Cosmetic Thickener Market

Cosmetic Thickener Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702148 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Cosmetic Thickener Market Size

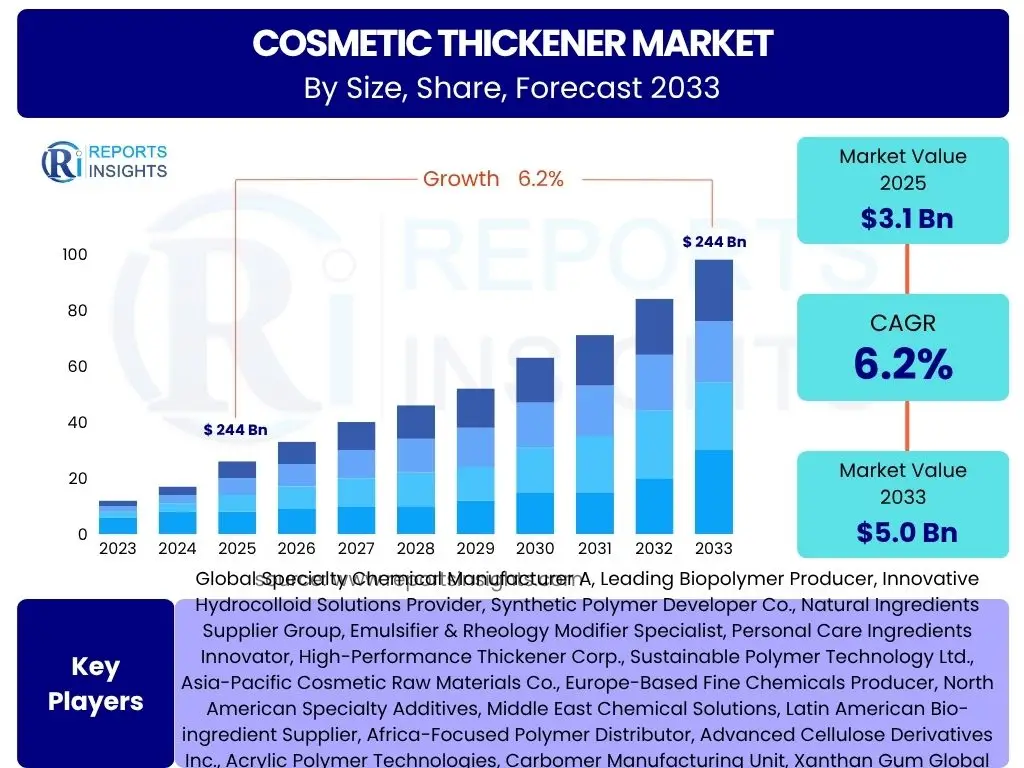

According to Reports Insights Consulting Pvt Ltd, The Cosmetic Thickener Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2033. The market is estimated at USD 3.1 Billion in 2025 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Key Cosmetic Thickener Market Trends & Insights

User queries regarding the Cosmetic Thickener market trends frequently revolve around the adoption of natural ingredients, the impact of sustainability initiatives, and the development of multi-functional thickeners. Consumers are increasingly seeking products with transparent ingredient lists and eco-friendly profiles, driving manufacturers to innovate in bio-based and naturally derived thickening agents. This shift is also influencing packaging and production methods, aligning with a broader industry move towards environmental responsibility.

Furthermore, there is significant interest in thickeners that offer more than just viscosity control, such as those providing enhanced sensory properties, improved stability, or synergistic effects with other active ingredients. The demand for customized cosmetic formulations and advanced delivery systems also contributes to the evolution of thickener technologies, pushing the boundaries of what these excipients can achieve in modern cosmetic products.

- Growing preference for natural and bio-based thickeners driven by clean beauty trends.

- Emphasis on sustainable sourcing and manufacturing processes for cosmetic ingredients.

- Development of multi-functional thickeners offering sensory benefits and formulation stability.

- Increased demand for customized and personalized cosmetic formulations requiring adaptable thickener solutions.

- Integration of rheology modifiers for specific textures and consumer experiences, beyond mere viscosity.

AI Impact Analysis on Cosmetic Thickener

Common user questions concerning AI's influence on the Cosmetic Thickener market primarily focus on its application in formulation optimization, predictive analysis for ingredient performance, and accelerated research and development. Users are keen to understand how artificial intelligence can streamline the complex process of selecting and combining thickeners to achieve desired rheological properties, stability, and sensory profiles in cosmetic products. There is also significant interest in AI's capability to predict consumer preferences and market trends, thereby guiding ingredient innovation.

AI's role extends to enhancing supply chain efficiency and quality control, ensuring consistent performance of thickening agents. While the direct application of AI in the chemical synthesis of thickeners is still nascent, its power in data analysis, simulation, and predictive modeling is already transforming formulation science. Companies are exploring AI-driven platforms to reduce development cycles, minimize trial-and-error, and optimize ingredient ratios, leading to more cost-effective and superior cosmetic products.

- AI-driven formulation optimization for precise viscosity and texture control.

- Predictive modeling of thickener performance and stability in various cosmetic bases.

- Accelerated R&D through virtual screening of new thickener chemistries and combinations.

- Enhanced supply chain management and quality control for raw materials, including thickeners.

- Personalized cosmetic development using AI to match thickener profiles to individual consumer needs.

Key Takeaways Cosmetic Thickener Market Size & Forecast

Analysis of common user queries regarding the Cosmetic Thickener market size and forecast highlights a strong interest in understanding the primary growth drivers, the significance of natural vs. synthetic categories, and the geographic distribution of market expansion. Users frequently seek insights into which segments are poised for the most significant growth and the underlying factors contributing to these trends, such as evolving consumer preferences, regulatory landscapes, and technological advancements.

The key takeaways reveal a resilient market driven by continuous innovation in personal care and beauty sectors. The forecast indicates sustained growth, underpinned by increasing global disposable incomes and a rising awareness of cosmetic product benefits. While synthetic thickeners maintain a substantial share, the rapid expansion of the natural and bio-based segment is a dominant theme, reflecting broader clean beauty and sustainability movements across developed and emerging economies. Asia Pacific is consistently identified as a high-growth region, propelled by its large consumer base and burgeoning cosmetic industry.

- The Cosmetic Thickener market is projected for robust growth, driven by expansion in the global personal care industry.

- Natural and bio-based thickeners are emerging as a significant growth area, outpacing traditional synthetic alternatives.

- Asia Pacific is anticipated to be the fastest-growing region, fueled by rising disposable incomes and cosmetic consumption.

- Innovation in multi-functional thickeners and customized formulations will be crucial for market players.

- Sustainability and clean label initiatives will increasingly influence product development and market share.

Cosmetic Thickener Market Drivers Analysis

The cosmetic thickener market is significantly influenced by several key drivers that propel its growth across various regions. The increasing global demand for personal care and beauty products, driven by rising disposable incomes and changing consumer lifestyles, acts as a primary catalyst. Consumers are becoming more conscious about personal grooming and appearance, leading to higher consumption of cosmetics that require effective thickening agents to achieve desired textures and stability. This includes a wide array of products from skincare creams to shampoos and decorative cosmetics.

Furthermore, the continuous innovation in cosmetic formulations, aiming for enhanced sensory attributes, improved stability, and multi-functional benefits, necessitates the development and adoption of advanced thickeners. The clean beauty movement and the growing preference for natural and organic ingredients also significantly drive the market, compelling manufacturers to invest in research and development of naturally derived thickeners that meet consumer expectations for safety and environmental responsibility.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing Demand for Personal Care Products | +1.5% | Global, particularly Asia Pacific, Latin America | 2025-2033 |

| Rising Awareness of Clean Label and Natural Ingredients | +1.2% | North America, Europe, parts of Asia Pacific | 2025-2033 |

| Technological Advancements and Product Innovation | +0.8% | Global, especially developed economies | 2025-2030 |

| Increasing Disposable Income and Urbanization | +0.7% | Emerging Economies (China, India, Brazil) | 2025-2033 |

| Demand for Multi-functional Cosmetic Formulations | +0.6% | Global | 2025-2033 |

Cosmetic Thickener Market Restraints Analysis

Despite robust growth drivers, the cosmetic thickener market faces several restraints that could impede its expansion. Stringent regulatory frameworks governing the use of certain synthetic chemicals in cosmetic formulations pose a significant challenge. Regulatory bodies globally, particularly in Europe and North America, are increasingly scrutinizing ingredients for safety and environmental impact, leading to bans or restrictions on some commonly used thickeners. This necessitates costly reformulation and the search for compliant alternatives.

Another key restraint is the volatility in raw material prices, especially for petro-chemical derived synthetic thickeners. Fluctuations in crude oil prices directly impact the cost of production, leading to unpredictable pricing for end-users and affecting profit margins for manufacturers. Furthermore, the availability and cost of natural raw materials, which are subject to agricultural yields and climatic conditions, can also be a limiting factor for the natural thickener segment. Lastly, the inherent technical challenges in achieving desired rheological properties with some natural alternatives, without compromising stability or sensory appeal, also act as a restraint.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Stringent Regulatory Landscape for Synthetic Ingredients | -0.9% | Europe, North America | 2025-2033 |

| Volatility in Raw Material Prices | -0.7% | Global | 2025-2033 |

| Technical Challenges with Natural Thickener Formulation | -0.5% | Global | 2025-2030 |

| Competition from Substitute Ingredients | -0.4% | Global | 2025-2033 |

| Supply Chain Disruptions | -0.3% | Global | 2025-2027 |

Cosmetic Thickener Market Opportunities Analysis

The cosmetic thickener market is ripe with opportunities, primarily driven by the expanding demand for bio-based and sustainable ingredients. As consumer awareness regarding environmental impact grows, there is an escalating market for thickeners derived from renewable resources, such as plant-based gums, cellulose derivatives, and microbial polysaccharides. This trend provides significant avenues for innovation in green chemistry and sustainable production methods, enabling companies to cater to an increasingly eco-conscious consumer base and gain a competitive edge.

Moreover, the rise of personalized cosmetics and bespoke formulations presents another substantial opportunity. As consumers seek products tailored to their unique needs and preferences, formulators require versatile thickeners that can be easily integrated into diverse product matrices without compromising stability or performance. This paves the way for advanced rheology modifiers that offer precise control over texture and spreadability. The untapped potential in emerging markets, characterized by rapid economic development and burgeoning middle classes, also offers significant growth prospects for both established and new thickener manufacturers.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development of Bio-based and Sustainable Thickeners | +1.0% | Global, particularly Europe, North America, and Asia Pacific | 2025-2033 |

| Expansion into Emerging Markets | +0.8% | Asia Pacific (Southeast Asia, India), Latin America, Middle East | 2025-2033 |

| Growth of Personalized and Custom Cosmetic Formulations | +0.7% | Developed Economies | 2025-2033 |

| Focus on Multi-functional and Performance-enhancing Thickeners | +0.6% | Global | 2025-2033 |

| Advancements in Biotechnological Production of Thickeners | +0.5% | Global | 2028-2033 |

Cosmetic Thickener Market Challenges Impact Analysis

The cosmetic thickener market faces various challenges that can impact its growth trajectory. One significant hurdle is the difficulty in balancing the desired rheological properties, such as viscosity and spreadability, with the aesthetic appeal and stability of the final cosmetic product, especially when transitioning to new or natural ingredients. Formulators often struggle to achieve the same performance characteristics with natural thickeners as with well-established synthetics, which can lead to longer development cycles and higher costs.

Another challenge is related to supply chain complexities, particularly for natural or specialty thickeners whose availability might be subject to agricultural cycles, geopolitical factors, or specific processing requirements. Ensuring consistent quality and sourcing ethically and sustainably across a global supply chain adds layers of complexity. Additionally, increasing competition within the market, coupled with the need for continuous innovation to meet evolving consumer demands and regulatory changes, puts pressure on manufacturers to invest heavily in research and development while maintaining competitive pricing. The need for significant capital investment in R&D and manufacturing upgrades for novel thickener production further presents a notable barrier.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Achieving Performance Parity with Natural Alternatives | -0.8% | Global | 2025-2030 |

| Supply Chain Vulnerability and Raw Material Sourcing | -0.6% | Global | 2025-2033 |

| High R&D Costs for Novel Thickener Development | -0.5% | Global | 2025-2033 |

| Intense Market Competition and Pricing Pressures | -0.4% | Global | 2025-2033 |

| Navigating Evolving Consumer Preferences and Trends | -0.3% | Global | 2025-2033 |

Cosmetic Thickener Market - Updated Report Scope

This comprehensive report provides an in-depth analysis of the global Cosmetic Thickener market, meticulously covering historical data, current market dynamics, and future projections. It segments the market extensively by type, application, and form, offering detailed insights into each segment's performance and growth prospects. The report also highlights key regional trends and competitive landscapes, providing a holistic view for stakeholders to make informed strategic decisions.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 6.2% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Specialty Chemical Manufacturer A, Leading Biopolymer Producer, Innovative Hydrocolloid Solutions Provider, Synthetic Polymer Developer Co., Natural Ingredients Supplier Group, Emulsifier & Rheology Modifier Specialist, Personal Care Ingredients Innovator, High-Performance Thickener Corp., Sustainable Polymer Technology Ltd., Asia-Pacific Cosmetic Raw Materials Co., Europe-Based Fine Chemicals Producer, North American Specialty Additives, Middle East Chemical Solutions, Latin American Bio-ingredient Supplier, Africa-Focused Polymer Distributor, Advanced Cellulose Derivatives Inc., Acrylic Polymer Technologies, Carbomer Manufacturing Unit, Xanthan Gum Global Supplier, Guar Gum Processing Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Cosmetic Thickener market is meticulously segmented to provide granular insights into its diverse components, aiding in a deeper understanding of market dynamics and growth trajectories. The primary segmentation includes categorizing thickeners by their chemical origin, their end-use applications within various cosmetic product categories, and their physical form. Each segment exhibits unique characteristics and growth drivers, reflecting the varied needs of cosmetic manufacturers and evolving consumer preferences.

The "By Type" segmentation distinguishes between natural and synthetic thickeners, reflecting a significant shift in the industry towards bio-based and sustainable alternatives. The "By Application" segment showcases the wide array of cosmetic products where thickeners are indispensable, from everyday skincare and haircare to specialized makeup and sun protection products. This segmentation highlights the broad utility and critical role of thickeners in achieving desired product textures, stability, and consumer appeal across the entire personal care spectrum. The "By Form" segment further differentiates products based on their physical state, catering to specific manufacturing and formulation requirements.

- By Type:

- Natural Thickeners (e.g., Xanthan Gum, Guar Gum, Cellulose Derivatives, Alginates, Carrageenan, Bentonite Clay, Acacia Gum)

- Synthetic Thickeners (e.g., Carbomers, Acrylates Copolymers, Polyacrylamides, Cellulose Ethers, Polyethylene Glycols)

- By Application:

- Skincare (e.g., Creams, Lotions, Serums)

- Haircare (e.g., Shampoos, Conditioners, Styling Gels)

- Oral Care (e.g., Toothpastes, Mouthwashes)

- Makeup (e.g., Foundations, Mascaras, Lip Glosses)

- Sun Care (e.g., Sunscreens, After-sun products)

- Other Personal Care Products (e.g., Deodorants, Baby Products)

- By Form:

- Liquid

- Powder

- Gel

Regional Highlights

Regional analysis reveals significant variations in the dynamics of the Cosmetic Thickener market, driven by diverse consumer preferences, regulatory environments, and economic developments. Asia Pacific stands out as the largest and fastest-growing market, primarily fueled by its vast population, rising disposable incomes, and the burgeoning beauty and personal care industry in countries like China, India, Japan, and South Korea. The increasing adoption of western beauty standards combined with a strong local cosmetic manufacturing base contributes significantly to this region's dominance. Innovation in traditional and natural ingredients is also a key characteristic of this market.

North America and Europe represent mature markets with high demand for premium, natural, and sustainable cosmetic products. Regulatory stringency in these regions drives innovation towards safer and more eco-friendly thickener alternatives. The clean beauty movement and a strong consumer focus on ingredient transparency are particularly influential here. Latin America and the Middle East and Africa (MEA) are emerging markets, showing considerable growth potential due to increasing urbanization, expanding middle-class populations, and rising awareness about personal grooming, leading to higher consumption of cosmetic products.

- Asia Pacific: Dominant market, experiencing rapid growth due to increasing disposable incomes, large consumer base, and flourishing local and international cosmetic brands. Focus on both mass-market and premium natural products.

- North America: Mature market characterized by high consumer awareness regarding product safety, natural ingredients, and sustainability. Strong emphasis on R&D for advanced and clean label thickeners.

- Europe: Similar to North America, driven by stringent regulations on cosmetic ingredients and a strong demand for natural, organic, and ethically sourced thickeners within the well-established beauty industry.

- Latin America: Emerging market with significant growth potential, fueled by expanding middle-class populations, increasing urbanization, and a rising interest in personal care products.

- Middle East and Africa (MEA): Growth attributed to rising beauty consciousness, increasing purchasing power, and the entry of international cosmetic brands, leading to a demand for diverse thickening agents.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Thickener Market.- Global Specialty Chemical Manufacturer A

- Leading Biopolymer Producer

- Innovative Hydrocolloid Solutions Provider

- Synthetic Polymer Developer Co.

- Natural Ingredients Supplier Group

- Emulsifier & Rheology Modifier Specialist

- Personal Care Ingredients Innovator

- High-Performance Thickener Corp.

- Sustainable Polymer Technology Ltd.

- Asia-Pacific Cosmetic Raw Materials Co.

- Europe-Based Fine Chemicals Producer

- North American Specialty Additives

- Middle East Chemical Solutions

- Latin American Bio-ingredient Supplier

- Africa-Focused Polymer Distributor

- Advanced Cellulose Derivatives Inc.

- Acrylic Polymer Technologies

- Carbomer Manufacturing Unit

- Xanthan Gum Global Supplier

- Guar Gum Processing Company

Frequently Asked Questions

What is a cosmetic thickener?

A cosmetic thickener is an ingredient added to cosmetic formulations to increase their viscosity and improve their texture, stability, and sensory properties. These ingredients prevent separation, enhance spreadability, and provide a pleasant feel, ranging from gels and creams to lotions and shampoos.

What are the primary types of cosmetic thickeners?

Cosmetic thickeners are broadly categorized into natural and synthetic types. Natural thickeners include plant-derived gums (e.g., xanthan gum, guar gum), cellulose derivatives, and clays. Synthetic thickeners often comprise carbomers, acrylates copolymers, and polyacrylamides, known for their versatility and performance in various formulations.

How is the demand for natural cosmetic thickeners evolving?

The demand for natural cosmetic thickeners is rapidly growing due to increasing consumer preference for clean label, sustainable, and organic beauty products. This trend is driven by heightened awareness of ingredient origins and environmental impact, prompting manufacturers to invest in bio-based and plant-derived thickening solutions.

Which regions are leading the growth in the Cosmetic Thickener market?

Asia Pacific is currently the leading region in the Cosmetic Thickener market and is expected to exhibit the fastest growth. This is primarily attributed to rising disposable incomes, rapid urbanization, and a flourishing cosmetics and personal care industry across countries like China, India, and South Korea.

What challenges do manufacturers face in using cosmetic thickeners?

Manufacturers face challenges in achieving optimal rheological properties, maintaining product stability with certain thickeners, and managing raw material price volatility. Additionally, stringent regulatory requirements and the need for continuous innovation to meet evolving consumer demands for multi-functional and sustainable products present significant hurdles.