Food Industry Automation Market

Food Industry Automation Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700279 | Last Updated : July 23, 2025 |

Format : ![]()

![]()

![]()

![]()

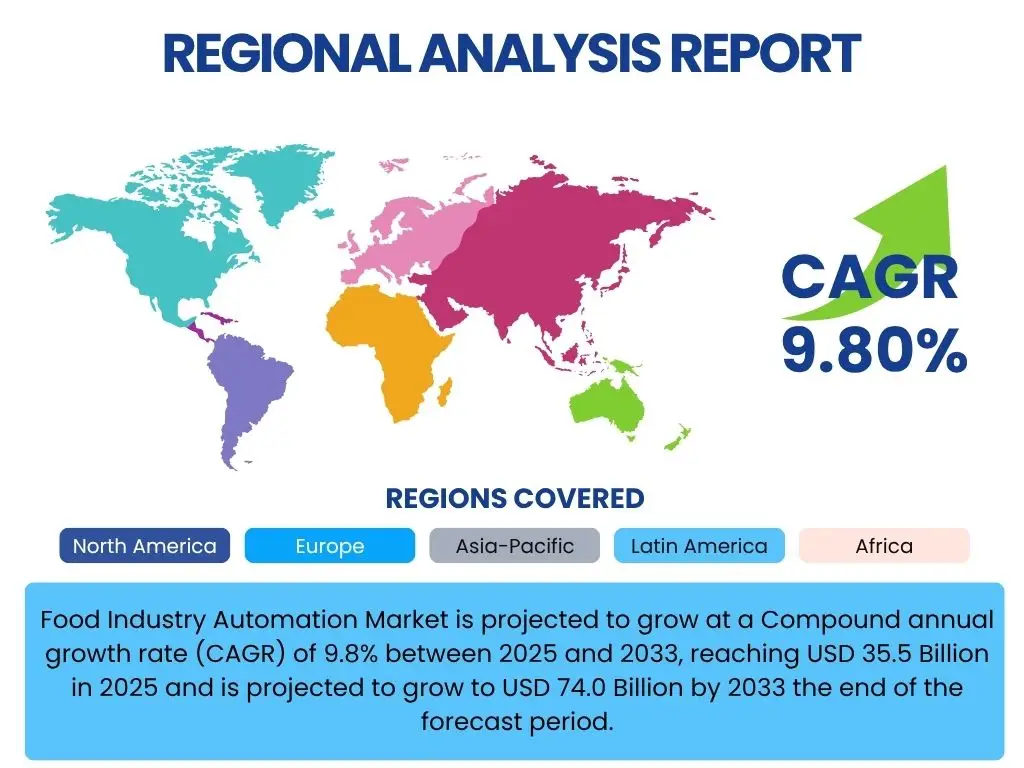

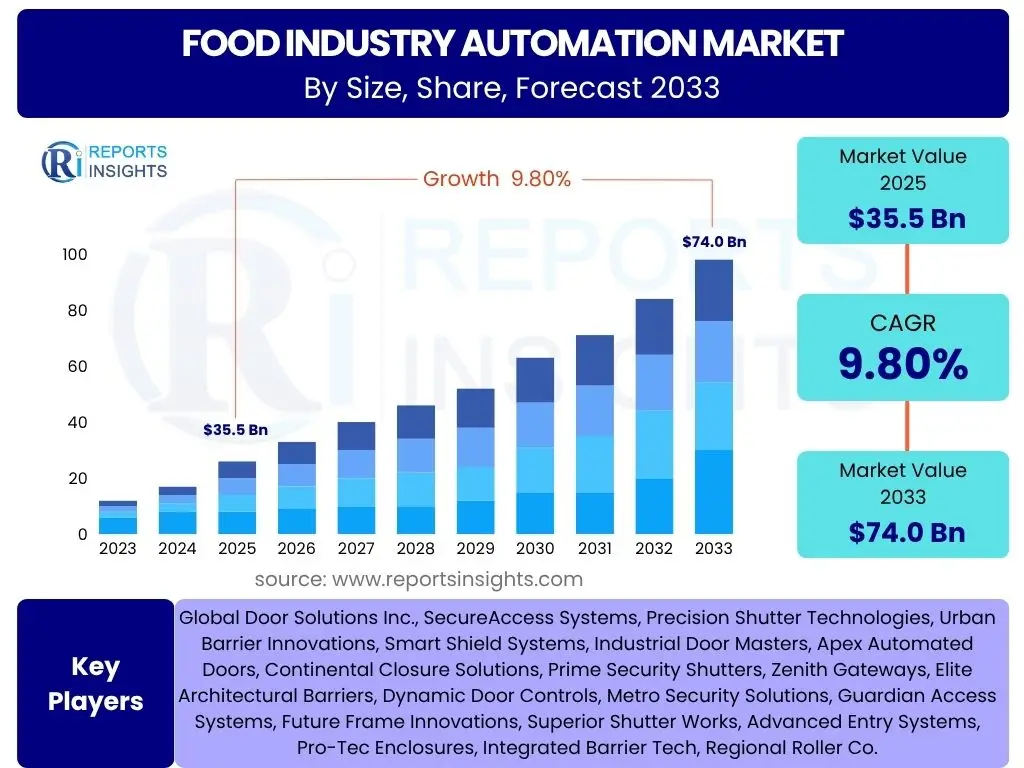

Food Industry Automation Market is projected to grow at a Compound annual growth rate (CAGR) of 9.8% between 2025 and 2033, reaching USD 35.5 Billion in 2025 and is projected to grow to USD 74.0 Billion by 2033 the end of the forecast period.

Key Food Industry Automation Market Trends & Insights

The Food Industry Automation Market is currently experiencing a transformative phase, driven by a confluence of technological advancements, evolving consumer demands, and operational imperatives. Key trends are centered around enhancing efficiency, ensuring food safety, and adapting to labor challenges, pushing the adoption of sophisticated automation solutions across the entire food processing value chain. From raw material handling to packaging and logistics, automation is becoming indispensable for maintaining competitive advantage and meeting stringent regulatory standards.

Furthermore, the integration of advanced robotics, artificial intelligence, and Internet of Things (IoT) is redefining possibilities within the sector. These technologies enable predictive maintenance, real-time quality control, and highly flexible production lines, allowing manufacturers to respond swiftly to market shifts and customize offerings. The emphasis is increasingly on creating smart factories that can autonomously manage complex operations, optimize resource utilization, and significantly reduce human error, thereby leading to superior product consistency and cost efficiencies.

- Increased adoption of collaborative robots (cobots) for flexible production.

- Integration of advanced sensor technology for real-time quality control.

- Growth in demand for automated sorting and inspection systems.

- Shift towards modular and scalable automation solutions.

- Emphasis on software-driven automation and data analytics for process optimization.

AI Impact Analysis on Food Industry Automation

Artificial Intelligence (AI) is rapidly emerging as a pivotal force in the evolution of food industry automation, moving beyond traditional automation to enable intelligent, self-optimizing processes. AI algorithms, particularly in machine vision and predictive analytics, are revolutionizing quality assurance, inventory management, and equipment maintenance. This allows food processors to detect defects with unprecedented accuracy, forecast demand more precisely, and schedule maintenance proactively, minimizing downtime and waste.

Moreover, AI's application extends to optimizing complex supply chains and enhancing food traceability, providing greater transparency from farm to fork. Machine learning models can analyze vast datasets to identify patterns in consumer preferences, optimize recipes, and even simulate new product development cycles, significantly accelerating innovation. As AI becomes more sophisticated and accessible, its impact on operational efficiency, product quality, and responsiveness to market dynamics within the food industry will continue to expand dramatically.

- Enhanced precision in quality control through AI-powered vision systems.

- Predictive maintenance for automation equipment, reducing downtime.

- Optimized production scheduling and resource allocation via machine learning.

- Improved food traceability and supply chain transparency with AI analytics.

- Development of smart sensors and IoT devices integrating AI for real-time data analysis.

Key Takeaways Food Industry Automation Market Size & Forecast

- The Food Industry Automation Market is projected to achieve substantial growth, driven by increasing demand for efficiency and safety.

- The market is estimated to reach USD 35.5 Billion in 2025.

- By 2033, the market is forecasted to expand significantly to USD 74.0 Billion.

- A robust Compound Annual Growth Rate (CAGR) of 9.8% is expected from 2025 to 2033.

- Growth is primarily fueled by technological advancements, labor cost pressures, and stringent food safety regulations.

- Emerging economies present significant untapped potential for automation adoption in the food sector.

Food Industry Automation Market Drivers Analysis

The global Food Industry Automation Market is propelled by several robust drivers, fundamentally transforming traditional food processing and manufacturing landscapes. A primary driver is the increasing demand for enhanced food safety and quality, necessitating automated systems that can consistently maintain hygiene standards, reduce human error, and provide precise control over processing parameters. Consumers and regulatory bodies alike are demanding higher levels of safety and transparency, making automation an essential investment for compliance and brand reputation.

Another significant factor is the escalating labor costs and persistent shortage of skilled workers across many regions. Automation offers a sustainable solution to mitigate these challenges by reducing reliance on manual labor for repetitive, arduous, or hazardous tasks, thereby improving operational efficiency and reducing overall production expenses. Furthermore, the burgeoning global population and a rising disposable income in emerging economies are fueling demand for processed and packaged foods, prompting manufacturers to scale up production capabilities through automation to meet this expanding market need.

Moreover, the continuous advancements in automation technologies, including robotics, artificial intelligence, and the Internet of Things (IoT), are making these solutions more accessible, versatile, and cost-effective. These technological innovations enable greater flexibility, real-time monitoring, and data-driven decision-making, allowing food companies to optimize production lines, minimize waste, and achieve higher yields. The drive for sustainability and energy efficiency also acts as a catalyst, as automated systems can optimize resource consumption and reduce the environmental footprint of food production.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Food Safety and Quality | +2.5% | Global, especially North America, Europe | Short to Medium Term (2025-2029) |

| Rising Labor Costs and Shortage of Skilled Workforce | +2.0% | North America, Europe, parts of Asia Pacific | Short to Long Term (2025-2033) |

| Technological Advancements in Automation and Robotics | +2.2% | Global, driven by innovation hubs | Medium to Long Term (2027-2033) |

| Growing Demand for Processed and Packaged Foods | +1.8% | Asia Pacific, Latin America, Africa, Emerging Economies | Medium to Long Term (2026-2033) |

| Emphasis on Production Efficiency and Waste Reduction | +1.5% | Global | Short to Medium Term (2025-2029) |

| Government Initiatives and Regulations Supporting Automation | +1.0% | Specific countries like Germany, Japan, China, USA | Medium Term (2026-2030) |

| Increasing Focus on Supply Chain Resilience | +0.8% | Global | Short to Medium Term (2025-2029) |

Food Industry Automation Market Restraints Analysis

Despite the strong growth trajectory, the Food Industry Automation Market faces several significant restraints that could temper its expansion. One of the primary barriers is the substantial upfront capital investment required for adopting advanced automation systems. Small and medium-sized enterprises (SMEs) in particular often lack the financial resources to procure and integrate sophisticated machinery, which includes not only the equipment cost but also expenses for installation, software, and necessary infrastructure upgrades. This high initial outlay can deter many potential adopters, especially in regions with less developed industrial economies.

Another crucial restraint is the complexity of integrating new automation technologies with existing legacy systems. Many food processing facilities operate with older equipment and fragmented IT infrastructure, making seamless integration of modern, interconnected automation solutions a challenging and costly endeavor. This integration often requires significant operational overhauls, extensive re-engineering, and specialized technical expertise, which can lead to production downtime and operational disruptions during the transition phase, thus increasing the total cost of ownership and project complexity.

Furthermore, the need for a highly skilled workforce to operate, maintain, and troubleshoot advanced automation systems poses a significant challenge. The rapid pace of technological change often outstrips the availability of adequately trained personnel, leading to a skills gap. This deficit necessitates continuous training and upskilling of the existing workforce or the hiring of specialized talent, adding to operational expenses. Regulatory hurdles and concerns over job displacement due to automation also represent socio-economic restraints that can influence the pace of adoption in certain regions.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Capital Investment | -1.8% | Global, particularly affecting SMEs | Short to Medium Term (2025-2029) |

| Lack of Skilled Workforce and Technical Expertise | -1.5% | Global, more pronounced in developing economies | Medium to Long Term (2026-2033) |

| Challenges in Integrating New Systems with Legacy Infrastructure | -1.2% | Global, especially in mature markets with existing setups | Short to Medium Term (2025-2029) |

| Perceived High Maintenance Costs | -0.9% | Global | Short Term (2025-2027) |

| Customization Challenges for Diverse Food Products | -0.7% | Global, specific to specialized food segments | Medium Term (2026-2030) |

Food Industry Automation Market Opportunities Analysis

The Food Industry Automation Market is ripe with compelling opportunities for growth and innovation, driven by evolving industry dynamics and technological advancements. One significant opportunity lies in the burgeoning demand for customized and personalized food products. Automation, particularly flexible robotic systems and adaptive manufacturing lines, can efficiently handle small batch production and rapid changeovers, allowing food manufacturers to cater to diverse consumer preferences, dietary restrictions, and regional tastes with greater agility and cost-effectiveness. This enables market players to tap into niche segments and expand their product portfolios.

Furthermore, the increasing focus on sustainability and reducing food waste presents a substantial avenue for growth. Automated systems equipped with advanced sensors and artificial intelligence can optimize resource utilization, precisely monitor ingredients, and minimize spoilage during processing, packaging, and distribution. This not only contributes to environmental goals but also translates into significant cost savings for manufacturers, making automation an attractive investment for achieving operational efficiency and corporate social responsibility targets. The development of smart factories, leveraging IoT and data analytics, offers the potential for unprecedented levels of optimization and predictive capabilities.

The untapped potential in emerging economies also represents a vast opportunity. As these regions experience economic development and urbanization, there is a rising demand for processed and convenience foods. Automation providers can capitalize on this by offering scalable and affordable solutions tailored to the specific needs and infrastructure limitations of these markets. Additionally, the post-pandemic emphasis on resilient supply chains and contactless processing is accelerating the adoption of automation, creating new opportunities for remote monitoring, robotic picking and packing, and automated logistics to ensure business continuity and enhance operational safety.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Demand for Personalized and Customized Food Products | +2.3% | Global, particularly North America, Europe, parts of Asia | Medium to Long Term (2026-2033) |

| Focus on Reducing Food Waste and Enhancing Sustainability | +2.0% | Global, driven by regulatory and consumer pressure | Short to Medium Term (2025-2029) |

| Untapped Potential in Emerging Economies | +1.7% | Asia Pacific, Latin America, Middle East, Africa | Long Term (2028-2033) |

| Advancements in AI, IoT, and Cloud-based Solutions | +1.5% | Global, driven by technology providers | Medium to Long Term (2027-2033) |

| Increasing Need for Supply Chain Resilience and Traceability | +1.0% | Global | Short to Medium Term (2025-2029) |

Food Industry Automation Market Challenges Impact Analysis

Despite the prevailing opportunities, the Food Industry Automation Market is confronted by several complex challenges that demand strategic navigation. One significant hurdle is the inherent variability of food products. Unlike standardized industrial components, food items come in diverse shapes, sizes, textures, and sensitivities, making it challenging to develop universal automation solutions. Robotic grippers, vision systems, and processing machinery must be highly adaptable to handle delicate, sticky, or irregular food items without causing damage or compromising hygiene, requiring significant research and development efforts and specialized engineering.

Another critical challenge is ensuring seamless integration of automation across the entire food supply chain, from farm to fork. The food industry often involves numerous disparate processes and stakeholders, including raw material sourcing, primary processing, secondary processing, packaging, and distribution. Achieving end-to-end automation and data connectivity across this fragmented ecosystem is complex, requiring robust interoperability standards, significant IT infrastructure investment, and collaborative efforts among various industry players to ensure data flow and operational synchronization.

Furthermore, regulatory compliance and stringent hygiene standards present ongoing challenges for automation providers. Food processing environments are subject to rigorous health and safety regulations (e.g., HACCP, FDA, EFSA), which dictate materials, design, and cleaning protocols for machinery. Automated equipment must not only perform its function efficiently but also be easily cleanable, resistant to corrosive cleaning agents, and designed to prevent contamination, adding complexity and cost to development and maintenance. The rapid pace of technological obsolescence also means that initial investments may quickly require upgrades, posing a financial challenge for long-term planning.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Variability and Delicate Nature of Food Products | -1.5% | Global, across all food segments | Medium to Long Term (2026-2033) |

| Integration Complexity Across the Supply Chain | -1.3% | Global | Medium Term (2026-2030) |

| Stringent Hygiene and Regulatory Compliance | -1.0% | Global, especially in highly regulated markets | Short to Medium Term (2025-2029) |

| High Energy Consumption of Advanced Systems | -0.8% | Global, particularly in regions with high energy costs | Short to Medium Term (2025-2029) |

| Resistance to Change and Cultural Barriers | -0.6% | Global, especially in traditional businesses | Medium Term (2026-2030) |

Food Industry Automation Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Food Industry Automation Market, offering critical insights into its current landscape and future growth projections. The scope encompasses detailed market sizing, trend analysis, growth drivers, restraints, opportunities, and challenges across various segments and key geographical regions. The report is designed to equip stakeholders with actionable intelligence for strategic decision-making in this rapidly evolving sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 74.0 Billion |

| Growth Rate | 9.8% from 2025 to 2033 |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Robotics Solutions, Industrial Automation Systems Inc., Precision Engineering Automation, Advanced Control Technologies, FoodTech Innovations, Integrated Process Solutions, Smart Factory Robotics, Automated Packaging Systems, Visionary Automation Group, Industrial Motion Control, Robotic Food Processing Systems, Omni Automation Solutions, Elite Manufacturing Technologies, NextGen Automation, Automation Dynamics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Food Industry Automation Market is broadly segmented to provide a granular understanding of its diverse components and their respective growth trajectories. These segments reflect the various types of technologies employed, the specific applications within food processing, and the end-use industries that benefit from automation. Analyzing these segments helps in identifying key areas of investment, technological adoption patterns, and market saturation levels across the global food sector, enabling stakeholders to pinpoint lucrative opportunities and tailor their strategies effectively.

The segmentation by type illustrates the diverse range of automation technologies available, from robotic systems that handle delicate food items with precision to complex process control systems that ensure consistent product quality. Application-based segmentation highlights how automation is being deployed across the food manufacturing value chain, impacting everything from initial processing to final packaging and quality inspection. Finally, the end-use industry segmentation provides insights into the specific needs and adoption rates of automation within different food categories, such as dairy, bakery, meat, and beverages, revealing market maturity and growth potential in each sector.

- By Type: This segment categorizes automation solutions based on the core technology or machinery utilized within food processing environments.

- Robotics: Encompasses various types of robots adapted for food handling and processing.

- Articulated Robots: Versatile robots with multiple rotary joints, ideal for complex tasks like palletizing, packaging, and cutting.

- SCARA Robots: Known for high speed and precision in assembly and pick-and-place operations.

- Delta Robots: Suited for high-speed pick and place of lightweight items, common in confectionery and bakery.

- Collaborative Robots (Cobots): Designed to work alongside humans, enhancing flexibility and safety in shared workspaces.

- Cartesian Robots: Offer high accuracy in linear movements, often used for precise dispensing and gantry systems.

- Others: Includes specialized robots like cylindrical and spherical robots.

- Automated Material Handling Systems: Focuses on automated movement and storage of goods.

- Conveyors: Systems for transporting products or raw materials within a facility.

- Automated Storage and Retrieval Systems (ASRS): Robotic systems for automated storage and retrieval of items in warehouses.

- Automated Guided Vehicles (AGVs): Driverless vehicles used for transporting materials autonomously.

- Palletizers: Machines that automate the stacking of products onto pallets.

- Process Control Systems: Technologies that monitor and control manufacturing processes.

- SCADA (Supervisory Control and Data Acquisition): Software systems for real-time monitoring and control of industrial processes.

- DCS (Distributed Control System): A control system for processes where autonomous controllers are distributed throughout a system.

- PLC (Programmable Logic Controller): Industrial computers that control manufacturing processes.

- HMI (Human-Machine Interface): User interfaces or dashboards that connect an operator to a controller.

- Sensor and Vision Systems: Technologies for detection, measurement, and inspection.

- Temperature Sensors: For monitoring precise temperature during processing and storage.

- Pressure Sensors: To measure and control pressure in pipes and processing vessels.

- Level Sensors: For monitoring liquid and solid levels in tanks and bins.

- Flow Sensors: To measure the flow rate of liquids or gases.

- Proximity Sensors: For detecting the presence or absence of an object without physical contact.

- Machine Vision Systems: Automated optical inspection systems for quality control, sorting, and guidance.

- Packaging and Labeling Automation: Solutions for efficient and precise packaging and labeling.

- Primary Packaging: Direct packaging of food products (e.g., filling, sealing).

- Secondary Packaging: Packaging that bundles primary packages (e.g., cartons, boxes).

- Tertiary Packaging: Packaging for transport and storage (e.g., pallet wrapping).

- Labeling Machines: Automated systems for applying labels to products or packages.

- Software Solutions: Software applications that manage and optimize automation processes.

- Manufacturing Execution Systems (MES): Systems that manage and monitor work-in-process on the factory floor.

- Enterprise Resource Planning (ERP): Integrated management of main business processes, often including manufacturing.

- Quality Management Systems (QMS): Software for managing and documenting quality processes.

- Predictive Analytics Software: Utilizes historical data to forecast future outcomes and maintenance needs.

- By Application: This segment outlines the specific operational areas within food manufacturing where automation is applied.

- Processing: Automation used in the core transformation of raw ingredients into food products.

- Mixing: Automated blending and agitation of ingredients.

- Cutting: Precision automated cutting and portioning of food items.

- Baking: Automated control of ovens and baking processes.

- Cooking: Automated cooking systems for various food types.

- Freezing: Automated systems for rapid and controlled freezing.

- Fermentation: Automated monitoring and control of fermentation processes.

- Pasteurization: Automated heat treatment to kill pathogens in liquids.

- Sterilization: Automated processes to completely eliminate microorganisms.

- Packaging: Automation specifically for packaging finished food products.

- Primary Packaging: Direct packaging of food items.

- Secondary Packaging: Bundling of primary packages.

- Tertiary Packaging: Preparing goods for shipping and distribution.

- Palletizing and Depalletizing: Automated stacking and unstacking of products on pallets.

- Sorting and Grading: Automated systems for separating products based on quality, size, or type.

- Material Handling and Logistics: Automation for moving, storing, and distributing materials within and outside the factory.

- Quality Control and Inspection: Automated systems for checking product quality, detecting defects, and ensuring compliance.

- Cleaning-in-Place (CIP) and Sterilization-in-Place (SIP): Automated systems for cleaning and sterilizing equipment without disassembly.

- Processing: Automation used in the core transformation of raw ingredients into food products.

- By End-Use Industry: This segment classifies the market based on the type of food products being processed and the specific industries involved.

- Dairy Products: Automation in milk processing, cheese production, yogurt manufacturing, etc.

- Bakery and Confectionery: Automation in bread, pastries, cakes, chocolates, and candy production.

- Meat, Poultry, and Seafood: Automation in slaughtering, deboning, cutting, processing, and packaging of meat products.

- Fruits and Vegetables: Automation in washing, sorting, cutting, peeling, and packaging of fresh and processed produce.

- Beverages: Automation in bottling, canning, mixing, and packaging of drinks.

- Processed Foods: Automation for convenience foods, frozen meals, snacks, and other pre-prepared items.

- Confectionery: Specific automation solutions for candies, chocolates, and other sweet treats.

- Grains and Cereals: Automation in milling, baking, and packaging of grain-based products.

- North America: North America stands as a dominant region in the food industry automation market, primarily driven by high labor costs, stringent food safety regulations, and a strong focus on enhancing productivity and efficiency.

- United States: A key market due to significant investments in advanced manufacturing technologies, high adoption rates of robotics and AI in food processing, and a robust consumer demand for diverse food products requiring flexible automation. The need for reduced human contact post-pandemic also accelerated automation adoption.

- Canada: Follows similar trends with a strong emphasis on food safety and export quality, leading to increased automation in meat processing, dairy, and bakery sectors. Government initiatives to boost manufacturing competitiveness also play a role.

- Europe: Europe is another leading region, characterized by mature food processing industries, a strong emphasis on sustainability, and high labor costs, driving the adoption of sophisticated automation solutions.

- Germany: A leader in industrial automation and robotics, showcasing high integration of advanced systems in food and beverage manufacturing, particularly in process control and intelligent packaging.

- United Kingdom: Growing automation adoption driven by post-Brexit labor challenges and a focus on improving food security and traceability.

- France: Investing in automation to enhance efficiency in traditional food sectors like dairy, bakery, and wine production, while meeting strict quality standards.

- Netherlands: Known for its advanced agricultural and food processing sector, leveraging automation for high-tech farming, dairy, and horticultural products to maintain global competitiveness.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid industrialization, increasing population, rising disposable incomes, and a booming processed food market.

- China: A massive market experiencing rapid automation growth due to rising labor costs, government support for industrial upgrades, and expanding domestic food consumption. Focus on robotics and smart factories.

- Japan: Highly advanced in robotics technology, with a strong focus on precision automation for food processing, packaging, and quality control, driven by an aging workforce.

- India: An emerging market with significant growth potential as food processing industries modernize to meet the demands of its large and growing middle-class population. Government initiatives like 'Make in India' support automation.

- Australia & New Zealand: Driven by demand for high-quality food exports and addressing labor shortages in agriculture and meat processing through automation.

- Latin America: This region is experiencing steady growth in automation adoption, spurred by efforts to modernize food processing industries and improve export competitiveness.

- Brazil: The largest economy in the region, with significant automation investments in meat, poultry, and beverage processing, driven by increasing domestic consumption and export demands.

- Mexico: A key market due to its large food processing sector and close trade ties with North America, driving the adoption of automation to enhance efficiency and quality for export.

- Middle East and Africa (MEA): While starting from a smaller base, MEA is anticipated to witness considerable growth, primarily due to rising food demand, urbanization, and initiatives to enhance local food production and security.

- UAE & Saudi Arabia: Investing heavily in food production and logistics automation as part of their food security strategies, diversifying economies away from oil.

- South Africa: A leading market in Africa, driven by the need to modernize its food and beverage industry to meet growing domestic and regional demands.

- Global Robotics Solutions

- Industrial Automation Systems Inc.

- Precision Engineering Automation

- Advanced Control Technologies

- FoodTech Innovations

- Integrated Process Solutions

- Smart Factory Robotics

- Automated Packaging Systems

- Visionary Automation Group

- Industrial Motion Control

- Robotic Food Processing Systems

- Omni Automation Solutions

- Elite Manufacturing Technologies

- NextGen Automation

- Automation Dynamics

- Process Optimization Technologies

- Automated Solutions Group

- Innovative Food Machinery

- Systems Integration Specialists

- Universal Automation Providers

Regional Highlights

The global Food Industry Automation Market exhibits distinct regional dynamics, influenced by varying levels of industrial development, labor costs, regulatory environments, and consumer preferences. Understanding these regional highlights is crucial for market participants to tailor their strategies and investments effectively. Each region presents a unique set of drivers and opportunities that shape the adoption and growth of automation technologies in the food sector.

Top Key Players:

The market research report covers the analysis of key stake holders of the Food Industry Automation Market. Some of the leading players profiled in the report include -Frequently Asked Questions:

What is Food Industry Automation?

Food industry automation refers to the application of various technologies and systems, such as robotics, process control, and software solutions, to perform tasks in food processing, packaging, and logistics with minimal human intervention. Its primary goals are to enhance efficiency, improve food safety and quality, reduce operational costs, and increase production capacity to meet global demand.

What are the primary benefits of automation in the food sector?

The key benefits of automation in the food sector include significantly improved food safety and hygiene due to reduced human contact, enhanced product quality and consistency through precise control, increased production efficiency and throughput, reduced labor costs and waste, better traceability, and improved workplace safety by automating hazardous tasks. It also allows for greater flexibility in handling diverse products.

How is AI impacting food industry automation?

AI is profoundly impacting food industry automation by enabling smarter, more adaptive systems. AI-powered machine vision systems perform highly accurate quality control and defect detection. Predictive analytics optimize maintenance schedules, reducing downtime. Machine learning algorithms enhance process control, raw material optimization, and supply chain management, leading to greater efficiency and responsiveness to market changes.

What challenges does the Food Industry Automation Market face?

The Food Industry Automation Market faces several challenges, including high initial capital investment costs for acquiring and integrating sophisticated systems, the complex task of handling the natural variability and delicate nature of food products, the necessity for a highly skilled workforce to operate and maintain advanced machinery, and stringent regulatory and hygiene compliance requirements that necessitate specialized equipment design and maintenance protocols.

Which regions are leading the adoption of food industry automation?

North America and Europe are currently leading the adoption of food industry automation due to high labor costs, stringent safety regulations, and technological maturity. However, the Asia Pacific region, particularly China and India, is projected to be the fastest-growing market, driven by rapid industrialization, rising population, and increasing demand for processed and packaged foods, leading to significant investments in modernization.

- Robotics: Encompasses various types of robots adapted for food handling and processing.