Geoanalytical & Geochemistry Services Market

Geoanalytical & Geochemistry Services Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_678232 | Last Updated : July 21, 2025 |

Format : ![]()

![]()

![]()

![]()

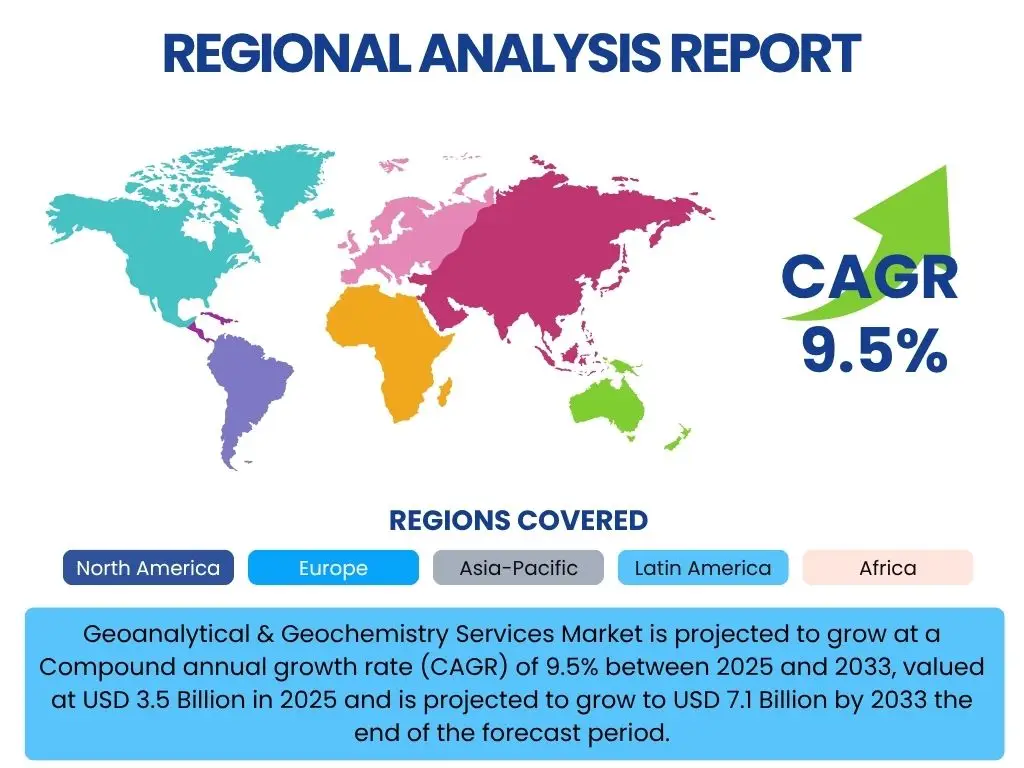

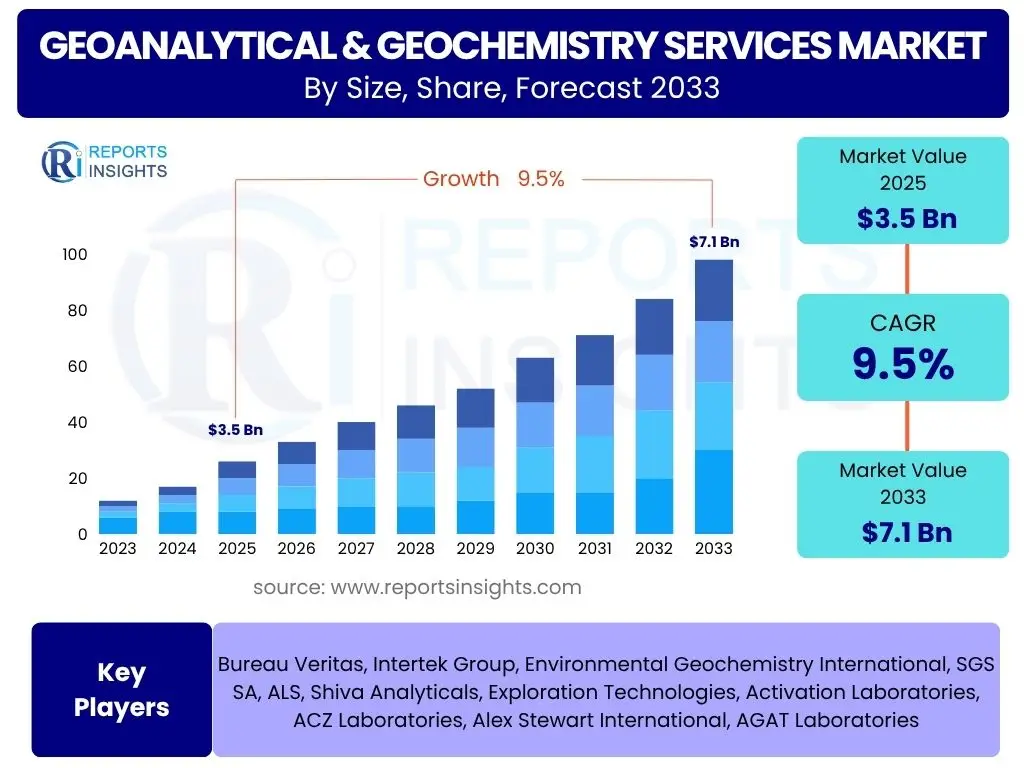

Geoanalytical & Geochemistry Services Market is projected to grow at a Compound annual growth rate (CAGR) of 9.5% between 2025 and 2033, valued at USD 3.5 Billion in 2025 and is projected to grow to USD 7.1 Billion by 2033 the end of the forecast period.

Key Geoanalytical & Geochemistry Services Market Trends & Insights

The Geoanalytical & Geochemistry Services market is undergoing significant transformation, driven by technological advancements, increasing demand from diverse industries, and evolving regulatory landscapes. Key trends highlight a shift towards more efficient, accurate, and environmentally conscious analytical methods, alongside a growing emphasis on real-time data and integrated solutions. These shifts are redefining operational paradigms for service providers and end-users, fostering innovation and expanding the market's reach into new frontiers.

- Increasing demand for mineral exploration and mining.

- Rising focus on environmental monitoring and remediation.

- Technological advancements in analytical instruments and methodologies.

- Growing adoption of automation and digitalization in laboratories.

- Emphasis on sustainable and responsible resource management.

- Expansion of applications in unconventional oil and gas exploration.

- Global increase in infrastructure development projects.

AI Impact Analysis on Geoanalytical & Geochemistry Services

Artificial intelligence (AI) is poised to revolutionize the Geoanalytical & Geochemistry Services market by enhancing data processing capabilities, improving predictive modeling, and automating complex analytical tasks. AI-driven solutions are enabling faster, more accurate interpretations of vast geological datasets, leading to optimized exploration strategies, better environmental risk assessments, and more efficient resource management. This integration of AI is not only boosting operational efficiency but also unlocking new possibilities for discovery and problem-solving within the geoanalytical domain.

- Enhanced data processing and interpretation of large geological datasets.

- Improved predictive modeling for mineral deposits and environmental contamination.

- Automation of laboratory procedures and data analysis workflows.

- Accelerated identification of anomalies and patterns in geochemical data.

- Development of intelligent decision-support systems for exploration.

- Optimization of resource extraction and site remediation strategies.

- Real-time monitoring and anomaly detection in environmental applications.

Key Takeaways Geoanalytical & Geochemistry Services Market Size & Forecast

- The Geoanalytical & Geochemistry Services Market is projected for substantial growth.

- Expected to more than double its market size between 2025 and 2033.

- CAGR of 9.5% signifies a robust expansion trajectory.

- Market value poised to increase from USD 3.5 Billion to USD 7.1 Billion by 2033.

- Growth driven by increasing demand across various end-use industries.

- Technological innovation and environmental regulations are key accelerators.

- Represents a significant investment opportunity within the natural resources and environmental sectors.

Geoanalytical & Geochemistry Services Market Drivers Impact Analysis

The Geoanalytical & Geochemistry Services market is significantly propelled by a confluence of factors, primarily the escalating global demand for natural resources and the increasing stringency of environmental regulations. As populations grow and industrial activities expand, the need for precise data on mineral deposits, energy sources, and environmental quality becomes paramount. This drives exploration, extraction, and monitoring efforts, directly fueling the demand for advanced geoanalytical and geochemistry services.

Furthermore, rapid technological advancements in analytical instrumentation and data processing capabilities are enhancing the efficiency and accuracy of these services, making them indispensable for modern resource management and environmental protection. The integration of cutting-edge techniques allows for more detailed characterization of samples, leading to better decision-making in mining, oil and gas, agriculture, and environmental remediation. These innovations not only improve service quality but also open up new applications, thereby expanding the market's scope and potential.

The global push towards sustainable development and circular economy principles also acts as a significant driver. Companies and governments are increasingly investing in geological and geochemical studies to assess environmental impacts, manage waste, and ensure responsible resource stewardship. This regulatory and corporate emphasis on environmental due diligence and sustainable practices further underpins the strong demand for specialized geoanalytical and geochemistry services across various industries worldwide.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Mineral Exploration and Mining Activities | +1.8% | Global, notably Africa, Latin America, Australia, Canada | Short to Mid-Term (2025-2030) |

| Growing Environmental Regulations and Monitoring Needs | +1.5% | North America, Europe, Asia Pacific (China, India) | Long-Term (2025-2033) |

| Technological Advancements in Analytical Techniques | +1.3% | Global, especially developed economies | Continuous (2025-2033) |

| Expansion of Oil & Gas Exploration and Production | +1.0% | Middle East, North America (shale), South America | Mid-Term (2026-2031) |

| Infrastructure Development and Urbanization | +0.9% | Asia Pacific (China, India), Africa, Latin America | Long-Term (2025-2033) |

| Rising Demand for Agricultural Soil Analysis | +0.7% | Global, particularly high-yield agricultural regions | Mid to Long-Term (2027-2033) |

Geoanalytical & Geochemistry Services Market Restraints Impact Analysis

Despite robust growth prospects, the Geoanalytical & Geochemistry Services market faces notable restraints that could temper its expansion. One significant challenge is the high capital investment required for advanced analytical equipment and specialized laboratories. The sophisticated nature of geoanalytical instruments, coupled with the need for continuous upgrades to keep pace with technological advancements, imposes substantial financial burdens on service providers. This can limit the entry of new players and restrict the scaling capabilities of smaller firms, thereby concentrating market power among a few large entities.

Another key restraint is the scarcity of skilled professionals with expertise in both geochemistry and advanced analytical techniques. The interdisciplinary nature of geoanalytical services demands a highly specialized workforce capable of operating complex instruments, interpreting intricate data, and providing insightful recommendations. The talent gap, particularly in emerging economies, can hinder service quality and delay project timelines, thus impacting market efficiency and growth potential.

Furthermore, price sensitivity among clients, particularly in the highly competitive mining and environmental sectors, can exert downward pressure on service fees. While clients require high-quality, accurate data, they often seek cost-effective solutions. This can force service providers to balance investment in technology and expertise with competitive pricing, potentially impacting profit margins and reinvestment into research and development. Economic downturns or commodity price volatility can exacerbate this sensitivity, leading to reduced demand for non-essential analyses and project delays.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Capital Investment in Equipment and Infrastructure | -0.8% | Global, more pronounced in developing regions | Long-Term (2025-2033) |

| Shortage of Skilled Geochemists and Analytical Scientists | -0.7% | Global, especially emerging markets | Mid to Long-Term (2026-2033) |

| Economic Volatility and Fluctuating Commodity Prices | -0.6% | Global, particularly commodity-dependent economies | Short to Mid-Term (2025-2030) |

| Strict Regulatory Compliance and Permitting Processes | -0.5% | North America, Europe, highly regulated industries | Continuous (2025-2033) |

| Competition from In-house Laboratories of Large Corporations | -0.4% | Mature markets with established industries | Long-Term (2025-2033) |

Geoanalytical & Geochemistry Services Market Opportunities Impact Analysis

The Geoanalytical & Geochemistry Services market is presented with significant opportunities, primarily driven by the increasing global emphasis on sustainable resource management and the transition towards renewable energy. As nations strive to reduce their carbon footprint and diversify energy sources, the demand for critical minerals essential for batteries, solar panels, and wind turbines is surging. Geoanalytical and geochemistry services are vital for identifying, exploring, and characterizing these new mineral deposits, creating a substantial growth avenue for the market.

Furthermore, the expanding applications of geoanalytical services beyond traditional mining and oil and gas sectors into areas like agriculture, urban planning, and forensic geology offer promising diversification opportunities. For instance, precision agriculture relies on detailed soil geochemical analysis to optimize crop yields and minimize environmental impact. Similarly, rapid urbanization necessitates geochemical assessments for land development, pollution monitoring, and groundwater quality studies, opening up new client segments and revenue streams for service providers.

The growing adoption of advanced analytical technologies, including artificial intelligence, machine learning, and automation, also presents a substantial opportunity for market players. Investing in these technologies allows for enhanced efficiency, improved data accuracy, and the development of innovative service offerings, such as predictive analytics for geological formations or real-time environmental monitoring. This technological integration not only improves the value proposition for clients but also positions service providers at the forefront of the evolving geoanalytical landscape, ensuring long-term competitiveness and market expansion.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Rising Demand for Critical Minerals (e.g., Lithium, Cobalt) | +1.6% | Global, strong in regions with EV manufacturing (Asia, Europe) | Long-Term (2025-2033) |

| Growth in Renewable Energy Infrastructure Projects | +1.4% | North America, Europe, Asia Pacific (China, India) | Long-Term (2025-2033) |

| Emergence of New Applications (e.g., Agriculture, Forensics) | +1.2% | Global, especially emerging agricultural economies | Mid to Long-Term (2027-2033) |

| Digital Transformation and Data Analytics Integration | +1.0% | Global, higher adoption in technologically advanced regions | Continuous (2025-2033) |

| Increased Focus on Environmental, Social, and Governance (ESG) | +0.8% | Global, driven by corporate and investor mandates | Long-Term (2025-2033) |

Geoanalytical & Geochemistry Services Market Challenges Impact Analysis

The Geoanalytical & Geochemistry Services market is not without its challenges, which can impact its growth trajectory. One significant challenge is the inherent complexity and variability of geological samples. The diverse range of matrices, mineral compositions, and trace element concentrations requires highly specialized analytical methods and rigorous quality control, making standardization difficult and often time-consuming. This complexity can lead to higher operational costs and potential inconsistencies in results if not managed meticulously, posing a constant challenge for service providers to maintain accuracy and reliability.

Another major challenge stems from the global geopolitical landscape and fluctuating commodity prices. Many major mineral deposits and oil and gas reserves are located in politically unstable regions, introducing risks related to project continuity, security, and investment. Furthermore, the volatility in prices of key commodities like gold, copper, and crude oil directly impacts the profitability and investment appetite of mining and energy companies, which are primary clients for geoanalytical services. Downturns can lead to reduced exploration budgets and delayed projects, thereby suppressing demand for these services.

Moreover, the intense competition within the market, coupled with the need for continuous technological upgrades, presents a persistent challenge. Service providers must invest heavily in the latest instrumentation and analytical techniques to remain competitive, which requires significant capital expenditure. Simultaneously, they face pressure to offer competitive pricing while maintaining high service quality and fast turnaround times. This balancing act can strain resources, particularly for smaller firms, and necessitates a strong focus on innovation and efficiency to overcome these market dynamics.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complexity and Variability of Geological Samples | -0.7% | Global, intrinsic to geological analysis | Continuous (2025-2033) |

| Geopolitical Instability in Resource-Rich Regions | -0.6% | Africa, Middle East, parts of Latin America | Short to Mid-Term (2025-2030) |

| Pressure to Reduce Turnaround Times and Costs | -0.5% | Global, across all industries seeking services | Continuous (2025-2033) |

| Data Management and Cybersecurity Risks | -0.4% | Global, especially for digitally mature operations | Long-Term (2025-2033) |

| Environmental Concerns and Social License to Operate | -0.3% | Global, particularly sensitive regions | Long-Term (2025-2033) |

Geoanalytical & Geochemistry Services Market - Updated Report Scope

This comprehensive market research report on Geoanalytical & Geochemistry Services provides an in-depth analysis of market dynamics, growth drivers, restraints, opportunities, and challenges. It offers a detailed forecast of market size and growth rates, segmenting the market by type, application, end-use industry, and geography. The report aims to equip stakeholders with actionable insights to make informed strategic decisions in this evolving sector, covering historical trends and future projections.

| Report Attributes | Report Details |

|---|---|

| Report Name | Geoanalytical & Geochemistry Services Market |

| Market Size in 2025 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | CAGR of 2025 to 2033 9.5% |

| Number of Pages | 250 |

| Key Companies Covered | Bureau Veritas, Intertek Group, Environmental Geochemistry International, SGS SA, ALS, Shiva Analyticals, Exploration Technologies, Activation Laboratories, ACZ Laboratories, Alex Stewart International, AGAT Laboratories |

| Segments Covered | By Type, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Customization Scope | Avail customised purchase options to meet your exact research needs. Request For Customization |

Segmentation Analysis

: Market Product Type Segmentation:-- Laboratory Based

- In-field Based

Market Application Segmentation:-

- Industrial

- Scientific Research

- Statistical

Regional Highlights

- North America: This region is a major contributor to the Geoanalytical & Geochemistry Services market, driven by significant mineral exploration activities, particularly in Canada and the United States, alongside stringent environmental regulations and a strong presence of advanced analytical laboratories. The oil and gas sector, including shale exploration, also heavily relies on these services, ensuring a consistent demand.

- Europe: Europe stands out for its strong emphasis on environmental monitoring, remediation projects, and compliance with high regulatory standards. Countries like Germany, the UK, and Scandinavia are at the forefront of adopting advanced geoanalytical techniques for pollution control, waste management, and sustainable land use, contributing significantly to market growth.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to rapid industrialization, extensive infrastructure development, and increasing mining activities in countries like China, India, and Australia. The growing demand for raw materials and the expanding need for environmental impact assessments are key factors propelling the market in this region.

- Latin America: Latin America is a critical region for the Geoanalytical & Geochemistry Services market owing to its vast reserves of minerals such as copper, gold, and iron ore. Countries like Chile, Peru, and Brazil are major mining hubs, where exploration and production activities drive substantial demand for geochemical analysis and geological mapping services.

- Middle East and Africa (MEA): This region's growth is primarily fueled by the extensive oil and gas sector in the Middle East and significant mineral exploration opportunities in Africa. As African nations continue to develop their mining industries and attract foreign investment, the demand for precise geoanalytical data for resource characterization and environmental management is on the rise.

Top Key Players:

The market research report covers the analysis of key stake holders of the Geoanalytical & Geochemistry Services Market. Some of the leading players profiled in the report include -

- Bureau Veritas

- Intertek Group

- Environmental Geochemistry International

- SGS SA

- ALS

- Shiva Analyticals

- Exploration Technologies

- Activation Laboratories

- ACZ Laboratories

- Alex Stewart International

- AGAT Laboratories

Frequently Asked Questions:

What are Geoanalytical & Geochemistry Services?

Geoanalytical and geochemistry services involve the laboratory or in-field analysis of geological materials, such as rocks, soil, water, and minerals, to determine their chemical composition, physical properties, and geological history. These services are crucial for identifying mineral deposits, assessing environmental impacts, ensuring compliance with regulations, and supporting various industrial applications. They provide essential data for decision-making in sectors like mining, oil and gas, environmental protection, and agriculture.

What is the projected growth rate for the Geoanalytical & Geochemistry Services Market?

The Geoanalytical & Geochemistry Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2033. This robust growth rate indicates a significant expansion in market size over the forecast period, driven by increasing demand for natural resources and heightened environmental awareness globally.

What are the primary drivers of the Geoanalytical & Geochemistry Services Market?

Key drivers for the Geoanalytical & Geochemistry Services Market include increasing global mineral exploration and mining activities, rising environmental regulations and monitoring needs, continuous technological advancements in analytical techniques, and the ongoing expansion of oil and gas exploration. Additionally, infrastructure development, urbanization, and agricultural soil analysis contribute significantly to market demand.

How does AI impact Geoanalytical & Geochemistry Services?

AI significantly impacts Geoanalytical & Geochemistry Services by enabling enhanced data processing and interpretation of large geological datasets, improving predictive modeling for mineral deposits and environmental contamination, and automating laboratory procedures. It also accelerates the identification of anomalies, optimizes resource extraction strategies, and supports real-time environmental monitoring, thereby boosting efficiency and accuracy across the sector.

Which regions are leading the Geoanalytical & Geochemistry Services Market?

North America and Asia Pacific are leading the Geoanalytical & Geochemistry Services Market. North America benefits from extensive mining and oil and gas activities and robust environmental regulations. Asia Pacific is experiencing rapid growth due to widespread industrialization, significant infrastructure development, and increasing demand for raw materials in countries like China, India, and Australia. Europe also holds a strong position due to its focus on environmental compliance and advanced analytical capabilities.