Islamic Banking Software Market

Islamic Banking Software Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700379 | Last Updated : July 24, 2025 |

Format : ![]()

![]()

![]()

![]()

Islamic Banking Software Market Size

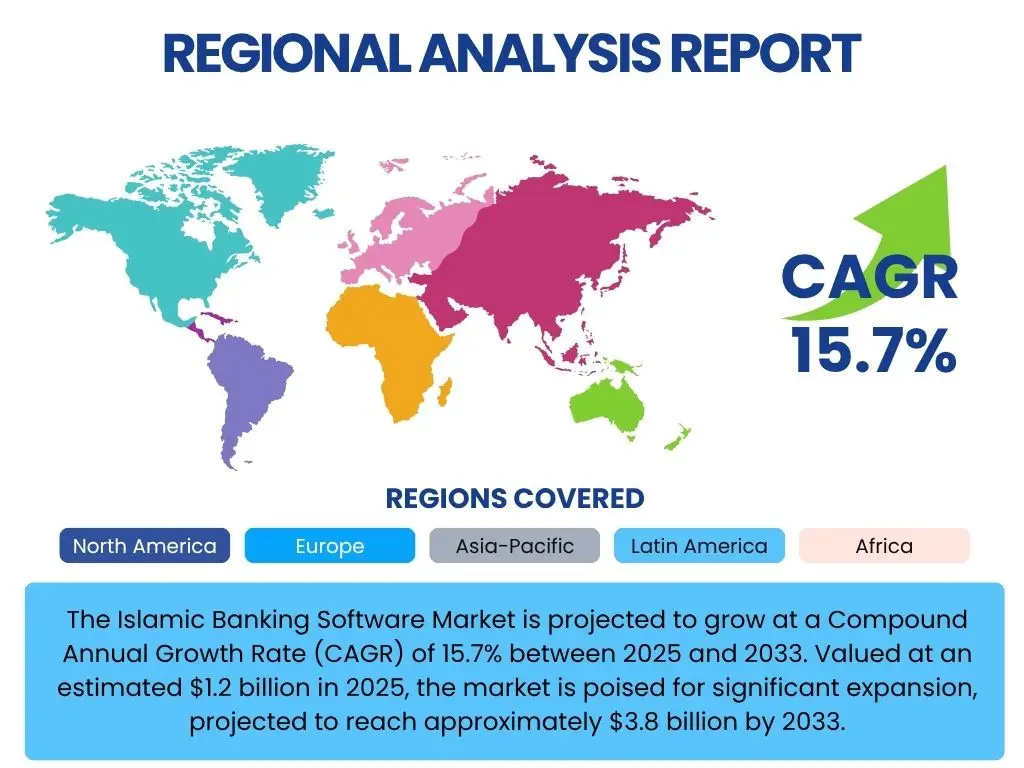

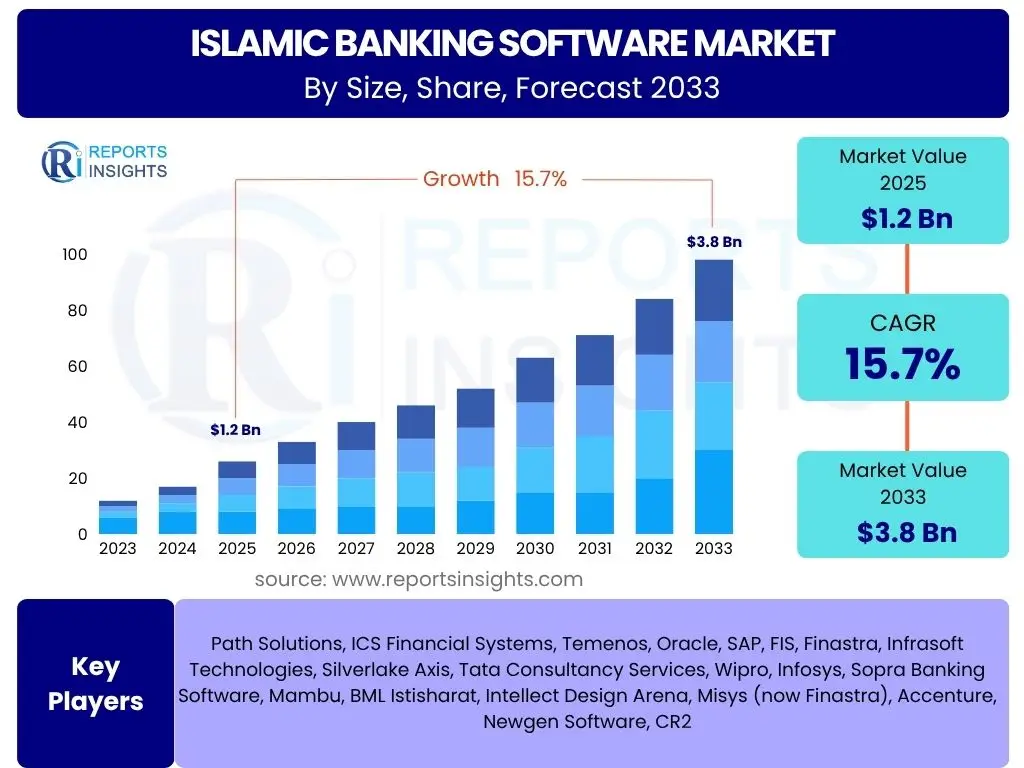

The Islamic Banking Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.7% between 2025 and 2033. Valued at an estimated $1.2 billion in 2025, the market is poised for significant expansion, projected to reach approximately $3.8 billion by 2033. This robust growth trajectory underscores the increasing global demand for Sharia-compliant financial solutions and the pivotal role of advanced software in supporting the digital transformation of Islamic financial institutions. The expansion is driven by both the organic growth of Islamic finance and the strategic adoption of modern technological infrastructures to enhance operational efficiency, regulatory compliance, and customer experience.

Key Islamic Banking Software Market Trends & Insights

The Islamic Banking Software market is evolving rapidly, driven by various technological advancements and shifting market demands. Key trends shaping this sector include the accelerated adoption of digital transformation initiatives, emphasizing mobile banking and online platforms to enhance customer accessibility and engagement. There is a growing integration of advanced analytics and artificial intelligence (AI) to personalize financial offerings, improve risk management, and ensure robust Sharia compliance. Furthermore, the market is witnessing an increased preference for cloud-based solutions, offering scalability, cost-efficiency, and enhanced security for Islamic banks.

- Digital transformation and mobile-first strategies gaining prominence.

- Increasing adoption of Artificial Intelligence and Machine Learning for enhanced decision-making.

- Shift towards cloud-native and Software-as-a-Service (SaaS) deployment models.

- Emphasis on robust cybersecurity measures and data privacy within Sharia frameworks.

- Growing demand for integrated solutions covering core banking, treasury, and trade finance.

- Focus on sustainable and ethical financing, aligning with broader ESG principles.

- Expansion into untapped geographical markets, particularly in Africa and Central Asia.

AI Impact Analysis on Islamic Banking Software

Artificial Intelligence (AI) is set to profoundly transform the Islamic Banking Software landscape by enhancing operational efficiency, personalizing customer experiences, and strengthening Sharia compliance. AI-powered algorithms enable banks to automate routine processes, from loan application processing to transaction monitoring, thereby reducing manual errors and improving turnaround times. Furthermore, AI facilitates sophisticated data analysis, allowing Islamic financial institutions to identify emerging market trends, predict customer behavior, and offer highly customized, Sharia-compliant products. This technology also plays a crucial role in real-time fraud detection, anti-money laundering (AML) efforts, and ensuring adherence to complex Islamic finance principles, making it an indispensable tool for future growth and regulatory assurance.

- Enhanced Sharia compliance through automated verification and audit trails.

- Personalized product offerings and customer relationship management.

- Advanced fraud detection and risk assessment capabilities.

- Automation of back-office operations and customer service via chatbots.

- Predictive analytics for market trends and investment opportunities.

- Improved data security and integrity for sensitive financial information.

Key Takeaways Islamic Banking Software Market Size & Forecast

- The Islamic Banking Software Market is on a significant growth trajectory, driven by increasing adoption of Sharia-compliant finance globally.

- A Compound Annual Growth Rate (CAGR) of 15.7% is projected from 2025 to 2033, indicating rapid expansion.

- The market is expected to surge from an estimated $1.2 billion in 2025 to $3.8 billion by 2033.

- Digitalization and technological integration are core to sustaining this growth and enhancing operational efficiencies.

- Key regions, particularly the Middle East, Southeast Asia, and Africa, will be instrumental in driving market demand.

- Investment in advanced software solutions is critical for Islamic financial institutions to remain competitive and compliant.

Islamic Banking Software Market Drivers Analysis

The growth of the Islamic Banking Software market is propelled by a confluence of macroeconomic, regulatory, and technological factors. A primary driver is the burgeoning global demand for financial products and services that align with Islamic principles, necessitating specialized software to manage complex Sharia-compliant transactions. Additionally, the widespread digital transformation initiatives across the banking sector, coupled with supportive governmental and regulatory frameworks in key Islamic finance hubs, are significantly contributing to the adoption of advanced software solutions. These drivers collectively create a fertile ground for market expansion, pushing financial institutions to invest in robust and efficient Islamic banking software to cater to an expanding client base and meet evolving compliance standards.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Global Demand for Sharia-Compliant Financial Products | +3.5% | Middle East, Southeast Asia, North Africa, Europe (minority populations) | Long-term (5+ years) |

| Accelerated Digital Transformation in the Banking Sector | +2.8% | Global, particularly emerging markets | Medium-term (3-5 years) |

| Supportive Regulatory Frameworks and Government Initiatives | +2.0% | Malaysia, UAE, Saudi Arabia, Bahrain, Indonesia, Pakistan | Ongoing |

| Increasing Focus on Operational Efficiency and Cost Reduction | +1.5% | Global | Short-term (1-3 years) |

| Integration with Broader FinTech Ecosystems | +1.8% | Global, innovation hubs | Medium-term (3-5 years) |

The Growing Global Demand for Sharia-Compliant Financial Products is a paramount driver. As the global Muslim population expands and awareness of Islamic finance increases, there is a natural surge in the need for banking services that strictly adhere to Sharia law. This escalating demand compels conventional banks to introduce Islamic windows and dedicated Islamic banks to invest in specialized software that can accurately process Murabaha, Ijarah, Mudarabah, Musharakah, and other Sharia-compliant contracts, ensuring ethical and transparent financial operations. The software is critical for managing the unique aspects of Islamic finance, such as profit-and-loss sharing and avoidance of interest (riba), making it indispensable for market penetration and service delivery in this growing sector.

Accelerated Digital Transformation in the Banking Sector globally acts as another significant impetus. Islamic financial institutions are increasingly adopting digital platforms to enhance customer experience, streamline operations, and broaden their reach. This transformation mandates robust Islamic banking software capable of supporting mobile banking, online account management, digital payments, and AI-driven analytics. The push towards digitalization ensures that Islamic banks remain competitive with conventional counterparts and cater to a tech-savvy generation seeking convenient and accessible financial services. The software facilitates this transition by providing the necessary digital infrastructure.

Supportive Regulatory Frameworks and Government Initiatives in key Islamic finance jurisdictions are vital for market expansion. Governments and central banks in countries like Malaysia, UAE, Saudi Arabia, and Bahrain are actively promoting Islamic finance through favorable regulations, tax incentives, and dedicated Sharia supervisory boards. These initiatives create a conducive environment for Islamic banks to thrive, and consequently, for the software solutions that underpin their operations to be widely adopted. Compliance with these evolving regulatory landscapes requires sophisticated software that can adapt quickly to new guidelines, ensuring adherence and minimizing operational risks.

The Increasing Focus on Operational Efficiency and Cost Reduction is a universal banking imperative that also drives the Islamic banking software market. Manual processes in traditional banking are prone to errors and high operational costs. Islamic banking software automates complex Sharia-compliant calculations, transaction processing, and reporting, significantly improving efficiency and reducing overheads. By streamlining back-office operations and enhancing front-end customer interactions, these software solutions enable Islamic banks to optimize resource allocation, enhance productivity, and achieve greater profitability, thereby justifying investment in modern platforms.

Finally, the Integration with Broader FinTech Ecosystems is a crucial driver, enabling Islamic banks to leverage innovative technologies beyond their core systems. Islamic banking software increasingly offers APIs and interoperability features that allow seamless integration with third-party FinTech solutions, such as blockchain for smart contracts, RegTech for compliance, and InsurTech for Takaful products. This integration capability allows Islamic banks to innovate rapidly, offer diverse services, and stay ahead in a competitive financial landscape, fostering a dynamic and technologically advanced Islamic finance industry.

Islamic Banking Software Market Restraints Analysis

Despite its promising growth trajectory, the Islamic Banking Software market faces several significant restraints that could impede its full potential. A primary challenge is the lack of universal standardization across different Sharia interpretations, leading to complexities in developing and implementing globally compatible software solutions. Furthermore, the high initial implementation costs associated with integrating new software into legacy banking systems can be prohibitive for smaller institutions or those with limited IT budgets. The scarcity of specialized IT professionals with expertise in both Islamic finance principles and advanced software development also poses a significant hurdle, affecting deployment efficiency and ongoing support. Addressing these restraints is crucial for the sustained and robust expansion of the Islamic banking software ecosystem.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Lack of Universal Standardization in Sharia Interpretations | -2.0% | Global, particularly cross-border operations | Ongoing |

| High Initial Implementation and Maintenance Costs | -1.8% | Emerging Markets, Smaller Institutions | Medium-term (3-5 years) |

| Scarcity of Skilled IT Professionals with Islamic Finance Expertise | -1.5% | Global | Long-term (5+ years) |

| Cybersecurity Concerns and Data Privacy Regulations | -1.0% | Global | Ongoing |

The Lack of Universal Standardization in Sharia Interpretations poses a significant restraint. Different regions and even different Sharia boards within the same country may have varying interpretations of Islamic finance principles. This divergence necessitates highly customizable software solutions that can adapt to specific regional or institutional Sharia requirements, increasing development complexity and costs. For software vendors, creating a universally applicable product becomes challenging, limiting economies of scale and hindering seamless cross-border operations for Islamic banks seeking to expand their services.

High Initial Implementation and Maintenance Costs represent a substantial barrier, especially for smaller Islamic banks or those transitioning from legacy systems. The acquisition of advanced Islamic banking software, coupled with the expenses for customization, integration with existing infrastructure, staff training, and ongoing maintenance, can require a considerable capital outlay. This financial burden can deter institutions from upgrading their systems, opting instead for less efficient manual processes or older technologies, thereby slowing down market adoption rates.

The Scarcity of Skilled IT Professionals with Islamic Finance Expertise is a critical operational restraint. The development, deployment, and maintenance of specialized Islamic banking software demand a unique blend of technical IT skills and in-depth knowledge of Sharia principles and Islamic finance products. A limited talent pool makes it challenging for both software vendors and Islamic financial institutions to find and retain qualified personnel, leading to longer project timelines, higher consulting fees, and potential operational inefficiencies. This human capital gap can hinder innovation and the effective utilization of advanced software features.

Cybersecurity Concerns and Data Privacy Regulations present an ongoing restraint for the entire banking software sector, including Islamic banking. As financial institutions increasingly rely on digital platforms and cloud services, they become more vulnerable to sophisticated cyber threats. The need to protect sensitive customer data and financial transactions from breaches, coupled with the stringent requirements of global data privacy regulations (e.g., GDPR, local data protection laws), adds layers of complexity and cost to software development and deployment. Ensuring robust security measures within Sharia-compliant frameworks requires continuous investment and vigilance, impacting overall market growth.

Islamic Banking Software Market Opportunities Analysis

The Islamic Banking Software market is ripe with opportunities driven by technological advancements and unmet market needs. A significant avenue for growth lies in the increasing adoption of cloud-based solutions, which offer scalability, flexibility, and cost-effectiveness, appealing to institutions of all sizes. The integration of cutting-edge technologies like Artificial Intelligence (AI) and Blockchain presents transformative potential, enabling enhanced security, transparency, and efficiency in Sharia-compliant transactions. Furthermore, the market can expand significantly by tapping into currently underserved or nascent markets, particularly in non-OIC countries with growing Muslim populations, and by developing innovative software solutions for emerging Sharia-compliant product lines such as green finance and social impact investments.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Adoption of Cloud-Based Solutions (SaaS/PaaS) | +2.8% | Global, especially for SMEs | Medium-term (3-5 years) |

| Integration of Emerging Technologies (AI, Blockchain) | +3.0% | Innovation Hubs, Global | Long-term (5+ years) |

| Expansion into Untapped and Emerging Markets | +2.5% | Africa, Central Asia, Western Europe (non-OIC), South Asia | Long-term (5+ years) |

| Development of Niche Sharia-Compliant Products and Services | +1.5% | Global, specialized markets | Medium-term (3-5 years) |

The Growing Adoption of Cloud-Based Solutions (SaaS/PaaS) presents a significant opportunity. Cloud deployment models reduce the need for extensive on-premise infrastructure, lowering capital expenditure and operational costs for Islamic banks. This scalability and flexibility make advanced Islamic banking software accessible to a wider range of institutions, including smaller banks and FinTech startups. Cloud solutions also facilitate faster deployment, easier updates, and enhanced data accessibility, enabling Islamic banks to innovate quickly and adapt to market changes without heavy IT overheads, thus driving wider market adoption.

The Integration of Emerging Technologies, particularly AI and Blockchain, offers transformative opportunities. AI can revolutionize risk management, customer service, and personalized product offerings in Islamic finance, enabling more accurate Sharia compliance checks and predictive analytics. Blockchain, with its immutable ledger technology, can enhance transparency, security, and efficiency in Sharia-compliant transactions, particularly in areas like Zakat management, Waqf (endowment) administration, and cross-border Islamic trade finance. Software vendors who effectively embed these technologies will gain a competitive edge by offering advanced, future-proof solutions that address critical industry needs.

Expansion into Untapped and Emerging Markets represents a substantial growth avenue. While Islamic finance is concentrated in certain regions, there are significant underserved Muslim populations and growing interest in ethical finance in countries across Africa, Central Asia, and even Western Europe. Software providers can tailor solutions to meet the unique regulatory and cultural nuances of these markets, helping local financial institutions establish or expand their Islamic banking operations. This geographical expansion not only diversifies revenue streams for software vendors but also contributes to the global proliferation of Islamic finance.

The Development of Niche Sharia-Compliant Products and Services creates demand for specialized software capabilities. As Islamic finance evolves, there is a growing interest in areas like green Sukuk, sustainable Takaful, Waqf-based social impact investments, and Islamic crowdfunding. Software solutions that can specifically support the unique structures, compliance requirements, and reporting mechanisms of these innovative products will unlock new market segments and revenue streams. This specialization allows vendors to cater to distinct market needs and contribute to the diversification of the Islamic finance industry.

Islamic Banking Software Market Challenges Impact Analysis

Despite the inherent opportunities, the Islamic Banking Software market faces notable challenges that require strategic navigation. The primary hurdle is the complex and often varying regulatory landscape across different jurisdictions, which demands highly adaptable software to ensure continuous Sharia compliance and legal adherence. Furthermore, the inherent resistance to technological change within some traditional financial institutions can slow down the adoption of new software systems, impacting market penetration. Issues related to data privacy and security regulations, alongside intense competition from conventional banking software providers, also pose significant impediments. Overcoming these challenges necessitates innovative solutions, robust compliance features, and effective market education strategies.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complex and Varying Regulatory Landscape | -1.5% | Global, specific regulatory hubs | Ongoing |

| Resistance to Technological Change within Traditional Institutions | -1.2% | Established markets, legacy institutions | Long-term (5+ years) |

| Ensuring Data Privacy and Security Compliance | -1.0% | Global | Ongoing |

| Intense Competition from Conventional Banking Software Providers | -0.8% | Global | Ongoing |

The Complex and Varying Regulatory Landscape is a primary challenge. Islamic financial institutions operate under dual regulatory frameworks: conventional financial regulations and Sharia law. The interpretations and applications of Sharia law can differ significantly across countries and even within regions, making it challenging for software developers to create standardized solutions. Software must be highly configurable and flexible to accommodate diverse local Sharia requirements and conventional banking regulations, increasing development complexity and compliance costs, which can slow down market entry and product deployment.

Resistance to Technological Change within Traditional Institutions poses another significant challenge. Many established Islamic banks have heavily invested in legacy systems and may be reluctant to undertake costly and complex modernization projects. Fear of disruption, lack of internal technical expertise, and an entrenched preference for existing operational models can hinder the adoption of advanced Islamic banking software. Overcoming this inertia requires demonstrating clear return on investment, providing extensive training, and ensuring seamless integration, which can be a protracted process.

Ensuring Data Privacy and Security Compliance is a constant and escalating challenge. With increasing digital adoption, Islamic banks handle vast amounts of sensitive customer data, making them prime targets for cyberattacks. Adhering to stringent global data protection regulations (like GDPR) and local privacy laws, while also embedding security features that align with Islamic ethical principles (e.g., trust and confidentiality), requires significant investment in robust cybersecurity infrastructure and continuous software updates. Any security breach can lead to severe reputational damage, financial penalties, and erosion of customer trust, making it a critical area of focus.

Intense Competition from Conventional Banking Software Providers is a structural challenge. While Islamic banking software is specialized, many large conventional software vendors are adapting their core banking solutions to include Sharia-compliant modules or acquiring niche Islamic finance software companies. This creates a highly competitive environment where specialized Islamic software providers must differentiate themselves through superior functionality, deeper Sharia integration, and specialized customer support. Maintaining a competitive edge requires continuous innovation and a clear value proposition against well-established and resource-rich conventional players.

Islamic Banking Software Market - Updated Report Scope

This comprehensive market research report delves into the intricate dynamics of the Islamic Banking Software market, providing an updated scope that covers historical performance, current market sizing, and detailed future projections. It offers a strategic analysis of market trends, drivers, restraints, opportunities, and challenges, along with an in-depth segmentation analysis across various parameters. The report aims to equip stakeholders with actionable insights to navigate the evolving landscape of Islamic finance technology, facilitating informed decision-making and strategic planning for sustained growth in this specialized and burgeoning sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | $1.2 Billion |

| Market Forecast in 2033 | $3.8 Billion |

| Growth Rate | 15.7% from 2025 to 2033 |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Path Solutions, ICS Financial Systems, Temenos, Oracle, SAP, FIS, Finastra, Infrasoft Technologies, Silverlake Axis, Tata Consultancy Services, Wipro, Infosys, Sopra Banking Software, Mambu, BML Istisharat, Intellect Design Arena, Misys (now Finastra), Accenture, Newgen Software, CR2 |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Islamic Banking Software market is meticulously segmented to provide a granular understanding of its diverse landscape, enabling stakeholders to identify specific growth areas and tailor their strategies effectively. These segments are based on critical attributes such as the type of components offered (solutions and services), deployment modes (on-premise and cloud), enterprise size (large enterprises and SMEs), and various banking applications. Each segmentation offers unique insights into market preferences, technological adoption patterns, and the varying needs of different financial institutions operating under Sharia law.

- By Component: This segment differentiates between the software itself and the services required for its implementation and maintenance.

- Solutions: Encompasses the core software platforms and modules integral to Islamic banking operations.

- Core Banking: Essential systems for managing deposits, loans, customer accounts, and general ledger for Sharia-compliant transactions.

- Treasury: Software for managing liquidity, investments, and foreign exchange in accordance with Islamic finance principles.

- Trade Finance: Solutions supporting Murabaha, Musawamah, and other Sharia-compliant trade financing activities.

- Risk Management & Compliance: Tools for assessing financial risks, ensuring adherence to Sharia laws, and meeting regulatory requirements.

- Channels & Digital Banking: Platforms for online banking, mobile apps, and other customer-facing digital channels.

- Accounting & Reporting: Systems for generating Sharia-compliant financial statements and regulatory reports.

- Others: Includes specialized modules for wealth management, Takaful (Islamic insurance), and Zakat management.

- Services: Refers to the support functions crucial for effective software utilization.

- Implementation & Integration: Services for deploying new software and integrating it with existing IT infrastructure.

- Consulting: Expert guidance on system optimization, Sharia compliance, and strategic technology adoption.

- Support & Maintenance: Ongoing technical assistance, troubleshooting, and software updates to ensure continuous operation.

- Solutions: Encompasses the core software platforms and modules integral to Islamic banking operations.

- By Deployment Mode: This segment distinguishes how the software is hosted and accessed.

- On-Premise: Software installed and managed directly on the financial institution's internal servers and data centers.

- Cloud: Software hosted by a third-party provider and accessed over the internet, including SaaS (Software-as-a-Service), PaaS (Platform-as-a-Service), and IaaS (Infrastructure-as-a-Service) models, offering scalability and reduced infrastructure costs.

- By Enterprise Size: This segment categorizes financial institutions based on their scale of operations.

- Large Enterprises: Major Islamic banks and financial groups with extensive operations and significant IT budgets.

- Small and Medium-sized Enterprises (SMEs): Smaller Islamic banks, credit unions, and emerging financial entities with more constrained resources.

- By Application: This segment focuses on the specific banking areas where the software is utilized.

- Retail Banking: Solutions for individual customers, including savings accounts, personal finance, and consumer financing products.

- Corporate Banking: Software catering to businesses, including corporate finance, trade finance, and treasury management.

- Investment Banking: Systems supporting Sharia-compliant investments, asset management, and capital market activities.

- Fund Management: Solutions for managing Islamic investment funds, including equity, Sukuk, and real estate funds.

- Others: Includes applications for wealth management, microfinance, and community banking within an Islamic framework.

Regional Highlights

The regional analysis of the Islamic Banking Software market reveals diverse growth patterns and levels of adoption influenced by local regulatory environments, economic conditions, and the prevalence of Islamic finance. While the Middle East and Southeast Asia remain the powerhouses of this industry, other regions are rapidly emerging as significant contributors to market expansion. Understanding these regional dynamics is crucial for businesses aiming to penetrate specific markets and for policymakers seeking to foster the growth of Islamic finance globally.

- Middle East and Africa (MEA): This region is the undisputed leader in the Islamic Banking Software market, primarily driven by the strong presence of Islamic financial institutions in the GCC countries (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar). Governments in these nations actively promote Islamic finance through supportive regulations and large-scale investments in digital infrastructure. Countries like Saudi Arabia and UAE are undergoing rapid digital transformation, leading to significant demand for advanced Sharia-compliant banking solutions. Additionally, North African countries are showing increasing interest in Islamic finance, with potential for strong growth in adopting specialized software. The region's large Muslim population and growing awareness of ethical finance principles further bolster market expansion.

- Asia Pacific (APAC): Southeast Asian countries like Malaysia and Indonesia are key growth engines within APAC, driven by well-established Islamic finance ecosystems and proactive regulatory bodies. Malaysia is a global hub for Islamic finance, boasting a mature market and high adoption of digital banking. Indonesia, with the largest Muslim population globally, is witnessing rapid expansion in its Islamic finance sector, necessitating robust software solutions. Other countries such as Pakistan and Bangladesh also present significant growth opportunities due to their substantial Muslim populations and increasing government support for Islamic finance. The overall trend in APAC is towards greater digitalization and the integration of FinTech into Islamic banking.

- Europe: While smaller in scale compared to MEA and APAC, Europe is an emerging market for Islamic Banking Software, particularly in countries with significant Muslim populations or those acting as international financial centers (e.g., UK, Germany, Luxembourg). The demand here is driven by the need for conventional banks to offer Islamic windows and for specialized Islamic financial institutions to cater to minority Muslim communities. Compliance with European financial regulations alongside Sharia principles presents a unique challenge, driving demand for highly adaptable and compliant software solutions.

- North America: The adoption of Islamic Banking Software in North America is relatively nascent, primarily driven by niche financial institutions catering to Muslim communities. The growth is slower compared to other regions due to smaller market size and less developed regulatory frameworks specifically for Islamic finance. However, there is a growing interest in ethical and socially responsible investing, which could indirectly boost demand for Sharia-compliant financial products and, consequently, the software that supports them.

- Latin America: Islamic banking and finance are in very early stages of development in Latin America. While opportunities exist in countries with growing Muslim populations or those interested in diversifying financial services, the demand for Islamic banking software is currently limited. Any future growth will be dependent on regulatory support and increased awareness and adoption of Islamic finance principles.

Top Key Players:

The market research report covers the analysis of key stake holders of the Islamic Banking Software Market. Some of the leading players profiled in the report include -- Path Solutions

- ICS Financial Systems

- Temenos

- Oracle

- SAP

- FIS

- Finastra

- Infrasoft Technologies

- Silverlake Axis

- Tata Consultancy Services

- Wipro

- Infosys

- Sopra Banking Software

- Mambu

- BML Istisharat

- Intellect Design Arena

- Newgen Software

- CR2

- Software Group

- Profund Solutions

Frequently Asked Questions:

What is Islamic Banking Software?

Islamic Banking Software refers to specialized digital platforms and applications designed to facilitate financial operations that strictly adhere to Sharia law. These systems manage unique aspects of Islamic finance, such as profit-and-loss sharing, avoidance of interest (riba), ethical investment screening, and specific contract types like Murabaha and Ijarah, ensuring full compliance with religious principles while offering modern banking functionalities.

What drives the growth of the Islamic Banking Software Market?

The growth of the Islamic Banking Software Market is primarily driven by the increasing global demand for Sharia-compliant financial products, accelerated digital transformation initiatives within financial institutions, and supportive regulatory frameworks in key Islamic finance hubs. The need for operational efficiency, enhanced compliance, and expanded customer reach also significantly contributes to market expansion.

How does AI impact Islamic Banking Software?

Artificial Intelligence significantly impacts Islamic Banking Software by enabling advanced analytics for personalized product offerings, improving risk management and fraud detection, automating Sharia compliance checks, and enhancing operational efficiency through intelligent automation. AI helps Islamic banks make data-driven decisions, offer tailored services, and maintain strict adherence to Islamic finance principles.

Which regions are leading the adoption of Islamic Banking Software?

The Middle East and Africa (MEA) region, particularly the GCC countries, along with Southeast Asia (Malaysia, Indonesia), are leading the adoption of Islamic Banking Software. These regions have well-established Islamic finance industries, proactive regulatory support, and a high demand for Sharia-compliant financial services, driving substantial investment in specialized software solutions.

What are the key challenges faced by the Islamic Banking Software Market?

Key challenges for the Islamic Banking Software Market include the complex and varying interpretations of Sharia law across different jurisdictions, leading to standardization issues. Other challenges involve high initial implementation costs, a scarcity of skilled IT professionals with dual expertise in technology and Islamic finance, and ongoing concerns regarding cybersecurity and data privacy compliance.