Industrial IoT Wireless Module Market

Industrial IoT Wireless Module Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701044 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Industrial IoT Wireless Module Market Size

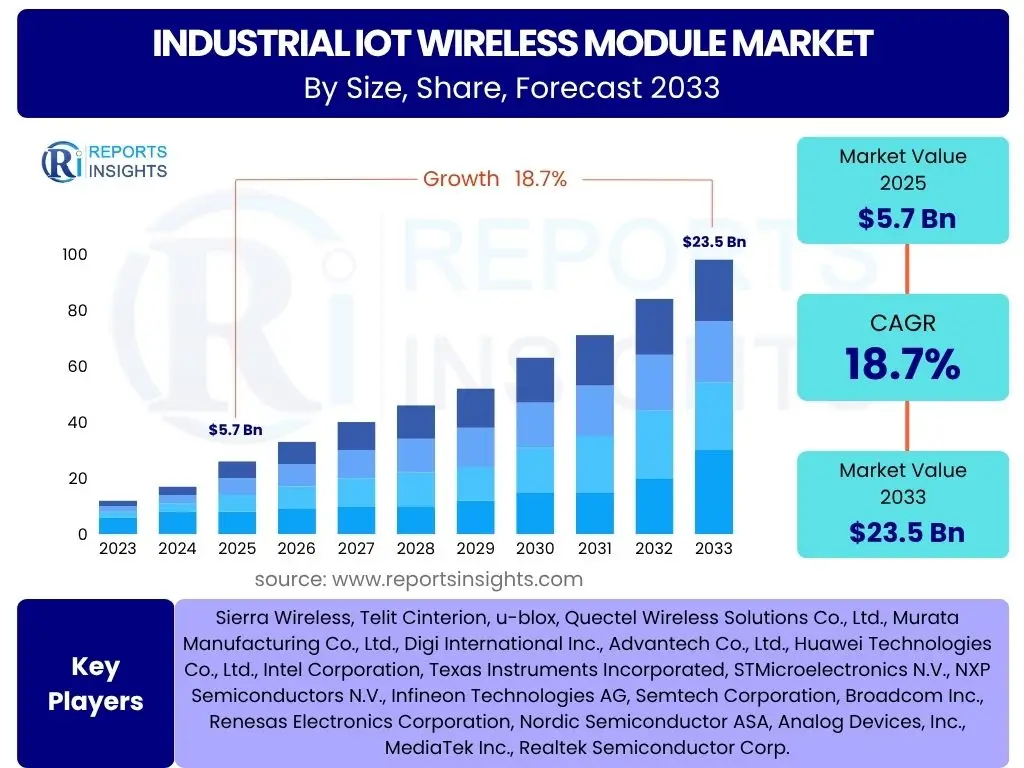

According to Reports Insights Consulting Pvt Ltd, The Industrial IoT Wireless Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.7% between 2025 and 2033. The market is estimated at USD 5.7 Billion in 2025 and is projected to reach USD 23.5 Billion by the end of the forecast period in 2033.

Key Industrial IoT Wireless Module Market Trends & Insights

The Industrial IoT (IIoT) wireless module market is experiencing dynamic shifts driven by technological advancements and evolving industrial requirements. Users frequently inquire about the integration of next-generation connectivity standards, the proliferation of edge computing capabilities, and the growing emphasis on cybersecurity within IIoT ecosystems. There is also significant interest in how miniaturization, power efficiency, and the increasing demand for real-time data processing are shaping module design and deployment across various industrial applications. Furthermore, the convergence of operational technology (OT) and information technology (IT) is a key theme, pushing for more seamless and secure communication solutions.

A notable trend involves the widespread adoption of 5G and Low-Power Wide-Area Network (LPWAN) technologies, offering enhanced bandwidth, lower latency, and extended battery life, respectively. This dual progression allows for diverse applications ranging from high-throughput video analytics in smart factories to long-term monitoring of remote assets. The market is also witnessing a surge in modules incorporating embedded artificial intelligence and machine learning capabilities, enabling on-device data processing and predictive analytics, which significantly reduces cloud dependency and enhances response times. Additionally, the focus on interoperability through standardized protocols and modular designs is becoming paramount, facilitating easier integration into complex industrial environments and promoting a more connected and efficient operational landscape.

- Integration of 5G and LPWAN technologies for diverse connectivity needs.

- Proliferation of edge computing and AI/ML capabilities in modules.

- Enhanced cybersecurity features and secure boot mechanisms.

- Miniaturization and increased power efficiency for compact industrial devices.

- Growing emphasis on interoperability and standardized communication protocols.

AI Impact Analysis on Industrial IoT Wireless Module

User inquiries frequently center on how artificial intelligence (AI) transforms the functionality and value proposition of Industrial IoT wireless modules. Common questions revolve around AI's role in enabling predictive maintenance, optimizing industrial processes, enhancing data analytics at the edge, and improving overall operational efficiency. There is also keen interest in understanding the challenges associated with deploying AI on resource-constrained devices, such as managing power consumption, ensuring data privacy and security, and the computational demands for real-time processing within industrial environments. Users seek insights into how AI integration can lead to smarter, more autonomous industrial systems, fundamentally changing how data is collected, processed, and acted upon.

The integration of AI capabilities directly into Industrial IoT wireless modules represents a significant leap forward, moving beyond simple data transmission to intelligent data interpretation at the source. This "edge AI" enables modules to perform complex analytics, identify anomalies, and make autonomous decisions without constant reliance on cloud servers, thereby reducing latency and bandwidth usage. For instance, AI algorithms can analyze sensor data in real-time to detect equipment malfunctions before they occur, optimizing maintenance schedules and minimizing downtime. Moreover, AI-powered modules can adapt to changing environmental conditions, optimize energy consumption, and even enhance security by detecting unusual network traffic patterns. While challenges like computational resource optimization and data governance persist, the benefits of AI-enhanced modules in creating more resilient, efficient, and intelligent industrial operations are driving substantial innovation and adoption.

- Enables edge intelligence for real-time data processing and analytics.

- Facilitates predictive maintenance and anomaly detection on industrial assets.

- Optimizes energy consumption and resource allocation within networks.

- Enhances cybersecurity through intelligent threat detection at the device level.

- Supports autonomous decision-making and adaptive industrial control systems.

Key Takeaways Industrial IoT Wireless Module Market Size & Forecast

The Industrial IoT wireless module market is poised for robust expansion, driven by the accelerating pace of digital transformation across global industries. Key inquiries from users highlight the market's significant growth trajectory, emphasizing the increasing demand for seamless and reliable connectivity solutions in smart factories, energy grids, and logistics. Insights reveal that the market's future growth will be significantly shaped by the continuous adoption of Industry 4.0 principles, the expansion of wireless infrastructure, and the imperative for real-time data for operational excellence. Stakeholders are particularly interested in identifying the primary revenue streams and the regions expected to exhibit the highest growth rates, signaling a shift towards more intelligent and automated industrial ecosystems.

The substantial projected Compound Annual Growth Rate (CAGR) underscores the critical role IIoT wireless modules play in enabling advanced industrial applications. A significant takeaway is the market's resilience and adaptability, continuously evolving with emerging technologies such as 5G and AI, which are set to unlock new capabilities and use cases. The manufacturing sector remains a dominant force, yet emerging applications in healthcare, agriculture, and smart cities present considerable diversification opportunities. Geographically, the Asia Pacific region is expected to lead in market penetration due to rapid industrialization and government support for smart initiatives, while North America and Europe will continue to drive innovation and high-value deployments. The consistent demand for enhanced productivity, improved safety, and cost reduction through automation solidifies the market's long-term positive outlook.

- The market anticipates strong double-digit growth driven by Industry 4.0 adoption.

- Manufacturing and energy & utilities sectors will remain primary demand drivers.

- Technological advancements in 5G, LPWAN, and edge AI are pivotal for expansion.

- Asia Pacific is projected to be the fastest-growing region due to rapid industrialization.

- Increasing focus on predictive maintenance, asset tracking, and remote monitoring fuels demand.

Industrial IoT Wireless Module Market Drivers Analysis

The Industrial IoT wireless module market is propelled by a confluence of powerful drivers stemming from the global digital transformation agenda and the imperative for operational efficiency across industries. The widespread adoption of Industry 4.0 initiatives, which emphasize automation, data exchange, and smart manufacturing technologies, directly fuels the demand for robust and reliable wireless connectivity. Furthermore, the increasing need for real-time data analytics to enable predictive maintenance, optimize supply chains, and enhance remote monitoring capabilities necessitates sophisticated wireless modules. Governments worldwide are also fostering smart city and industrial automation projects, creating a conducive environment for market expansion, while the continuous innovation in wireless communication standards offers enhanced performance and new application possibilities, collectively accelerating market growth.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rapid Adoption of Industry 4.0 and Digital Transformation | +4.2% | Global, particularly North America, Europe, APAC | Short to Mid-term (2025-2030) |

| Increasing Demand for Real-time Data and Analytics | +3.8% | Global, across all industrial sectors | Short to Mid-term (2025-2030) |

| Growing Need for Predictive Maintenance & Asset Tracking | +3.5% | Manufacturing, Energy & Utilities, Logistics | Mid-term (2026-2031) |

| Advancements in Wireless Communication Technologies (5G, LPWAN) | +3.0% | Global, particularly developed economies | Short to Long-term (2025-2033) |

| Government Initiatives and Investments in Smart Infrastructure | +2.5% | China, India, Germany, USA, Japan | Mid to Long-term (2027-2033) |

Industrial IoT Wireless Module Market Restraints Analysis

Despite the substantial growth potential, the Industrial IoT wireless module market faces several significant restraints that could impede its expansion. One primary concern is the high initial investment required for deploying IIoT solutions, which includes not only the modules themselves but also the associated sensors, infrastructure upgrades, and software platforms. This cost can be particularly prohibitive for small and medium-sized enterprises (SMEs). Furthermore, escalating cybersecurity threats and data privacy concerns pose a considerable challenge, as industrial networks become increasingly interconnected and vulnerable to breaches. The inherent complexities of integrating diverse systems and ensuring interoperability between various hardware and software components also present a technical hurdle, necessitating specialized expertise and prolonged deployment phases.

Another significant restraint is the lack of standardized protocols and fragmented connectivity options, which can lead to vendor lock-in and complicate large-scale deployments across different industrial environments. The shortage of skilled personnel proficient in IIoT technologies, including network management, data analytics, and cybersecurity, further limits the pace of adoption and effective utilization of these modules. Additionally, regulatory complexities and compliance requirements vary widely across regions and industries, creating a challenging landscape for global deployment strategies. These factors, alongside potential issues related to power management in remote or harsh industrial settings, collectively contribute to slower adoption rates in certain segments and regions, impacting the market's overall growth trajectory.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Deployment Costs | -2.8% | Global, particularly SMEs and developing regions | Short to Mid-term (2025-2029) |

| Growing Cybersecurity Concerns and Data Privacy Risks | -2.5% | Global, across all industries | Ongoing, Long-term (2025-2033) |

| Interoperability Issues and Lack of Standardization | -2.0% | Global, prevalent in diverse industrial ecosystems | Mid-term (2026-2031) |

| Shortage of Skilled Workforce and Technical Expertise | -1.5% | Global, particularly emerging economies | Long-term (2027-2033) |

Industrial IoT Wireless Module Market Opportunities Analysis

Significant opportunities abound for growth in the Industrial IoT wireless module market, driven by emerging technological frontiers and expanding application domains. The ongoing integration of 5G technology, with its ultra-low latency and massive connectivity capabilities, presents a transformative opportunity to unlock new industrial applications requiring high-bandwidth and real-time responsiveness, such as augmented reality for maintenance and autonomous industrial vehicles. Furthermore, the proliferation of edge computing capabilities alongside AI and machine learning integration within modules enables smarter, localized data processing, reducing reliance on centralized cloud infrastructure and opening doors for more efficient and secure operations in remote or latency-sensitive environments. These advancements allow for predictive analytics and autonomous decision-making at the device level, creating immense value.

Beyond technological advancements, the market benefits from expanding into new vertical markets and developing innovative use cases. Opportunities exist in retrofitting existing industrial infrastructure with IIoT capabilities, enabling legacy systems to benefit from modern connectivity and data insights without complete overhaul. The increasing focus on sustainability and energy efficiency within industries also presents an opportunity for IIoT modules to monitor and optimize energy consumption, contributing to green initiatives. Additionally, the development of niche applications in areas like smart agriculture, smart healthcare, and intelligent logistics is creating new demand segments, diversifying the market's revenue streams. Collaboration between hardware manufacturers, software providers, and system integrators to offer comprehensive, end-to-end solutions will also be key to capitalizing on these evolving opportunities and fostering wider adoption.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Widespread Rollout of 5G Networks for Industrial Applications | +3.5% | Global, particularly developed economies and urban industrial zones | Mid to Long-term (2026-2033) |

| Integration of Edge Computing and AI/ML Capabilities | +3.2% | Global, across high-value industrial segments | Mid to Long-term (2026-2033) |

| Expansion into New Vertical Markets (Healthcare, Agriculture, Retail) | +2.8% | Global, with specific regional concentrations | Mid-term (2027-2032) |

| Retrofitting Legacy Industrial Systems for Smart Connectivity | +2.0% | Established industrial regions (Europe, North America) | Mid-term (2026-2031) |

Industrial IoT Wireless Module Market Challenges Impact Analysis

The Industrial IoT wireless module market faces several critical challenges that demand strategic responses from industry players. One significant hurdle is the persistent threat of cybersecurity breaches, which can compromise sensitive industrial data, disrupt operations, and damage reputation. As more devices become interconnected, the attack surface expands, requiring sophisticated security measures that are often difficult to implement on resource-constrained modules. Another key challenge is power management, especially for devices deployed in remote locations or harsh environments where access to power is limited and battery life is paramount. Ensuring long-term, reliable operation under such conditions requires constant innovation in low-power communication protocols and energy harvesting technologies.

Moreover, the absence of universally adopted standardization remains a considerable challenge, leading to fragmentation in protocols, interfaces, and data formats. This lack of interoperability can complicate the integration of devices from different vendors and hinder the scalability of IIoT deployments, adding complexity and cost. Managing the vast volume of data generated by IIoT devices is also a growing concern, as it necessitates robust data processing, storage, and analytics capabilities to derive actionable insights without overwhelming network infrastructure. The harsh operating environments, characterized by extreme temperatures, vibrations, and electromagnetic interference, present engineering challenges for module durability and reliability. Addressing these multifaceted challenges is crucial for fostering broader adoption and realizing the full potential of Industrial IoT wireless modules across diverse industrial landscapes.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Escalating Cybersecurity Threats and Vulnerabilities | -2.7% | Global, especially in critical infrastructure | Ongoing, Long-term (2025-2033) |

| Complex Power Management in Remote/Harsh Environments | -2.2% | Specific to remote monitoring, agriculture, energy sectors | Ongoing, Mid-term (2025-2030) |

| Lack of Universal Standardization and Interoperability | -1.8% | Global, impacts large-scale, multi-vendor deployments | Mid-term (2026-2031) |

| Managing Data Overload and Ensuring Data Quality | -1.5% | Global, across data-intensive applications | Ongoing, Long-term (2025-2033) |

Industrial IoT Wireless Module Market - Updated Report Scope

This comprehensive market research report delves into the intricate dynamics of the Industrial IoT Wireless Module market, offering an in-depth analysis of its current landscape, historical performance, and future growth trajectories. The scope encompasses detailed segmentation across various types, technologies, applications, and regional markets, providing stakeholders with granular insights into market opportunities and challenges. It includes extensive coverage of competitive intelligence, highlighting strategies of key market players and their product innovations. The report is designed to assist businesses in making informed strategic decisions, identify emerging trends, and navigate the complexities of this rapidly evolving industrial technology sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.7 Billion |

| Market Forecast in 2033 | USD 23.5 Billion |

| Growth Rate | 18.7% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Sierra Wireless, Telit Cinterion, u-blox, Quectel Wireless Solutions Co., Ltd., Murata Manufacturing Co., Ltd., Digi International Inc., Advantech Co., Ltd., Huawei Technologies Co., Ltd., Intel Corporation, Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., Infineon Technologies AG, Semtech Corporation, Broadcom Inc., Renesas Electronics Corporation, Nordic Semiconductor ASA, Analog Devices, Inc., MediaTek Inc., Realtek Semiconductor Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Industrial IoT wireless module market is highly diversified, segmented across various dimensions to cater to the specific needs of different industrial applications and operational environments. These segments highlight the breadth of technologies and solutions available, from short-range communication protocols ideal for localized factory automation to wide-area cellular technologies enabling extensive asset tracking and remote infrastructure monitoring. Understanding these segmentations is crucial for identifying precise market opportunities, competitive landscapes, and the specific technological requirements for different industrial verticals. The market's complexity reflects the varied demands for data rates, power consumption, range, and security across the vast landscape of industrial applications, driving innovation across module types and underlying technologies.

The segmentation by technology, for instance, distinguishes between cellular options (like 4G, 5G, LTE-M, NB-IoT) that offer wide coverage and high data throughput, and Low-Power Wide-Area Networks (LPWAN) such as LoRa and Sigfox, optimized for long battery life and extensive range with lower data rates. Short-range wireless technologies like Wi-Fi, Bluetooth, and Zigbee continue to dominate in localized, high-density environments. Application-based segmentation reveals the primary use cases driving demand, including predictive maintenance, asset tracking, and process automation, each with unique module requirements. Furthermore, breaking down the market by industry vertical illuminates how specific sectors like manufacturing, energy & utilities, and automotive are adopting these modules to enhance their operational efficiency, safety, and productivity, underpinning the market's robust and multifaceted growth.

- By Type: Covers specific wireless communication standards integrated into the modules, including Wi-Fi for high-speed local networks, Bluetooth for short-range device connectivity, Zigbee for mesh networking in control systems, LoRa and NB-IoT for low-power wide-area applications, 5G for next-generation high-bandwidth and low-latency needs, Wi-SUN for utility networks, and Thread for secure home/building automation.

- By Technology: Categorizes modules based on the core wireless technology utilized. This includes Cellular (encompassing 2G, 3G, 4G LTE, and the emerging 5G for robust and wide-area communication), Low-Power Wide-Area Network (LPWAN) for energy-efficient, long-range deployments, and Short-Range Wireless (such as Wi-Fi, Bluetooth, and Zigbee for localized connectivity within factories or specific sites).

- By Application: Focuses on the primary industrial use cases enabled by these modules, such as Predictive Maintenance (monitoring equipment health), Asset Tracking (locating and managing industrial assets), Remote Monitoring (supervising distant operations), Process Automation (automating industrial processes), Energy Management (optimizing energy consumption), Industrial Control Systems, Smart Logistics, and Surveillance & Security.

- By Industry Vertical: Delineates market adoption across various industrial sectors including Manufacturing (smart factories, assembly lines), Energy & Utilities (smart grids, remote pipeline monitoring), Automotive & Transportation (connected vehicles, fleet management), Healthcare (medical device connectivity), Agriculture (precision farming), Retail & Consumer Goods (inventory management), Building & Construction, Mining, Oil & Gas, and Smart Cities.

- By Component: Breaks down the module into its constituent parts: Hardware (e.g., microcontrollers, transceivers, antennas, sensors, memory), Software (e.g., firmware, embedded operating systems, connectivity stacks), and associated Services (e.g., module deployment, integration, maintenance, and support).

- By Frequency Band: Segments modules based on the radio frequency spectrum they operate in, including Sub-1 GHz (for long-range, low-power applications), 2.4 GHz (common for Wi-Fi and Bluetooth), 5 GHz (for higher bandwidth Wi-Fi), and Licensed Cellular Bands (for 4G/5G communications).

Regional Highlights

The global Industrial IoT wireless module market demonstrates varied growth trajectories and adoption rates across key regions, influenced by factors such as industrial maturity, government initiatives, technological infrastructure, and investment in digital transformation. Each region presents unique opportunities and challenges for market players.

- North America: This region stands as a significant market, characterized by early adoption of advanced industrial technologies, robust R&D investments, and a strong presence of key technology providers. The emphasis on smart manufacturing, automation in industries like automotive and aerospace, and significant cybersecurity investments are key drivers. The region benefits from well-established IT infrastructure and a highly skilled workforce, leading to high-value IIoT deployments and a continuous demand for advanced wireless modules.

- Europe: Driven by initiatives like "Industry 4.0" and a strong focus on smart factories in countries such as Germany, Europe exhibits substantial growth. The region prioritizes regulatory compliance, data security, and sustainable industrial practices, leading to demand for highly secure and energy-efficient wireless modules. Adoption is significant in automotive, machinery, and energy sectors, with a growing trend towards integrating AI and edge computing for enhanced operational efficiency.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid industrialization, burgeoning manufacturing sectors in China and India, and increasing government support for smart city and industrial automation projects. Large-scale deployments in diverse industries, coupled with competitive manufacturing capabilities for IIoT components, drive high volume demand. The expansion of 5G networks and favorable government policies further accelerate market penetration across various applications, including consumer electronics manufacturing and infrastructure development.

- Latin America: This region is experiencing nascent yet significant growth, primarily driven by increasing investments in modernizing key industries such as mining, oil & gas, and agriculture. The need for remote monitoring and asset tracking in geographically dispersed operations fuels the adoption of IIoT wireless modules. While infrastructure development is ongoing, the increasing focus on digital transformation by local governments and enterprises offers substantial opportunities for market expansion.

- Middle East and Africa (MEA): The MEA region presents emerging opportunities, largely propelled by ambitious smart city initiatives in the GCC countries and investments in industrial diversification away from traditional oil and gas. There is a growing emphasis on developing robust digital infrastructure, leading to increased demand for IIoT solutions in logistics, energy management, and public services. Challenges include initial infrastructure costs and the need for localized technical expertise, but long-term growth prospects are positive.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial IoT Wireless Module Market.- Sierra Wireless

- Telit Cinterion

- u-blox

- Quectel Wireless Solutions Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Digi International Inc.

- Advantech Co., Ltd.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Texas Instruments Incorporated

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Semtech Corporation

- Broadcom Inc.

- Renesas Electronics Corporation

- Nordic Semiconductor ASA

- Analog Devices, Inc.

- MediaTek Inc.

- Realtek Semiconductor Corp.

Frequently Asked Questions

Analyze common user questions about the Industrial IoT Wireless Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Industrial IoT Wireless Module?

An Industrial IoT (IIoT) wireless module is an embedded electronic component that enables industrial devices, sensors, and machines to connect and communicate wirelessly within an IoT ecosystem. These modules facilitate data exchange, remote monitoring, and control in various industrial environments, supporting applications from factory automation to smart infrastructure.

What are the primary applications of IIoT Wireless Modules?

Primary applications include predictive maintenance for machinery, real-time asset tracking and management, remote monitoring of industrial processes, automated control systems, energy management, and smart logistics. They are critical for enabling Industry 4.0 initiatives across manufacturing, energy, transportation, and healthcare sectors.

How does 5G technology impact Industrial IoT Wireless Modules?

5G technology significantly impacts IIoT wireless modules by offering ultra-low latency, high bandwidth, and massive connectivity, which are crucial for demanding industrial applications. It enables real-time control, enhances data transmission for AI at the edge, and supports high-density deployments, unlocking new possibilities for automation and smart factories.

What are the main challenges in adopting IIoT Wireless Modules?

Key challenges include high initial investment costs, managing escalating cybersecurity threats, ensuring interoperability across diverse systems, dealing with power management constraints in remote deployments, and the lack of standardized protocols. Additionally, a shortage of skilled personnel for implementation and maintenance poses a significant hurdle.

What is the future outlook for the Industrial IoT Wireless Module market?

The future outlook for the IIoT wireless module market is highly positive, driven by the ongoing digital transformation, advancements in 5G and AI, and increasing demand for operational efficiency. The market is expected to witness robust growth, with continued innovation in module capabilities and expansion into new industrial verticals, creating more intelligent and connected industrial environments.