Dispersant Market

Dispersant Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_705277 | Last Updated : August 11, 2025 |

Format : ![]()

![]()

![]()

![]()

Dispersant Market Size

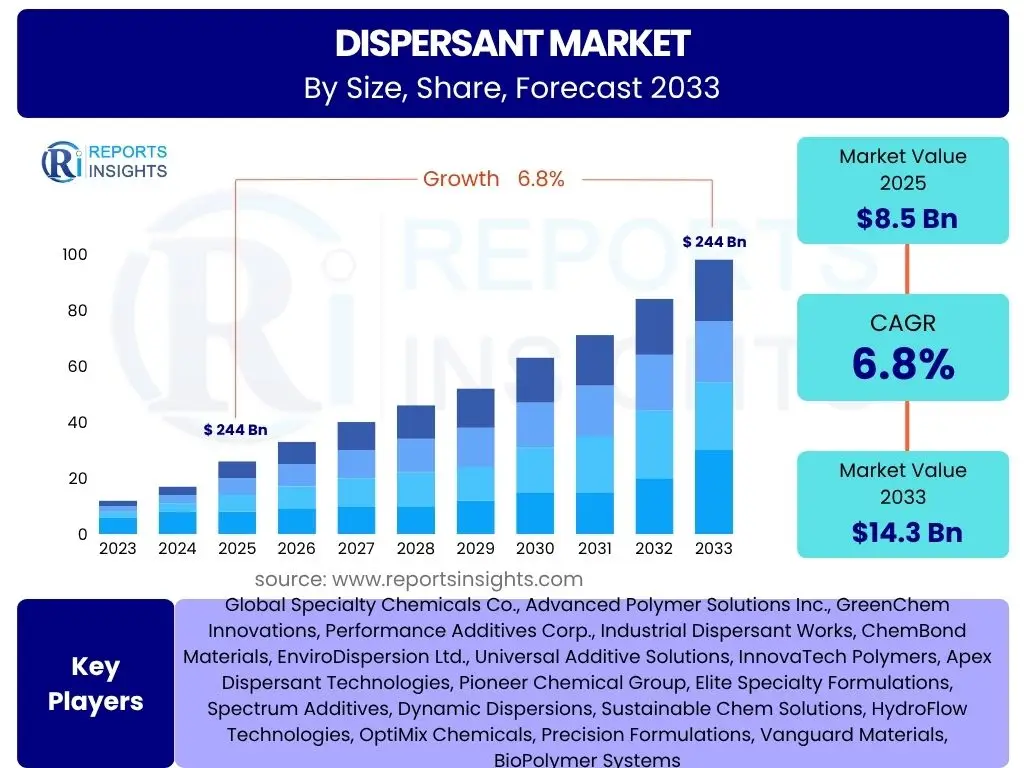

According to Reports Insights Consulting Pvt Ltd, The Dispersant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 8.5 billion in 2025 and is projected to reach USD 14.3 billion by the end of the forecast period in 2033.

Key Dispersant Market Trends & Insights

User inquiries regarding dispersant market trends consistently highlight the shift towards sustainable and bio-based solutions, driven by escalating environmental regulations and consumer demand for eco-friendly products. There is also significant interest in advanced dispersant technologies that offer enhanced performance and multi-functionality across diverse applications, such as high-performance concrete admixtures and specialized coatings. Additionally, the increasing digitalization of industrial processes and supply chains is influencing how dispersants are developed, distributed, and applied, leading to a greater focus on efficiency and data-driven optimization.

Another prominent area of user curiosity revolves around the specific industry demands shaping the market. The continued expansion of construction and infrastructure projects globally, particularly in emerging economies, is a major trend influencing demand for dispersants in concrete and building materials. Similarly, the evolving landscape of the oil and gas sector, with a focus on enhanced oil recovery and environmental spill remediation, necessitates innovative dispersant formulations. The paints and coatings sector's push for low-VOC and high-solid formulations further underscores the need for advanced dispersant solutions that can maintain stability and performance under new compositional requirements.

- Growing demand for bio-based and environmentally friendly dispersants.

- Development of high-performance, multi-functional dispersants for specialized applications.

- Increased adoption of nanotechnology in dispersant formulations for improved efficiency.

- Shift towards digitalization and automation in dispersant manufacturing and application processes.

- Rising focus on regulatory compliance and product safety across industries.

AI Impact Analysis on Dispersant

User questions about AI's impact on the dispersant market primarily center on its potential to revolutionize research and development, optimize manufacturing processes, and enhance supply chain efficiency. Users are keenly interested in how AI can accelerate the discovery of novel dispersant chemistries, predict their performance characteristics, and facilitate the formulation of customized solutions for specific industrial needs. The prospect of AI-driven material design and virtual screening for sustainable alternatives is a key area of inquiry, suggesting a strong desire for more efficient and environmentally conscious product development.

Beyond R&D, there is considerable user curiosity regarding AI's role in operational improvements. This includes its application in predictive maintenance for manufacturing equipment, optimizing synthesis parameters for higher yields and reduced waste, and intelligent quality control systems that ensure product consistency. Furthermore, users often inquire about AI's potential to create more resilient and responsive supply chains for dispersant raw materials and finished products, leveraging predictive analytics for demand forecasting and inventory management. The overall expectation is that AI will lead to significant cost reductions, improved product quality, and faster time-to-market for new dispersant solutions.

- Accelerated discovery and design of novel dispersant formulations through AI algorithms.

- Optimization of manufacturing processes for dispersants, leading to increased efficiency and reduced waste.

- Enhanced quality control and performance prediction of dispersant products using machine learning.

- Improved supply chain management and demand forecasting for dispersant raw materials and finished goods.

- Development of smart dispersant systems with real-time performance monitoring and adaptive capabilities.

Key Takeaways Dispersant Market Size & Forecast

Analysis of common user questions regarding the Dispersant market size and forecast reveals a strong emphasis on understanding the underlying drivers of growth, particularly within key industrial applications. Users are interested in identifying the segments poised for the most significant expansion and the geographical regions that will dominate market demand. The consistent inquiries about the long-term outlook indicate a need for clarity on sustainable growth trajectories, considering factors such as evolving regulatory landscapes and technological advancements in dispersant chemistry.

Furthermore, users seek concise insights into the strategic implications of the forecasted growth. This includes understanding potential investment opportunities, the impact of competitive dynamics, and the critical success factors for market participants. There is also a notable desire for information on how macro-economic trends and industry-specific developments, such as the push for eco-friendly products or advancements in construction materials, will influence the market's trajectory up to 2033. The focus is on actionable intelligence that distills complex market data into clear, interpretable conclusions.

- The global dispersant market is set for robust growth, driven by industrial expansion and infrastructure development.

- Sustainability and bio-based solutions represent a significant growth opportunity within the market.

- The Asia Pacific region is expected to lead market expansion due to rapid industrialization and urbanization.

- Technological advancements in dispersant formulation are crucial for meeting evolving industry demands.

- Key end-use industries like construction, paints and coatings, and oil and gas will remain primary revenue generators.

Dispersant Market Drivers Analysis

The global dispersant market is significantly propelled by the burgeoning construction and infrastructure sector, particularly in developing economies. Dispersants are crucial in concrete admixtures, enhancing workability, reducing water content, and improving the strength and durability of building materials. As urban populations grow and governments invest in new infrastructure projects, the demand for high-performance construction chemicals, including dispersants, escalates commensurately. This growth is not limited to new builds but also extends to renovation and maintenance activities, further solidifying the construction industry's role as a primary market driver.

Another substantial driver is the expanding paints and coatings industry, driven by rising demand from automotive, architectural, and industrial applications. Dispersants are essential for achieving stable pigment dispersion, improving color strength, gloss, and overall film integrity in paints and coatings. The shift towards water-based and low-VOC (Volatile Organic Compound) formulations in this sector necessitates advanced dispersants that can maintain stability and performance, thereby creating continuous demand for innovative solutions. Furthermore, the oil and gas industry's ongoing exploration and production activities, including enhanced oil recovery (EOR) techniques and drilling fluids, require specialized dispersants to prevent sludge formation and ensure efficient operations.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Construction and Infrastructure Development | +1.5% | Asia Pacific, Latin America, Middle East | 2025-2033 |

| Rising Demand from Paints and Coatings Industry | +1.2% | North America, Europe, Asia Pacific | 2025-2033 |

| Expansion of Oil and Gas Exploration & Production | +0.8% | North America, Middle East, Africa | 2025-2030 |

| Increasing Adoption in Agrochemicals and Detergents | +0.7% | Asia Pacific, Latin America | 2025-2033 |

Dispersant Market Restraints Analysis

The dispersant market faces significant restraints from stringent environmental regulations concerning the use and discharge of chemical additives. Regulatory bodies globally are increasingly imposing stricter limits on the permissible levels of certain chemicals, particularly those with potential toxicological or eco-toxicological profiles. This necessitates costly research and development efforts by manufacturers to formulate more benign and environmentally friendly dispersants, which can increase production costs and potentially impact market competitiveness, especially for traditional chemical-based products.

Another notable restraint is the volatility in raw material prices, particularly for petrochemical-derived precursors essential for many synthetic dispersants. Fluctuations in crude oil prices and the supply-demand dynamics of various chemical intermediates directly affect the cost of production for dispersants. This price instability can lead to unpredictable manufacturing expenses, impacting profit margins for market players and potentially influencing pricing strategies for end-users, thereby creating uncertainty in the market. Additionally, the availability and cost of bio-based raw materials, though promising, can also be subject to variability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Environmental Regulations | -0.9% | Europe, North America | 2025-2033 |

| Volatility in Raw Material Prices | -0.6% | Global | 2025-2030 |

| Health and Safety Concerns of Certain Chemicals | -0.4% | Global | 2025-2033 |

| Competition from Substitute Technologies | -0.3% | Global | 2028-2033 |

Dispersant Market Opportunities Analysis

The burgeoning demand for bio-based and sustainable chemical solutions presents a significant growth opportunity for the dispersant market. With increasing environmental consciousness and stricter regulations, industries are actively seeking alternatives to conventional petroleum-derived dispersants. This shift creates a fertile ground for innovations in dispersants derived from renewable resources like lignin, carbohydrates, and vegetable oils. Companies that can successfully develop and commercialize high-performance bio-based dispersants will gain a competitive advantage and tap into a rapidly expanding market segment driven by both consumer preference and regulatory mandates.

Emerging economies, particularly in Asia Pacific and Latin America, offer substantial untapped potential for market expansion. Rapid urbanization, industrialization, and significant government investments in infrastructure development in these regions are fueling demand across various end-use industries such as construction, paints and coatings, and agriculture. As these regions continue their economic growth trajectory, the need for advanced industrial chemicals, including dispersants, will escalate. Market players focusing on establishing strong distribution networks and localized production capabilities in these high-growth regions can capitalize on this immense opportunity.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Bio-based Dispersants | +1.3% | Global, especially Europe & North America | 2025-2033 |

| Expansion in Emerging Economies (APAC, LATAM) | +1.0% | Asia Pacific, Latin America | 2025-2033 |

| Innovation in Specialty and High-Performance Applications | +0.8% | North America, Europe, Asia Pacific | 2025-2033 |

| Circular Economy Initiatives and Waste Valorization | +0.6% | Europe, North America | 2028-2033 |

Dispersant Market Challenges Impact Analysis

The dispersant market faces significant challenges related to navigating complex and evolving regulatory frameworks across different geographies. Compliance with diverse environmental, health, and safety regulations, such as REACH in Europe or EPA guidelines in the US, requires substantial investment in testing, registration, and product reformulation. This regulatory complexity can hinder market entry for new products, increase operational costs for manufacturers, and necessitate continuous monitoring and adaptation of product portfolios, thereby posing a notable barrier to innovation and market growth.

Another critical challenge is the high cost associated with research and development for novel and sustainable dispersant technologies. Developing new dispersants that offer superior performance while adhering to stringent environmental standards often involves extensive laboratory work, pilot plant trials, and rigorous testing, all of which demand significant financial resources and specialized expertise. Furthermore, ensuring consistent product quality and performance across a wide array of industrial applications, given varying raw material qualities and process conditions, presents a continuous technical challenge for manufacturers, impacting market reputation and competitiveness.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Navigating Complex Regulatory Frameworks | -0.8% | Global | 2025-2033 |

| High R&D Costs for Sustainable Solutions | -0.7% | Global | 2025-2033 |

| Ensuring Consistent Product Quality & Performance | -0.5% | Global | 2025-2033 |

| Supply Chain Disruptions and Raw Material Scarcity | -0.4% | Global | 2025-2030 |

Dispersant Market - Updated Report Scope

This market research report provides an in-depth analysis of the global Dispersant market, offering a comprehensive overview of market dynamics, segmentation, regional insights, and the competitive landscape. It meticulously covers historical data from 2019 to 2023, establishes 2024 as the base year, and presents detailed forecasts spanning from 2025 to 2033. The report quantifies market sizes, projects growth rates, and identifies key trends, drivers, restraints, opportunities, and challenges impacting the market's trajectory, allowing stakeholders to make informed strategic decisions.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 8.5 billion |

| Market Forecast in 2033 | USD 14.3 billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Specialty Chemicals Co., Advanced Polymer Solutions Inc., GreenChem Innovations, Performance Additives Corp., Industrial Dispersant Works, ChemBond Materials, EnviroDispersion Ltd., Universal Additive Solutions, InnovaTech Polymers, Apex Dispersant Technologies, Pioneer Chemical Group, Elite Specialty Formulations, Spectrum Additives, Dynamic Dispersions, Sustainable Chem Solutions, HydroFlow Technologies, OptiMix Chemicals, Precision Formulations, Vanguard Materials, BioPolymer Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The dispersant market is meticulously segmented to provide a granular understanding of its diverse landscape and dynamics. This segmentation facilitates a deeper analysis of market trends, drivers, and opportunities across various product types, applications, and end-use industries. Each segment plays a crucial role in shaping the overall market trajectory, reflecting specific industry needs and technological advancements.

The primary segmentation by type includes synthetic polymers such as Polycarboxylate Ethers (PCE), Lignosulfonates, Naphthalene Sulfonate Formaldehyde Condensates (NSF), and Polyacrylates, alongside a category for 'Others' that encompasses various emerging and niche chemistries like polyphosphates and fatty acid esters. These different types offer unique performance characteristics, making them suitable for distinct applications. Further segmentation by application highlights their widespread use in critical sectors such as paints and coatings, construction, oil and gas, pulp and paper, agrochemicals, detergents, personal care, and pharmaceuticals, illustrating the market's broad industrial footprint. Finally, the market is also segmented by end-use industry, providing insights into demand from sectors like building and construction, automotive, marine, chemical, textile, food and beverage, healthcare, and agriculture, offering a comprehensive view of consumption patterns.

- By Type:

- Polycarboxylate Ethers (PCE)

- Lignosulfonates

- Naphthalene Sulfonate Formaldehyde Condensates (NSF)

- Polyacrylates

- Others (e.g., Polyphosphates, Fatty Acid Esters)

- By Application:

- Paints and Coatings

- Construction

- Oil and Gas

- Pulp and Paper

- Agrochemicals

- Detergents

- Personal Care

- Pharmaceuticals

- Others

- By End-use Industry:

- Building and Construction

- Automotive

- Marine

- Chemical

- Textile

- Food and Beverage

- Healthcare

- Agriculture

Regional Highlights

- North America: This region represents a mature dispersant market characterized by a strong emphasis on technological innovation and stringent environmental regulations. Demand is robust from the oil and gas sector (for drilling fluids and EOR), paints and coatings (driven by architectural and industrial applications), and the construction industry. The focus here is increasingly on high-performance and sustainable dispersant solutions due to advanced research and development capabilities and a push for green chemistry.

- Europe: Europe is a significant market for dispersants, largely driven by the automotive, construction, and paints and coatings industries. The region is at the forefront of adopting bio-based and eco-friendly dispersants, propelled by strict environmental norms and the EU's commitment to the circular economy. Innovation in sustainable formulations and a focus on specialized applications define the European market landscape.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the dispersant market due to rapid industrialization, urbanization, and significant infrastructure development, particularly in countries like China, India, and Southeast Asian nations. The burgeoning construction sector, expanding paints and coatings industry, and growing demand from agriculture and textile industries are key drivers. The region offers immense growth opportunities for both established and new market players.

- Latin America: This region exhibits steady growth in the dispersant market, primarily influenced by ongoing construction projects, an expanding oil and gas sector, and increasing industrial activity. Countries such as Brazil, Mexico, and Argentina contribute significantly to regional demand. The market here is characterized by increasing adoption of modern industrial practices and a growing awareness of the benefits of dispersant use.

- Middle East and Africa (MEA): The MEA region is an emerging market for dispersants, driven predominantly by large-scale infrastructure investments, ongoing oil and gas exploration, and development projects. Rapid urbanization and diversification efforts away from oil dependency are also fostering growth in sectors like construction and manufacturing. The demand for specialized dispersants in water treatment and mining also contributes to market expansion in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dispersant Market.- Global Specialty Chemicals Co.

- Advanced Polymer Solutions Inc.

- GreenChem Innovations

- Performance Additives Corp.

- Industrial Dispersant Works

- ChemBond Materials

- EnviroDispersion Ltd.

- Universal Additive Solutions

- InnovaTech Polymers

- Apex Dispersant Technologies

- Pioneer Chemical Group

- Elite Specialty Formulations

- Spectrum Additives

- Dynamic Dispersions

- Sustainable Chem Solutions

- HydroFlow Technologies

- OptiMix Chemicals

- Precision Formulations

- Vanguard Materials

- BioPolymer Systems

Frequently Asked Questions

What is the current market size and projected growth of the Dispersant market?

The global Dispersant Market is estimated at USD 8.5 billion in 2025 and is projected to reach USD 14.3 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period.

What are the primary drivers influencing the Dispersant market's expansion?

Key drivers include the significant growth in construction and infrastructure development globally, rising demand from the paints and coatings industry, and expanding oil and gas exploration and production activities. Additionally, increasing adoption in agrochemicals and detergents contributes to market growth.

Which applications contribute most significantly to Dispersant demand?

The most significant applications driving dispersant demand include the construction industry (for concrete admixtures), paints and coatings (for pigment dispersion), and the oil and gas sector (for drilling fluids and enhanced oil recovery). Other notable applications are in pulp and paper, agrochemicals, and detergents.

What are the key trends shaping the future of the Dispersant industry?

Major trends include a strong shift towards bio-based and environmentally friendly dispersants, the development of high-performance and multi-functional formulations, the integration of nanotechnology, and increased digitalization in manufacturing and R&D processes. Regulatory compliance and product safety are also critical shaping factors.

How do regional factors influence the Dispersant market dynamics?

Regional factors significantly impact the market. Asia Pacific is the fastest-growing region due to rapid industrialization and infrastructure development. North America and Europe emphasize sustainable and high-performance solutions driven by stringent regulations. Latin America and MEA are emerging markets with growing demand from construction and resource extraction.