a strong focus on sustainable manufacturing drive demand for high-precision, high-quality rolled rings. Germany, France, and the UK are prominent contributors.

- Asia Pacific (APAC): The fastest-growing region, driven by rapid industrialization, burgeoning infrastructure development, and increasing defense spending, notably in China, India, and Southeast Asian countries. The region is emerging as a global manufacturing powerhouse, fueling demand for both standard and specialized rolled rings.

- Latin America: Expected to witness steady growth, primarily influenced by investments in mining, oil & gas exploration, and infrastructure projects. Brazil and Mexico are key markets in this region.

- Middle East and Africa (MEA): Growth is largely spurred by significant investments in the oil & gas sector, power generation projects, and emerging industrial diversification initiatives, particularly in Saudi Arabia and the UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rolled Ring Market.- Global Forgings Inc.

- Precision Ring Solutions

- Advanced Metals & Forgings

- Industrial Components Group

- Forged Products Unlimited

- Special Metals Fabrication

- Turbine Forging Specialists

- Energy Forgings Ltd.

- High-Strength Alloys Corp.

- Custom Ring Technologies

- Apex Forging & Machining

- Universal Rings & Components

- Premier Industrial Forgings

- Consolidated Metal Products

- Elite Forged Solutions

- Precision Steel Rings

- Dynamic Forgings Co.

- Integrated Metalworks

- Titan Ring & Gear

- Supreme Forging Industries

Frequently Asked Questions

What is the projected growth rate of the Rolled Ring market?

The Rolled Ring market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033, reaching an estimated value of USD 24.5 billion by 2033.

Which industries are the primary drivers for the Rolled Ring market?

Key drivers for the Rolled Ring market include the aerospace & defense industry, power generation (especially renewable energy), heavy industrial machinery, and the oil & gas sector, all requiring high-performance, durable components.

How does AI impact the Rolled Ring manufacturing process?

AI significantly impacts Rolled Ring manufacturing by optimizing forging parameters, enabling predictive maintenance for machinery, enhancing quality control through computer vision, and accelerating the development of new materials and designs.

What are the main types of materials used in Rolled Ring production?

Common materials used in Rolled Ring production include carbon steel, alloy steel, stainless steel, superalloys (nickel-based, cobalt-based, iron-based), aluminum alloys, and titanium alloys, chosen based on application requirements for strength, corrosion, and temperature resistance.

Which geographic region is expected to show the highest growth in the Rolled Ring market?

The Asia Pacific (APAC) region is anticipated to exhibit the highest growth in the Rolled Ring market, driven by rapid industrialization, extensive infrastructure development, and increasing manufacturing activities in countries like China and India.