Ethylbenzene Market

Ethylbenzene Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702083 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Ethylbenzene Market Size

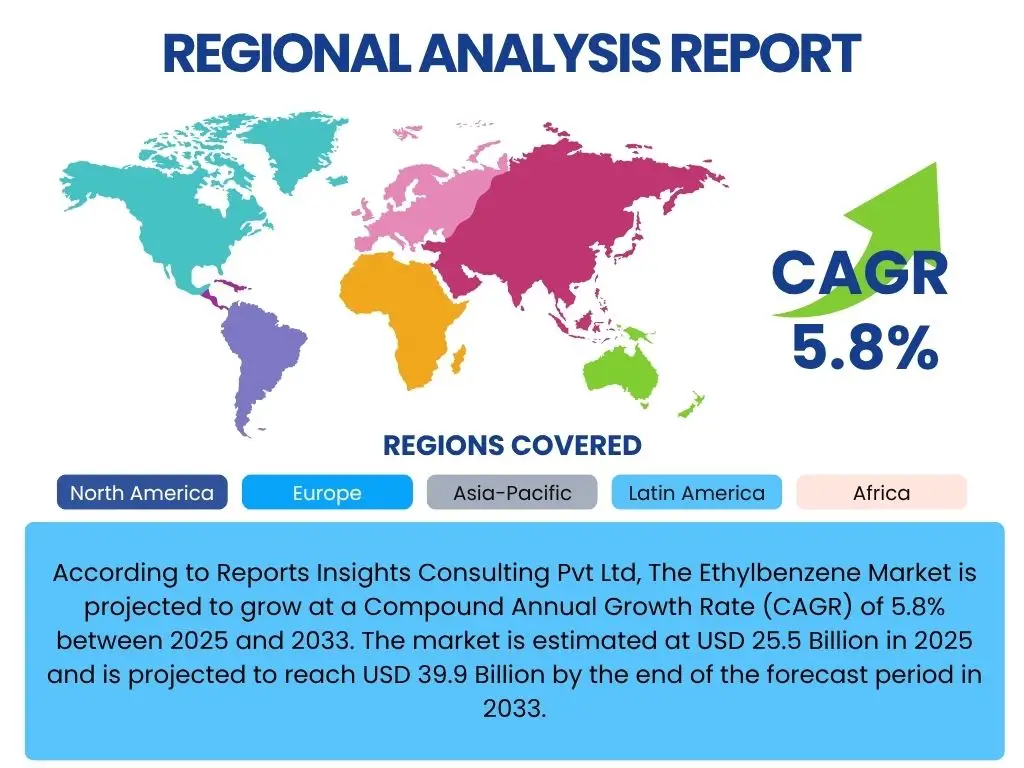

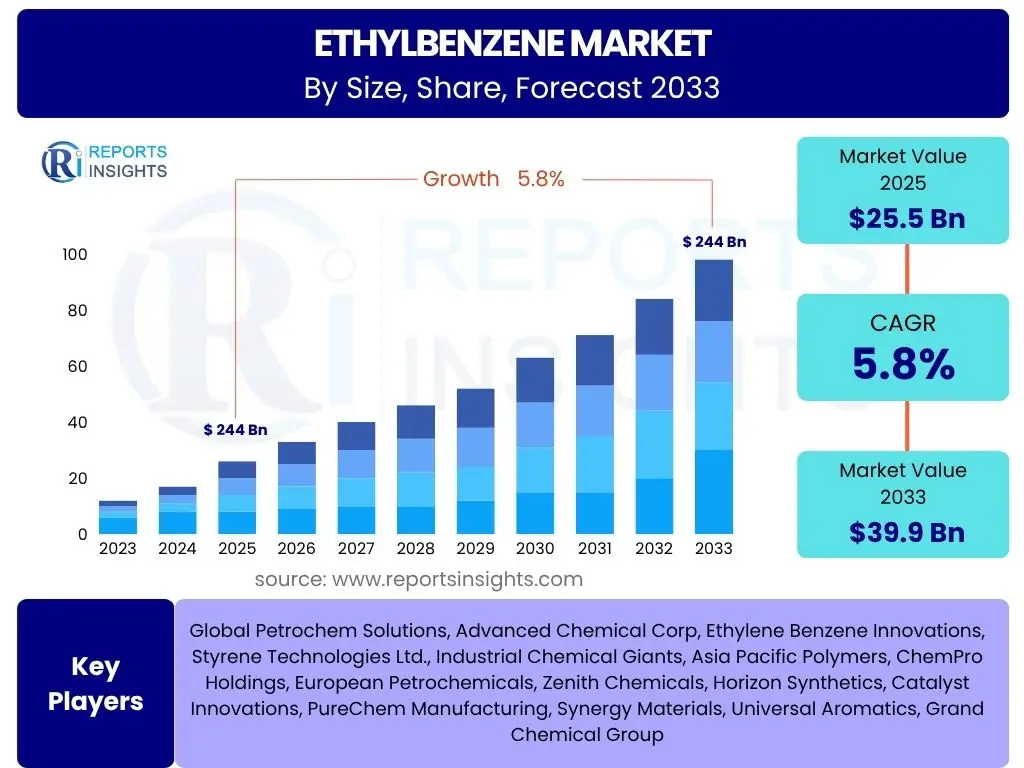

According to Reports Insights Consulting Pvt Ltd, The Ethylbenzene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2033. The market is estimated at USD 25.5 Billion in 2025 and is projected to reach USD 39.9 Billion by the end of the forecast period in 2033.

Key Ethylbenzene Market Trends & Insights

The Ethylbenzene market is predominantly driven by the robust demand for styrene, which is a key derivative used in the production of polystyrene, styrene-butadiene rubber (SBR), and acrylonitrile butadiene styrene (ABS) resins. These materials find extensive applications in packaging, automotive, construction, and consumer goods industries, underpinning the sustained growth of the Ethylbenzene sector. The expansion of these end-use sectors, particularly in emerging economies, significantly influences market dynamics, leading to increased production capacities and technological advancements aimed at optimizing manufacturing processes.

Furthermore, sustainability and environmental considerations are increasingly shaping market trends. There is a growing emphasis on developing more energy-efficient production methods and exploring bio-based or renewable feedstocks for Ethylbenzene synthesis to reduce the carbon footprint. Regulatory pressures regarding volatile organic compound (VOC) emissions and industrial waste management are also compelling manufacturers to invest in greener technologies and cleaner production processes. This shift towards sustainable practices is expected to create new opportunities for innovation and differentiation within the market.

- Increasing demand for styrene and its derivatives across diverse end-use industries, including packaging, construction, and automotive.

- Growing investment in petrochemical infrastructure and capacity expansions, particularly in Asia Pacific and the Middle East.

- Rising focus on sustainability and green chemistry, driving research into bio-based Ethylbenzene and energy-efficient production methods.

- Technological advancements aimed at improving process efficiency, reducing energy consumption, and minimizing environmental impact in Ethylbenzene synthesis.

- Volatility in raw material prices, such as benzene and ethylene, influencing production costs and market strategies.

AI Impact Analysis on Ethylbenzene

The integration of Artificial Intelligence (AI) across the chemical manufacturing value chain is poised to significantly transform the Ethylbenzene market. AI technologies, including machine learning, predictive analytics, and process automation, are being increasingly adopted to optimize production efficiency, enhance supply chain management, and improve quality control. By analyzing vast datasets from sensors, production lines, and market trends, AI algorithms can predict equipment failures, suggest optimal operating parameters, and streamline logistics, leading to reduced operational costs and improved resource utilization in Ethylbenzene production facilities.

Moreover, AI is playing a crucial role in accelerating research and development efforts for novel catalysts and more sustainable manufacturing routes for Ethylbenzene. AI-driven simulations and material informatics can rapidly screen potential chemical compounds and reaction pathways, significantly cutting down the time and cost associated with traditional experimental methods. This capability enables manufacturers to innovate faster, develop greener processes, and respond more agilely to evolving market demands and environmental regulations, thereby fostering a more competitive and sustainable Ethylbenzene industry.

- Enhanced process optimization and control in Ethylbenzene manufacturing plants, leading to higher yields and reduced energy consumption.

- Predictive maintenance for critical equipment, minimizing downtime and extending asset lifespan in production facilities.

- Optimized supply chain management through AI-driven forecasting and logistics, ensuring efficient raw material procurement and product distribution.

- Accelerated research and development of new catalysts and greener Ethylbenzene production technologies through AI-powered material discovery.

- Improved quality control and consistency of Ethylbenzene products through real-time data analysis and anomaly detection.

Key Takeaways Ethylbenzene Market Size & Forecast

The Ethylbenzene market is positioned for steady growth over the forecast period, primarily propelled by the relentless expansion of its downstream applications, particularly in the production of styrene and its diverse derivatives. The strong demand from the packaging, construction, and automotive sectors globally remains a fundamental driver, ensuring a continuous need for Ethylbenzene. Emerging economies, especially those in Asia Pacific, are expected to be the epicenters of this growth, driven by rapid industrialization and urbanization. This sustained demand underlines the market's resilience and foundational role within the petrochemical industry.

Beyond demand, technological advancements and a burgeoning focus on sustainability are set to redefine the market landscape. Manufacturers are increasingly investing in process innovations that enhance efficiency and reduce environmental impact, driven by both regulatory imperatives and corporate social responsibility initiatives. While geopolitical factors and raw material price volatility present challenges, the long-term outlook remains positive, supported by the intrinsic utility of Ethylbenzene in various indispensable end-products. The market is also witnessing a strategic shift towards capacity expansions and integration to secure supply chains and capitalize on regional growth opportunities.

- The Ethylbenzene market is poised for significant growth, projected to reach USD 39.9 Billion by 2033, driven by expanding downstream styrene applications.

- Asia Pacific is expected to remain the dominant and fastest-growing region, fueled by robust industrial and construction sector expansion.

- Technological advancements in production processes and increasing adoption of sustainable practices are key factors influencing market development.

- Volatility in raw material prices and stringent environmental regulations represent persistent challenges that require strategic adaptation from market players.

- The market's stability is underpinned by the essential role of styrene derivatives in diverse and expanding global industries.

Ethylbenzene Market Drivers Analysis

The escalating demand for styrene and its derivatives stands as the most significant driver for the Ethylbenzene market. Ethylbenzene serves almost exclusively as an intermediate for styrene production, which is a fundamental building block for polymers such as polystyrene (PS), styrene-butadiene rubber (SBR), acrylonitrile butadiene styrene (ABS), and unsaturated polyester resins (UPR). These materials are indispensable across a wide array of end-use industries, including packaging, automotive components, construction materials (insulation, pipes), consumer electronics, and home appliances. The continuous growth in these sectors globally, particularly in developing economies with rising disposable incomes and infrastructure development, directly translates into increased demand for Ethylbenzene.

Furthermore, the rapid urbanization and industrialization, especially across the Asia Pacific region, are fostering a substantial increase in the consumption of plastic and rubber products. This demographic and economic shift necessitates higher production volumes of styrene, thereby bolstering the demand for Ethylbenzene. Investments in new petrochemical capacities and expansions of existing facilities to meet this burgeoning demand also serve as a powerful market driver. Innovations in polymer science leading to new applications for styrene derivatives also incrementally contribute to market expansion, ensuring a steady growth trajectory for Ethylbenzene.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand for Styrene and its Derivatives | +2.5% | Asia Pacific, North America, Europe | Long-term (2025-2033) |

| Growth in Packaging and Construction Industries | +1.8% | Global, particularly Emerging Economies | Mid-to-Long term (2025-2033) |

| Expansion of Automotive Sector and Electric Vehicles | +1.2% | Global, especially China, EU, USA | Mid-to-Long term (2025-2033) |

| Technological Advancements in Production Efficiency | +0.8% | Global | Mid-term (2025-2029) |

Ethylbenzene Market Restraints Analysis

The Ethylbenzene market faces significant restraints primarily due to the volatility and fluctuating prices of its key raw materials: benzene and ethylene. Both are crude oil derivatives, making their prices highly susceptible to global crude oil price movements, geopolitical instability, and supply-demand imbalances in the petrochemical sector. Such price fluctuations directly impact the production costs of Ethylbenzene, eroding profit margins for manufacturers and leading to potential production curtailments or price increases for downstream products. This instability introduces considerable risk for market participants and can deter long-term investment in new capacities.

Furthermore, stringent environmental regulations concerning emissions and waste disposal from petrochemical plants pose a significant challenge. The production of Ethylbenzene and subsequent styrene manufacturing involves complex chemical processes that can generate volatile organic compounds (VOCs) and other pollutants. Governments worldwide are imposing stricter limits on industrial emissions and promoting sustainable manufacturing practices, which necessitate substantial capital investments in pollution control technologies and adherence to complex compliance procedures. These regulatory burdens can increase operational costs, limit production flexibility, and potentially slow down market growth, particularly in regions with rigorous environmental oversight.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatility of Raw Material Prices (Benzene & Ethylene) | -1.5% | Global | Short-to-Mid term (2025-2028) |

| Stringent Environmental Regulations and Emission Standards | -1.0% | Europe, North America, China | Long-term (2025-2033) |

| Potential for Overcapacity in Styrene Production | -0.7% | Asia Pacific (China), Middle East | Mid-term (2027-2030) |

| Competition from Alternative Materials and Technologies | -0.5% | Global | Long-term (2029-2033) |

Ethylbenzene Market Opportunities Analysis

The emerging emphasis on sustainable and bio-based chemical production presents a significant opportunity for the Ethylbenzene market. As environmental concerns escalate and consumer preferences shift towards greener products, there is a growing interest in developing Ethylbenzene from renewable feedstocks rather than traditional fossil fuels. Research and development into processes utilizing bio-ethanol or other biomass-derived benzene precursors could open new avenues for production, allowing manufacturers to reduce their carbon footprint and appeal to a broader market segment sensitive to environmental impact. This shift not only aligns with global sustainability goals but also offers potential long-term stability against the volatility of fossil fuel prices.

Furthermore, the expansion of new end-use applications for styrene derivatives beyond conventional uses offers considerable growth opportunities. Innovations in materials science are leading to the development of advanced polymers with enhanced properties suitable for specialized applications in areas like lightweight automotive components, high-performance insulation for energy-efficient buildings, and advanced materials for renewable energy infrastructure. The increasing adoption of electric vehicles, for instance, drives demand for lightweight plastics and rubbers, which directly translates to a need for more styrene and thus Ethylbenzene. These evolving application areas provide a fertile ground for market expansion, pushing manufacturers to innovate and diversify their product portfolios.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Bio-based Ethylbenzene Production | +1.0% | Europe, North America, Japan | Long-term (2028-2033) |

| Expansion into New and Specialized Styrene Applications | +0.9% | Global | Mid-to-Long term (2026-2033) |

| Capacity Expansions in Emerging Petrochemical Hubs | +0.7% | Middle East, India, Southeast Asia | Mid-term (2025-2030) |

| Advancements in Catalyst Technology for Improved Yield | +0.6% | Global | Short-to-Mid term (2025-2029) |

Ethylbenzene Market Challenges Impact Analysis

The Ethylbenzene market faces a persistent challenge from the intense competition and overcapacity within the broader styrene monomer industry. As numerous players invest in large-scale styrene production facilities, particularly in Asia, there is a continuous risk of oversupply relative to demand. This overcapacity can lead to downward pressure on styrene prices, which in turn impacts the profitability of Ethylbenzene production. The highly integrated nature of the petrochemical value chain means that imbalances in one segment, such as styrene, can reverberate upstream to Ethylbenzene, making it difficult for manufacturers to maintain stable margins and plan long-term investments effectively.

Another significant challenge lies in the increasing public and regulatory scrutiny concerning the environmental impact of chemical manufacturing. Ethylbenzene and styrene are subjects of concerns regarding air quality and potential health impacts. This scrutiny translates into stricter operational permits, higher compliance costs, and potential public opposition to new plant constructions or expansions. Companies are compelled to invest heavily in advanced pollution control technologies and sustainable practices, which, while beneficial for the environment, add to the capital expenditure and operational burden. Furthermore, geopolitical uncertainties and trade disputes can disrupt global supply chains for raw materials and finished products, adding another layer of complexity and risk to market operations.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Competition and Potential Overcapacity in Styrene Market | -1.2% | Asia Pacific, Global | Mid-term (2026-2030) |

| Shifting Regulatory Landscape and Compliance Costs | -0.9% | Europe, North America, China | Long-term (2025-2033) |

| Supply Chain Disruptions and Geopolitical Instability | -0.8% | Global | Short-term (2025-2027) |

| Fluctuations in Energy Costs for Production | -0.6% | Global | Short-to-Mid term (2025-2028) |

Ethylbenzene Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the global Ethylbenzene market, offering a detailed overview of its current size, historical performance, and future growth projections up to 2033. The report segments the market by application, end-use industry, manufacturing process, and purity level, delivering granular insights into various market dynamics. It further delves into the major drivers, restraints, opportunities, and challenges impacting the market, alongside a thorough regional analysis and competitive landscape assessment, presenting a holistic view for strategic decision-making.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 39.9 Billion |

| Growth Rate | 5.8% |

| Number of Pages | 265 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Petrochem Solutions, Advanced Chemical Corp, Ethylene Benzene Innovations, Styrene Technologies Ltd., Industrial Chemical Giants, Asia Pacific Polymers, ChemPro Holdings, European Petrochemicals, Zenith Chemicals, Horizon Synthetics, Catalyst Innovations, PureChem Manufacturing, Synergy Materials, Universal Aromatics, Grand Chemical Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Ethylbenzene market is intricately segmented to provide a granular view of its various facets, enabling a deeper understanding of market dynamics and opportunities. The primary segmentation is by application, where Ethylbenzene is overwhelmingly utilized for the production of Styrene Monomer (SM), highlighting its critical role in the polymer industry. Smaller applications include its use as a solvent or as an intermediate in the synthesis of other specialty chemicals. This application-based segmentation directly reflects the downstream demand drivers for Ethylbenzene.

Further segmentation by end-use industry categorizes the consumption of styrene derivatives across major sectors such as packaging, automotive, construction, and consumer goods. This breakdown helps identify which industries are propelling demand and where future growth is most likely. Additionally, the market is segmented by manufacturing process, recognizing the different technologies employed in Ethylbenzene synthesis, such as liquid phase alkylation, vapor phase alkylation, and the more advanced zeolite-based alkylation processes. These distinctions are crucial for assessing technological shifts and competitive advantages among producers. Lastly, segmentation by purity level (high purity vs. technical grade) differentiates Ethylbenzene based on its intended use, with higher purity grades typically required for specialized polymer applications.

- By Application:

- Styrene Monomer (SM) Production

- Solvent Applications

- Other Chemical Intermediates

- By End-Use Industry:

- Packaging

- Automotive

- Construction

- Consumer Goods

- Electrical & Electronics

- Others

- By Manufacturing Process:

- Liquid Phase Alkylation

- Vapor Phase Alkylation

- Zeolite-based Alkylation

- Others

- By Purity Level:

- High Purity

- Technical Grade

Regional Highlights

The global Ethylbenzene market exhibits distinct regional dynamics, primarily influenced by industrial growth, petrochemical infrastructure, and regulatory environments. Asia Pacific stands as the undisputed leader in both production and consumption of Ethylbenzene, largely driven by the colossal manufacturing bases in China, India, and Southeast Asian countries. Rapid urbanization, increasing disposable incomes, and booming construction and automotive sectors in these nations fuel an insatiable demand for styrene derivatives, necessitating substantial Ethylbenzene production capacities. The region benefits from lower manufacturing costs and government support for industrial expansion, making it a pivotal growth hub.

North America and Europe represent mature markets for Ethylbenzene, characterized by established petrochemical industries and a strong focus on technological innovation and environmental compliance. While growth rates may be more modest compared to Asia Pacific, these regions emphasize process efficiency, sustainable production, and high-value applications. The presence of major automotive and advanced manufacturing industries continues to provide a stable demand base. Regulatory pressures in these regions also drive innovation towards greener chemical processes and higher purity products.

The Middle East and Africa (MEA) and Latin America are emerging as significant players in the Ethylbenzene market. The MEA region, rich in hydrocarbon resources, is witnessing substantial investments in integrated petrochemical complexes, aiming to diversify economies and become major exporters of chemicals, including Ethylbenzene and styrene. Latin America, particularly Brazil and Mexico, also presents opportunities driven by growing industrialization and increasing demand from domestic end-use sectors, although economic stability and infrastructure development remain critical factors for sustained growth.

- Asia Pacific: Dominant market due to rapid industrialization, urbanization, and high demand from China, India, and Southeast Asia. Significant capacity expansions and cost-effective production.

- North America: Mature market with established petrochemical infrastructure, focus on technological advancements, and steady demand from automotive and construction sectors in the United States and Canada.

- Europe: Characterized by stringent environmental regulations, emphasis on sustainable production, and innovation in advanced materials, with demand from Germany, France, and the UK.

- Middle East & Africa: Growing region with substantial investments in petrochemical projects, leveraging abundant feedstock availability to serve both regional and export markets.

- Latin America: Emerging market driven by industrial growth in countries like Brazil and Mexico, with potential for increased consumption in packaging and automotive industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethylbenzene Market.- Global Petrochem Solutions

- Advanced Chemical Corp

- Ethylene Benzene Innovations

- Styrene Technologies Ltd.

- Industrial Chemical Giants

- Asia Pacific Polymers

- ChemPro Holdings

- European Petrochemicals

- Zenith Chemicals

- Horizon Synthetics

- Catalyst Innovations

- PureChem Manufacturing

- Synergy Materials

- Universal Aromatics

- Grand Chemical Group

- Polymer Solutions Inc.

- Integrated Chemical Works

- EcoChem Producers

- NextGen Aromatics

- Vertex Petrochemicals

Frequently Asked Questions

What is Ethylbenzene primarily used for?

Ethylbenzene is almost exclusively used as an intermediate in the production of styrene monomer (SM), which is a key building block for various polymers like polystyrene, ABS, and SBR, widely used in packaging, automotive, and construction industries.

What are the main drivers of the Ethylbenzene market growth?

The primary drivers include the increasing global demand for styrene and its derivatives, rapid growth in packaging and construction sectors, and expansion of the automotive industry, particularly in emerging economies.

Which region dominates the Ethylbenzene market?

The Asia Pacific region, led by China and India, dominates the Ethylbenzene market in terms of both production and consumption, driven by significant industrial expansion and demand for downstream products.

What are the key challenges facing the Ethylbenzene market?

Major challenges include volatility in raw material prices (benzene and ethylene), stringent environmental regulations, potential overcapacity in the styrene market, and global supply chain disruptions.

How is AI impacting the Ethylbenzene industry?

AI is impacting the industry by optimizing production processes, enabling predictive maintenance, improving supply chain efficiency, and accelerating research and development for new catalysts and sustainable manufacturing methods.