Sulfur Fertilizer Market

Sulfur Fertilizer Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703344 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Sulfur Fertilizer Market Size

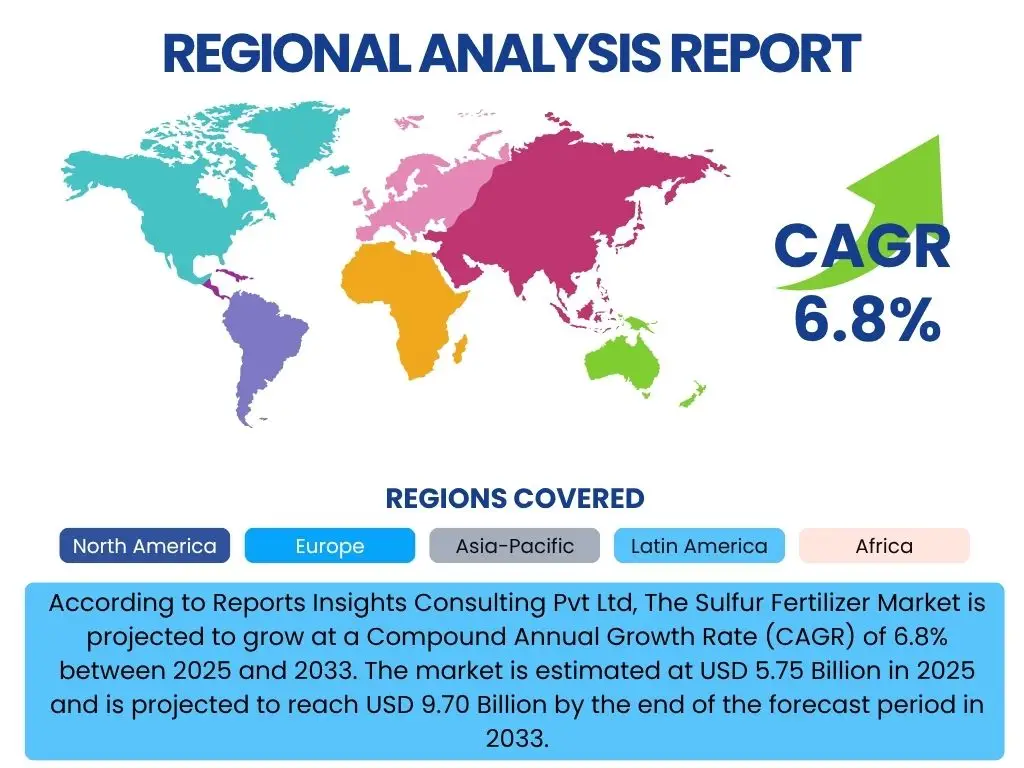

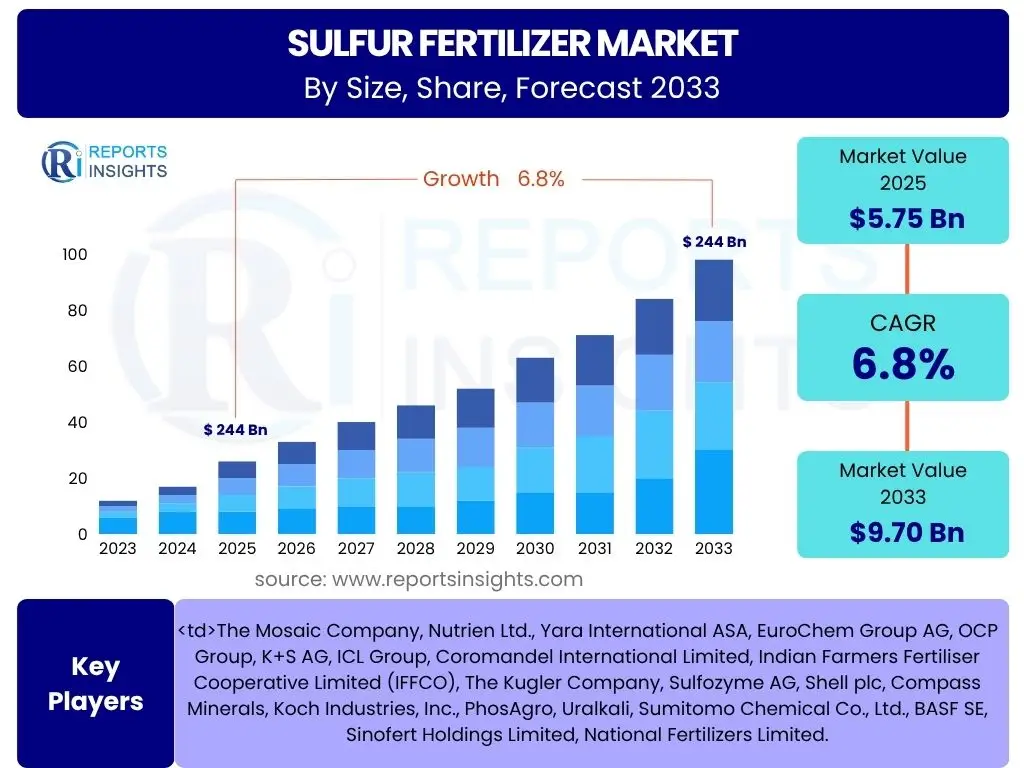

According to Reports Insights Consulting Pvt Ltd, The Sulfur Fertilizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 5.75 Billion in 2025 and is projected to reach USD 9.70 Billion by the end of the forecast period in 2033.

Key Sulfur Fertilizer Market Trends & Insights

User inquiries frequently focus on the evolving landscape of agricultural practices, the increasing awareness of soil nutrient deficiencies, and the quest for enhanced crop productivity and sustainability. These questions reveal a significant interest in novel fertilizer formulations, precision application methods, and the broader integration of technology in agriculture to optimize sulfur utilization. The market is driven by the imperative to meet rising global food demand while addressing environmental concerns associated with traditional farming.

Another area of common interest lies in the regional disparities in sulfur fertilizer adoption and the impact of changing climatic patterns on agricultural yield and nutrient requirements. Users also seek to understand the long-term economic viability and environmental benefits of shifting towards more efficient sulfur management strategies. This collective curiosity underscores a market that is not only expanding in volume but also undergoing a profound transformation towards more intelligent and sustainable nutrient delivery systems.

The market is witnessing a profound shift towards specialty and slow-release sulfur fertilizers, designed to improve nutrient use efficiency and minimize environmental impact. This trend is complemented by the growing adoption of precision agriculture techniques, which allow for targeted application based on real-time soil and crop data, ensuring optimal sulfur delivery and reducing wastage. Furthermore, there is an increasing emphasis on integrated nutrient management systems that combine sulfur with other essential nutrients for synergistic effects on plant health and yield.

- Growing adoption of precision agriculture and smart farming technologies for optimized sulfur application.

- Increased demand for specialty, slow-release, and fortified sulfur fertilizers to enhance nutrient use efficiency.

- Rising awareness among farmers regarding sulfur deficiency in soils and its impact on crop yields.

- Development of innovative sulfur-containing compounds for improved soil health and plant resilience.

- Shift towards sustainable and environmentally friendly agricultural practices driving the use of advanced sulfur solutions.

AI Impact Analysis on Sulfur Fertilizer

Common user questions regarding AI's impact on the sulfur fertilizer domain primarily revolve around how artificial intelligence can enhance efficiency, optimize resource allocation, and contribute to sustainable agricultural practices. Users are keen to understand the practical applications of AI in areas such as soil analysis, predictive modeling for crop nutrient needs, and the automation of fertilizer application. There is a clear expectation that AI will bring about a paradigm shift in how sulfur fertilizers are managed, from production to field application.

Furthermore, users frequently express interest in AI's role in addressing complex challenges like climate change, soil degradation, and nutrient runoff. They seek insights into how AI-driven analytics can provide personalized recommendations for sulfur fertilization, considering variable factors such as weather patterns, crop types, and specific soil conditions. The desire for data-driven decision-making to achieve higher yields with reduced environmental footprints is a recurring theme.

The anticipation is that AI will not only streamline existing processes but also unlock new opportunities for innovation in fertilizer development and distribution. Concerns often relate to data privacy, the accessibility of AI technologies for small-scale farmers, and the initial investment required for implementation. Despite these challenges, the prevailing sentiment is one of optimism regarding AI's transformative potential to revolutionize sulfur fertilizer management, leading to more productive, resilient, and environmentally responsible agricultural systems.

- AI-powered predictive analytics for precise sulfur deficiency detection and nutrient recommendations based on soil data and weather patterns.

- Optimization of sulfur fertilizer application rates and timings through AI-driven sensors and drone technology, minimizing waste.

- Enhanced supply chain management and demand forecasting for sulfur fertilizers using AI algorithms to improve logistics and reduce costs.

- Development of smart farming platforms integrating AI for real-time monitoring of crop health and sulfur uptake.

- AI-assisted research and development for novel sulfur fertilizer formulations with improved efficacy and environmental profiles.

Key Takeaways Sulfur Fertilizer Market Size & Forecast

Common user questions about key takeaways from the Sulfur Fertilizer market size and forecast highlight a strong interest in understanding the primary growth drivers, the most promising regions for investment, and the technological advancements shaping the industry. Users seek concise summaries of market dynamics, including factors influencing market expansion, the anticipated trajectory of market value, and the critical role sulfur plays in global agriculture. This collective inquiry reflects a need for actionable insights to inform strategic decisions in the agricultural and chemical sectors.

Another area of focus for user questions pertains to the impact of sustainability initiatives and environmental regulations on market growth, as well as the emergence of niche segments within the sulfur fertilizer landscape. There is keen interest in identifying which crop types are driving demand and how market players are adapting to evolving farmer needs and environmental pressures. The overarching goal is to grasp the fundamental forces that will define the market's future and its resilience against various internal and external challenges.

The market is poised for robust expansion, primarily propelled by increasing global food consumption and the critical need to enhance crop yields on finite arable land. The sustained growth underscores the indispensable role of sulfur as a macronutrient essential for plant development, protein synthesis, and overall crop quality. Asia Pacific is expected to remain a dominant force, driven by large-scale agricultural practices and escalating demand for high-value crops, while North America and Europe will continue to innovate in precision agriculture and specialty formulations.

- The sulfur fertilizer market exhibits strong growth potential, driven by global food security concerns and agricultural intensification.

- Asia Pacific is projected to maintain its position as the largest and fastest-growing regional market due to extensive agricultural lands and rising population.

- Technological advancements, particularly in precision agriculture and slow-release formulations, are pivotal in shaping market dynamics and improving nutrient efficiency.

- Increasing awareness among farmers regarding sulfur deficiency in soils is a significant catalyst for market expansion across various crop segments.

- The market is characterized by a shift towards sustainable practices, with innovations focusing on environmentally friendly and highly efficient sulfur fertilizer solutions.

Sulfur Fertilizer Market Drivers Analysis

The sulfur fertilizer market is primarily driven by the escalating global demand for food, which necessitates higher agricultural productivity and optimized crop yields. As the world population continues to grow, the pressure on agricultural land intensifies, making the efficient use of nutrients like sulfur crucial for maximizing output per acre. Furthermore, a growing awareness among farmers and agronomists about widespread sulfur deficiencies in arable soils, often overlooked in the past, contributes significantly to market expansion. Modern farming practices, including the use of high-analysis NPK fertilizers that contain less sulfur, and reduced atmospheric sulfur deposition from industrial emissions control, have exacerbated these deficiencies, creating an urgent need for targeted sulfur fertilization to maintain soil fertility and crop health.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing global food demand and population growth | +1.2% | Global, particularly Asia Pacific, Africa, Latin America | Long-term (2025-2033) |

| Growing awareness of sulfur deficiency in soils and its impact on crop yields | +0.9% | North America, Europe, Asia Pacific | Mid-term (2025-2029) |

| Expansion of agricultural land under cultivation and intensive farming practices | +0.8% | Developing economies, particularly Southeast Asia, South America | Mid to Long-term (2025-2033) |

| Need for enhanced crop quality and nutritional value | +0.7% | Global, especially premium crop markets | Mid-term (2026-2030) |

Sulfur Fertilizer Market Restraints Analysis

Despite robust growth, the sulfur fertilizer market faces several restraints, most notably the volatility in raw material prices, particularly elemental sulfur. Price fluctuations, driven by global supply and demand dynamics in the petroleum and mining industries, can directly impact the cost of sulfur-based fertilizers, potentially affecting farmer adoption rates, especially in price-sensitive agricultural markets. Furthermore, stringent environmental regulations concerning fertilizer application and nutrient runoff in certain regions pose a challenge, pushing manufacturers to develop more environmentally friendly and efficient formulations, which can increase production costs and complexity. The initial capital investment required for adopting advanced sulfur application technologies, such as precision farming equipment, also represents a barrier for small and medium-sized farms, limiting the widespread adoption of optimized sulfur management practices.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility in raw material prices (elemental sulfur) | -0.7% | Global | Short to Mid-term (2025-2028) |

| Environmental regulations and concerns over nutrient runoff | -0.5% | Europe, North America, specific Asian countries | Long-term (2025-2033) |

| High initial investment for advanced precision application technologies | -0.4% | Developing regions, small-scale farms | Mid-term (2025-2030) |

Sulfur Fertilizer Market Opportunities Analysis

Significant opportunities in the sulfur fertilizer market stem from the continuous innovation in product development, particularly the creation of advanced formulations such as slow-release, controlled-release, and micronutrient-fortified sulfur fertilizers. These products improve nutrient use efficiency, reduce environmental impact, and provide sustained sulfur availability to crops, addressing both economic and environmental concerns for farmers. The increasing adoption of precision agriculture and smart farming technologies presents a substantial opportunity for optimized sulfur application, allowing for targeted nutrient delivery based on real-time soil and plant data, thereby maximizing efficacy and minimizing waste. Moreover, the vast untapped potential in emerging agricultural markets, especially in developing countries within Asia Pacific, Latin America, and Africa, where agricultural practices are intensifying and awareness of nutrient management is growing, offers significant avenues for market expansion. The rising demand for organic and specialty crops also opens new niches for specific sulfur fertilizer types that align with these cultivation practices.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of innovative, slow-release, and fortified sulfur fertilizers | +0.8% | Global, particularly North America, Europe, Asia Pacific | Mid to Long-term (2026-2033) |

| Increased adoption of precision agriculture and smart farming solutions | +0.7% | North America, Europe, parts of Asia Pacific | Mid-term (2025-2030) |

| Emerging markets in developing countries due to agricultural intensification | +0.6% | Asia Pacific, Latin America, Africa | Long-term (2025-2033) |

Sulfur Fertilizer Market Challenges Impact Analysis

The sulfur fertilizer market faces several persistent challenges that can impede its growth trajectory. Logistical complexities in the distribution and storage of sulfur-based products, particularly elemental sulfur, can be significant due to their physical properties and handling requirements. Ensuring efficient and cost-effective delivery to diverse agricultural regions, especially remote ones, presents a considerable hurdle. The impact of climate change on agricultural productivity and soil health also poses a long-term challenge, as altered weather patterns and increased extreme events can affect crop nutrient uptake and lead to unpredictable demand shifts for fertilizers. Furthermore, the competitive landscape, marked by the availability of various substitute products and alternative nutrient management strategies, requires continuous innovation and differentiation from sulfur fertilizer manufacturers. Educating farmers, particularly in less developed regions, about the specific benefits of sulfur application and overcoming existing knowledge gaps regarding nutrient deficiencies remain crucial for widespread market penetration.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Logistical complexities in distribution and storage | -0.5% | Global, particularly developing regions | Persistent (2025-2033) |

| Impact of climate change on agricultural productivity and soil health | -0.4% | Global | Long-term (2025-2033) |

| Competitive landscape with substitute products and alternative nutrient sources | -0.3% | Global | Mid-term (2025-2030) |

Sulfur Fertilizer Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Sulfur Fertilizer Market, detailing its current size, historical performance, and future growth projections. It offers a thorough examination of key market trends, drivers, restraints, opportunities, and challenges influencing industry dynamics. The report segments the market by product type, crop type, application method, and form, providing detailed insights into each category's contribution to market growth and regional landscapes. Furthermore, it includes a competitive analysis of key market players, highlighting their strategies and market positioning, to offer a holistic view of the global sulfur fertilizer industry and its future outlook.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 5.75 Billion |

| Market Forecast in 2033 | USD 9.70 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 245 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | The Mosaic Company, Nutrien Ltd., Yara International ASA, EuroChem Group AG, OCP Group, K+S AG, ICL Group, Coromandel International Limited, Indian Farmers Fertiliser Cooperative Limited (IFFCO), The Kugler Company, Sulfozyme AG, Shell plc, Compass Minerals, Koch Industries, Inc., PhosAgro, Uralkali, Sumitomo Chemical Co., Ltd., BASF SE, Sinofert Holdings Limited, National Fertilizers Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Sulfur Fertilizer Market is meticulously segmented across various parameters to provide a granular view of its dynamics and growth prospects. This segmentation allows for a detailed analysis of specific product types, their applications across diverse crop categories, and the preferred methods of application, providing valuable insights into market preferences and technological adoption trends. Understanding these segments is crucial for stakeholders to identify key growth areas and tailor their strategies to specific market needs and opportunities. The comprehensive breakdown highlights the diverse solutions available in the market to address varying agricultural requirements and soil conditions globally.

- By Type: This segment categorizes sulfur fertilizers based on their chemical composition and form.

- Elemental Sulfur: Highly concentrated sulfur, requiring microbial oxidation in the soil to become plant-available.

- Sulfate Fertilizers: Readily available forms of sulfur for immediate plant uptake.

- Ammonium Sulfate: A popular choice providing both nitrogen and sulfur.

- Calcium Sulfate/Gypsum: Provides calcium and sulfur, also improving soil structure.

- Potassium Sulfate: Supplies potassium and sulfur, particularly beneficial for chloride-sensitive crops.

- Others: Includes magnesium sulfate, iron sulfate, etc.

- Liquid Sulfur Fertilizers: Solutions and suspensions designed for ease of application and quick nutrient release.

- By Crop Type: This segment analyzes sulfur fertilizer consumption across major agricultural crops, reflecting specific nutrient demands and farming practices.

- Grains & Cereals: Includes Wheat, Rice, Corn, and other cereals that require significant sulfur for protein synthesis and yield.

- Oilseeds & Pulses: Covers crops like Soybean, Canola/Rapeseed, Sunflower, and others where sulfur is critical for oil content and nitrogen fixation.

- Fruits & Vegetables: Specific sulfur needs for quality, flavor, and disease resistance in horticultural crops.

- Others: Encompasses crops such as Sugarcane, Cotton, Forages, and various industrial crops.

- By Application Method: This segment focuses on how sulfur fertilizers are delivered to the plants and soil.

- Soil Application: Broadcast, banding, or localized application of solid or liquid forms directly to the soil.

- Foliar Application: Spraying sulfur solutions directly onto plant leaves for rapid absorption.

- Fertigation: Applying sulfur fertilizers through irrigation systems, ensuring even distribution and nutrient delivery.

- By Form: This segment differentiates sulfur fertilizers based on their physical state, influencing handling, storage, and application.

- Granular: Common solid form, easy to handle and apply.

- Prilled: Spherical, uniform particles, often used for elemental sulfur.

- Powder: Fine particulate form, can be used for direct application or in liquid formulations.

- Liquid: Solutions or suspensions, offering convenience and uniform coverage.

Regional Highlights

- Asia Pacific (APAC): The largest and fastest-growing market for sulfur fertilizers, primarily driven by the expansive agricultural lands, high population density, and surging food demand in countries like China, India, and Southeast Asian nations. Intensive farming practices to maximize yields from limited arable land, coupled with increasing awareness of sulfur deficiencies and government support for agricultural modernization, are key growth catalysts. The region's diverse crop portfolio and significant production of oilseeds and pulses further fuel demand for sulfur.

- North America: A mature market characterized by the widespread adoption of precision agriculture techniques and a strong emphasis on nutrient use efficiency. The United States and Canada are leading the way in integrating advanced technologies for optimized fertilizer application. Demand is driven by large-scale commercial farming operations, a focus on high-yield crops like corn and soybeans, and continuous research into soil health management. Environmental regulations are also prompting a shift towards more sustainable and efficient sulfur products.

- Europe: This region exhibits steady growth, influenced by stringent environmental regulations promoting sustainable agriculture and a focus on specialized and high-quality crop production. European farmers are increasingly adopting advanced sulfur formulations that minimize nutrient leaching and improve environmental performance. Countries like France, Germany, and the UK are investing in research and development for innovative fertilizer solutions, and the demand for organic and specialty crops contributes to the market for specific sulfur fertilizer types.

- Latin America: Expected to demonstrate robust growth due to the expanding agricultural sector, particularly in Brazil and Argentina, which are major global producers of soybeans, corn, and sugarcane. The conversion of new lands into cultivation, coupled with the need to enhance soil fertility and crop productivity, drives the demand for sulfur fertilizers. Government initiatives to support agricultural development and increasing farmer education on nutrient management also contribute to market expansion.

- Middle East and Africa (MEA): An emerging market with significant growth potential, driven by efforts to enhance food security and develop indigenous agricultural capabilities. While the region faces challenges like water scarcity and varied soil conditions, the increasing investment in irrigation infrastructure and modern farming techniques is boosting fertilizer consumption. Countries like South Africa, Egypt, and Saudi Arabia are focusing on improving agricultural output, leading to a gradual rise in sulfur fertilizer demand, particularly for high-value crops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sulfur Fertilizer Market.- The Mosaic Company

- Nutrien Ltd.

- Yara International ASA

- EuroChem Group AG

- OCP Group

- K+S AG

- ICL Group

- Coromandel International Limited

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- The Kugler Company

- Sulfozyme AG

- Shell plc

- Compass Minerals

- Koch Industries, Inc.

- PhosAgro

- Uralkali

- Sumitomo Chemical Co., Ltd.

- BASF SE

- Sinofert Holdings Limited

- National Fertilizers Limited

Frequently Asked Questions

Analyze common user questions about the Sulfur Fertilizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is sulfur fertilizer used for?

Sulfur fertilizer is essential for various plant physiological processes, including protein synthesis, enzyme activation, chlorophyll formation, and vitamin production. It significantly enhances crop yield, quality, and resistance to environmental stresses, particularly important for oilseeds, pulses, and cruciferous vegetables.

Why is sulfur deficiency becoming more common in soils?

Sulfur deficiency is increasingly prevalent due to several factors: reduced atmospheric sulfur deposition from cleaner industrial emissions, increased crop yields depleting soil sulfur faster, and decreased use of sulfur-containing pesticides and fertilizers. These combined effects necessitate supplemental sulfur application to maintain soil fertility.

What are the main types of sulfur fertilizers available in the market?

The primary types of sulfur fertilizers include elemental sulfur, which slowly oxidizes in soil to become available; sulfate-based fertilizers like ammonium sulfate, gypsum (calcium sulfate), and potassium sulfate, which offer immediate plant availability; and liquid sulfur fertilizers for ease of application and rapid nutrient uptake.

Which region dominates the global sulfur fertilizer market, and why?

Asia Pacific currently dominates the global sulfur fertilizer market. This is primarily due to the region's vast agricultural land, large and growing population driving demand for food, and the prevalence of intensive farming practices. Countries like China and India contribute significantly to this dominance, focusing on improving crop yields and soil health.

How does sulfur fertilizer contribute to sustainable agriculture?

Sulfur fertilizer contributes to sustainable agriculture by improving nutrient use efficiency, enabling crops to absorb other essential nutrients more effectively, which reduces the need for excessive application of other fertilizers. It enhances crop resilience, supports higher yields on existing land, and helps maintain soil health, minimizing environmental impact and promoting long-term productivity.