OEM and ODM Clothing Market

OEM and ODM Clothing Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703341 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

OEM and ODM Clothing Market Size

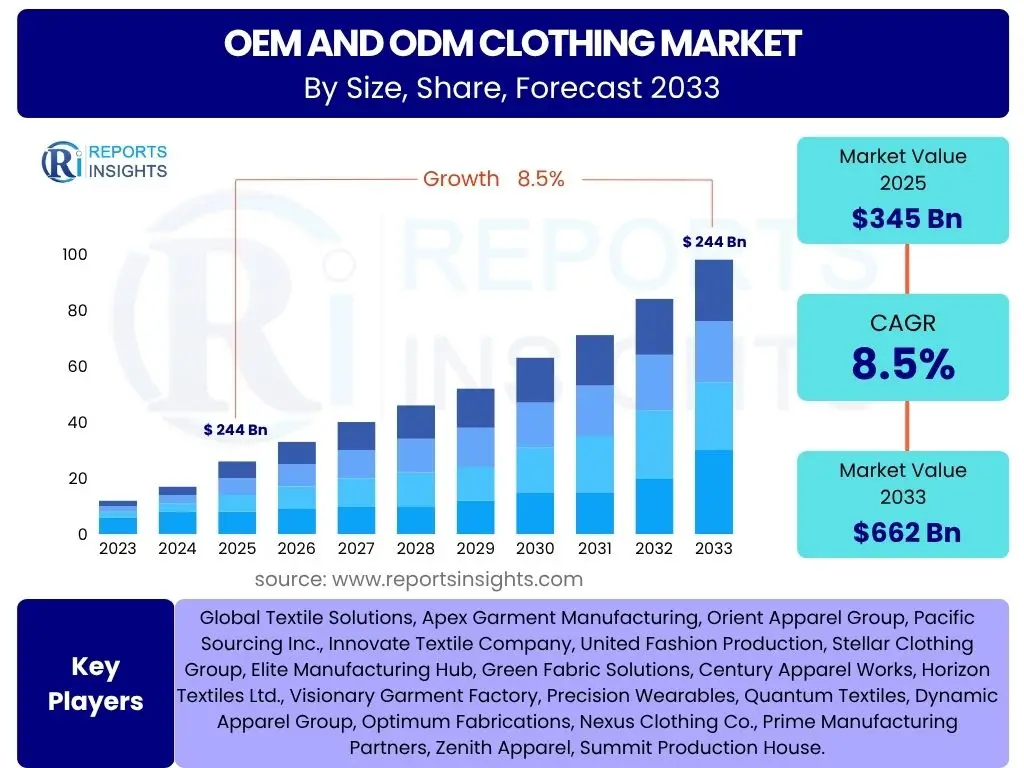

According to Reports Insights Consulting Pvt Ltd, The OEM and ODM Clothing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. The market is estimated at USD 345 Billion in 2025 and is projected to reach USD 662 Billion by the end of the forecast period in 2033.

Key OEM and ODM Clothing Market Trends & Insights

The OEM and ODM clothing market is undergoing significant transformation, driven by evolving consumer demands, technological advancements, and a heightened focus on ethical and sustainable practices. Users frequently inquire about the forces shaping this sector, particularly regarding supply chain resilience, innovation in materials, and the accelerating pace of fashion cycles. Key insights reveal a shift towards more agile and responsive manufacturing models, driven by the need for quicker time-to-market and reduced inventory risks. The traditional large-batch production is increasingly complemented by smaller, more frequent orders, enabling brands to test new designs and respond rapidly to trends.

Furthermore, there is a growing emphasis on transparency and traceability across the supply chain, as consumers and regulatory bodies demand greater accountability for social and environmental impact. This is pushing OEM and ODM manufacturers to invest in certifications, sustainable materials, and advanced monitoring systems. The digital transformation within manufacturing, encompassing everything from design to distribution, is also a predominant trend, leading to enhanced efficiency and customization capabilities.

- Shift towards demand-driven, agile manufacturing and smaller batch production.

- Increased adoption of sustainable and ethical manufacturing practices.

- Digitalization of the supply chain, including 3D design and virtual prototyping.

- Nearshoring and reshoring initiatives to enhance supply chain resilience and speed.

- Growing demand for personalized and customized clothing solutions.

AI Impact Analysis on OEM and ODM Clothing

User queries regarding artificial intelligence in the OEM and ODM clothing sector largely revolve around its potential to revolutionize design, production efficiency, supply chain management, and demand forecasting. There is a strong interest in how AI can optimize operational costs, enhance product quality, and enable greater personalization. Concerns also include the initial investment required, data privacy, and the reskilling of the workforce to leverage these new technologies effectively. The overarching expectation is that AI will be a critical enabler for smart factories and more responsive, data-driven manufacturing processes.

AI's influence is evident in several areas, from predictive analytics that minimize material waste and overproduction to intelligent automation in cutting and sewing. It allows for more precise demand forecasting, reducing lead times and ensuring optimal inventory levels. Furthermore, AI-powered quality control systems can detect defects with high accuracy, significantly improving product consistency and reducing returns. The integration of AI also facilitates mass customization, allowing manufacturers to cater to individual customer preferences at scale, thereby opening new market opportunities and enhancing customer satisfaction.

- Enhanced demand forecasting and inventory optimization through predictive analytics.

- Automation of design processes and virtual sampling, accelerating product development.

- Improved quality control and defect detection using computer vision.

- Optimization of production lines and resource allocation for increased efficiency.

- Personalization and mass customization capabilities driven by AI algorithms.

Key Takeaways OEM and ODM Clothing Market Size & Forecast

Analysis of user questions concerning the OEM and ODM clothing market size and forecast consistently highlights an interest in understanding the underlying drivers of growth, the resilience of supply chains, and the potential for new market entrants. There is a clear need for insights into how macroeconomic factors, technological shifts, and evolving consumer behavior will shape the market's trajectory. Users seek to identify strategic opportunities and potential risks associated with the projected growth, aiming to inform their investment decisions and long-term business planning.

The market's robust growth forecast is primarily underpinned by several factors. Brands are increasingly focusing on core competencies like marketing and design, outsourcing manufacturing to specialized OEM and ODM partners to leverage their expertise, scale, and cost efficiencies. The rise of e-commerce platforms and direct-to-consumer (DTC) brands further fuels this outsourcing trend, as these entities often lack in-house production capabilities. Additionally, the rapid pace of fashion trends necessitates agile and flexible manufacturing partners capable of quick turnarounds and diverse product offerings. The forecast indicates that manufacturers who can integrate technology, offer sustainable solutions, and maintain resilient global supply chains will be best positioned for success.

- Substantial market growth driven by outsourcing trends and brand focus on core activities.

- Increasing importance of supply chain agility and resilience in a dynamic global environment.

- Technology adoption, particularly AI and automation, will be critical for future competitiveness.

- Sustainability and ethical manufacturing practices are becoming non-negotiable for market players.

- Emerging markets offer significant growth opportunities for OEM and ODM partnerships.

OEM and ODM Clothing Market Drivers Analysis

The OEM and ODM clothing market is propelled by a confluence of powerful drivers that encourage brands to externalize their production. A primary driver is the increasing complexity and capital intensity of modern manufacturing, which often makes in-house production less cost-effective than leveraging the specialized infrastructure and expertise of OEM/ODM providers. Additionally, the rapid evolution of fashion cycles and the imperative for quick response times necessitate manufacturing partners who can scale operations efficiently and adapt swiftly to changing trends and consumer demands. The global expansion of e-commerce and direct-to-consumer models further fuels this demand, as many online brands lack the manufacturing infrastructure to produce their own lines.

Another significant factor is the desire for brands to focus on their core competencies, such as design, marketing, and brand building, leaving the intricacies of production to specialized manufacturers. This strategic outsourcing allows brands to allocate resources more effectively and reduce operational overheads. Moreover, the OEM/ODM model provides access to a global network of suppliers, specialized technologies, and diverse labor pools, offering flexibility in sourcing and production strategies. This includes access to advanced material innovations and manufacturing techniques that might be too costly or complex for individual brands to develop internally.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing brand focus on core competencies | +1.2% | Global | 2025-2033 |

| Growth of e-commerce and DTC brands | +1.0% | North America, Europe, Asia Pacific | 2025-2033 |

| Demand for faster lead times and quick response fashion | +0.9% | Global | 2025-2033 |

| Cost efficiency and economies of scale offered by OEM/ODM | +0.8% | Asia Pacific, Latin America | 2025-2033 |

| Access to specialized manufacturing technologies and expertise | +0.7% | Global | 2025-2033 |

OEM and ODM Clothing Market Restraints Analysis

Despite the robust growth trajectory, the OEM and ODM clothing market faces several significant restraints that could impede its expansion. One prominent restraint is the increasing geopolitical instability and trade protectionism, which can disrupt global supply chains, impose tariffs, and create uncertainty for manufacturers relying on international trade. Such factors complicate the logistics of material sourcing and product distribution, leading to higher operational costs and delayed deliveries. Furthermore, the rising labor costs in traditional manufacturing hubs, particularly in parts of Asia, are reducing the cost advantage that historically drew brands to these regions, pushing manufacturers to explore new, often less developed, production locations with their own set of challenges.

Another key restraint is the growing scrutiny over ethical labor practices and environmental sustainability within the fashion industry. Consumers, NGOs, and regulatory bodies are demanding greater transparency and accountability from manufacturers regarding working conditions, fair wages, and pollution. This pressure often necessitates significant investments in compliance, certifications, and sustainable technologies, which can increase production costs and complexity for OEM/ODM providers. Intellectual property infringement and design piracy also remain a persistent concern, particularly for brands relying on exclusive designs and for manufacturers who invest heavily in R&D for innovative textiles or production methods. These issues erode trust and can deter investment in new partnerships.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Geopolitical instability and trade protectionism | -0.8% | Global | 2025-2030 |

| Rising labor costs in key manufacturing regions | -0.7% | Asia Pacific | 2025-2033 |

| Stringent environmental regulations and compliance costs | -0.6% | Europe, North America | 2025-2033 |

| Supply chain disruptions and logistics challenges | -0.5% | Global | 2025-2028 |

| Intellectual property infringement and design piracy concerns | -0.4% | Asia Pacific | 2025-2033 |

OEM and ODM Clothing Market Opportunities Analysis

The OEM and ODM clothing market is ripe with opportunities for innovation and expansion, driven by evolving industry needs and technological advancements. One significant area of opportunity lies in the accelerating adoption of Industry 4.0 technologies, including AI, IoT, automation, and 3D printing. These technologies enable greater manufacturing efficiency, flexibility, and the capability for mass customization, allowing OEM/ODM providers to offer more advanced and tailored services to their brand partners. Companies that proactively invest in these digital transformation initiatives can significantly enhance their competitive edge and attract a broader range of high-value clients.

Furthermore, the global shift towards sustainable and circular fashion presents a transformative opportunity. As brands commit to reducing their environmental footprint, there is a growing demand for OEM/ODM manufacturers capable of working with recycled materials, implementing waste-reduction processes, and utilizing eco-friendly dyeing and finishing techniques. Providers offering certified sustainable production processes can tap into a burgeoning market segment and differentiate themselves significantly. Diversification into specialized niches, such as technical textiles for performance wear, smart clothing, or medical textiles, also represents a promising avenue for growth, leveraging specialized expertise and higher-value production.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Integration of Industry 4.0 technologies (AI, automation) | +1.5% | Global | 2025-2033 |

| Shift towards sustainable and circular manufacturing practices | +1.3% | Europe, North America, Asia Pacific | 2025-2033 |

| Expansion into technical textiles and smart clothing | +1.1% | Global | 2025-2033 |

| Diversification into emerging markets and new production hubs | +0.9% | Africa, Latin America, Southeast Asia | 2025-2033 |

| Increased demand for personalized and on-demand production | +0.8% | Global | 2025-2033 |

OEM and ODM Clothing Market Challenges Impact Analysis

The OEM and ODM clothing market faces a range of significant challenges that can impact profitability and operational stability. One pervasive challenge is the intense competition within the global manufacturing landscape, particularly from low-cost regions, which puts continuous pressure on pricing and profit margins. Manufacturers must consistently innovate and improve efficiency to remain competitive, often investing heavily in technology and process optimization. Furthermore, maintaining ethical labor practices and ensuring supply chain transparency in a globally distributed production network poses a complex challenge. Brands and consumers increasingly demand visibility into working conditions and environmental impact, requiring stringent oversight and adherence to international standards.

Another critical challenge is managing the volatility of raw material prices and the availability of essential resources, such as cotton, polyester, and dyes. Fluctuations in these commodity markets can directly impact production costs and lead times, requiring sophisticated risk management strategies. Rapid technological obsolescence also presents a hurdle; while technology offers opportunities, the need for continuous investment in new machinery and software to keep pace with industry advancements can be a substantial financial burden. Finally, navigating complex international trade regulations, customs procedures, and potential trade barriers adds layers of complexity and cost to global operations, demanding expert logistical and compliance capabilities.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense price competition and margin pressure | -0.9% | Global | 2025-2033 |

| Ensuring ethical labor practices and compliance | -0.8% | Asia Pacific, Global | 2025-2033 |

| Volatile raw material prices and supply chain disruptions | -0.7% | Global | 2025-2028 |

| Adapting to rapid technological advancements and investment costs | -0.6% | Global | 2025-2033 |

| Navigating complex international trade regulations and tariffs | -0.5% | Global | 2025-2030 |

OEM and ODM Clothing Market - Updated Report Scope

This report offers a comprehensive analysis of the OEM and ODM Clothing Market, providing in-depth insights into its current size, historical performance, and future growth projections from 2025 to 2033. It examines key market trends, drivers, restraints, opportunities, and challenges influencing the industry landscape. The scope also includes a detailed segmentation analysis across various categories, regional market dynamics, and profiles of leading market players, offering a holistic view for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 345 Billion |

| Market Forecast in 2033 | USD 662 Billion |

| Growth Rate | 8.5% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Textile Solutions, Apex Garment Manufacturing, Orient Apparel Group, Pacific Sourcing Inc., Innovate Textile Company, United Fashion Production, Stellar Clothing Group, Elite Manufacturing Hub, Green Fabric Solutions, Century Apparel Works, Horizon Textiles Ltd., Visionary Garment Factory, Precision Wearables, Quantum Textiles, Dynamic Apparel Group, Optimum Fabrications, Nexus Clothing Co., Prime Manufacturing Partners, Zenith Apparel, Summit Production House. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The OEM and ODM clothing market is intricately segmented to provide a granular understanding of its diverse components and sub-sectors. This segmentation allows for precise market analysis, identifying distinct growth drivers and trends within each category, from the type of manufacturing service offered to the specific product categories and end-user applications. Understanding these segments is crucial for stakeholders to identify niche opportunities, tailor their strategies, and allocate resources effectively across the value chain. The differentiation between OEM, focusing on exact replication of client designs, and ODM, involving design and development services, highlights varied partnership models that cater to diverse brand needs.

- By Type: Original Equipment Manufacturing (OEM), Original Design Manufacturing (ODM)

- By Product Type: Apparel (Tops, Bottoms, Outerwear, Dresses, Activewear, Intimates, Swimwear, Workwear, Uniforms), Accessories (Bags, Belts, Scarves, Hats, Gloves), Footwear (Casual, Athletic, Formal)

- By Material: Natural Fibers (Cotton, Linen, Silk, Wool), Synthetic Fibers (Polyester, Nylon, Spandex, Rayon), Blends and Specialty Fabrics (Recycled Materials, Organic Fabrics, Performance Fabrics)

- By End-User: Men's Clothing, Women's Clothing, Children's Clothing, Sports & Fitness Apparel, Workwear & Uniforms

- By Application: Fashion & Apparel, Sports & Activewear, Workwear & Uniforms, Medical & Healthcare Textiles, Home Textiles, Other Industrial Applications

Regional Highlights

- Asia Pacific (APAC): Dominates the OEM and ODM clothing market due to established manufacturing infrastructure, competitive labor costs in countries like China, Vietnam, Bangladesh, and India, and a large pool of skilled labor. The region is a global manufacturing hub, constantly upgrading its technological capabilities and focusing on scalability.

- Europe: Characterized by a strong emphasis on design, quality, and sustainable practices. Countries such as Turkey and Portugal are gaining traction for their proximity to European brands, offering quicker lead times and higher ethical compliance standards compared to some Asian counterparts. There is also a focus on niche and high-value textiles.

- North America: While historically a net importer, North America is witnessing a resurgence in local manufacturing driven by reshoring and nearshoring trends. This is motivated by the desire for reduced lead times, increased supply chain control, and consumer demand for ethically produced goods. Automation and advanced manufacturing technologies are key.

- Latin America: Emerging as a viable alternative for nearshoring, particularly for North American brands. Countries like Mexico and Central American nations offer competitive advantages in terms of logistics, cultural affinity, and growing manufacturing capabilities, especially for quick response and smaller batch orders.

- Middle East and Africa (MEA): Growing potential driven by developing textile industries, strategic geographical locations, and government initiatives to diversify economies. Countries like Egypt, Jordan, and Ethiopia are attracting investment due to lower operating costs and preferential trade agreements, though infrastructure development remains key.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the OEM and ODM Clothing Market.- Global Textile Solutions

- Apex Garment Manufacturing

- Orient Apparel Group

- Pacific Sourcing Inc.

- Innovate Textile Company

- United Fashion Production

- Stellar Clothing Group

- Elite Manufacturing Hub

- Green Fabric Solutions

- Century Apparel Works

- Horizon Textiles Ltd.

- Visionary Garment Factory

- Precision Wearables

- Quantum Textiles

- Dynamic Apparel Group

- Optimum Fabrications

- Nexus Clothing Co.

- Prime Manufacturing Partners

- Zenith Apparel

- Summit Production House

Frequently Asked Questions

Analyze common user questions about the OEM and ODM Clothing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between OEM and ODM in clothing manufacturing?

OEM (Original Equipment Manufacturing) involves producing garments exactly according to a client's specific designs, materials, and specifications. ODM (Original Design Manufacturing) refers to manufacturers who design and develop products themselves, which clients can then select, customize, and brand as their own, offering a more complete solution.

What are the primary growth prospects for the OEM and ODM clothing market?

The market's growth is primarily driven by brands focusing on core competencies, the rapid expansion of e-commerce and DTC models, demand for faster fashion cycles, and the cost efficiencies and economies of scale offered by specialized manufacturers. Sustainability and technological integration also present significant opportunities.

How does sustainability impact OEM and ODM clothing manufacturers?

Sustainability is a crucial factor. Manufacturers are increasingly adopting eco-friendly materials, reducing waste, optimizing energy consumption, and ensuring ethical labor practices. This shift is driven by consumer demand, regulatory pressures, and brand commitments, opening new market segments for compliant and responsible manufacturers.

What role does technology play in modern OEM and ODM clothing production?

Technology, including AI, automation, 3D design, and IoT, is transforming production. It enables enhanced demand forecasting, automated quality control, optimized supply chains, accelerated product development, and mass customization, leading to greater efficiency, reduced waste, and improved product quality.

Which regions are dominant in OEM and ODM clothing manufacturing?

Asia Pacific, particularly countries like China, Vietnam, Bangladesh, and India, remains the dominant region due to established infrastructure and cost advantages. Europe is strong in high-value and sustainable production, while North America and Latin America are growing due to reshoring and nearshoring trends.