MOSFET Transistor Market

MOSFET Transistor Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_700716 | Last Updated : July 27, 2025 |

Format : ![]()

![]()

![]()

![]()

MOSFET Transistor Market Size

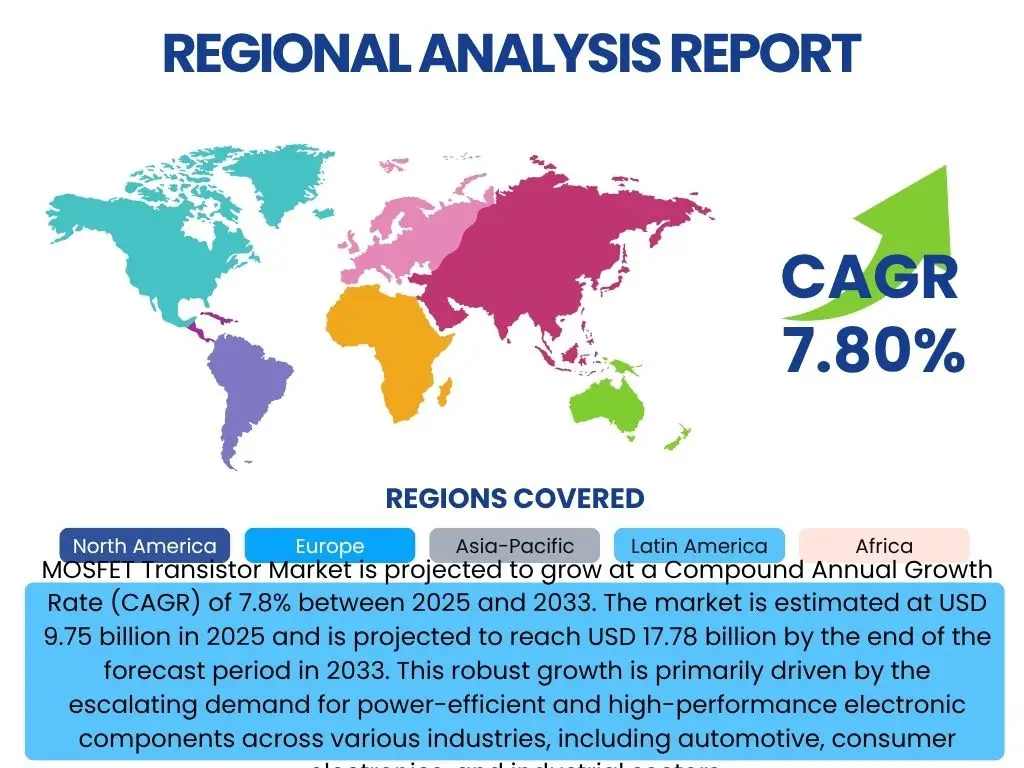

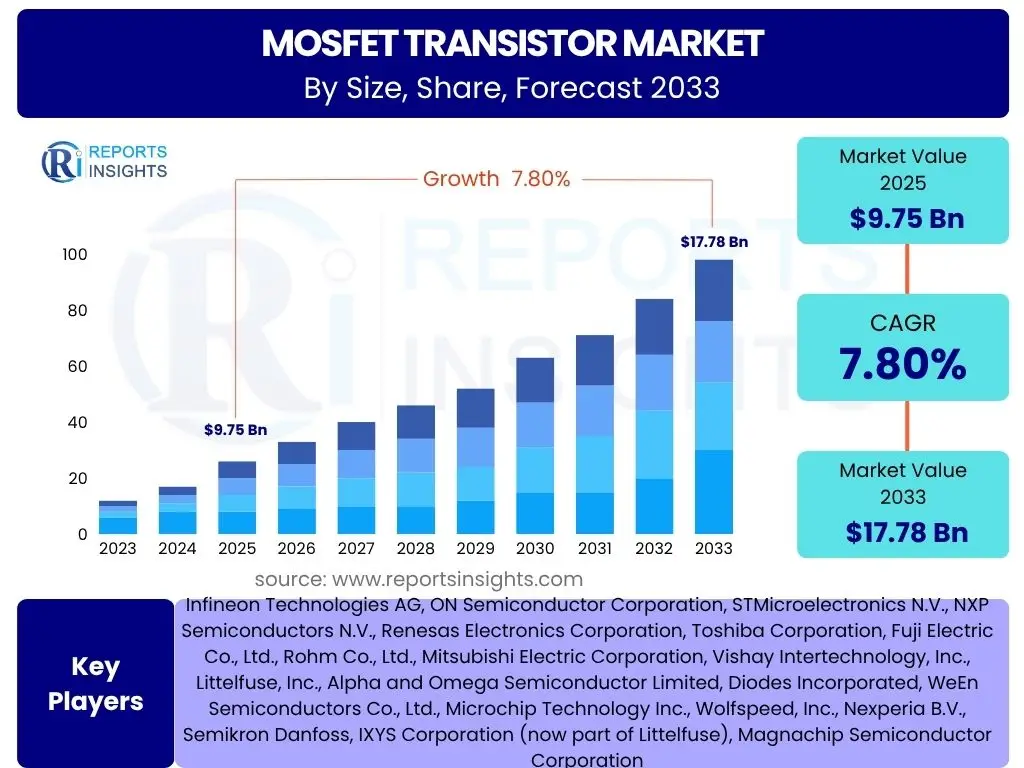

MOSFET Transistor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2033. The market is estimated at USD 9.75 billion in 2025 and is projected to reach USD 17.78 billion by the end of the forecast period in 2033. This robust growth is primarily driven by the escalating demand for power-efficient and high-performance electronic components across various industries, including automotive, consumer electronics, and industrial sectors.

The continuous technological advancements in semiconductor manufacturing, coupled with the increasing adoption of electric vehicles (EVs) and 5G infrastructure, are significantly contributing to the market expansion. Miniaturization and enhanced power density requirements in modern electronic devices further amplify the need for advanced MOSFET solutions. The market is also witnessing a shift towards wide bandgap materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) due to their superior performance characteristics in high-voltage and high-frequency applications, paving the way for new growth avenues.

Key MOSFET Transistor Market Trends & Insights

The MOSFET Transistor market is undergoing significant transformation driven by evolving technological landscapes and increasing performance demands across diverse applications. Common user questions often revolve around understanding the dominant technological shifts, the impact of emerging applications, and the strategic directions market players are taking. Key insights indicate a pronounced trend towards higher power efficiency, greater power density, and the integration of advanced materials to meet the rigorous demands of next-generation electronic systems. The confluence of consumer demand for compact, powerful devices and industrial requirements for robust, reliable power solutions is shaping these trends.

Furthermore, the automotive sector's rapid transition towards electrification and the global rollout of 5G networks are acting as powerful catalysts, necessitating the development of specialized MOSFETs. Users are keen to know about the adoption rate of wide bandgap materials like SiC and GaN, which offer superior thermal conductivity and breakdown voltage compared to traditional silicon. These materials are becoming critical for high-power, high-frequency applications, driving innovation in package design and thermal management. The emphasis is increasingly on solutions that can deliver efficiency gains while managing heat effectively in compact designs, indicating a clear direction for research and development in the coming years.

- Growing adoption of Wide Bandgap (WBG) materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN) for superior performance in high-voltage, high-frequency, and high-temperature applications.

- Increasing demand from the automotive sector, particularly for Electric Vehicles (EVs), Hybrid Electric Vehicles (HEVs), and Advanced Driver-Assistance Systems (ADAS), requiring high-power and efficient MOSFETs for inverters, chargers, and DC-DC converters.

- Expansion of 5G infrastructure and data centers driving the need for high-speed, low-loss power management solutions utilizing advanced MOSFETs.

- Miniaturization and integration trends in consumer electronics, leading to the development of smaller, more power-efficient MOSFETs for smartphones, laptops, and wearable devices.

- Rising adoption in industrial automation and renewable energy systems, including solar inverters and wind power systems, emphasizing robust and reliable power switching components.

AI Impact Analysis on MOSFET Transistor

The pervasive integration of Artificial Intelligence (AI) across various industries is significantly influencing the MOSFET Transistor market, a common point of inquiry among users seeking to understand the future landscape. AI's core requirements for massive computational power, high-speed data processing, and efficient energy management directly translate into heightened demands for advanced power solutions. Data centers, edge AI devices, and high-performance computing (HPC) platforms, which are the backbone of AI operations, necessitate MOSFETs capable of delivering superior power efficiency and thermal stability to minimize energy consumption and manage heat generated by intense processing activities. Users are particularly concerned with how existing MOSFET technologies will adapt to these evolving AI-driven requirements and whether new designs are emerging to address the specific power delivery challenges of AI accelerators.

Furthermore, AI itself is beginning to play a role in optimizing the design and manufacturing processes of MOSFETs. Machine learning algorithms can be employed to predict material properties, simulate device performance, and identify potential failure points, leading to more efficient R&D cycles and improved product reliability. This dual impact—AI as a driver of MOSFET demand and AI as a tool for MOSFET innovation—highlights a symbiotic relationship. The continuous pursuit of higher computational density in AI hardware will invariably push the boundaries for MOSFET technology, focusing on achieving lower on-resistance, faster switching speeds, and higher thermal performance in increasingly compact footprints. This symbiotic evolution is critical for sustaining the growth of both the AI and semiconductor industries, ensuring that power delivery can keep pace with processing power advancements.

- Increased demand for high-efficiency, high-power density MOSFETs in AI data centers and servers to manage the substantial power requirements of AI accelerators and GPUs.

- Drive for advanced MOSFETs in edge AI devices and Internet of Things (IoT) applications, where energy efficiency and compact size are critical for prolonged battery life and localized processing.

- Necessity for faster switching and lower loss MOSFETs to handle the dynamic power delivery requirements of AI processors, minimizing energy waste and heat generation.

- Potential for AI and machine learning to optimize MOSFET design, simulation, and manufacturing processes, leading to more efficient and reliable power devices.

- Requirement for robust thermal management solutions for MOSFETs used in AI applications, as high power consumption translates to significant heat dissipation challenges.

Key Takeaways MOSFET Transistor Market Size & Forecast

Users frequently inquire about the overarching conclusions and most impactful insights derived from the MOSFET Transistor market size and forecast analysis. The primary takeaway underscores a robust and sustained growth trajectory for the global MOSFET market, driven by secular trends across multiple industrial and consumer sectors. The market's expansion is not merely incremental but reflective of fundamental shifts in technology adoption, particularly in areas demanding higher power efficiency, reliability, and miniaturization. The forecast period highlights a compounding annual growth rate that signals significant opportunities for innovation and market penetration for both established players and emerging entrants, making it a dynamic and attractive segment within the broader semiconductor industry.

A crucial insight is the increasing prominence of application-specific MOSFETs, tailored to meet unique performance criteria for demanding environments such as electric vehicles, advanced telecommunications infrastructure, and next-generation data centers. This specialization, coupled with the accelerating adoption of wide bandgap materials, suggests a strategic pivot for manufacturers towards high-value, high-performance segments. The long-term forecast indicates that the market will continue to be shaped by ongoing research into material science and advanced packaging technologies, ensuring that MOSFETs remain foundational components for the future of electronics and power management. Understanding these key drivers and technological shifts is paramount for stakeholders aiming to capitalize on the market's projected growth.

- The MOSFET Transistor market is projected to experience substantial growth, reaching nearly USD 17.78 billion by 2033, driven by increasing electrification and digitalization across industries.

- Automotive and IT & Telecom sectors are key growth engines, with significant demand for high-performance and power-efficient MOSFETs for EVs, 5G, and data center applications.

- The transition towards Wide Bandgap (WBG) materials like SiC and GaN is a critical trend, enabling superior power density and efficiency, especially in high-voltage and high-frequency scenarios.

- Technological advancements in packaging and thermal management are crucial for meeting the demands of miniaturization and higher power dissipation in modern electronic devices.

- Geographic expansion, particularly in the Asia Pacific region, fueled by manufacturing hubs and rapid adoption of advanced electronics, will play a pivotal role in market development.

MOSFET Transistor Market Drivers Analysis

The MOSFET Transistor market is propelled by a confluence of powerful drivers stemming from global technological advancements and increasing demands for efficient power management. The widespread adoption of electric and hybrid electric vehicles globally stands as a paramount driver, as MOSFETs are critical components in power inverters, onboard chargers, and battery management systems, necessitating high-performance and reliable solutions. Simultaneously, the rapid expansion of 5G infrastructure and the proliferation of data centers globally are creating immense demand for high-speed, low-loss power components to ensure efficient and stable operation of network equipment and servers. These drivers collectively contribute to the escalating need for advanced MOSFET technologies capable of handling higher power densities and operating with greater energy efficiency, thereby stimulating market growth across various regions and applications.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) Production | +2.5% | Global, particularly Asia Pacific (China, Japan), Europe, North America | Short to Long-term (2025-2033) |

| Expansion of 5G Infrastructure and Data Centers | +1.8% | Global, with strong growth in North America, Asia Pacific, and Europe | Short to Mid-term (2025-2030) |

| Growing Demand for Power-Efficient Consumer Electronics | +1.5% | Global, especially Asia Pacific (China, India), North America, Europe | Short to Mid-term (2025-2030) |

| Rising Adoption of Industrial Automation and Robotics | +1.2% | Europe, North America, Asia Pacific (Japan, South Korea, Germany) | Mid to Long-term (2027-2033) |

| Increased Investment in Renewable Energy Systems (Solar, Wind) | +1.0% | Global, particularly China, India, Europe, North America | Mid to Long-term (2027-2033) |

MOSFET Transistor Market Restraints Analysis

Despite the robust growth trajectory, the MOSFET Transistor market faces several restraints that could potentially impede its full growth potential. One significant challenge is the inherent complexity and high cost associated with manufacturing advanced MOSFETs, particularly those based on wide bandgap materials, which require specialized fabrication processes and expensive raw materials. This can lead to higher average selling prices, potentially limiting adoption in cost-sensitive applications. Furthermore, the semiconductor industry is susceptible to volatile supply chain disruptions, as witnessed in recent years, which can lead to material shortages, production delays, and increased lead times, directly impacting the availability and pricing of MOSFETs globally.

Another crucial restraint stems from intense competition and price pressure within the mature silicon-based MOSFET segment. With numerous players offering similar products, differentiation becomes challenging, often leading to commoditization and margin erosion. Additionally, the rapid pace of technological change means that existing MOSFET technologies can quickly become obsolete as newer, more efficient solutions emerge, requiring continuous and substantial investment in research and development, which smaller players might find challenging to sustain. These factors combined necessitate strategic planning and adaptability for market participants to navigate the competitive landscape successfully.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Manufacturing Costs and Capital-Intensive Production | -1.5% | Global, particularly new entrants and smaller players | Short to Mid-term (2025-2030) |

| Supply Chain Volatility and Geopolitical Tensions Affecting Raw Material Access | -1.2% | Global, impacting regions reliant on specific raw material imports (e.g., China for rare earths) | Short-term (2025-2027) |

| Intense Competition and Price Pressure in Mature Silicon-Based Segments | -1.0% | Global, especially highly competitive markets like consumer electronics | Ongoing (2025-2033) |

| Technological Obsolescence and Need for Continuous R&D Investment | -0.8% | Global, impacting companies with limited R&D budgets | Long-term (2028-2033) |

MOSFET Transistor Market Opportunities Analysis

Significant opportunities abound in the MOSFET Transistor market, primarily driven by emerging technological advancements and expanding application areas. The most prominent opportunity lies in the accelerating transition towards Wide Bandgap (WBG) materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials enable the creation of MOSFETs with superior performance characteristics, including higher power density, increased efficiency, and improved thermal management, making them ideal for high-growth sectors like electric vehicles, fast chargers, and renewable energy systems. Investing in the development and scaling of SiC and GaN MOSFET production offers a pathway to capture significant market share in premium and high-performance segments.

Furthermore, the rapid evolution of the Internet of Things (IoT) and edge computing creates new avenues for power-efficient and compact MOSFETs, particularly for low-power applications where prolonged battery life and minimal heat generation are paramount. The continuous innovation in advanced packaging technologies, such as system-in-package (SiP) and wafer-level packaging, also presents an opportunity to achieve further miniaturization and enhanced integration of MOSFETs with other components, catering to the demand for more compact and powerful electronic devices across consumer and industrial applications. These opportunities demand strategic investment in research, manufacturing capabilities, and market expansion to fully capitalize on future growth.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Accelerated Adoption of Wide Bandgap (SiC & GaN) MOSFETs | +2.0% | Global, particularly in Automotive (EVs), Renewable Energy, and Industrial Power | Short to Long-term (2025-2033) |

| Emergence of New Applications in IoT, Edge Computing, and Artificial Intelligence | +1.5% | Global, with strong presence in North America, Europe, and Asia Pacific | Mid to Long-term (2027-2033) |

| Advancements in Packaging Technologies for Miniaturization and Integration | +1.0% | Global, driven by consumer electronics and portable device markets | Mid-term (2026-2031) |

| Increasing Demand from Healthcare (Medical Imaging, Portable Devices) and Aerospace & Defense | +0.8% | North America, Europe, and select Asia Pacific countries | Long-term (2028-2033) |

MOSFET Transistor Market Challenges Impact Analysis

The MOSFET Transistor market confronts several critical challenges that require concerted efforts from manufacturers and innovators to overcome. One significant hurdle is effective thermal management, especially as devices continue to miniaturize and operate at higher power densities. Dissipating heat efficiently from compact MOSFET packages is crucial for ensuring device reliability and longevity, particularly in high-power applications like electric vehicles and data center servers. Failure to address thermal issues can lead to performance degradation and premature device failure, posing a substantial technical challenge for design engineers.

Another key challenge involves maintaining high reliability and performance under extreme operating conditions, such as high temperatures, voltage fluctuations, and harsh environments found in automotive or industrial applications. Achieving consistent performance across a wide range of operational parameters while keeping manufacturing costs competitive remains a complex balancing act. Furthermore, the increasing complexity of semiconductor fabrication processes, particularly for advanced materials like SiC and GaN, demands highly specialized equipment and skilled labor, which can be difficult and expensive to acquire and retain. These challenges necessitate continuous innovation in materials science, device architecture, and manufacturing techniques to sustain market growth and meet evolving industry demands.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complex Thermal Management in High-Power and Miniaturized Devices | -1.3% | Global, particularly in automotive, data centers, and high-performance computing | Ongoing (2025-2033) |

| Maintaining Reliability and Performance Under Extreme Operating Conditions | -1.0% | Global, critical for automotive, industrial, and aerospace & defense applications | Ongoing (2025-2033) |

| High Entry Barriers and Capital Expenditure for Advanced Fabrication Facilities | -0.9% | Global, particularly for new entrants and players scaling WBG production | Long-term (2028-2033) |

| Shortage of Skilled Workforce in Semiconductor Manufacturing and Design | -0.7% | Global, especially North America, Europe, and certain Asian regions | Mid to Long-term (2027-2033) |

MOSFET Transistor Market - Updated Report Scope

This comprehensive market research report on the MOSFET Transistor market provides an in-depth analysis of market size, trends, drivers, restraints, opportunities, and challenges across various segments and geographies. It offers a detailed forecast from 2025 to 2033, covering historical data from 2019 to 2023, and insights into the competitive landscape, including profiles of key market players. The report aims to equip stakeholders with actionable intelligence to make informed strategic decisions regarding market entry, product development, and geographic expansion.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 9.75 Billion |

| Market Forecast in 2033 | USD 17.78 Billion |

| Growth Rate | 7.8% |

| Number of Pages | 250 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, ON Semiconductor Corporation, STMicroelectronics N.V., NXP Semiconductors N.V., Renesas Electronics Corporation, Toshiba Corporation, Fuji Electric Co., Ltd., Rohm Co., Ltd., Mitsubishi Electric Corporation, Vishay Intertechnology, Inc., Littelfuse, Inc., Alpha and Omega Semiconductor Limited, Diodes Incorporated, WeEn Semiconductors Co., Ltd., Microchip Technology Inc., Wolfspeed, Inc., Nexperia B.V., Semikron Danfoss, IXYS Corporation (now part of Littelfuse), Magnachip Semiconductor Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The MOSFET Transistor market is intricately segmented to provide a granular understanding of its diverse components and their respective contributions to the overall market dynamics. This segmentation facilitates a detailed analysis of various product types, material compositions, voltage ranges, and end-use applications, offering a comprehensive view of market trends and growth opportunities within each specific category. Understanding these segments is crucial for stakeholders to identify niche markets, tailor product development, and formulate targeted marketing strategies, ensuring optimal resource allocation and competitive positioning within the complex semiconductor landscape.

- By Type: This segment differentiates MOSFETs based on their operational characteristics, including Depletion-mode MOSFETs (normally on, conducting current with zero gate-source voltage) and Enhancement-mode MOSFETs (normally off, requiring a positive gate-source voltage to conduct). Enhancement-mode MOSFETs are more commonly used in digital circuits.

- By Material: This crucial segmentation categorizes MOSFETs by the semiconductor material used, primarily Silicon (Si), and increasingly, Wide Bandgap (WBG) materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC and GaN offer superior performance in high-power, high-frequency, and high-temperature environments.

- By Voltage Range: MOSFETs are designed for specific voltage applications, categorized into Low Voltage MOSFETs (typically <100V), Medium Voltage MOSFETs (100V-500V), and High Voltage MOSFETs (>500V). Each range serves distinct applications, from battery-powered devices to industrial power supplies.

- By Application: This segment covers the diverse end-use industries and specific applications where MOSFETs are integral components, including:

- Automotive (EV/HEV Inverters, On-Board Chargers, DC-DC Converters, Advanced Driver-Assistance Systems - ADAS)

- Consumer Electronics (Smartphones, Laptops, Home Appliances, Gaming Consoles, Wearables)

- Industrial (Power Supplies, Motor Drives, Industrial Automation Systems, Robotics, Welding Equipment)

- IT & Telecom (Servers, Data Centers, Networking Equipment, 5G Base Stations)

- Energy & Power (Solar Inverters, Wind Turbines, Uninterruptible Power Supply - UPS Systems, Smart Grid Infrastructure)

- Healthcare (Medical Imaging Equipment, Portable Medical Devices, Diagnostic Tools)

- Aerospace & Defense (Radar Systems, Avionics, Power Distribution Units, Satellite Systems)

Regional Highlights

- North America: This region demonstrates significant demand for high-performance MOSFETs, driven by robust investments in data centers, 5G infrastructure, and electric vehicle advancements. The presence of key technology innovators and early adoption of advanced semiconductor solutions contribute to its market share. Growth is also fueled by expanding applications in industrial automation and medical electronics.

- Europe: Europe exhibits strong growth, particularly in the automotive sector, with substantial R&D and manufacturing capabilities for EVs and HEVs. The region is also a key player in industrial power electronics and renewable energy systems, driving the demand for high-efficiency and reliable MOSFETs, especially those based on SiC and GaN.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for MOSFET transistors, primarily due to the presence of major electronics manufacturing hubs in China, Japan, South Korea, and Taiwan. The booming consumer electronics industry, rapid expansion of 5G networks, and increasing EV production in countries like China and India are propelling market growth. Significant government support for semiconductor manufacturing also contributes to its dominance.

- Latin America: While a smaller market, Latin America is experiencing gradual growth, driven by increasing industrialization, infrastructure development, and growing adoption of consumer electronics. Investments in renewable energy projects and automotive manufacturing facilities are expected to provide further impetus for MOSFET demand in the coming years.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth, largely influenced by rising investments in renewable energy projects (especially solar farms), infrastructure development, and smart city initiatives. Increasing adoption of consumer electronics and a nascent automotive market also contribute to the demand for MOSFETs, albeit at a slower pace compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MOSFET Transistor Market.- Infineon Technologies AG

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Rohm Co., Ltd.

- Mitsubishi Electric Corporation

- Vishay Intertechnology, Inc.

- Littelfuse, Inc.

- Alpha and Omega Semiconductor Limited

- Diodes Incorporated

- WeEn Semiconductors Co., Ltd.

- Microchip Technology Inc.

- Wolfspeed, Inc.

- Nexperia B.V.

- Semikron Danfoss

- IXYS Corporation

- Magnachip Semiconductor Corporation

Frequently Asked Questions

Analyze common user questions about the MOSFET Transistor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a MOSFET transistor and how does it work?

A MOSFET (Metal-Oxide-Semiconductor Field-Effect Transistor) is a type of transistor used for amplifying or switching electronic signals. It works by controlling the conductivity of a semiconductor channel through the application of a voltage to a gate electrode, which is insulated from the channel by a thin oxide layer. This allows it to act as a voltage-controlled switch, making it highly efficient for various electronic applications.

What are the primary applications of MOSFETs?

MOSFETs are extensively used across numerous applications, including power management in consumer electronics (smartphones, laptops), motor control in industrial automation, power conversion in electric vehicles and renewable energy systems (solar inverters), and amplification in telecommunications equipment (5G base stations) and data centers.

How are Silicon Carbide (SiC) and Gallium Nitride (GaN) impacting the MOSFET market?

SiC and GaN are Wide Bandgap (WBG) materials that are significantly impacting the MOSFET market by enabling devices with superior performance compared to traditional silicon. They offer higher power density, increased efficiency, faster switching speeds, and better thermal management, making them ideal for high-voltage, high-frequency applications like electric vehicle chargers, industrial power supplies, and 5G infrastructure.

What is the forecast for the global MOSFET transistor market?

The global MOSFET transistor market is projected to experience robust growth, estimated to reach USD 17.78 billion by 2033, growing at a CAGR of 7.8% from USD 9.75 billion in 2025. This growth is primarily driven by the increasing demand for power-efficient components in automotive, IT & Telecom, and industrial sectors, alongside the rising adoption of WBG materials.

Which regions are key contributors to the MOSFET market's growth?

Asia Pacific (APAC) is the largest and fastest-growing region, driven by its extensive electronics manufacturing base, rapid 5G deployment, and significant EV production. North America and Europe also play crucial roles, characterized by strong demand from data centers, advanced industrial applications, and increasing adoption of electric vehicles and renewable energy technologies.