Ceramic Blast Media Market

Ceramic Blast Media Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701173 | Last Updated : July 29, 2025 |

Format : ![]()

![]()

![]()

![]()

Ceramic Blast Media Market Size

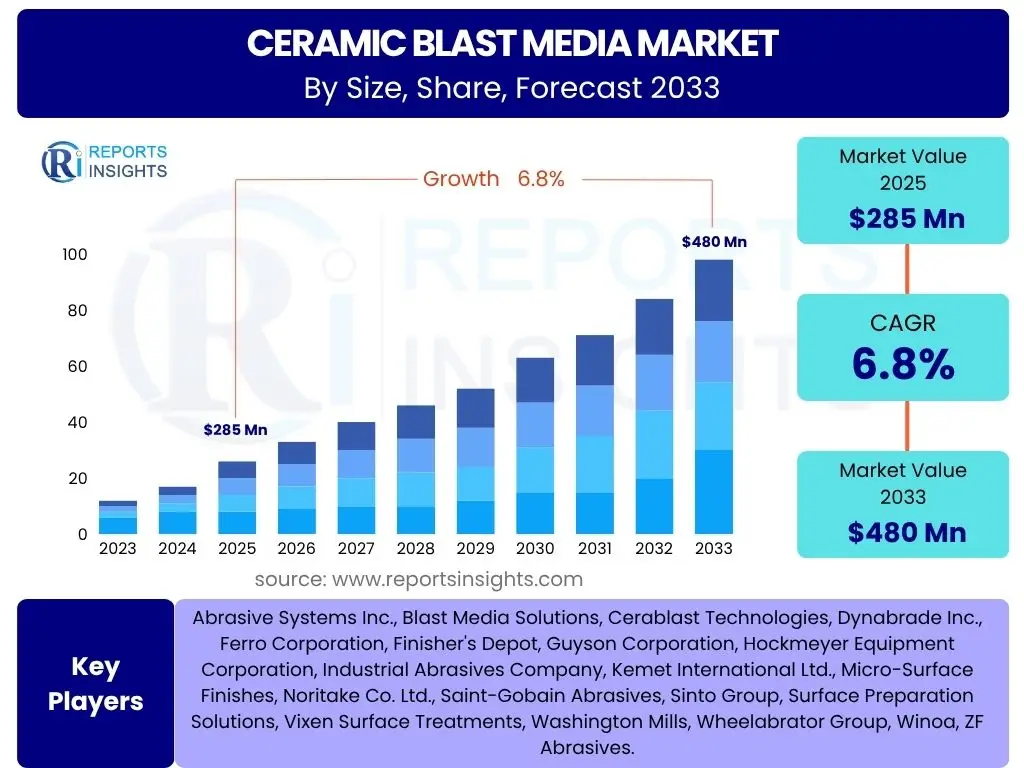

According to Reports Insights Consulting Pvt Ltd, The Ceramic Blast Media Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. This growth is primarily driven by the increasing demand for high-quality surface finishing across various industrial sectors, coupled with the inherent benefits of ceramic media such as superior hardness, durability, and non-contaminating properties. The market's expansion is further supported by the growing adoption of automated blasting systems that leverage the consistent performance of ceramic media.

The market is estimated at USD 285 million in 2025, reflecting its established presence in critical manufacturing processes that require precise and repeatable surface preparation. As industries continue to prioritize operational efficiency, material integrity, and environmental compliance, the specialized attributes of ceramic blast media are expected to drive its valuation upwards. The versatility of ceramic media in applications ranging from aerospace components to medical devices underscores its indispensable role in modern industrial finishing.

Based on current trajectories and anticipated technological advancements, the Ceramic Blast Media Market is projected to reach USD 480 million by the end of the forecast period in 2033. This significant increase highlights the market's robust potential, fueled by advancements in ceramic material science, expanding application areas, and a global emphasis on sustainable and efficient manufacturing practices. The long-term outlook remains highly positive, with ceramic blast media poised to become an even more integral part of advanced manufacturing workflows worldwide.

Key Ceramic Blast Media Market Trends & Insights

Common inquiries regarding the Ceramic Blast Media market often revolve around its evolving applications, technological advancements, and alignment with sustainability goals. Users frequently seek to understand how market dynamics are shifting beyond traditional uses, exploring the integration of ceramic media into new industrial processes and its role in achieving superior surface integrity for advanced materials. There is significant interest in how environmental regulations are influencing material choices and the adoption of more eco-friendly blasting solutions, positioning ceramic media as a preferred option due to its reusability and reduced dust generation. Furthermore, questions arise concerning the impact of automation and smart manufacturing on blasting operations, highlighting the desire for higher efficiency and precision.

The market is witnessing a notable shift towards specialized applications where extreme precision and minimal contamination are paramount. Industries such as aerospace, medical devices, and electronics are increasingly adopting ceramic blast media for critical surface preparation, peening, and finishing tasks. This trend is driven by the need to enhance component performance, extend service life, and meet stringent quality standards for high-value parts. The non-ferrous and non-reactive nature of ceramic media makes it ideal for sensitive materials, preventing embedding or discoloration that can occur with metallic or organic abrasives. Consequently, manufacturers are exploring innovative ceramic formulations to cater to these demanding requirements, leading to a diversification of product offerings within the market.

Another prominent trend is the growing emphasis on sustainable manufacturing practices, which favors ceramic blast media due to its longevity and reusability. Unlike single-use abrasives, ceramic media can be recycled multiple times, significantly reducing waste generation and disposal costs. This aligns with global efforts to minimize environmental impact and promotes a circular economy approach within industrial processes. Furthermore, advancements in dust collection and filtration systems complement the use of ceramic media, creating cleaner working environments and reducing airborne particulate matter. The integration of ceramic media with robotic blasting systems and intelligent process controls is also gaining traction, enabling greater consistency, higher throughput, and reduced manual labor, thereby optimizing overall operational efficiency.

- Growing adoption in precision industries such as aerospace and medical for critical surface finishing.

- Increased focus on sustainable blasting solutions due to reusability and lower environmental impact.

- Integration with automated and robotic blasting systems for enhanced precision and efficiency.

- Development of specialized ceramic formulations for high-performance and application-specific needs.

- Rising demand for lightweight and high-strength components driving ceramic media usage for post-processing.

AI Impact Analysis on Ceramic Blast Media

User queries regarding the impact of Artificial Intelligence (AI) on the Ceramic Blast Media market frequently explore how automation and data analytics can enhance operational efficiency, optimize material consumption, and improve the consistency of blasting processes. There's a keen interest in understanding if AI can predict maintenance needs for blasting equipment, analyze surface quality in real-time, or even guide the development of new ceramic formulations. Concerns also include the potential displacement of manual labor and the data infrastructure required to leverage AI effectively within industrial blasting environments. Users seek insights into how AI can transform a traditionally mechanical process into a data-driven, intelligent operation, aiming for superior outcomes and reduced waste.

AI's influence on the Ceramic Blast Media market is emerging primarily through the optimization of blasting parameters and process control. AI-powered vision systems can analyze the surface topography of components before and after blasting, providing real-time feedback that allows for immediate adjustment of media flow, pressure, and nozzle angle. This capability ensures consistent surface roughness, texture, and cleanliness, reducing rework and material waste. Furthermore, predictive maintenance algorithms can monitor the wear and tear of blasting equipment components, scheduling preventative maintenance before failures occur. This significantly minimizes downtime, extends equipment lifespan, and maintains peak operational efficiency, thereby lowering overall production costs for end-users of ceramic blast media.

Beyond process optimization, AI is also poised to impact material innovation and supply chain management within the ceramic blast media sector. Machine learning algorithms can analyze vast datasets on material properties, performance under various conditions, and manufacturing parameters to accelerate the development of new, more efficient, or specialized ceramic formulations. This data-driven approach can lead to breakthroughs in media durability, abrasion resistance, and specific surface effects. In the supply chain, AI can forecast demand more accurately, optimize inventory levels, and enhance logistics, ensuring timely availability of ceramic blast media for manufacturers worldwide. While the full integration of AI is still nascent, its potential to revolutionize precision finishing operations, making them smarter, more efficient, and more sustainable, is substantial.

- AI-driven real-time process optimization for media flow, pressure, and nozzle angle.

- Predictive maintenance for blasting equipment, reducing downtime and extending lifespan.

- Automated quality control through AI vision systems for consistent surface finishing.

- Data-driven insights for optimizing media consumption and reducing material waste.

- Potential for AI to accelerate R&D in new ceramic formulations and material properties.

Key Takeaways Ceramic Blast Media Market Size & Forecast

Common user questions regarding the key takeaways from the Ceramic Blast Media market size and forecast typically focus on the most impactful drivers, the primary growth regions, and the overarching implications for industrial manufacturers. Users are keen to understand what factors will most significantly contribute to the market's projected growth and which applications or end-user industries are expected to see the most substantial expansion. There is also interest in identifying the core competitive advantages of ceramic blast media that will sustain its demand against alternative abrasives, alongside insights into any critical challenges that might influence the market's trajectory.

A primary takeaway is the market's robust growth trajectory, driven by the escalating demand for high-precision surface finishing in advanced manufacturing sectors. Industries such as aerospace, automotive, medical devices, and electronics are increasingly relying on ceramic blast media due to its superior performance characteristics, including hardness, durability, reusability, and non-contaminating properties. This reliance is fueled by stringent quality standards, the need for enhanced component longevity, and the pursuit of operational efficiency. The inherent ability of ceramic media to deliver consistent and repeatable results makes it an indispensable component in achieving the exacting surface specifications required for critical applications.

Another significant insight is the market's strategic alignment with global sustainability initiatives. The reusability of ceramic blast media significantly reduces waste generation and minimizes environmental impact, making it a preferred choice for companies seeking to lower their ecological footprint and comply with increasingly strict environmental regulations. Furthermore, the rising adoption of automated blasting systems, often integrated with AI and robotics, is enhancing the efficiency and consistency of ceramic blasting processes, driving further market penetration. While challenges such as initial cost and competition from traditional media exist, the long-term benefits in terms of performance, cost-effectiveness over time, and environmental compliance are expected to strongly underpin the sustained expansion of the ceramic blast media market through 2033.

- Significant market growth fueled by demand for high-precision surface finishing in key industries.

- Strong adoption in aerospace, automotive, and medical sectors due to superior material properties.

- Positive impact from sustainability trends, as ceramic media offers reusability and reduced waste.

- Increased integration with automation and AI enhancing process efficiency and consistency.

- Market expansion driven by advantages over traditional abrasives in terms of durability and performance.

Ceramic Blast Media Market Drivers Analysis

The Ceramic Blast Media market is significantly propelled by a confluence of factors underscoring its indispensable role in modern manufacturing. Foremost among these is the escalating demand for precision surface finishing across various high-tech industries. Components used in aerospace, medical devices, and high-performance automotive parts require extremely precise surface textures, cleanliness, and material integrity, which ceramic media is uniquely positioned to provide. Its consistent particle size, high hardness, and chemical inertness ensure superior results, preventing contamination and delivering uniform finishes that are critical for performance and longevity. This drive for quality and precision is a foundational pillar for market expansion.

Furthermore, the inherent advantages of ceramic blast media over traditional abrasives significantly contribute to its market growth. Unlike metallic or organic media, ceramic media offers extended lifespan, superior hardness, and minimal breakdown, leading to reduced media consumption and lower operational costs over time. Its non-ferrous nature eliminates the risk of ferrous contamination on treated surfaces, which is crucial for sensitive materials. The increasing focus on environmental sustainability also plays a role, as ceramic media's reusability and lower dust generation align with stricter environmental regulations and corporate sustainability goals, making it an attractive option for eco-conscious manufacturers. The continuous innovation in ceramic formulations also ensures that the media can meet evolving industrial requirements.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growing demand for precision surface finishing | +1.5% | North America, Europe, Asia Pacific (esp. Japan, South Korea, Germany, USA) | Short to Long Term (2025-2033) |

| Increasing adoption in aerospace and automotive industries | +1.2% | Global (esp. USA, Germany, China, India) | Mid to Long Term (2027-2033) |

| Advantages over traditional blasting media (durability, non-contamination) | +1.0% | Global | Short to Mid Term (2025-2030) |

| Stringent quality control standards across industries | +0.8% | Europe, North America | Mid to Long Term (2026-2033) |

| Focus on environmental sustainability and reusability | +0.7% | Europe, North America, parts of Asia Pacific | Long Term (2028-2033) |

Ceramic Blast Media Market Restraints Analysis

Despite its significant advantages, the Ceramic Blast Media market faces several restraints that could impede its growth trajectory. One primary concern is the relatively higher initial cost of ceramic media compared to conventional abrasive alternatives such as sand, steel shot, or glass beads. While ceramic media offers a longer lifespan and superior performance, the upfront investment can deter smaller manufacturers or those operating with tight budget constraints. This cost differential often necessitates a detailed cost-benefit analysis for potential adopters, and a lack of awareness regarding the long-term savings from reduced consumption and improved quality can hinder widespread adoption, particularly in price-sensitive markets.

Another restraint is the availability and widespread use of various substitute blasting media. The market for abrasives is highly competitive, with a multitude of options catering to different applications and budget points. While ceramic media excels in precision and critical applications, for general-purpose cleaning or less demanding surface preparation tasks, cheaper alternatives often suffice. This broad availability of substitutes means that ceramic media must continually demonstrate a clear value proposition and superior performance benefits to justify its premium pricing. Furthermore, the economic volatility and slowdowns in key industrial sectors can also temporarily suppress demand for high-performance abrasives, as companies may opt for more economical solutions during downturns. Ensuring consistent quality and supply chain stability for ceramic raw materials can also pose challenges, affecting pricing and availability.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Higher initial cost compared to conventional abrasives | -0.9% | Global (esp. Emerging Economies) | Short to Mid Term (2025-2030) |

| Availability of substitute blasting media | -0.7% | Global | Short to Mid Term (2025-2030) |

| Economic slowdowns impacting industrial output | -0.5% | Specific affected regions (e.g., Europe, parts of Asia) | Short Term (2025-2026) |

| Limited awareness of long-term benefits in some industries | -0.4% | Emerging Markets | Mid Term (2026-2031) |

Ceramic Blast Media Market Opportunities Analysis

The Ceramic Blast Media market is poised to capitalize on several promising opportunities that could significantly accelerate its growth. One key area of expansion lies in the increasing adoption of advanced manufacturing techniques such as additive manufacturing (3D printing). Post-processing of 3D printed metal and plastic parts often requires precise surface finishing, deburring, and stress relief, where ceramic blast media excels due to its ability to achieve uniform surfaces without material embedding or damage. As additive manufacturing becomes more widespread across industries like aerospace, automotive, and medical, the demand for high-performance ceramic media tailored for these unique applications is expected to surge, presenting a significant growth avenue.

Another notable opportunity is the untapped potential in emerging economies. Countries in Asia Pacific, Latin America, and the Middle East are experiencing rapid industrialization and modernization, leading to increased investment in manufacturing capabilities across diverse sectors. As these regions upgrade their production processes and strive for higher quality standards, the demand for advanced surface treatment solutions like ceramic blast media will naturally rise. Market players have an opportunity to expand their distribution networks, educate local industries on the benefits of ceramic media, and offer customized solutions to meet the specific requirements of these developing markets. Furthermore, ongoing research and development into new ceramic formulations and surface modification techniques promise to unlock new applications and enhance the performance attributes of existing products, creating further opportunities for market differentiation and growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion into new applications (e.g., additive manufacturing post-processing) | +1.3% | Global (esp. North America, Europe, China) | Mid to Long Term (2027-2033) |

| Growth in emerging economies and industrialization | +1.0% | Asia Pacific (esp. India, Southeast Asia), Latin America, MEA | Long Term (2028-2033) |

| Technological advancements in ceramic material formulations | +0.8% | Global | Mid to Long Term (2027-2033) |

| Integration with automated and robotic blasting systems | +0.7% | North America, Europe, Japan | Short to Mid Term (2025-2030) |

Ceramic Blast Media Market Challenges Impact Analysis

The Ceramic Blast Media market faces several challenges that require strategic navigation for sustained growth. One significant challenge is the intense price sensitivity within the broader abrasives market. Despite the superior performance and longer lifespan of ceramic media, its higher initial cost often leads to reluctance from some customers, especially those with established processes using cheaper alternatives. Competing on price alone is difficult, necessitating a strong emphasis on value proposition, demonstrating long-term cost savings, and highlighting quality improvements. This price pressure can stifle innovation or limit market penetration in segments where budget constraints are paramount, demanding a delicate balance between premium positioning and competitive pricing strategies.

Another challenge stems from the dynamic nature of end-user industries and their evolving material science. As new alloys, composites, and manufacturing techniques emerge, the requirements for surface preparation continually change. Ceramic blast media manufacturers must invest significantly in research and development to ensure their products remain compatible and effective with these new materials and processes. This necessitates ongoing innovation in ceramic compositions, particle sizes, and morphologies. Furthermore, regulatory complexities related to industrial dust exposure, waste disposal, and occupational safety can pose hurdles. Compliance with diverse global and regional regulations adds to operational costs and requires continuous monitoring and adaptation, influencing product formulations, handling, and application guidelines across the industry.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Price sensitivity and competition from low-cost alternatives | -1.0% | Global (esp. Asia Pacific, Latin America) | Short to Mid Term (2025-2030) |

| Technological evolution of materials requiring new media formulations | -0.8% | Global | Mid to Long Term (2027-2033) |

| Supply chain disruptions and raw material fluctuations | -0.6% | Global (depends on geopolitical stability) | Short Term (2025-2026) |

| Regulatory complexities regarding dust and waste disposal | -0.5% | Europe, North America | Long Term (2028-2033) |

Ceramic Blast Media Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Ceramic Blast Media Market, covering historical performance, current market dynamics, and future growth projections from 2025 to 2033. It examines key trends, drivers, restraints, opportunities, and challenges influencing market expansion. The report offers detailed segmentation analysis by type, application, and end-user industry, along with a thorough regional assessment to provide a holistic view of the market landscape. Strategic insights into competitive dynamics and profiles of leading market participants are also included, offering stakeholders a robust foundation for informed decision-making and strategic planning.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 285 million |

| Market Forecast in 2033 | USD 480 million |

| Growth Rate | 6.8% CAGR |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Abrasive Systems Inc., Blast Media Solutions, Cerablast Technologies, Dynabrade Inc., Ferro Corporation, Finisher's Depot, Guyson Corporation, Hockmeyer Equipment Corporation, Industrial Abrasives Company, Kemet International Ltd., Micro-Surface Finishes, Noritake Co. Ltd., Saint-Gobain Abrasives, Sinto Group, Surface Preparation Solutions, Vixen Surface Treatments, Washington Mills, Wheelabrator Group, Winoa, ZF Abrasives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Ceramic Blast Media market is meticulously segmented to provide a granular understanding of its diverse applications and material compositions, enabling stakeholders to identify specific growth areas and target markets. This segmentation facilitates a detailed analysis of demand patterns, technological preferences, and industry-specific requirements across various end-use sectors. By classifying the market based on ceramic type, application area, and end-user industry, the report offers comprehensive insights into market dynamics, competitive landscapes, and strategic opportunities within each defined segment. This structured approach helps in understanding the nuances of how ceramic media is adopted and utilized in different industrial processes.

The segmentation by type includes various ceramic compositions such as alumina ceramic media, known for its hardness and cost-effectiveness; zirconia ceramic media, valued for its extreme durability and fine finish capabilities; and silicon carbide ceramic media, recognized for its aggressive cutting action. Other specialized ceramic media, including engineered ceramic beads or mixed ceramic formulations, cater to niche applications requiring specific properties. Each type offers distinct advantages tailored to different materials and surface requirements. Analyzing these segments reveals trends in material science and the preferences of end-users for specific performance characteristics.

Application-based segmentation covers critical processes like surface preparation, deburring, peening, cleaning, finishing, and coating removal, each representing a unique demand driver for ceramic blast media. For instance, peening applications, crucial for enhancing fatigue strength in metals, often require specific ceramic media properties to achieve controlled compressive stress. End-user industry segmentation, encompassing automotive, aerospace, medical and dental, electronics, energy, construction, marine, and general industrial manufacturing, highlights the widespread utility of ceramic media across diverse sectors. The varying requirements for surface quality, material compatibility, and regulatory compliance within each industry drive distinct demand patterns, making this granular analysis essential for market strategists.

- By Type:

- Alumina Ceramic Media

- Zirconia Ceramic Media

- Silicon Carbide Ceramic Media

- Other Ceramic Media (e.g., Ceramic Beads, Mixed Ceramics)

- By Application:

- Surface Preparation

- Deburring

- Peening

- Cleaning

- Finishing

- Coating Removal

- By End-User Industry:

- Automotive

- Aerospace

- Medical & Dental

- Electronics

- Energy (Oil & Gas, Renewables)

- Construction

- Marine

- General Industrial Manufacturing

- Others

Regional Highlights

- North America: This region stands as a significant market for ceramic blast media, driven by robust aerospace, automotive, and medical device manufacturing sectors. The United States, in particular, demonstrates strong demand due to its advanced industrial base, stringent quality control standards, and increasing adoption of automated blasting technologies. Companies in North America are increasingly investing in high-performance materials to enhance product longevity and efficiency, aligning well with the benefits offered by ceramic media. Regulatory frameworks emphasizing environmental safety also encourage the use of reusable and less hazardous abrasive solutions, further boosting market growth in this region.

- Europe: Europe represents a mature yet dynamic market, propelled by its strong industrial heritage, particularly in Germany, France, and the UK. The region's emphasis on precision engineering, high-value manufacturing (e.g., luxury automotive, aerospace, medical implants), and strict environmental regulations makes ceramic blast media a preferred choice. The drive towards Industry 4.0 and automation in manufacturing facilities is also fostering the adoption of advanced blasting solutions. European manufacturers are continuously seeking innovative materials and processes that offer improved efficiency, reduced waste, and adherence to high-quality standards, thereby sustaining the demand for ceramic blast media.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Ceramic Blast Media Market, primarily due to rapid industrialization, burgeoning manufacturing sectors, and increasing foreign investments in countries like China, India, Japan, and South Korea. China's massive industrial output, coupled with its rising focus on quality and advanced manufacturing, is a key driver. Japan and South Korea, with their strong automotive and electronics industries, are significant adopters of precision blasting solutions. The region's expanding infrastructure development and rising disposable incomes are also fueling demand for high-quality finished goods, creating a conducive environment for market expansion.

- Latin America: The Latin American market for ceramic blast media is in a growth phase, albeit smaller than other regions. Brazil and Mexico are leading the adoption, driven by their developing automotive, aerospace, and general manufacturing industries. Increased foreign direct investment in manufacturing capabilities, coupled with a growing awareness of advanced surface finishing techniques, is contributing to market expansion. While economic volatility can pose challenges, the long-term industrial growth prospects in key countries present significant opportunities for ceramic blast media manufacturers.

- Middle East and Africa (MEA): The MEA region is an emerging market for ceramic blast media, with growth primarily influenced by investments in oil & gas, automotive assembly, and infrastructure projects. Countries like Saudi Arabia, UAE, and South Africa are witnessing industrial diversification efforts, leading to increased demand for high-quality surface preparation materials. The region's focus on maintaining critical infrastructure and developing advanced manufacturing capabilities is creating a gradual but steady increase in the adoption of durable and efficient blasting solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Blast Media Market.- Abrasive Systems Inc.

- Blast Media Solutions

- Cerablast Technologies

- Dynabrade Inc.

- Ferro Corporation

- Finisher's Depot

- Guyson Corporation

- Hockmeyer Equipment Corporation

- Industrial Abrasives Company

- Kemet International Ltd.

- Micro-Surface Finishes

- Noritake Co. Ltd.

- Saint-Gobain Abrasives

- Sinto Group

- Surface Preparation Solutions

- Vixen Surface Treatments

- Washington Mills

- Wheelabrator Group

- Winoa

- ZF Abrasives

Frequently Asked Questions

Analyze common user questions about the Ceramic Blast Media market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using ceramic blast media over traditional abrasives?

Ceramic blast media offers several distinct advantages over conventional abrasives like sand, steel shot, or glass beads. Its superior hardness and toughness lead to an extended lifespan and greater reusability, significantly reducing media consumption and associated disposal costs. Unlike metallic media, ceramic abrasives are non-ferrous and non-contaminating, making them ideal for sensitive materials where ferrous embedding or discoloration must be avoided. They also produce less dust during blasting, contributing to cleaner working environments and reduced airborne particulate matter. These characteristics result in more consistent and precise surface finishes, improved operational efficiency, and a lower overall cost of ownership for industrial applications demanding high quality and reliability.

In which industries is ceramic blast media most commonly utilized?

Ceramic blast media finds widespread application across a diverse range of industries, particularly those requiring high-precision surface finishing and material integrity. The aerospace sector extensively uses it for peening, deburring, and surface preparation of critical components to enhance fatigue life and reduce stress. In the automotive industry, it's employed for finishing engine parts, transmissions, and brake components. The medical and dental fields rely on ceramic media for cleaning, deburring, and texturing implants and instruments, ensuring biocompatibility and optimal surface characteristics. Additionally, the electronics industry utilizes it for cleaning circuit boards and delicate components, while general industrial manufacturing benefits from its use in tool cleaning, mold maintenance, and general surface preparation for painting or coating.

Is ceramic blast media considered an environmentally friendly option?

Yes, ceramic blast media is generally considered a more environmentally friendly option compared to many traditional abrasives. Its exceptional durability allows for multiple cycles of reuse, drastically reducing the volume of waste generated from blasting operations. This extended lifespan translates to less frequent media replacement and lower disposal costs, contributing to a more sustainable manufacturing process. Furthermore, ceramic media typically produces less dust during the blasting process, improving air quality in the workplace and reducing the need for extensive dust collection and filtration systems. The non-toxic nature of most ceramic formulations also minimizes environmental concerns related to hazardous waste, aligning with global efforts to promote greener industrial practices and resource efficiency.

What types of surface finishes can be achieved with ceramic blast media?

Ceramic blast media is highly versatile and capable of achieving a wide range of precise surface finishes, from gentle cleaning to aggressive material removal and controlled texturing. The specific finish depends on factors such as the ceramic type (e.g., alumina, zirconia, silicon carbide), particle size, blasting pressure, and angle of impact. Fine ceramic beads can create smooth, satin, or matte finishes, ideal for aesthetic purposes or preparing surfaces for delicate coatings. Coarser ceramic media can be used for more aggressive cleaning, scale removal, or creating specific roughness profiles for enhanced adhesion. It is particularly effective for achieving uniform, consistent finishes without embedding ferrous contaminants, making it suitable for applications where material integrity and visual quality are paramount.

How do automation and AI impact the future of ceramic blast media usage?

Automation and Artificial Intelligence (AI) are poised to significantly enhance the efficiency and precision of ceramic blast media usage. Automated blasting systems, often integrated with robotic arms, ensure highly consistent and repeatable results by precisely controlling parameters like media flow, pressure, and nozzle trajectory. This reduces human error, optimizes media consumption, and accelerates production cycles. AI further elevates this by enabling real-time quality control through vision systems that analyze surface finish and make immediate adjustments. Predictive maintenance algorithms, powered by AI, can forecast equipment wear, minimizing downtime and extending the lifespan of blasting machinery. Ultimately, the synergy between ceramic blast media and intelligent automation promises more precise, efficient, and cost-effective surface finishing operations, driving future market demand.