Mobile Advertising Market

Mobile Advertising Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701323 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Mobile Advertising Market Size

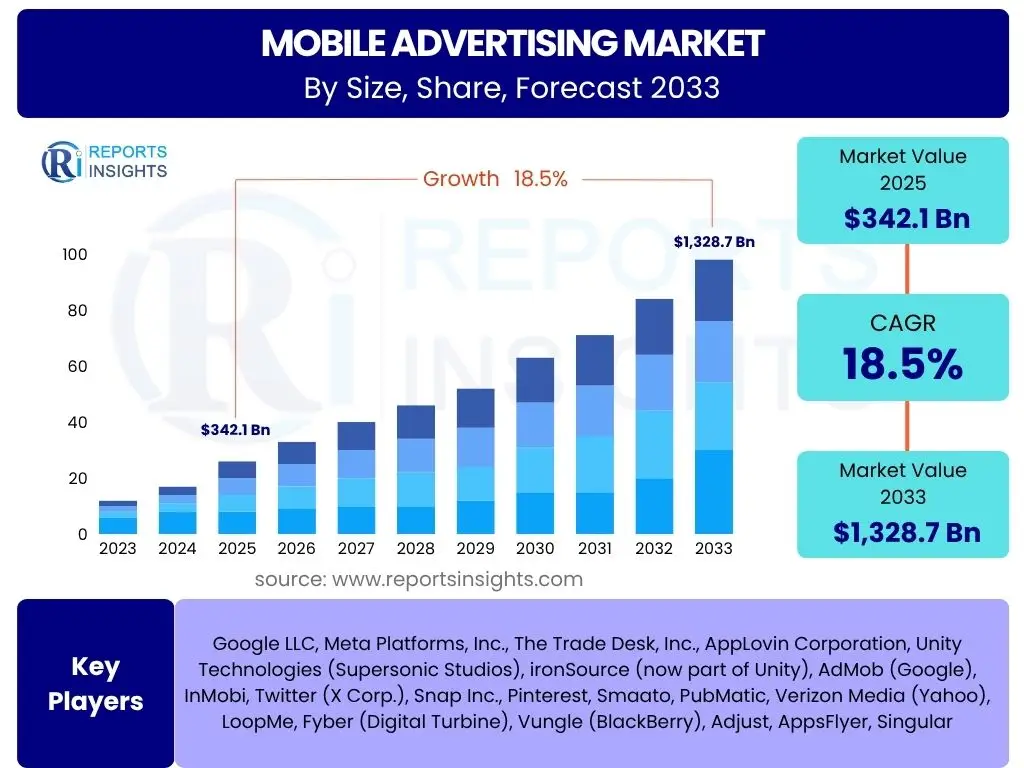

According to Reports Insights Consulting Pvt Ltd, The Mobile Advertising Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033. The market is estimated at USD 342.1 Billion in 2025 and is projected to reach USD 1,328.7 Billion by the end of the forecast period in 2033.

Key Mobile Advertising Market Trends & Insights

The mobile advertising landscape is undergoing rapid transformation, driven by technological advancements, evolving consumer behavior, and stricter privacy regulations. Key user inquiries often revolve around the most impactful trends, such as the dominance of video advertising, the rise of programmatic buying, the integration of artificial intelligence for enhanced targeting and personalization, and the ongoing shift towards in-app advertising over traditional mobile web ads. Furthermore, concerns regarding data privacy, brand safety, and the effectiveness of cross-channel measurement are frequently highlighted. The market is also seeing a surge in interactive and immersive ad formats, aiming to boost user engagement in an increasingly crowded digital space.

Another significant trend gaining traction is the convergence of mobile advertising with emerging technologies like 5G, augmented reality (AR), and virtual reality (VR). As 5G networks become more pervasive, they enable faster load times and higher-quality rich media content, opening new avenues for advertisers. Similarly, AR and VR offer novel ways for brands to create immersive experiences, blurring the lines between advertising and entertainment. Advertisers are increasingly focusing on building first-party data strategies to navigate cookie deprecation and foster more direct, privacy-compliant relationships with their audience. This shift is crucial for maintaining effective personalization and measurement capabilities in a privacy-first world.

- Programmatic advertising's continued expansion across all ad formats.

- Dominance of mobile video advertising, including short-form and CTV integration.

- Hyper-personalization driven by advanced AI and machine learning algorithms.

- Increased focus on in-app advertising and premium inventory.

- Rising importance of first-party data strategies for targeting and measurement.

- Emergence of interactive and immersive ad formats (AR, VR, playable ads).

- Growing emphasis on privacy-preserving advertising technologies and solutions.

- The impact of 5G on enabling richer and faster ad experiences.

AI Impact Analysis on Mobile Advertising

Common user questions regarding AI's impact on mobile advertising frequently center on its role in optimizing campaign performance, enhancing targeting precision, and automating labor-intensive processes. Users are keen to understand how AI contributes to real-time bidding, creative optimization, and predictive analytics for audience segmentation. There's also significant interest in AI's potential to combat ad fraud, improve brand safety, and personalize user experiences at scale. Concerns often arise around data privacy implications when AI processes vast amounts of user data, as well as the need for transparency in algorithmic decision-making. The overarching expectation is that AI will drive greater efficiency, effectiveness, and intelligence across the entire mobile advertising ecosystem.

AI's influence extends beyond mere automation, fundamentally reshaping how advertisers interact with their audiences and manage their campaigns. It enables sophisticated audience segmentation based on behavioral patterns, intent signals, and demographic data, allowing for highly relevant ad delivery. Furthermore, AI-powered tools are revolutionizing creative development and optimization, through dynamic creative optimization (DCO) that tailors ad content in real-time based on user context and past interactions. Predictive analytics, fueled by AI, allows advertisers to forecast campaign outcomes, identify high-value users, and allocate budgets more effectively, significantly reducing wasted spend and maximizing return on investment (ROI).

- Enhanced ad targeting and audience segmentation through predictive analytics.

- Automated real-time bidding (RTB) and programmatic ad buying optimization.

- Dynamic creative optimization (DCO) for personalized ad content delivery.

- Improved fraud detection and prevention mechanisms.

- Advanced campaign performance analytics and attribution modeling.

- Chatbot and conversational AI for interactive advertising and customer engagement.

- Predictive analysis for identifying consumer intent and purchasing behavior.

- Development of AI-generated content for ad campaigns.

Key Takeaways Mobile Advertising Market Size & Forecast

Users frequently inquire about the core insights derived from the mobile advertising market's size and forecast, seeking to grasp the fundamental growth drivers, investment opportunities, and critical strategic implications. The primary takeaways emphasize the market's robust growth trajectory, propelled by increasing smartphone penetration, expanding internet access, and the pervasive shift of consumer attention to mobile devices. Advertisers are increasingly prioritizing mobile channels due to their high engagement rates and precise targeting capabilities. The forecast underscores a sustained upward trend, highlighting mobile advertising as a pivotal component of digital marketing strategies for businesses across all scales.

The market's significant projected growth indicates that mobile will continue to be the dominant force in digital advertising expenditure. Key insights reveal that video, social media, and in-app advertising formats are expected to be major revenue drivers, benefiting from technological advancements and evolving user consumption habits. Furthermore, the integration of emerging technologies such as AI and 5G is not merely incremental but transformative, promising new monetization avenues and enhanced user experiences. Strategic focus for market players will involve navigating privacy regulations, leveraging data effectively, and investing in innovative ad formats to capture audience attention and maintain competitive advantage in this dynamic environment.

- The mobile advertising market is poised for substantial growth, projected to quadruple by 2033.

- Increased smartphone adoption and mobile internet usage are primary growth catalysts.

- Video, social media, and in-app advertising are key segments driving revenue expansion.

- AI and advanced analytics are becoming indispensable for optimizing campaign performance.

- Privacy regulations and data management will critically influence market development.

- Emerging markets, particularly in Asia Pacific, offer significant untapped growth potential.

- Advertisers must adapt to new ad formats and technologies to maintain user engagement.

Mobile Advertising Market Drivers Analysis

The rapid proliferation of smartphones and tablets globally forms the bedrock of the mobile advertising market's growth, making mobile devices the primary gateway to digital content for billions. This ubiquitous access, coupled with ever-improving mobile network infrastructure and affordable data plans, fuels a constant increase in user engagement with mobile applications and web content. As consumers spend more time on their mobile devices for communication, entertainment, shopping, and information, advertisers naturally follow this attention, shifting their budgets towards mobile-first strategies. This trend is further amplified by the younger demographics who are inherently mobile-native, driving demand for innovative and interactive mobile ad experiences.

Technological advancements in advertising technology (ad tech) also serve as significant drivers. Innovations such as programmatic buying, real-time bidding, and sophisticated data analytics platforms enable advertisers to target audiences with unprecedented precision, optimize campaigns in real-time, and achieve higher returns on investment. The rise of e-commerce and m-commerce has created a powerful direct response channel for mobile advertising, linking ads directly to purchase opportunities. Additionally, the continuous evolution of diverse ad formats, including interactive video ads, playable ads, and augmented reality (AR) experiences, enhances user engagement and offers brands creative avenues to connect with their audience, thereby sustaining market momentum.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Smartphone Penetration and Mobile Internet Usage | +2.3% | Global, particularly APAC and Latin America | 2025-2033 |

| Growth of Programmatic Advertising | +1.8% | North America, Europe, China | 2025-2033 |

| Rise of Video Content Consumption on Mobile | +1.5% | Global, especially India, Southeast Asia | 2025-2033 |

| Technological Advancements in Ad Tech (AI, ML, Big Data) | +1.7% | North America, Europe, Developed APAC | 2025-2033 |

| Expansion of E-commerce and M-commerce Activities | +1.2% | Global, strongest in China, US, EU | 2025-2033 |

| Proliferation of Mobile Gaming and In-App Engagement | +0.9% | Global, prominent in emerging markets | 2025-2033 |

| Emergence of 5G Network Infrastructure | +0.8% | North America, China, South Korea, Japan | 2026-2033 |

Mobile Advertising Market Restraints Analysis

One of the most significant restraints impeding the unbridled growth of the mobile advertising market is the increasing consumer concern over data privacy and the subsequent implementation of stringent privacy regulations. Regulations such as the GDPR in Europe and the CCPA in California mandate explicit consent for data collection and usage, significantly limiting the ability of advertisers to track users across apps and websites. This shift impacts personalized targeting, retargeting, and accurate attribution, forcing advertisers to rethink their data strategies and find new, compliant methods for reaching audiences. The ongoing deprecation of third-party cookies by major browsers and operating systems (e.g., Apple's App Tracking Transparency) further exacerbates these challenges, making it harder to build comprehensive user profiles and measure campaign effectiveness.

Another persistent challenge is ad fraud, which diverts significant advertising spend to non-human traffic, fake installs, and other deceptive practices. This not only erodes advertiser trust and ROI but also distorts performance metrics, making it difficult to assess true campaign success. Coupled with ad fraud, the widespread adoption of ad-blocking software by consumers remains a considerable hurdle, directly preventing ads from being displayed and reducing potential impressions. Users often deploy ad blockers due to intrusive ad experiences, slow page load times, and data consumption concerns, necessitating a greater focus on non-intrusive, value-added ad formats. The evolving regulatory landscape and the constant battle against fraudulent activities create an environment where transparency and trust are paramount, yet difficult to achieve consistently.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Strict Data Privacy Regulations (GDPR, CCPA, etc.) | -1.5% | Europe, North America, Global influence | 2025-2033 |

| Ad Fraud and Brand Safety Concerns | -1.2% | Global | 2025-2033 |

| Rise of Ad-Blocking Software | -0.8% | Global, particularly developed markets | 2025-2033 |

| Deprecation of Third-Party Cookies and Device IDs | -1.0% | Global | 2025-2028 |

| User Fatigue from Over-Advertising and Intrusive Ads | -0.7% | Global | 2025-2033 |

| Difficulty in Cross-Device Tracking and Attribution | -0.5% | Global | 2025-2033 |

| High Customer Acquisition Costs in Competitive Verticals | -0.4% | Global | 2025-2033 |

Mobile Advertising Market Opportunities Analysis

The emergence of 5G technology presents a transformative opportunity for mobile advertising, enabling richer, faster, and more immersive ad experiences. With significantly higher bandwidth and lower latency, 5G facilitates seamless streaming of high-definition video ads, interactive augmented reality (AR) and virtual reality (VR) advertisements, and complex playable ads that demand real-time responsiveness. This technological leap allows advertisers to create highly engaging and impactful campaigns that were previously constrained by network limitations, leading to increased user engagement and conversion rates. Beyond content delivery, 5G also opens doors for hyper-localized advertising, as its precision in location services can deliver highly relevant ads based on real-time proximity to businesses or points of interest.

The growing integration of mobile advertising with emerging digital channels, such as connected TV (CTV) and in-car entertainment systems, represents another significant opportunity. As consumers increasingly split their attention across multiple screens, advertisers can leverage unified platforms to deliver coherent, cross-device campaigns, extending their reach and reinforcing brand messaging. The shift towards first-party data strategies, driven by privacy changes, also creates an opportunity for brands to build stronger direct relationships with their customers. By collecting and leveraging consented first-party data, advertisers can achieve highly accurate targeting and personalization without relying on third-party identifiers, fostering trust and providing a sustainable competitive advantage in a privacy-centric ecosystem. Additionally, the continuous innovation in interactive and personalized ad formats, including gamified ads and shoppable content, offers brands new ways to captivate audiences and drive direct conversions.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of 5G Network Infrastructure and Adoption | +1.8% | North America, Europe, Asia Pacific | 2026-2033 |

| Growth in Augmented Reality (AR) and Virtual Reality (VR) Advertising | +1.5% | Global, prominent in gaming/entertainment | 2027-2033 |

| Integration with Connected TV (CTV) and Cross-Screen Advertising | +1.3% | North America, Europe | 2025-2033 |

| Development of First-Party Data Strategies and Data Clean Rooms | +1.0% | Global | 2025-2033 |

| Rise of Interactive and Shoppable Ad Formats | +0.9% | Global, especially e-commerce driven markets | 2025-2033 |

| Emergence of New Ad Monetization Models in Gaming | +0.7% | Global, particularly APAC | 2025-2033 |

| Hyper-Localization for Proximity-Based Advertising | +0.6% | Urban areas globally | 2025-2033 |

Mobile Advertising Market Challenges Impact Analysis

The deprecation of third-party cookies and evolving privacy regulations, such as Apple's App Tracking Transparency (ATT) framework, pose a significant challenge to mobile advertisers. These changes severely limit the ability to track users across applications and websites, making precise targeting, frequency capping, and accurate attribution significantly more complex. Advertisers are struggling to find alternative, privacy-compliant identifiers and measurement solutions that maintain campaign effectiveness without infringing on user privacy. This necessitates a fundamental shift in data strategy, emphasizing first-party data collection and contextual advertising, which can be a costly and time-consuming transition for many organizations.

Another persistent challenge is ad fraud, which encompasses a range of deceptive practices including bot traffic, fake installs, and click injection, designed to siphon off advertising budgets. Ad fraud not only leads to financial losses for advertisers but also distorts performance metrics, making it difficult to optimize campaigns effectively and justify ad spend. Maintaining brand safety in a fragmented mobile content landscape is also a continuous struggle, as brands seek to ensure their ads do not appear alongside inappropriate or harmful content. Furthermore, the increasing saturation of mobile ad inventory and the growing competition among advertisers are driving up customer acquisition costs, particularly in mature markets, requiring more sophisticated strategies to achieve a favorable return on investment and stand out from the noise.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Impact of Privacy Regulations and Cookie Deprecation | -1.8% | Global | 2025-2033 |

| Combatting Sophisticated Ad Fraud and Bots | -1.4% | Global | 2025-2033 |

| Ensuring Brand Safety Across Diverse Mobile Content | -1.0% | Global | 2025-2033 |

| Rising Customer Acquisition Costs (CAC) and Campaign Saturation | -0.9% | North America, Europe | 2025-2033 |

| Technological Complexity and Integration Challenges for Ad Tech | -0.7% | Global | 2025-2033 |

| Talent Shortage in Ad Tech and Data Science | -0.5% | North America, Europe, Developed APAC | 2025-2033 |

| User Resistance to Intrusive or Irrelevant Ads | -0.6% | Global | 2025-2033 |

Mobile Advertising Market - Updated Report Scope

This comprehensive market research report on mobile advertising provides an in-depth analysis of market size, trends, drivers, restraints, opportunities, and challenges across various segments and key regions. It offers a detailed forecast from 2025 to 2033, incorporating insights from the historical period, and leverages advanced analytical models to project future market dynamics. The report thoroughly examines the impact of artificial intelligence and emerging technologies, such as 5G and AR/VR, on the advertising ecosystem. It also provides a robust competitive landscape analysis, profiling leading companies and their strategic initiatives, alongside a deep dive into segmentation by ad format, platform, industry vertical, and purchase mode to offer granular insights for stakeholders.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 342.1 Billion |

| Market Forecast in 2033 | USD 1,328.7 Billion |

| Growth Rate | 18.5% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Google LLC, Meta Platforms, Inc., The Trade Desk, Inc., AppLovin Corporation, Unity Technologies (Supersonic Studios), ironSource (now part of Unity), AdMob (Google), InMobi, Twitter (X Corp.), Snap Inc., Pinterest, Smaato, PubMatic, Verizon Media (Yahoo), LoopMe, Fyber (Digital Turbine), Vungle (BlackBerry), Adjust, AppsFlyer, Singular |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The mobile advertising market is extensively segmented to provide a granular view of its diverse components, offering critical insights into specific growth avenues and market dynamics. This segmentation facilitates a deeper understanding of how different ad formats, platforms, industry verticals, and purchase modes contribute to the overall market landscape. Analyzing these segments helps stakeholders identify lucrative niches, tailor their strategies, and allocate resources effectively to capitalize on specific market opportunities. The robust growth observed across various segments underscores the adaptability and innovation within the mobile advertising ecosystem, catering to evolving advertiser needs and consumer behaviors.

- Ad Format: This segment categorizes mobile advertising based on the creative execution and delivery method.

- Search Advertising: Ads displayed on mobile search engine results pages, highly intent-driven.

- Display Advertising: Image, text, or rich media banner ads appearing on mobile websites and apps.

- Video Advertising: Pre-roll, mid-roll, post-roll, and out-stream video ads delivered on mobile.

- Social Media Advertising: Ads integrated within social media platforms like Facebook, Instagram, TikTok.

- Native Advertising: Ads designed to seamlessly blend with the surrounding content and user experience.

- Others: Includes Audio Advertising (in podcasts/music apps), SMS/MMS advertising, and interstitial ads.

- Platform: Divides the market based on where the ads are primarily displayed.

- Mobile Web: Advertising delivered through mobile browsers on websites.

- Mobile Application: Advertising integrated within mobile applications (in-app advertising).

- Industry Vertical: Classifies advertising spend based on the primary industry of the advertiser.

- Retail & E-commerce: Advertising for online and offline retail businesses, driving product sales.

- Automotive: Promoting vehicle sales, dealerships, and automotive services.

- Financial Services: Advertising for banks, insurance, investment products, and fintech.

- Telecom: Promoting mobile plans, devices, and telecommunication services.

- Media & Entertainment: Advertising for games, streaming services, movies, and digital content.

- Healthcare: Promoting pharmaceutical products, healthcare services, and medical devices.

- Travel & Tourism: Advertising for airlines, hotels, tour operators, and travel agencies.

- Education: Promoting educational institutions, online courses, and learning platforms.

- Others: Includes Consumer Packaged Goods (CPG), Food & Beverages, Real Estate, etc.

- Purchase Mode: Differentiates based on how ad inventory is bought and sold.

- Programmatic: Automated buying and selling of ad inventory through real-time bidding platforms.

- Non-Programmatic: Direct deals or traditional sales methods for purchasing ad space.

Regional Highlights

- North America: The North American mobile advertising market is highly mature and technologically advanced, driven by high smartphone penetration, robust digital infrastructure, and significant investments in ad tech innovation. The region, particularly the United States, leads in programmatic advertising adoption, video ad spend, and the integration of AI for sophisticated targeting and optimization. However, it also faces increasing scrutiny regarding data privacy regulations, pushing for greater transparency and first-party data strategies. Canada also contributes significantly, following similar trends in digital transformation and mobile media consumption.

- Europe: The European mobile advertising market is characterized by strong regulatory frameworks, notably the GDPR, which heavily influences data collection and targeting practices. This has led to an emphasis on privacy-compliant solutions, contextual advertising, and the exploration of privacy-enhancing technologies. Despite regulatory challenges, the market exhibits consistent growth, propelled by increasing mobile video consumption, social media engagement, and the growth of mobile commerce across major economies like the Kingdom, Germany, and France. Southern and Eastern European countries are also showing strong mobile advertising growth rates as digital adoption accelerates.

- Asia Pacific (APAC): APAC is the largest and fastest-growing mobile advertising market globally, fueled by its immense population base, surging smartphone adoption, and expanding internet connectivity, especially in emerging economies like India, Indonesia, and Vietnam. China remains a dominant force, characterized by its unique ecosystem of super apps and advanced mobile payment integrations. The region exhibits high consumption of mobile video, social media, and gaming, creating vast opportunities for advertisers. Investment in mobile-first strategies, particularly in programmatic and in-app advertising, is escalating rapidly across the region.

- Latin America: The Latin American mobile advertising market is experiencing significant growth, driven by increasing smartphone penetration, expanding mobile internet access, and a youthful, digitally engaged population. Countries like Brazil, Mexico, and Argentina are leading the adoption of mobile commerce and digital content consumption. The market benefits from rising programmatic investments and a growing appetite for mobile video and social media advertising. Despite economic volatilities in some areas, the region presents substantial untapped potential as digital transformation continues to reshape consumer behavior.

- Middle East and Africa (MEA): The MEA region is undergoing rapid digital transformation, with mobile devices serving as the primary internet access point for a large portion of the population. This has created fertile ground for mobile advertising growth, especially in technologically forward-looking markets like the UAE, Saudi Arabia, and South Africa. Investments in 5G infrastructure and a young, tech-savvy demographic are driving increased mobile video consumption and in-app engagement. While still developing in terms of ad tech maturity compared to Western markets, the region offers promising opportunities for mobile advertisers seeking to capitalize on a rapidly digitizing consumer base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Advertising Market.- Google LLC

- Meta Platforms, Inc.

- The Trade Desk, Inc.

- AppLovin Corporation

- Unity Technologies (Supersonic Studios)

- ironSource (now part of Unity)

- AdMob (Google)

- InMobi

- Twitter (X Corp.)

- Snap Inc.

- Smaato

- PubMatic

- Verizon Media (Yahoo)

- LoopMe

- Fyber (Digital Turbine)

- Vungle (BlackBerry)

- Adjust

- AppsFlyer

- Singular

Frequently Asked Questions

Analyze common user questions about the Mobile Advertising market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate for the Mobile Advertising Market?

The Mobile Advertising Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2033.

How is AI impacting mobile advertising?

AI significantly impacts mobile advertising by enhancing targeting accuracy, optimizing real-time bidding, enabling dynamic creative personalization, improving fraud detection, and providing advanced campaign analytics.

What are the main challenges facing mobile advertisers?

Key challenges include navigating strict data privacy regulations, combating sophisticated ad fraud, ensuring brand safety across diverse content, and managing rising customer acquisition costs due to market saturation.

Which ad formats are dominating the mobile advertising market?

Mobile video advertising, social media advertising, and in-app advertising are currently the dominant formats, driven by high user engagement and technological advancements.

How are privacy regulations affecting mobile advertising strategies?

Privacy regulations are compelling advertisers to pivot towards first-party data strategies, contextual advertising, and privacy-enhancing technologies to maintain effective targeting and measurement while respecting user consent.